7+ Book keeping Business Plan Examples to Download

No matter the type of business or the industry you are into, especially those that involve money, which is almost everything, you really need to account all the transactions of the entity. Bookkeeping is needed in every kind of business, and an entity must have their own bookkeeper to perform the bookkeeping tasks. You may also see strategic plan examples.

Bookkeeping is naturally challenging because you are dealing with the company’s financial resources, the lifeblood of the company. In order to do your bookkeeping effectively and efficiently, you need to lay out your bookkeeping plans in a formal document called business plan. Bookkeeping business plans will guide you to the small steps to achieve your desired goals in bookkeeping.

Accounting and Bookkeeping Business Plan Example

Basic Bookkeeping Business Plan Example

Importance of Bookkeeping

Bookkeeping is an important aspect in the life of every business entity. It involves the recording of financial transactions, which includes purchases, sales, general receipts, and payments. It can help the users of the financial statements as well as the related parties in different ways. Below are the common importance of bookkeeping:

1. It limits the pain of auditing

Internal and external auditing are the two auditing procedures that must be performed on the financial statements of an entity. In auditing, the auditors need to gather the necessary information to determine whether the financial statements are presented fairly in all material aspects. Bookkeeping can help the auditor easily check the financial information of the company.

2. Files for tax filing are gathered

In filing for tax payments, certain papers are needed such as the simple receipts for the revenues and expenses and other related documents evidencing the amount that must be paid by the company for their tax payable. Bookkeeping can help in tax filing because through bookkeeping, the necessary files are already gathered in place.

3. Analysis and management

Through the information and the general summary of the digits of the purchases, sales, receipts, and payments, the management can analyze their performance for the improvement of the entity. The internal control can also be tested on whether or not it is reliable especially in the preparation of the financial statements.

4. Requirement of the law

The law requires that a company must do bookkeeping in their accounts and to keep proper records not just for auditing but for tax purposes as well.

5. You can plan ahead

Based on the previous transactions that you have recorded in your books, you can plan ahead on what you are going to do with the aspects that you think are your weaknesses and do something to improve your strengths.

Company Bookkeeping Business Plan Example

Comprehensive Bookkeeping Business Plan Example

Steps in Bookkeeping

Bookkeeping may be burdensome for some; however, it must be done in order to help not only the management but also any other users of financial information of the company. Having a license as an accountant is not a requirement for bookkeeping, but being a Certified Public Accountant is an advantage as they already know the necessary steps to do bookkeeping. You may also see business plan guidelines examples.

To help you in doing your bookkeeping, here are the simple but important things that you must remember:

1. Prepare the source documents

The first thing that you must do in bookkeeping is to gather all the necessary documents—source documents. You must prepare the source documents for all the transactions that your company has entered into such as in operations, finance, and investment as these are the starting point in your bookkeeping process. You may also see risk plan examples.

2. Determine the relevant information about each transaction

Now that you have gathered all the necessary documents for all the transactions of your company, you must determine the relevant information about each transaction. You must also record the financial effects for each of the transactions and other business events. You may also like business operational plan examples.

3. Record journal entries into the general journal

Record in chronological order the relevant transactions into the general journal. Commonly, a double entry system is being used by most of the companies. It states that for every debit, there must be credit.

Hence, when you are going to record an account as a debit, you must also record pair it with its credit. It is better that you study more on the double entry system to understand more about this topic as this can get complicated when you got lots of rare transactions. You may also check out market analysis business plan examples.

4. Perform end-of-period procedures

Most business entities need accounting reports at the end of each quarter or at the end of the month. Hence, you must perform end-of-period procedures which are the critical steps and can be used for getting the accounting records updated and ready for the preparation of management accounting reports, tax returns, and simple financial statements.

5. Compile the adjusted trial balance

When you have finished performing the end-of-period procedures, you must compile a complete list of all the accounts in your record in the adjusted trial balance. In the adjusted trial balance, all the changes in the accounts that has been affected by the transaction within a certain period are reflected. You might be interested in network marketing business plan examples.

6. Close the books

Lastly, close the books of the accounts by eliminating the nominal accounts by transferring them to their respective real accounts. Closing the books can help get things ready for the next period’s bookkeeping process.

Detailed Bookkeeping Business Plan Example

Lengthy Bookkeeping Business Plan Example

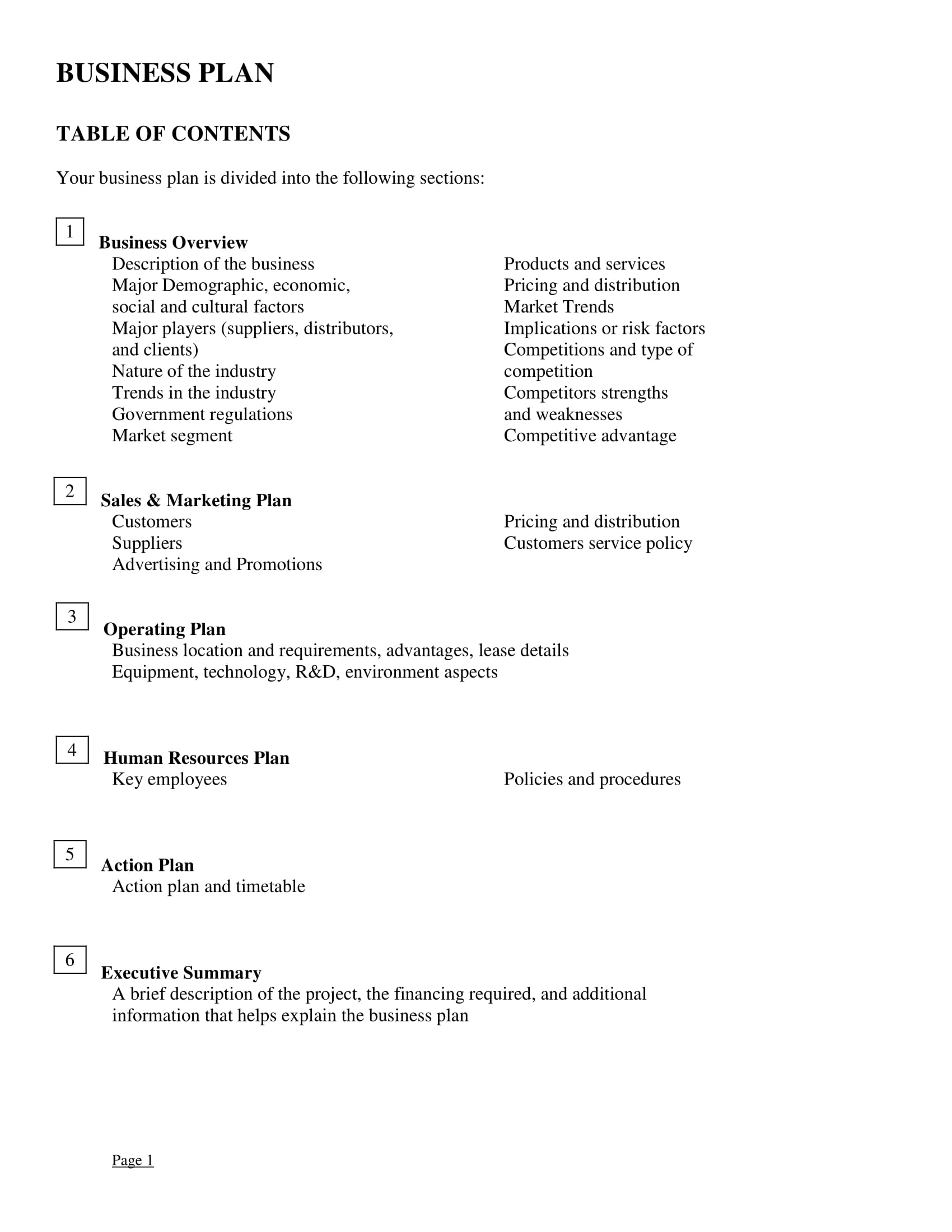

Typical Structure of a Business Plan

In creating a business plan for a professional goal that you have in mind, you must make a formal paper, detailing all the necessary information that would lead you to achieving your predetermined goal.

1. Cover Page

The first part of your business plan must be your cover page. In your cover page, you must write the title of your business plan, your company, and the date. This is important so you can easily determine this document from your other documents of your entity, especially when you are compiling a hard copy of the document.

2. Table of Contents

The table of contents must also be present in your business plan especially when you are creating a lengthy business plan. This can guide the users and the readers of the different sections in your business. If you are creating a business plan digitally, you may create a clickable table of contents linking the items in your table of content to their respective contents.

3. Executive Summary

In your executive summary, you must summarize the whole document in a way that the readers can be easily acquainted with your business plan without having to read it all. It must contain a brief statement of the problem or subject covered in the business plan, background information, concise analysis, and main conclusions.

4. Mission Statement

In this section you must present the general mission statement or the short statement of an organizations purpose. It must identify the goals of its operations. You may also include in this section the organization’s values or philosophies, your company’s competitive advantages, or a desired future state.

5. Business Description

You must present in this section the description of the business you are in. You can include the nature of the business that you are into as well as the operations and systems that you are implementing in your business.

6. SWOT Analysis

SWOT analysis or the analysis of your strengths, weaknesses, opportunities, and threats must be presented in this section. You must specify the objectives of your entity and identify the internal as well as the external factors that are favorable and unfavorable to achieving those objectives.

7. Industry Background

In this section, you must present the type of industry of your company, whether you are a service provider for a certain service, a manufacturer of a certain good, among others.

8. Competitor Analysis

This section of your general business plan is where you present your competitor analysis. Competitor analysis is the assessment of the strengths and weaknesses of current and potential competitors of the same industry that your company is into. This general analysis provides an offensive as well as defensive strategic context to identify opportunities and threats from those competitors.

9. Market Analysis

In this section, you must include your market analysis, your studies on the attractiveness, and the dynamics of a special market within a special industry. In this analysis, you can also identify the strengths, weaknesses, opportunities, and threats of your company. This is also known as a documented investigation of a market that is used to inform a firm’s planning activities.

10. Marketing Plan

A marketing plan is an important component of your business plan as this serves as a blueprint, outlining the business advertising and marketing efforts of the entity for the coming year. It also describes business activities that are involved in accomplishing specific marketing objectives within a specified period of time.

Moreover, it includes a description of the current marketing position of your company, a discussion of the target market for your goods and services, and a description of the marketing mix that a company is going to use to achieve their marketing goals.

11. Operations Plan

You must also include a section for your operations plan. This includes your strategic goals and objectives. Your operations plan describes milestones, conditions for success, and explains how or what portion of a strategic plan must be put into operation in a certain operational period. This is usually the basis for your annual operating budget request. It also addresses the following questions:

- What is our current standing now?

- Where do we want to be?

- How can we get there?

- How can we measure our progress?

12. Financial Plan

In this section, you must present a comprehensive evaluation of your company’s current pay as well as the future financial state—financial plan. This can be done through the use of the current known variables to forecast future income, asset values, etc., of the company. This also includes a budget that organizes company’s finances and a series of steps or specific goals for spending and saving in the future. This is sometimes referred to as an investment plan.

13. Attachments and Milestones

In this section, you must present the attachments that are necessary for the complete understanding of the above documents and sections that you have presented. You may also include the notes for your financial statement, which details the information that are not included in the financial statement. You may also see advertising and marketing business plan examples.

Furthermore, you may present the milestones that your company has reached at this point as well as the achievements that you have achieved so far.

Practical Bookkeeping Business Plan Example

Well-Explained Bookkeeping Business Plan Example

Quick Recap

Bookkeeping is important as it can help limit the pain of auditing, the files used for filing tax are already set in place, it can be used for simple analysis and management, it is the requirement of the law, and through bookkeeping, you can plan ahead.

Bookkeeping is really not a tough task. To perform bookkeeping, the following steps are necessary: prepare the source documents, determine the relevant information about each transaction, record journal entries into the general journal, perform end-of-period procedures, compile the adjusted trial balance, and lastly, close the books. You may also see hotel business plan examples.

However, before doing bookkeeping, you must plan ahead on what you are going to achieve. This can be done through making a simple business plan. The typical structure of a business plan involves the following: cover page, table of contents, executive summary, mission statement, business description, general SWOT analysis, industry background, competitor analysis, market analysis, marketing plan, operations plan, management summary, financial plan, and attachments and milestones.

To understand more about bookkeeping business plans, don’t forget to refer to the comprehensive and detailed examples of bookkeeping business plans above.