23+ Budget Sheet Examples to Download

Even if budgeting gets tedious, taking the time to manage your finances can really pay off in the long run. It has so many benefits and one remarkable benefit is that it can help you save up for whatever you want to spend on or pay off in the future such as emergencies, debts, travel expenses, the things you’ve always wanted to buy, and even your pension. You may also see task sheet examples & samples.

23+ Budget Sheet Examples

Budget Spreadsheet Template

Event Planning Budget Worksheet

Household Budget Worksheet Template

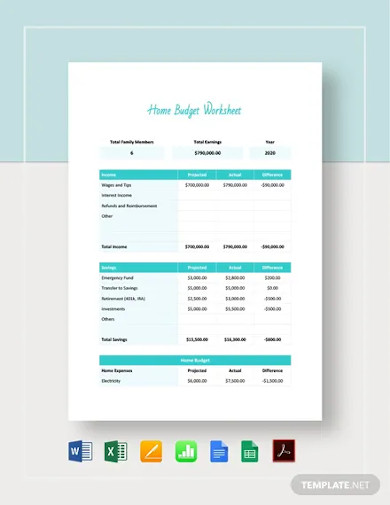

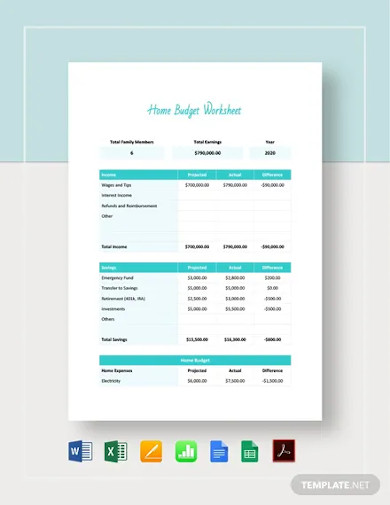

Home Budget Worksheet Template

Family Budget Worksheet Template

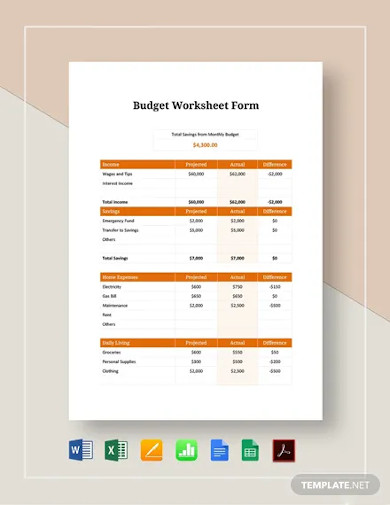

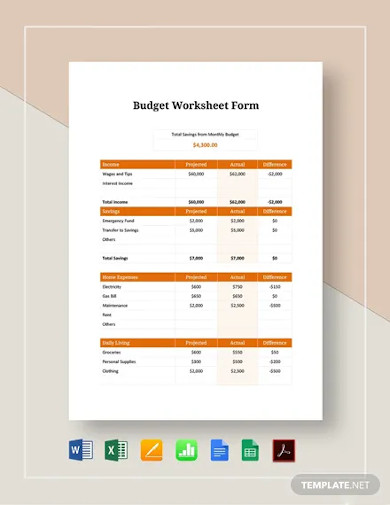

Budget Worksheet Form Template

Simple Budget Spreadsheet Template

Wedding Budget Worksheet Template

Budget Worksheet Template

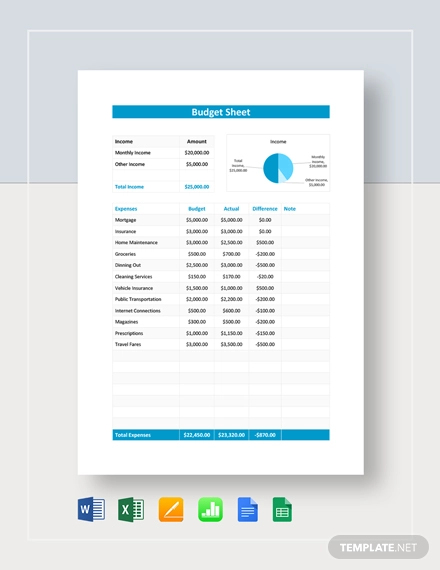

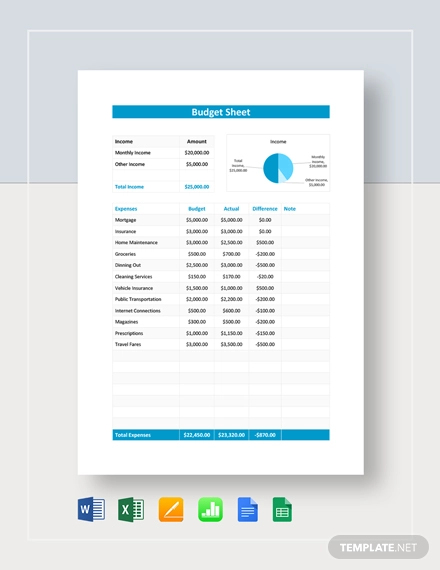

Budget Sheet Template

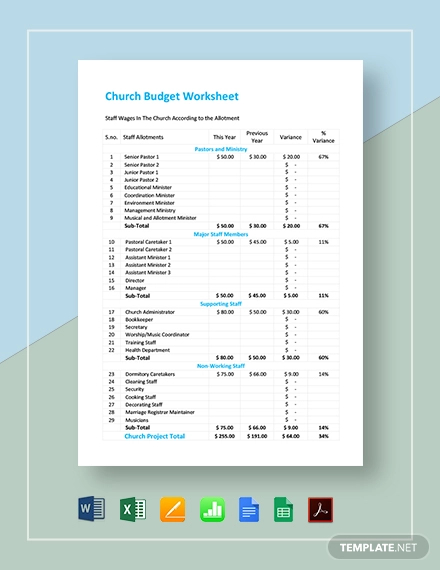

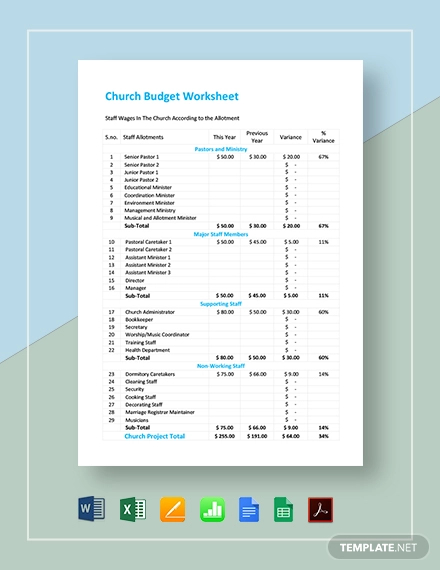

Church Budget Worksheet

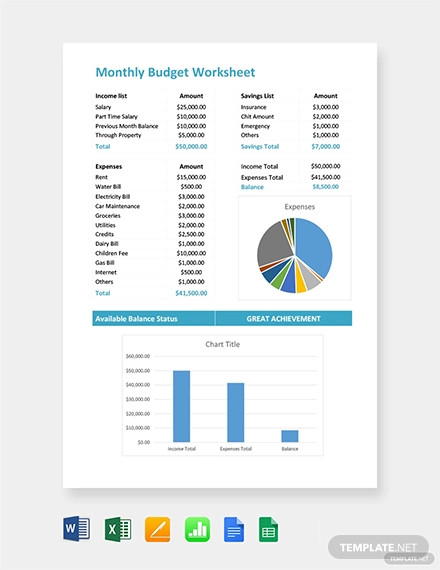

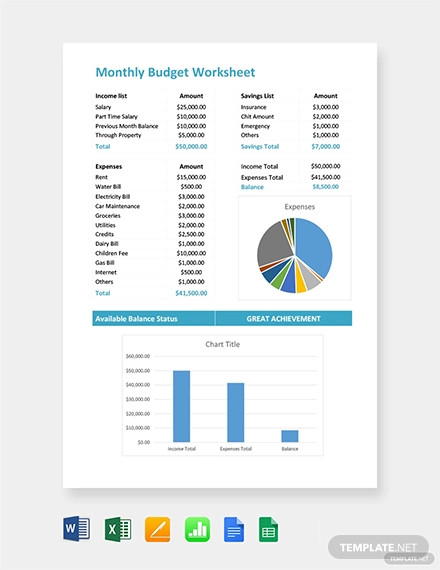

Monthly Budget Worksheet Example

Since budgeting can get difficult times, you may need a tool that can help you control and manage your finances. One of such tools is budget sheets. Read on to see the budget sheet examples that we have provided for you in this article as well as some tips on how to set up and stick to your budget. You may also like job sheet examples & samples.

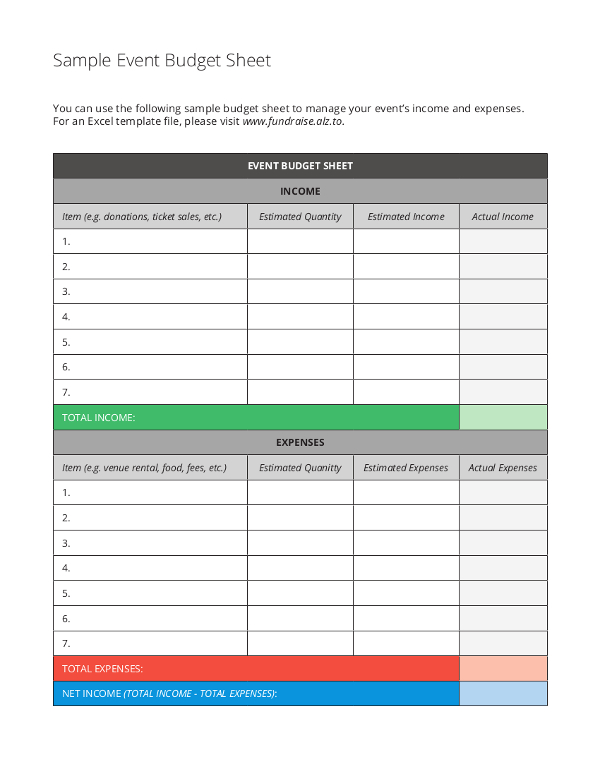

Sample Event Budget Sheet

Budget Sheet

Budget Planner Sheet

Sample Budget Sheet

Budget Sheet Example

Detailed Budget Sheet

Sample Itemized Budget Sheet

Study Abroad Budget Worksheet

Monthly Budget Worksheet

Sample Budget Worksheet

Tips and Tricks Related to Budgeting

What’s the use of budget sheets if you do not know how to budget and that you do not know how to maintain and stick to your budget? With that, here are some tips on how you can budget your personal finances or your business finances:

Recording your expenses is the best first step you should take when budgeting. You should record even the cheapest thing you bought, yes, even that one piece of candy. You are accountable for every single cent and penny you buy. Once you have recorded everything, you should organize it by category so you will have a clearer picture of what are you usually spending your money on and how you can manage it.

Since you now have an idea of what you spend your money on, you can now begin to organize your recorded expenses into your budget sheet. You should then determine how your budget can able to outline how your expenses sum or measure up to your income. You might notice some categories that you usually would be spending and this can help you limit overspending. In addition to your monthly expenses, be sure to factor in expenses that occur regularly but not every month, such as car maintenance. Find more information about creating a budget. You may also see overtime sheet examples & samples.

Now that you’ve made budget categories, you may also include a savings category because for sure, you have not saved anything at all. Now that you have also identified what are the categories you would usually overspend on, you can also identify what are the expenses you should cut and put all those in your savings.

You may have had a lot of non-essential expenses such as such as mindless shopping, entertainment, and dining out. End all those unnecessary spendings and place the money you spend for it in your savings. Make saving a daily habit. Your future self will greatly thank you. You may also see activity sheet examples & samples.

Saving money is also a difficult thing to do, right? One way of making saving an easy task to set a goal. You might have something you’ve always wanted, it could be buying a car, a house, or a vacation. With that, you can determine how much is the possible total price or budget for that and from what you have come up, you can also then determine how much you need to save up within a time frame. You may also see monthly sheet examples & samples.

Have a separate saving account for your short-term goals and long-term goals. Saving in bank accounts is more efficient and you can avoid temptation better. There are a lot of banks that offer automated transfers between your checking and savings accounts so you do not have to worry or get hassled transferring your income to your saving account. Automated transfers are also one of the great ways to save money since it stops you from constantly thinking about your money and of course, thinking of you can possibly spend it for some things you do not actually need. You may also see training sheet examples & samples.

Do not just leave your budget sheet behind and make it a point to constantly check your progress every month, or daily if you have a daily budget sheet. This will help you stick to your personal savings more and that you can easily identify and fix any financial-related problems. Tracking your progress also helps you in hitting your goals easier and faster as well. You may also see assignment sheet examples & samples.

This might not be a usual thing to do but letting everyone know that you are focused on your budget works wonders as well. Getting everyone – your friends, family members, and your office mates – involved can help you maintain your budget because they will then stop inviting you out for a lunch or dinner out. Eventually, they will also be inspired by your excellent budgeting if they have not started yet. You may also see student sheet examples & samples.

Draw a line between your needs and wants. You and your budget will greatly benefit from this. You might think you need a particular thing, let’s say, a new top to wear for work, but no; you actually do not need one and you still have a lot of clothes and all you have to do is do some mix and match in order to create a new look. Necessity is being defined as an “indispensable thing” and these things are the things you need to survive, such as food, water, shelter, and clothing. It is already a want when you would acquire things more than what you actually need. You may also see task sheet examples & samples.

Additional Tips Related to Budgeting

1. As much as possible, budget before the month begins because budgets are made to be focused on the future. Planning beforehand is helpful is better than struggling to keep up with what’s behind such as your debts.

2. Be the boss of your own finances and not the other way around. You may also see score sheet examples & samples

3. Tracking every expense you make can greatly help your budget in ways you cannot imagine.

4. Create a miscellaneous category because no matter how you budget your finances, there will always be instances when some things come up and you have to spend extra. Having a miscellaneous money category makes you ready for whatever those extra things are. You may also like bid sheet examples & samples

5. Even if budgeting is never a fun activity, for the record, you better start budgeting for fun so that you would not feel too burdened with budgeting. Just keep in mind that you can benefit so much from budgeting.

6. Update your budget sheet every month. Your budget sheet categories can stay as it is but there are some months when your categories will increase or decrease in number. Life has always been unpredictable so try to review and keep updating your budget on a monthly basis. You may also check out training sheet examples & samples

2 Reasons Why Keeping a Budget Is Important

There are a lot of reasons why keeping a budget is very important but these two are enough to convince you to start saving now:

1. Keeping a budget helps you in creating a clearer and better financial picture.

You can now manage your finances well. This means no more debts and you are also more prepared for whatever possible sudden expenses you will have in the future. You may also see instruction sheet examples & samples.

2. Keeping a budget helps you save money easier.

Since you now have included savings as one of the categories of your budget sheet, you can now easily save and you will save as if your life depends on it. You may also like fact sheet examples & samples.

We hope you have learned a lot about budgeting from this article. Start budgeting now!

23+ Budget Sheet Examples to Download

Even if budgeting gets tedious, taking the time to manage your finances can really pay off in the long run. It has so many benefits and one remarkable benefit is that it can help you save up for whatever you want to spend on or pay off in the future such as emergencies, debts, travel expenses, the things you’ve always wanted to buy, and even your pension. You may also see task sheet examples & samples.

23+ Budget Sheet Examples

Budget Spreadsheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Event Planning Budget Worksheet

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Household Budget Worksheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Home Budget Worksheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Family Budget Worksheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

Size: A4 & US

Budget Worksheet Form Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Simple Budget Spreadsheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Wedding Budget Worksheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Budget Worksheet Template

Details

File Format

MS Word

Pages

Google Docs

Google Sheets

Numbers

MS Excel

PDF

Size: A4 & US

Budget Sheet Template

Details

File Format

Google Docs

Google Sheets

MS Excel

MS Word

Numbers

Pages

Size: US, A4

Church Budget Worksheet

Details

File Format

Google Docs

Google Sheets

MS Excel

MS Word

Numbers

Pages

Size: A4, US

Monthly Budget Worksheet Example

Details

File Format

Google Docs

Google Sheets

MS Excel

MS Word

Numbers

Pages

Size: A4, US

Since budgeting can get difficult times, you may need a tool that can help you control and manage your finances. One of such tools is budget sheets. Read on to see the budget sheet examples that we have provided for you in this article as well as some tips on how to set up and stick to your budget. You may also like job sheet examples & samples.

Sample Event Budget Sheet

alz.to

Details

File Format

PDF

Size: 440.1 KB

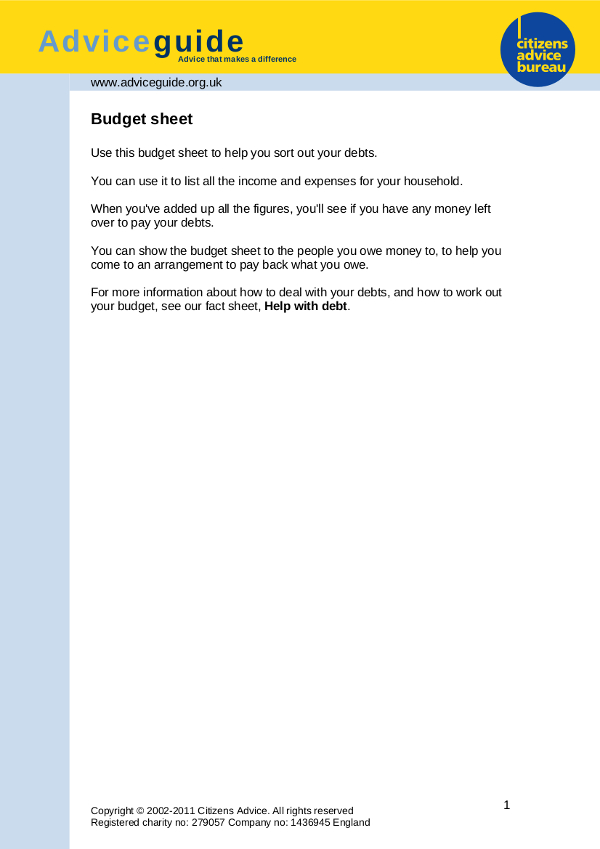

Budget Sheet

citizensadvice.org.uk

Details

File Format

PDF

Size: 42.3 KB

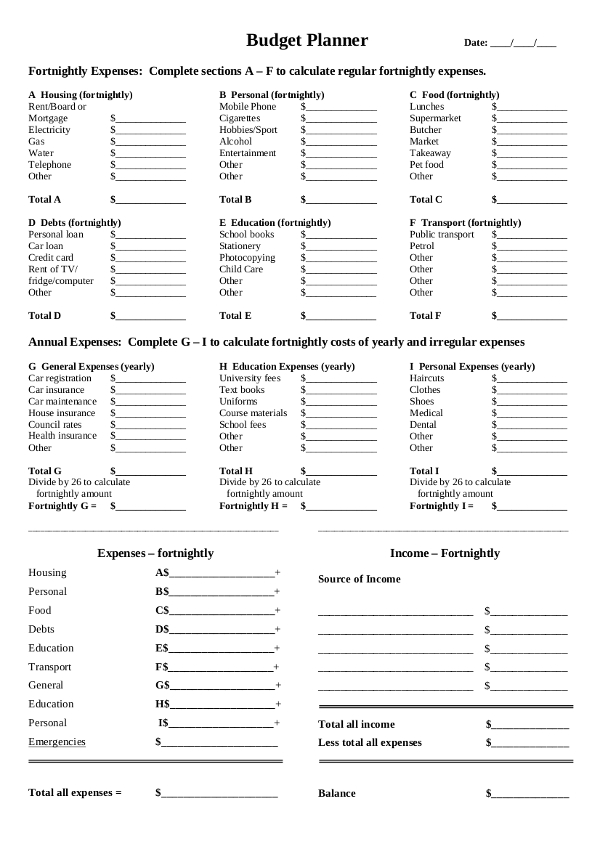

Budget Planner Sheet

utas.edu.au

Details

File Format

PDF

Size: 78.3 KB

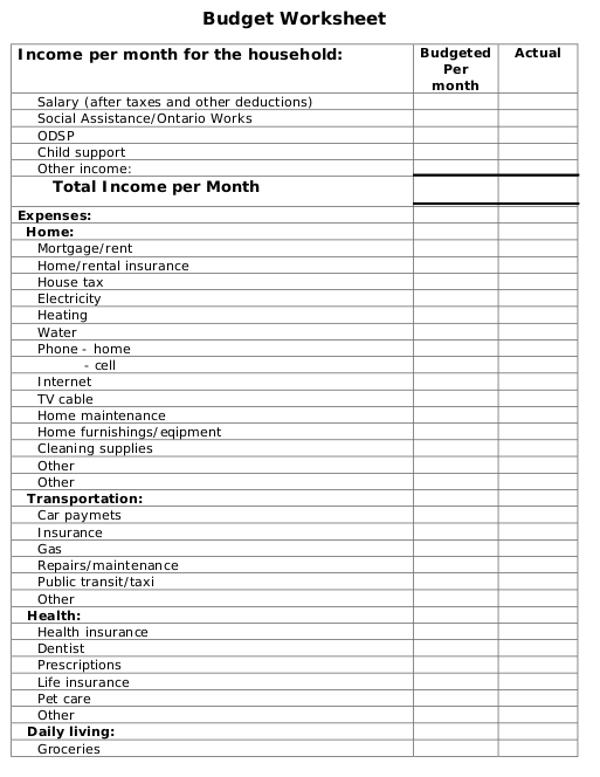

Sample Budget Sheet

svdptoronto.org

Details

File Format

PDF

Size: 27.8 KB

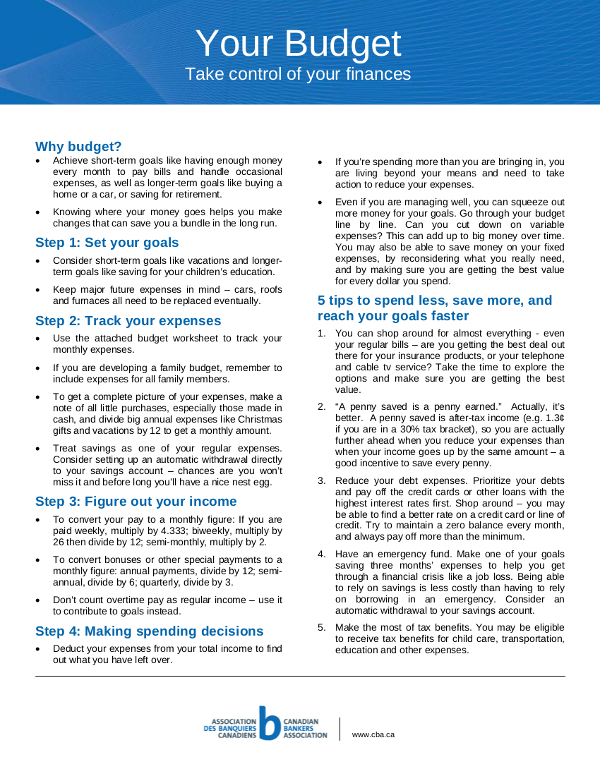

Budget Sheet Example

cba.ca

Details

File Format

PDF

Size: 67.6 KB

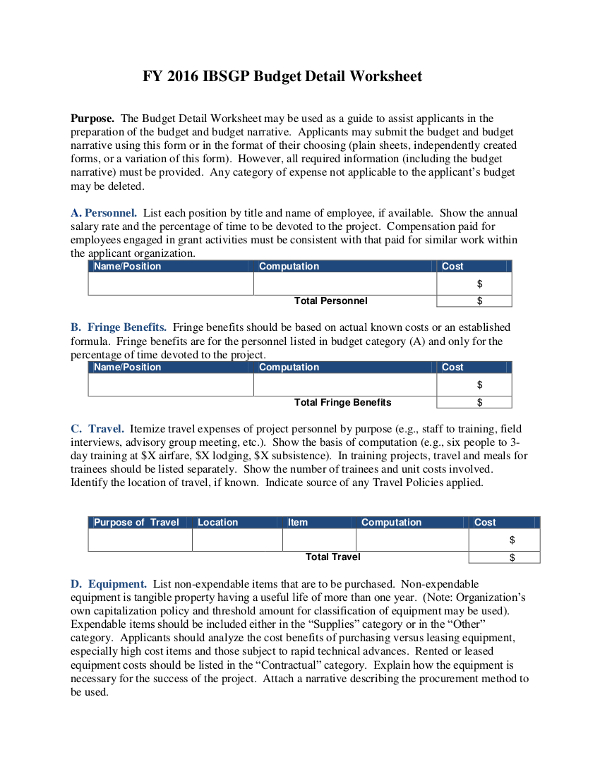

Detailed Budget Sheet

fema.gov

Details

File Format

PDF

Size: 172.5 KB

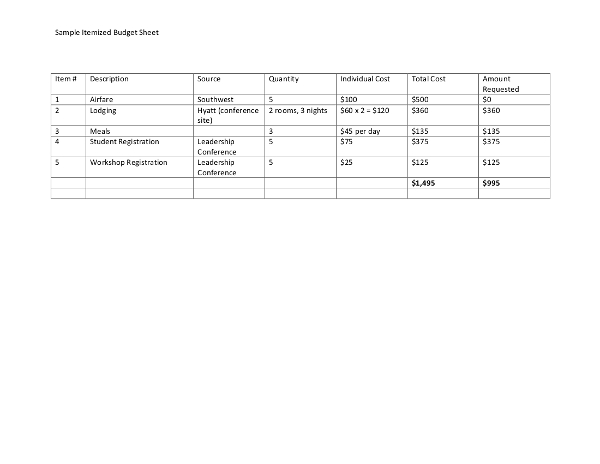

Sample Itemized Budget Sheet

evc.edu

Details

File Format

PDF

Size: 60.6 KB

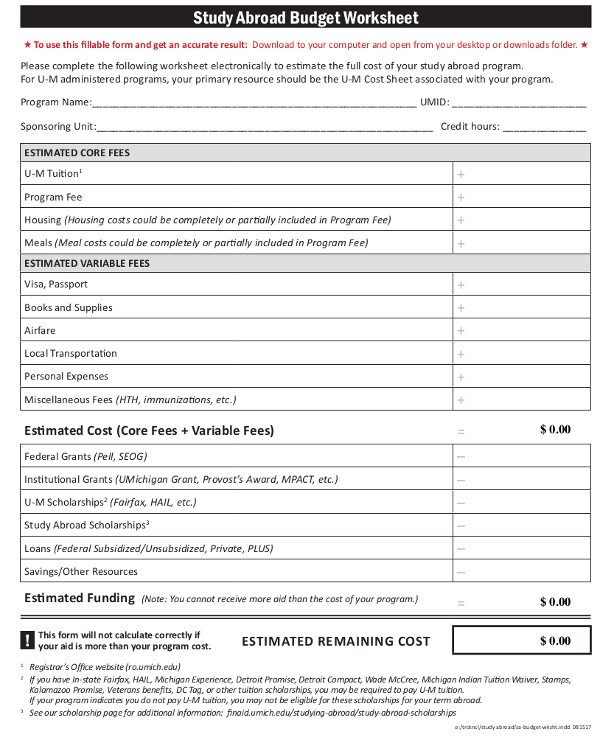

Study Abroad Budget Worksheet

finaid.umich.edu

Details

File Format

PDF

Size: 190.7 KB

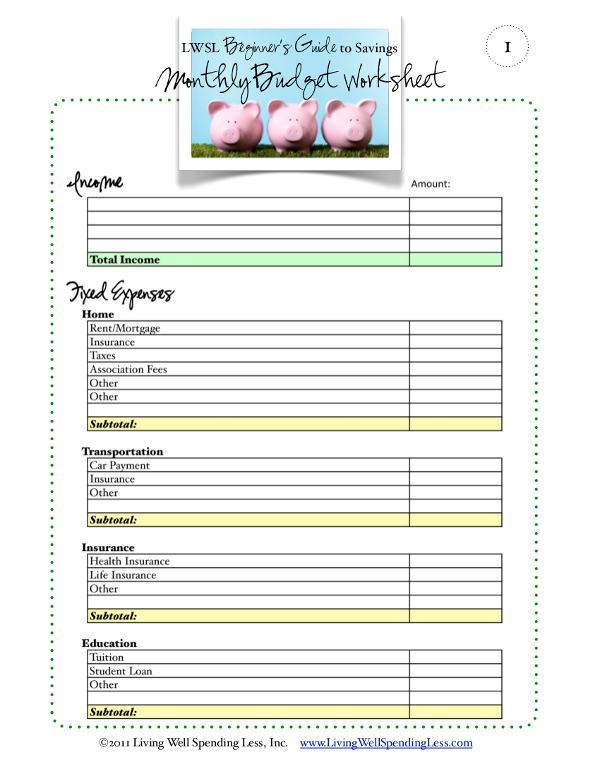

Monthly Budget Worksheet

livingwellspendingless.com

Details

File Format

PDF

Size: 1.1 MB

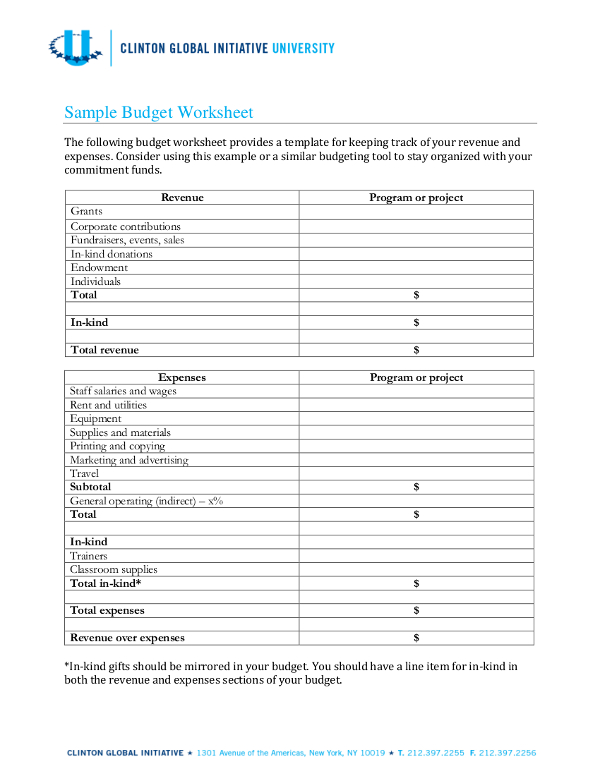

Sample Budget Worksheet

clintonfoundation.org

Details

File Format

PDF

Size: 179.7 KB

Tips and Tricks Related to Budgeting

What’s the use of budget sheets if you do not know how to budget and that you do not know how to maintain and stick to your budget? With that, here are some tips on how you can budget your personal finances or your business finances:

Recording your expenses is the best first step you should take when budgeting. You should record even the cheapest thing you bought, yes, even that one piece of candy. You are accountable for every single cent and penny you buy. Once you have recorded everything, you should organize it by category so you will have a clearer picture of what are you usually spending your money on and how you can manage it.

Since you now have an idea of what you spend your money on, you can now begin to organize your recorded expenses into your budget sheet. You should then determine how your budget can able to outline how your expenses sum or measure up to your income. You might notice some categories that you usually would be spending and this can help you limit overspending. In addition to your monthly expenses, be sure to factor in expenses that occur regularly but not every month, such as car maintenance. Find more information about creating a budget. You may also see overtime sheet examples & samples.

Now that you’ve made budget categories, you may also include a savings category because for sure, you have not saved anything at all. Now that you have also identified what are the categories you would usually overspend on, you can also identify what are the expenses you should cut and put all those in your savings.

You may have had a lot of non-essential expenses such as such as mindless shopping, entertainment, and dining out. End all those unnecessary spendings and place the money you spend for it in your savings. Make saving a daily habit. Your future self will greatly thank you. You may also see activity sheet examples & samples.

Saving money is also a difficult thing to do, right? One way of making saving an easy task to set a goal. You might have something you’ve always wanted, it could be buying a car, a house, or a vacation. With that, you can determine how much is the possible total price or budget for that and from what you have come up, you can also then determine how much you need to save up within a time frame. You may also see monthly sheet examples & samples.

Have a separate saving account for your short-term goals and long-term goals. Saving in bank accounts is more efficient and you can avoid temptation better. There are a lot of banks that offer automated transfers between your checking and savings accounts so you do not have to worry or get hassled transferring your income to your saving account. Automated transfers are also one of the great ways to save money since it stops you from constantly thinking about your money and of course, thinking of you can possibly spend it for some things you do not actually need. You may also see training sheet examples & samples.

Do not just leave your budget sheet behind and make it a point to constantly check your progress every month, or daily if you have a daily budget sheet. This will help you stick to your personal savings more and that you can easily identify and fix any financial-related problems. Tracking your progress also helps you in hitting your goals easier and faster as well. You may also see assignment sheet examples & samples.

This might not be a usual thing to do but letting everyone know that you are focused on your budget works wonders as well. Getting everyone – your friends, family members, and your office mates – involved can help you maintain your budget because they will then stop inviting you out for a lunch or dinner out. Eventually, they will also be inspired by your excellent budgeting if they have not started yet. You may also see student sheet examples & samples.

Draw a line between your needs and wants. You and your budget will greatly benefit from this. You might think you need a particular thing, let’s say, a new top to wear for work, but no; you actually do not need one and you still have a lot of clothes and all you have to do is do some mix and match in order to create a new look. Necessity is being defined as an “indispensable thing” and these things are the things you need to survive, such as food, water, shelter, and clothing. It is already a want when you would acquire things more than what you actually need. You may also see task sheet examples & samples.

Additional Tips Related to Budgeting

1. As much as possible, budget before the month begins because budgets are made to be focused on the future. Planning beforehand is helpful is better than struggling to keep up with what’s behind such as your debts.

2. Be the boss of your own finances and not the other way around. You may also see score sheet examples & samples

3. Tracking every expense you make can greatly help your budget in ways you cannot imagine.

4. Create a miscellaneous category because no matter how you budget your finances, there will always be instances when some things come up and you have to spend extra. Having a miscellaneous money category makes you ready for whatever those extra things are. You may also like bid sheet examples & samples

5. Even if budgeting is never a fun activity, for the record, you better start budgeting for fun so that you would not feel too burdened with budgeting. Just keep in mind that you can benefit so much from budgeting.

6. Update your budget sheet every month. Your budget sheet categories can stay as it is but there are some months when your categories will increase or decrease in number. Life has always been unpredictable so try to review and keep updating your budget on a monthly basis. You may also check out training sheet examples & samples

2 Reasons Why Keeping a Budget Is Important

There are a lot of reasons why keeping a budget is very important but these two are enough to convince you to start saving now:

1. Keeping a budget helps you in creating a clearer and better financial picture.

You can now manage your finances well. This means no more debts and you are also more prepared for whatever possible sudden expenses you will have in the future. You may also see instruction sheet examples & samples.

2. Keeping a budget helps you save money easier.

Since you now have included savings as one of the categories of your budget sheet, you can now easily save and you will save as if your life depends on it. You may also like fact sheet examples & samples.

We hope you have learned a lot about budgeting from this article. Start budgeting now!