19+ Budget Worksheet Examples to Download

Admit it: even if budgeting is the most basic and effective way to manage one’s finances, it is the hardest thing to do and people would even avoid doing it altogether. Budgeting has this connotation that gives you the feeling of being limited on doing something that you really want to do, specifically shopping and splurging for things that you think you need.

But despite that, you know what budgeting really does to your finances. You know how helpful budgeting can be when you would be allocating your money to important expenses such as food and utilities. Budgeting also helps you keeps from swimming in debt. Although budgeting has a connotation which limits us from enjoying the things we want, the things we need are much more important and budgeting allows us not to spend our money on temporary bliss.

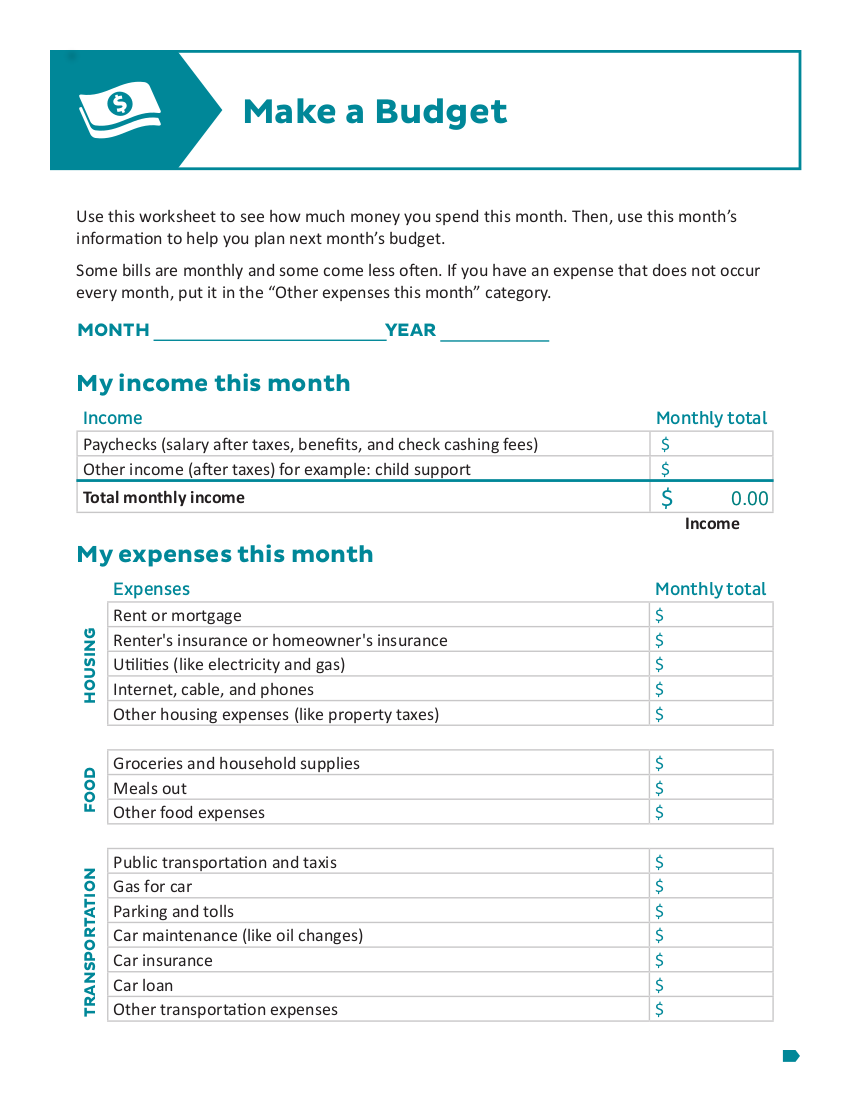

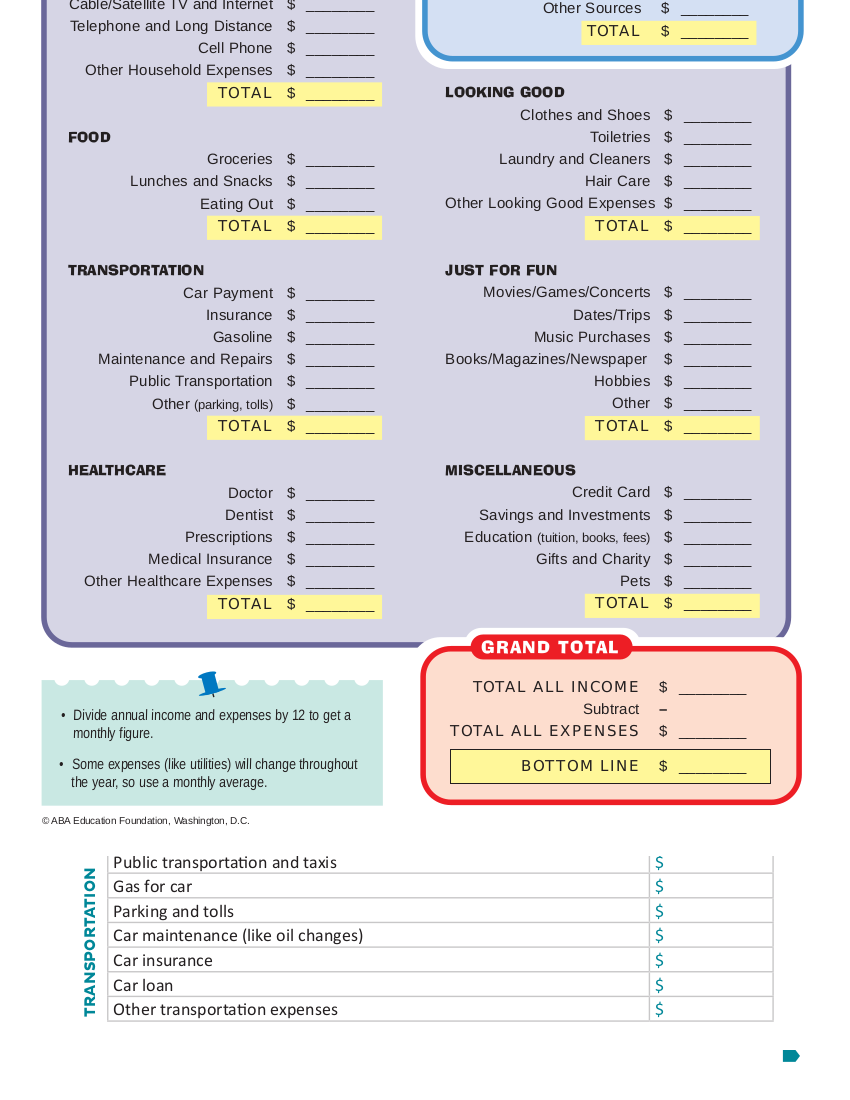

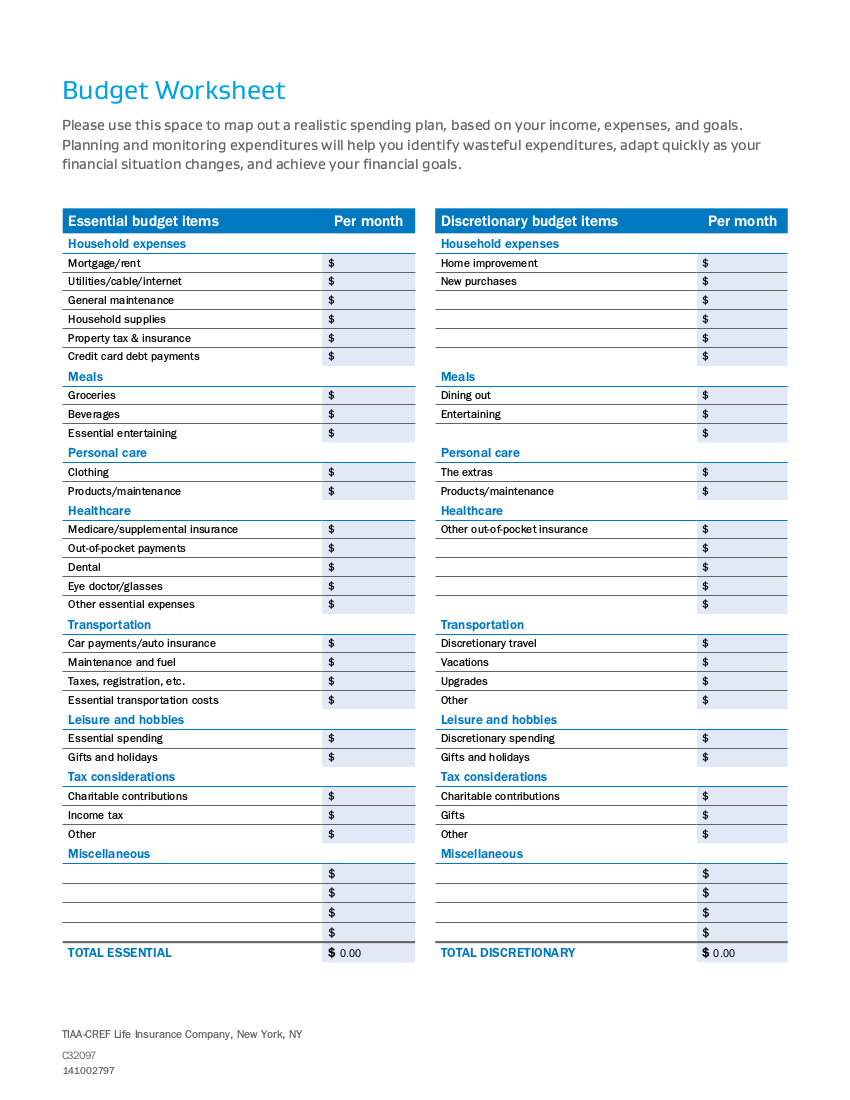

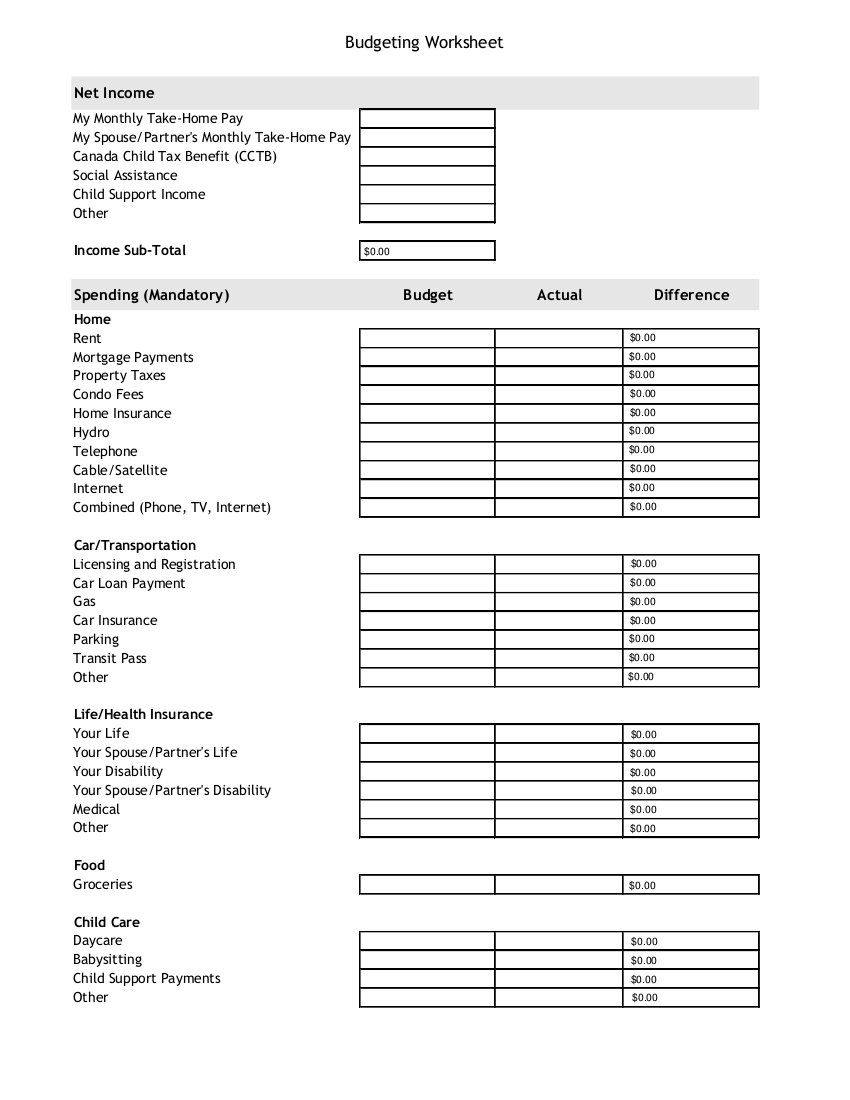

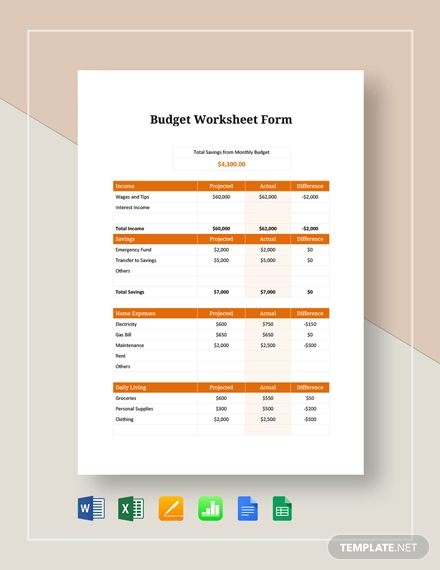

Budget Worksheet Template

Budget Worksheet Form Template

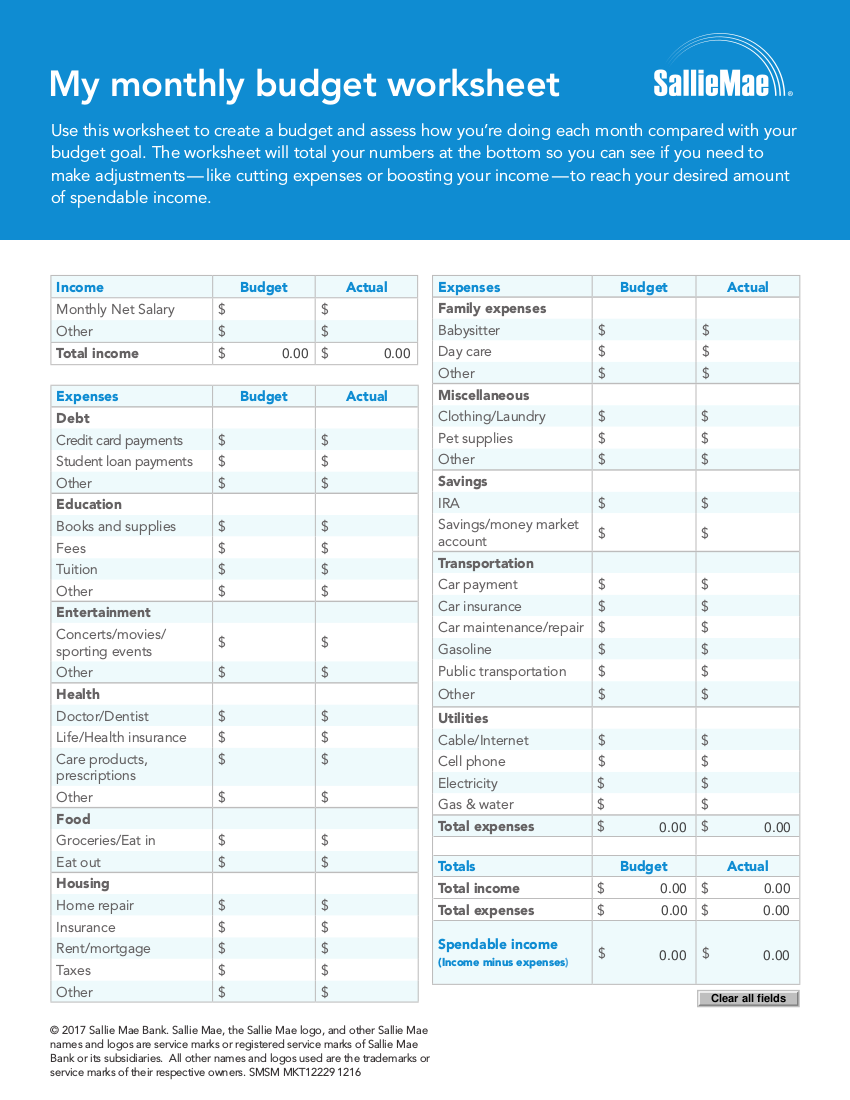

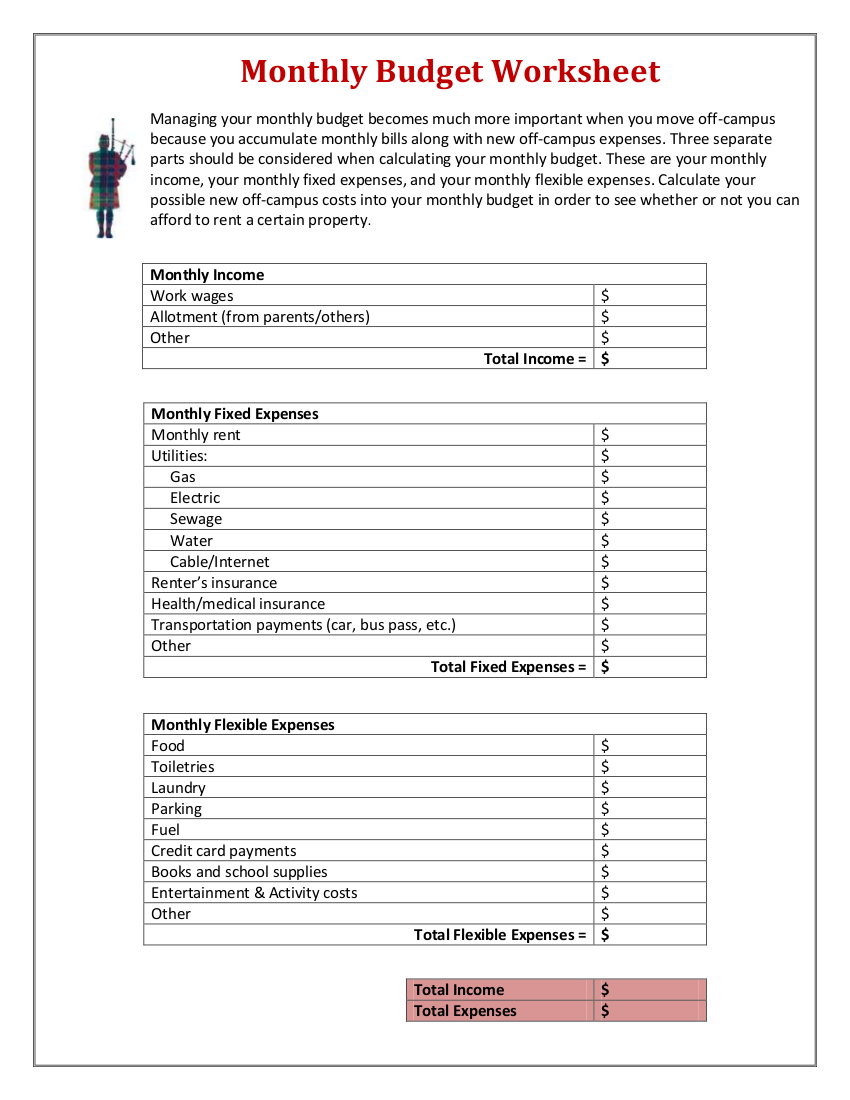

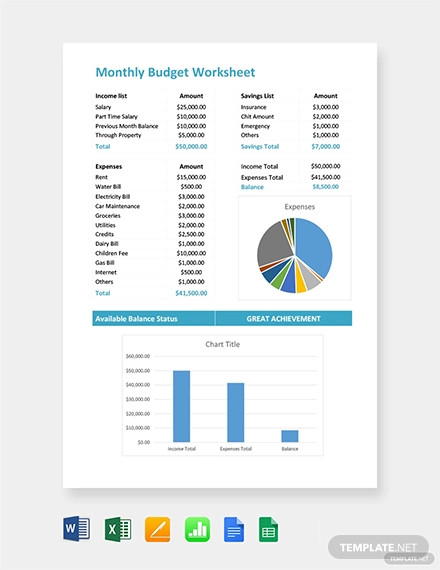

Monthly Budget Worksheet Example

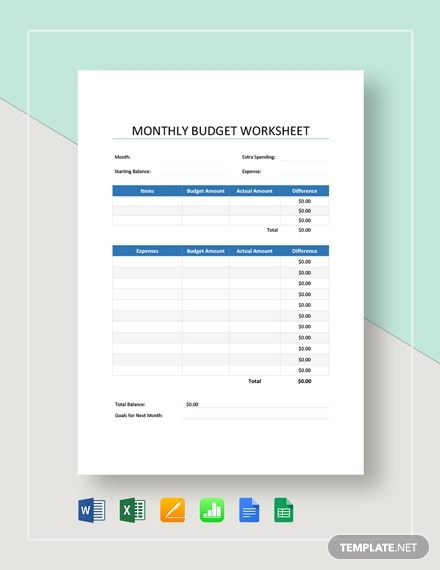

Simple Monthly Budget Worksheet Template

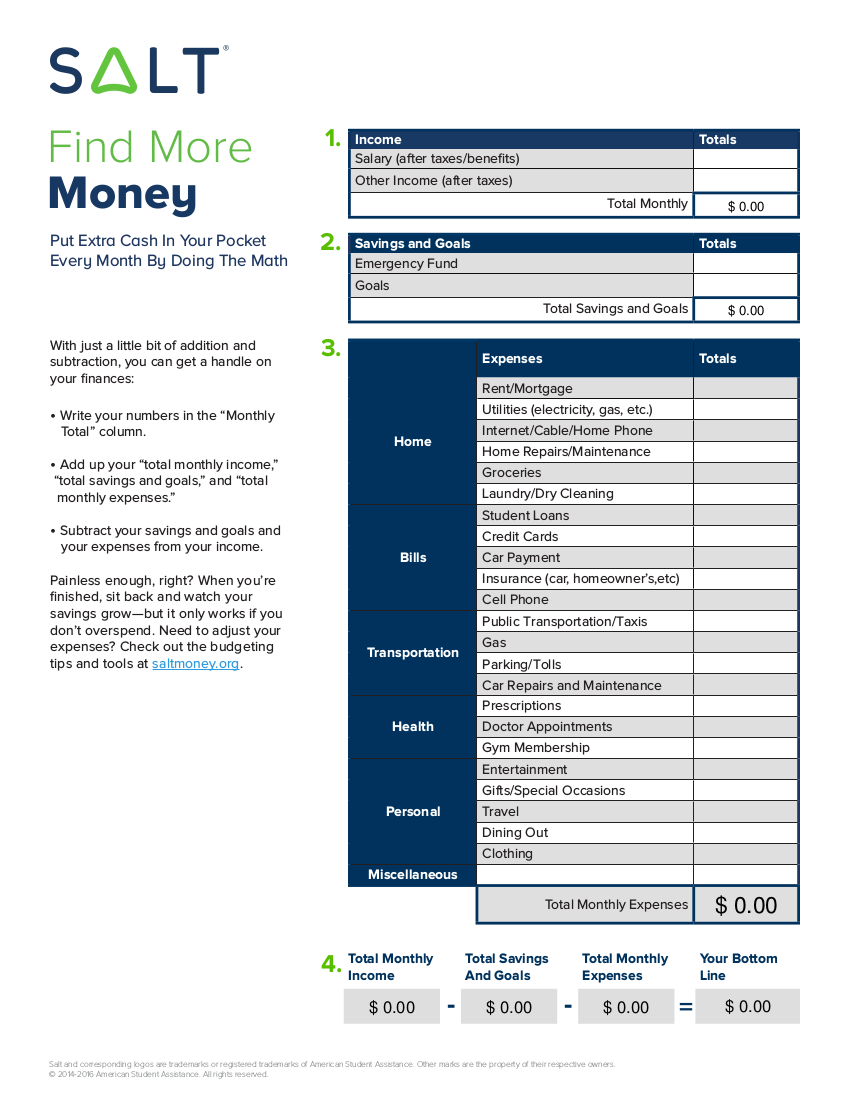

Budgeting, in all honesty, can be really difficult. There are some people who do not have the capacity to control themselves. There are a lot of solutions to that dilemma and one of them is using budget worksheets. In this article, we will be providing you 16 examples of budget worksheets that will inspire and also assist you in creating an effective budgeting plan.

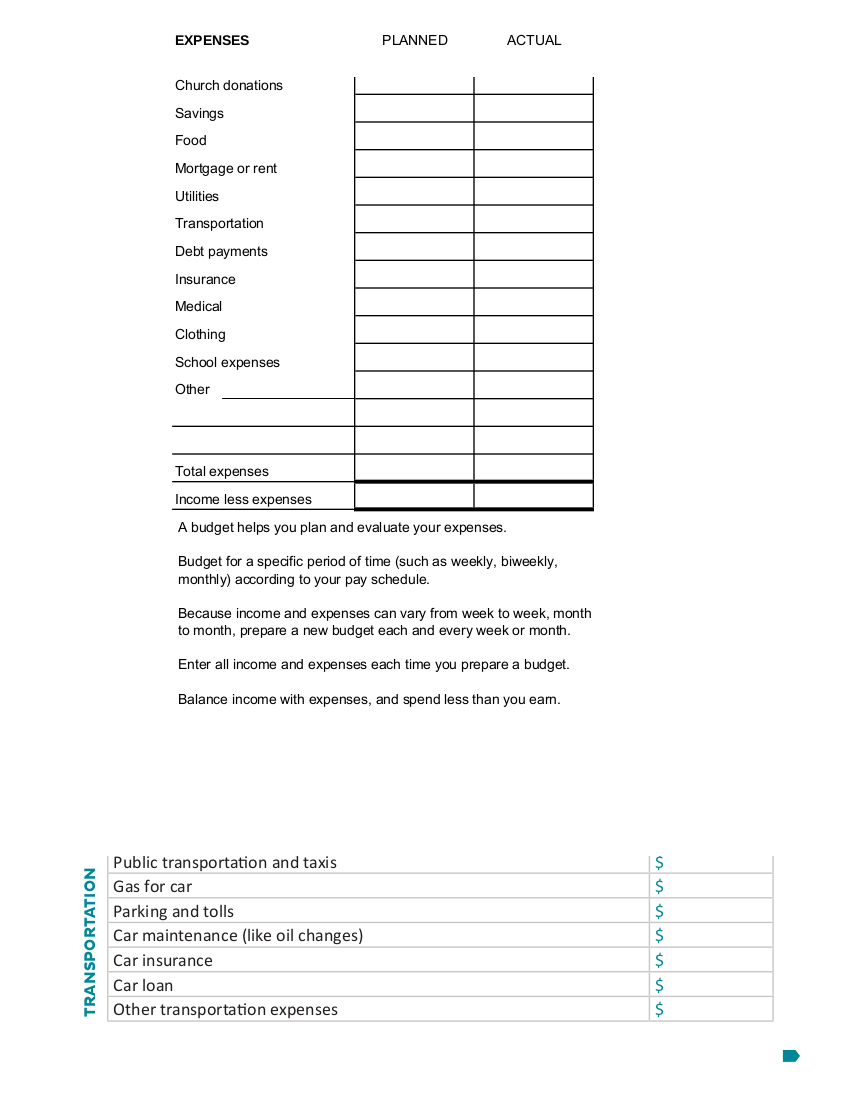

How to Complete Your Budget Worksheet

Here are some tips and steps on how to complete a simple budget worksheet.

Before starting on your worksheet, you have to gather all important financial-related data (i.e. salary/income, bills and planned expenses for the month/year) so you will be able to have an accurate estimate of your expected spending.

If you are making a monthly budget, determine first the total amount that you are going to spend the entire month. Divide your sheet into columns. One example would be listing down all the possible expenses you will be incurring in the first column, listing your allocated budget for each item in the second column, and listing the actual amount that you spent in the third column. The third column helps you keep track of what you are spending and helps you avoid the same financial mistakes in the succeeding months. You may also see 10 Budget Plan Examples & Samples.

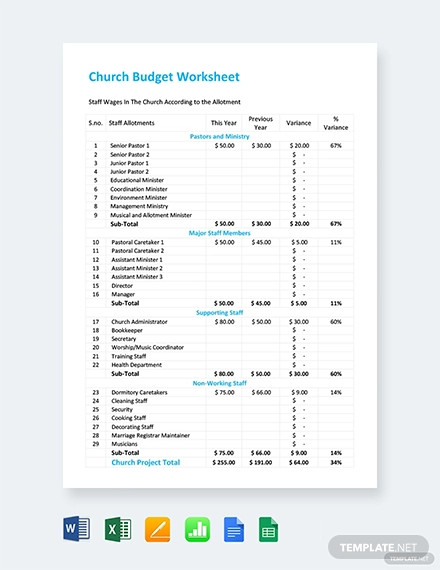

Church Budget Worksheet

Worksheet for Making a Budget Example

Colorful Budget Worksheet Example

Simple Budget Worksheet Example

Sample Budget Worksheet Example

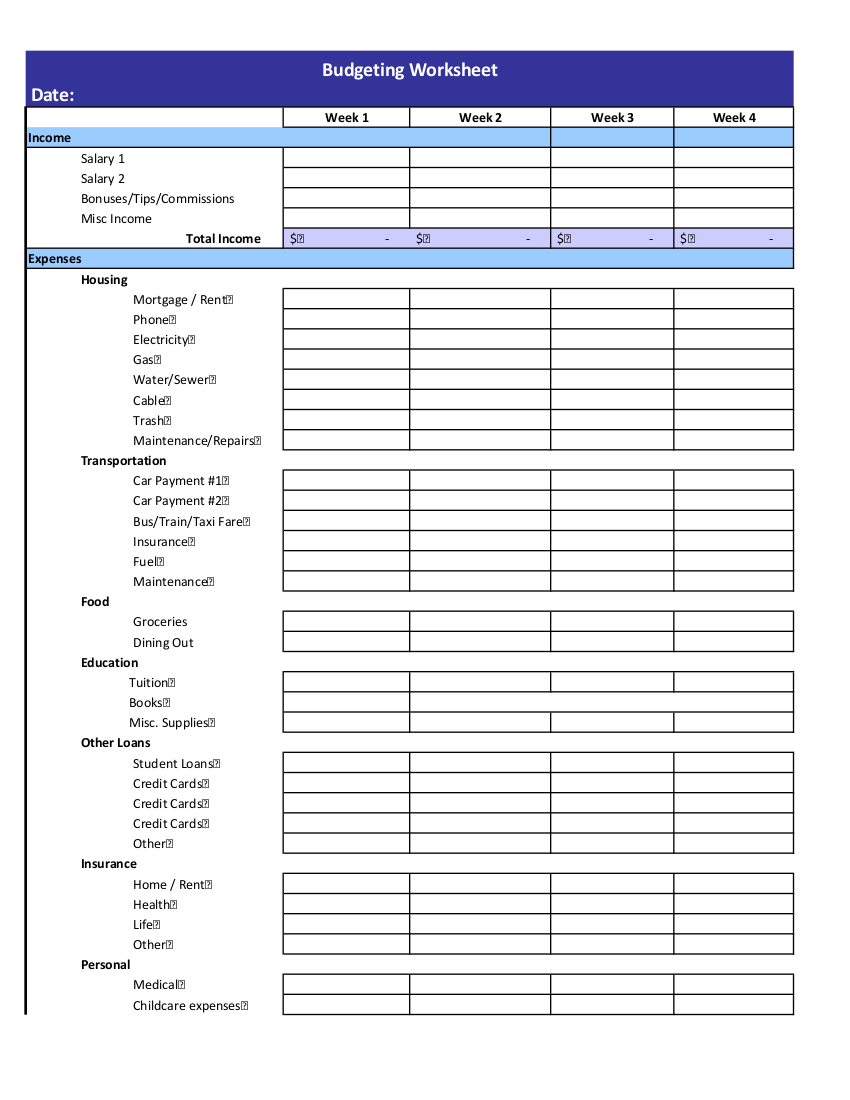

Budgeting Worksheet Example

Monthly Budget Worksheet Example

Budget Worksheet Sample

Sample Monthly Budget Worksheet

6 Different Kinds of Budget

1. Time-based Budget

A time-based budget is something that you can track within a specific time frame. It could be a weekly budget, a monthly budget, or a yearly budget. You may also want to know what a Profit and Loss Budget is.

Weekly budget

This kind of budget is helpful for those who get paid on a weekly basis. The things typically spent from a weekly budget are usually groceries, transportation fares, and night outs with family or friends. You may also see 10 Human Resource Budget Examples.

Monthly budget

Having a monthly budget is the usual way of how most people would be tracking their money since most are paid on a monthly or bi-monthly basis. The priority monthly expenses include rent and utility expenses as well as expenses for house or vehicular repairs. Having a monthly budget enables you to have an overview of all the things you need to pay or buy for on a monthly basis. You may also know How to Set Up Your Entire Marketing Budget.

Yearly budget

Having a yearly budget will give you an overview of what months of the year where you need to have an extra budget. Take for example the holidays where you need to have an extra budget for food, gifts and travel. For travel expenses, you don’t only need a budget for your fare but as well as for food, fare and shopping. A yearly budget also enables you with your long-term expenses, such as when you are purchasing a new house or new car. You may also see How to Prepare a Nonprofit Grant Proposal Budget.

2. Cash-only budget

If you want to balance your bills at home, this kind of budget will surely help you. A cash-only budget means, as the term suggests, that you would only use cash when paying your bills and other things that you would have to spend for. The use of credit/debit cards and checks are not allowed. This kind of budget is a low-maintenance way that can help you in keeping track of your spending and in reaching your financial goals. You may also see 8 Bi-Weekly Budget Examples & Samples.

3. Bare bones budget

This kind of budget is a plan for your most basic necessities in life. And by “most” basic, it means your food, shelter, clothing and, transportation. This kind of budget can also be helpful as a backup plan when unexpected events happen such as getting laid off from a job unexpectedly, having a medical emergency or experiencing a death in the family. A bare bones budget will help you in surviving such cases. You may also see 15 Personal Budget Examples & Samples.

4. Special events budget

We all know that special events mean you have to be extra special, and by being extra special, you need to cash out. Such special events could be a birthday, wedding, a baby shower, graduation ceremony, and other annual or once in a lifetime events. Creating a budget for these kinds of events can be tricky, so make sure you take your time and consult with other individuals who are involved in the event. You may also see 11 Event Budget Examples.

5. Irregular income budget

Those who have irregular income are those who are freelancers and those who work a part-time job to support their daily expenses. It can be quite difficult for them to pay their bills since their income flow is not consistent and they don’t usually have fixed dates on when they will be receiving their salaries.

6. Cash flow budget

One way to streamline your finances is to have a cash flow budget. A cash flow budget is defined as an estimate of all the cash receipts and all cash expenditures that are expected to occur in business operations during a particular time period. These estimates can be derived from the business on a monthly, bimonthly, or quarterly basis. You may also see 7 Budget Proposal Examples.

Household Budgeting Worksheet Example

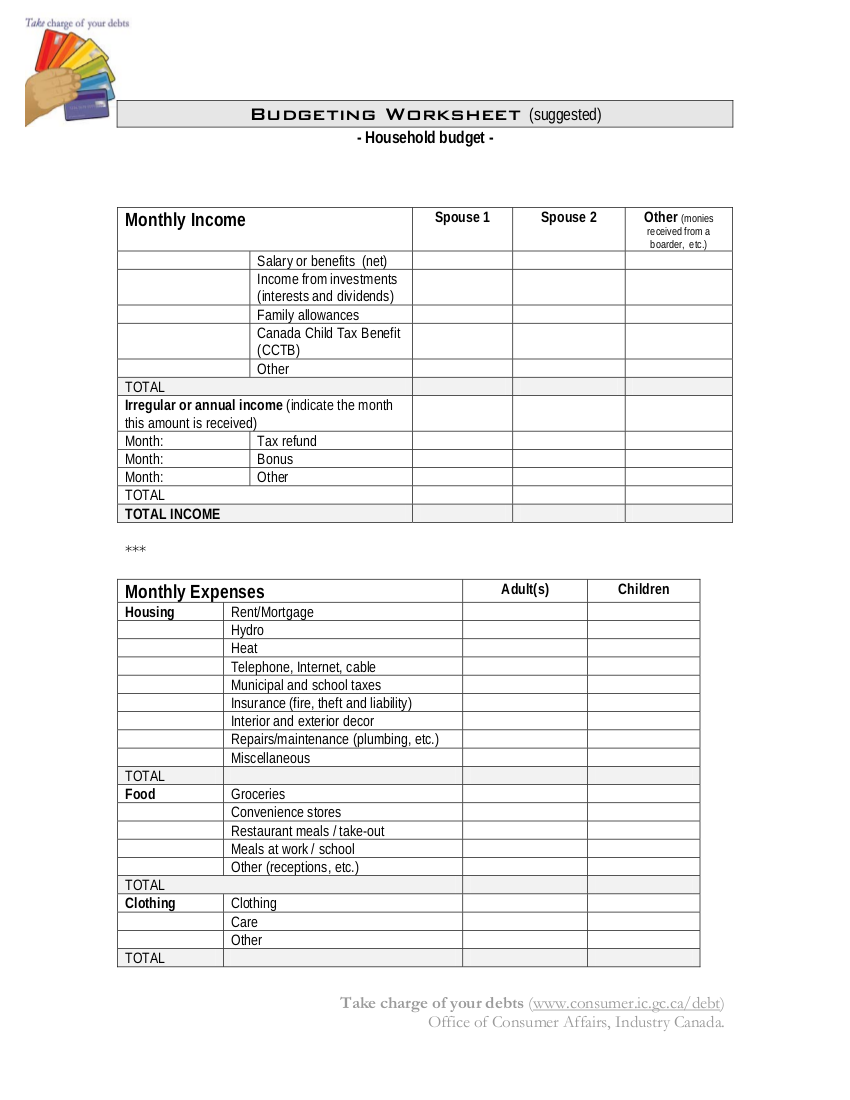

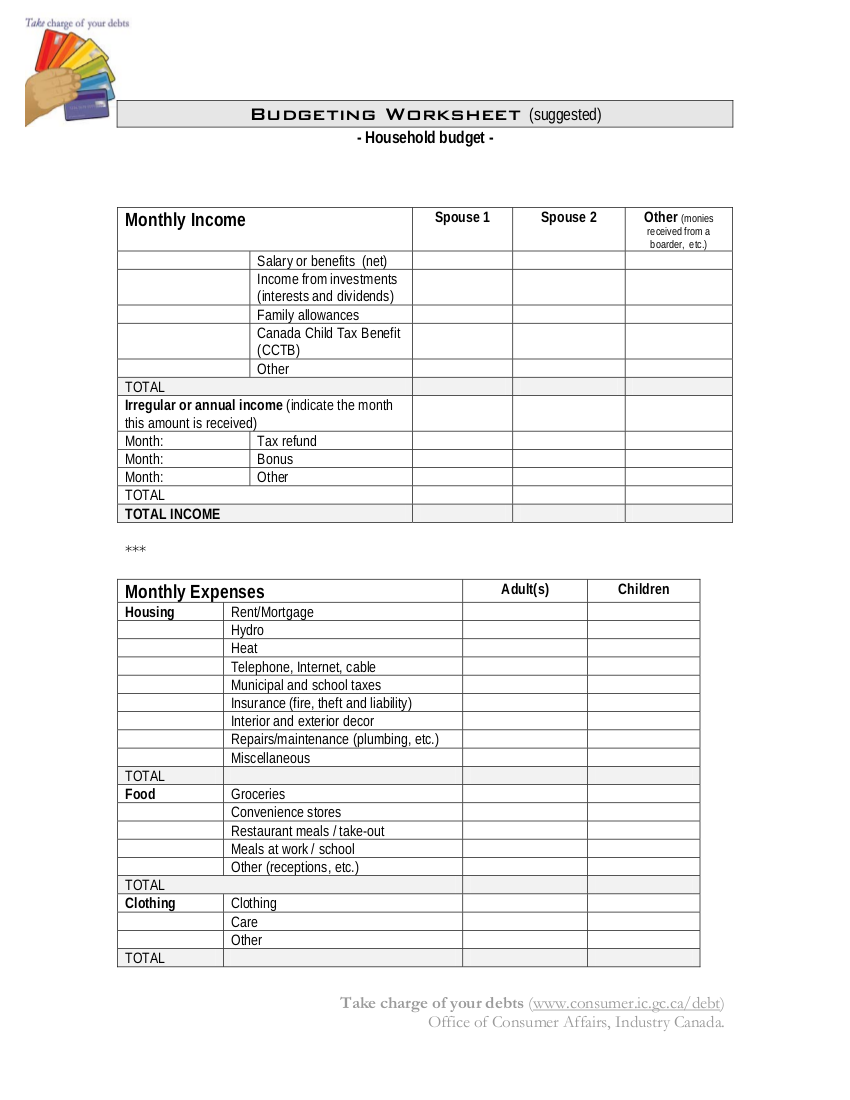

Suggested Budgeting Worksheet Example

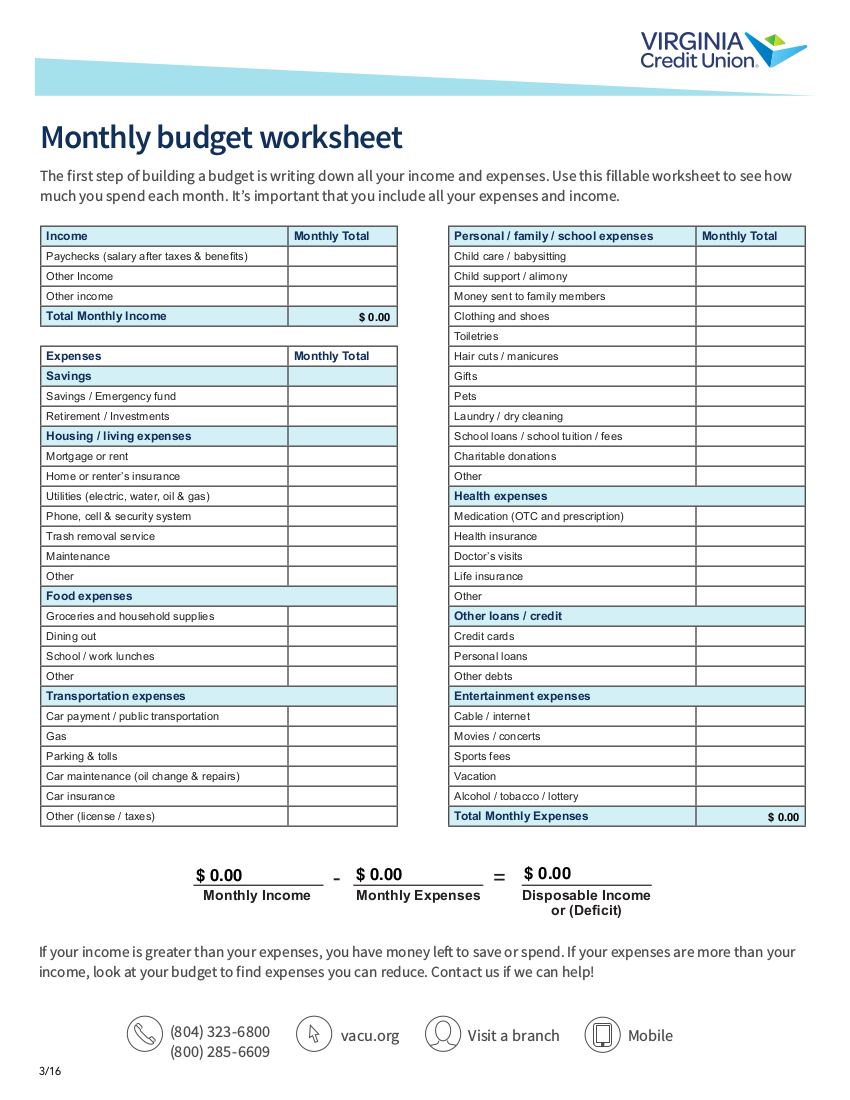

Monthly Budget Worksheet Example

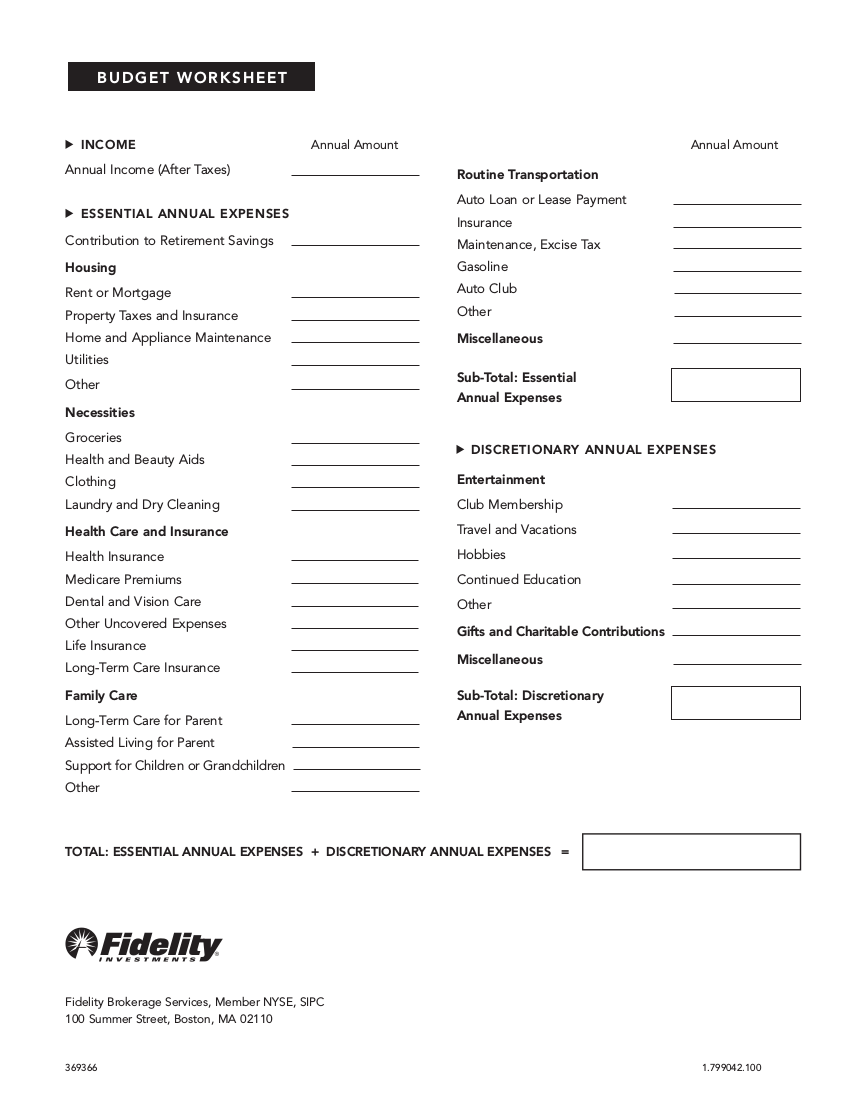

Budget Worksheet Example

Sample Budget Worksheet Example

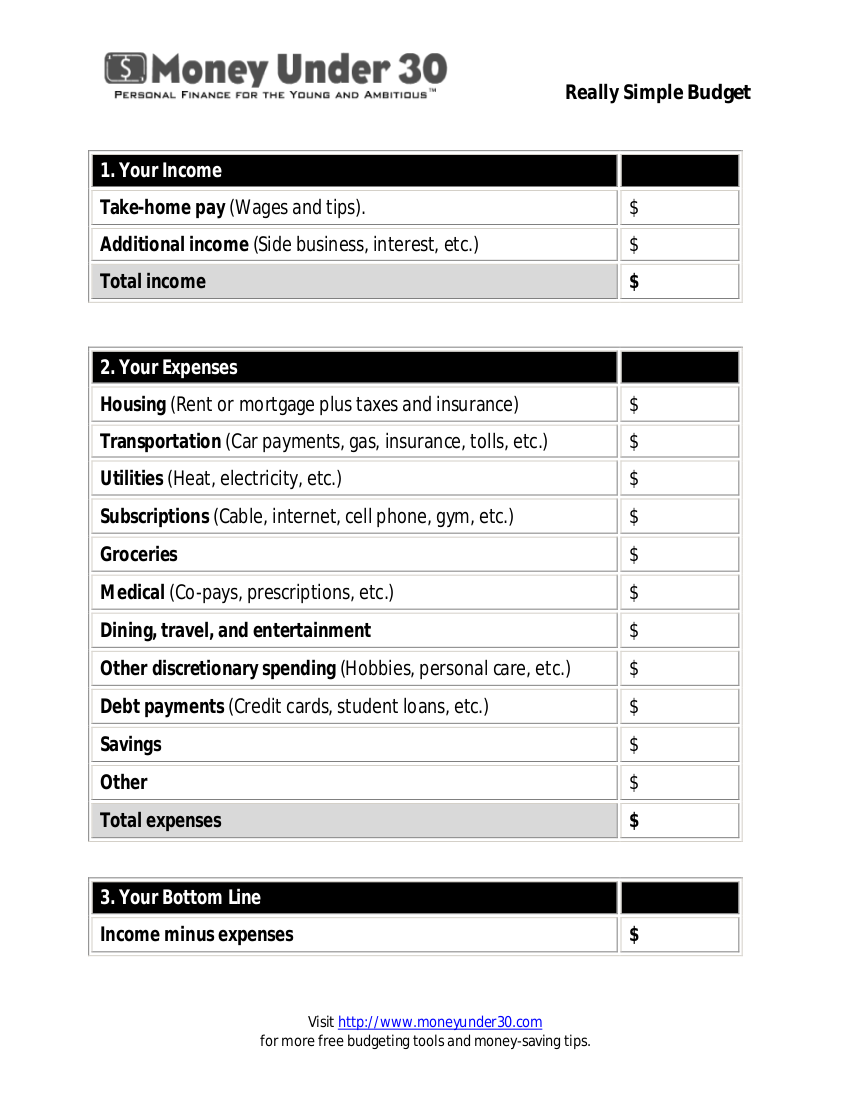

Really Simple Budget Worksheet Example

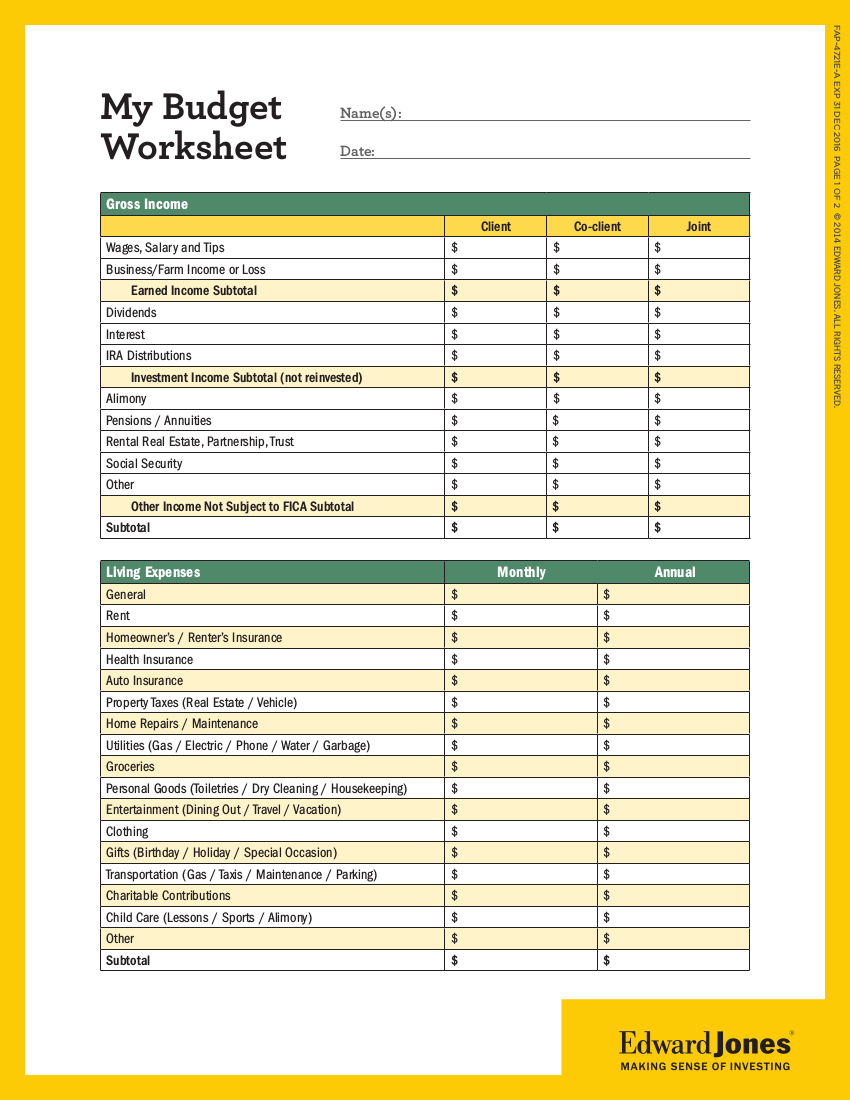

Personal Budget Worksheet Example

Importance of Keeping a Budget

Whether you’re a student, parent, senior citizen, factory worker, engineer, or doctor, budgeting is very important and should not be avoided at all costs. Here are four reasons why keeping a budget is important:

It helps you create a better financial picture

In creating a budget, you will be putting all of your income and expenses into one document so that you will be able to create a clear financial plan.

Having a clear financial plan will help you manage your finances well. You will also be able to allocate a budget for all your expenses such as bills, basic needs, and other items you want to purchase. Budgeting also enables you to save up for your emergency funds as well as retirement.

It helps you save money

Even if you receive a salary that can help you in making ends meet, budgeting will help you save money. When completing a budget worksheet, you segregate your expenses into groups or categories for easier analysis of your budget plan. You can also include savings in your budget worksheet, such as savings for long-term expenses (i.e. retirement fund, emergency fund, college fund, vacation fund, etc.). With a good budget, you will be able to save not just for the present but also for the future.

It projects (realistically) your current situation

Having a budget will enable you to assess your current situation with a more realistic and practical view. If your monthly income is just enough for spending for basic needs, your budget will reveal that. Do not act like a millionaire and just spend your income on irrelevant things. This is when the saying “live within your own means” comes into play.

We hope you have learned a lot about budgeting and that the examples of budget worksheets we have provided will help you in your budgeting plan.