6+ Small Business Budget Examples to Download

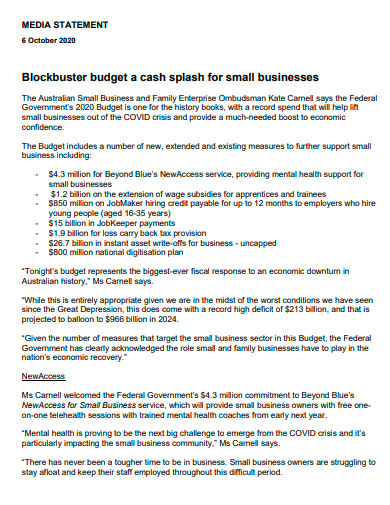

Are you planning to open a cute pastel restaurant? Or perhaps do you already have a relaxing cafe that plays acoustic music that would serve as a resting place for busy people? Whether you are still in the process of planning or you are reassessing your small business plan, there is a complicated hurdle that you need to jump through. This complex step is setting your budget plan. Calculating and budgeting for your business, may it be a big business or a small one, is just as crucial. Make sure to take everything into account by generating a plan for your small business budget.

6+ Small Business Budget Examples

1. Small Business Budget Example

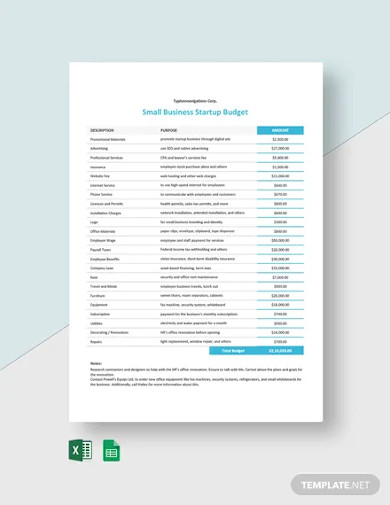

2. Small Business Startup Budget

3. Printable Small business Budget

4. Small Business Budget Marketing

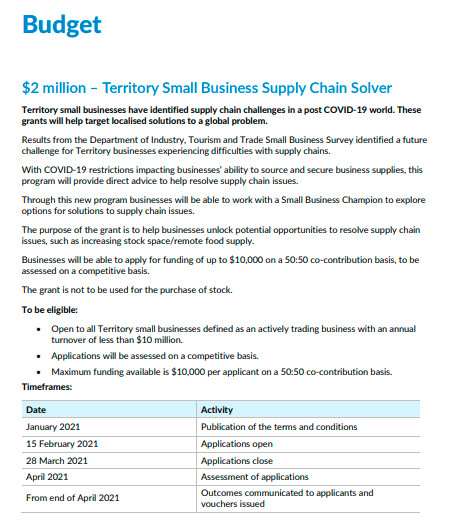

5. Territory Small Business Budget

6. Editable Small business Budget

7. Professional Small Business Budget

What Is a Small Business Budget?

A small business budget is a document that highlights where your business budget goes. It includes calculating income and expenses from numerous components of your business. Your budget plan will help you evaluate the cash flow, as well as determine the profit of your small business. In addition, it will also help you decide where to spend your cash to boost the growth of your business.

How To Plan for Your Small Business Budget

Money goes in and out of the doors of a business. That said, it is necessary to have complete and accurate knowledge of where the money goes and where you should spend it. It would not be an exaggeration to say that your business budget plan is a decisive factor in your business’ success rate. Every step and process you undergo in developing your business will involve money. Ensure to undergo this strategic planning meticulously.

1. Total Your Business Income

The first step in this process is to take the sum of all the income of your business. Consider all the money your business is raking in by consulting all the appropriate statements and financial reports involved. If you are still planning or starting your business, you can base it on the average revenues of small businesses with similar nature as yours.

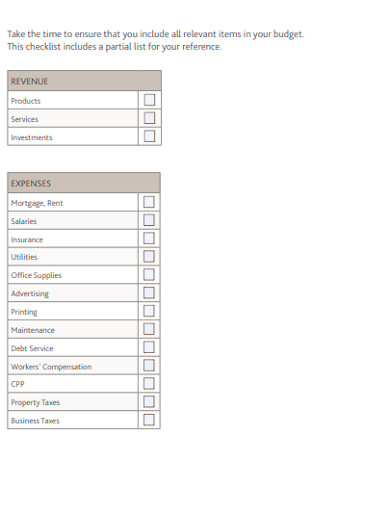

2. Calculate Your Expenses

After totaling your income, you should start calculating your business expenses, both fixed and variable. Your fixed expenses that stay consistent no matter the circumstances include your monthly rent, utility bills, insurance, as well as other payments for legal services. On the other hand, the operating expenses that can change depending on the situation include your small business inventory, raw materials, credit card fees, shipping fees, and packaging fees.

3. Set Aside Your Emergency Fund

Emergencies come unexpectedly. The tricky thing about this step is you have no idea when it might need it. In addition, you also would not know how much you will need to save for it. That said, it is advisable to save up gradually. Despite that, you should aim to set aside enough money to fund your emergency action plan. This step is a smart move to avoid potential risks that emergencies can cause your small business.

4. Draft Your Budget Plan

Now that you have the necessary figure and data to start calculating, the next step is to draft your budget plan. You can not finalize your budget instantly. You need to undergo a lengthy process of readjusting and revising. In addition, you should also choose a small business worksheet or budget sheet that you think would work best for you.

FAQs

What are the various methods of budgeting?

There numerous business ventures with varying natures and sizes. That said, there are also different budgeting methods to calculate their costs and expenses. These methods include zero-based budgeting, incremental budgeting, activity-based budgeting, and value proposition budgeting. Each of these types has its advantages and disadvantages. That said, in choosing a method, you need to study each of them intensively.

What is a small business?

The definition of a small business depending on a varying set of standards and criteria. Despite that, there is a universal definition of a small business. If a business has an independent owner or group of owners that operate it, it is a small business. On the other hand, the number of employees of the staffing plan for a small business can vary. Some say that it can have fifty employees, and some claim that it can cater to a hundred employees.

How do you construct a budget plan?

Constructing a budget plan involves referring to your income and expense worksheet to track your spendings. Another step you should take to generate this document is to set your business goals and marketing plan. In addition, to ensure the effectiveness of your budget sheet, you need to adjust the habits that can affect your expense budget.

May businesses have closed, but the others showed rapid growth. You can encounter either fate depending on your budget plan. Your survival rate in the business industry equates to how well you budget your business. That said, you should continuously note and keep track of your daily expenses. Construct a detailed small business budget and be one of the people sharing their small business to big business success stories.