10+ Budget Summary Examples to Download

Many people when it comes to budgets think that it is not as necessary or important as it really is. The truth is, if you are not able to know how to budget anything, chances are, you will lose more than what you have gained. This is true when it comes to companies, projects, businesses or even a personal budget. When you think of budgets, you think of the amount of money you will need to save up in order to get the things you want. To be able to budget on the things you will need in the future is important. To track your budget you can also make a budget summary.

10+ Budget Summary Examples

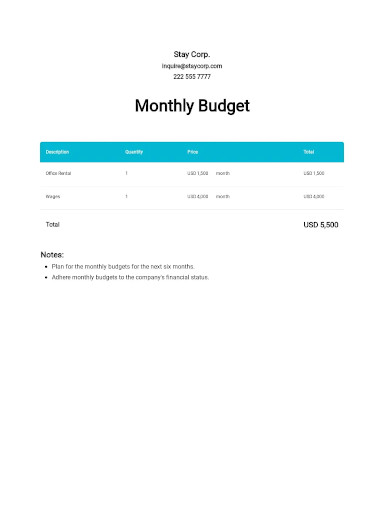

1. Budget Summary Template

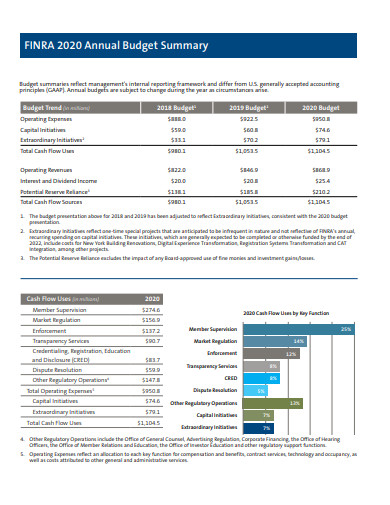

2. Annual Budget Summary

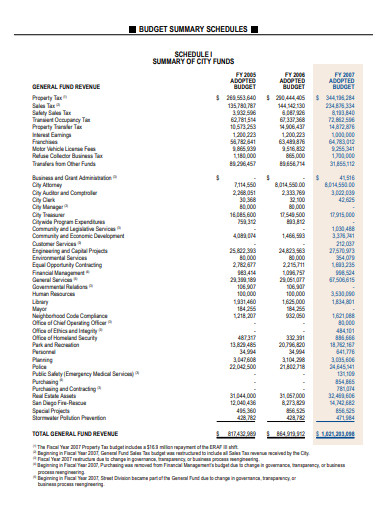

3. Budget Summary Schedules

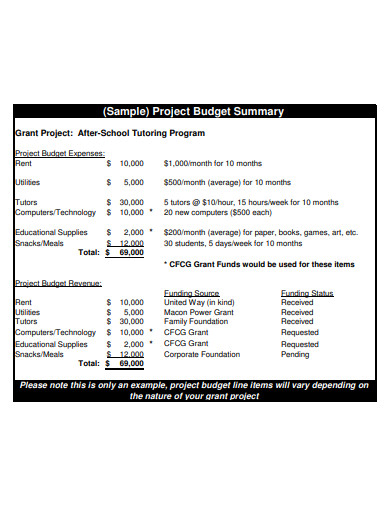

4. Sample Project Budget Summary

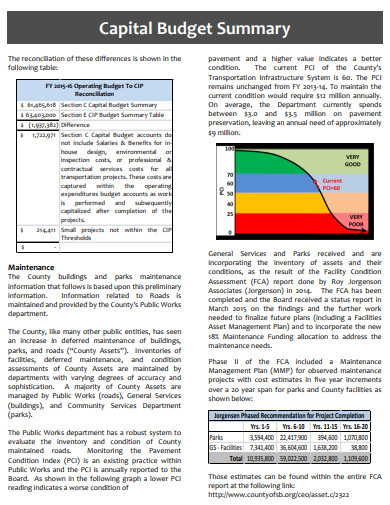

5. Capital Budget Summary

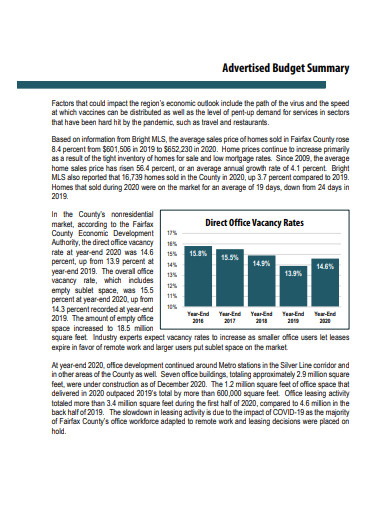

6. Advertised Budget Summary Template

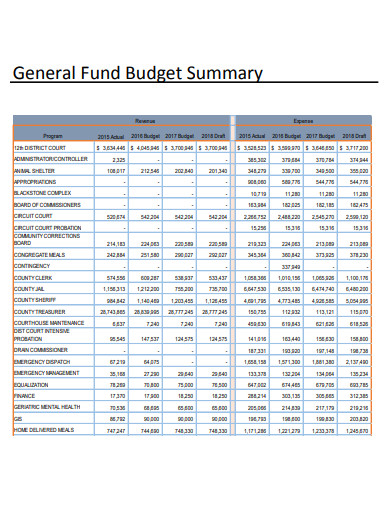

7. General Fund Budget Summary

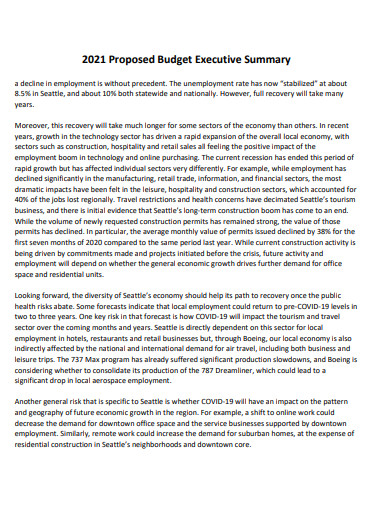

8. Proposed Budget Executive Summary

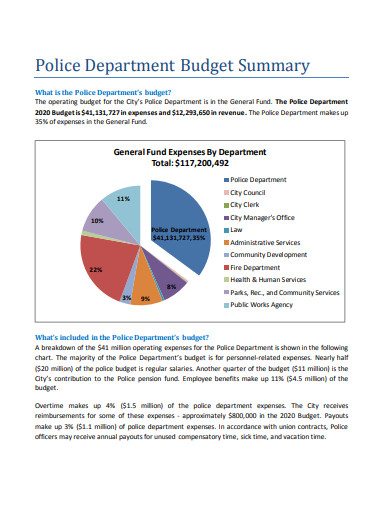

9. Police Department Budget Summary

10. Budget Performance Summary

11. Budget Summary Form in DOC

What Is a Budget Summary?

Budget summaries are tools used when you want to track the expenses and the savings you have made. Budget summaries are the type of narratives that companies, banks, businesses or even on a personal level you can do. The summary shows your daily budget, weekly budget, or monthly budget summary and the amount of money you have spent or saved. In addition, the budget summary gives you an opportunity to see whether or not you are over budget or within the budget lines. Lastly, when you want to see how much budget you still have for that week or month, make a budget summary.

How to Write a Budget Summary

Making a budget summary is important. Whether the budget summary is for business, a company, a project, or for something personal. The important thing to remember is that when you make your budget summary, it can be in different ways or forms. To get the bigger picture, here are steps to making a budget summary.

Step 1: Make a Budget Sheet

The first step to making a budget summary is to make a budget sheet. The budget sheet helps you in determining the list of materials, the amount of money and of course the total amount. Budget sheets are used in order to arrange your budget from date or month.

Step 2: List Down the Items or Materials

List down items or the materials you have spent on the budget sheet. Make sure that the items you are listing are complete and add in the date you have purchased them in as well. Listing down the items or the materials to your budget sheet will surely help you in the long run, as well in the next few steps.

Step 3: Record the Amount of Money for Each Item

Record the amount of money for each item you have bought. As much as possible, the amount has to be the exact amount or the cost of the item you have bought it. As this will help you when you summarize everything and add it up. To see whether you went through the budget you made or you are still within your budget. Keeping the receipts also helps.

Step 4: Summarize the Entire Budget

The last step is to summarize the entire budget. Add the total amount of the recorded price you made. The total and your total budget will explain whether you have gone or you are under your budget.

FAQs

What is a budget summary?

A budget summary is a document or a sheet that shows you the exact budget for daily, weekly, monthly or quarterly costs and expenses you made. These can be through projects, businesses, or even personal.

How do you make a budget summary?

To make a budget summary, all you need to do is to list down your budget for the day or for the week. The next thing is to make sure to list down the needs and your wants with the correct cost or the cost estimate.

Who can make a budget summary?

Anyone can make a budget summary. Whether you are a student on a budget, a company, a bank, an organization or even a business. Budget sheets are helpful.

Many people when it comes to budgets think that it is not as necessary or important as it really is. However, when you want to know how much you spend in a day, in a week, or in a month, you would soon come to realize that making a budget summary is important. To keep track of your expenses and your costs.