10+ Business Budget Examples to Download

Every start up entrepreneurs faces pressure. You won’t understand if your investments will double by the end of the month or not. Indeed, for every small business, starting is always the most crucial part of the process. You need to take good care of your marketing and sales while organizing your finances. It can always either be a hit or miss situation. Therefore, it is still mandatory to check on your financial plan. The creation of a proper business budget is one of the most critical actions a business person can take for assessing the business’ capital in hand, then its revenue earning and expenditure once the company has started operating.

20+ Business Budget Examples

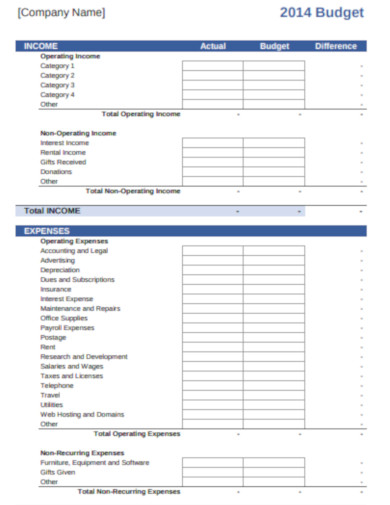

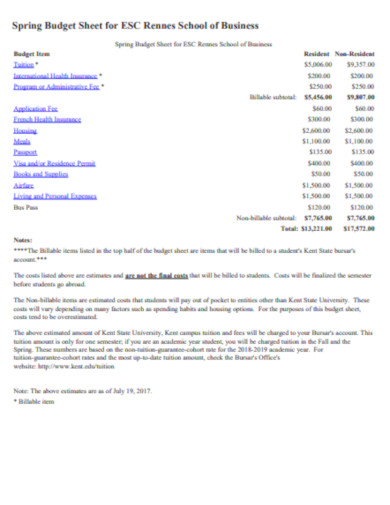

1. Business Budget Template

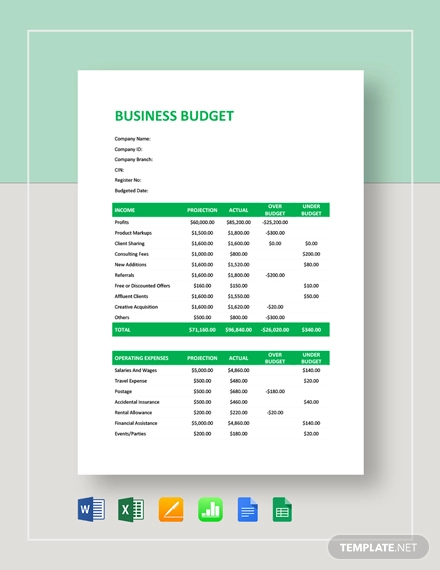

2. Annual Business Budget Template

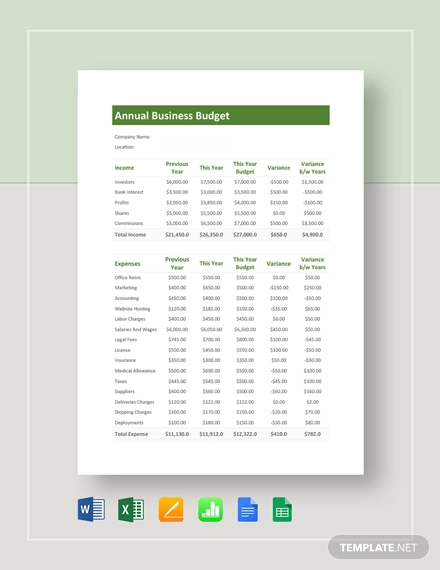

3. Small Business Budget Template

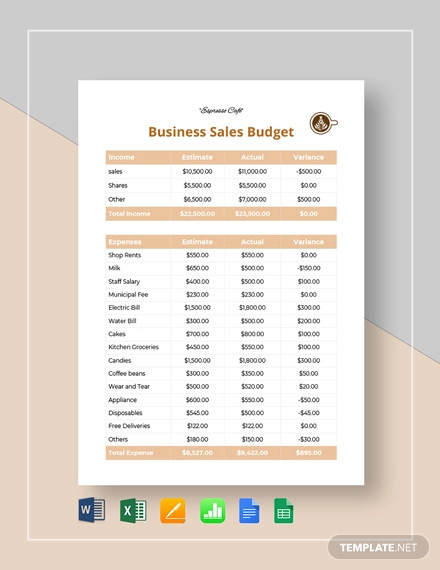

4. Business Sales Budget Template

5. Simple Business Plan Budget Template

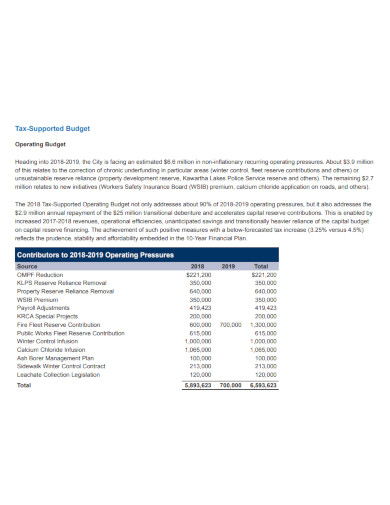

6. Better Business Budget Planning

7. Monthly Business Budget

8. Business Plan and Budget Sample

9. Business Plan and Annual Budget

10. Annual Business Plan & Annual Business Budget

11. Business Plan and Budget Summary

12. Five Year Business Plan and Budget

13. Corporate Business Plan Budget

14. Business Plan and Budget Proposal

15. Business Budget Template

16. Budget and Business Plan

17. Annual Business Plan and Budget

18. Budget & Business Analysis

19. Small Business Budget

20. Business Budget Examples

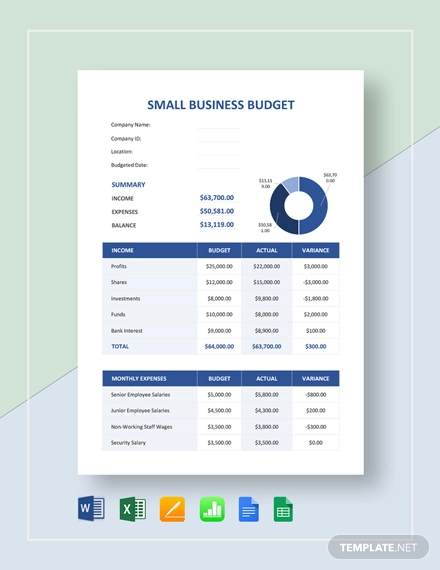

21. Spring Business Budget Sheet

What Is a Business Budget?

A business budget is an essential document that contains a list of finances or expenses for a company’s plan. It helps in the alignment of the funds with the necessary costs. Without this, it would be difficult to track financial records.

The Cost of Starting a Business

For someone who is just building a brand in the business industry, know that it can be a tough and tricky game. There are various aspects that you need to weigh in, and part of that is a detailed business budgeting. After all, investments are costly. Perhaps, according to a report released by the Minority Business Development Agency, the average cost of starting a business is $30,000. To ensure that you get the same or more profit later on, you should track down your expenses. Set a budget and make a breakdown of cost because this will get you far.

How To Make a Business Budget

In making a basic business budget plan, you need to consider different aspects, such as profit and expenses. Listing down these line items can be complicated. However, a company financial statement doesn’t have to be that daunting. We list the steps that would help you come up with great content. Read on.

1. Specify the Revenue Sources

To start with your annual budget, it would be better to look back on your financial status and compare it with your current estimates. Since different factors could add up to your monthly revenue, examine all the sources of your income. That will serve as your basis for the later deduction where you will deduct your expenses from. With this, you can accurately organize the items you can add to your tracker.

2. Enumerate the Fixed Costs

After you identify your income sources, you have to determine the recurring costs. These are the weekly or monthly fixed costs that you have to pay for, such as the building rental, depreciation assets, and payroll for your employees. Enumerate all of these in your company budget so that you can subtract these costs from your income. Make sure you don’t miss anything, or this can significantly affect your budget later on.

3. Include the Variable Costs

Next, aside from the fixed costs, you also have to identify the variable costs. These are expenses that aren’t recurring every week or month. These are also amount that may vary depending on the usage, such as utilities, gasoline, and office resources. You have to lower the variable costs during the lean month and double it when there is extra profit based on your sales report. Calculating these with the income and fixed fee will help you come up with your actual profit.

4. Set an Allowance

In business, there are always unexpected costs that could affect your budgeting assessment. With this, you should come up with an emergency fund and contingency plan for possible expenses that you can easily add up to your inventory without breaking your budget.

FAQs

What is one example of a budget?

One example of a budget is for lifestyle purposes when one person spends a new bed sheet for the house.

What are the types of budget?

The budget has three common types. It includes a balanced budget, deficit budget, and surplus budget.

What are the two classifications of budgeting?

The two classifications of a budget include the short-term and long-term.

Are you now confident to budget your business finances? Start with an empty document and organize different aspects by following the steps above. Remember, it’s never a waste of time to understand if you are still within your budget. So, to avoid the struggles of debt, be aware enough of how budgeting must be done.