6+ Company Budget Examples to Download

A budget can be defined as an approximation of income and expense of related activity in a set period of time. It is calculated by predicting the future estimated income & spending, with reference to the experience in the past that gives one an exact idea of the total in and out of the finance distribution. Preparing a budget for a company helps in making accurate financial decision and analysis to improve the efficiency of an organization. It enables the decision makers to know about the methods of improving profits and taking sufficient steps to increase the return on investments. It helps in managing the cash flow and taking a timely decision in minimizing the cost. It helps to monitor the company expenses at different levels of the organizations, especially when using structured budget templates for better tracking.

Organizations use different techniques and management rules to prepare an efficient budget to achieve the maximization of resources which ultimately leads to the growth of an organization. This article will cover examples, samples, reports, templates, and process relating to company budget of different business sectors.

Company Budget Examples & Templates

1. Company Budget Sample

Budgeting is a significant part of an organization’s monetary planning and it becomes mandatory for companies of any size to utilize such concepts to improve their efficiency. The above file is a research paper on a company’s performance after the application of a sample budget published in the European Scientific Journal. It also evaluates the firm’s performance by preparing more than one sample budget for different scenarios. It is a ten-page study on concepts like family companies, institutionalization, budgeting, and financial & strategic planning. Download this report to learn about the mentioned concepts and be enlightened about the effective methods of budget preparation. This research focuses on family business and can be a key for business owners to attain a clear direction of financial management through budgeting.

2. Company Car Tax Budget Sample

Revision of budget is an essential part of the planning. One has to revise the budget in case of miscalculations and during the occurrence of unpredictable scenarios. Such revised decision help in knowing the exact status and outcome of a company’s finance or a project’s budget. This file is a guide to the spring 2019 budget for fleet decision-makers published by the Alphabet. The budget examines the key points and budget statements related to fleet operators and company car drivers. It is a nine-page guide divided into seven sections viz. vehicle excise duty, company car tax, capital allowances, fuel allowances, class 1A NIC, commercial vehicles, and ULEV Plug-in grants. The file is a professionally prepared budget document with perfect synchronization of statistics and content explanation.

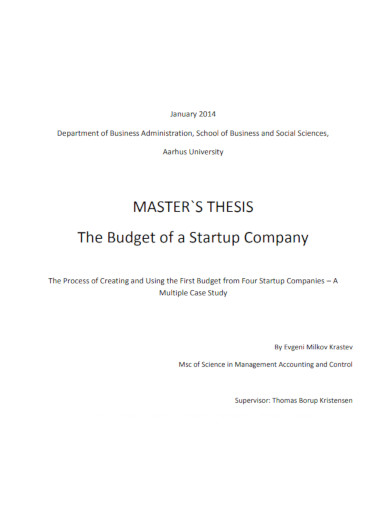

3. Startup Company Budget

A startup model is considered to have a dynamic budget. Funds have to be allotted for many unpredictable activities/causes and there are also possibilities of increased cash flow due to different factors affecting the startup. It becomes necessary to prepare an efficient budget for a startup and then constantly monitor the same. This file is a sixty-eight-page thesis titled The Budget of a Startup Company. It is a multiple case study including the process of creating and using the first budget from four startup companies. The very purpose of the paper is to show how a budget is created in a startup model and how efficiently it is used during the same budgeting period. If you intend to create a budget for your startup then explore this research and prepare an impactful budget.

4. Public Company Budget Sample

Public Limited Companies have an entirely different operation pattern compared to that of a Private Limited Company or a Public-Private Limited Company. The budget of a public limited company is always comprehensive and needs approval by the securities commission, shareholders, and the board of directors. Such budgets are prepared after thorough research of the income and expense record of that company. Detailed breakup of every section with intricate details is covered in the budget. Public company budgets are annual budgets which are then further divided into months and weeks for accurate monitoring. The approval from the securities commission is in the interest of the investors where a budget is evaluated on all parameters to test its accuracy. This file is an example of an approval letter of a public company budget from the securities commission.

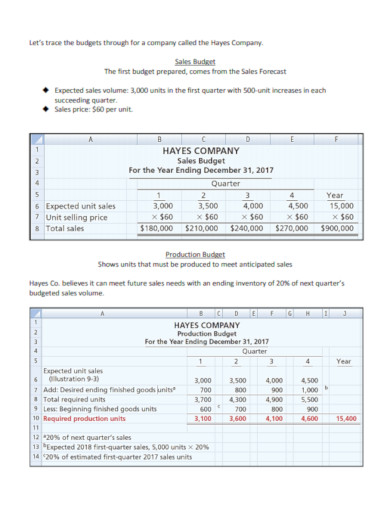

5. Company Budget Example

It can be a tiresome task to prepare a company budget without sufficient experience and guidance. One has to accurately evaluate all parameters from the previous data and compile it to form a budget. Missing out important expenses or predicting under or over sales can also make it difficult for a budget to survive. This file is an example of a company budget for reference and understanding of learners. One can conveniently download the above file in PDF format and understand the important parameters and formatting of budget making. It is an eight-page document divided into more than ten sections of expenses which are further expanded in terms of details & cost analysis.

6. Sample of Company Budget

6+

6+

Is it mandatory for an individual to be trained for making a budget? Yes, it is very important. Budgeting for even a micro scale organization with a turnover of 20lacs if not done precisely can result in mismanagement and retardation in the growth of the company. A trained individual with ample experience in budget making and drafting of monitoring policies of the same budget along with budget implementation is extremely necessary. This file is at two-page PwC academic certification brochure on Planning & Budgeting: A Company Budget. It includes information on training objectives, target audience, duration, certification, training methodology, and key areas of the training course.

7. Company Budget Process

Drafting a company budget is a hectic & lengthy process. Analyzing the present and the past data for making necessary assumptions is almost always the first step. Every budget-making process has variations according to the size and data of the company. A budgeting process also differs on the period of time for which a budget is prepared. This file is a case study of the company’s budget process published by Jonkoping University. The authors intend to map out and analyze the present budgeting process at Tage Rejems bil AB in order to help in identifying the issues in the same and for suggesting methods of improvement.