8+ Debt Budget Examples to Download

A debt budget is simply a spending plan to track your incomes and expenditures with a single aim of helping you out of debt. It lists down all your sources of incomes and then the things you spend it on each month. Having a debt budget is an important first step in taking charge of your finances.

Also, it will help you to identify areas in your budget that you can save on. Because most of your debt payments and household bills are made on a monthly basis, it is advisable that all the figures in your calendar be monthly.

In this article, we tell you 9+ debt budget templates that you can use as a guide to create your own budget plan and clear your debts. Continue reading to learn more. If you want to rid yourself of your debts completely, you may also want to check out these debt worksheet examples.

Debt Budget Examples & Templates

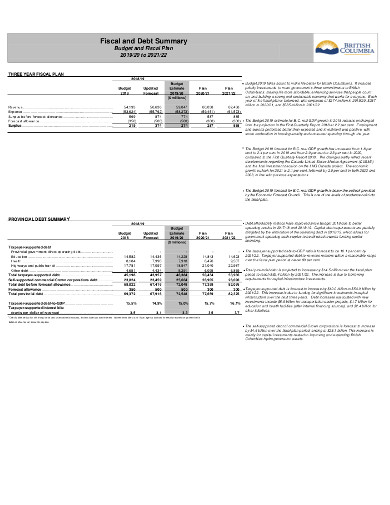

1. Fiscal and Debt Budget Summary

This fiscal and debt budget summary offers you a clear strategy of reducing your debt. It lets you enter your current creditors, the balance for each debt and interest rates, as well as monthly payments you are making to clear the debts. You need to have a clear idea regarding the amount of money that you will be paying each month to offset credit card bills.

The template is available easily upon download, and you can access it anywhere you are. Also, it is easy to use and edit, as there is no requirement of a special program to edit it. Get the template today!

2. Budget Deficit and National Debt

The budget deficit and National Debt template is a good example of a debt budget that you may want to use to plan on how to pay off your credit card bills and other debts. The template gives you enough strategies and resources to reduce your debt. It also comes with a printable payment schedule to make your work of tracking your monthly payments easier.

Do you want to fix your credit rating? You just need to download this template and start paying off your debts. The template is easily available on instant download and can be customized to match your own situation. Download today.

3. Managing Debt and Budget

Preparing a plan to settle your debts may sound scary, but this doesn’t need to be the case. Through using a template, you can have a plan of paying off your debts. Just download this debt reduction template and be started clearing your debts. You may also want to consider using a proven debt management plan.

This template is available in PDF format but you can easily edit and customize it to suit your debts. The template is pre-formatted and contains formulas, so your only work is to download and then open the template. After that, just enter a few numbers and let the template do the rest.

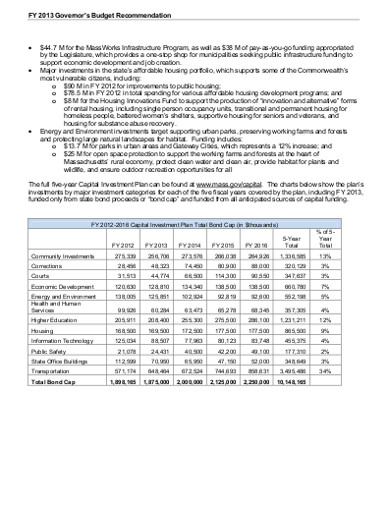

4. Capital Budget and Debt

The capital budget and debt template is a great tool if you want an effective debt payoff plan. The template comes filled with some data to illustrate to you how it works. Once you have downloaded it, just open and make a few edits.

The template is editable easily using common programs. It is also easy to use and enables you to manage your debts and be debt-free.

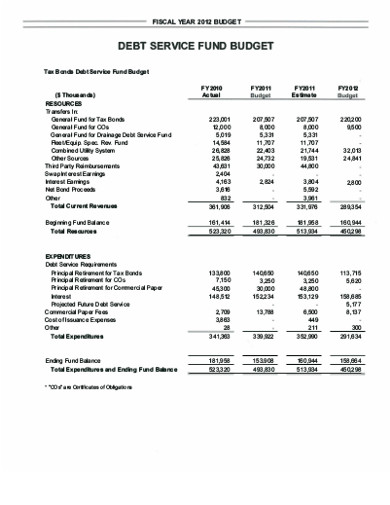

5. Debt Service Fund Budget

The debt service fund budget template has been professionally created by industry experts to help people like you manage their debts better. Paying off your debts will help you fix your credit score, enabling you to qualify for loans in future.

Just download the PDF-based template from the internet wherever you are, at anytime. Open it and customize it by removing or adding items that don’t apply to you. It’s easy to use and gives you a simpler way of paying off your debts.

6. Budgeting and Debt Management

With this budgeting and debt management template, you have a solid plan of paying off your debts. The template if pre-filled with data and you only need to enter your information and see your current debt repayment status.

Easy to use, highly customizable and fully editable, this PDF-based template is available for instant download. You can access it anywhere and at anytime. Just download, open, customize and make a few edits and you are good to go.

7. Household Budget & Managing Debt

A critical component of managing your debt is having a spending plan. This not only shows you where your money goes each month, but it also eliminates your bad spending habits. The surplus you get can be directed towards clearing your debt.

This template gives you an accurate status of your financial situation. Once you have known that, you can plan accordingly to start paying your debts. The template is easy to use and can be edited without requiring a special program. Also, you can customize it to match your specific situation. Download it today.

8. Debt Service Budget Sample

Once you are done creating a budget that’s tailored to your income and needs, you can now create your debt reduction plan. A properly created debt budget will help you save money that then goes towards repayment of your debts. This template acts as a perfect guide for creating your own debt payment plan.

It’s available on instant download so you can access it anywhere, at anytime. Also, the template can be customized to match your own situation. Just download it today and start managing your debts.

9. Debt Service Fund Proposed Budget

This free budget planner template will show you your income and expenses automatically and if you have deficit or surplus at the end of every month. it will take you only an hour or two to fill this budget template and be able to see how you are spending your money. This enables you to start making some changes and b back on track.

You can use this template as a basis of making your own budget planner to help you free yourself from the clutches of debt. Available on the internet on instant download, the template is easily editable and fully customizable. Download today!