15+ Household Budget Examples to Download

In a house, there is a family that consists of the mother, father, and kids. Also, some extended relatives require may require more essentials that you have to take good care of. You always want to make sure that everyone eats healthy and gets what they need. Therefore, you will need a detailed family budget. With this, you can plot and organize the family’s major expenses and incomes. Since you want to make sure that you won’t go beyond what you get with your monthly salary, it is best to keep a record and track where you spend most of your money.

15+ Household Budget Examples

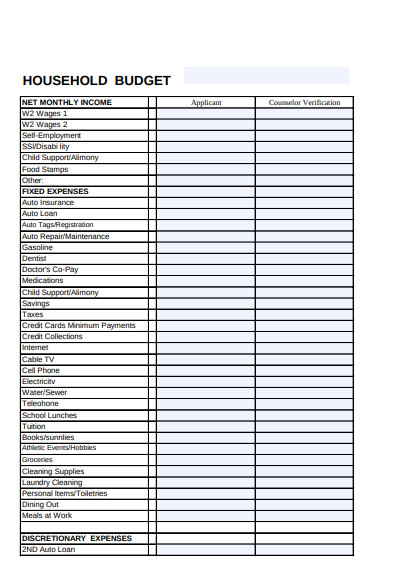

1. Household Budget Template

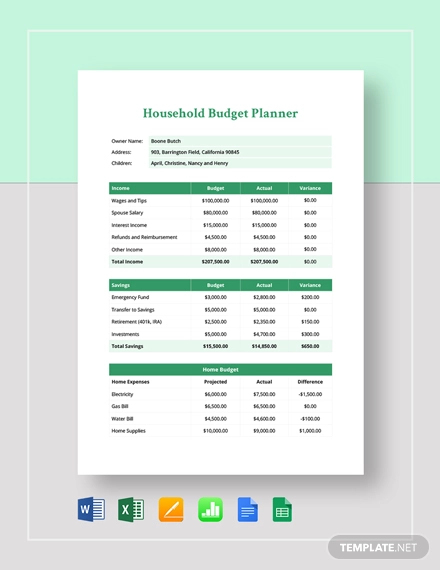

2. Household Budget Planner Template

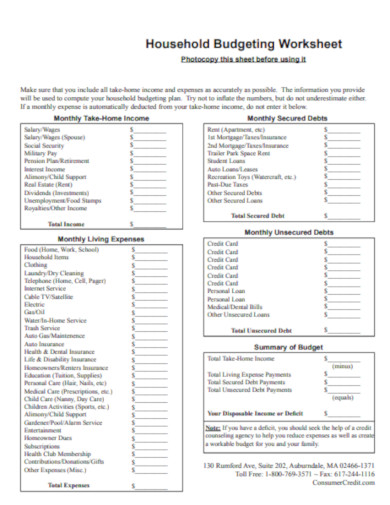

3. Household Budgeting Worksheet

4. Creating a Household Budget

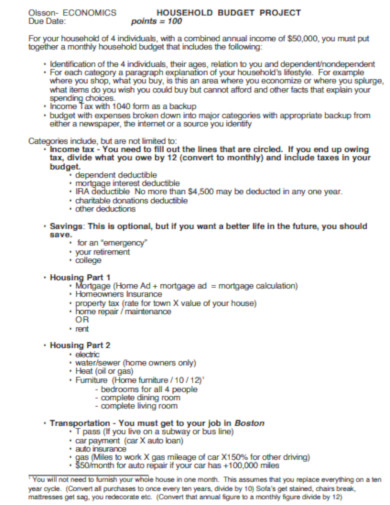

5. Household Budget Project

6. Household Budget Survey

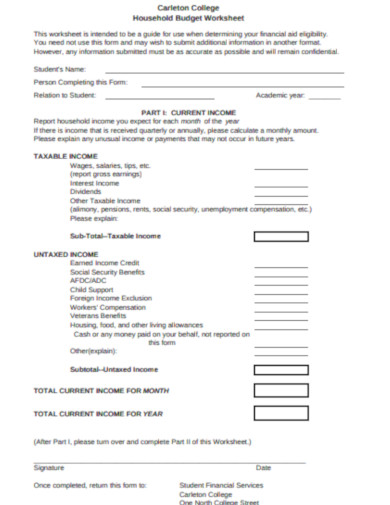

7. Household Budget Worksheet

8. Outlining Household Budget

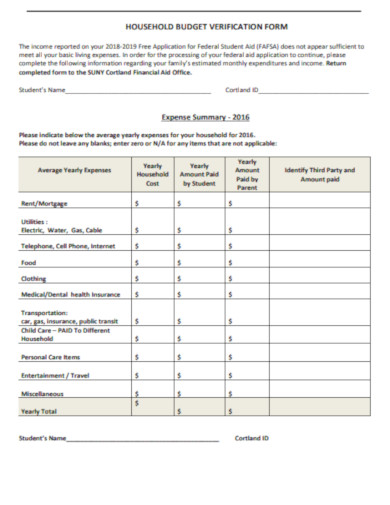

9. Household Budget Verification Form

10. Household Budget & Managing

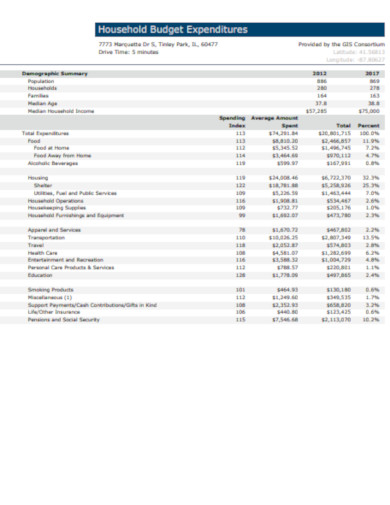

11. Household Budget Expenditure

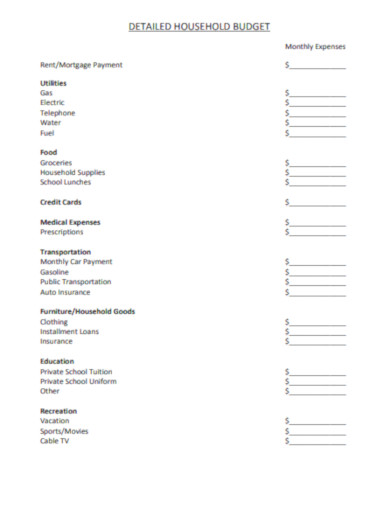

12. Detailed Household Budget

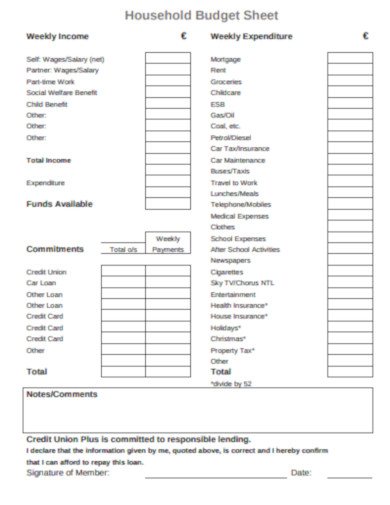

13. Household Budget Sheet

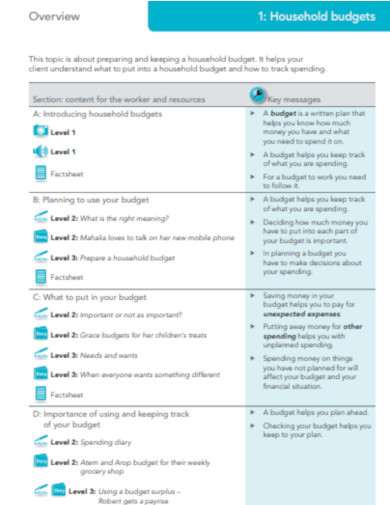

14. Household budgets Overview

15. Sample Household Budget

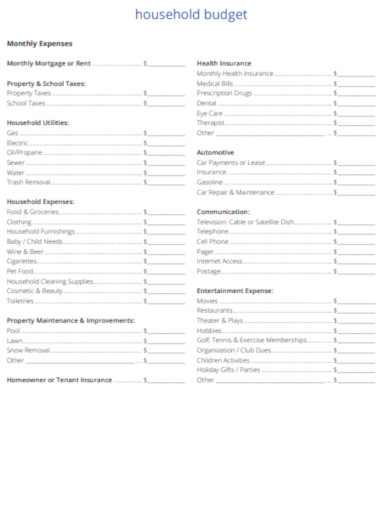

16. Household Budget Example

What Is a Household Budget?

A household budget is a personal financial plan that covers different aspects of family savings and expenses. It is a suitable material for homeowners to secure basic resources that needs budgeting, such as household bills and weekly groceries.

A Growing Family’s Dilemma

Many people who are just starting to grow a family is now experiencing a financial dilemma. Is it because of the scarcity of job openings? Or is it because of the increasing cost concerning the necessities? No one knows, or it can be both. Perhaps, according to the report released by the Economic Policy Institute (EPI), the food budget for a family of four could reach $951 per month. This added with the medical or healthcare needs, which is $950 monthly as well as a thousand dollars or more. It’s a tough life, especially when you do not know how to budget your income with the expenses. Now, think of the future savings you can have when you consider taking good care of your personal budget.

How To Create a Household Budget

A growing family means growing needs. Therefore, you should be keen on adjusting your expense budget. You can keep a planner you can update and track. So, to help you start, follow the steps below and come up with a budget record that will help you.

1. Understand Your Current Financial Status

It may be a complicated start, but it pays to understand your current financial status before you begin with your budgeting. Get over the doubt and review your cash flow and financial statements. Because you are probably keeping so many receipts, it’s time to know if you are below or beyond your monthly salary. Are you in debt? Do you have more savings? Remember, proper financial planning will never get you to involve in any problem.

2. Pen Down Your Monthly Expenses

Now, start adding your monthly expenses into your budget list. Separate the essential from the variable and make sure to categorize them. Necessary expenditures include the mortgage, house rentals, insurance, and cards. These are fixed costs, so you should not worry about the additional expense in this section. For the variables, make sure to manage your expectations as these can go higher than the average cost you pay monthly, including the gasoline, electricity bill, food, and medication. Organize these items so you won’t miss anything.

3. Give Extra for Reasonable Values

In your budget sheet, make sure to allot a small portion for your wants. Although these are things that you want, make sure they are reasonable and worth the value. This can be for hobbies or entertainment as long as it doesn’t exceed your annual budget. With this, you know which category you will get money from.

4. Calculate Your Expenses

Now, calculate your expenses. Make sure to subtract the total amount from your basic salary. It can be daunting to see how much you’ve totaled, but this is the best way to know if you are still on the right track. It is good to know that you can keep a little money for your savings. So, make a plan and assess where you can cut your expenses from.

5. Update It Regularly

Don’t settle with your budget plan. Since you know that your needs change regularly, you have to ensure that your document is up to date. It can create drastic changes in your savings once you update it. With this, you will know what your limitations will be.

FAQs

What are the types of budget?

There are three types of budget. It includes the balanced, surplus, and deficit budget.

What are the two classifications of a budget?

A budget is classified into short-term and long-term.

How do you define a project budget?

A project budget is a financial plan for a particular project. It includes detailed estimates of the resources and labor works.

Life may be tough for you when it comes to your finances, but it shouldn’t just end there. You have to make sure to align all your budget with your personal plan. Perhaps, it doesn’t hurt to come up with a household budget to secure that your family won’t have to face debt in the future. With that, create a budget by following the steps above.