10+ Nonprofit Budget Examples to Download

Nonprofit organizations have events, programs, activities, and operating processes that need to be sustained. Because of this, donations, grants, and fundraising revenue expenses need to be allocated properly or put into a line item. The best tool for this allocation is a budget document. Such a document is highly applicable for any monthly, quarterly, and annual proposed development. Moreover, it can be used for both startup and long-established nonprofit organizations. To secure the finances of your nonprofit institution’s undertakings, we highly recommend you check out our nonprofit budget examples! They come in different varieties to give you more choices for a reference! Not only that, we also have some important insights about the budget document written on our article! Learn more below.

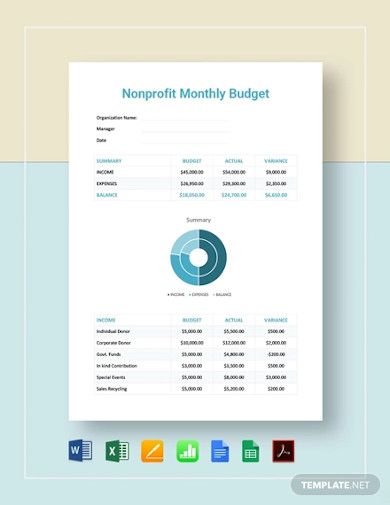

10+ Nonprofit Budget Examples

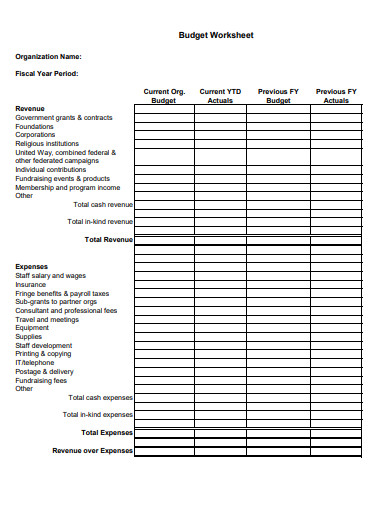

1. Nonprofit Monthly Budget

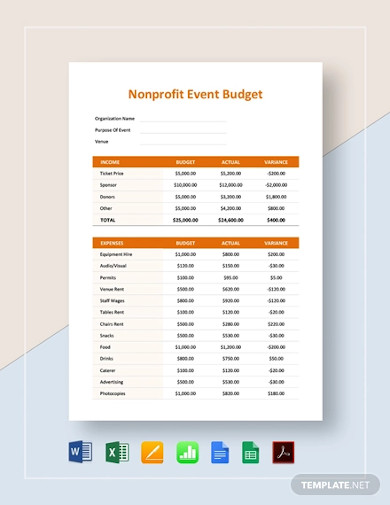

2. Nonprofit Event Budget Example

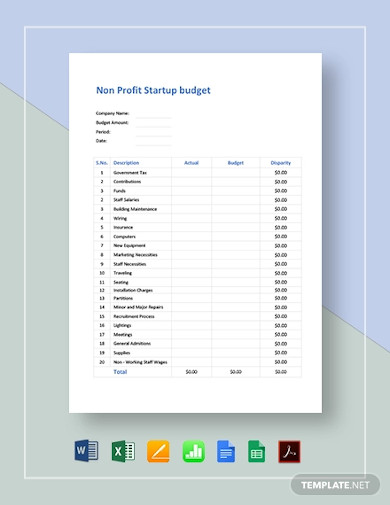

3. Sample Non Profit Startup Budget

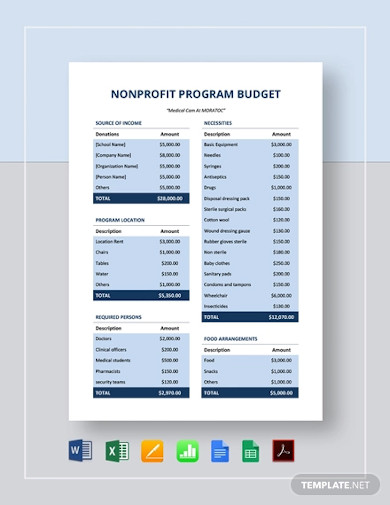

4. Simple Nonprofit Program Budget

5. Sample Nonprofit Fundraising Budget

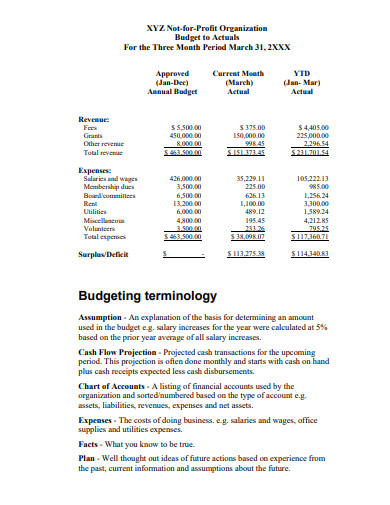

6. Nonprofit Budgeting Example

7. Nonprofit Charity Budget

8. Fundraising Nonprofit Budget

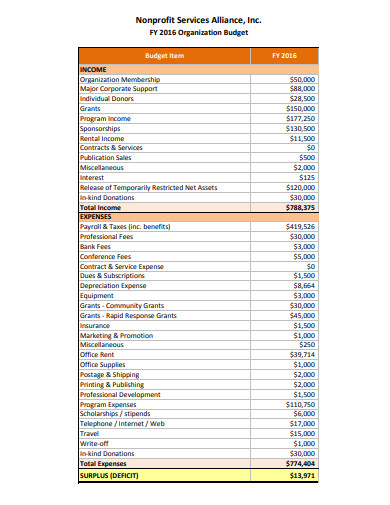

9. Nonprofit Budget Worksheet

10. Budgeting for Nonprofit Organizations

11. Printable Nonprofit Budget Example

What Is a Nonprofit Budget?

A nonprofit budget is a document that helps nonprofit organizations in predicting their expenditure. It takes into account the different figures from the past fundraising budget records, nonprofit financial reports, financial statements, and other paperwork that involves the organizations’ previous spending. These documents will be the very basis in making the financial predictions for a certain nonprofit undertaking. In her February 2019 article for Donorbox Nonprofit Blog, Ilma Ibrisevic wrote that one of the benefits that budgeting brings for nonprofits is that it helps in reaching both the short-term and long-term goals. She then elaborated that through the document, nonprofit organizations can set limits on their spending following the availability of financial resources. Needless to say, such a document is very important for this sector of organizations.

How Nonprofits Make Money?

For some people, the functionalities of a nonprofit organization remain unclear. Many of them would often ask how they generate money. To clear things up, here’s how they work.

Nonprofit organizations have philanthropic goals. Because of this kind of goal, few people would present themselves as donors and offer support, which is mostly in the form of money. That’s one way of how they acquire money. Another way is through government grants. These are financial means that are given to organizations with a mission and the success rate worthy of investment. The last method is through the organization’s independent efforts, as their strategic fundraising plans. Through the activities set in the plan, proceeds are acquired, whether through ticket sales, item auctions, or others.

Regardless of how a nonprofit organization generates money, they all go in two ways. One is towards charitable activities, and the other is towards the sustainment of the organization.

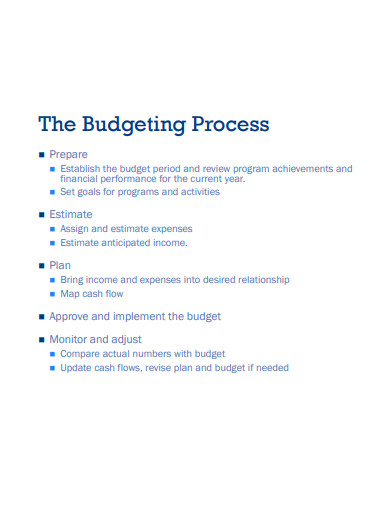

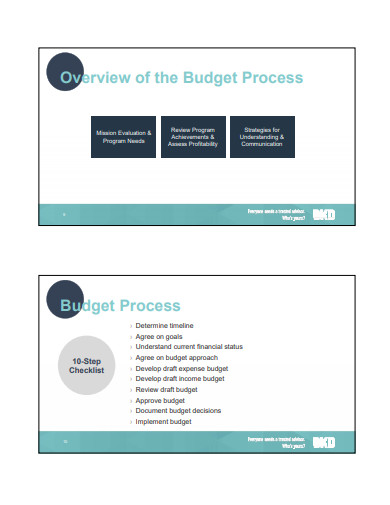

How To Create a Nonprofit Budget

Making your personal budget is already a difficult task. How much more for an entire organization? Going through the process of budgeting requires a balance of hard and soft skills. You may be good at computations, but without patience and attention to details, the budget document will most likely go off-course. Below, we give you our list of steps to take that will guide you in keeping your document standard-based.

1. Identify Your Current Nonprofit Goals

Every year, a nonprofit organization conducts various movements to resolve or mitigate social issues. As you create your nonprofit budget, identify your organization’s goal for this time. A fundraising event would mean that you need to create a fundraiser budget. Selling products requires a sales budget. The list could go on and on. So whatever project your organization’s board of directors is planning to do, it should have a corresponding project budget.

2. Know What Needs To Be Considered

Any undertaking has areas that need to be put into account, especially when creating a budget. These areas depend entirely on what kind of activity is going to be held. If your organization plans to hold a concert for a cause, you have to consider the costs for the venue, organizing committee, marshalls, equipment, printable ticket production, and many more.

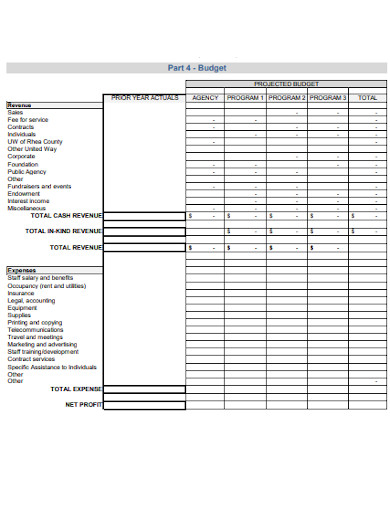

3. Learn From Historical Data

One important fact about a budget is that it needs to be based on factual records. This is why you need to collect as many sources as you can from your data inventory to successfully set your budget details. Expense reports, profit and loss statements, and previous financial budget are good documents to start with. You can also ask for quotations from various suppliers or contractors.

4. Categorize the Items

After gathering all the necessary sources of your numbers and figures, pick out the items that are relevant to your nonprofit activity. Keep the expense items and their corresponding estimated prices from your organization’s financial resources. Take note that the amount of your financial resources must be the latest.

5. Distribute the Available Funds

Once everything’s set, finalize your nonprofit budget by appropriately distributing your organization’s current funds to your predicted expense items. Make sure that the expense amount doesn’t exceed the total current funds.

FAQs:

What’s the difference between a budget and a forecast?

Budget states what a company is expecting in a short period, while forecast projects the financial fluctuations based on the current trends.

How many nonprofits are there in the United States?

The National Center for Charitable Statistics (NCCS) revealed that there are currently 1.5 million nonprofit organizations registered in the United States. These organizations consist of civic leagues, public charities, fraternal organizations, and private organizations.

What are the biggest nonprofit organizations in the United States?

According to Forbes Magazine, the biggest nonprofit organizations in the United States are the following:

1. United Way – USD 3.3 billion private donations

2. Feeding America – USD 2.8 billion private donations

3. The Task Force for Global Health – USD 2.6 billion private donations

4. The Salvation Army – USD 2 billion privation donations

5. St. Jude Children’s Research Hospital – USD 1.7 billion private donations

Considering how important the role of nonprofit organizations are in the society, it is just right to secure their planned undertakings. And, the financial aspect must be the top priority. Fortunately for the nonprofits’ stakeholders, budgeting exists. Through it, their institution can carefully set things up way before any project takes place, revamping its efficiency during the actual implementation.