10+ Personal Budget Planner Examples to Download

Budget. Money. Company. Business. We often hear these words and think that this has something to do with people who own businesses or companies, who are not only successful but have been through so much that they technically know what they are doing. When you hear the words personal budget planner, the first thing you may be thinking about is your very own personal budget. Which is not wrong really. It is rather a nice thing to have especially when you have plans for it. Of course a lot of people would be so delighted to have an opportunity to make their own budget planner, in the hopes that it would make their saving and spending a little less hassled and a little less complicated.

It goes without saying making a personal budget planner is the best thing you can do for yourself. If you own a company or even a business, having your own personal budget planner helps you in more ways than one. It helps you financially manage your income to make sure that your business grows into something better as well as being able to enjoy the perks of making it. Though some may say it can be a bit challenging at first seeing as you may think that there are a lot of things you want to buy, making this personal planner would help you maintain the needs and wants in a friendlier manner.

10+ Personal Budget Planner Examples

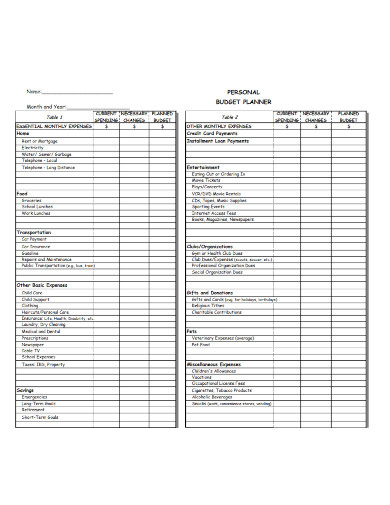

1. Personal Budget Planner Template

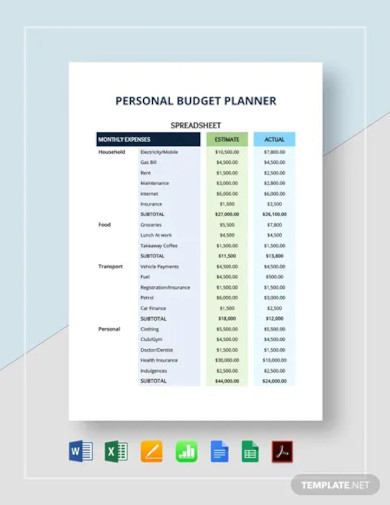

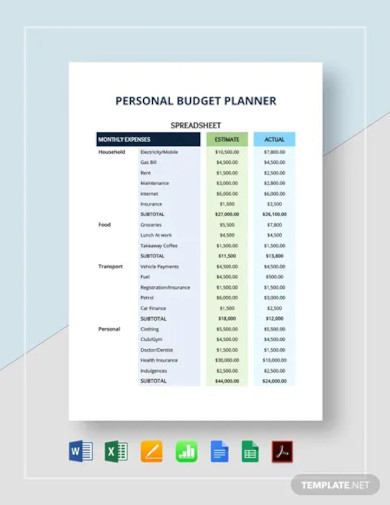

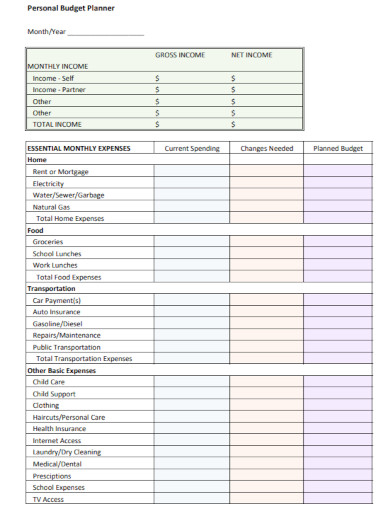

2. Personal Budget Planner Spreadsheet Template

3. Personal Budget Planner Example

4. Personal Income Budget Planner

5. Personal Simple Budget Planner

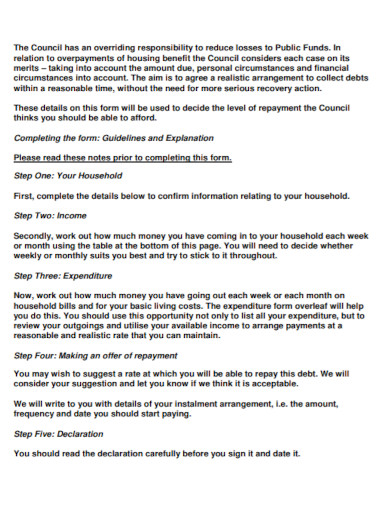

6. Personal Budget Planner in PDF

7. Draft Personal Budget Planner

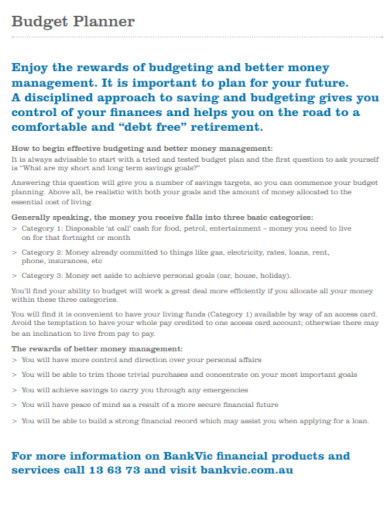

8. Your Personal Budget Planner

9. Simple Personal Budget Planner

10. Personal Budget Planner Format

11. Personal General Budget Planner

What Is a Personal Budget Planner?

Taking the word into something literal, we would come up with the idea of something you would want. Something personal would mean that it is yours. So a personal budget planner would mean something you have come up with to budget your savings, investments and financial earnings in your business or the company you work with. The income that you receive from working, you are going to be placing it into a budget friendly manner. The personal budget planner is a tool that a lot of people use when they plan to save up the money they have worked hard for, in case of emergencies or when they plan on something in the near future.

Its uses would depend on how you may want to see it. But in general, a personal budget planner is used as a checklist or a list that you fill out in order to see how much you have been spending and how much you have been saving. The budget planner also helps by making you see if you have gone through your budget or you have maintained the budget you have set for yourself.

How to Write a Personal Budget Planner?

In order to be able to budget your investments, your income and your money in general, one must be able to make their own personalized budget planner. Here are your tips.

1. List Down the Wants and the Needs

Make a list of all the things you want and the things that you need. Regardless of what these wants or needs may be. It could be something personal or even something that you want to get. As long as you list these things down, this is the first step to your personal budget planner.

2. Add the Necessities for the Month

After making the wants and the needs, add the estimated amount for your total necessities for the month. Of course you can use weekly, others may prefer to use monthly. It is of course the same process and the same steps. The only difference is the week or the month.

3. Break Down the List into Two Parts

For this part of the budget planner, you are going to be making a checklist or a table. In the table or the checklist you are going to be breaking down your list into two parts. Your two or more parts would have a title and this depends on how you are going to write or what it would be. As long as you are going to be breaking down your list to make it easier.

4. Fill Out the Estimated Amount of Money

On a different side of the list or of your table or checklist, add the estimated amount of money for each of the things you made. Regardless if you say it is a luxury or a necessity. Anything you added in your checklist or list should have the estimated amount of money. If you are able to know the exact amount, the better.

5. Write the Total of Your Expenses for the Whole Month

When everything has already been given their estimated amount or the estimated price for each of the things listed, you may now add the total to your expenses for the whole week or month. This way, when you plan to budget something, you can base it on the total expenses and start from there. Doing this may sound tiring and frustrating during your first tries, but in the long run, they are really worth it.

FAQs

What is a personal budget planner?

A tool used to help you budget your income by dividing it to the things you want to the things you need.

How does this personal budget planner help?

The personal budget planner helps by making you see how much should be spent in a certain week or month. It also helps by letting you see if you are over your budget for the month and to trace how it came to happen.

What other things can be used for a personal budget planner?

You can use your personal budget planner as a means of seeing how much money you have spent within the week or month. To trace or to find a better solution to keeping your budget stick as well.

When we think of budgets, we think that we are restricted to spending the things we want and to focus on the things we need. It is not necessarily the case. When you plan on using a budget planner, you are simply going to focus on the things you want to save up to get to the things you want. The necessary things in your budget planner are also required for this to work. But it does not necessarily constrict you into buying only what you may need. It does help you decide on what to do with your income and to spend and save wisely.

10+ Personal Budget Planner Examples to Download

![10+ Personal Budget Planner Examples [ Company, Income, Business ]](https://images.examples.com/wp-content/uploads/2022/01/10-Personal-Budget-Planner-Examples-Company-Income-Business-.jpg)

Budget. Money. Company. Business. We often hear these words and think that this has something to do with people who own businesses or companies, who are not only successful but have been through so much that they technically know what they are doing. When you hear the words personal budget planner, the first thing you may be thinking about is your very own personal budget. Which is not wrong really. It is rather a nice thing to have especially when you have plans for it. Of course a lot of people would be so delighted to have an opportunity to make their own budget planner, in the hopes that it would make their saving and spending a little less hassled and a little less complicated.

It goes without saying making a personal budget planner is the best thing you can do for yourself. If you own a company or even a business, having your own personal budget planner helps you in more ways than one. It helps you financially manage your income to make sure that your business grows into something better as well as being able to enjoy the perks of making it. Though some may say it can be a bit challenging at first seeing as you may think that there are a lot of things you want to buy, making this personal planner would help you maintain the needs and wants in a friendlier manner.

10+ Personal Budget Planner Examples

1. Personal Budget Planner Template

Details

File Format

MS Word

Apple Pages

2. Personal Budget Planner Spreadsheet Template

Details

File Format

MS Word

Google Docs

Google Sheets

MS Excel

Numbers

Pages

PDF

3. Personal Budget Planner Example

csdcu.org

Details

File Format

PDF

Size: 115 KB

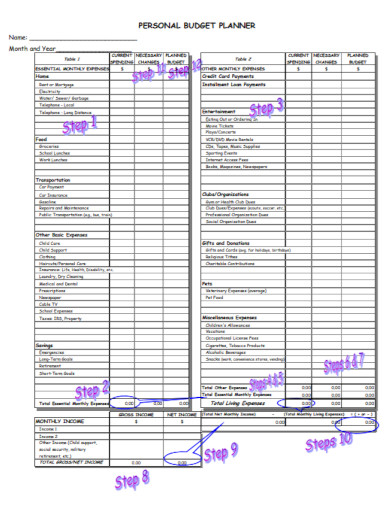

4. Personal Income Budget Planner

abileneteachersfcu.org

Details

File Format

PDF

Size: 140 KB

5. Personal Simple Budget Planner

statebankofdekalb.com

Details

File Format

PDF

Size: 292 KB

6. Personal Budget Planner in PDF

valeofglamorgan.gov.uk

Details

File Format

PDF

Size: 52 KB

7. Draft Personal Budget Planner

alvinbank.com

Details

File Format

PDF

Size: 58 KB

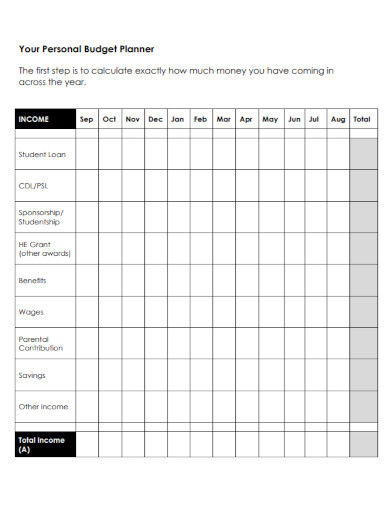

8. Your Personal Budget Planner

guildofstudents.com

Details

File Format

PDF

Size: 157 KB

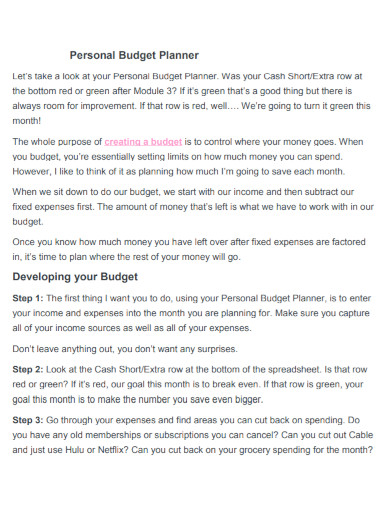

9. Simple Personal Budget Planner

highpointcommunitybank.com

Details

File Format

PDF

Size: 355 KB

10. Personal Budget Planner Format

livinglowkey.com

Details

File Format

PDF

Size: 332 KB

11. Personal General Budget Planner

datocms-assets.com

Details

File Format

PDF

Size: 102 KB

What Is a Personal Budget Planner?

Taking the word into something literal, we would come up with the idea of something you would want. Something personal would mean that it is yours. So a personal budget planner would mean something you have come up with to budget your savings, investments and financial earnings in your business or the company you work with. The income that you receive from working, you are going to be placing it into a budget friendly manner. The personal budget planner is a tool that a lot of people use when they plan to save up the money they have worked hard for, in case of emergencies or when they plan on something in the near future.

Its uses would depend on how you may want to see it. But in general, a personal budget planner is used as a checklist or a list that you fill out in order to see how much you have been spending and how much you have been saving. The budget planner also helps by making you see if you have gone through your budget or you have maintained the budget you have set for yourself.

How to Write a Personal Budget Planner?

In order to be able to budget your investments, your income and your money in general, one must be able to make their own personalized budget planner. Here are your tips.

1. List Down the Wants and the Needs

Make a list of all the things you want and the things that you need. Regardless of what these wants or needs may be. It could be something personal or even something that you want to get. As long as you list these things down, this is the first step to your personal budget planner.

2. Add the Necessities for the Month

After making the wants and the needs, add the estimated amount for your total necessities for the month. Of course you can use weekly, others may prefer to use monthly. It is of course the same process and the same steps. The only difference is the week or the month.

3. Break Down the List into Two Parts

For this part of the budget planner, you are going to be making a checklist or a table. In the table or the checklist you are going to be breaking down your list into two parts. Your two or more parts would have a title and this depends on how you are going to write or what it would be. As long as you are going to be breaking down your list to make it easier.

4. Fill Out the Estimated Amount of Money

On a different side of the list or of your table or checklist, add the estimated amount of money for each of the things you made. Regardless if you say it is a luxury or a necessity. Anything you added in your checklist or list should have the estimated amount of money. If you are able to know the exact amount, the better.

5. Write the Total of Your Expenses for the Whole Month

When everything has already been given their estimated amount or the estimated price for each of the things listed, you may now add the total to your expenses for the whole week or month. This way, when you plan to budget something, you can base it on the total expenses and start from there. Doing this may sound tiring and frustrating during your first tries, but in the long run, they are really worth it.

FAQs

What is a personal budget planner?

A tool used to help you budget your income by dividing it to the things you want to the things you need.

How does this personal budget planner help?

The personal budget planner helps by making you see how much should be spent in a certain week or month. It also helps by letting you see if you are over your budget for the month and to trace how it came to happen.

What other things can be used for a personal budget planner?

You can use your personal budget planner as a means of seeing how much money you have spent within the week or month. To trace or to find a better solution to keeping your budget stick as well.

When we think of budgets, we think that we are restricted to spending the things we want and to focus on the things we need. It is not necessarily the case. When you plan on using a budget planner, you are simply going to focus on the things you want to save up to get to the things you want. The necessary things in your budget planner are also required for this to work. But it does not necessarily constrict you into buying only what you may need. It does help you decide on what to do with your income and to spend and save wisely.