11+ Business Plan Profit Loss Examples to Download

When creating a business plan, it is important for you to showcase your financial statements, one of which is the profit and loss statement. This document is used to show both the revenues and expenses of your organization within a particular time period. With the usage of a business plan profit and loss statement, you can easily present how you transform your revenues into net income which is a great way to attract and/or update your business stakeholders as well as to ensure that your financial conditions can sustain your operations and support your future action plans.

- Free Statement Examples and Samples – PDF, DOC

- General Partnership Agreement Examples and Samples – PDF, DOC

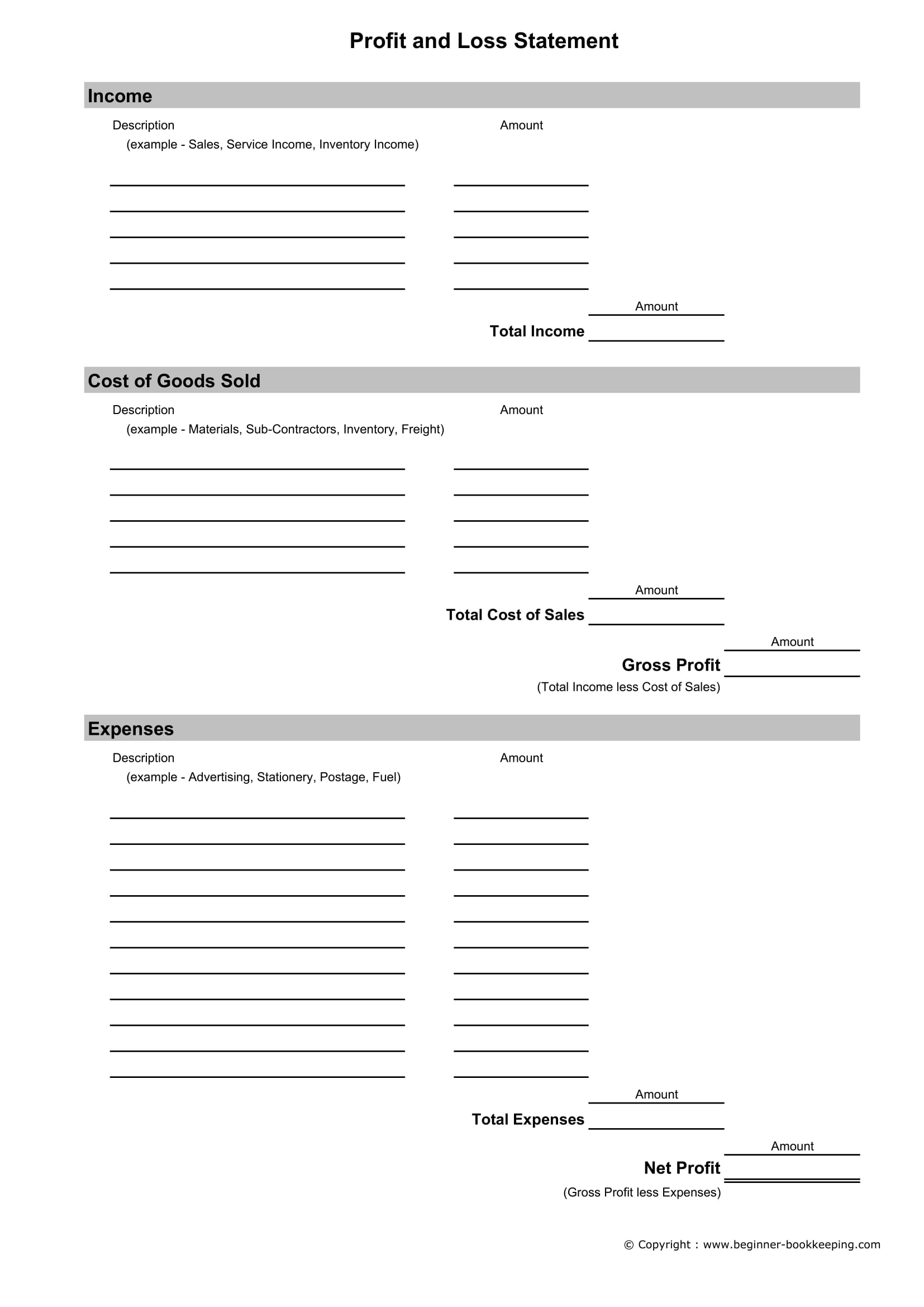

Business Plan Profit And Loss Example Template

We have listed a number of business plan profit and loss template examples in this post available at your disposal. Make sure to download and look into the templates and examples that we have provided so you can have credible guides when developing both the format and content of your business plan profit and loss statement.

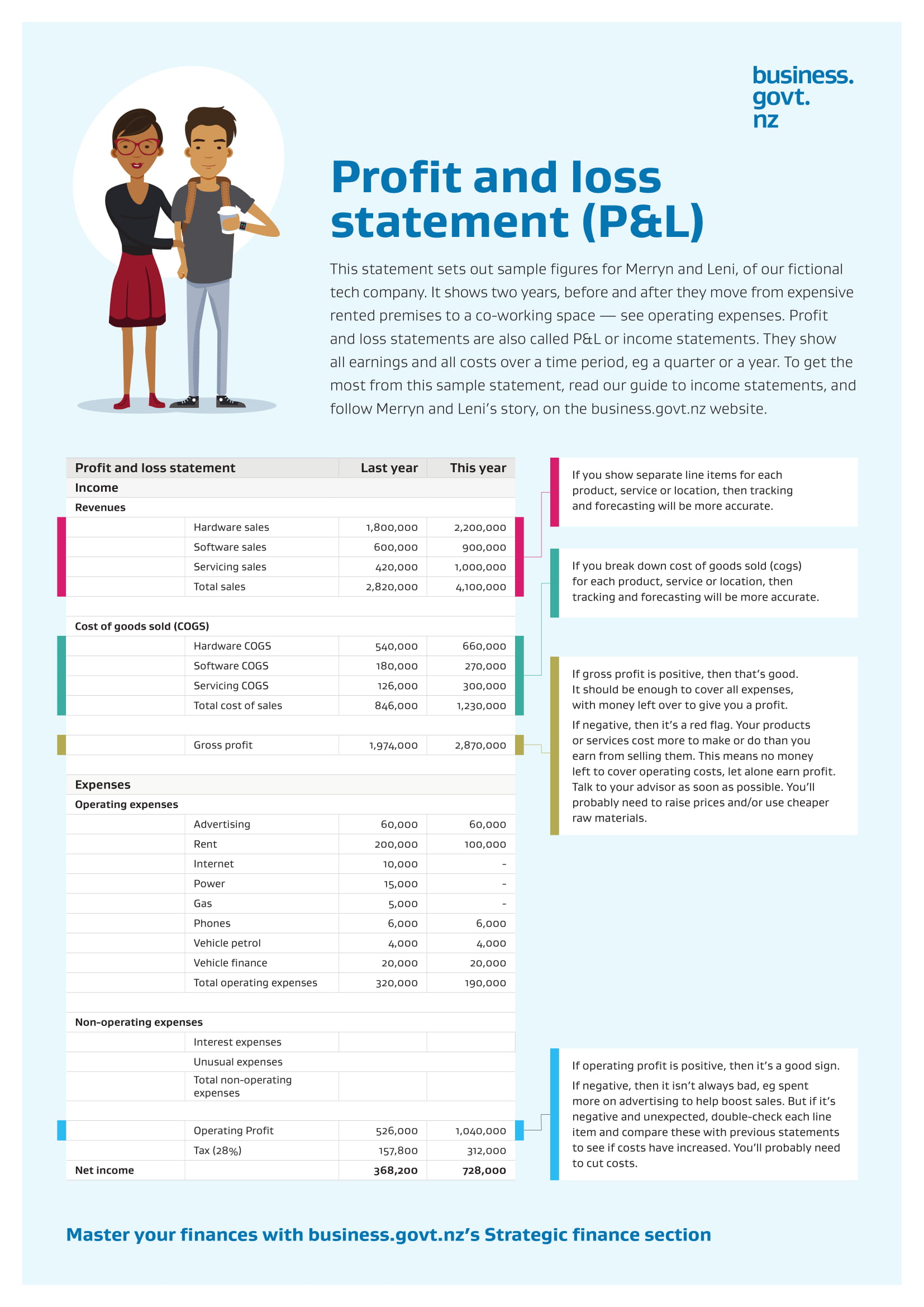

Business Plan Template with Profit and Loss Discussion Example

Business Plan with Profit and Loss Statement Example

Things to Look into When Creating a Business Plan Profit and Loss Statement

A business plan profit and loss statement is very important as it can help you address certain issues and/or problems about your financial condition. Moreover, it can present the actual figures that you need to be aware of not only with regards your profits but also your expenses. To come up with an effective business plan profit and loss statement, you have to make sure that you will be keen and specific when listing down all the details that are needed to be present in the document. Here are some of the elements and factors that you have to consider when making a comprehensive business plan profit and loss statement:

- Be aware of where the business plan profit and loss statement will be used. This can help you identify the time period that is needed to be observed in the statement presentation. Profit and loss statements commonly scope the monthly, quarterly, or yearly sales and expenses of your business. The length of time seen in the document will depend on the reason why the profit and loss statement is currently needed.

- Do not get confused about a business plan profit and loss statement and a balance sheet. Even if they are both necessary to be included in your financial statement, you have to remember that there are still differences between the two. Like a cash flow statement, your business plan profit and loss statement is time-bound. This means that the document is a representation of what had occurred within a specific or given time period. On the other hand, a balance sheet only presents the capital, expenses, and liabilities of the company just in a particular moment or point in time.

- Just like when developing a profit and loss budget, you have to be reminded that the creation of your business plan profit and loss statement must not be entirely dependent on the same documents used by other businesses. Creating a business plan profit and loss statement contains numbers that are based on actual and firsthand information. Hence, you have to make sure that you will use methods and judgments that are suitable for the details of your own statement.

- There are many ways that a profit and loss statement can be called. Some entities call it income statement and others also use a variety of terms. Even if there are differences with what this document is called, the content of each are still the same with one another when it comes to specifications of the ability, or the inability, of businesses to be profit-generating.

Business Plan Profit and Loss Statement Basic Guide and Template Example

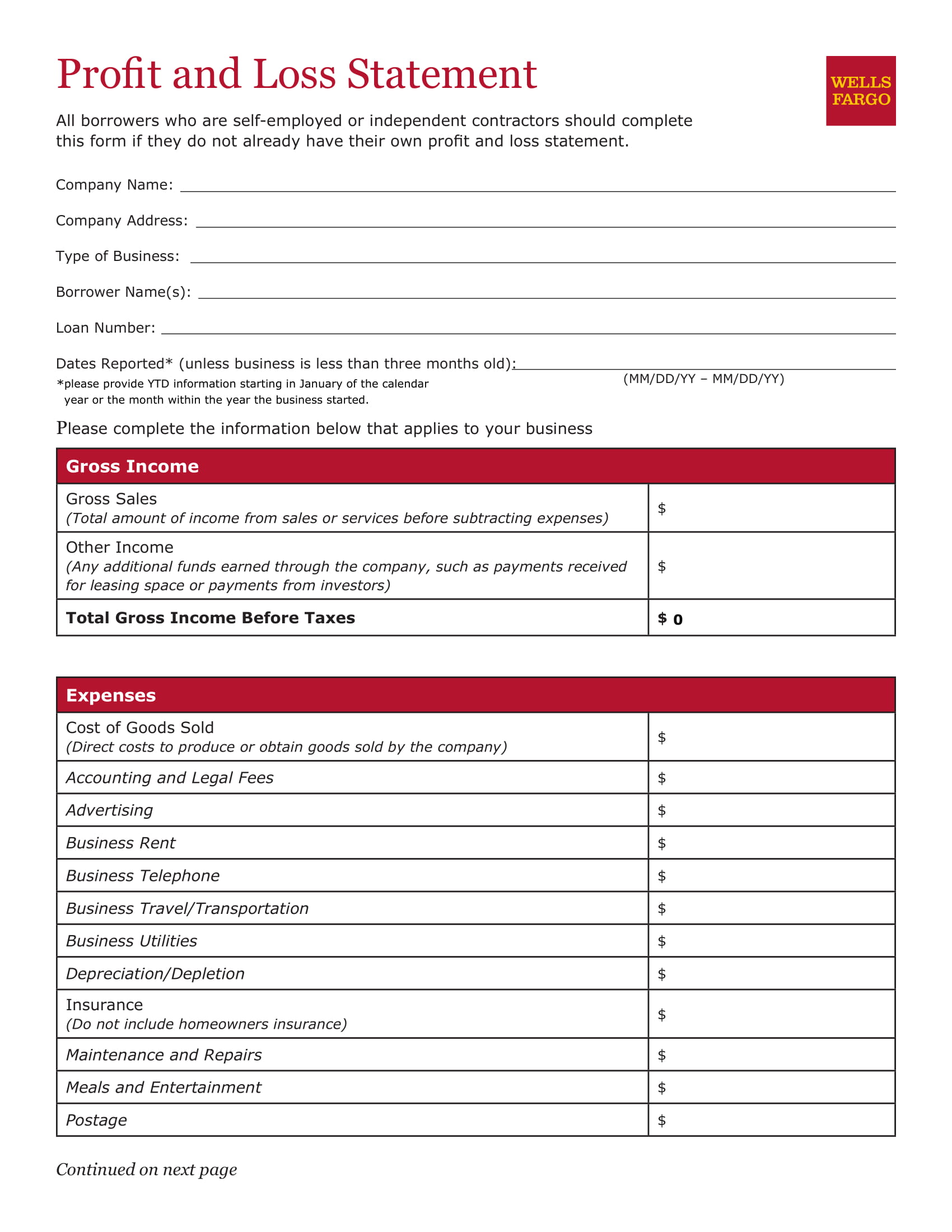

Profit and Loss Statement Template Example

Business Plan Profit and Loss Statement Template Example

Advantages of Having and Using a Business Plan Profit and Loss Statement

Aside from a customer profitability analysis, market analysis, and business plan profit and loss analysis, there are still a lot of documents and analysis materials that a business need to prepare to make sure that it will always be updated of its current standing as a corporate entity. To veer away from looking into the hardships and challenges that you may undergo once you immerse yourself in the development of business documents, you and your team must be aware of the positive impacts and effects that having particular materials and tools can provide your business with. Listed below are some of the benefits and advantages that you can get and experience if you will create a functional, accurate, and thorough business plan profit and loss statement.

- A business plan profit and loss statement can help your creditors and investors to be knowledgeable of how your business performed within a particular time period. An impressive business plan profit and loss statement can give your business the advantage of easily persuading or convincing your stakeholders to further support your corporate undertakings.

- A business plan profit and loss statement can make it more effective for you to predict your future financial performance. Through this, you can measure your company’s ability and capacity to generate cash flows accordingly as you sustain your business and its operations.

- A business plan profit and loss statement can serve as a reference whenever you need to create wise financial decisions that can impact or affect your business and its stakeholders. Having this document at hand can give you an idea of what to prioritize, what to change, and what to remove in your financial activities and processes.

- A business plan profit and loss statement can be one of the proofs of the financial successes and milestones that your business have acquired and attained. Understanding your net income and how it can reflect the performance of your business can also give you an idea of the growth and development that your company was able to achieve at a given time span.

- A business plan profit and loss statement is usually one of the requirements of the government and industry associations so that a business can legally continue its operations, maintain its association membership status, present its current condition, and/or ensure that it is following particular regulations. If you will create a business plan profit and loss statement regularly, then you can ensure that your efforts will not be wasted as you already have the document that you are required to present to particular entities at any given time.

- A business plan profit and loss statement can make it easier for your business to prepare when filing its taxes. However, this document should not be limited for this circumstance as it can also be used to present how the company is performing not only to investors but also to the employees and other stakeholders of the business.

Simple Profit and Loss Statement Layout Example

Profit and Loss Statement for a Business Plan Example

Breaking Down a Business Plan’s Profit and Loss Statement

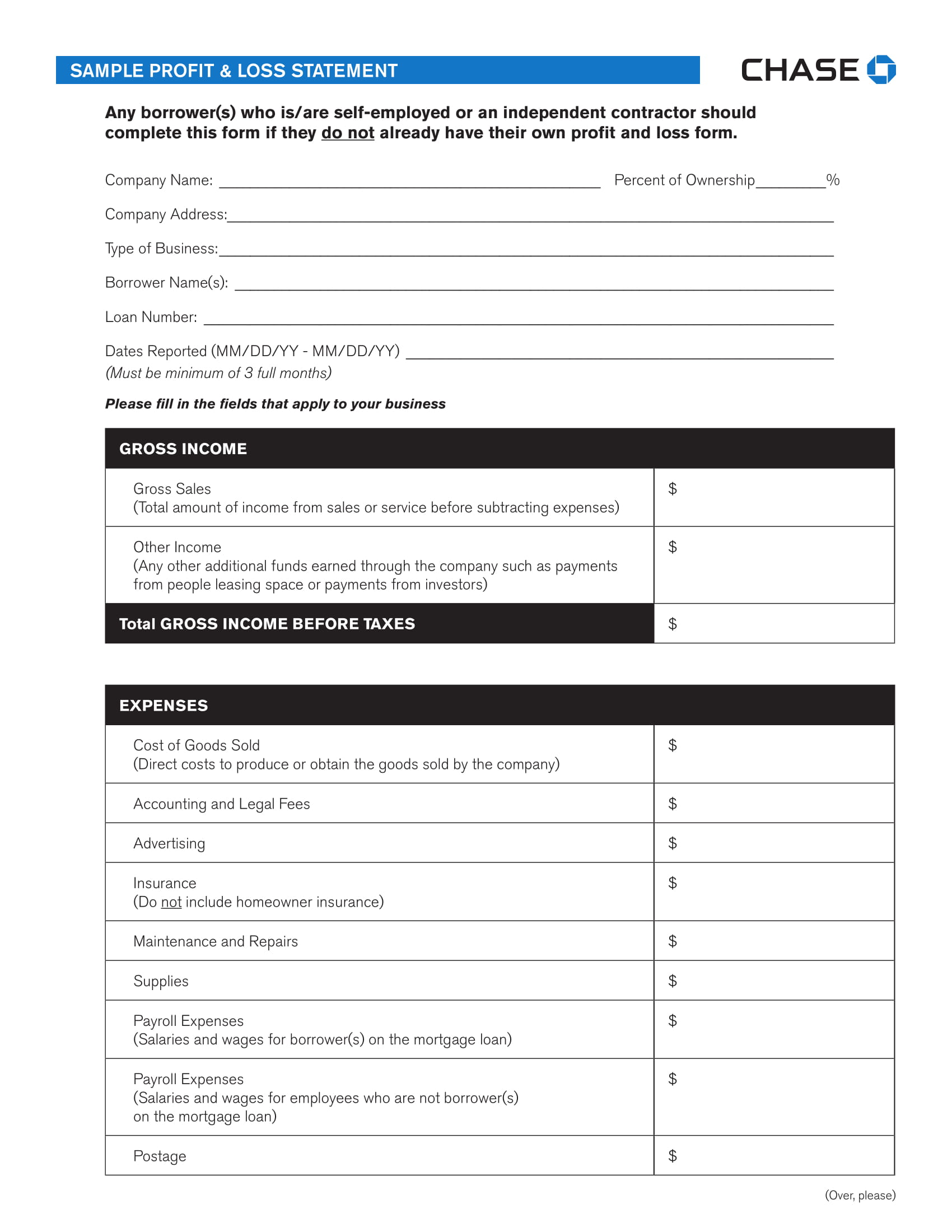

Most business plan profit and loss statements are done annually. However, there are also some businesses that would like to have an updated monthly or quarterly profit and loss statement. With this, you have to keep in mind that developing the specified document must be based on the needs of your business and not solely when it is required by external organizations and entities. Unlike a business consulting business plan where content varies on the area/s of the business where consultation is necessary, the composition of profit and loss statements are mostly the same. Here are some of the common or basic items that you can see in a simple business plan profit and loss statement:

- The clean and accurate financial records that have been used as references in the development of the profit and loss statement

- The specification of the selected time period which limits and scopes the duration where the details within the profit and loss statement are based on and has been gathered from

- The reason of the profit and loss statement’s creation

- The name of the person or the identification of the team who made the profit and loss statement

- The gross profit which is identified by deducting the business’s cost of sales from the revenue

- The operating profit which is identified by specifying the gross profit of the business and subtracting operating expenses from it

- The display of non-operating expenses and revenues of the organization which are essential to still be taken into account for a more accurate financial assessment

- The description and presentation of the total profit or loss of the business.

Business Plan with Profit and Loss Table Example

Business Planning: Profit and Loss Statement Preparation Example

Why Do You Need a Business Plan Profit and Loss Statement?

Do you really think that it is essential and necessary for you to create a business plan profit and loss statement? Even if it is added work to your team, we highly recommend you to develop this document as it can provide a lot of benefits to your organization. Just like a management consulting business plan, a business plan profit and loss statement can also be an added value to your overall business operations and management. Listed below are some of the reasons why your business needs to have its own business plan profit and loss statement.

- Using a business plan profit and loss statement can present you the reality about your financial condition. This is a great way to know the actual profit that your business is making, or even losing, within a specific period.

- Making a business plan profit and loss statement can give you references that can be used when making decisions about improving sales targets, developing financial practices, or changing different activities that can better your financial state as a business.

- Developing a business plan profit and loss statement can help you a lot if you need to apply for business loans. The ability of your business to present its financial status can make it easier for creditors and investors to trust you.

- Creating a business plan profit and loss statement can make it easier for you to present to different stakeholders during meetings. It can be for the owner of the business, the shareholders of the company, the management, and even the employees of the organization.

Business Plan Profit and Loss Statement Format Example

Tips in Developing a Business Plan Profit and Loss Statement

Business plan profit and loss statements that are used by different organizations from various industries can sometimes be very basic but can also be complex. A few of the tips that you can use and refer to if you want to make a detailed and well-formulated business plan profit and loss statement include the following:

- Just as how you create a lawn care business plan and other business document, it is important for you to know the scope and limitations of the information that you will discuss in your business plan profit and loss statement. Ensure that all the details in the document are relevant and necessary.

- You have to be knowledgeable of the guidelines and regulations that are formulated by governing bodies in your country. Some business plan profit and loss statement specifications are country-specific, which is why you have to always be up to date regarding changes or updates about the particular matter.

- Mind that there is a need for business plan profit and loss statements that your company have developed in different periods of accounting to be compared with one another. This is to identify the level of growth of your business based on the differences seen in your profit and loss statements.

Ensure the reliability and accuracy of the details that are going to be seen by your target audience in the business plan profit and loss statement. With the basic knowledge about the development of business plan profit and loss statement as well as the references that we have put together in this post, you can already easily create your own profit and loss statement. What are you waiting for? Try to develop a profit and loss statement now.