6+ Capital Funding Examples to Download

Capital funding refers to the funds provided by the lenders and equity holders to business firms under a legal contractual agreement. This funding is given for a long term period to support the business needs by the providers to the traders as debts and equities. Traders utilize the capital and adopt different strategies to double the amount to satisfy the interest business interest of the firm and the lenders and the providers.

6+ Capital Funding – Mortgage Examples in PDF | DOC

1. Capital Grant Funding Report

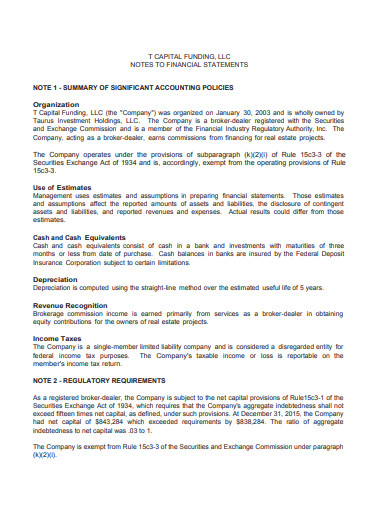

2. Capital Funding in Financial Statement

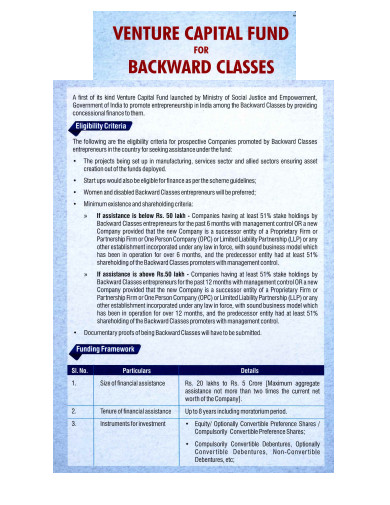

3. Venture Capital Fund for Backward Classes

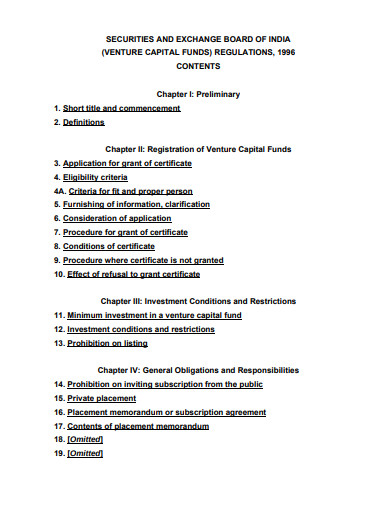

4. Sample Venture Capital Fund

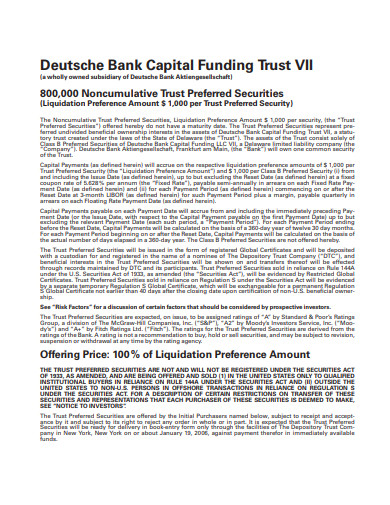

5. Bank Capital Funding Trust Example

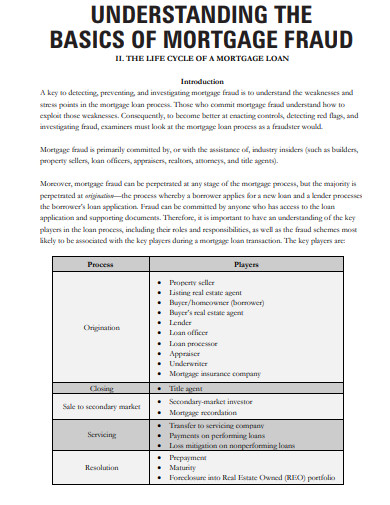

6. Basics of Mortgage Fraud Example

7. Funding of Capital Items Examplle

What is Capital Funding Mortgage?

Capital funding mortgage more specifically defines the legal agreement which secures the capital provided to the needy traders by the lenders or the banks. This capital is provided in the interest of exchanging the title of the debtor’s property. It also states that the agreement becomes void and null once the debt is paid. Traders don not use their capital always to buy or acquire capital or assets, these are mostly done through capital funding.

Most of the businesses use two primary capital raising routes stock issuance and debt issuance.

Stock Issuance

Companies often issue stocks using initial public offering (IPO) or through additional shares. But whichever way is chosen for acquiring the capital and stocks, investors only provide it for more capital initiatives and appreciation. The return on investment (ROI) is the cost of equities, used for addressing the interest of the investors on the return of the capital. Stock investors can be provided with the ROI by managing the company’s resources and paying debts and dividend. In this way, the share value grows. Issuing of additional funds might dilute the existing and supporting shareholders as in a stock issuance process the proportional ownership and voting influence might get impacted or reduced.

Debt Issuance

Capital funding can also be raised by making contractual agreements with the lenders and asking debt under corporate bonds. Such bonds read the investors compensated with the semi-annual coupon payments until the time specified in the bond. Such coupon refers to the cost of the debt to the company that issues the bond. It also adds that the investor’s interest to invest in the bonds should get it in discount as the values get repaid in its maturity. The bond matures when the other party can share the percentage of interest imposed on the debt.

What does Capital Funding include?

Capital funding gives wy to several responsibilities that are worked upon to fund several projects and trade investments that can double the capital value. The traders take a considerable time until which the investors fund the trade and the traders utilize it to make more money. This includes the responsibilities to-

- Plan the financial growth of the firm and take several measures to manage the growth positive and company-friendly.

- Focus on the acquired assets and funds to utilize it properly to make money double and keep them function smoothly.

- Plan properly strategized steps to expand the business or the company reach to the most of its target audience.

- Focus on the measures to evolve or improve the products and services and invent and develop new products and services.

- Repurposing the available stocks until they cause the benefit as expected with it.

- Repurposing stocks.

How does Capital Financing Works?

Companies may raise funds and equities by issuing a proper bond to the lending company or the firm. By making the bond with the companies get assured funding until the time specified in the bond. And the investors get reimbursed their money with coupon payments several times in a year as specified in the bond until it matures. The investors are offered a discount for buying the bonds many a time which they are always reimbursed.

In business, borrowing debt can be done in two ways like leasing, or taking loans, by dealing with the financing institutions.

If a business house takes capital debt from banks or other financing institutions they are always imposed with some percentage of interest rates which they have to pay the institution apart from the actual capital taken.

Debt or loan in business is always a liability but it may decrease as the firm pays it in several intervals of the year, it can also be said as an expanse.

What is Venture Capital Funding for Companies?

Venture capital funding is mostly seen being used by entrepreneurs and new business practitioners, especially those which seem to contain more risks and might not get funding through any common source. But for raising fund the companies or the startups have to show some sort of high growth plan and assurance. The business plan has to assure the investors that it has high chances of a successful ROI.

Debt and equity can be used for venture capital funding, not directly but with shares or by cutting it from the future earnings. Venture capitalists collaborate with the companies at certain stages of their development. In such investment of the interest holder in any startups, the investors possess partial or full authority at times to direct and command the company.