7+ Check Register Examples to Download

When you are dealing seriously with your transactions especially as regards the disbursements of checks, you must see to it that you have records of all your check disbursements not only to monitor the amount you have left in a certain bank but also to manage your expenses or cut off some costs.

This record keeping can be done with the help of a check register. In a check register, you can constantly keep watch of your finances specifically regarding checks. A check register is also helpful when you want to calculate the amount of outstanding checks and deposits in transit and even update your records in the financial statement.

In this regard, it is better to use a check register as early as now through the examples of check register presented in the next section.

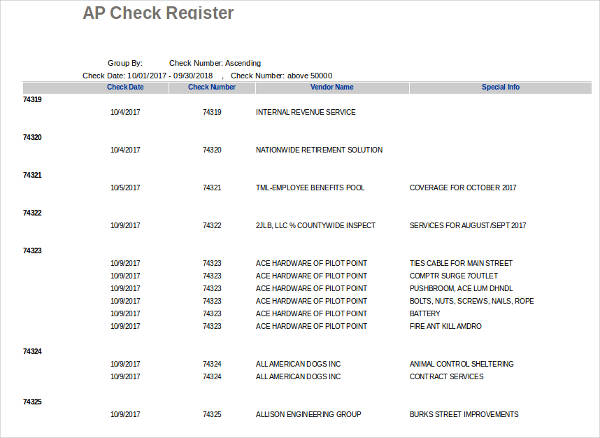

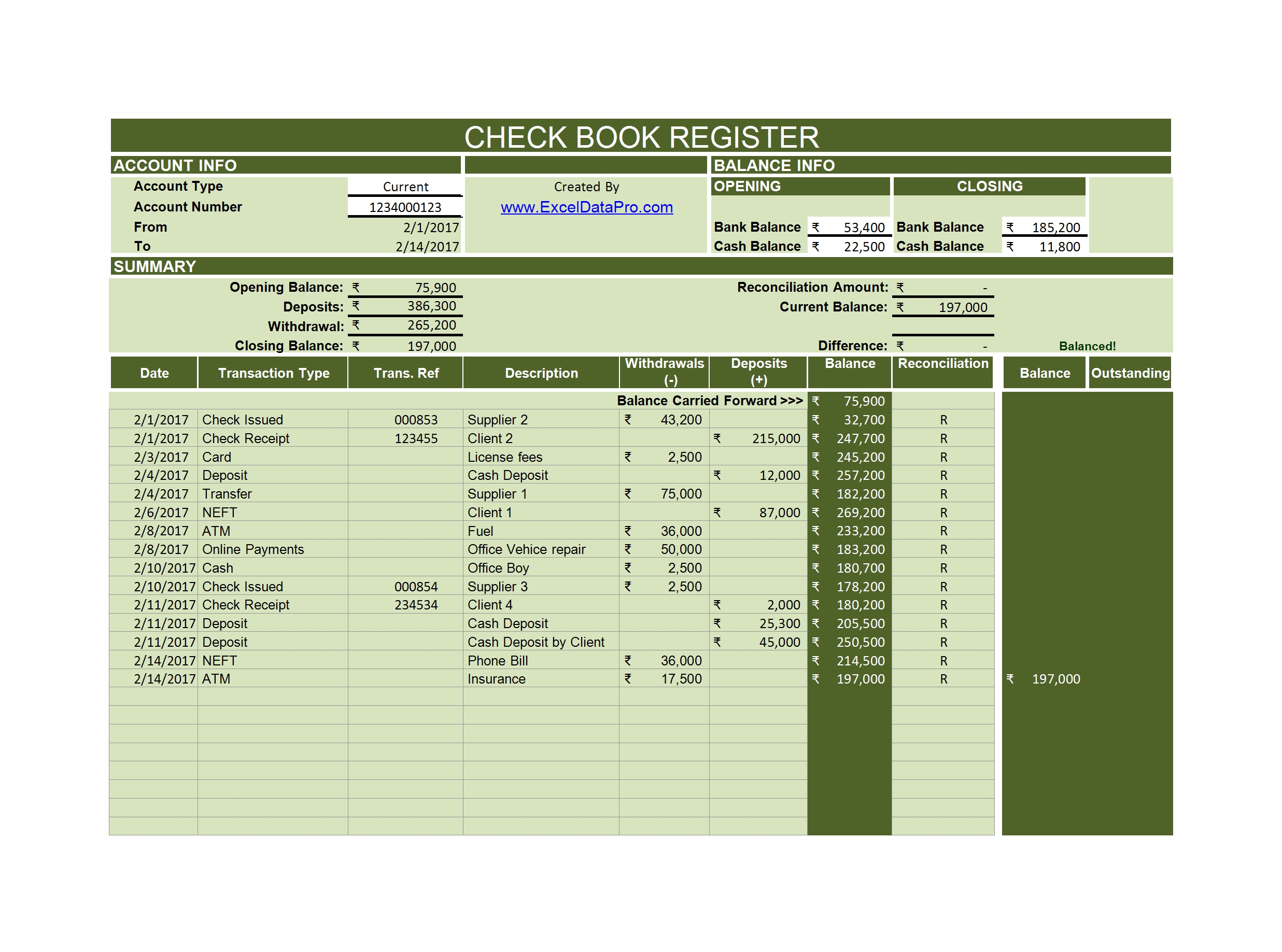

Accounts Payable Check Register Example

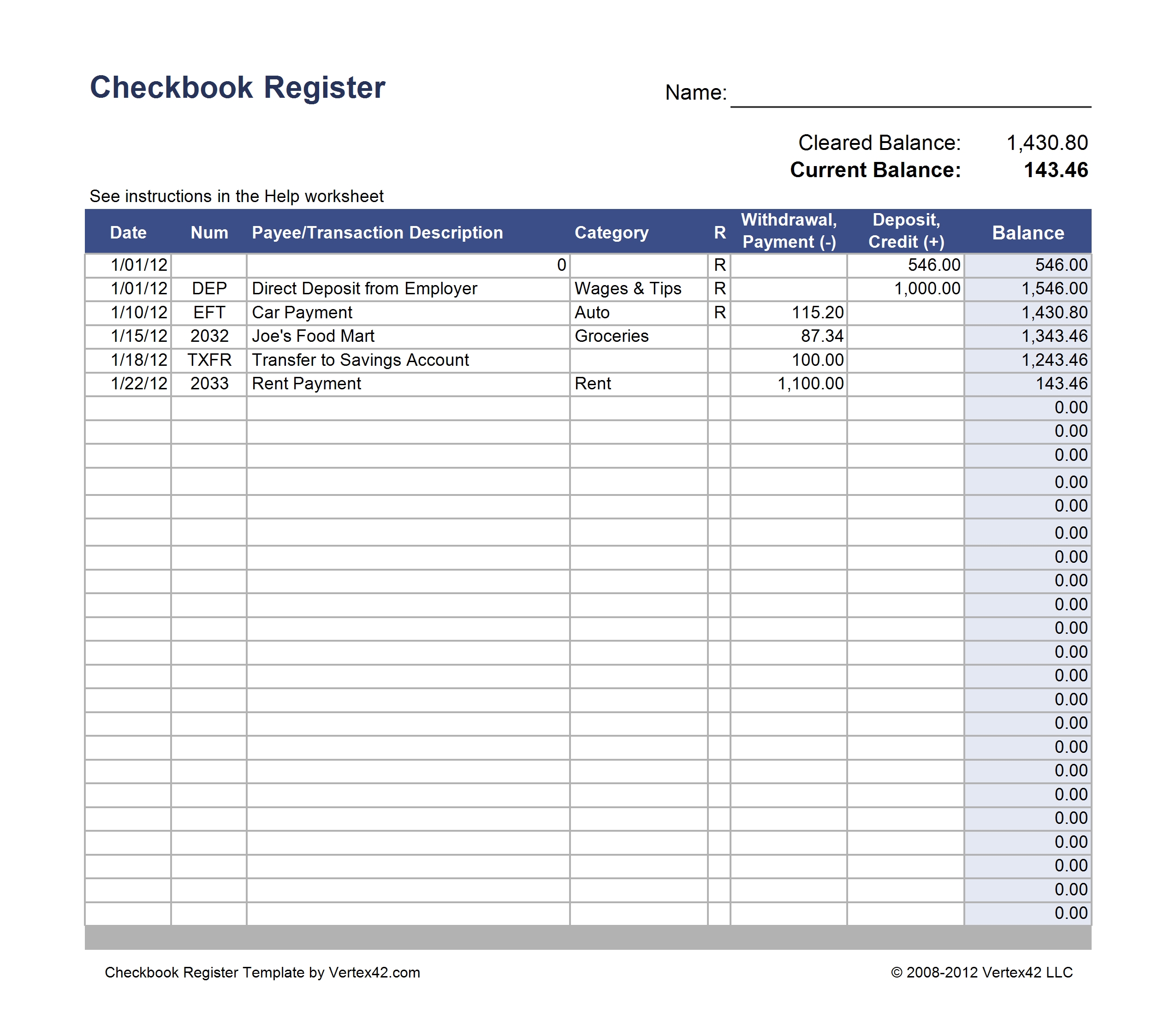

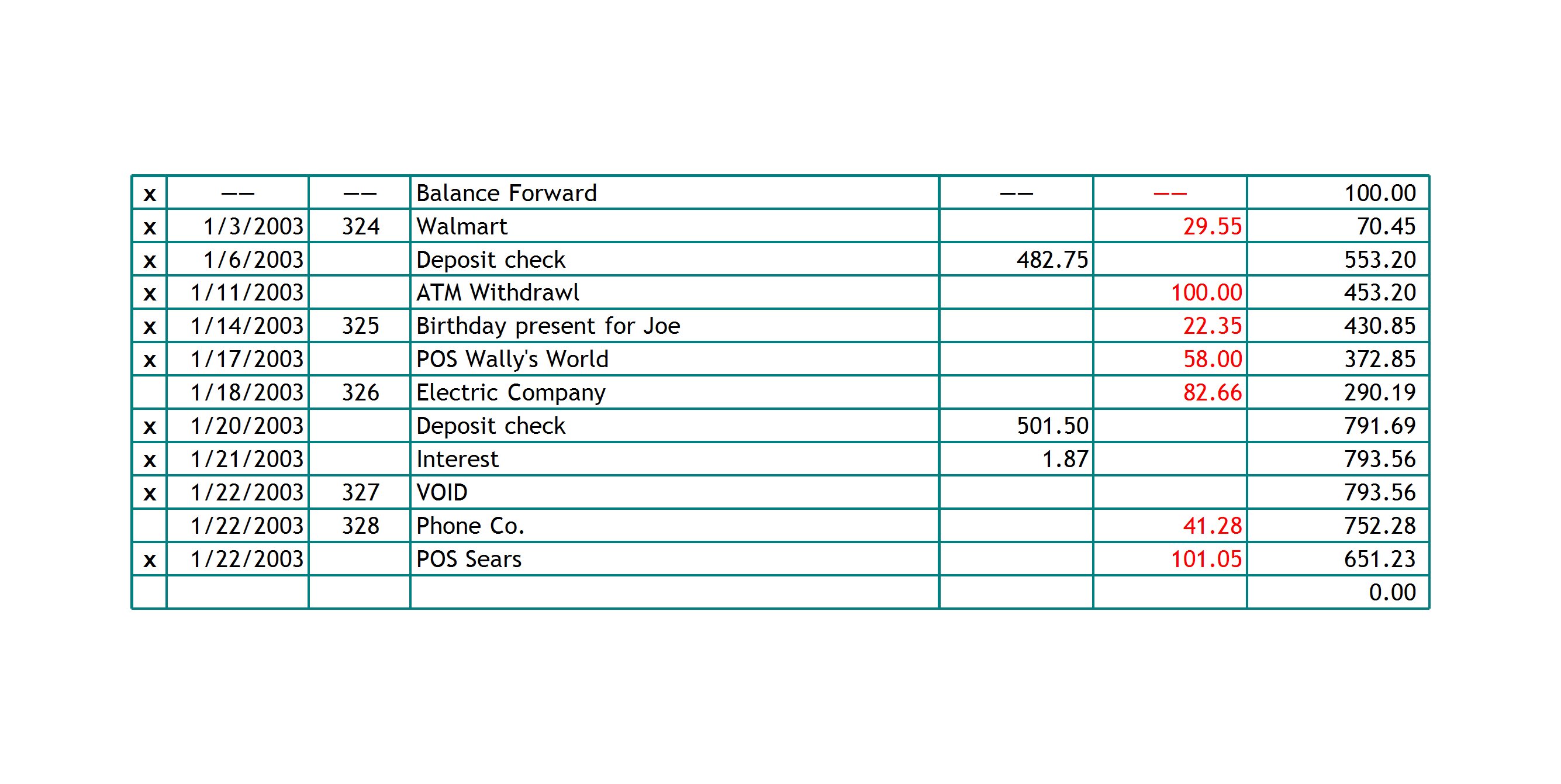

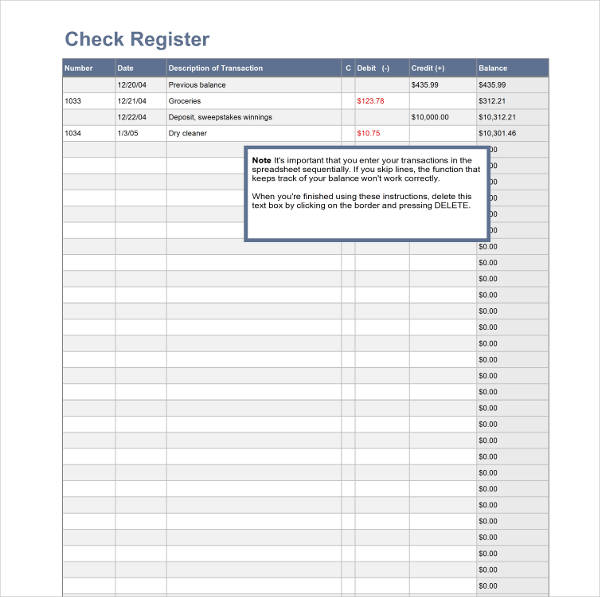

Bank Check Register Example

What Is a Check Register?

Also called cash disbursements journal, a check register is a journal used to record the check and cash payments as well as outlays of cash during a certain accounting period. All transactions involving checks are recorded in a check register before they are posted in the general ledger and other ledgers relating to the transaction. You may also see work attendance register examples.

You also use a check register to calculate the remaining or the running balance of your checking account. In this way, you will be updated with the current balance of your account which will be helpful when you want to do some budgeting and monitoring of your expenses. You may also like risk register examples.

There are different accounts that can be found in a check register, and these depend on the nature of business of the company. For example, in a manufacturing company, the accounts usually found in a check register are purchases for raw materials and cost for production. On the other hand, for retailing company, the common accounts are accounts payable and general inventory.

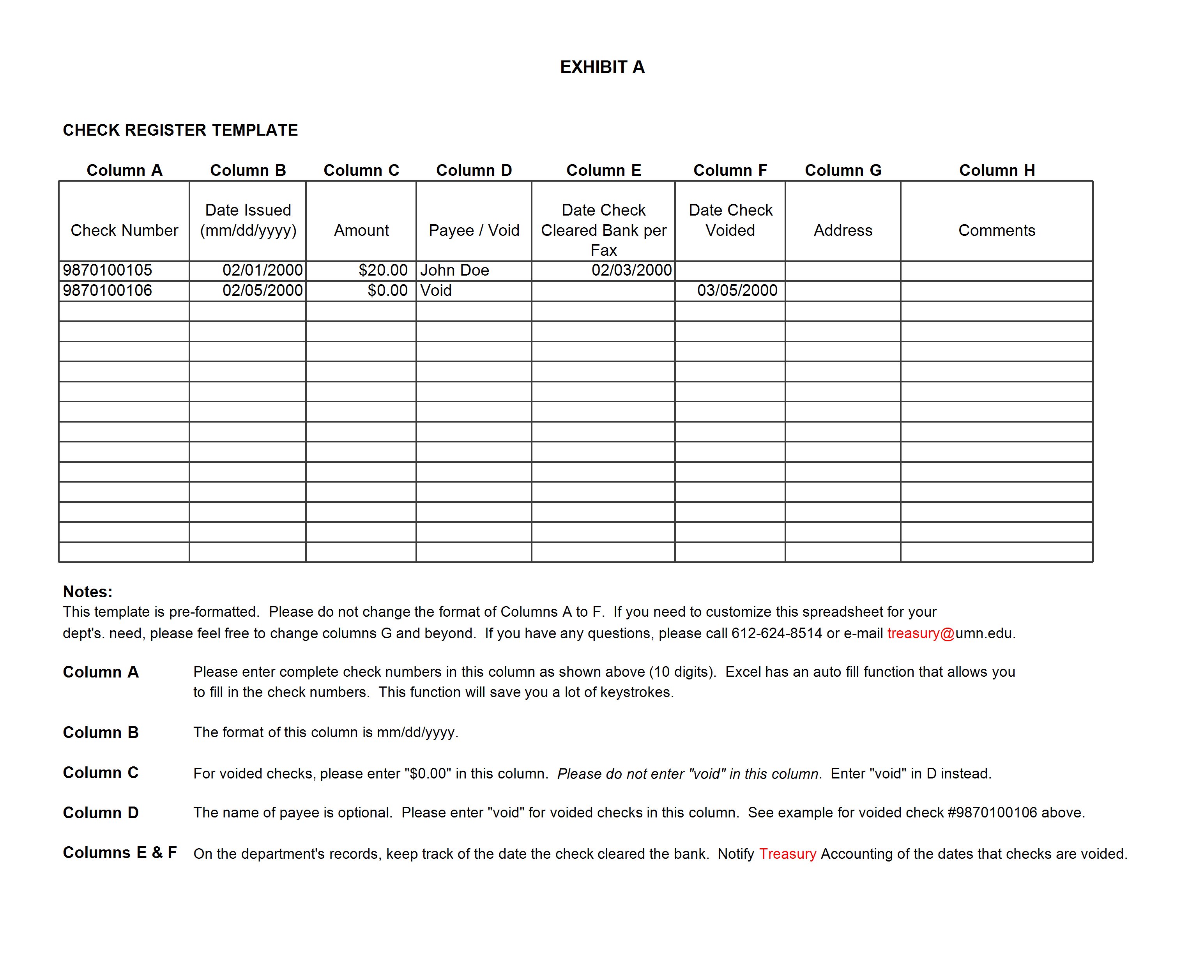

Components of a Check Register

In a check register, you can find several columns that can help you organize your check register so that the next time you will browse through your check register, you can easily find what you are looking for and it is easy for you to interpret its content. You may also see baby registry checklist examples.

Here are the columns that are typically found in a check register:

- Check number

- Date of transaction

- Description

- Debit

- Credit

- Balance

Importance of a Check Register

Why do we need a check register? Does it really affect our bookkeeping of the different transaction especially relating to checks?

You may not immediately see the importance of check register until the time when you need to account your transactions with regard to checks. During this time, a check register is important so it is easier for you to check through the balance as well as to determine the transaction you had regarding checks. You may also like material list examples.

Here are several importance of having a check register:

1. You can review your purchases

One of the important reasons why entities keep a check register is that through check register, you can review your purchases. You will see the details of the transaction, for example, when you are disbursing checks to pay for the raw materials that you have purchased. Also, you can review not only the transaction but also the date as to when you have made such purchase. You may also check out to-do list templates and examples.

2. Provides you an up-to-date account balance

When you keep a record of your transactions in a check register, you can immediately determine your account balance; hence, it provides you an update balance of your account. You do not need to check your account in the bank or through online banking because you have the records on hand with you. It might lessen the hassle of balance inquiry as the digits are presented plainly and clearly in your check register. You might be interested in contact list examples.

3. Helps you to avoid overspending

When you are updated with the balance of your account, there is a lesser tendency that you will be overspending. You know the limit of the amount you must spend, and you know how to control your expenses. Thus, a check register is helpful not only to avoid overspending but also to budget your expenses. You will also know in which area or purchases you have spent most of your checks. You may also see class list examples.

4. Helps you in bank reconciliation

An updated check register would also greatly help in your bank reconciliation. There are times when the balance you have in the bank is not updated due to deposits in transit and outstanding checks. These are the two most common bank reconciling items. When you have your check register with you, you can immediately determine which checks are still deposits in transit and which are those that are outstanding checks. You may also like grocery list examples.

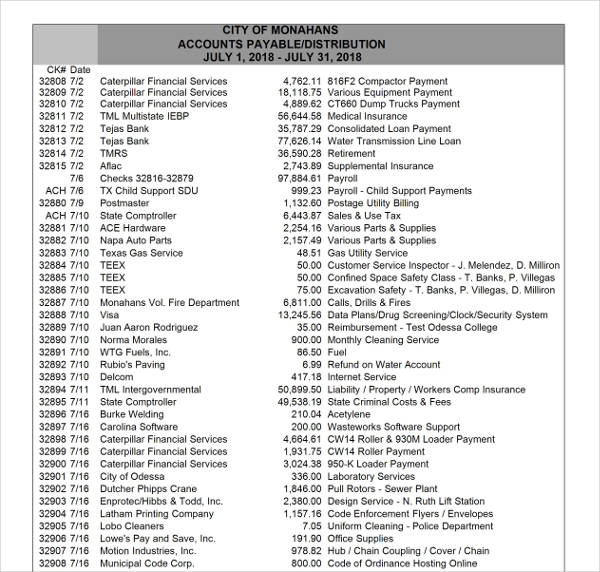

City of Monahans Check Register Example

Comprehensive Check Register Example

Types of Check

Checks have different types, and you must at least have a background of these types for you to understand the nature of the check that you are holding or the check that you will be disbursing.

Here are some of the common types of check that you must know:

1. Personal Check

This type of check is among the common types of check which is payable only to the individual who is named on the check, hence personal check. The holder of the account writing the check is held responsible for the availability of the funds and make sure that it is enough to cover the amount of the check. You may also see birthday list examples.

2. Bearer Check

In this type of check, it is payable to any person who will present the check for the check is marked “cash” without specifying a name in particular. Thus, when you receive a bearer check, you can take it and encash it in the bank without the bank having to bank them into your personal account. When you are writing a bearer check, this would mean that you are allowing anyone who will be holding the check to encash it. You may also like list templates in word.

3. Certified Check

This type of check is issued by a bank after it has determined that there are enough available funds in the account of the writer of the check to cover the amount stated or written on the check.

The bank then will verify if there is indeed necessary funds and that the signature on the check is true and genuine. After, the bank will withdraw the amount written on the check from the owner’s bank account and hold it, ensuring that the check will be paid out. You may also check out packing list examples.

4. Cashier’s Check

Also known as an official check, treasurer’s check, or manager’s check, these checks are issued by banks and the bank made the promise to pay and not the person using the check. The check is then written by the financial institution. It is signed by its cashier or manager. This is said to be a guaranteed check and is treated similarly to a cash. You might be interested in punch list examples.

5. Traveler’s Check

As the name itself implies, this type of check is used when traveling. You can get traveler’s checks in any denomination in whatever currency. They are used to pay for hotels and merchants. They are also used to insure against loss, theft, damage, or destruction.

6. Money Order

This is a type of check that has been acquired at either a financial institution or the US Post Office. It is prepaid with cash, debit card, or traveler’s check, and you do not need to have an account with a financial institution, such as a bank account, to purchase or cash a money order. You may also see address list examples.

Concise Checkbook Register Example

Reconciled Check Register Example

Other Types of Check According to Their Issuance

There are many other types of check that are categorized according to their issuance, and they are as follows:

1. Open Check

This type of check is payable to the person specified in the check or to any person who is holding the check and present it for payment over the counter.

An open check is also called a bearer check, when the word bearer on the face of the check is not crossed or cancelled. There are cases when a check is lost and someone might find the check. In this case, the person can collect payment from the bank since anyone who is holding the check can present it for payment over the counter. You may also see vendor list examples.

2. Order Check

In the moment when the word bearer, which is written on the face of the check, is crossed or cancelled, the check will then become an order check. This check is payable to the person specified in the check or to any other person whom the check is endorsed.

3. Crossed Check

This type of check is considered as the safest type of check. It can only be accredited to the payee’s account, the person whose name is specified in the face of the check. The one issuing or writing the check must specify it as an account payable to the payee by simply marking the check with two parallel lines on the top left of the check or middle or right-hand corner of the check. You may also like bucket list templates & examples.

4. Ante-Dated Check

In this type of check, the date of the check is earlier than the date of the presentation for payment. Hence, this check bears a date in the past. For example, a check may be written in February but is dated before February, that is, January. This check can be sent to a bank for payment to be made the moment it is issued. However, it must not be more than six months old or else the payment would not be made. You may also check out attendance list examples.

5. Post-Dated Check

In this type of check, the check bears the date in the future. It is honored only when the date stated on the check comes or after that certain date, usually up to three months. Hence, when you receive a post-dated check, you cannot immediately present it to the bank for payment. You must wait for the date specified in the check. You might be interested in rooming list examples.

6. Stale Check

This refers to a check that is presented at the paying bank after the period of its payment date which is usually six months. It is deemed an irregular bill of exchange, but it is not an invalid check. It can still be honored in the bank when the drawer will reconfirm its payment by writing a new date of payment or by issuing a new check. You may also see inventory list examples.

7. Mutilated Check

In this type of check, the check gets torn into two or more pieces. When it is presented in the bank for payment, the bank required confirmation by the drawer for the bank to honor the check. Otherwise, this would mean that the intention of the torn check is to cancel the check or to render it void.

Simple Check Register Example

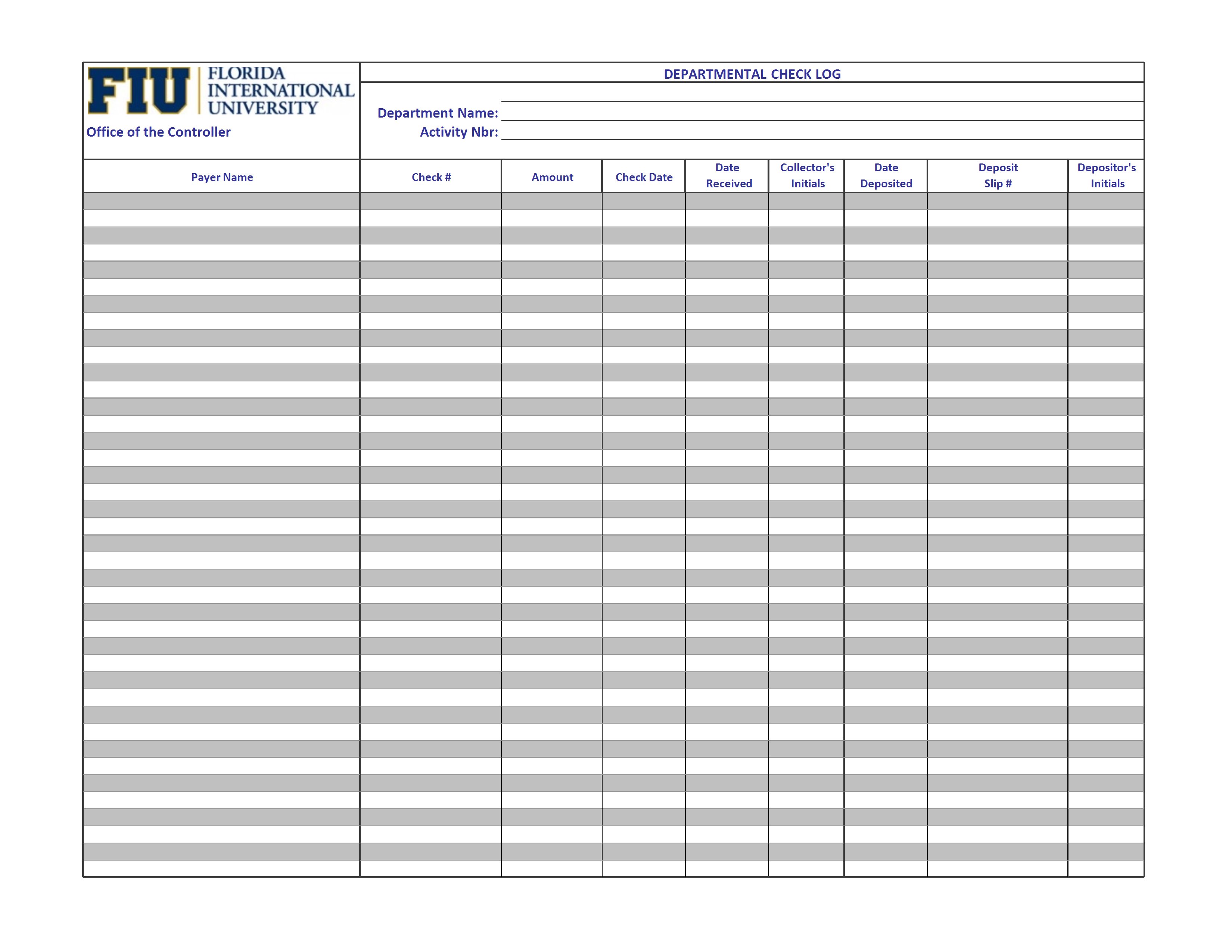

Blank Check Log Register Example

Wrap Up

Having a check register is important because through check registers, you can review the purchases and expenses you made, it provides you an updated balance of your account, it helps you avoid overspending, and it also helps you when you are doing bank reconciliation. You may also see reading list examples.

Also discussed above are the components of a check register—check number, date, description, debit, credit, and account balance—presented in columns which can help you organize your cash and checking account.

There are also various types of checks that you must know: personal, bearer, certified, cashier’s, traveler’s, and money order. Other types of checks according to their issuance are open check, order check, crossed check, ante-dated check, post-dated check, stale check, and mutilated check. You may also like management skills list and examples.

Lastly, do not forget to check out the examples and templates of check register in Excel presented above.