99+ Check Examples to Download

When you need to withdraw or pay large amounts of money you often can’t use paper bills. In today’s current culture, people will opt to use checks to withdraw or send large amounts of money to another person’s or business’s bank account. These checks appear in the form of a small rectangular paper with specific indentations to denote the check’s authenticity and validity. Banks will cash in checks as one of their products or services a person can avail, making banks a service business.

1. Altered Check

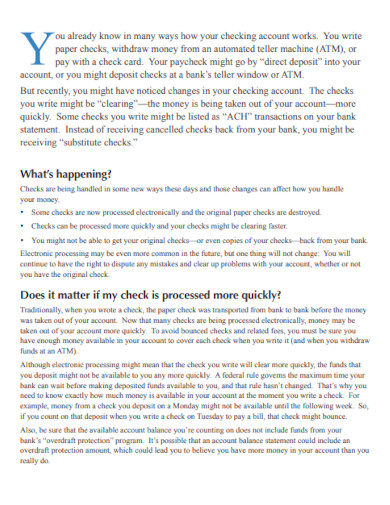

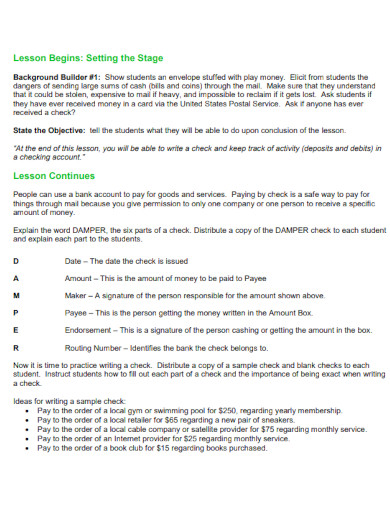

2. Writing a Check

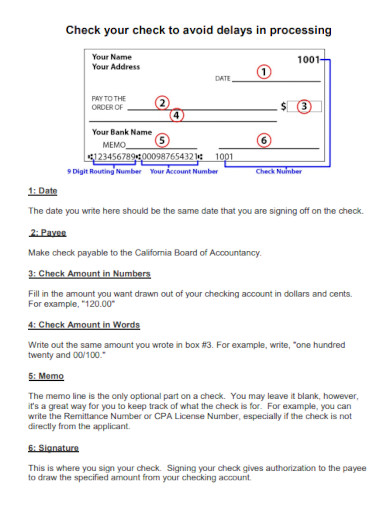

3. Check Filling

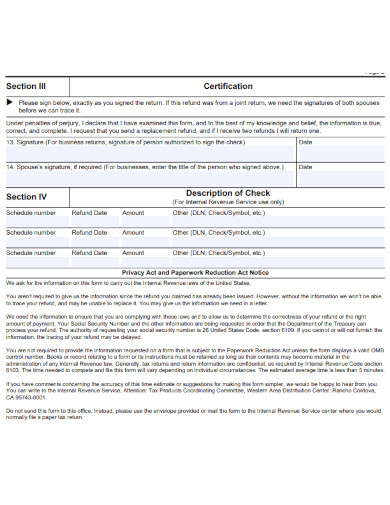

4. Refund Check Form

5. Credit Report Check

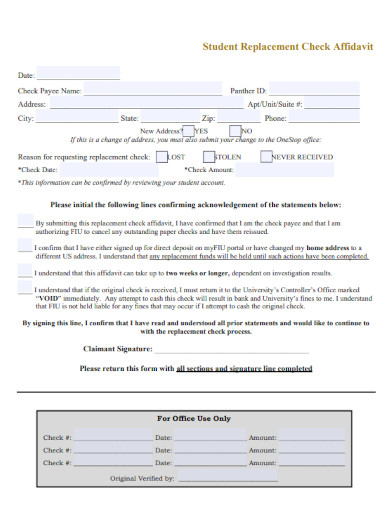

6. Student Replacement Check Affidavit

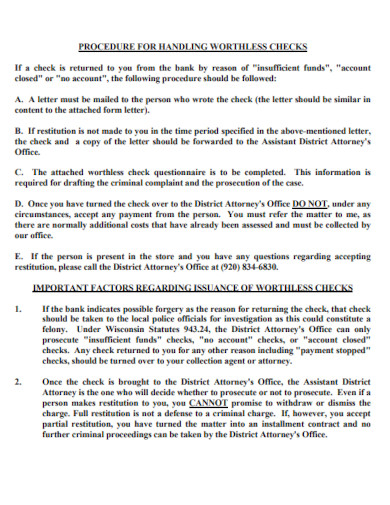

7. Issuance of Bad Check

8. Register Check

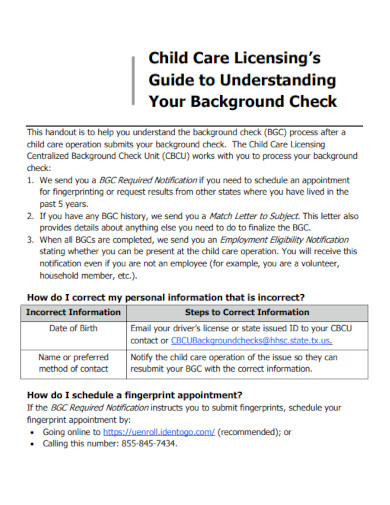

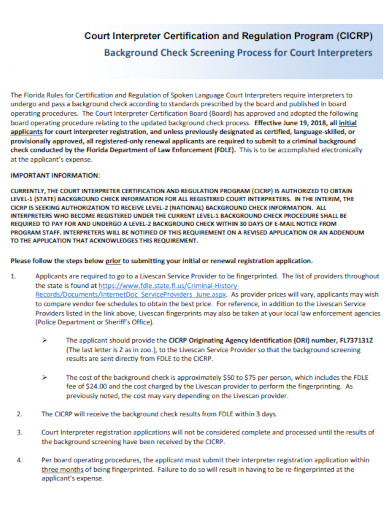

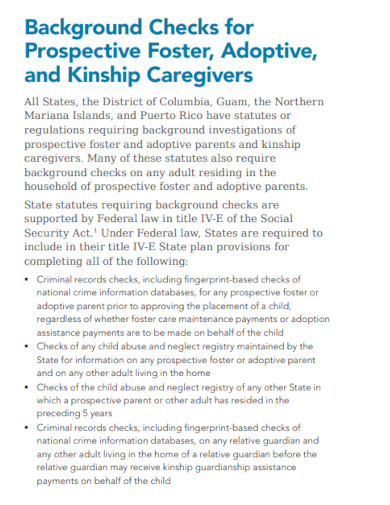

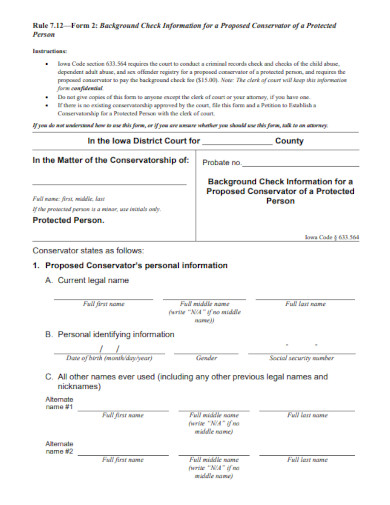

9. Background Check

10. Check Sample

11. Check Procedure

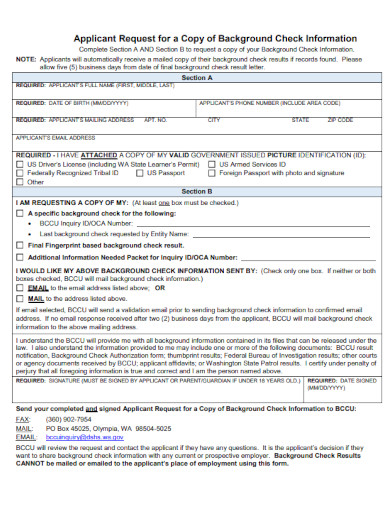

12. Request for a Copy of Background Check

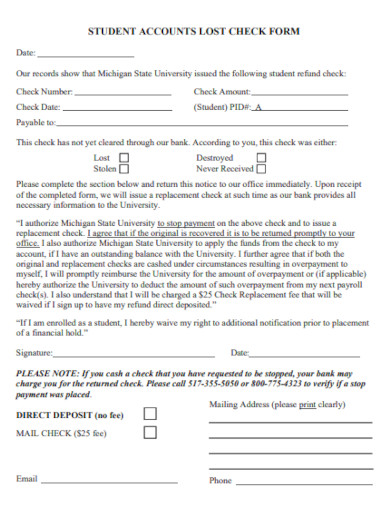

13. Student Accounts Lost Check Form

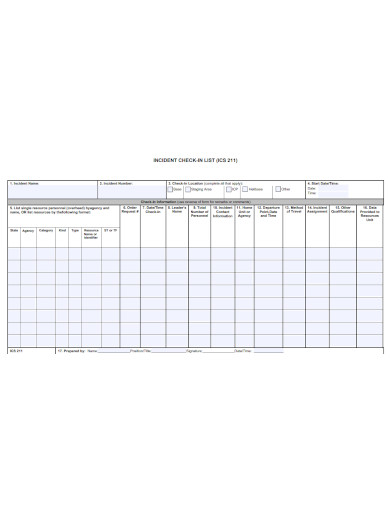

14. Incident Check-In List

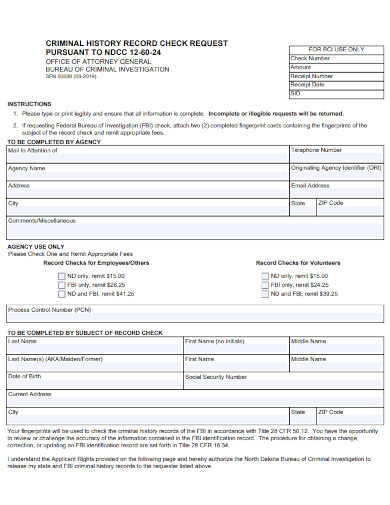

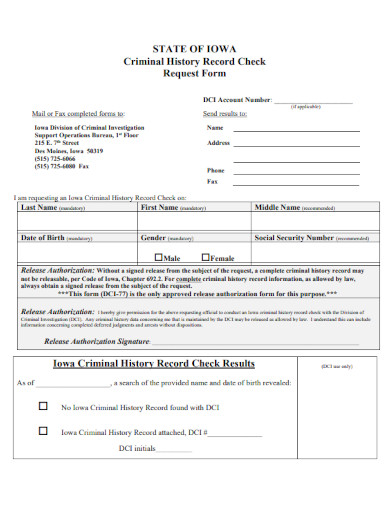

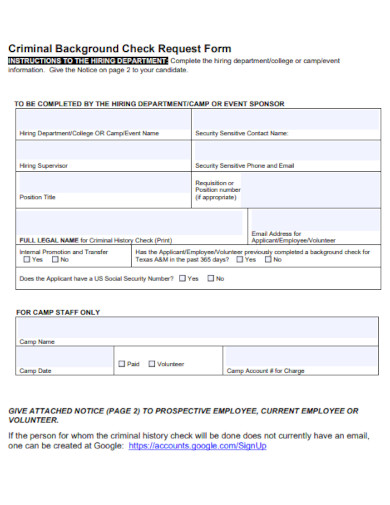

15. Criminal History Record Check Request

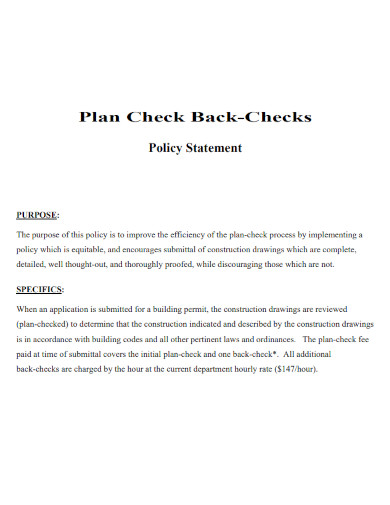

16. Plan Check Back-Checks

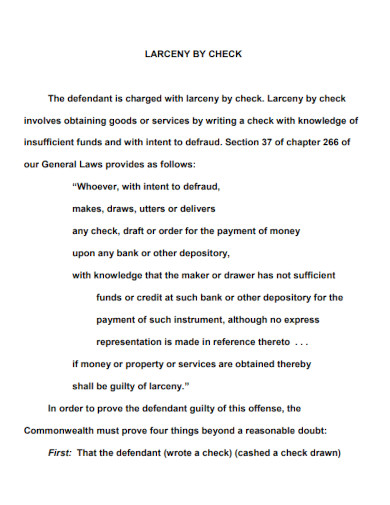

17. Larceny by Check

18. Check Format

19. Ditch Check

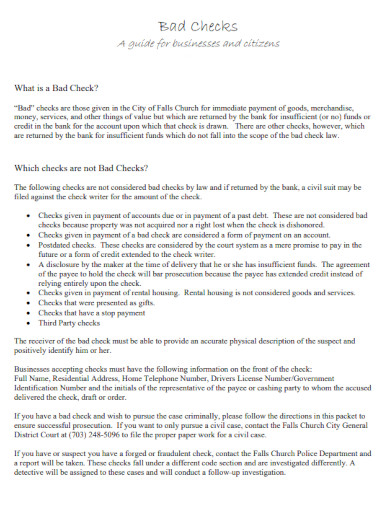

20. Bad Check Sample

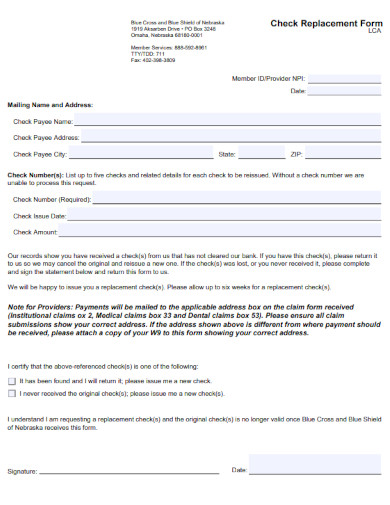

21. Check Replacement Form

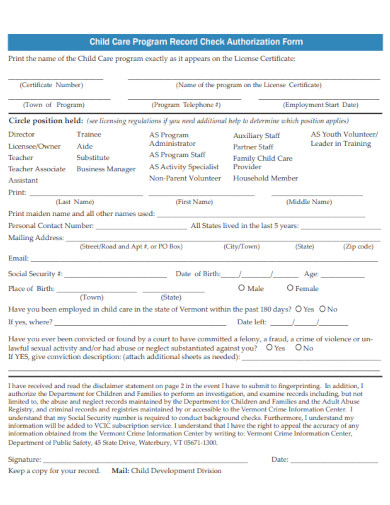

22. Check Authorization Form

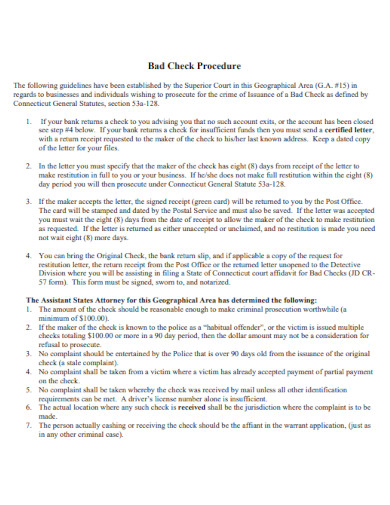

23. Bad Check Procedure

24. Check PDF

25. Check Request Form

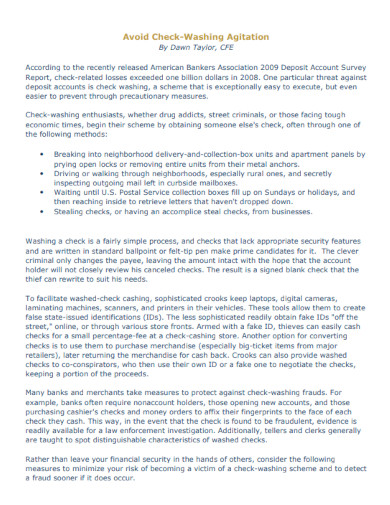

26. Avoid Check-Washing Agitation

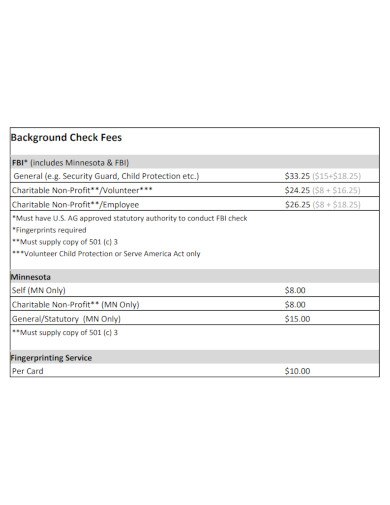

27. Background Check Fees

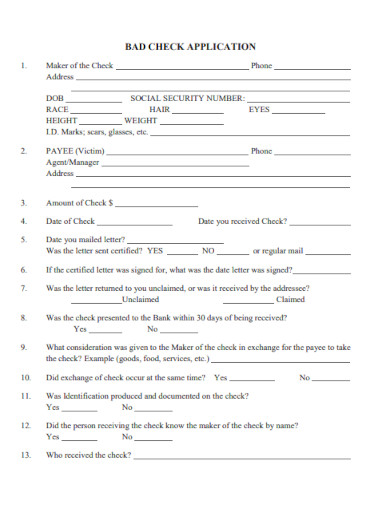

28. Bad Check Application

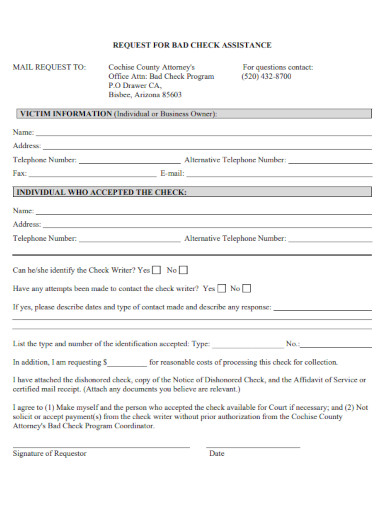

29. Request for Bad Check Assistance

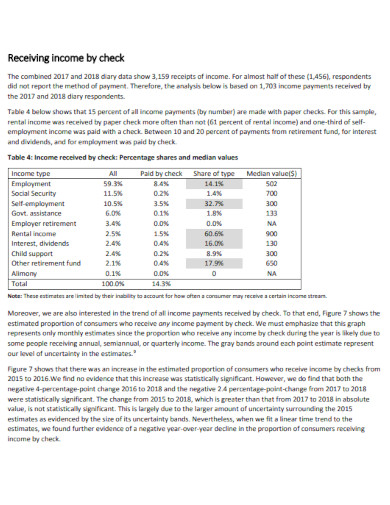

30. Receiving Income by Check

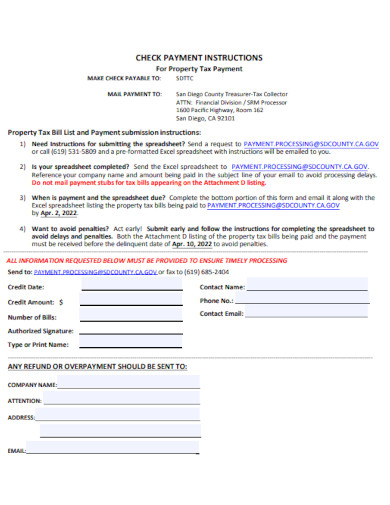

31. Check Payment

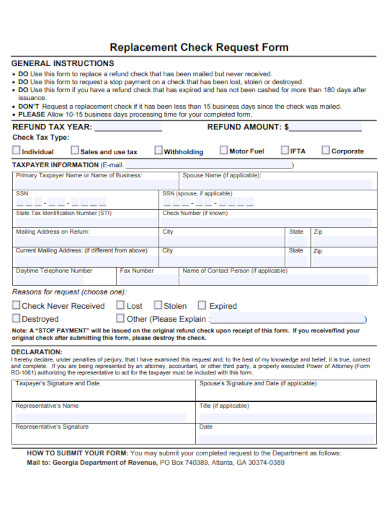

32. Replacement Check Request Form

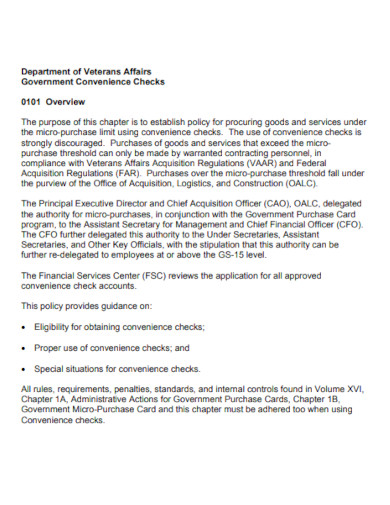

33. Government Convenience Checks

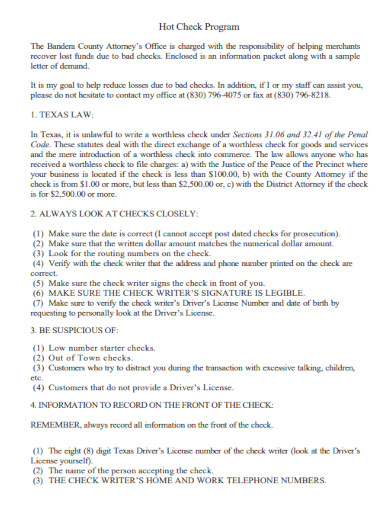

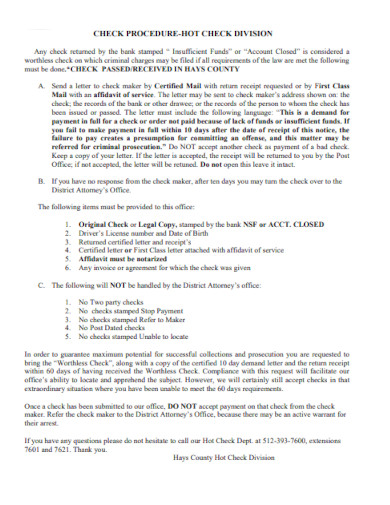

34. Hot Check Program

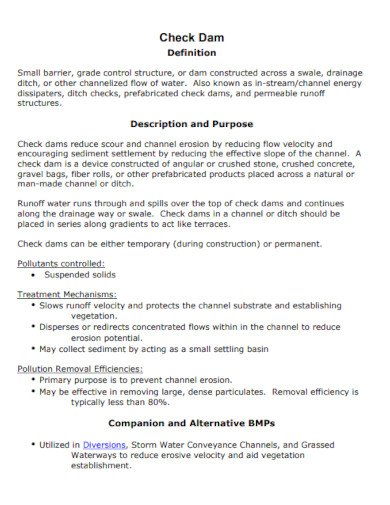

35. Check Dam

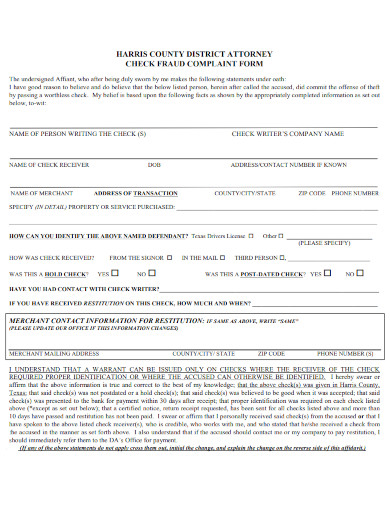

36. Check Fraud Complaint Form

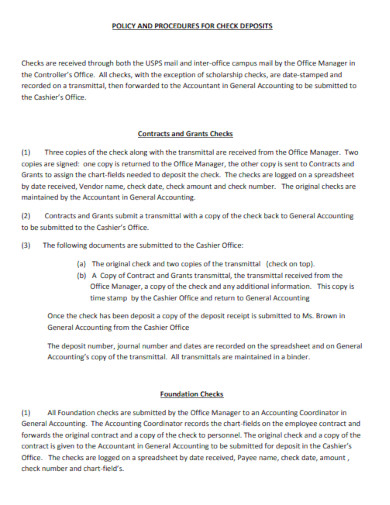

37. Check Deposits

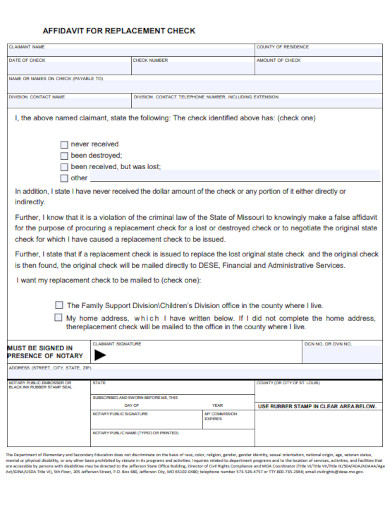

38. Affidavit for Replacement Check

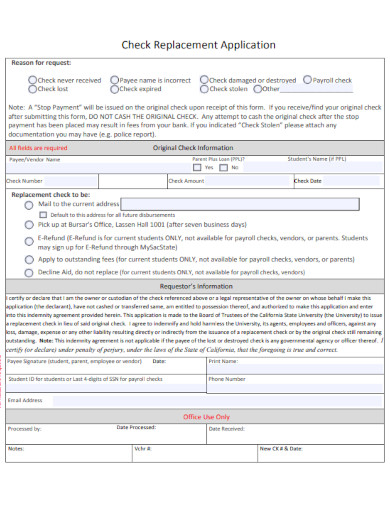

39. Check Replacement Application

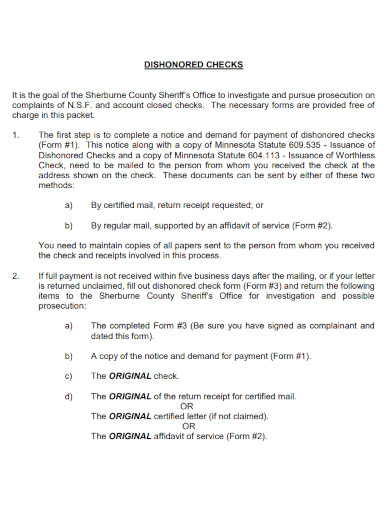

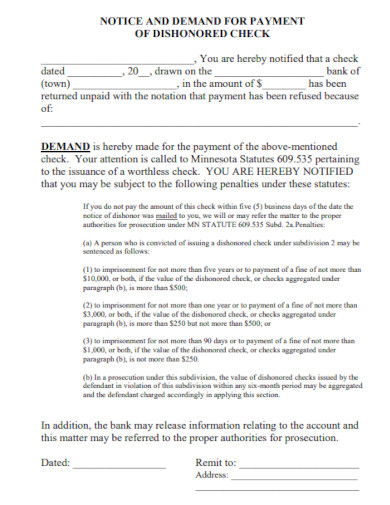

40. Dishonored Check

41. Check Example

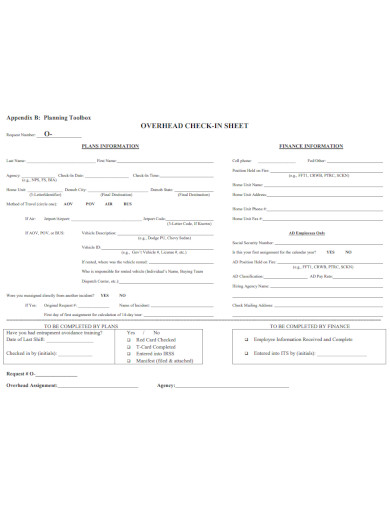

42. Overhead Check-In Sheet

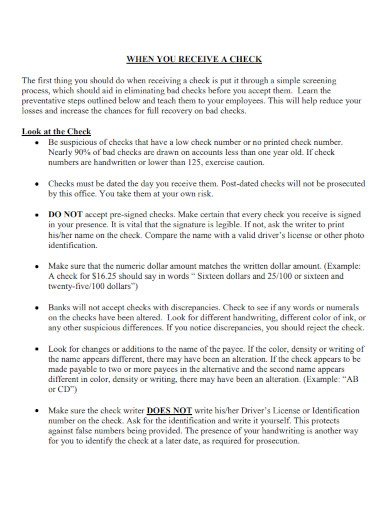

43. Receiving Check

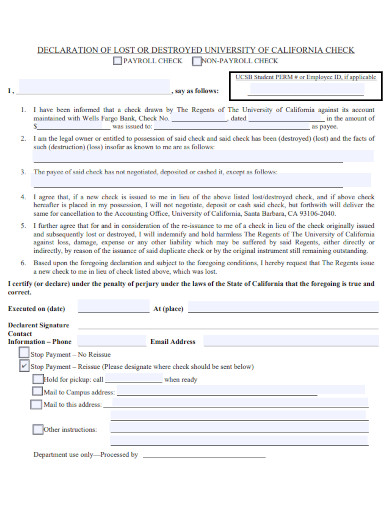

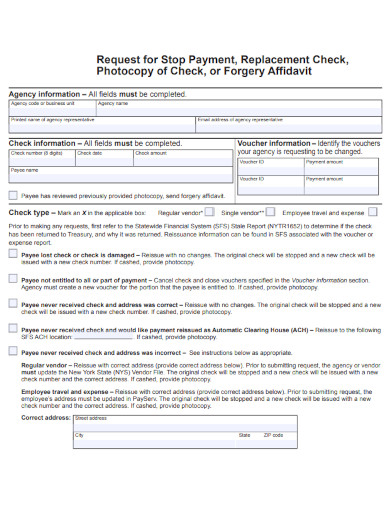

44. Replacement Check

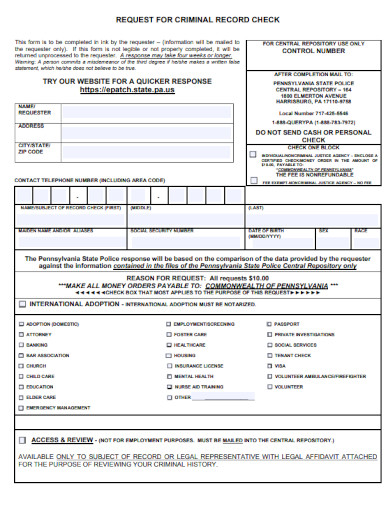

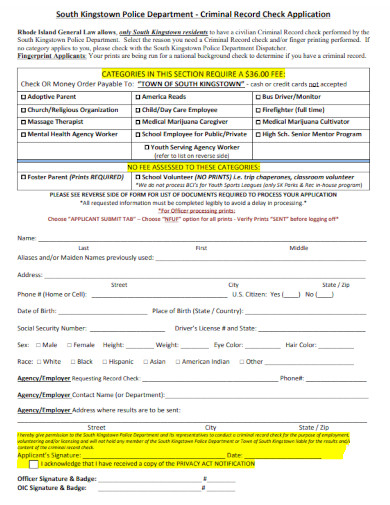

45. Request for Criminal Record Check

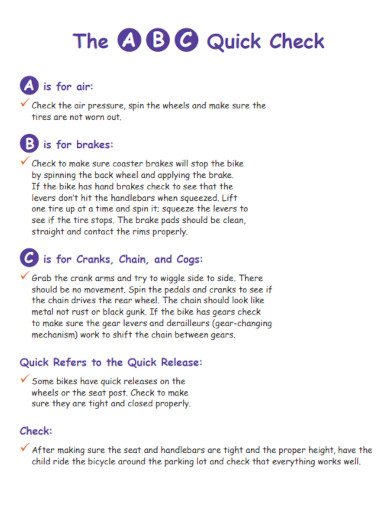

46. The Quick Check

47. Notice and Check

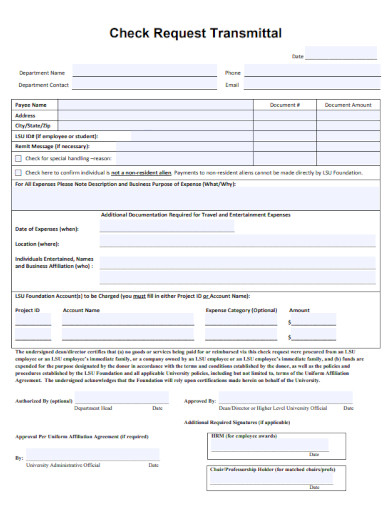

48. Check Request Transmittal

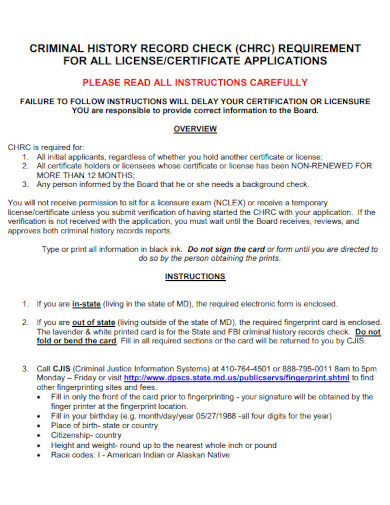

49. Record Check

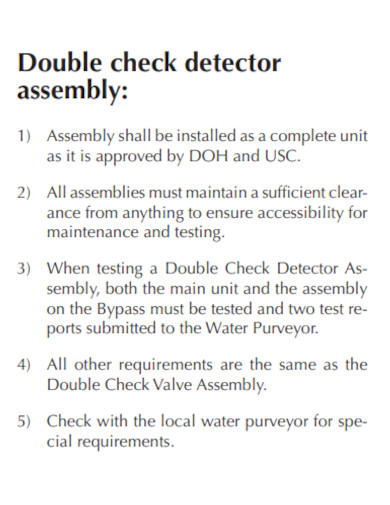

50. Double Check Detector

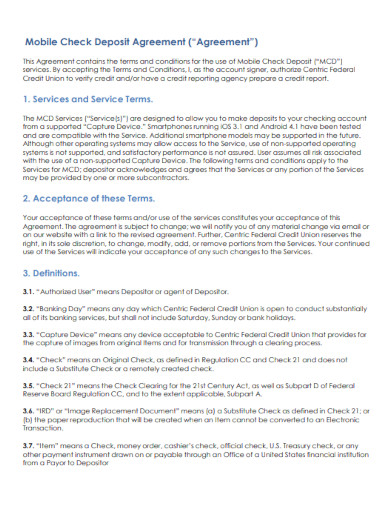

51. Mobile Check Deposit Agreement

52. Check Dams Example

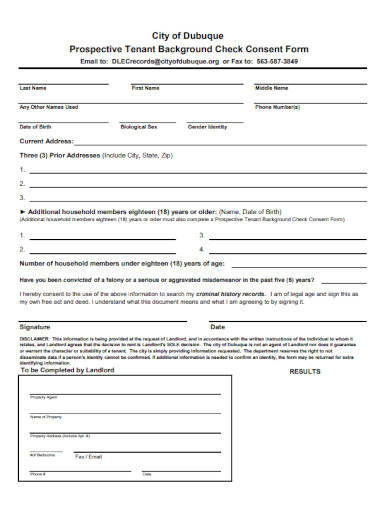

53. Tenant Background Check Consent Form

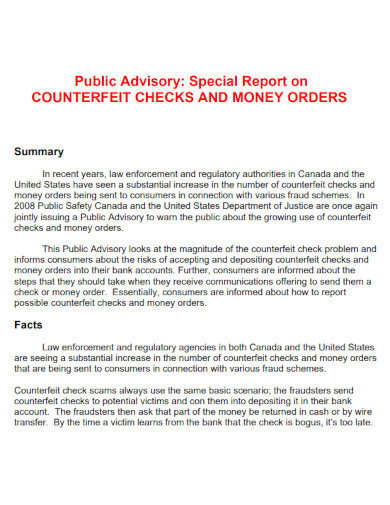

54. Counterfeit Check

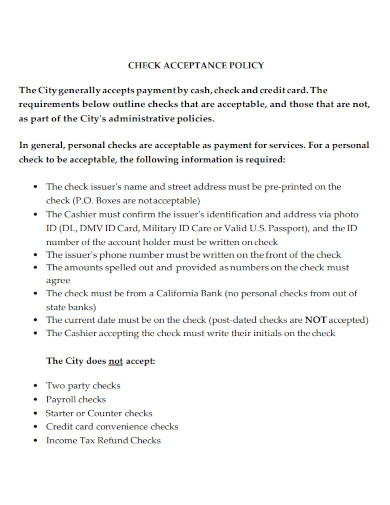

55. Check Acceptance Policy

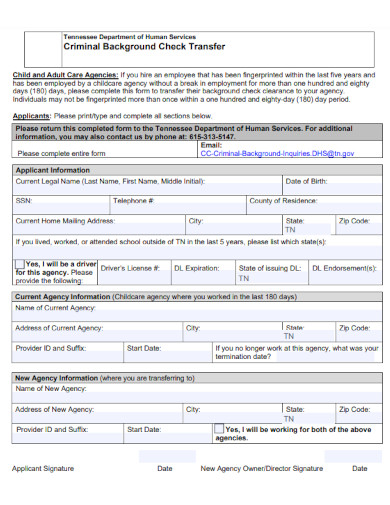

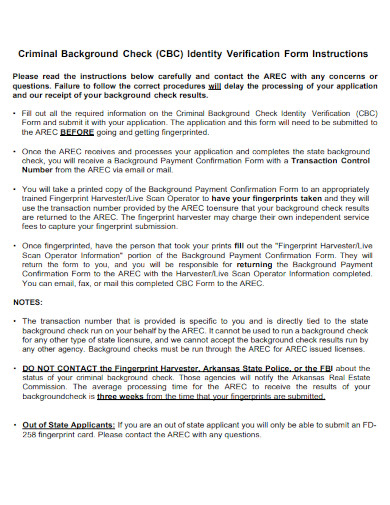

56. Criminal Background Check Transfer

57. Virtualization Health Check Service

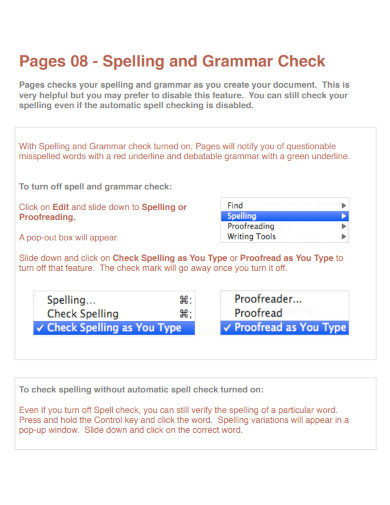

58. Grammar and Spelling Check

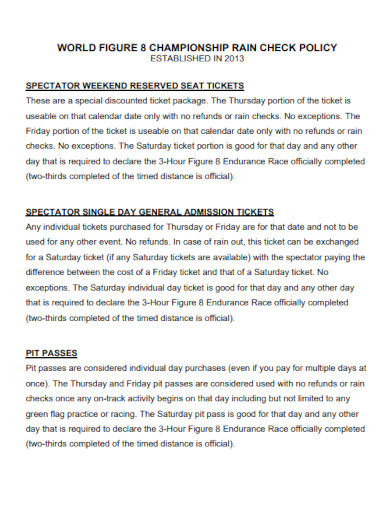

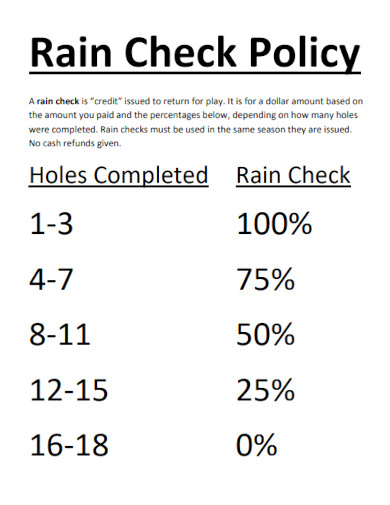

59. Rain Check

60. Rain Check Policy

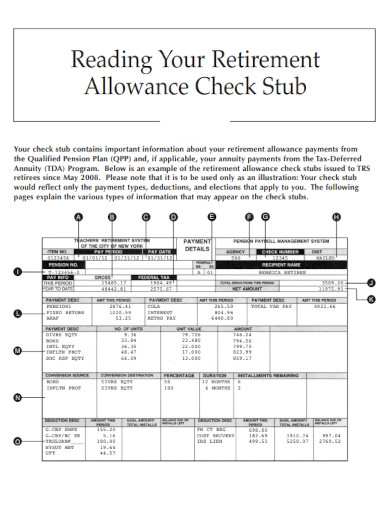

61. Check Stub

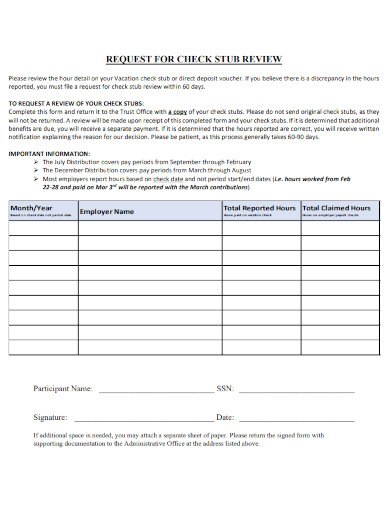

62. Request for Check Stub Review

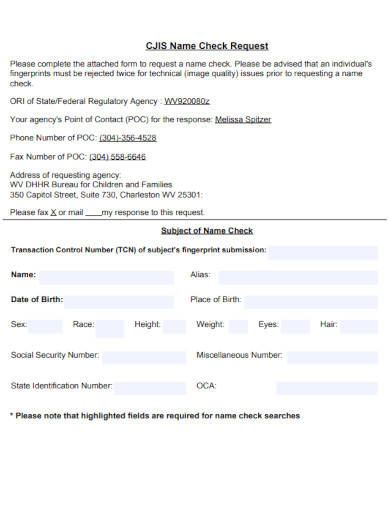

63. Name Check

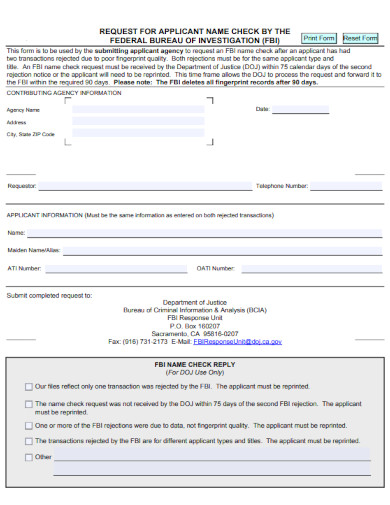

64. Applicant Check

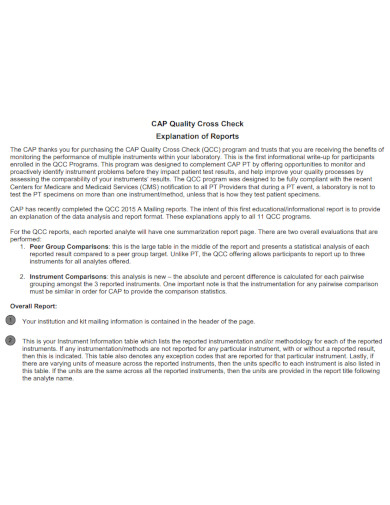

65. Quality Cross Check

66. Check kiting

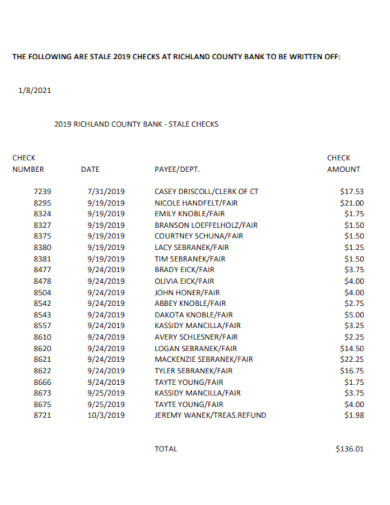

67. Stale Check

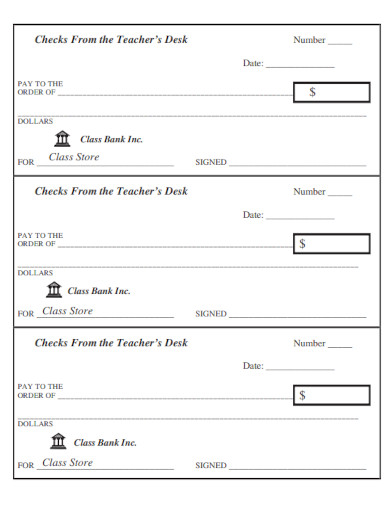

68. Checks from Teachers Desk

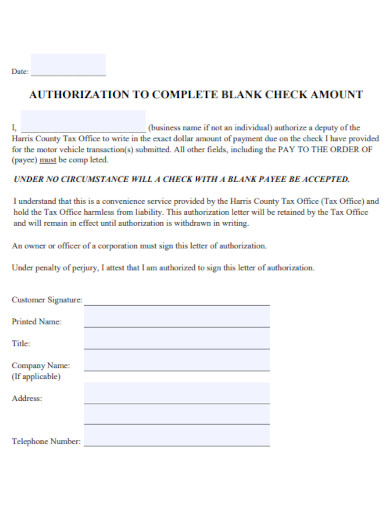

69. Blank Check Amount

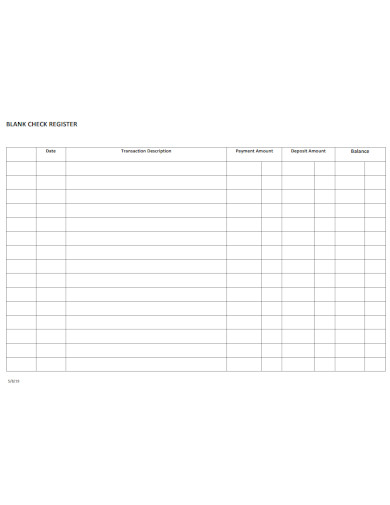

70. Blank Check Resister

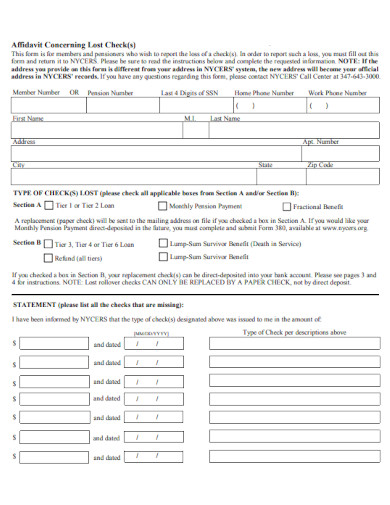

71. Affidavit Concerning Lost Check

72. Check Point Enterprise Support Programs

73. Lost Check Agreement

74. Standard Check

75. Private Donor Scholarship Check Procedures

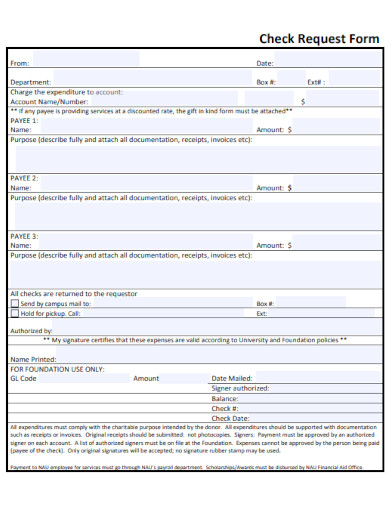

76. Check Request Form Example

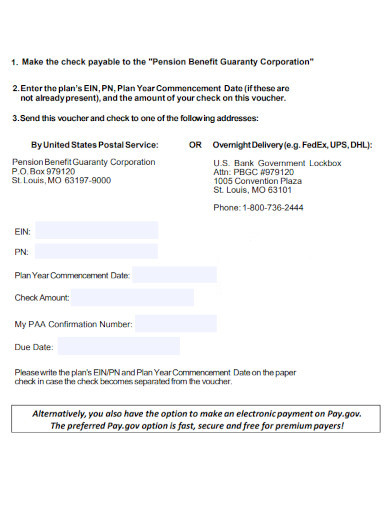

77. Check Voucher

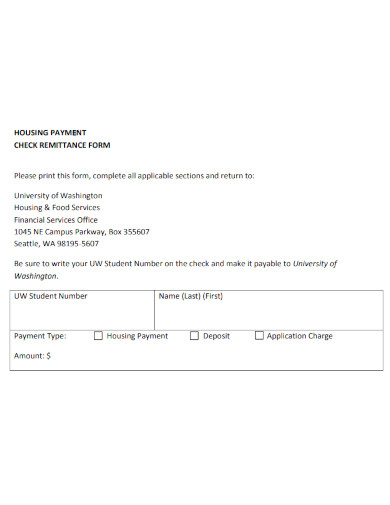

78. Check Remittance Form

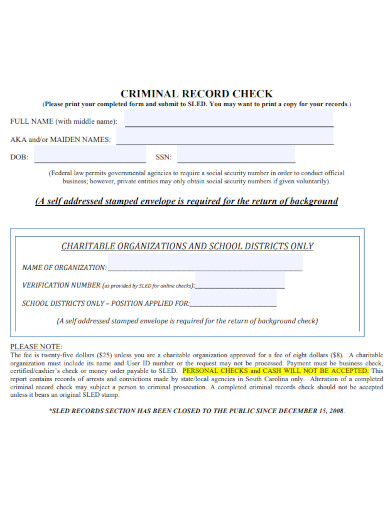

79. Criminal Record Check PDF

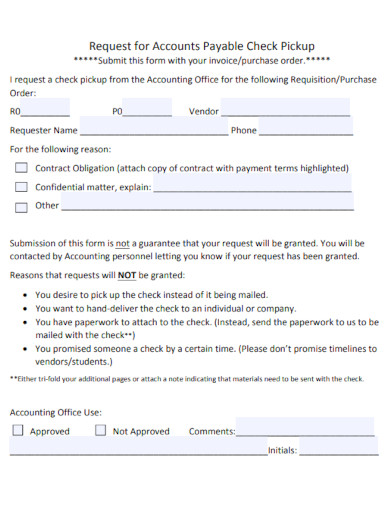

80. Request for Accounts Payable Check Pickup

81. Check Application

82. Check Sample Flyer

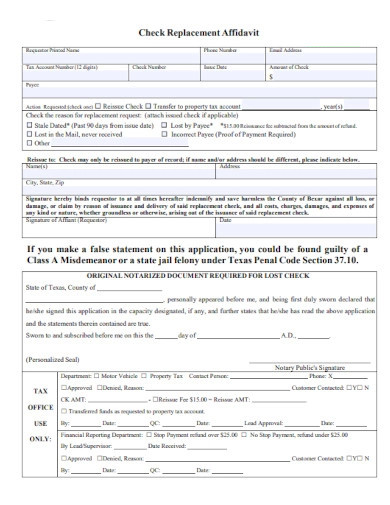

83. Check Replacement Affidavit PDF

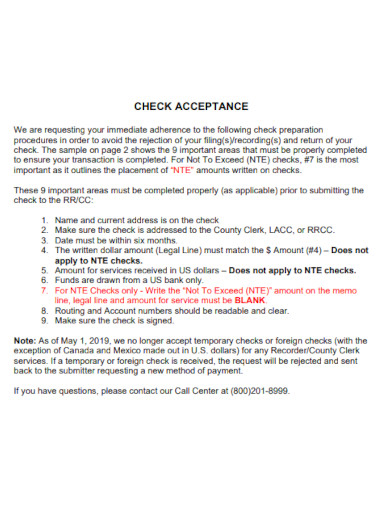

84. Check Acceptance

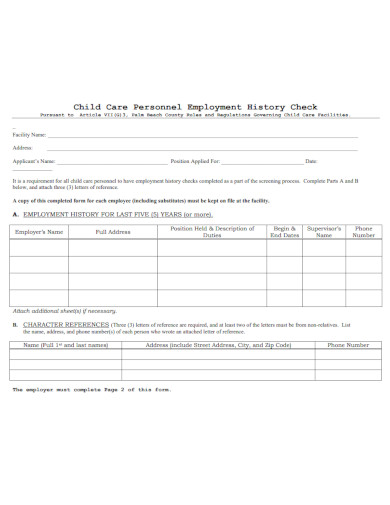

85. Employment History Check

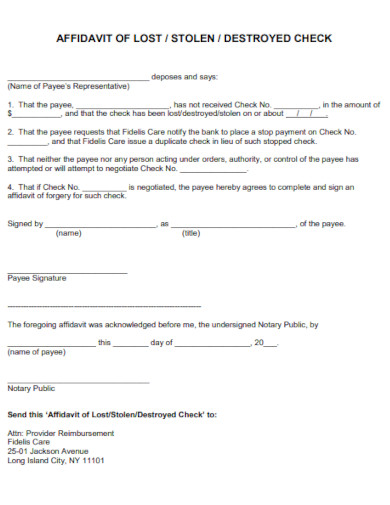

86. Stolen Check

87. Check Form

88. Check Verification Form

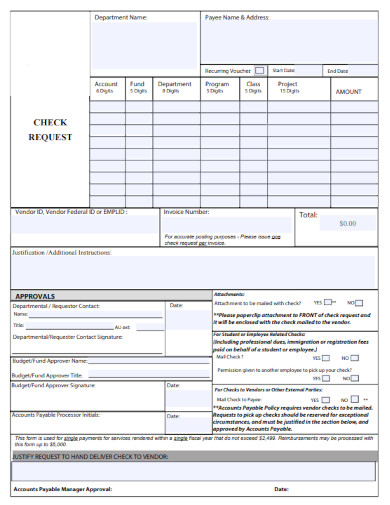

89. Check Request

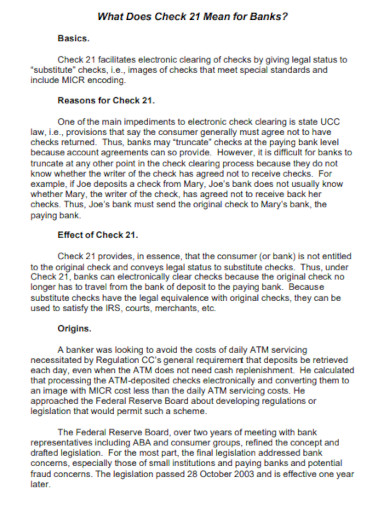

90. Check 21 for Banks

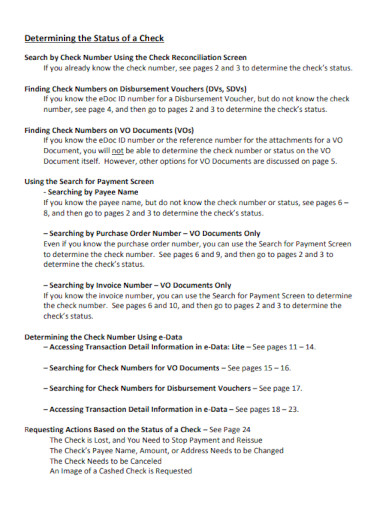

91. Status of Check

92. Printable Check

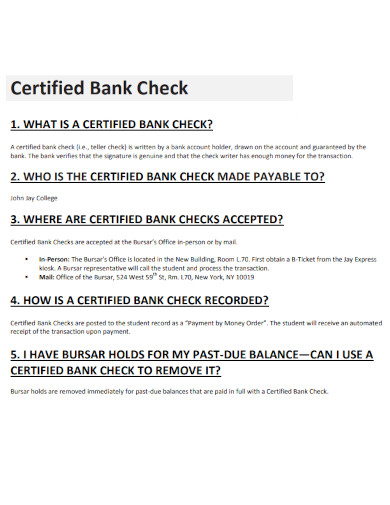

93. Certified Bank Check

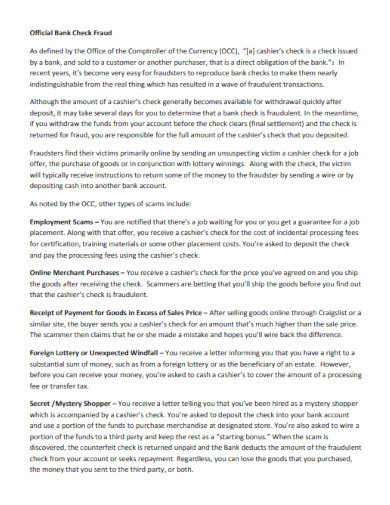

94. Official Bank Check Fraud

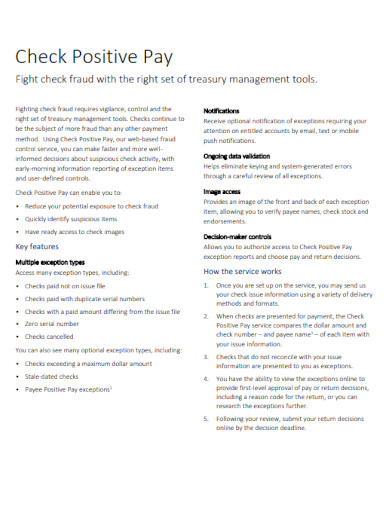

95. Check Positive Pay

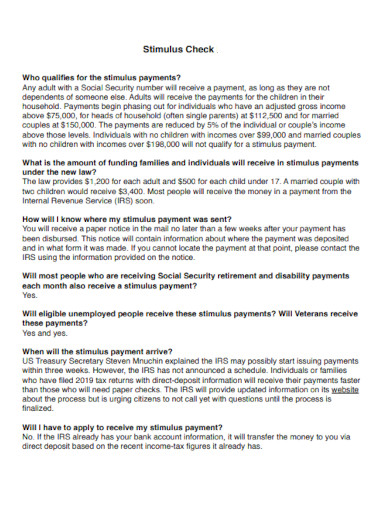

96. Stimulus Check

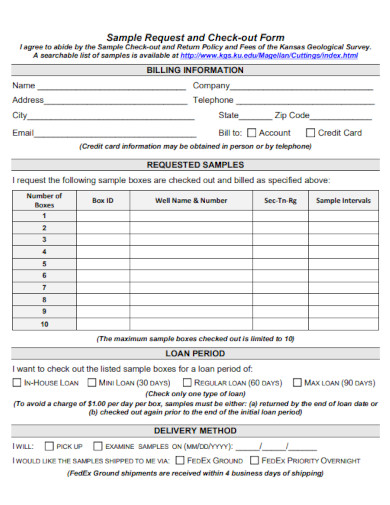

97. Check-Out Form

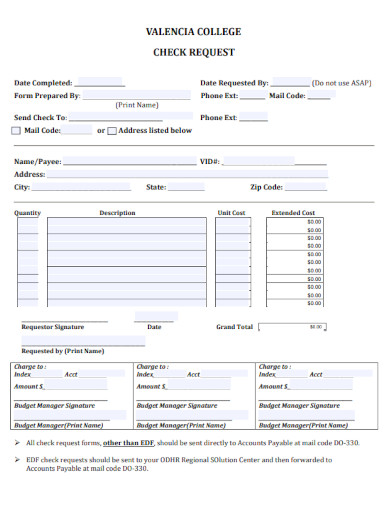

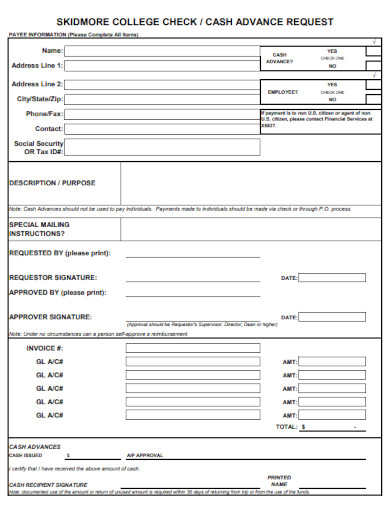

98. College Check

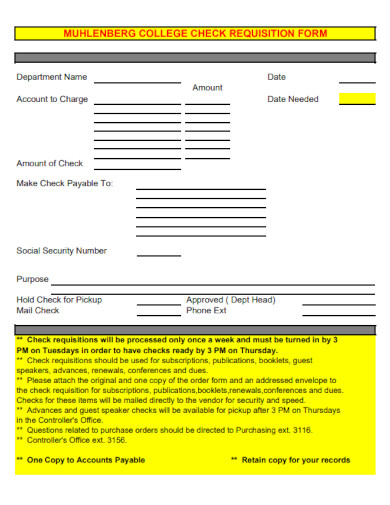

99. Check Requisition Form

100. Check

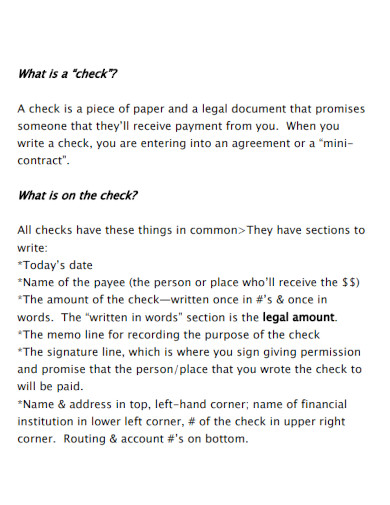

What is a Check

A check or cheque (British English spelling) is a written, dated, and signed paperwork or document that issues the bank with a pending order to pay the money to the person filling in the certified check, which is often called the drawee. The individual who has signed the check, which is called the payee, will be the one to provide payment for the check. People use the check to transfer money from a person’s bank account to another account, utilizing the bank as the method of transferring. The type or archetype of check you will be using will depend on the context or theme of the situation.

How to Write a Check

Writing a check is very intuitive and takes no skill, and will only take a few minutes to create when following a specific outline format or outline. But there are also a couple of things to look out for when creating a check. These can come in the form of erasures, random marks, and misspelled names. If any of these mistakes occur on your check, more often than not your check will either be bounced or unaccepted by the bank.

1.) Obtain a Checkbook from Your Bank

Start either by locating your own bank account’s checkbook or obtaining your checkbook from your associated bank. This is because some specific and personal details have to be printed onto your checkbook. Thus you cannot use anyone else’s checkbook other than your own.

2.) Ensure that the Check has Your Account Number

Check if the checkbook or the check you are using has the associated account number printed on the bottom of the check. This is to ensure that the check you are working on is your own. Writing or using someone else’s checkbook will result in a bounced or uncertified check, and can even be considered fraud.

3.) Write Down the Payee’s Name and The Sign-Off Date

You must then write down your full name on the Payee field of the check. This name must be the same as the one written on your bank account. You must also write the sign-off date on the top right corner of the check, this must be the date you will sign the check.

4.) Write Down the Check Amount in Numbers and Words and Sign

After you have written down your name and the date on your check, you will now write down the amount you will pay to the person in both numbers and words. These two will have distinct fields associated with them, the smaller box is for numbers while the larger field is for words. When you have finished will all of this you will now sign the check.

FAQs

Why are there many young people being scammed by check fraud or fraudulent checks?

The reason why this is occurring more frequently now is that most young people don’t know how written checks work. This is because the younger generations tend to not use or create written checks during the advent of online banking.

What is the lower limit or the lowest amount I can send with a check?

There is no limit to how much you can send with a check. This is with the caveat that you can only send as much money as you have in your bank account.

What happens when I deposit a bad or faulty check to the bank?

The check will bounce from your account, meaning that any money paid by the bank will be taken back. Note that this includes the amount of money you use after you deposited the bad check, which can cause your bank balance to have negative balance resulting in debt.

It is important to know how checks work, as these are often used to transfer large amounts of money from one account to another. Another takeaway from learning about checks is that you prevent yourself and the people you love from being scammed.