Retirement Income Checklist Examples to Download

Here is a fun fact that everyone may already know. At some point in our lives, we are expected to retire. May it be an early retirement or at the age of retirement. The one thing we all will have in common is, when we are at that certain age, we will retire. Of course when we retire, we are expected to have income to support us through our golden years. But what should we be expecting of the income we will receive when we retire? What are the things we should know about before we receive our retirement income? To get a good picture of it, you will need a retirement income checklist.

3+ Retirement Income Checklist Examples

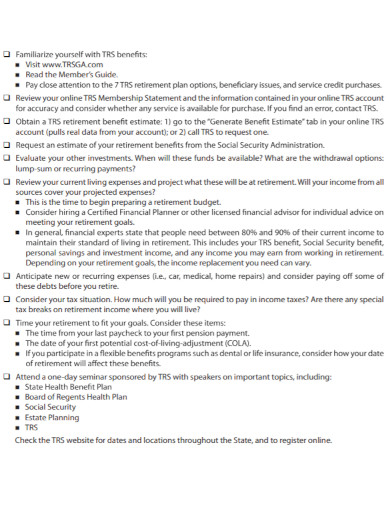

1. Pre-Retirement Income Checklist

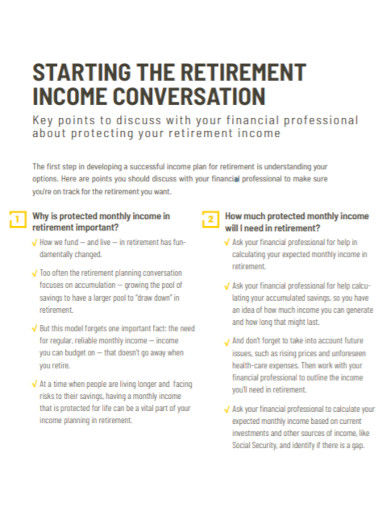

2. Retirement Income Conversation Checklist

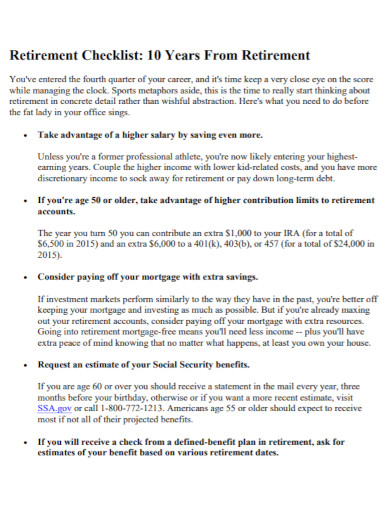

3. Retirement Higher Income Checklist

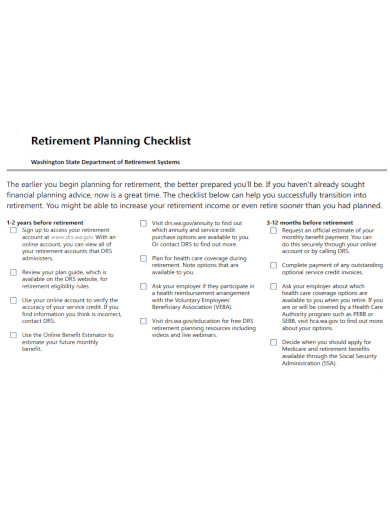

4. Retirement Planning Income Checklist

What Is a Retirement Income Checklist?

A retirement income checklist is a tool used to see and to check what are the necessary requirements or items you will need in order to get the correct retirement income. This checklist serves the purpose of helping you find out about your retirement income, where you are going to be getting the benefits, when and of course how much. In addition, the checklist provides the information, the do’s and don’ts and what you personally expect to get from your retirement income. Lastly, your retirement income can come in different ways, depending on whether you worked for a company or a business like a restaurant, or you are self-employed.

How to Create a Retirement Income Checklist

How do you create your own checklist for a retirement income? We know for a fact that a retirement checklist is a tool you can use to outline what you expect and what is facts. To get a good idea and a bigger picture of how to make your own retirement income checklist, here are steps to guide and help you along the way.

Step 1: Start by Creating an Income Inventory

Creating an income inventory helps you in figuring out what you will be expected to have and what you will actually have when you receive your retirement. The income inventory includes seeing to it that you do not have any debts or any credit card debts that you may not have noticed. Another thing to do when creating an income inventory is to see how much you make before you retire. This includes your payroll activities.

Step 2: Make a Back up Budget Plan

Make a back up budget plan. In case of any issues or emergencies that will need you to save up for your retirement income. Since retirement incomes often do not go as expected, even when you are making your checklist, it is still best to add a back up plan to your income checklist. Just in case of any emergencies.

Step 3: Get To Know Your Retirement Income Needs

In order for you to be set up for your retirement, you must also add to your checklist your retirement income needs. To make sure that what you expect in your retirement will also be what you think you need for the entire retirement process. Just as some also require you to write a letter that provides your proof of income to let everyone know of how much you may need.

Step 4: Review Your Checklist

The very last step is to review your income checklist. Just to be sure that anything you want to add or have to add is already there and is related to your retirement checklist.

FAQs

What is a retirement income checklist?

A retirement income checklist is a tool used in order to guide or to help you figure out the necessary things or requirements that you need to do in order to get a good idea of your retirement income.

What can this type of checklist do for you?

The purpose of this checklist is to help you find out the requirements you will need to make the retirement income. In addition, it also helps you find ways to seek out help from others who may already have gone through from the checklist.

What are other types of checklists?

The other types of checklists are:

We all retire at some point in our lives, and that is often the most important, and sometimes the saddest part when you still plan to work for a living. But what is important is to understand the retirement income you will be receiving. How much and what to expect. To be able to get the most out of it, make a checklist.