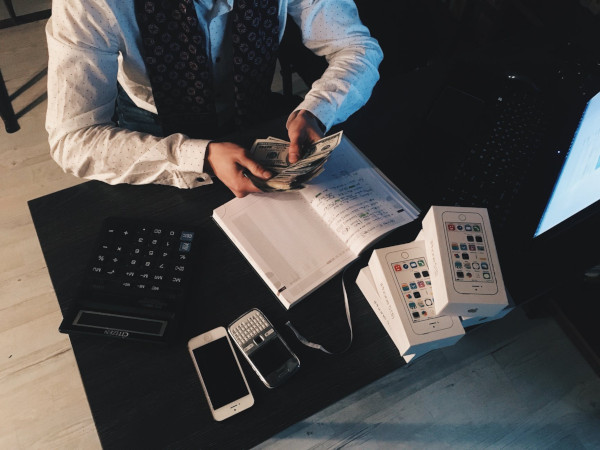

Complete Financial Portfolio Examples to Download

If you have already figured out how you would want your life to turn out like, have you also figured out how it can financially cost you to achieve the kind of life you want to live? If no is your answer?like most people?worry not because once you can build a complete financial portfolio, you get a step closer to living the life you’ve always wanted. A complete financial portfolio is considered as one of the corporate finance essentials one must secure. To achieve financial portfolio optimization, read on with this article to be guided.

What Is a Portfolio?

In finance, a portfolio is a group of financial assets held by investment companies and other financial institutions or individuals and managed by financial professionals and professional money managers. Such grouping would ideally include bonds, cash equivalents, commodities, currencies, stocks, and it should also include their fund counterparts, which include mutual, exchange-traded, and closed funds. Apart from that, a portfolio can also include real estate, art, private investments, and other non-publicly tradable securities.

How to Build a Financial Portfolio?

One of the personal finance essentials that you need to secure is a complete financial portfolio. Thus, we provide you these simple steps that you can easily follow through:

1. Determine and make a list of your assets and liabilities

Your assets may include your stocks, bonds, cash, and cash equivalents. Your liabilities may consist of your credit card balances and student loans.

2. Contribute to your 401(k) account

If your employer has matched you with a certain amount for funds, you must contribute to your 401(k) no matter how buried you are with a mountain of bills and debts to pay.

3. Pay off your credit card debts

Speaking of debts, you also need to pay off all your credit card debts, especially the high-interest ones. This process may take time, but you need to make sacrifices.

4. Open and fund a Roth IRA

In the United States, Roth IRA or Roth Individual Retirement Arrangement is considered by investors as the greatest financial account available. Contributions are made before the paycheck gets deducted with tax and these contributions can be withdrawn anytime without penalty.

5. Save for a down Payment on a house

Convert rent expenses into equity by purchasing your very own house. A home can also be considered as a practical investment that is generating a comparable return while diversifying your asset allocation into real estate.

6. Build an emergency cash reserve

Once you become a homeowner, you will inevitably face a significant amount of costs more than when you were just renting. This is why you should establish an emergency cash reserve that is sufficient for at least six months to cover your daily living expenses such as your mortgage, insurance, utilities, groceries, loans, and credit cards.

7. Pursue additional investments

Once you have completed steps 1 up to 6, you should now consider pursuing possible investment opportunities. You can start by opening a brokerage account that enables you to make investments in stocks, bonds, mutual funds, and more.

8. Make yourself an investment

Other than the aforementioned, you also need to invest in yourself. You can improve or enhance your skills by enrolling yourself in educational courses and professional certification programs

9. Save for your child’s education and your retirement

It is under your discretion whether you will put your child through school but regardless of your decision, you should make it a point to secure your retirement funds so you wouldn’t depend on your child at retirement.

10. Stick to the basics

In order to successfully build a complete financial portfolio, you need to stick to the basics of a financial portfolio and consistently make wise and disciplined financial decisions.

What Does a Financial Portfolio Consist Of?

A financial portfolio is a collection of asset classes. Asset classes are a grouping of investments that have similar characteristics, and this often includes a mix of stocks, bonds, cash, cash equivalents, and other alternative investments. Whatever your portfolio selection might be or whatever you decide to put in your financial portfolio, it would largely depend on how much risk you are willing to take and tolerate.

What is a 401(k) Company Match?

A 401(k) is a retirement saving and investment plan sponsored by company employers. This allows employees to save and invest a part of their paycheck before taxes are taken out for their retirement. One of the benefits an employee can get from 401(k) is a company matching program. Through a company match, employers add to your account over and above the amount of money you save or the amount of money you defer from your pay.

How to Fund a Roth IRA?

You need to open a Roth IRA account first before you can fund your first contribution. Your first contribution may come in the form of cash, check, or bank transfer. You can also fund your Roth IRA account by rolling over funds from your other accounts such as your traditional IRA account, employer-sponsored 401(k) and 403(b) plans, government 457(b) plan, Simplified Employee Pension IRA, and Savings Incentive Match Plan for Employees IRA. Additionally, you can also take advantage of the power of compounding, where you generate interests from your previous investments. No matter how your Roth IRA gets funded, make sure you start early and make contribution a habit.

10 Tips for Paying Off Credit Card Debt

One of the steps that you need to do in order to build a complete your financial or investment portfolio is to come up with a concrete plan on how you can pay off all your credit card debts. Thus, here are ten tips to help you pay off your credit card debts.

1. Accept responsibility for your financial life

Stop blaming others over your own credit card debt and start accepting the fact that you alone are responsible for whatever your financial status might be. You can begin by setting S.M.A.R.T. goals on how you can achieve a debt-free life.

2. Consider getting a side hustle

If the pay you get from your full-time day job does not cut it, consider looking for another source of income. When you introduce more money to your existing income, you can surely accelerate your debt payoff.

3. Freeze or cut up your credit cards

Keep yourself from using your credit cards by literally freezing your credit cards in blocks of ice or by cutting it. However, you don’t have to go that far?all you need is to commit never to use your credit cards again, change your mindset, and put your bad spending habits to an end.

4. Trim down your expenses

Speed up credit card debt payoff by reviewing your monthly payments and by looking for other ways on how you can lessen it. You can start by tracking your costs at least within the first two weeks of a month in order to give you an idea where your money usually goes.

5. Save all your extras and make micro-payments

Even if you just have a few dollars left from your grocery allowance or a few pennies left from your daily fare or gasoline allowance, it is ideal that you save all of your extras which you can use as additional payment for all your dues and debts.

6. Create a realistic spending plan

Setting up a realistic monthly spending plan can somehow help you to get out of your credit card debts and stop you from using your credit card. It will also encourage you to live within your means and give you an idea of when can you expect to get all of your credit card debts paid off.

7. Consider getting a 401(k) loan

Do you have a 401(k) or a retirement savings plan? Then, you should really consider taking a loan from it to pay off your credit card debts quickly. Just make sure that you repay your loan within the specific time frame given by the Internal Revenue Service (IRS).

8. Apply the Snowball Technique

When applying the snowball technique, you need to pay off your credit cards that have the lowest debts first. By using the snowball technique, you can somehow stretch whatever existing money you have left.

9. Declare bankruptcy

When worse comes to worst, declare bankruptcy. It is possible to completely eliminate or at least lower the payments of your credit card debts through bankruptcy or court order. Before you should go through the extensive process of declaring bankruptcy, you need to seek out a bankruptcy attorney first so you can thoroughly understand the benefits, drawbacks, and costs you can get when you file for bankruptcy.

10. Keep your financial portfolio in mind

By paying all of your credit card debts, you get a step closer to completing your financial portfolio. And once you complete your financial portfolio, it will also be easier for you to materialize all of your business and other life projects in mind since you have already acquired one of the project finance essentials for it to smoothly set sail.