17+ Credit Report Examples to Download

A report is a written or oral form of statement which gives a detailed information about something or someone directed to a particular audience. Importance of reports include information gathering and documentation, to name a few. This is why reports are considered as one important source of information and is widely used until today.

Reports are also widely used in business. They provide the information needed for a business owner to check on day-to-day operations and other important matters regarding his/her business. For instance, credit reports provide the information a financial institution (e.g. bank) needs when conducting a credit report inquiry.

Credit Report Template

Company Credit Account Denial for Unfavorable Report Template

Annual Credit Report Form Template

Credit Report Authorization Form Example

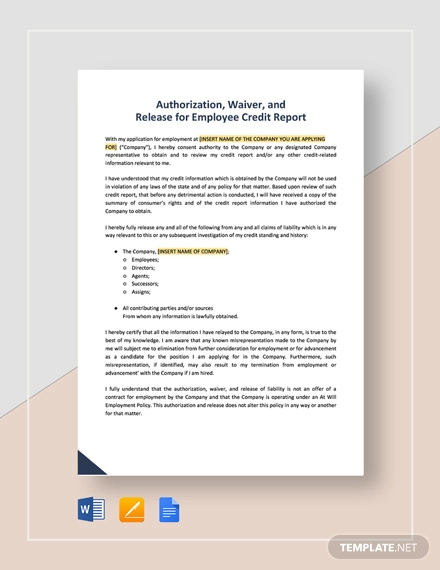

Authorization, Waiver, And Release For Employee Credit Report

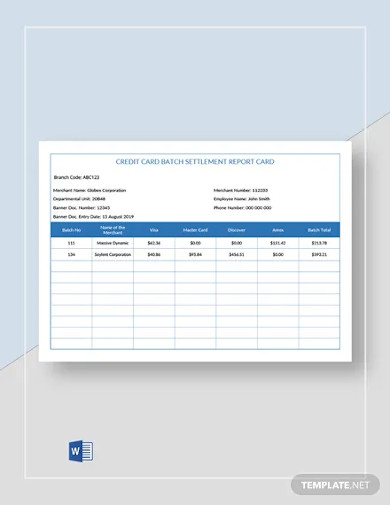

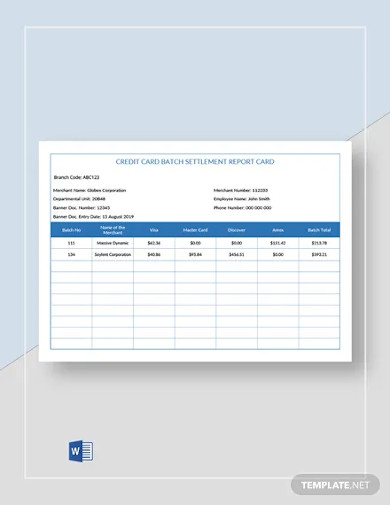

Credit Card Settlement Report Card

Credit Report Example

Request to Bank for Copy of Credit Report Template

Authorization, Waiver and Release for Employee Credit Report

Annual Credit

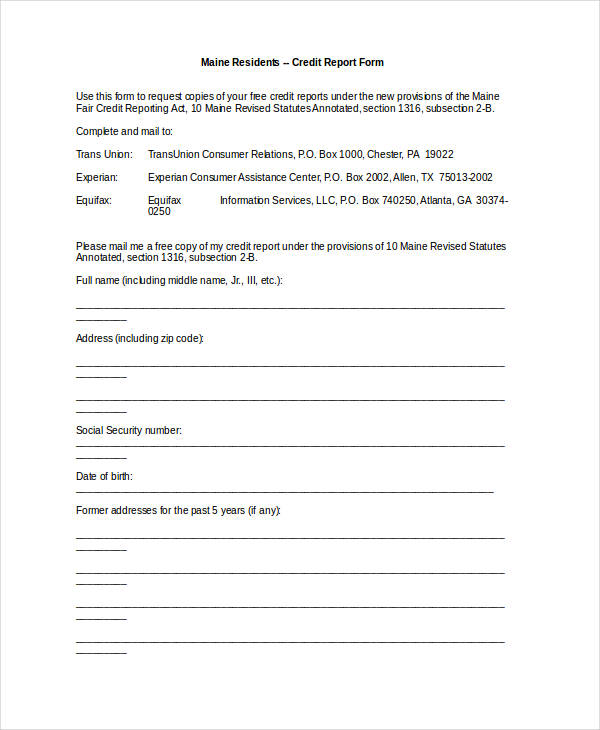

Editable Credit Report

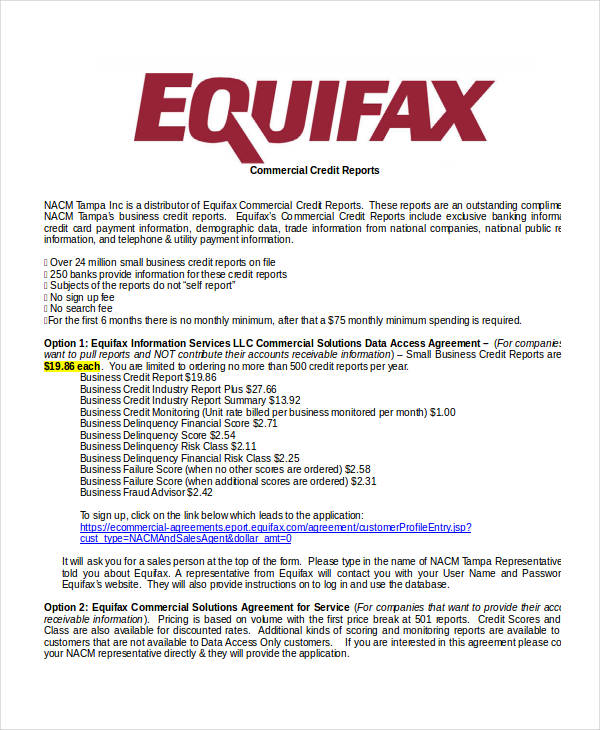

Commercial Credit Report

Free Credit Report Example

What Is a Credit Report?

An individual’s credit history, that is credits and credit accounts, and any other information on transactions involving financial companies (and the like) is usually found in a credit report.

Credit reports are usually managed by credit bureaus, also known as credit reporting agencies which make the information available for those who need them (i.e. financial institutions and credit card companies).

Credit reports also list all personal information including a person’s address, criminal records or history of lawsuits, any foreclosed property, and any records bankruptcy filings.

Purpose of a Credit Report

Purpose of a credit report determines if he/she is worthy or unworthy to be granted of loans of any kind. People who do business with you rely on credit reports to see whether or not you know how to handle your finances including credit activities.

Lenders or credit card companies use the data to determine if you are capable of paying your debts. Employers check your credit status to judge your diligence or any misbehaviour when it comes to paying debts. Simply put, credit reports are reliable sources of important information about an individual, most importantly his/her financial status. Credit report form examples are listed here for your guidance.

Company Credit Report

Employment Credit Report

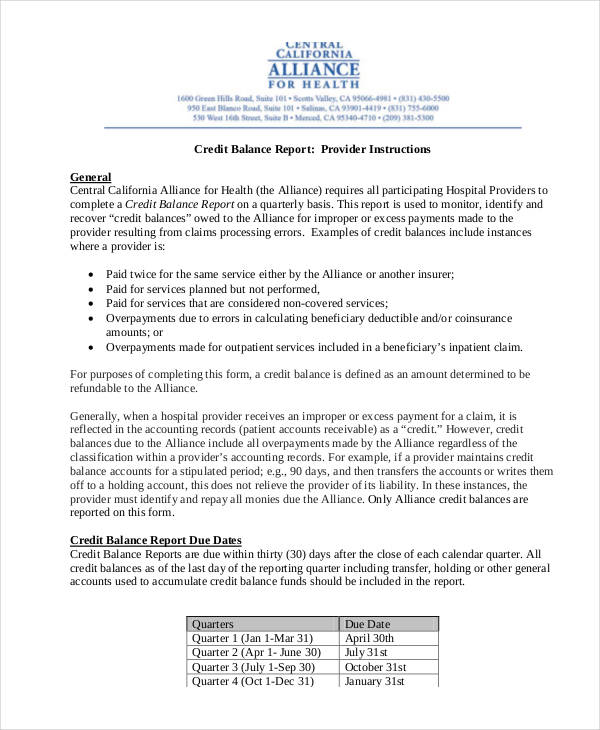

Credit Balance Report Example

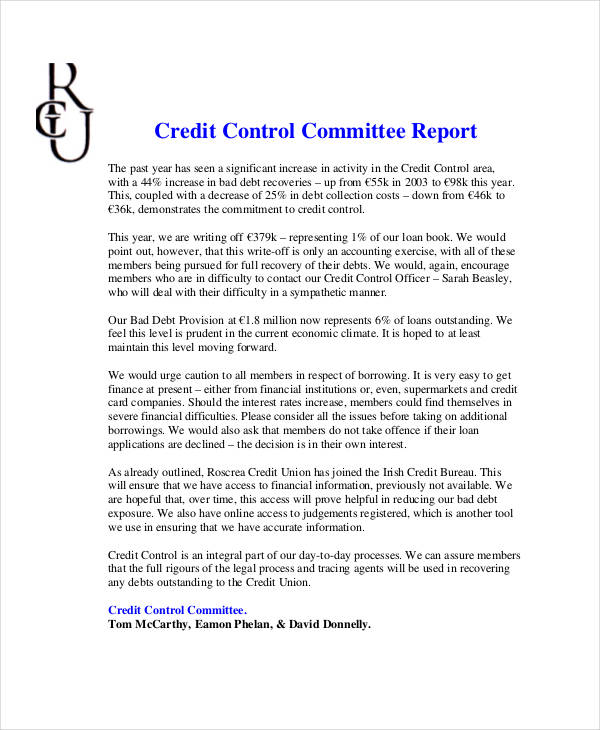

Credit Control Report

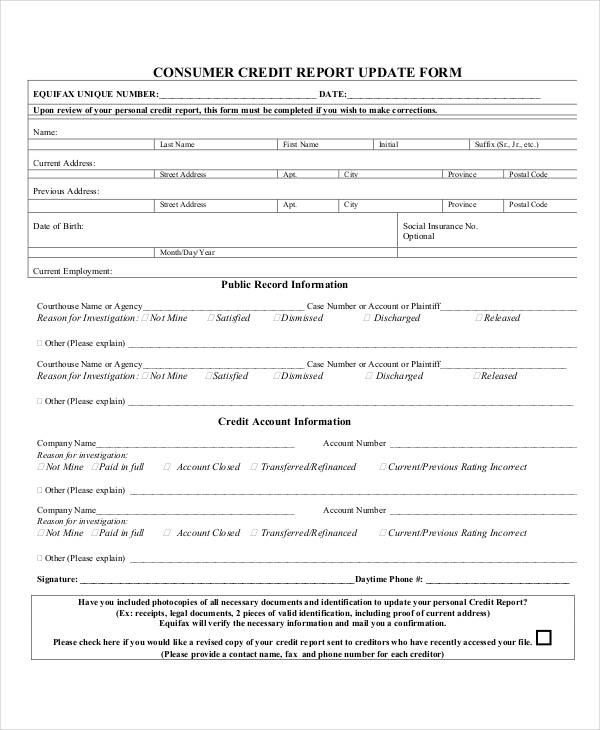

Consumer Report Update Form

Tips to Improve Credit Report

Credit reports rate if a person is credit worthy or not. Here are some points to consider if you want to improve your credit report:

- Ensure an accurate report. Make sure the information listed is accurate. If not, do something about it.

- Keep an eye on your credit card balances. Are your balances too high? If so, pay them off.

- Pay on time. If you want an organized credit report, pay your bills on time.

- Be responsible. You want to improve your credit report? Then be responsible of your own credit card accounts.

Why Check Your Credit Report

A person with an active credit account needs to regularly check his/her credit report. There are countless of reasons why you need to do so, and here are some:

- Checking for errors. Checking your credit report often will help you see errors such as identity theft.

- Reviewing credit status. This determines if your credit record is in good form, and is essential if you are applying for another loan.

- Ensuring report accuracy. This will help you know if all information of your past and present transactions are correct.

- Keeping track of your finances. This will help you in managing your finances, especially if you are saving up.

17+ Credit Report Examples to Download

A report is a written or oral form of statement which gives a detailed information about something or someone directed to a particular audience. Importance of reports include information gathering and documentation, to name a few. This is why reports are considered as one important source of information and is widely used until today.

Reports are also widely used in business. They provide the information needed for a business owner to check on day-to-day operations and other important matters regarding his/her business. For instance, credit reports provide the information a financial institution (e.g. bank) needs when conducting a credit report inquiry.

Credit Report Template

Details

File Format

Google Docs

MS Word

Apple Pages

Size: A4, US

Company Credit Account Denial for Unfavorable Report Template

Details

File Format

Google Docs

MS Word

Apple Pages

Size: A4, US

Annual Credit Report Form Template

Details

File Format

Google Docs

MS Word

Apple Pages

Size: A4, US

Credit Report Authorization Form Example

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Authorization, Waiver, And Release For Employee Credit Report

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Credit Card Settlement Report Card

Details

File Format

MS Word

Size: A4, US

Credit Report Example

Details

File Format

MS Word

Pages

Size: A4, US

Request to Bank for Copy of Credit Report Template

Details

File Format

MS Word

Pages

Size: A4, US

Authorization, Waiver and Release for Employee Credit Report

Details

File Format

MS Word

Pages

Size: A4, US

Annual Credit

massmutualfcuhb.org

Details

File Format

PDF

Size: 518 kB

Editable Credit Report

maine.gov

Details

File Format

Doc

Docx

Size: 4 kB

Commercial Credit Report

jrt.com.au

Details

File Format

Doc

Docx

Size: 282 kB

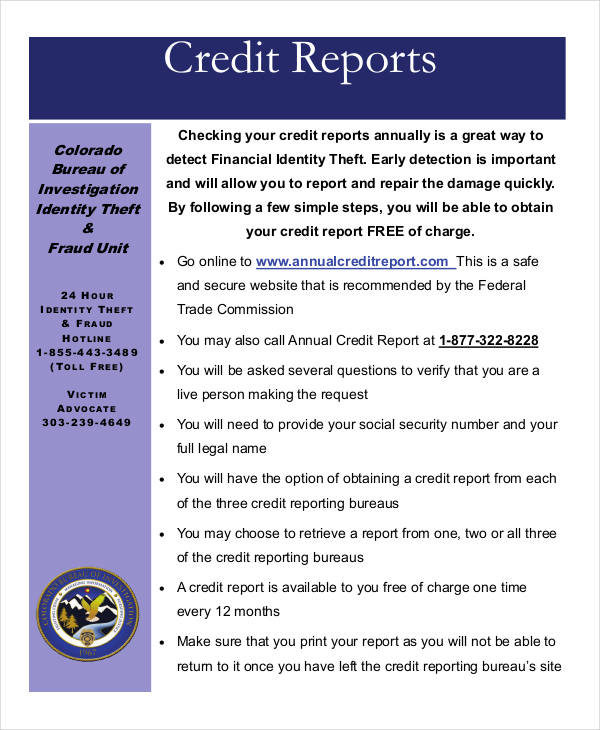

Free Credit Report Example

colorado.gov

Details

File Format

PDF

Size: 173 kB

What Is a Credit Report?

An individual’s credit history, that is credits and credit accounts, and any other information on transactions involving financial companies (and the like) is usually found in a credit report.

Credit reports are usually managed by credit bureaus, also known as credit reporting agencies which make the information available for those who need them (i.e. financial institutions and credit card companies).

Credit reports also list all personal information including a person’s address, criminal records or history of lawsuits, any foreclosed property, and any records bankruptcy filings.

Purpose of a Credit Report

Purpose of a credit report determines if he/she is worthy or unworthy to be granted of loans of any kind. People who do business with you rely on credit reports to see whether or not you know how to handle your finances including credit activities.

Lenders or credit card companies use the data to determine if you are capable of paying your debts. Employers check your credit status to judge your diligence or any misbehaviour when it comes to paying debts. Simply put, credit reports are reliable sources of important information about an individual, most importantly his/her financial status. Credit report form examples are listed here for your guidance.

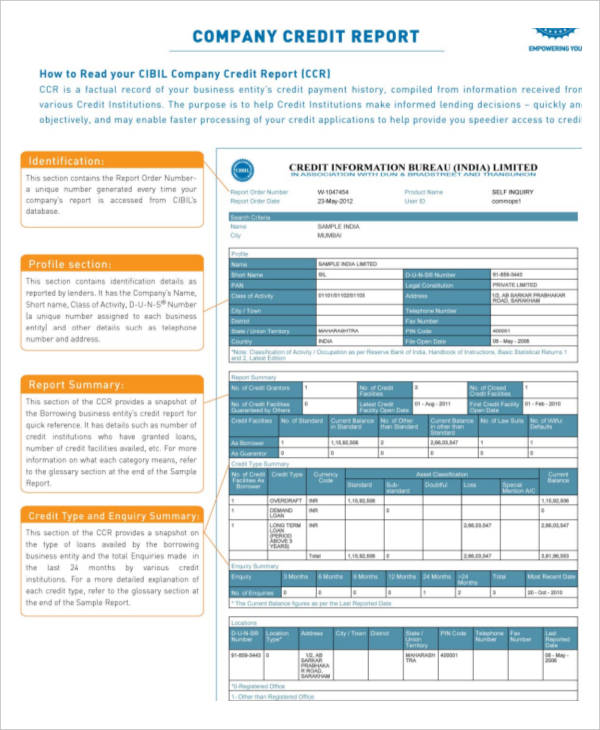

Company Credit Report

cibilhawk.com

Details

File Format

PDF

Size: 880 kB

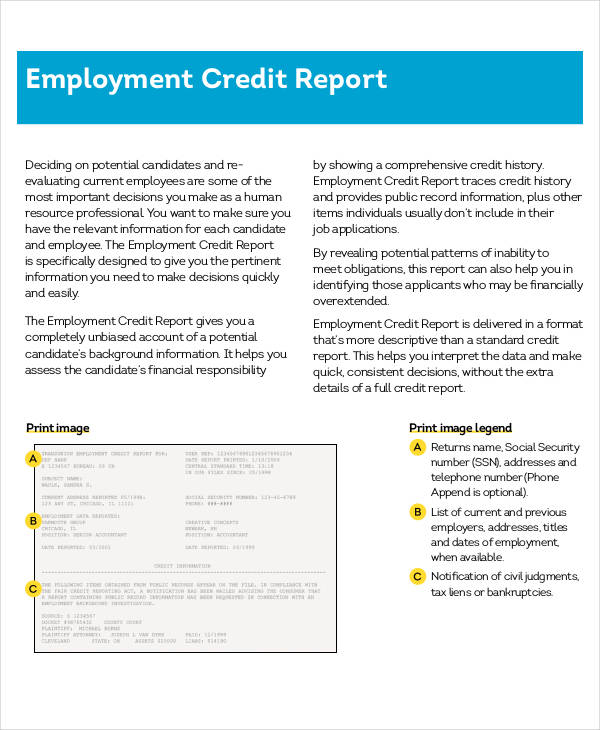

Employment Credit Report

transunion.com

Details

File Format

PDF

Size: 267 kB

Credit Balance Report Example

ccah-alliance.org

Details

File Format

PDF

Size: 169 kB

Credit Control Report

roscreacu.ie

Details

File Format

PDF

Size: 15 kB

Consumer Report Update Form

equifax.com

Details

File Format

PDF

Size: 100 kB

Tips to Improve Credit Report

Credit reports rate if a person is credit worthy or not. Here are some points to consider if you want to improve your credit report:

Ensure an accurate report. Make sure the information listed is accurate. If not, do something about it.

Keep an eye on your credit card balances. Are your balances too high? If so, pay them off.

Pay on time. If you want an organized credit report, pay your bills on time.

Be responsible. You want to improve your credit report? Then be responsible of your own credit card accounts.

Why Check Your Credit Report

A person with an active credit account needs to regularly check his/her credit report. There are countless of reasons why you need to do so, and here are some:

Checking for errors. Checking your credit report often will help you see errors such as identity theft.

Reviewing credit status. This determines if your credit record is in good form, and is essential if you are applying for another loan.

Ensuring report accuracy. This will help you know if all information of your past and present transactions are correct.

Keeping track of your finances. This will help you in managing your finances, especially if you are saving up.