10+ Current Assets Examples to Download

Current assets are short-term assets that a company expects to convert into cash, sell, or consume within one year or one operating cycle, whichever is longer. These assets are crucial for managing a company’s liquidity and are typically listed on the company balance sheet. Maintaining financial confidentiality agreements is essential to protect the sensitive information contained in liquid assets, ensuring the company’s financial health and competitive position.

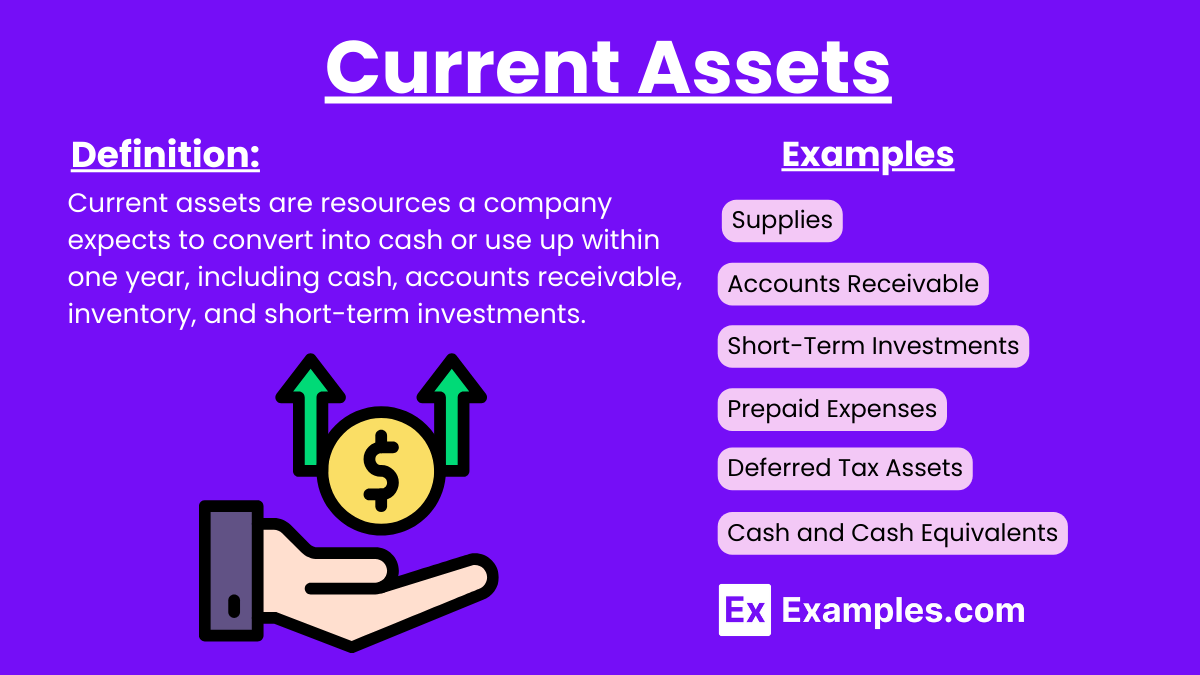

What are current assets?

Current assets are short-term assets that a company expects to convert into cash, sell, or use within one year or one operating cycle. They include cash, accounts receivable, inventory, and other liquid assets listed on the company’s balance sheet.

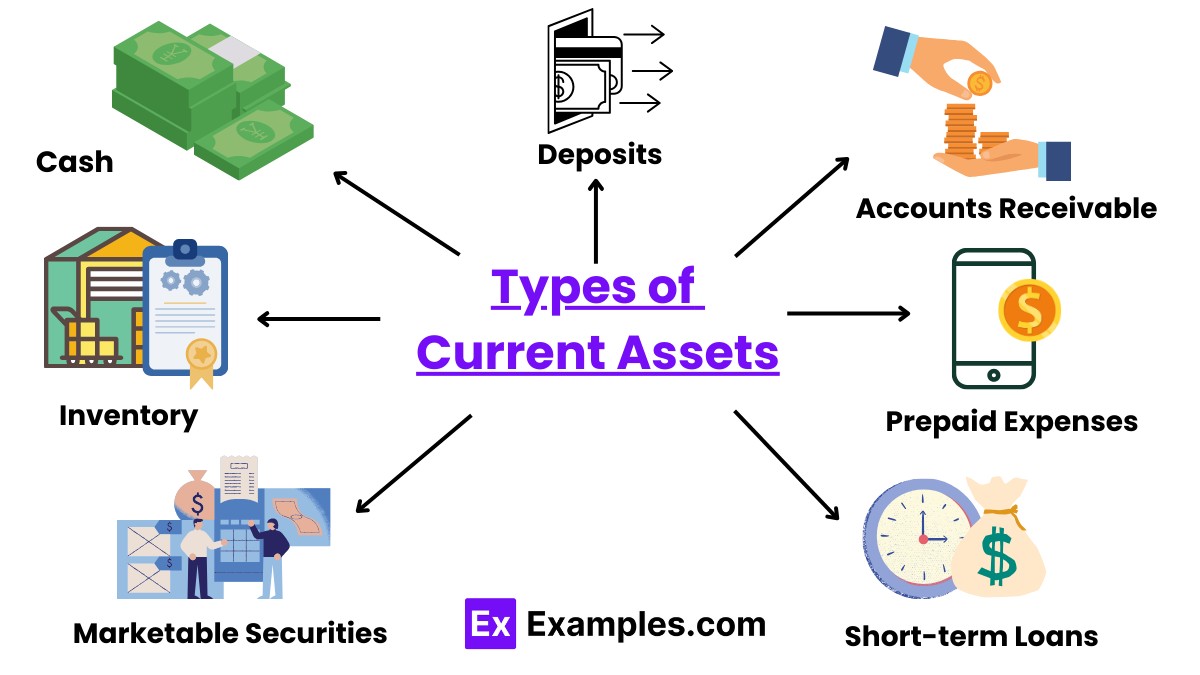

Types of Current Assets

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Marketable Securities

- Prepaid Expenses

- Short-term Loans and Advances

- Other Receivables

- Cash and Cash Equivalents: These are the most liquid assets, including currency, bank deposits, and short-term investments like Treasury bills. They are readily available to meet immediate expenses and obligations. Cash equivalents have a maturity period of three months or less.

- Accounts Receivable: These are amounts owed to the company by customers who have purchased goods or services on credit. Accounts receivable are typically collected within 30 to 90 days. Effective management of receivables is crucial for maintaining cash flow.

- Inventory: This includes raw materials, work-in-progress, and finished goods that a company intends to sell. Inventory management ensures the company has enough stock to meet customer demand without overstocking. It is converted into cash once sold.

- Marketable Securities: These are short-term investments that can be easily converted into cash, such as stocks and bonds. They are typically held for trading purposes and offer a higher return than cash equivalents. Marketable securities are valued at their fair market price.

- Prepaid Expenses: These are payments made in advance for goods or services to be received in the future, like rent, insurance, and subscriptions. Prepaid expenses are gradually expensed over time as the benefit is received. They are classified as current assets since they free up cash flow.

- Short-term Loans and Advances: These are loans given by the company to employees or other entities, expected to be repaid within a year. They include employee advances and short-term deposits. Managing these loans effectively helps in maintaining liquidity.

- Other Receivables: This category includes non-trade receivables such as interest receivable, tax refunds, and any other amounts due to the company within a year. They are considered current assets as they will convert into cash within the operating cycle. Proper tracking ensures accurate financial statements.

Examples of current assets

- Cash: Liquid funds readily available for business operations.

- Accounts Receivable: Money owed to the company by customers for sales made on credit.

- Inventory: Goods available for sale or raw materials used in production.

- Short-Term Investments: Investments that can be easily converted into cash within a year, such as marketable securities.

- Prepaid Expenses: Payments made in advance for goods or services to be received in the future.

- Marketable Securities: Financial instruments that can be quickly converted into cash, such as stocks and bonds.

- Supplies: Office or manufacturing supplies expected to be used within a year.

- Work in Progress: Goods that are in the production process but not yet completed.

- Cash Equivalents: Short-term, highly liquid investments that are easily convertible to known amounts of cash, with original maturities of three months or less.

- Deposits: Various other receivables expected to be collected within a year, such as interest receivable and tax refunds.

- Deferred Tax Assets: Taxes recoverable in the future due to deductible temporary differences and carryforwards.

How to calculate current assets

Step 1: Identify all current assets

- Gather all items listed under current assets on the company balance sheet. Common current assets include cash and cash equivalents, accounts receivable, inventory, marketable securities, prepaid expenses, and short-term loans and advances.

Step 2: List each current asset with its value

- Cash and Cash Equivalents: Include currency, bank balances, and short-term investments.

- Accounts Receivable: Include all receivables expected to be collected within the next year.

- Inventory: Include raw materials, work-in-progress, and finished goods intended for sale.

- Marketable Securities: Include short-term investments that can be quickly converted to cash.

- Prepaid Expenses: Include payments made for goods or services to be received within the year.

- Short-term Loans and Advances: Include loans expected to be repaid within the year.

- Other Receivables: Include non-trade receivables such as interest receivable and tax refunds.

Step 3: Sum the values of all current assets

- Add up the values of all the listed current assets to get the total current assets.

Example Calculation:

- Cash and Cash Equivalents: $50,000

- Accounts Receivable: $30,000

- Inventory: $40,000

- Marketable Securities: $20,000

- Prepaid Expenses: $5,000

- Short-term Loans and Advances: $10,000

- Other Receivables: $3,000

Total Current Assets = $50,000 + $30,000 + $40,000 + $20,000 + $5,000 + $10,000 + $3,000 = $158,000

Current Ratio

The current ratio measures a company’s ability to pay its short-term liabilities with its short-term assets. It provides insight into the liquidity and operational efficiency of a business.

Example Calculation:

- Current Assets: $150,000

- Current Liabilities: $75,000

Current Ratio=150,000/75,000 = 2.0

A current ratio of 2.0 means that the company has twice as many current assets as current liabilities, indicating good short-term financial health.

Quick Ratio

The quick ratio, also known as the acid-test ratio, measures a company’s ability to meet its short-term obligations with its most liquid assets. It excludes inventory from current assets, as inventory is not as easily converted to cash.

Example Calculation:

- Current Assets: $150,000

- Inventory: $40,000

- Current Liabilities: $75,000

Quick Ratio = 150,000−40,000/75,000 = 110,000/75,000 = 1.47

A quick ratio of 1.47 means that the company has $1.47 in liquid assets for every $1.00 of current liabilities, indicating a strong ability to cover short-term obligations without relying on inventory sales.

Current Assets vs Noncurrent Assets

| Aspect | Current Assets | Noncurrent Assets |

|---|---|---|

| Definition | Assets expected to be converted to cash or used within one year | Assets expected to provide value for more than one year |

| Examples | Cash, accounts receivable, inventory, marketable securities, prepaid expenses, short-term loans, other receivables | Property, plant, equipment, long-term investments, intangible assets (e.g., patents, trademarks), long-term receivables |

| Liquidity | Highly liquid and easily converted to cash | Less liquid and not easily converted to cash |

| Purpose | To meet short-term obligations and operational needs | To support long-term business operations and growth |

| Valuation | Usually valued at current market prices or cost | Often valued at historical cost minus depreciation or amortization |

| Balance Sheet Placement | Listed under current assets section | Listed under noncurrent assets or long-term assets section |

| Impact on Financial Ratios | Affects liquidity ratios like current ratio and quick ratio | Affects solvency ratios like debt-to-equity ratio and return on assets |

| Depreciation/Amortization | Not subject to depreciation or amortization | Subject to depreciation (tangible assets) or amortization (intangible assets) |

| Use in Business Analysis | Used to assess short-term financial health and liquidity | Used to assess long-term financial stability and investment potential |

Why are current assets important in corporate finance essentials?

Current assets are crucial in corporate finance essentials as they ensure a company’s liquidity, enabling it to meet short-term obligations and manage operational expenses effectively.

How do current assets differ from noncurrent assets?

Current assets are expected to be liquidated within a year, while noncurrent assets provide value over a longer period, typically more than one year. Noncurrent assets often include property, plant, equipment, and intangible assets.

What is included in the calculation of current assets?

The calculation of current assets includes cash and cash equivalents, accounts receivable, inventory, marketable securities, prepaid expenses, short-term loans, and other receivables.

How do you calculate the current ratio?

The current ratio is calculated by dividing current assets by current liabilities. It measures a company’s ability to pay short-term obligations with its short-term assets.

What role do marketable securities play in current assets?

Marketable securities are short-term investments that can be quickly converted into cash, providing companies with a flexible source of liquidity to meet immediate financial needs.

Can prepaid expenses be considered current assets?

Yes, prepaid expenses are considered current assets because they represent payments made in advance for goods or services to be received within a year, freeing up cash flow.

How does inventory management impact current assets?

Effective inventory management ensures that a company maintains optimal stock levels, preventing overstocking and understocking, and contributes to the efficient conversion of inventory into cash.

Are current assets subject to a depreciation schedule?

No, current assets are not subject to a depreciation schedule. Depreciation applies to noncurrent assets like property and equipment, which lose value over time due to wear and tear.

How do accounts receivable affect a company’s liquidity?

Accounts receivable represent money owed by customers. Efficient collection of receivables improves liquidity, ensuring that the company has sufficient cash flow to meet its short-term obligations.

What is the impact of high levels of current assets on a company’s financial health?

High levels of current assets can indicate strong liquidity, but excessive current assets may suggest inefficiency in asset utilization. Effective management of these assets is crucial for optimal financial performance.