10+ Current Liabilities Examples to Download

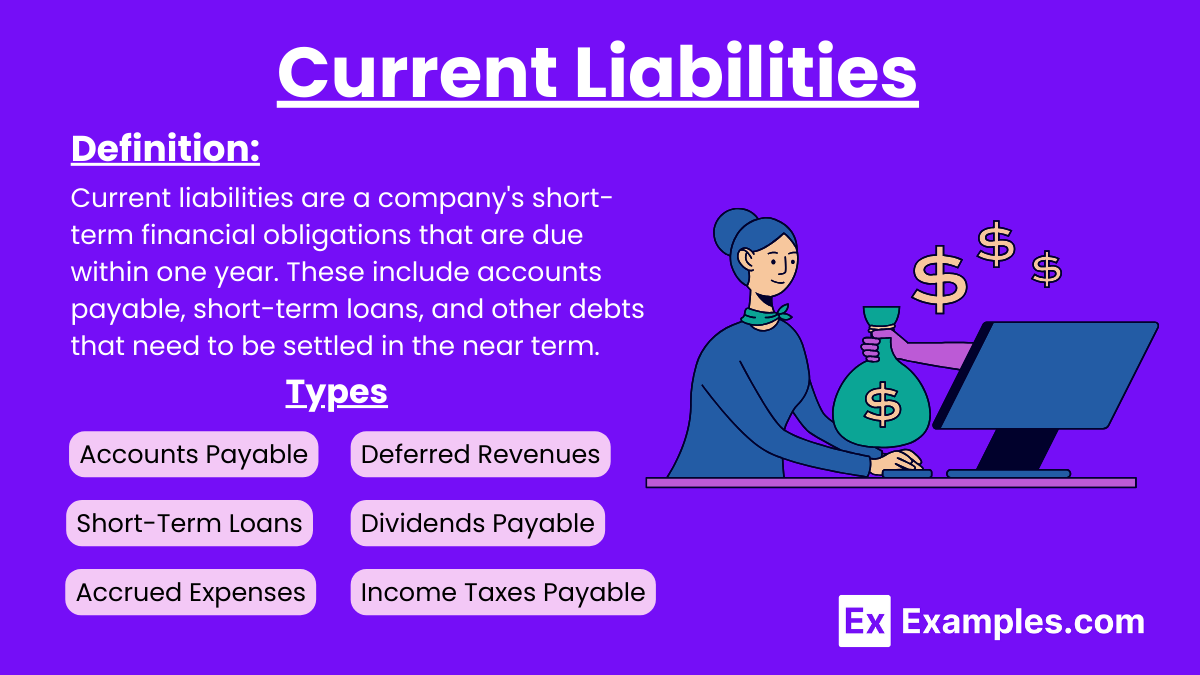

Current liabilities are financial obligations a company must pay within one year, crucial for assessing short-term financial health. They appear alongside assets on both nonprofit and company’s balance sheet, finance essentials indicating immediate debts such as accounts payable and short-term loans. Proper management of current liabilities ensures liquidity and operational stability.

Current Liabilities Formula

Example Calculation

Let’s calculate the current liabilities for a hypothetical company with the following data:

- Accounts Payable: $50,000

- Short-Term Loans: $20,000

- Accrued Expenses: $10,000

- Deferred Revenue: $15,000

- Current Portion of Long-Term Debt: $5,000

- Other Current Liabilities (e.g., taxes payable): $3,000

Current Liabilities = $50,000+$20,000+$10,000+$15,000+$5,000+$3,000

Current Liabilities = $103,000

Ratios and Formulas

| Ratio | Definition | Formula |

|---|---|---|

| Current Ratio | It is current assets divided by current liabilities. | Current Ratio = Current Assets/Current Liabilities |

| Quick Ratio | It is computed as current assets minus inventory, divided by current liabilities. | Quick Ratio = Current Assets−Inventory/Current Liabilities |

| Cash Ratio | These are the cash and equivalents of cash divided by current liabilities. | Cash Ratio = Cash and Cash Equivalents/Current Liabilities |

Examples of Current Liabilities

1. Interest Payable

Interest payable refers to interest that has accrued on loans and must be paid within the next year. These payments are critical to maintaining good credit and financial health. For example, a company owes $2,500 in interest on a short-term loan, payable in the next month.

2. Utilities Payable

Utilities payable include expenses for services like electricity, water, and gas that have been incurred but not yet paid. Managing these expenses is essential for keeping operational costs under control. For instance, a business has $1,200 in unpaid electricity and water bills that need to be settled within the next billing cycle.

3. Customer Deposits

Customer deposits are payments received from customers for products or services to be delivered in the future. These deposits represent a company’s obligation to fulfill its commitments. For example, a hotel collects $5,000 in deposits for future room bookings, which will be recognized as revenue when the service is provided.

4. Unearned Revenue

Unearned revenue refers to money received before services are performed or goods are delivered. This liability indicates a company’s obligation to provide future services or goods. An educational institution, for instance, receives $50,000 in tuition fees for the upcoming semester, to be recognized as revenue over the course of the semester.

5. Insurance Payable

Insurance payable represents premiums that have been incurred but not yet paid. Timely payment of these premiums is crucial for maintaining insurance coverage. For example, a company has an outstanding insurance bill of $3,000 due in the next 30 days.

6. Rent Payable

Rent payable includes rent expenses that have accrued but not yet been paid. These payments are necessary to maintain occupancy of business premises. A business, for instance, owes $4,000 in rent for the current month, which will be paid in the next month.

7. Supplies Payable

Supplies payable are amounts owed for supplies received but not yet paid for. Keeping track of these liabilities helps manage cash flow and inventory. For example, an office has an outstanding bill of $500 for office supplies purchased on credit, due within 30 days.

8. Legal Fees Payable

Legal fees payable include fees incurred but not yet paid for legal services. Managing these payments is essential for budgeting and financial planning. A corporation, for example, has incurred $7,000 in legal fees related to a lawsuit, which will be paid next month.

9. Warranty Liabilities

Warranty liabilities are estimated costs to repair or replace products under warranty. This liability reflects a company’s commitment to quality and customer service. For instance, a manufacturer estimates $10,000 for potential warranty claims on products sold within the year.

10. Tax Payable (Other than Income Tax)

Tax payable includes taxes other than income tax that are owed but not yet paid. These might include property, sales, or other local taxes. For example, a business owes $1,500 in property taxes due in the next quarter.

11. Payroll Taxes Payable

Payroll taxes payable represent payroll taxes withheld from employees’ wages but not yet remitted to the government. Timely payment is crucial to avoid penalties. For instance, a company has $3,200 in payroll taxes withheld from employees that need to be paid to the tax authority by the end of the month.

12. Bank Overdrafts

Bank overdrafts are negative balances in bank accounts that need to be repaid. Managing these overdrafts is important to maintain good financial standing and avoid additional fees. For example, a company overdrew its bank account by $2,000 and must cover the deficit within the next few days.

13. Marketing Partnership Agreement Payable

Marketing partnership agreement payable refers to payments due under a marketing partnership agreement for services received. These payments are crucial for maintaining beneficial marketing relationships. For example, a company owes $6,000 to a marketing partner for a campaign, payable within 90 days.

14. Disposable Income Adjustment Payable

Disposable income adjustment payable includes liabilities related to adjustments in disposable income for employees or stakeholders. This ensures accurate and fair distribution of income. A business, for example, owes $1,800 in adjusted income payments to employees, due in the next payroll cycle.

15. Corporate Finance Essentials Payable

corporate finance essentials payable refers to short-term financial obligations arising from corporate finance activities. Managing these payables is key to maintaining financial stability. For instance, a company must pay $5,000 in fees for financial consulting services within the next month.

16. Financing Leasing Payable

Financing leasing payable includes lease payments due within the next year under a financing lease agreement. These payments ensure the continued use of leased assets. For example, a business has $12,000 in annual lease payments for equipment, payable monthly at $1,000 each.

How Current Liabilities Work

1. Business Operations

- Accounts Payable: When a company purchases goods or services on credit, the amount owed to suppliers is recorded as accounts payable. This needs to be paid within the agreed credit terms, typically 30 to 90 days.

- Example: A retailer orders inventory worth $50,000 on credit, which it must pay off within 60 days.

2. Short-Term Borrowing

- Short-Term Loans: Companies often take out short-term loans to cover immediate expenses or capital needs. These loans must be repaid within a year.

- Example: A business borrows $100,000 for six months to Finance a new project, which it will repay with interest at the end of the term.

3. Accrued Expenses

- Accrued Expenses: These are expenses that have been incurred but not yet paid by the end of the accounting period. They include wages, utilities, and interest.

- Example: If employees have earned $20,000 in wages by the end of the month but will be paid in the next month, this amount is recorded as an accrued expense.

4. Deferred Revenues

- Deferred Revenues: When a company receives payment in advance for services or products to be delivered in the future, it records this as deferred revenue, a current liability.

- Example: A software company receives $12,000 for a one-year subscription service to be provided over the next year, recognizing it as deferred revenue and gradually reducing it as the service is delivered.

5. Impact on Financial Statements

- Company Balance Sheet: Current liabilities appear on the balance sheet under liabilities and must be managed to ensure sufficient liquidity to meet short-term obligations.

- Nonprofit’s balance sheet: Nonprofits also record current liabilities to show obligations they need to settle within the year, helping in planning and resource allocation.

6. Financial Ratios

- Current Ratio: This ratio compares current assets to current liabilities to assess a company’s ability to pay its short-term obligations.

- Example: A current ratio of 2:1 indicates that a company has twice as many current assets as current liabilities, suggesting good short-term financial health.

Types of Current Liabilities

- Accounts Payable: Money owed to suppliers for goods or services received on credit.

- Example: A company orders raw materials worth $30,000 and agrees to pay the supplier within 60 days.

- Short-Term Loans: Loans and other borrowings that are due for repayment within one year.

- Example: A business takes a $50,000 loan to cover immediate expenses, repayable within six months.

- Accrued Expenses: Expenses that have been incurred but not yet paid by the end of the accounting period.

- Example: Wages, utilities, and interest that have accrued but will be paid in the next period.

- Deferred Revenues: Payments received in advance for goods or services to be delivered in the future.

- Example: A company receives $20,000 for an annual subscription service, which it will provide over the next year.

- Current Portion of Long-Term Debt: The portion of long-term debt that is due within the next year.

- Example: If a company has a $100,000 loan with $10,000 due within the next year, this $10,000 is a current liability.

- Notes Payable: Written promises to pay a certain amount of money by a specific date, usually within one year.

- Example: A business signs a promissory note to pay $15,000 within three months.

- Dividends Payable: Dividends that have been declared but not yet paid to shareholders.

- Example: A company declares a dividend of $5,000 to be paid next month.

- Income Taxes Payable: Taxes owed to the government that must be paid within the next year.

- Example: A business owes $8,000 in income taxes for the current tax year, payable within the next few months.

- Sales Taxes Payable: Sales taxes collected from customers that must be remitted to the government.

- Example: A retail store collects $2,000 in sales taxes from customers and must pay this amount to the tax authority within the month.

- Wages Payable: Wages earned by employees but not yet paid by the end of the accounting period.

- Example: Employees have earned $25,000 in wages by the end of the month, which will be paid in the next pay period.

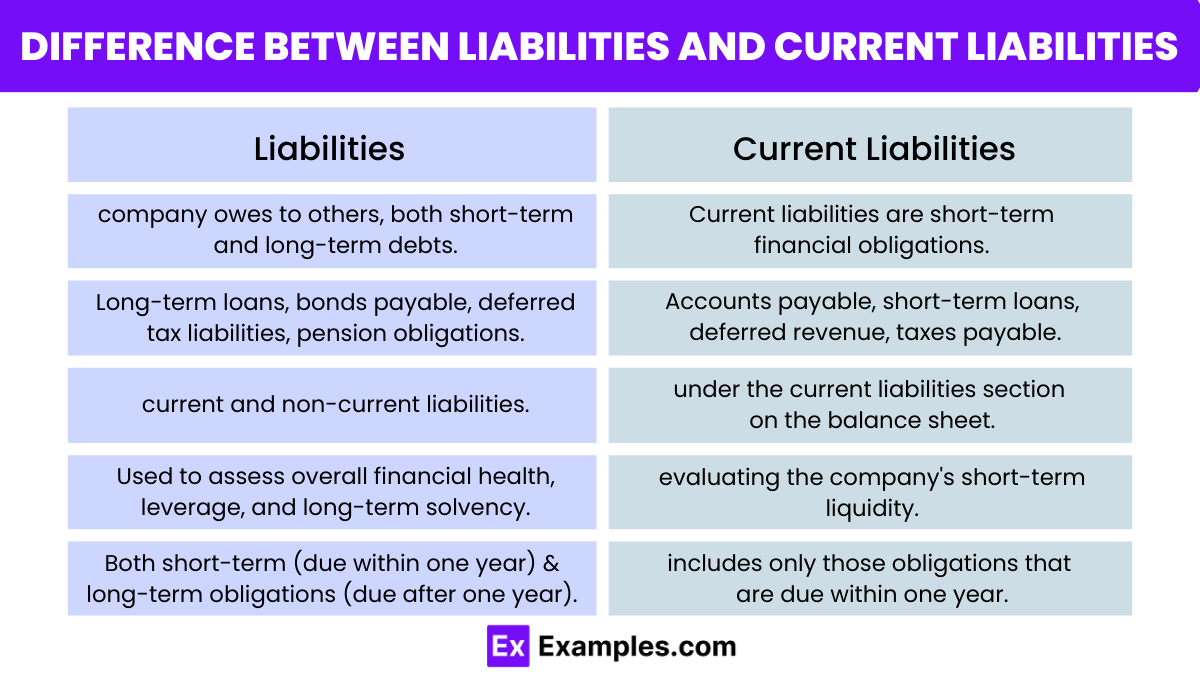

Difference Between Liabilities and Current Liabilities

| Aspect | Liabilities | Current Liabilities |

|---|---|---|

| Definition | Liabilities are all financial obligations a company owes to others, including both short-term and long-term debts. | Current liabilities are short-term financial obligations that a company must settle within one year. |

| Duration | Includes both short-term (due within one year) and long-term obligations (due after one year). | Specifically includes only those obligations that are due within one year. |

| Examples | Long-term loans, bonds payable, deferred tax liabilities, pension obligations. | Accounts payable, short-term loans, accrued expenses, deferred revenue, current portion of long-term debt, taxes payable. |

| Impact on Balance Sheet | Appears as a total figure on the balance sheet, categorized into current and non-current liabilities. | Appears under the current liabilities section on the balance sheet. |

| Financial Analysis | Used to assess overall financial health, leverage, and long-term solvency of the company. | Focused on evaluating the company’s short-term liquidity and ability to meet immediate financial obligations. |

What are current liabilities?

Current liabilities are short-term financial obligations a company must settle within one year, including accounts payable, short-term loans, and accrued expenses.

Why are current liabilities important?

Current liabilities are crucial for assessing a company’s short-term financial health and liquidity, indicating its ability to meet immediate obligations.

How do current liabilities affect a company’s balance sheet?

Current liabilities appear on the right side of the balance sheet under liabilities, reflecting debts and obligations due within one year.

What is the difference between current liabilities and non-current liabilities?

Current liabilities are due within one year, while non-current liabilities are long-term obligations due after one year.

Can current liabilities affect a company’s creditworthiness?

Yes, high current liabilities relative to current assets can negatively impact a company’s creditworthiness and financial stability.

How are current liabilities used in financial ratios?

Current liabilities are used in liquidity ratios like the current ratio, quick ratio, and cash ratio to evaluate a company’s short-term financial health.

What are some common examples of current liabilities?

Common examples include accounts payable, short-term loans, accrued expenses, deferred revenues, and the current portion of long-term debt.

How do accrued expenses fit into current liabilities?

Accrued expenses are costs that have been incurred but not yet paid by the end of the accounting period, making them a type of current liability.

Why is managing current liabilities crucial for business success?

Effective management ensures that a company can meet its short-term obligations without facing liquidity issues, supporting ongoing operations and financial stability.

How do current liabilities impact the cash flow statement?

Current liabilities impact the cash flow statement by showing changes in cash outflows related to paying off short-term debts and obligations, affecting the operating activities section.