80+ Debit and Credit Examples to Download

Debit and credit are fundamental concepts in finance that form the basis of the double-entry accounting system. These terms are used to record transactions in a company’s financial statements, ensuring accuracy and balance. A credit agreement outlines the terms under which credit is extended to a borrower, reflecting the importance of proper record-keeping. In accounting, a credit memo is issued to correct a transaction or return goods, highlighting the practical application of credits. Additionally, a recurring payment agreement ensures that regular transactions are systematically accounted for, demonstrating the seamless integration of debits and credits in everyday finance. Understanding these basics is essential for anyone looking to master the fundamentals in finance.

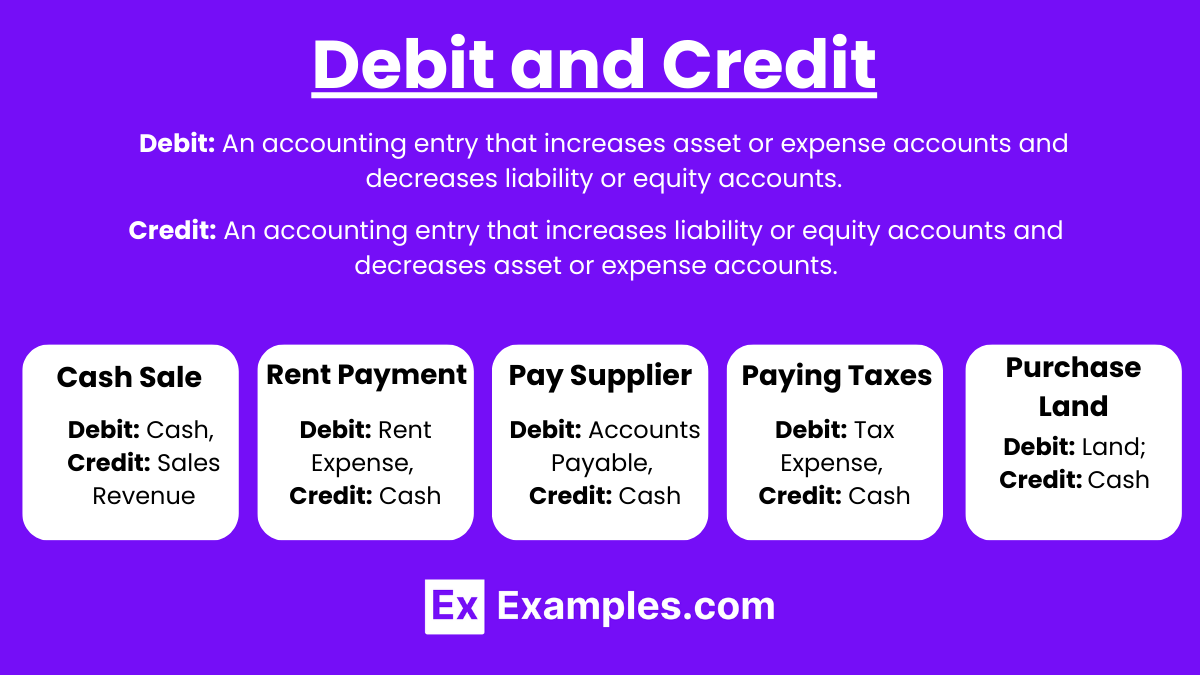

What is Debit and Credit?

Debit is an entry that increases asset or expense accounts and decreases liability, revenue, or equity accounts. Credit is an entry that decreases asset or expense accounts and increases liability, revenue, or equity accounts.

Examples of Debit and Credit

- Cash Sale: Debit: Cash; Credit: Sales Revenue

- Purchase Inventory: Debit: Inventory; Credit: Accounts Payable

- Pay Rent: Debit: Rent Expense; Credit: Cash

- Receive Loan: Debit: Cash; Credit: Loan Payable

- Purchase Equipment: Debit: Equipment; Credit: Cash

- Owner’s Capital Investment: Debit: Cash; Credit: Owner’s Equity

- Utility Bill Payment: Debit: Utilities Expense; Credit: Cash

- Interest Income Earned: Debit: Cash; Credit: Interest Income

- Receive Payment from Customer: Debit: Cash; Credit: Accounts Receivable

- Pay Supplier: Debit: Accounts Payable; Credit: Cash

- Employee Salary Payment: Debit: Salaries Expense; Credit: Cash

- Accrued Interest Expense: Debit: Interest Expense; Credit: Interest Payable

- Dividend Payment: Debit: Dividends; Credit: Cash

- Sales Return: Debit: Sales Returns and Allowances; Credit: Accounts Receivable

- Purchase Office Supplies: Debit: Office Supplies; Credit: Cash

- Depreciation of Equipment: Debit: Depreciation Expense; Credit: Accumulated Depreciation

- Accrued Wages: Debit: Wages Expense; Credit: Wages Payable

- Prepaid Insurance Payment: Debit: Prepaid Insurance; Credit: Cash

- Adjusting Entry for Prepaid Insurance: Debit: Insurance Expense; Credit: Prepaid Insurance

- Paying Off a Loan: Debit: Loan Payable; Credit: Cash

Examples of Debit

- Rent Payment: Paying monthly rent to a landlord.

- Utility Bills: Paying for electricity, water, gas, or internet services.

- Grocery Shopping: Purchasing food and household items at a supermarket.

- Credit Card Payment: Paying off a credit card bill.

- Loan Repayment: Making payments on a personal, auto, or student loan.

- Insurance Premiums: Paying for health, auto, or home insurance.

- Medical Bills: Paying for doctor’s visits, prescriptions, or medical procedures.

- Subscriptions: Paying for streaming services, magazines, or memberships.

- Gym Membership: Monthly or annual payment for gym access.

- Tuition Fees: Paying for educational courses or school fees.

- Car Maintenance: Paying for oil changes, tire rotations, or repairs.

- Home Repairs: Paying for plumbing, electrical work, or other home maintenance.

- Dining Out: Paying for meals at restaurants or cafes.

- Online Purchases: Buying items from e-commerce websites.

- Travel Expenses: Paying for flights, hotels, or rental cars.

- Public Transportation: Paying for bus, train, or subway fares.

- Charitable Donations: Contributing to non-profit organizations.

- Clothing Purchases: Buying clothes, shoes, or accessories.

- Phone Bills: Paying for mobile or landline services.

- Entertainment: Paying for movie tickets, concert tickets, or amusement park admissions.

- Pet Expenses: Buying pet food, veterinary care, or grooming services.

- Furniture Purchase: Buying tables, chairs, or other household furniture.

- House Cleaning Services: Paying for professional cleaning services.

- Childcare: Paying for daycare or babysitting services.

- Fitness Equipment: Purchasing exercise machines or gear.

Examples of Credit

- Credit Card Purchase: Buying groceries with a credit card.

- Loan Disbursement: Receiving funds from a personal loan.

- Salary Deposit: Employer deposits monthly salary into a bank account.

- Refund: Receiving a refund for a returned product.

- Interest Earned: Gaining interest on a savings account.

- Tax Refund: Receiving a tax refund from the government.

- Gift: Receiving money as a gift.

- Dividend Payment: Receiving dividends from investments.

- Social Security Benefits: Receiving monthly social security payments.

- Rent Received: Collecting rent from tenants.

- Freelance Income: Getting paid for freelance work.

- Sales Revenue: Receiving payment from customers for goods sold.

- Inheritance: Receiving money from an inheritance.

- Scholarship Grant: Receiving scholarship funds.

- Bond Redemption: Receiving payment upon bond maturity.

- Pension Payment: Receiving monthly pension payments.

- Bonus: Receiving a work performance bonus.

- Royalty Income: Receiving royalties from intellectual property.

- Commission: Earning sales commissions.

- Lottery Winnings: Receiving winnings from a lottery.

- Insurance Claim Payout: Receiving money from an insurance claim.

- Alimony: Receiving alimony payments.

- Child Support: Receiving child support payments.

- Trust Fund Disbursement: Receiving funds from a trust.

- Settlement Payment: Receiving money from a legal settlement.

Debit and Credit Accounts

The Accounting Equation

The accounting equation is the foundation of the double-entry system. It is expressed as:

Every transaction affects at least two accounts, maintaining the balance of the accounting equation.

Usage of Debit and Credit

Assets:

- Increase: Debit

- Decrease: Credit

Liabilities:

- Increase: Credit

- Decrease: Debit

Equity:

- Increase: Credit

- Decrease: Debit

Revenues:

- Increase: Credit

- Decrease: Debit

Expenses:

- Increase: Debit

- Decrease: Credit

Examples of Debit and Credit Entries

Example 1: Purchasing Office Supplies with Cash

- Office Supplies (Asset): Debit

- Cash (Asset): Credit

| Account | Debit ($) | Credit ($) |

|---|---|---|

| Office Supplies | 500 | – |

| Cash | – | 500 |

Example 2: Paying Off a Loan

- Loan Payable (Liability): Debit

- Cash (Asset): Credit

| Account | Debit ($) | Credit ($) |

|---|---|---|

| Loan Payable | 1000 | – |

| Cash | – | 1000 |

Example 3: Earning Revenue from Services

- Cash (Asset): Debit

- Service Revenue (Revenue): Credit

| Account | Debit ($) | Credit ($) |

|---|---|---|

| Cash | 2000 | – |

| Service Revenue | – | 2000 |

Common Debit and Credit Transactions

- Debit (Dr): Increases asset or expense accounts; decreases liability, revenue, or equity accounts.

- Credit (Cr): Increases liability, revenue, or equity accounts; decreases asset or expense accounts.

Common Transactions

Buying Inventory:

- Debit: Inventory (Asset)

- Credit: Cash or Accounts Payable (Asset or Liability)

Sales on Credit:

- Debit: Accounts Receivable (Asset)

- Credit: Sales Revenue (Revenue)

Paying Salaries:

- Debit: Salaries Expense (Expense)

- Credit: Cash (Asset)

Receiving a Loan:

- Debit: Cash (Asset)

- Credit: Loan Payable (Liability)

Depreciating Equipment:

- Debit: Depreciation Expense (Expense)

- Credit: Accumulated Depreciation (Contra-Asset)

Trial Balance

A trial balance is a list of all accounts and their balances at a specific time, showing debits and credits. It ensures that total debits equal total credits.

Example:

| Account | Debit ($) | Credit ($) |

|---|---|---|

| Cash | 5,000 | – |

| Accounts Receivable | 3,000 | – |

| Inventory | 7,000 | – |

| Equipment | 10,000 | |

| Accounts Payable | – | 2,000 |

| Loan Payable | – | 5,000 |

| Owner’s Equity | – | 15,000 |

| Sales Revenue | – | 8,000 |

| Salaries Expense | 2,000 | – |

| Rent Expense | 1,000 | – |

| Total | 28,000 | 28,000 |

Bank Statement

A bank statement summarizes all transactions in a bank account over a period. It shows deposits, withdrawals, and balances.

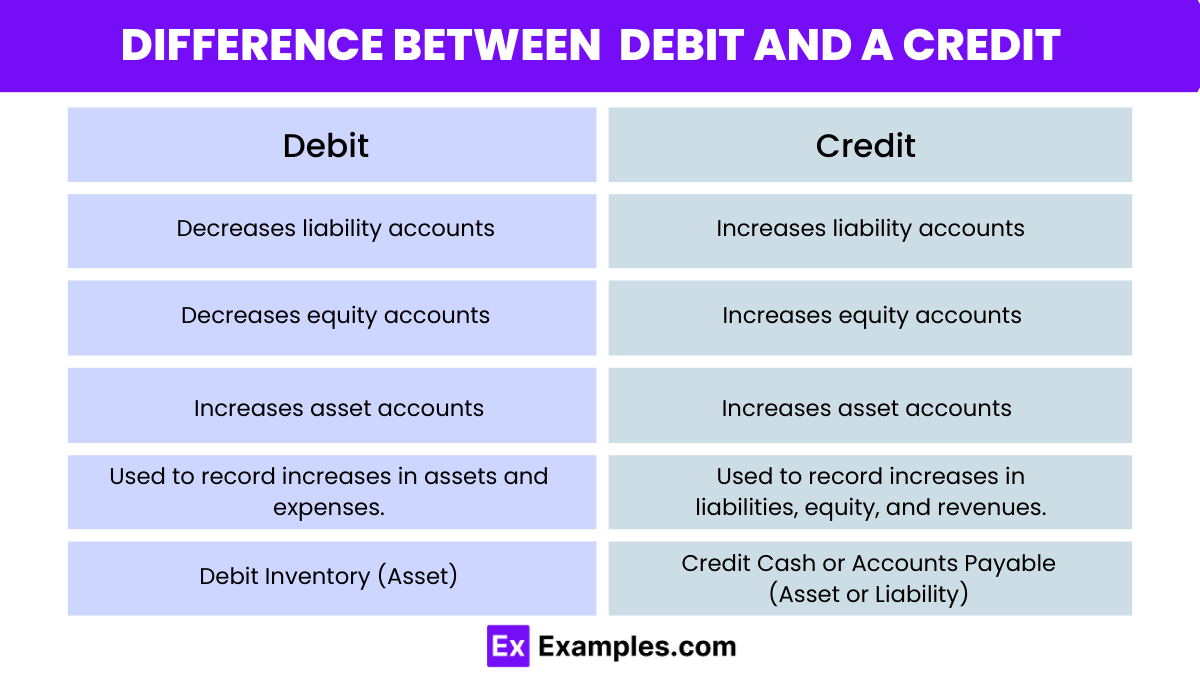

What is the Difference Between a Debit and a Credit?

| Aspect | Debit (Dr) | Credit (Cr) |

|---|---|---|

| Definition | An entry on the left side of an account ledger | An entry on the right side of an account ledger |

| Effect on Assets | Increases asset accounts | Decreases asset accounts |

| Effect on Liabilities | Decreases liability accounts | Increases liability accounts |

| Effect on Equity | Decreases equity accounts | Increases equity accounts |

| Effect on Revenues | Decreases revenue accounts | Increases revenue accounts |

| Effect on Expenses | Increases expense accounts | Decreases expense accounts |

| Usage | Used to record increases in assets and expenses, and decreases in liabilities, equity, and revenues | Used to record increases in liabilities, equity, and revenues, and decreases in assets and expenses |

| Account Balance | Left side of the ledger | Right side of the ledger |

| Example Transaction (Purchasing Inventory) | Debit Inventory (Asset) | Credit Cash or Accounts Payable (Asset or Liability) |

Tips for Remembering Debits and Credits

DEALER: An acronym to remember the rule of debits and credits:

- D: Dividends

- E: Expenses

- A: Assets

- L: Liabilities

- E: Equity

- R: Revenue

DEAD CLIC: Another mnemonic to aid in remembering:

- DEAD: Debits increase Expenses, Assets, and Dividends

- CLIC: Credits increase Liabilities, Income, and Capital

How do debits and credits affect the accounting equation?

Debits and credits keep the accounting equation (Assets = Liabilities + Equity) balanced.

What are examples of debit transactions?

Purchasing inventory, paying salaries, and buying equipment are common debit transactions.

What are examples of credit transactions?

Receiving a loan, earning revenue, and increasing equity are common credit transactions.

Why must total debits equal total credits?

Total debits must equal total credits to ensure accurate and balanced financial records.

How are debits and credits recorded in a ledger?

Debits are recorded on the left side, and credits are recorded on the right side of a ledger.

What is a trial balance?

A trial balance is a worksheet listing all accounts and their balances, ensuring total debits equal total credits.

Can debits decrease liabilities?

Yes, debits decrease liability accounts in accounting.

Can credits increase assets?

No, credits typically decrease asset accounts in accounting.

What happens if debits and credits don’t match?

The accounts are unbalanced, indicating an error in the transaction recording.

What is the purpose of a bank statement?

To summarize all transactions in a bank account over a period, helping reconcile records.