10+ Deposit Agreement Examples to Download

When putting up your properties on a lease, whether a real estate, vehicle or others, you can never guarantee when the lessee will stop making use of them. Because of this very reason, landlords or rental business owners need to ask for security deposits that help avoid or mitigate the effect of tenants’ misconduct. The same goes for property dealerships where dealers collect earnest money to potential customers who promise to purchase certain properties. For better protection for this type of settlement, you need a contract. But before that, you still have to create a pre-contract document, which is also known as an agreement. With that, we highly encourage you to take a peek on our article and deposit agreement examples below!

10+ Deposit Agreement Examples

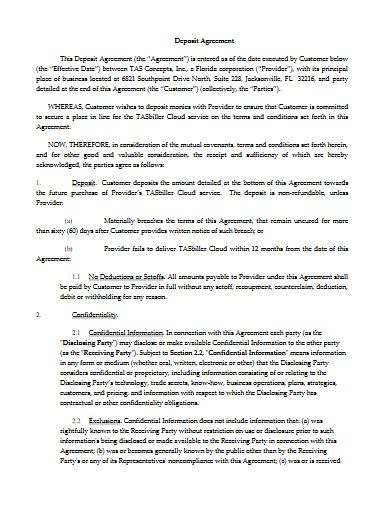

1. Deposit Agreement Template

2. Security Deposit Agreement Template

3. Direct Deposit Agreement Template

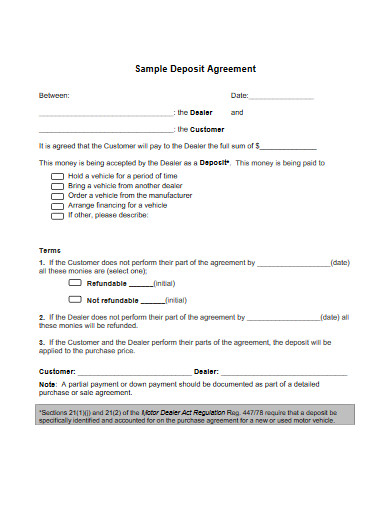

4. Sample Deposit Agreement

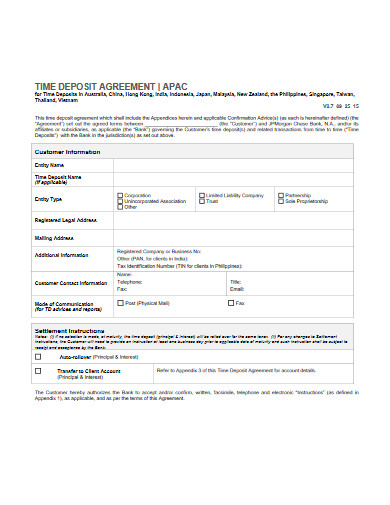

5. Time Deposit Agreement

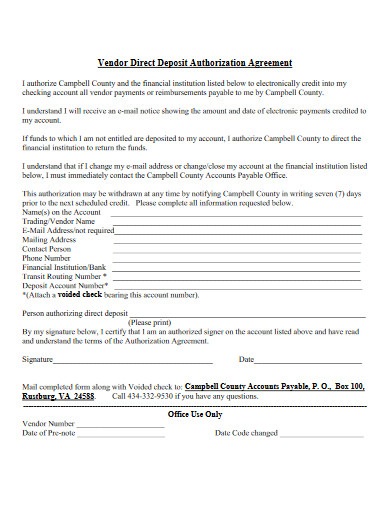

6. Vendor Direct Deposit Agreement

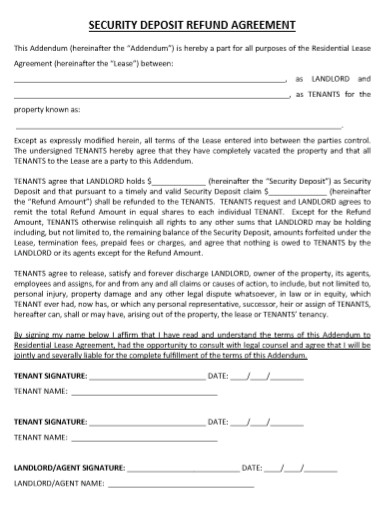

7. Security Deposit Refund Agreement

8. Deposit Agreement Example

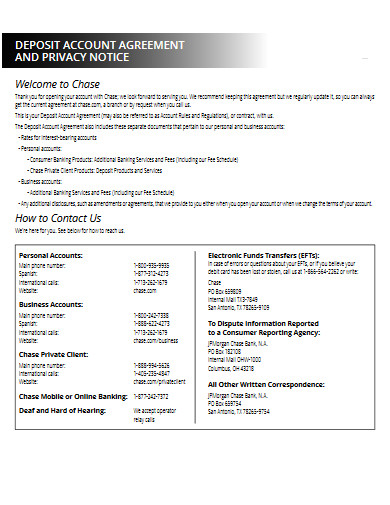

9. Deposit Account Agreement

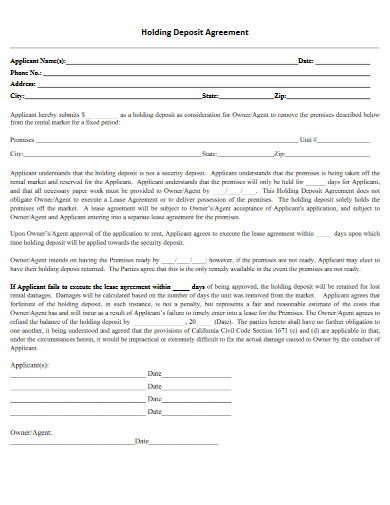

10. Holding Deposit Agreement

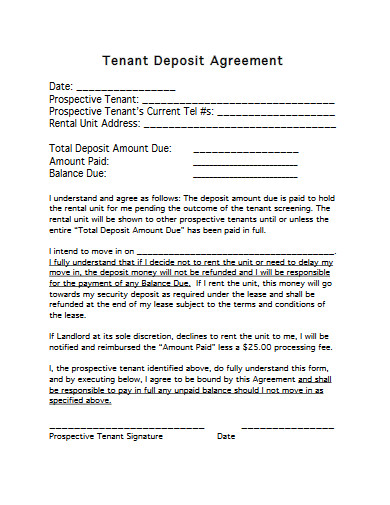

11. Tenant Deposit Agreement

What Is a Deposit Agreement?

A deposit agreement is a legal document that gives out the stipulations of two parties regarding their upfronts for a purchase policy, property lease agreement, or investment agreement. Erin Eberlin of The Balance Small Business pointed out that the paperwork acts as an insurance for landlords that protects them from any violation of tenant lease agreement. In her February 2020 article, she indicated that part of the deal’s coverage is the financial protection from a tenant’s non-payment, damages to units, cleaning charges, and his or her failure to return or replace unit properties. Take note that the availability of this type of arrangement depends on where the agreement took place. The examples mentioned earlier were following San Francisco’s codes.

Understanding Earnest Money

Earnest money is the buyer’s guarantee to the property sellers. Most of the time, the buyer hands it out later after signing a sales contract or purchase agreement and putting it under the seller’s custody until the full payments of the bought properties. If anything goes wrong with said contract or agreement, the buyer can reclaim the earnest money. Then again, the buyer can only have it back if the contract or agreement specified the process among the other stipulations. Given that it’s the buyer who violated the arrangement, he or she can no longer have it back.

How To Create a Deposit Agreement?

When writing contracts or agreements, you have to be knowledgeable enough not only on the subject matter but also on technical writing standards, particularly on the document flow. It may be true that hiring a lawyer to do the task for you is much more convenient. But it can be expensive. So to save you money, you can check out our standardized outline of guidelines instead!

1. Define the General Purpose

The first section for any agreement should be the statement of purpose. Here, you should define the very reason why you’re preparing the document clearly. In most cases, writers of such a document would include a summary of its entire content. This only means that you have to prepare yourself to make concise descriptions of each of the succeeding sections.

2. Identify the Parties

Still on the first section, you have to identify the involved parties. Also, give out your organization’s basic information and that of the other party, such as the legal names and addresses. Moreover, you must indicate who is making the deposit and who is the receiving party, or who the seller and who the buyer or lessee is.

3. Describe the Purchase/Lease/Investment

The next section should thoroughly discuss the purchase, lease, or investment and the deposit’s specifications. For this section, you must talk about your state’s security deposit limit, when and how you’re going to provide the deposit receipt, and on what terms you’ll be returning the deposits to the buyer or the lessee.

All U.S. states allow landlords to collect deposits, but most of them have set their respective maximum amounts. Additionally, some states have no limit, like Illinois and Texas. Some states also make deposit receipts as requirements when engaging in deposit agreements. Commonly, landlords have to provide them to their tenants 30-days after they moved in. Each of these states has a law that specifies how long the landlords can keep the deposit, but if the money’s not to be given back, the landlords must enumerate the reasons why.

4. Provide Payment Specifications

After describing the purchase, lease, or investment, you have to discuss when the deposit should take place from the other party to your organization. Not only that, but you also have put into consideration the maximum amount and the method of how you will be receiving the deposit.

5. Make a Termination Clause

Another section that you must not miss out is the clause where you’ll enumerate and elaborate on your termination policies and procedures. Some examples mentioned above (non-payment, damages to units, cleaning charges, and failure to return or replace unit properties) can be remedied through recompensation.

6. Protect Privacy

Once you have successfully set up your termination clause, proffer your confidentiality agreement. This allows you to protect both parties’ rights to the created pieces of information. Malpractice involving anything that’s stated in your agreement has its corresponding legal punishment.

FAQs:

How much should a security deposit be?

For rental properties, the security deposit should be equivalent to one to two months worth of rent. Some landlords or lessors would also look into the tenants or lessees’ credit reports and establish the deposit amounts from their credit scores.

When can I get my security deposit back?

You can get your security deposit back under the following circumstances:

– Your landlord failed to give you a deposit receipt after 30 days.

– Your landlord denies your right to check your records of deposits and repairs.

– Your landlord failed to put your deposit money on a separate account.

– If your tenancy ends and there is no written lease agreement.

– If moved out right after your tenancy ends.

How can I ask for my security deposit?

You can ask for your security deposit by making a demand letter or taking your landlord to court.

Oftentimes, businesses fall prey to wrongdoers. This fact gave way to the formulation of the landlords, lessors, retailers, and manufacturers’ defense mechanisms, which is through deposits. To ensure the effectiveness of the protection, a document, particularly a deposit agreement, is necessary.