Disposable Income

Disposable income or disposable personal income (DPI) refers to the amount of income left after the discretion of the taxes. It is personal income subtracted by current personal taxes and the left. In many nations, disposable income is the primary or major source of running the economy, and that is why economists always monitor such income.

What is the Requirement of Disposable Income?

Disposable income is the left out income amount of any individual who earns above a certain amount as their net salary. This subtraction is for tax purposes that employees payroll every month to keep the economy moving smoothly to develop positively. There are many other requirements and usage of disposable income like:

- Disposable income is required for several statistical measuring and economic indicators.

- This is a point from where the economists calculate different other metrics such as discretionary income, personal savings rates, and others.

- Disposable income is required to calculate and finalize discretionary income. It happens as disposable income minus all payments of expenses and liabilities.

- The personal savings depends on the disposable income you gt after the tax deduction.

- Disposable income is required to the federal government for wage garnishing. As they use disposable income as a point to calculate how much they need to seize from earner’s paycheck. The rule is that it should not exceed 25% of an individual’s disposable income.

What are the Differences between Disposable and Discretionary Income?

- Disposable income is the remaining amount of capital after the deduction of the taxes. Discretionary income is the capital remaining after the deduction of taxes, social security charges, expenses, liabilities, and other necessary living costs.

- Disposable income works as an economic indicator and helps the economists to analyse the financial condition and cash flow in the nation. Discretionary income derives from disposable income.

- Disposable income is what an individual or employee has available for making any investments, expenses, or other things. Discretionary income is not much different in this criteria from disposable income as this income is also used to pay the necessities.

8+ Disposable Income Examples

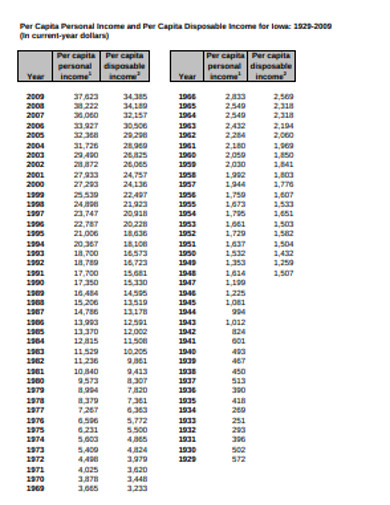

1. Sample Disposable Income Example

The term disposable income is used to refer to normal practice of real-life but this specific term is very relevant in the world of economics. If you want to understand more about the other terminologies and their usage and relevance you can choose this template. Framed with a descriptive definition of different processes this template might help you to increase your market and economical knowledge. So, have a look at this template before today!

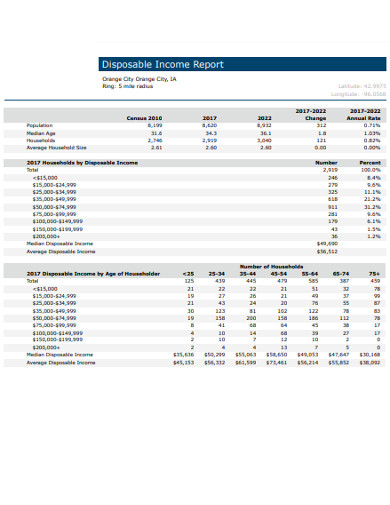

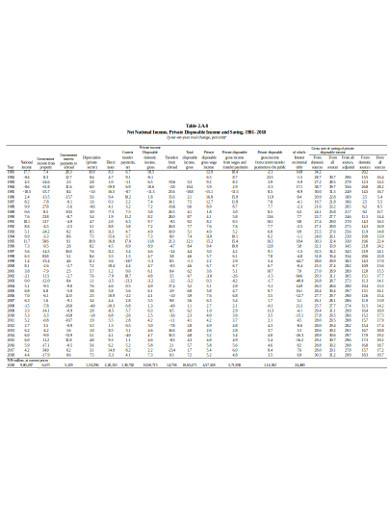

2. Disposable Income Report Example

Disposable personal income is a total personal earning of individuals that are deducted by a basic tax cost as set by the taxation agencies. This tax deduction is done following different norms and set regulations. If you want to understand those processes and procedures you can have a look at this template. The sample frames a report that shows the calculation of how to deduct and where to deduct personal income. You may check out this template once to get an idea of the process. So, try out it today!

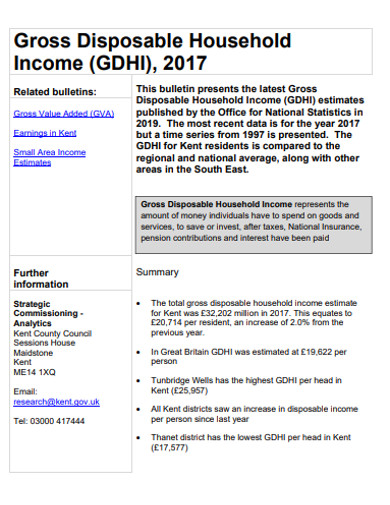

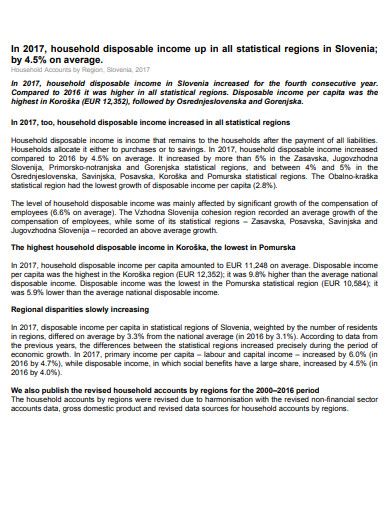

3. House Hold Disposable Income Example

If you want to have a clear idea of what is disposable income this template might be the best for you to understand the fact. The template frames the fact that the term is used for the taxation process over the individual’s income. Every nation set some norms and level of taxation price over the net income of common individual. This template frames other specifications of the process in detail. So, please have a look at it and learn about what you pay and why you pay.

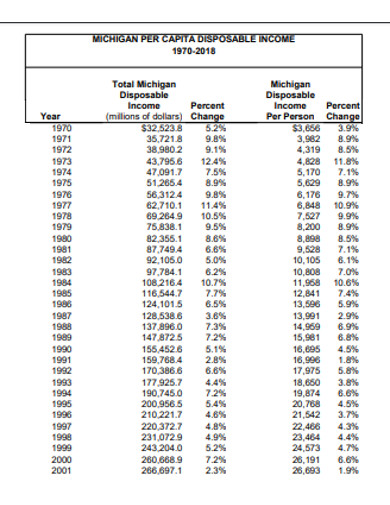

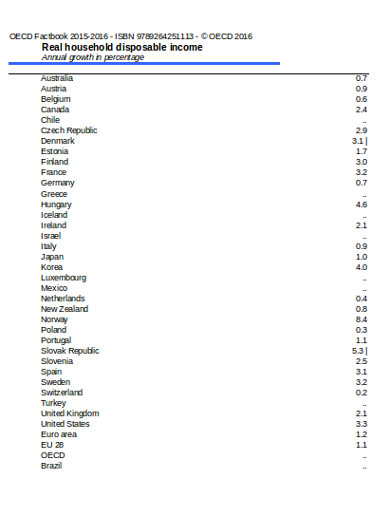

4. Gross Disposable Household Income Example

If you are an earner you should understand the disposable income process. The process takes some amount of money from you every month, so you should have a detailed idea of it. The given sample of the template may help you to understand the process clearly as it is designed taking and calculating different necessities and requirements. So, check out if the template is useful to you or not. Or you can also have a look at our templates on income statements to have more ideas.