10+ Estate Inventory Examples to Download

The wealth of a decedent—whether it is in the form of money, properties, or titles—is always a matter of big dispute for the family members that he has left behind.

But cases like this are not exactly surprising since the successors are expected to take it upon themselves to care for everything that the person they love has spent much of his life accumulating. Also, doing so would give them a considerable amount as a recompense for their efforts depending on how wealthy the decedent was. You may also see system inventory examples.

But, irregardless of the money that a person can get from handling his deceased loved one’s properties, it’s not exactly a situation any of us wants to be assigned to, nor is it, hopefully, something we have mastered. However, to settle a decedent’s estates, one of the surviving family members must take charge and act as the decedent’s personal representative or the executor of the estate. You may also like asset inventory examples.

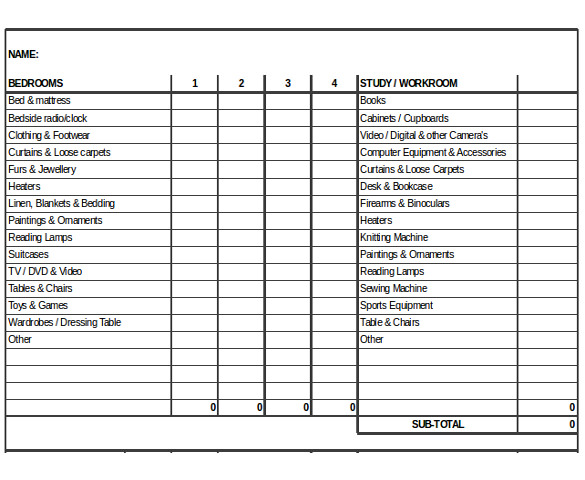

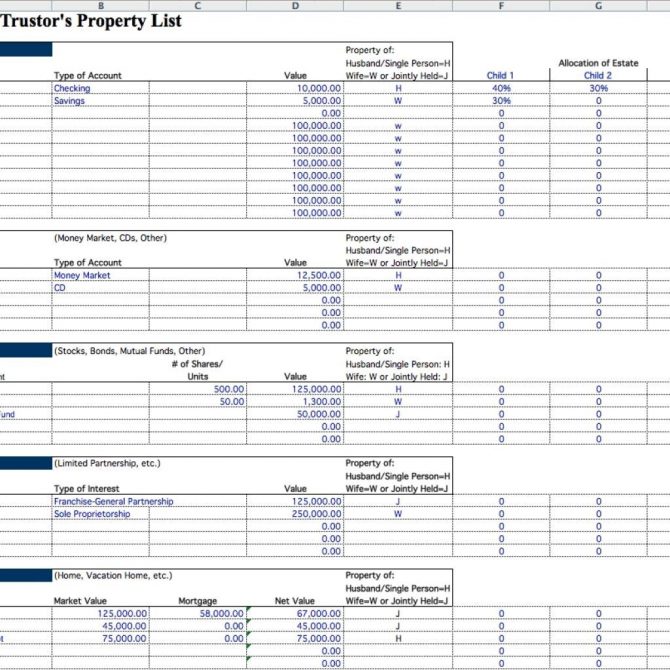

Inventory Template Sample

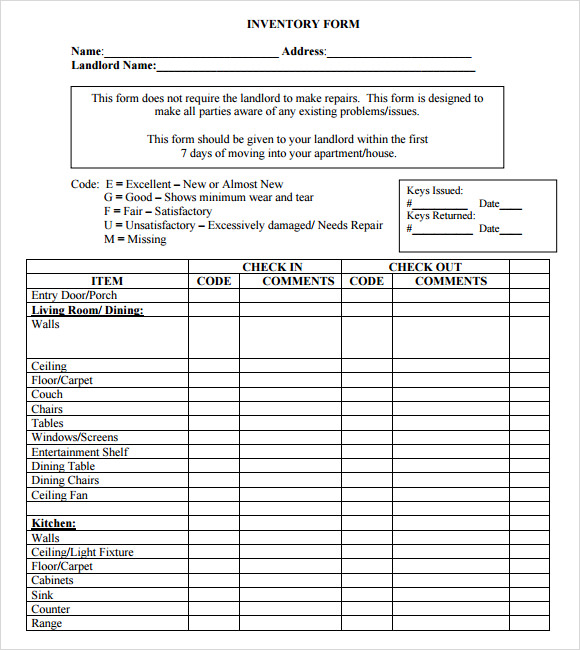

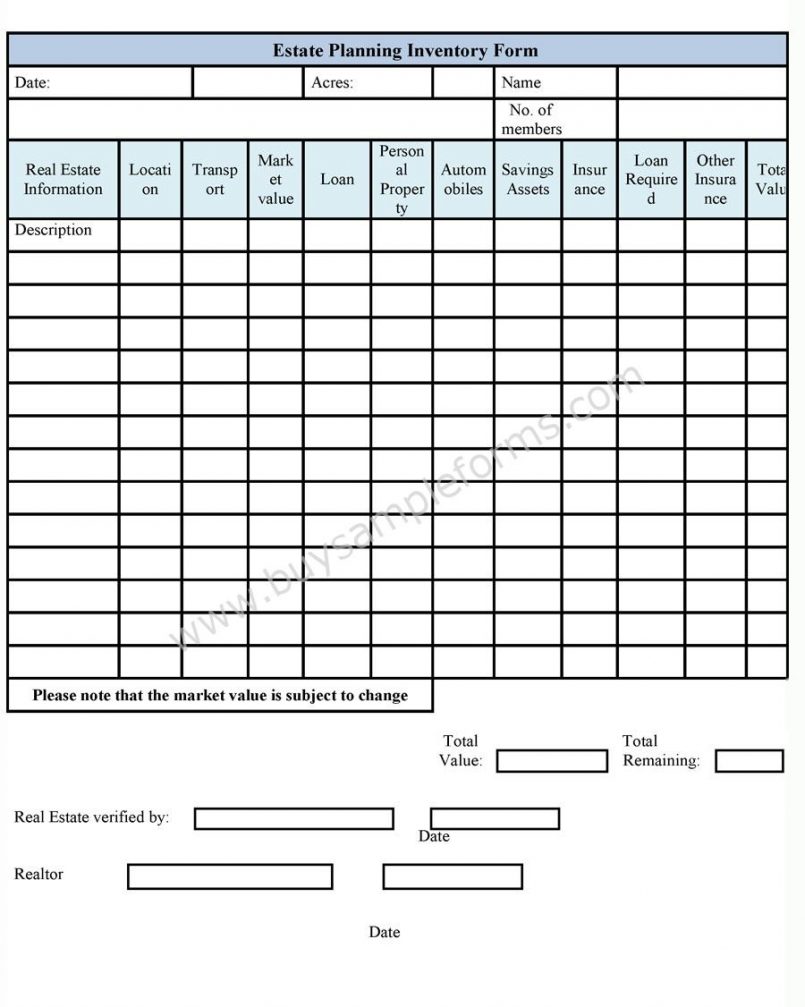

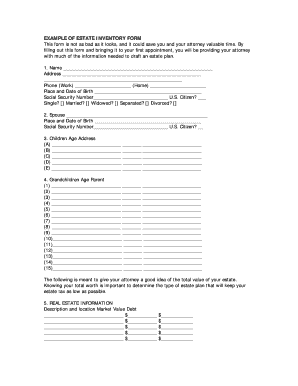

Inventory Form Sample

What Is Probate?

A legal court is always a required audience for cases involving properties and their heirs. The decedent’s successors simply can’t assume ownership over the properties in question since there is a systematic procedure that needs to be observed.

The probate is the court-supervised process that seeks to authenticate a last will and testament left by a person. Since this document will include the names of the people who will inherit the decedent’s wealth as per his demand, the distribution of the properties will be easier. You may also see inventory checklist examples.

Probate will also include the process of locating the assets and determining their worth. Taking over the responsibility of settling the unpaid bills and taxes of the decedent will also be a part of the probate’s affair. When all loose ends are tied, what’s left of the decedent’s fortune will be given to his successors. You may also like inventory examples in PDF.

Estate Inventory Form Sample

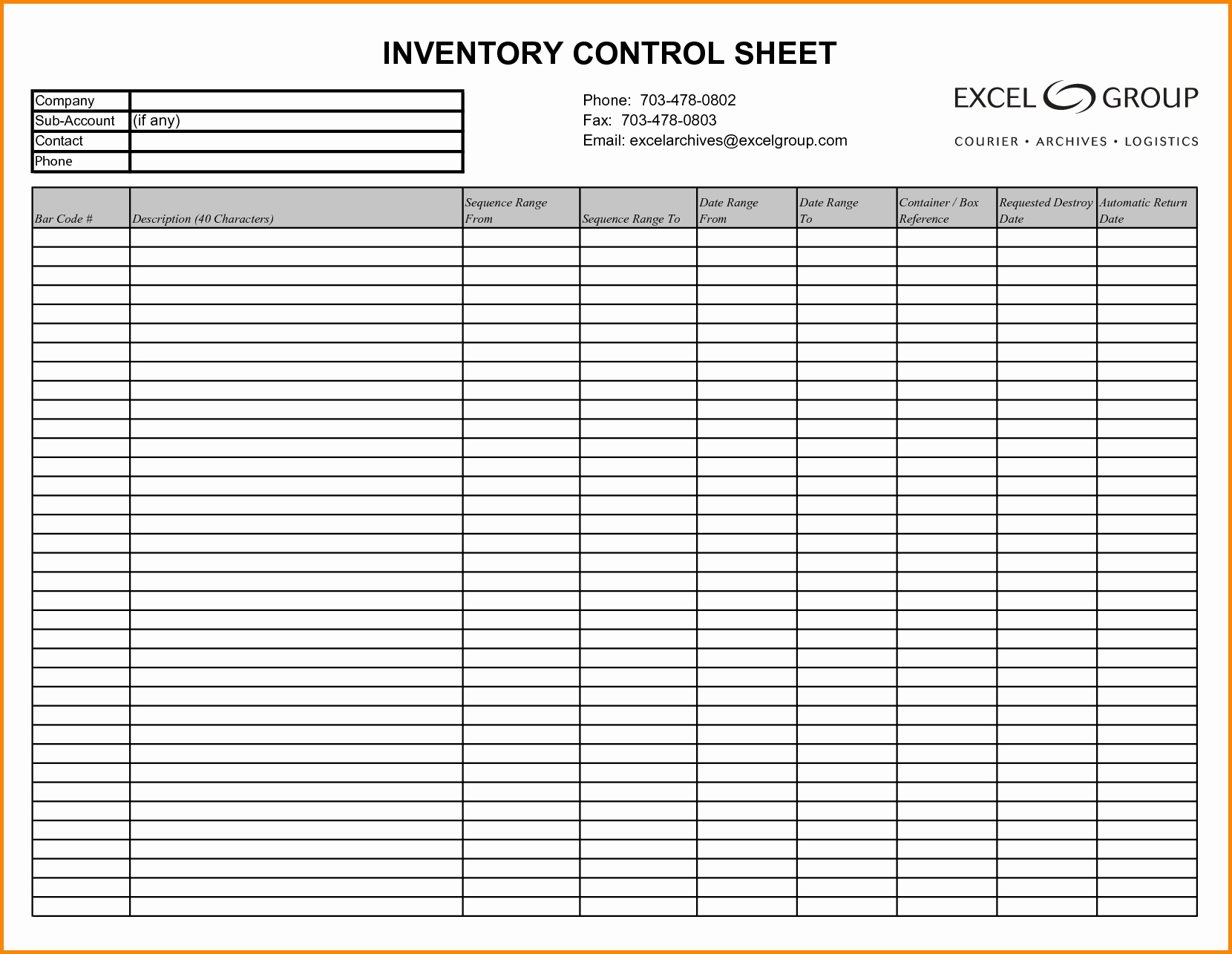

Inventory Control Sheet Sample

The Steps That Involve Probate

Probate codes are specific laws that each state follows when dealing with probating an estate. Aside from a few differences, most probate codes are similar everywhere. The following steps are what probate typically involve:

1. Validating the decedent’s last will and testament

It is the court’s first responsibility to look for a last will which they can use to determine the rightful successors of the decedent’s existing properties. If the court finds one and proves that it is, in fact, the true and most recent one made, it will be signed by a judge. You may also see free inventory examples.

2. Appointing a personal representative

As we’ve discussed earlier, a personal representative or an executor needs to be determined to help manage the case. He will be given the responsibility of seeing over the whole probate process and to settle the estates left. The decedent usually chooses his own executor by appointing a name in his will. But, in cases where a will is not present, the court will appoint a next of kin for the position. You may also like landlord inventory examples.

3. Locating the decedent’s assets

This will be the job of the executor. He will have to look for all of the assets of the decedent and make sure that they are protected and legally written under the decedent’s name.

4. Determining the date of death values of the assets

The date of death values of a decedent’s assets refer to the value of the property as calculated using the present-day market’s standards. Although this is a job that the executor oversees, he might need the help of professionals and experts in this matter since estimating the price of an estate is not as easy as it sounds. The decedent’s account statements and appraisals will pay a role in this specific stage in the process. You may also check out sample inventory.

5. Identifying known creditors

Debts are a tricky business, especially when it involves a person who is no longer capable of paying for them. So to avoid any future complications and even legal responsibilities, the executor must also determine the decedent’s existing creditors so that he can inform him of the death. You might be interested in school inventory examples.

The executor may even be required to post a notice of the death on the local newspaper to make sure that every creditor, especially those he may not know about, is alerted of the death since they will only be given a limited time to appeal against the estate about a debt.

6. Paying bills

The appointed personal representative must also pay for the decedent’s bills, including the debt claimed by creditors. However, he also has the power to reject any of these claims if he has a good reason to assume that they are not valid. To settle these debt-related disputes, the executor can ask the court for a probate judge who will determine the validity of the debt. You may also see accounting inventory examples.

7. Preparing and filing income tax returns.

These things don’t come tax-free, unfortunately. So, as usual, it will also be the executor’s responsibility to keep track of the taxes and make sure that they are paid on time. The estate at issue may also come with inheritance taxes which will have to be settled before the 9-month allowance period given after a decedent’s death. You may also like inventory examples in doc.

8. Distributing the balance of the estate to its beneficiaries.

After all of the aforementioned steps are completed and taken care of, the executor can now appeal to the court to claim all that is left of the decedent’s property and apportion it to the heirs enumerated in his last will and testament.

There are many cases where the decedent was not able to leave a last will, or if he did, the court has considered it invalid, or a kin has successfully contested it.

The properties will then be referred to as “intestate” estates. The probate process that will be observed for these cases are generally similar to situations where a last will is available. However, since there are no legally appointed heirs, the court will have to choose the heirs themselves. Usually, they are the decedent’s closely related family members which the court will be obligated by state laws to consider as successors. You may also check out simple inventory examples.

Estate Planning Inventory Form

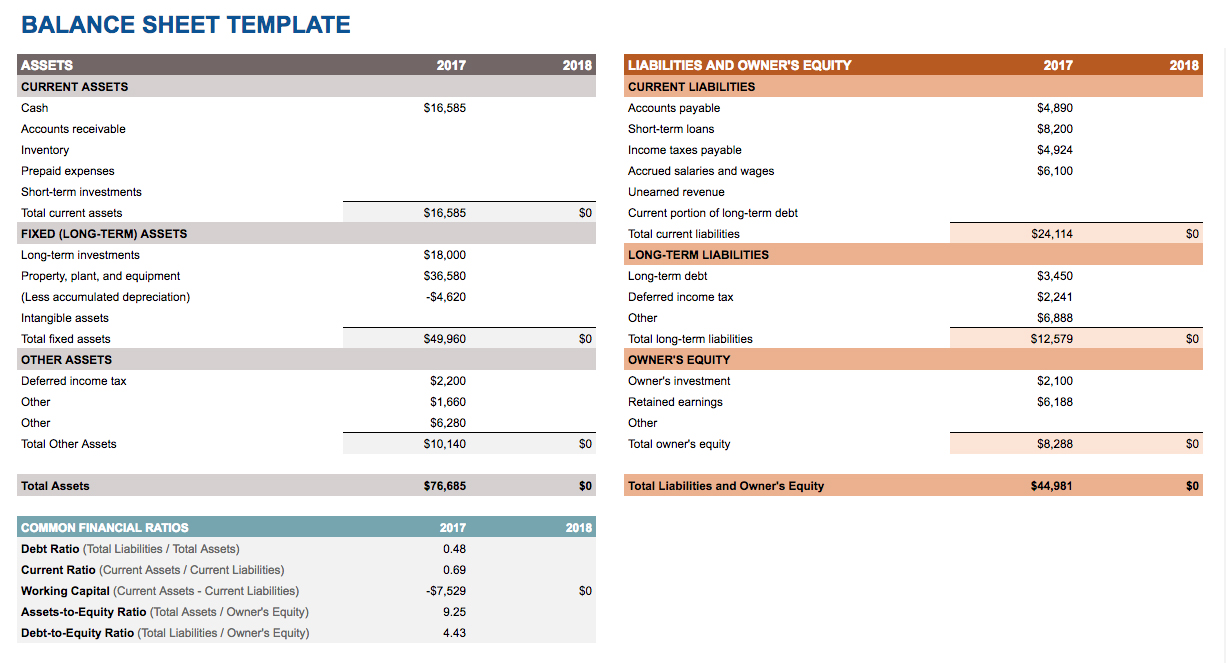

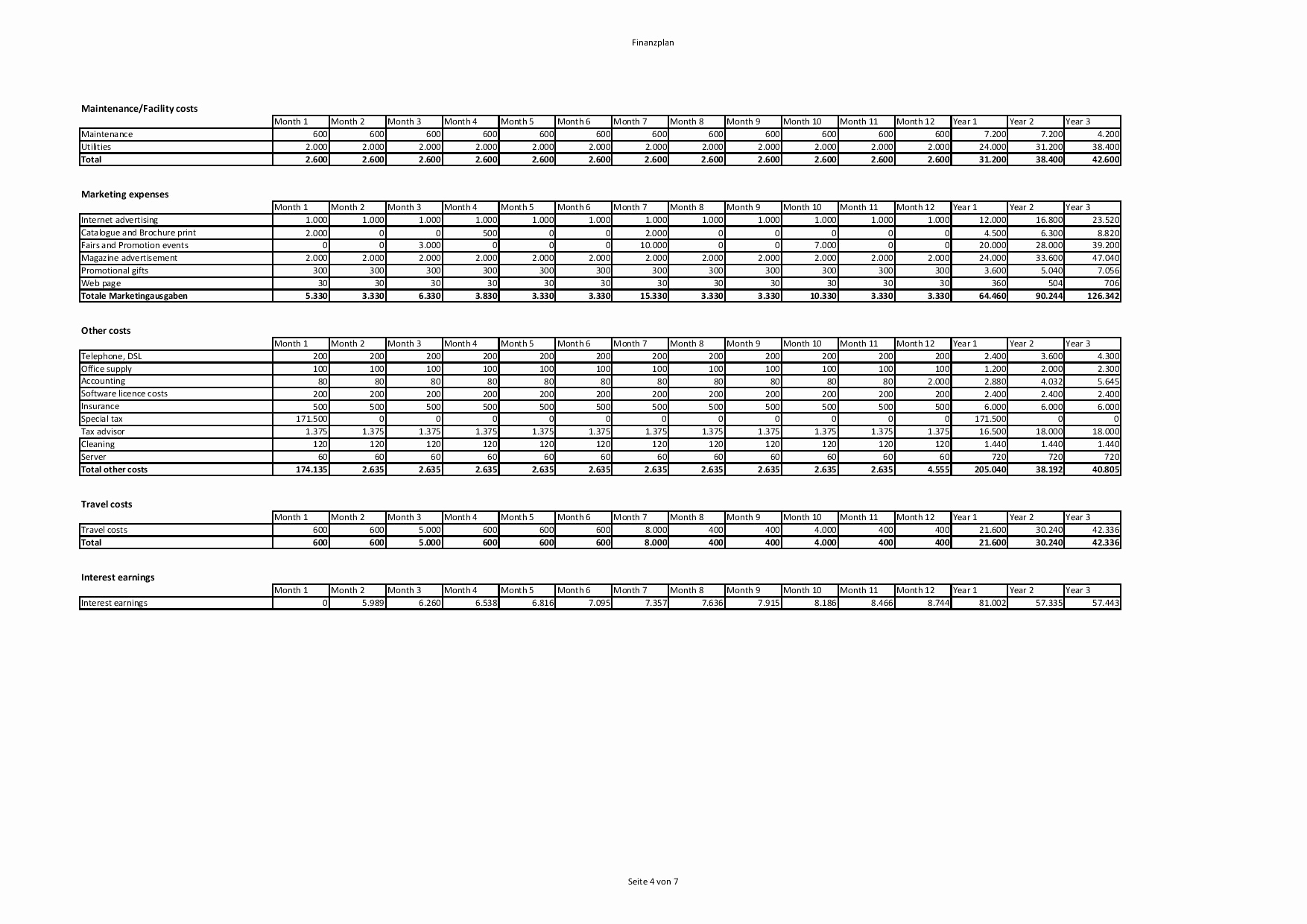

Estate Inventory Balance Sheet Form

An Executor’s Job During Estate Inventories

The executor is tasked to settle more than one simple task in handling his loved one’s estate. Since he will be the one who faces the court, the decedent’s creditors, and other legal and financial personalities affected by the death, he will have to carry all the paperwork and fiscal responsibilities before the court can give him the estate he rightfully owns. You may also see restaurant inventory examples.

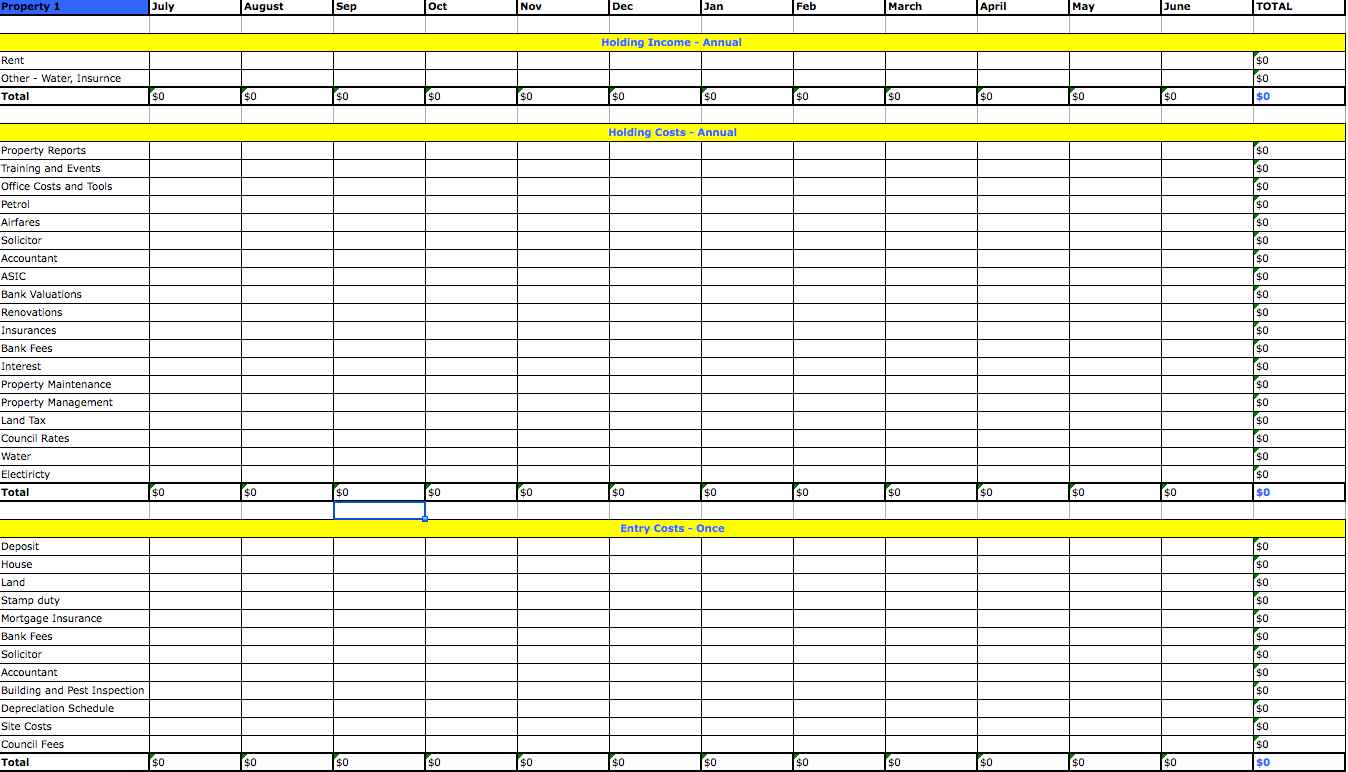

1. Finances

Of course, an estate inventory will include the financial assets of the decedent. So it will be the executor’s job to locate all bank accounts and safety deposit boxes that he owned. A death certificate can help him prove to a bank that the decedent has truly passed away. Only then will they give him the complete information regarding the amount held by the account. You may also like food inventory examples.

The executor must also keep track of all the cash that the decedent has left, and all the money that he is expecting to receive, such as last paychecks. The financial information will also not be complete without a thorough list of debts, such as credit card bills, student loans, child support, medical bills, and taxes.

2. Real Estate

If the deceased owns a house or other real estate properties, it is vital that the executor locate the deed to the properties at once. He must also determine the total value of the property by conducting a formal appraisal, or referring to the most recent assessment of the property’s taxes. Mortgage on the property and property tax information must also be made known to the executor. You may also check out inventory list examples.

3. Vehicles

A lot of people invest in vehicles rather than on real estate properties. This is why executors must also take a look into the vehicular assets of the decedent. Boats, recreational vehicles, and luxury cars must be appraised for their value. The executor must also find out any existing loans and the amount owed for the vehicles. You might be interested in process inventory examples.

4. Personal Property

Some people spend their lives collecting expensive objects instead of investing in vehicles and real estate, which is why the executor must also assess the decedent’s personal properties, or those that are directly displayed within his house, for monetary worth. This may include jewelry, furniture, artwork, and clothing.

It would be best for the executor to take a photo or a video of the decedent’s personal properties to avoid any complications in the future. After that, the objects must be appraised for their worth using fair market value, or what consumers are willing to buy for the commodity. However, for antiques, fine jewelry, and collectibles, the executor must seek the help of an expert in determining the property’s true value. You may also see store inventory examples.

5. Excluded Assets

There are also properties that an executor must not take into the equation. These are usually anything that is held jointly by the decedent and another outside party, such as joint bank accounts and real estate held jointly. Life insurance and retirement plans with named inventories can’t be calculated, as well as properties held in trust. You may also like blank inventory examples.

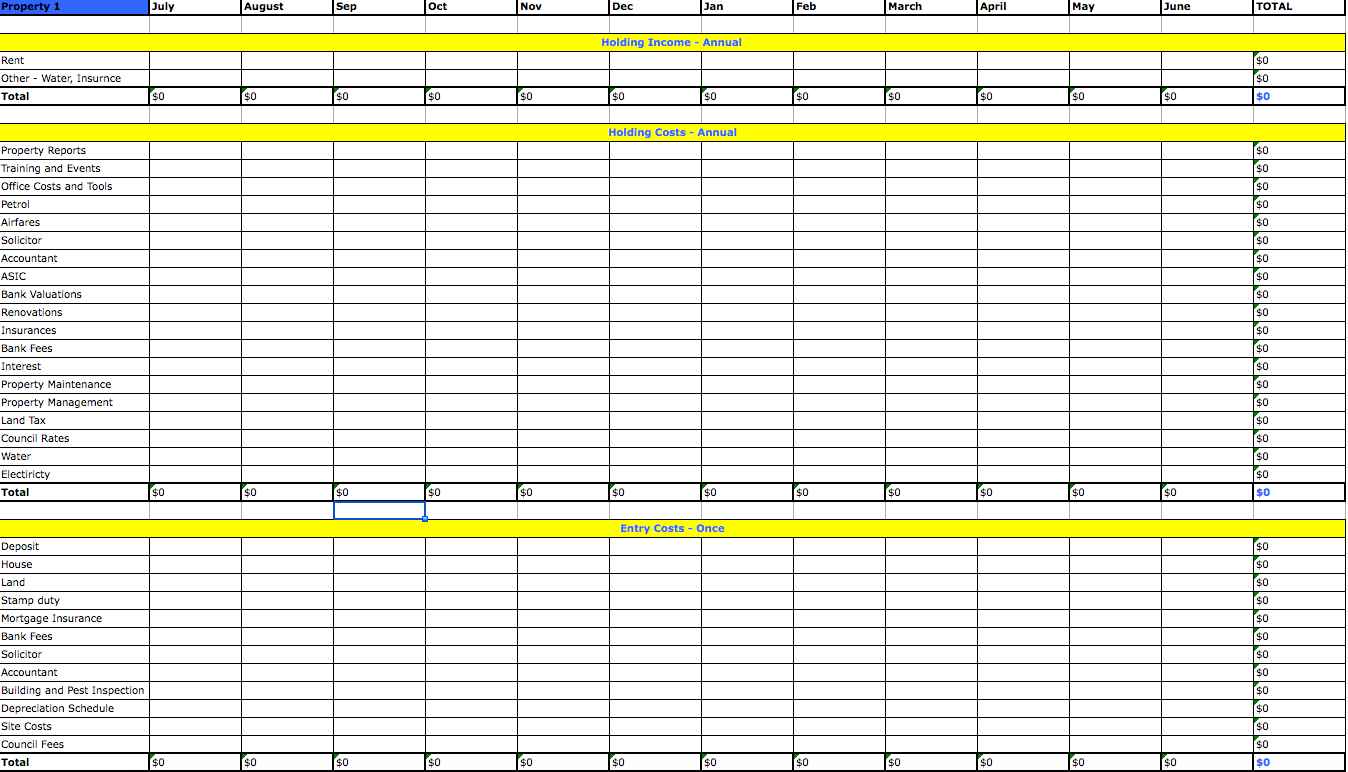

Estate Inventory in Spreadsheet Template

Estate Inventory Need-to-Knows

1. The personal representative, as you already know, is tasked with preparing the simple inventory and providing service to all tentative beneficiaries and any other interested persons. He must also provide a copy of the document within 91 days after the personal representative’s first appointment.

2. The properties involved in the case must be listed in detail along with its estimated market value as of the day of the decedent’s death, along with any type or amount of lien.

3. The personal representative may seek the help of professional appraisers. Their names, addresses, and the items that they have appraised must be listed in the inventory.

4. The personal representative is required to submit to the court enough information for them to compute the inventory fee owed to them within 91 days of the representative’s appointment. The fee must be paid before the estate and the case are closed, or within a year after the initial appointment, whichever is earlier. You may also see skills inventory examples.

5. If the decedent has a property whose market value cannot be determined at that time, it should be listed on the inventory as unknown. However, when the value is determined, the document must be amended to include the price of the said property. The same thing will be done if a property is discovered after the inventory is filed. It has to be amended and distributed to the people involved. You may also like property inventory examples.

6. Valuable personal properties (such as those discussed) must be listed separately. They can’t simply be calculated along with the other objects owned by the decedent. For example, your inventory will include an entry on household goods and their price of $5,000. If there is one object that stands out, such as an antique desk or an expensive set of china, it should be considered a separate entity. You may also check out moving inventory examples.

7. It is important that the appraisers are disinterested parties that will not benefit from the transaction to avoid subjectivity or unnecessary competition in handling the case.

8. If one of the interested parties involved questions or disagrees with any of the contents of the inventory, he may file a formal proceeding with the court to express his intention to challenge any aspect of the document.

Estate Planning Inventory Spreadsheet

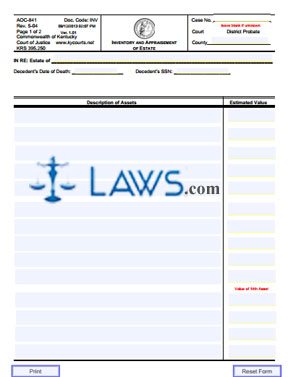

Example of Estate Inventory

What Are the Contents of an Estate Inventory?

An estate inventory will include all of the updated information about the assets and liabilities that a decedent had on the day of his death.

For cases where the deceased was married and a division of properties need to be conducted, the assets and liabilities of the spouse will also be recorded in the estate inventory. If the spouse has also passed away, an estate inventory for his assets and liabilities will also be prepared along with that of his spouse. You may also see data inventory examples.

An estate inventory meeting will have to be conducted to be able to establish the co-owners of any of the decedent’s properties, which is important to settle the assets owned by both parties. Otherwise, the property will not be of any use since the surviving co-owner can’t sell it or claim it as their own since there will be legal consequences. To avoid such complication, the wisest move is to work with the decedent’s executor to reach a simple agreement.

Estate Planning Inventory Questionnaire

Inventory and Appraisement of Estate

An executor is given at least three months to prepare and finalize the decedent’s estate inventory.

After that, there will be an allowance of three months for him to submit the document to a court. Since legal attorneys are not required to file the document, anyone who cares enough about the decedent to go through so much hassle can do the job. But for every stage of the process, it is always suggested to seek professional and expert health. You may also see classroom inventory examples.