36+ Expense Report Examples to Download

It can be easy to lose track of money. On any given day, we spend on various things whether it is important or not. As individuals or as groups, we need something to help us keep a record of our various expenses. Having said that, an expense report is just what anybody will need for that exact purpose. If you’ve never encountered this before, then you’re in luck. Read on to learn about this useful document and to choose the best expense report template from our extensive list.

Expense Report Form Example

Travel Expense Report Template

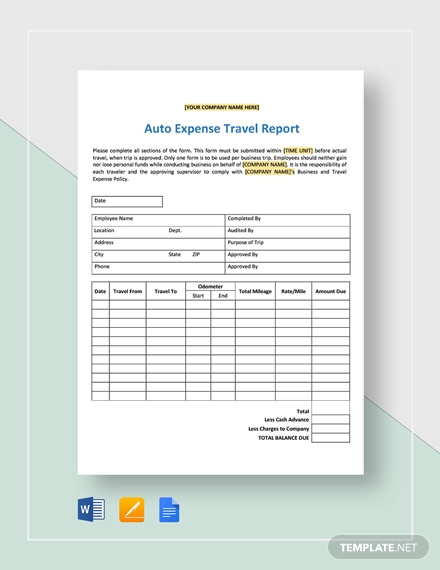

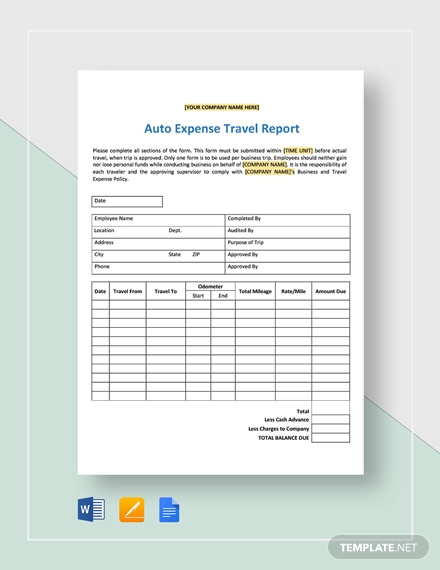

Auto Expense Travel Report Template

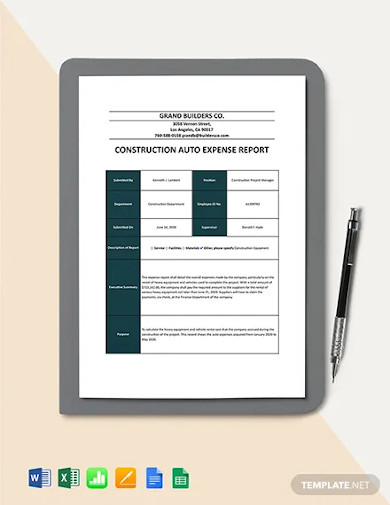

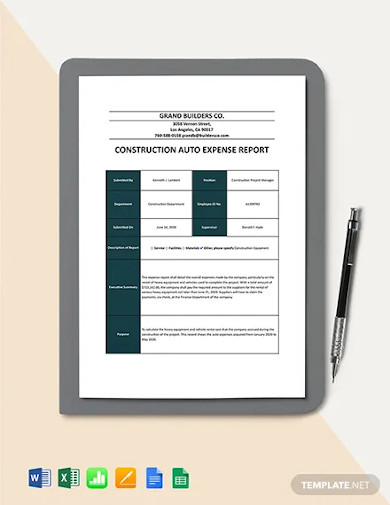

Construction Auto Expense Report Template

Monthly Expense Report Template

Trip Expense Report Template

Employee Expense Report Template

Business Expense Report Template

Simple Expense Report Template

Monthly Expense Report Template

Travel Expense Report Template

Business Expense Report Template

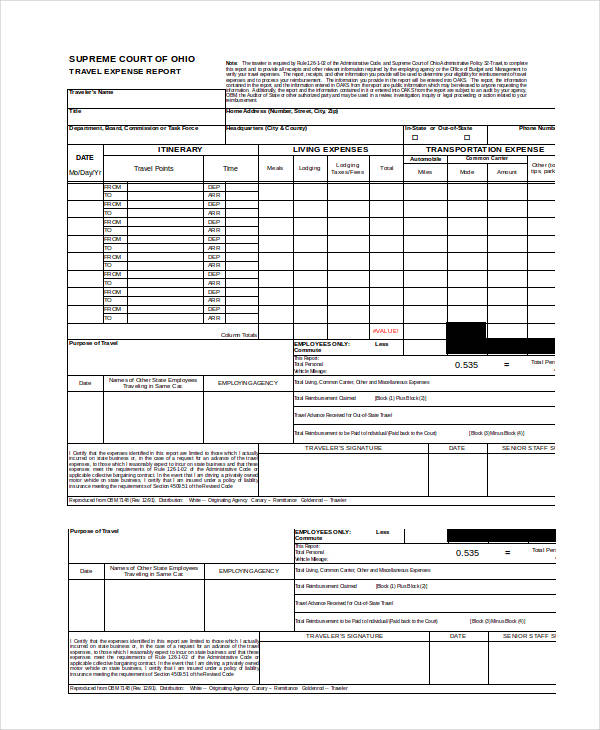

Travel Expense Report

Travel Expense Audit

Business Expense Report Example

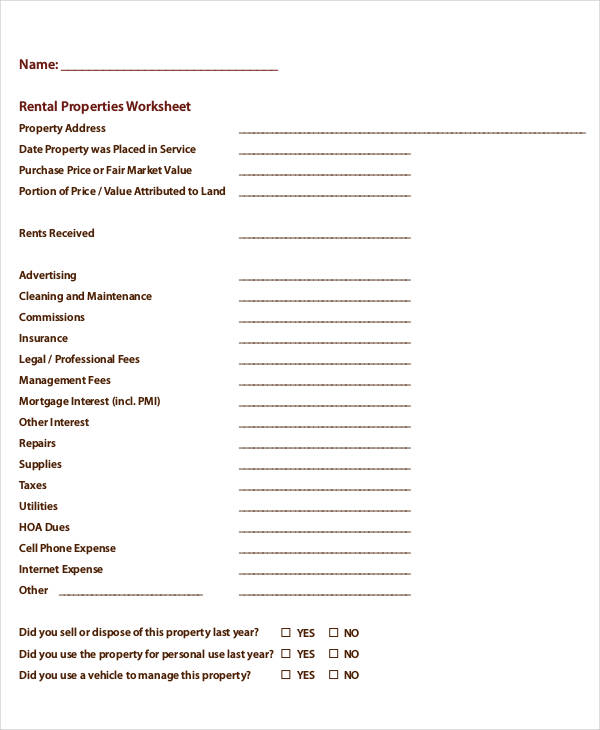

Small Business Report

Business Travel Expense Report

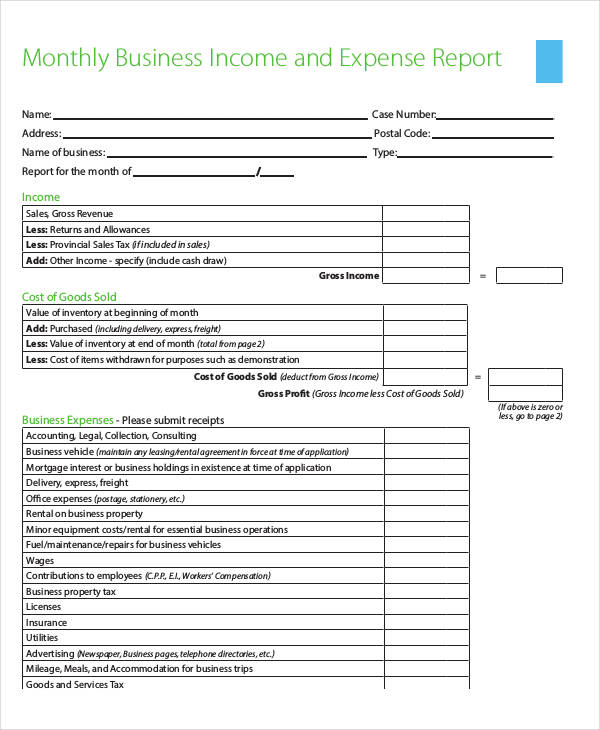

Monthly Business Income and Expense

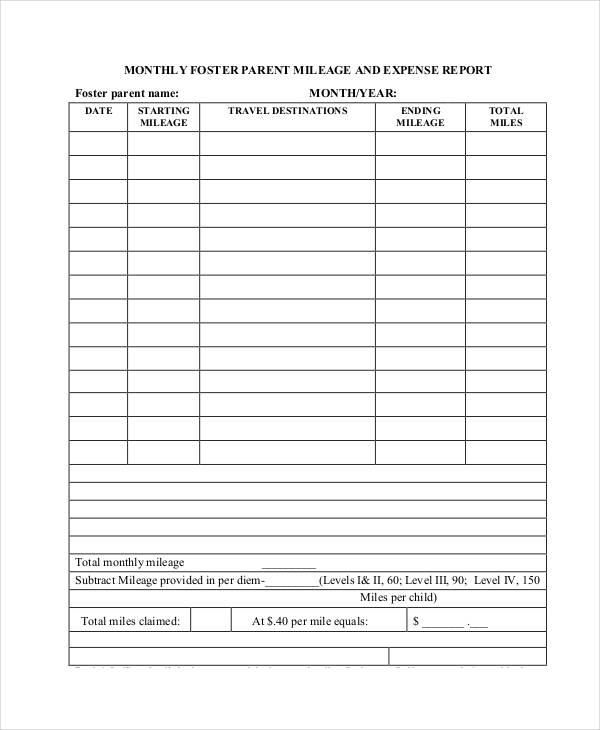

Mileage Expense Report

Monthly Foster Parent Mileage

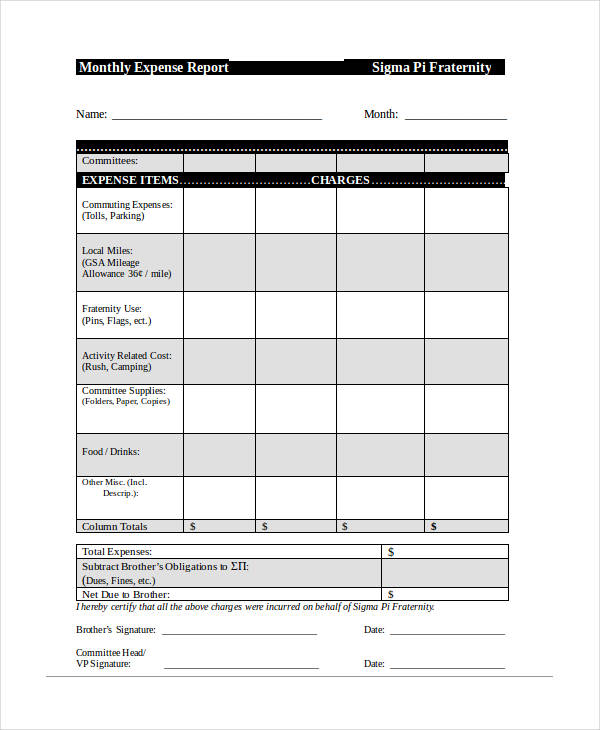

Monthly Expense Reports

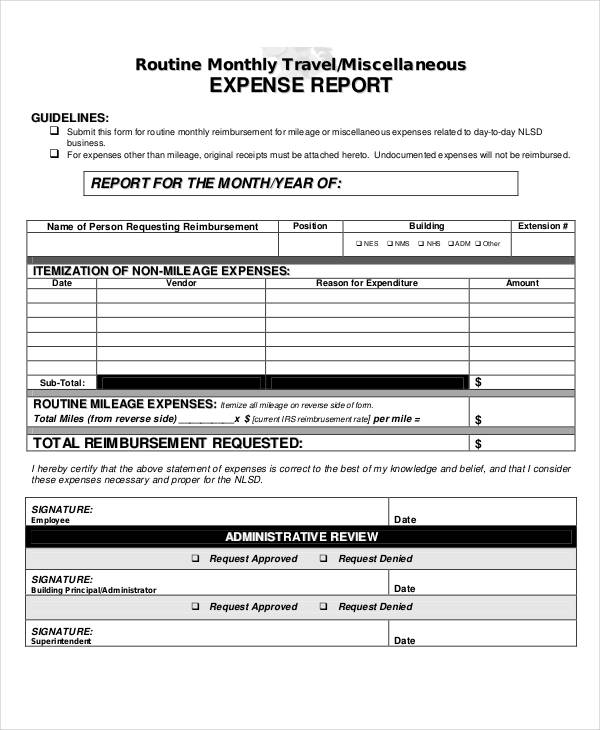

Routine/Monthly Travel Expense Report

Printable Monthly Expense Report

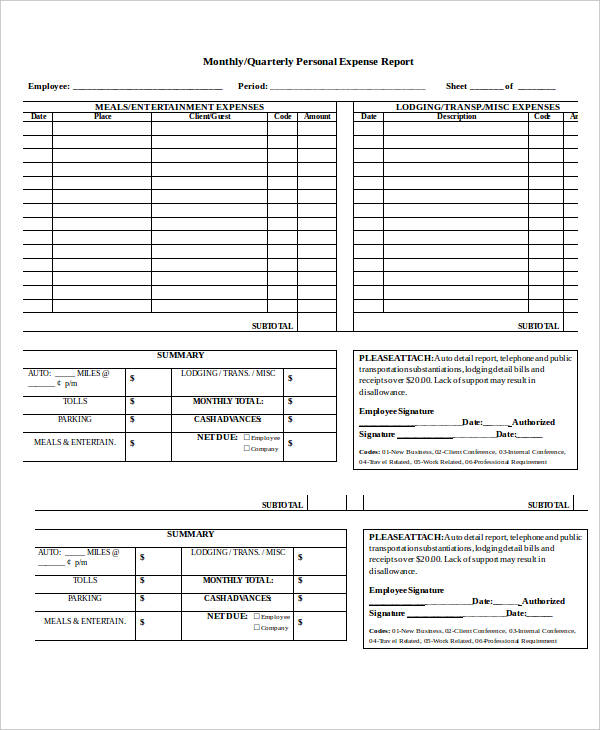

Personal Expense Report Samples

Monthly/Quarterly Personal Expense Report

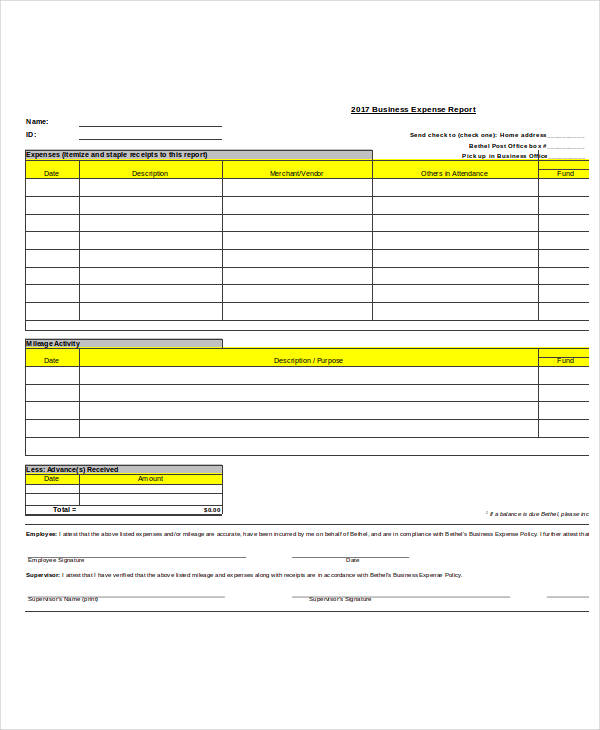

Personal Business Expense

Annual Expense Reports

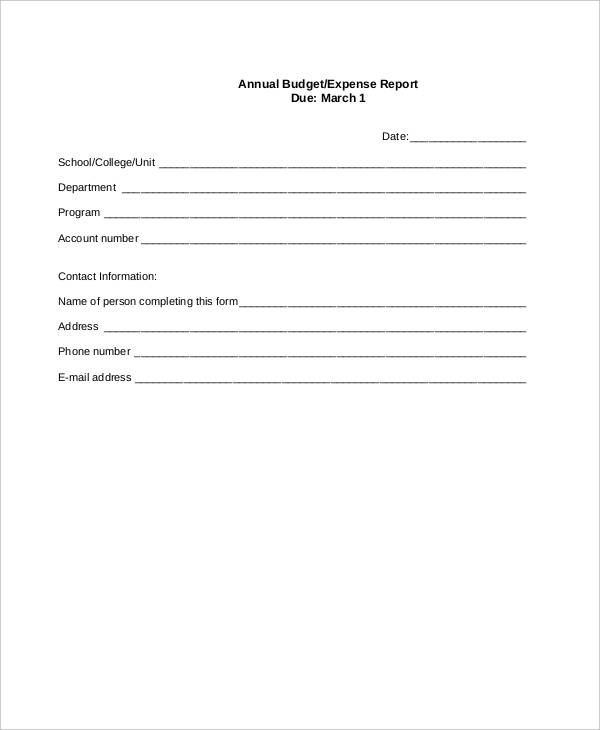

Annual Budget Report

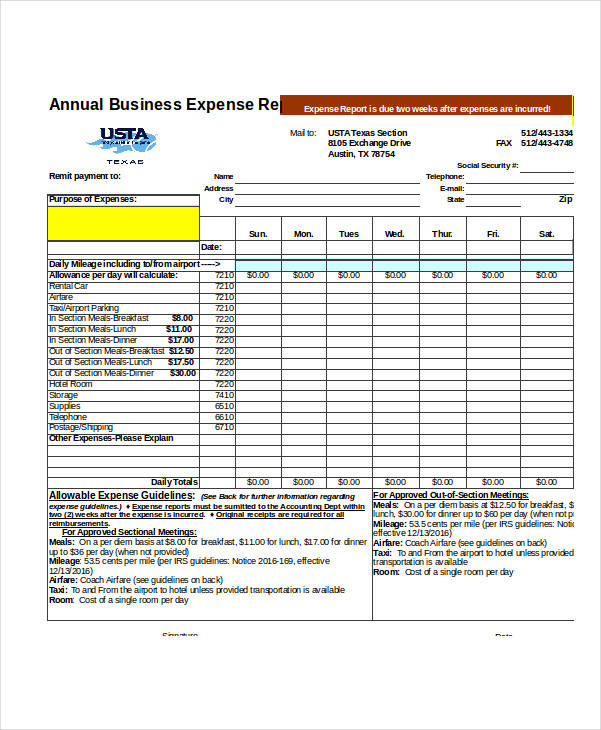

Annual Business Expense Report

Event Expense Reports

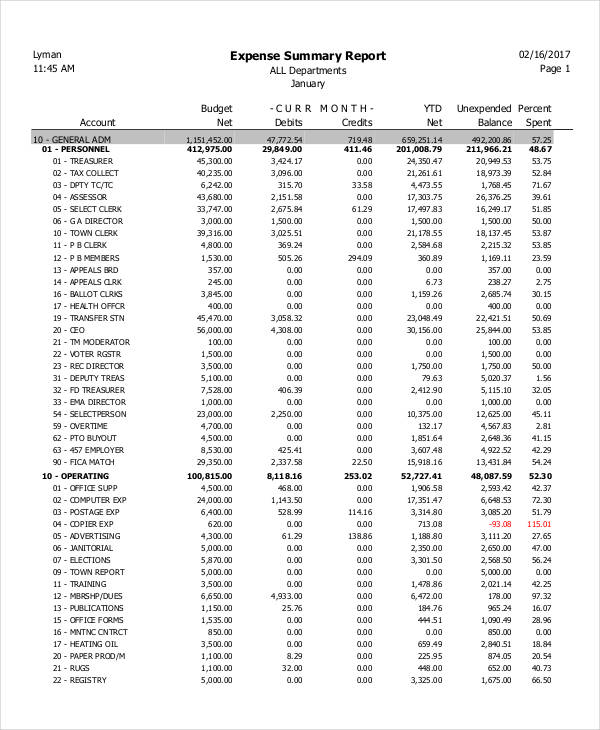

Expense Summary Report Example

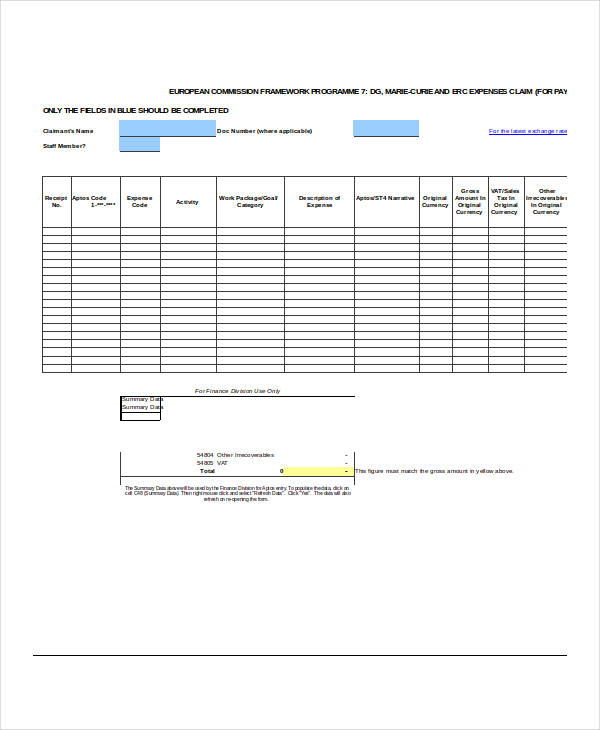

Expense Claim Summary

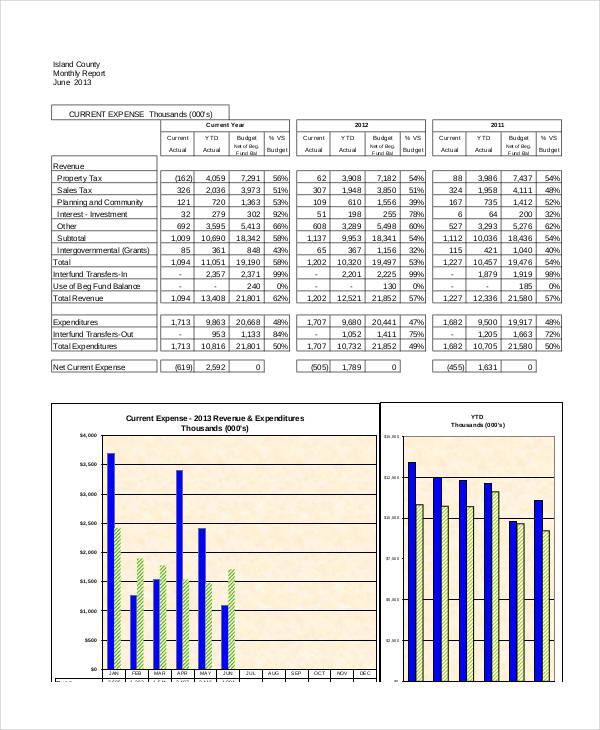

Monthly Report

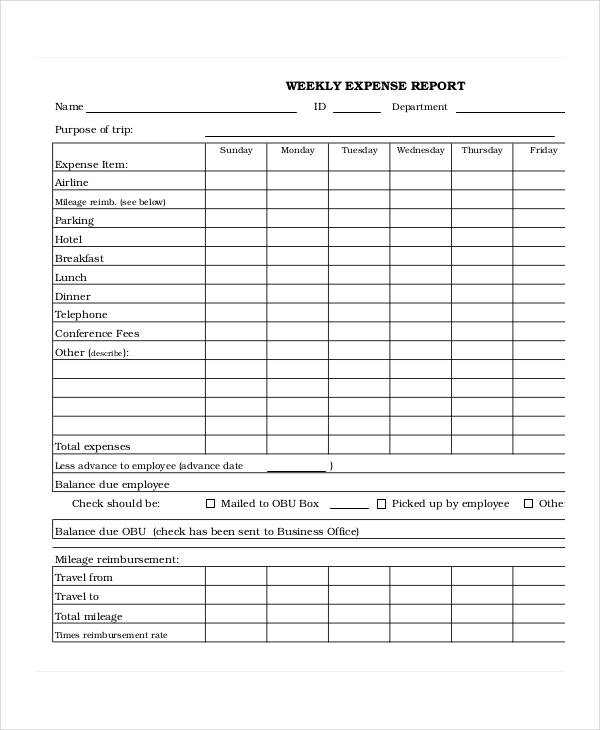

Weekly Expense Reports

Printable Weekly Expense Report

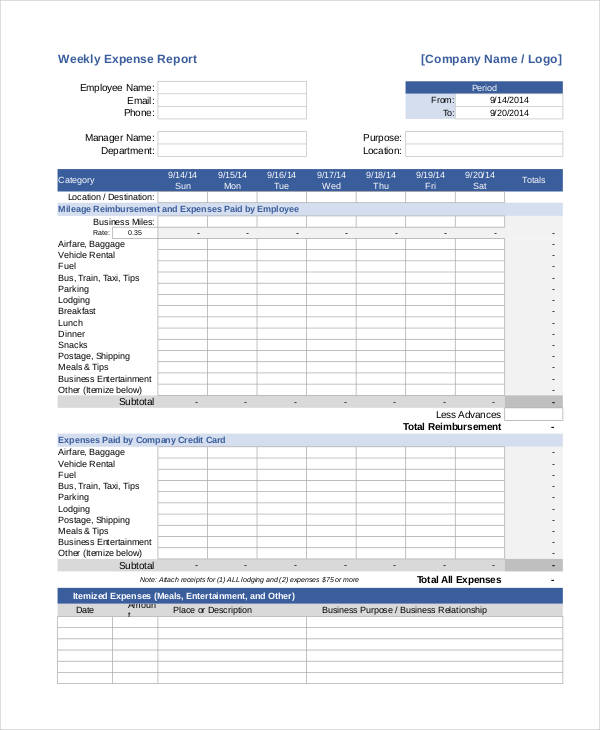

Sample Weekly Expense Report

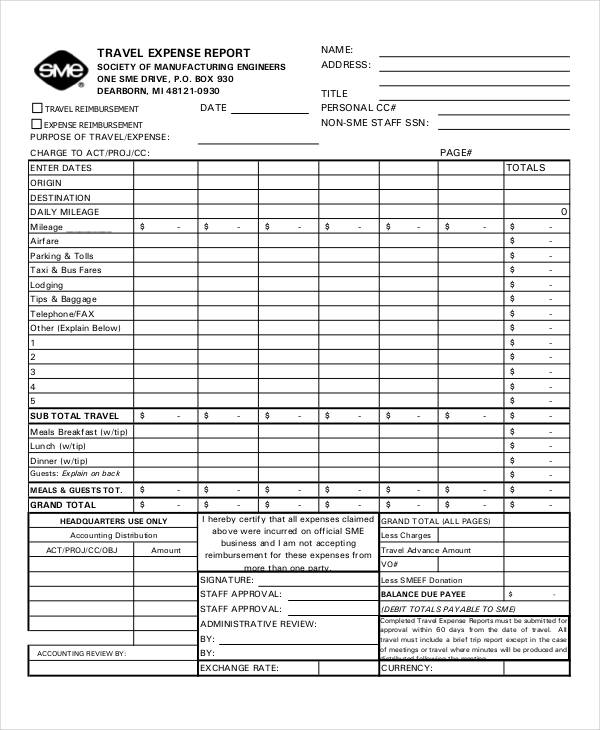

Generic Expense Report

Generic Travel Expense

Employee Expense Report Samples

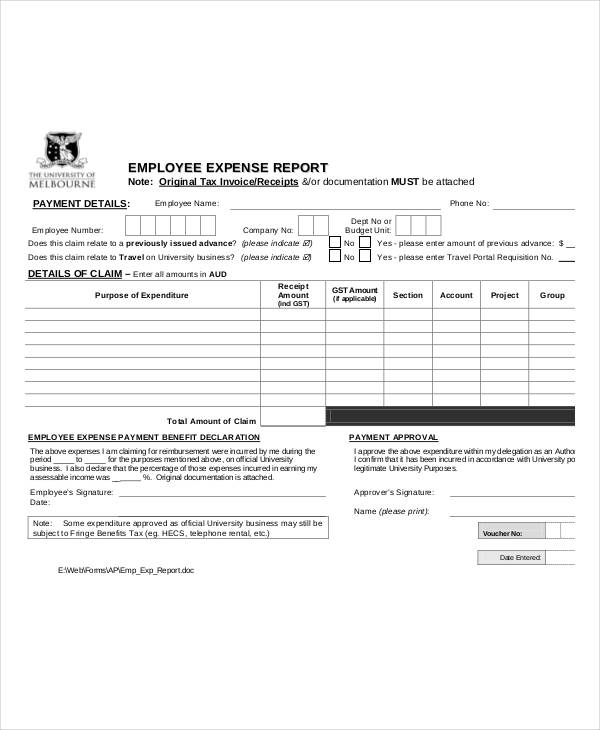

Free Employee Expense

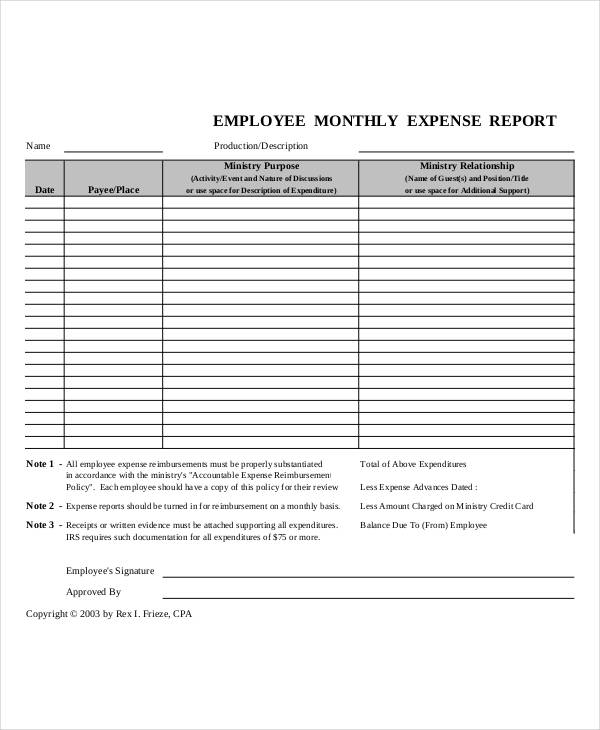

Employee Monthly Expense

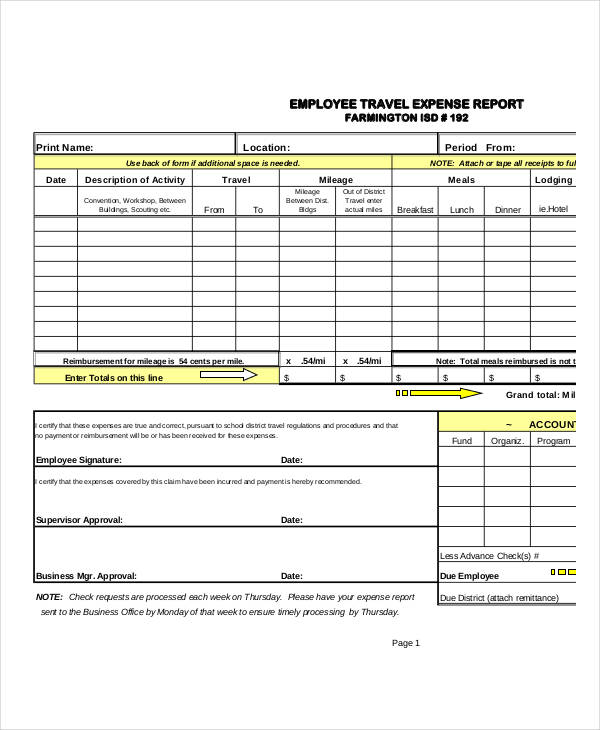

Employee Travel Expense Example

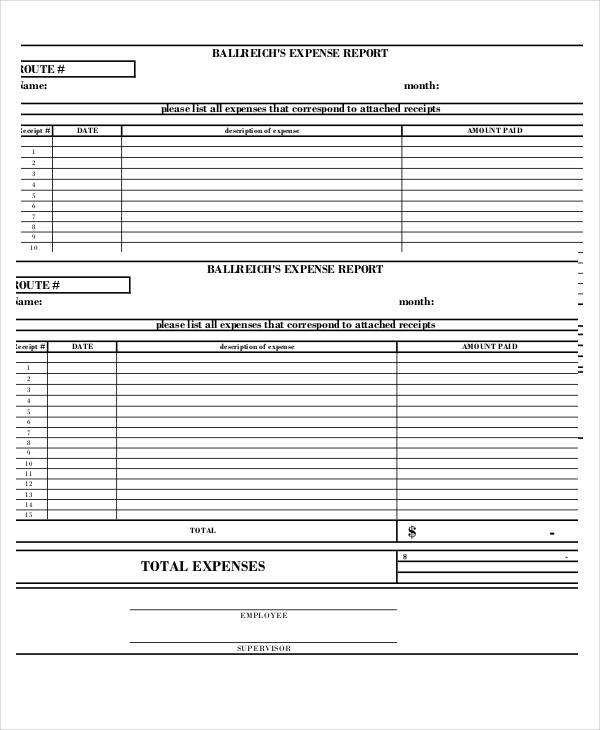

Sales Expense Report

Monthly Sales Expense Report

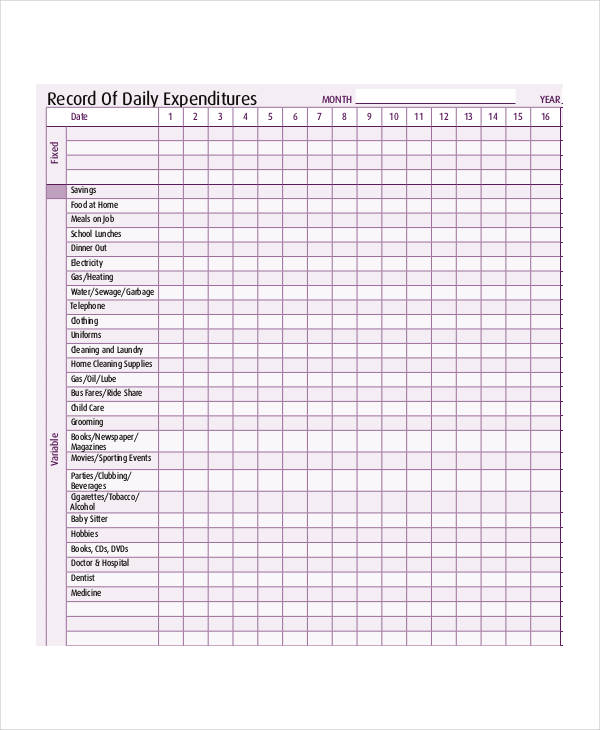

Daily Expense Report Examples

Record of Daily Expenditure

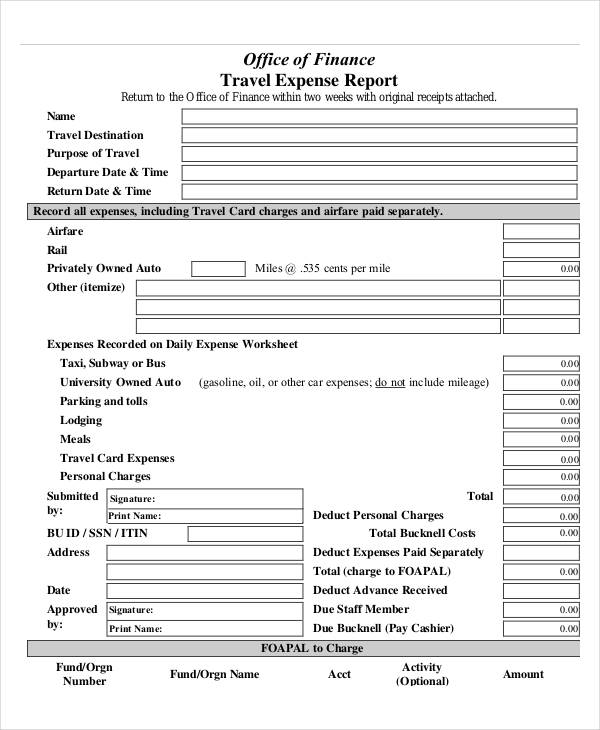

Office of Finance

Project Expense Report

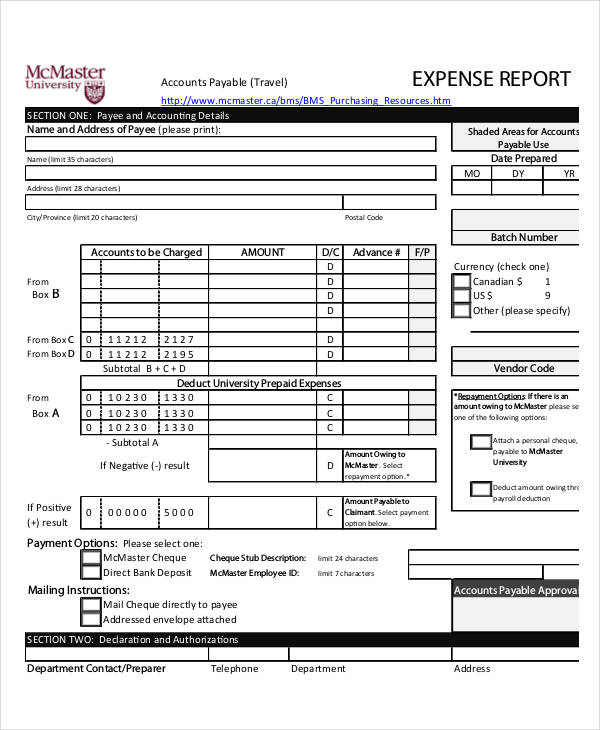

Standard Expense Report

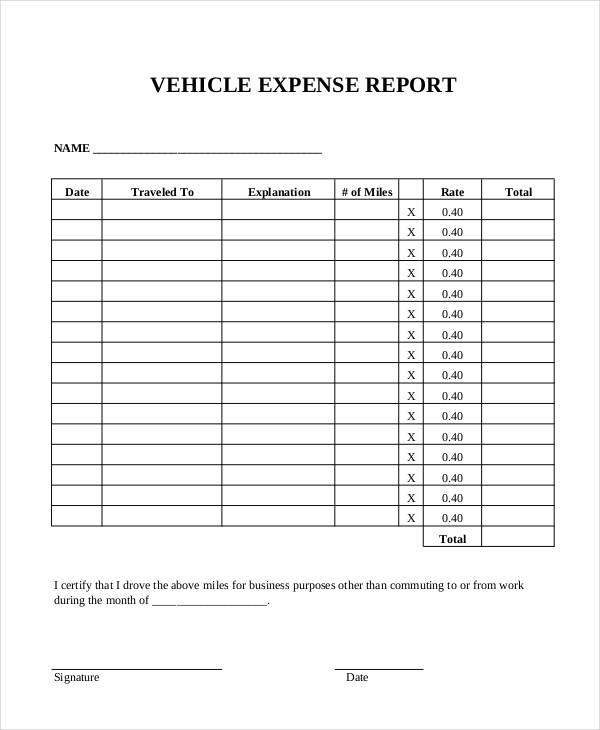

Vehicle Expense Report Sample

What Is an Expense Report?

An expense report, by its own simple definition, is a professional business report that details an individual’s exact expenses for documentation purposes. These tend to come from corporations that are spending on behalf of their employees. With an expense report, one can easily learn about where your employee has been, what he or she has spent on, and how much. There are multiple variants of these reports, with each serving its own unique purpose. A monthly expense report, for example, keeps track of all expenses within a given month. Then there’s the travel expense report, which helps document everything that’s been spent by an individual on any given business trip. There’s also the employee expense report, which is centered on a specific individual and his or her expenses.

How to Create Your Own Expense Report

Although you can easily download a printable expense report template, there’s nothing quite like learning how to make your own management report from scratch. Whether you decide to utilize an expense report software or write it up with more common programs, the following steps should prove to be of great use to you regardless:

Step 1: Start with Company or Personal Details

Before you begin with the nitty, gritty details, you must first enter your company’s details. This is usually found at the top of the document. Write down your company’s name, perhaps include the company logo, and insert the date and name of the person whose expenses you are tracking.

Step 2: Work on the Necessary Columns

There are multiple columns that need to show up on the expense report. Each column plays its own contributing role, so be sure to have the following: date of the items or service bought, the vendor, the client, the project, the account, the amount, and notes. You may want to include extra columns, although that will depend on the type of expense account you are working on.

Step 3: Insert the Itemized Expenses

This is where you need to get really specific with your details. Having already written the columns, now comes the part where you must list down the actual purchase order in chronological order. Remember not to skip out on things like the quantity of the items bought or the exact place where it was purchased from.

Step 4: Attach any Existing or Necessary Receipts

To complete the creation and use of your expense reports, it helps if you can somehow attach the receipts to it. This may or may not be necessary, depending on your company policy. Regardless, doing so will help with the documentation aspect of the reports at least.

FAQs

Why are expense reports needed?

Expense reports are useful in managing and keeping track of a company’s financial report status. By keeping track of all the expenses made by the employees for the company, the head of the company will be able to know if the company’s finances are being spent accordingly.

How does an expense report differ from an invoice?

The former serves as a form of employee report to serve as a tracker of expenses and as a determinant for any reimbursement. On the other hand, an invoice or a sales invoice in an instrument which, in most cases, demands payment from the buyer.

How can you better manage your expense reports?

There are a few ways for you to better manage your expense reports, with some examples being: setting clear policies on reports, providing clear training on the creation process, and auditing your expenses regularly.

Are you going to download a simple expense report template from our list, or is writing up your own sample expense report more appealing to you? Now that you’ve read our article from start to finish, that question should be much easier to answer. Take all of your newly acquired knowledge and be sure to put it to good use. Act now and you’ll be that much closer to keeping better track of your finances from here on out.

36+ Expense Report Examples to Download

It can be easy to lose track of money. On any given day, we spend on various things whether it is important or not. As individuals or as groups, we need something to help us keep a record of our various expenses. Having said that, an expense report is just what anybody will need for that exact purpose. If you’ve never encountered this before, then you’re in luck. Read on to learn about this useful document and to choose the best expense report template from our extensive list.

Expense Report Form Example

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Travel Expense Report Template

Details

File Format

Google Docs

MS Word

Apple Pages

Size: A4, US

Auto Expense Travel Report Template

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Construction Auto Expense Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

Monthly Expense Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

Trip Expense Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

Employee Expense Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

Business Expense Report Template

Details

File Format

MS Word

Pages

Google Docs

Size: A4, US

Simple Expense Report Template

Details

File Format

MS Word

Apple Pages

Size: A4, US

Monthly Expense Report Template

Details

File Format

MS Word

Pages

Size: A4, US

Travel Expense Report Template

Details

File Format

MS Word

Pages

Size: A4, US

Business Expense Report Template

Details

File Format

MS Word

Pages

Size: A4, US

Travel Expense Report

Travel Expense Audit

supremecourt.ohio.gov

Details

File Format

XLS

XLSx

Size: 16 kB

Business Expense Report Example

Small Business Report

watsoncpagroup.com

Details

File Format

PDF

Size: 537 kB

Business Travel Expense Report

Monthly Business Income and Expense

publications.gov.sk.ca

Details

File Format

PDF

Size: 75 kB

Mileage Expense Report

Monthly Foster Parent Mileage

marionkids.com

Details

File Format

PDF

Size: 63 kB

Monthly Expense Reports

Routine/Monthly Travel Expense Report

northwest.k12.oh.us

Details

File Format

PDF

Size: 33 kB

Printable Monthly Expense Report

orgs.salisbury.edu

Details

File Format

Doc

Docx

Size: 8 kB

Personal Expense Report Samples

Monthly/Quarterly Personal Expense Report

macoassociates.com

Details

File Format

Doc

Docx

Size: 10 kB

Personal Business Expense

bethel.edu

Details

File Format

XLS

XLSx

Size: 206 kB

Annual Expense Reports

Annual Budget Report

curriculumsystems.uga.edu

Details

File Format

PDF

Size: 7 kB

Annual Business Expense Report

amazonaws.com

Details

File Format

XLS

XLSx

Size: 167 kB

Event Expense Reports

Expense Summary Report Example

lyman-me.gov

Details

File Format

PDF

Size: 52 kB

Expense Claim Summary

lse.ac.uk

Details

File Format

XLS

XLSx

Size: 149 kB

Monthly Report

islandcountywa.gov

Details

File Format

PDF

Size: 93 kB

Weekly Expense Reports

Printable Weekly Expense Report

home.obu.edu

Details

File Format

PDF

Size: 5 kB

Sample Weekly Expense Report

yummydocs.com

Details

File Format

PDF

Size: 53 kB

Generic Expense Report

Generic Travel Expense

smechapter5.org

Details

File Format

PDF

Size: 280 kB

Employee Expense Report Samples

Free Employee Expense

medrmhwh.unimelb.edu.au

Details

File Format

PDF

Size: 41 kB

Employee Monthly Expense

friezeconsulting.com

Details

File Format

PDF

Size: 4 kB

Employee Travel Expense Example

farmington.k12.mn.us

Details

File Format

PDF

Size: 37 kB

Sales Expense Report

Monthly Sales Expense Report

ballreichsalesreps.com

Details

File Format

PDF

Size: 19 kB

Daily Expense Report Examples

Record of Daily Expenditure

fairchildfamilysupport.org

Details

File Format

PDF

Size: 246 kB

Office of Finance

bucknell.edu

Details

File Format

PDF

Size: 136 kB

Project Expense Report

fire-international.org

Details

File Format

PDF

Size: 6 kB

Standard Expense Report

bimr.ca

Details

File Format

PDF

Size: 306 kB

Vehicle Expense Report Sample

cectheatres.com

Details

File Format

PDF

Size: 3 kB

What Is an Expense Report?

An expense report, by its own simple definition, is a professional business report that details an individual’s exact expenses for documentation purposes. These tend to come from corporations that are spending on behalf of their employees. With an expense report, one can easily learn about where your employee has been, what he or she has spent on, and how much. There are multiple variants of these reports, with each serving its own unique purpose. A monthly expense report, for example, keeps track of all expenses within a given month. Then there’s the travel expense report, which helps document everything that’s been spent by an individual on any given business trip. There’s also the employee expense report, which is centered on a specific individual and his or her expenses.

How to Create Your Own Expense Report

Although you can easily download a printable expense report template, there’s nothing quite like learning how to make your own management report from scratch. Whether you decide to utilize an expense report software or write it up with more common programs, the following steps should prove to be of great use to you regardless:

Step 1: Start with Company or Personal Details

Before you begin with the nitty, gritty details, you must first enter your company’s details. This is usually found at the top of the document. Write down your company’s name, perhaps include the company logo, and insert the date and name of the person whose expenses you are tracking.

Step 2: Work on the Necessary Columns

There are multiple columns that need to show up on the expense report. Each column plays its own contributing role, so be sure to have the following: date of the items or service bought, the vendor, the client, the project, the account, the amount, and notes. You may want to include extra columns, although that will depend on the type of expense account you are working on.

Step 3: Insert the Itemized Expenses

This is where you need to get really specific with your details. Having already written the columns, now comes the part where you must list down the actual purchase order in chronological order. Remember not to skip out on things like the quantity of the items bought or the exact place where it was purchased from.

Step 4: Attach any Existing or Necessary Receipts

To complete the creation and use of your expense reports, it helps if you can somehow attach the receipts to it. This may or may not be necessary, depending on your company policy. Regardless, doing so will help with the documentation aspect of the reports at least.

FAQs

Why are expense reports needed?

Expense reports are useful in managing and keeping track of a company’s financial report status. By keeping track of all the expenses made by the employees for the company, the head of the company will be able to know if the company’s finances are being spent accordingly.

How does an expense report differ from an invoice?

The former serves as a form of employee report to serve as a tracker of expenses and as a determinant for any reimbursement. On the other hand, an invoice or a sales invoice in an instrument which, in most cases, demands payment from the buyer.

How can you better manage your expense reports?

There are a few ways for you to better manage your expense reports, with some examples being: setting clear policies on reports, providing clear training on the creation process, and auditing your expenses regularly.

Are you going to download a simple expense report template from our list, or is writing up your own sample expense report more appealing to you? Now that you’ve read our article from start to finish, that question should be much easier to answer. Take all of your newly acquired knowledge and be sure to put it to good use. Act now and you’ll be that much closer to keeping better track of your finances from here on out.