10+ Fibonacci Retracement Examples to Download

Derived from the facts and ideas of ancient days, Fibonacci helps in technical analysis by dividing the two extreme ends in the chart. In business Fibonacci retracement is a method used for determining support and resistance levels. This method is inspired by the idea that a predictable portion of a move will be retracted by the market and it will continue to move in the trending direction.

What is the History of Fibonacci?

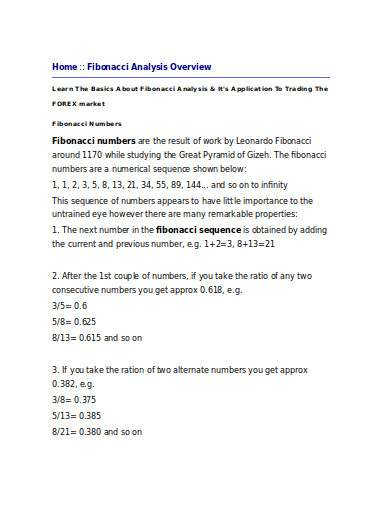

Fibonacci retracement is deeply connected with the Fibonacci series that is named after an Italian mathematician who discovered the Fibonacci numbers. This series is a sequence that starts with zero and is arranged in the order of the sum of the previous numbers. The series follows as 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89… infinity. This discovery in numbers was made by Leonardo Pisano Bogollo was mostly known as Fibonacci from Pisa, in the 12th century. He was an Italian mathematician expert.

every number is the sum of the previous numbers. Like

1+1=2

1+2=3

2+3=5

Another fact of this series is that after dividing any number by any previous number in the series the ratio always results as 1.618. Like

34/21= 1.618

55/34= 1.618

10+ Fibonacci Retracement Examples

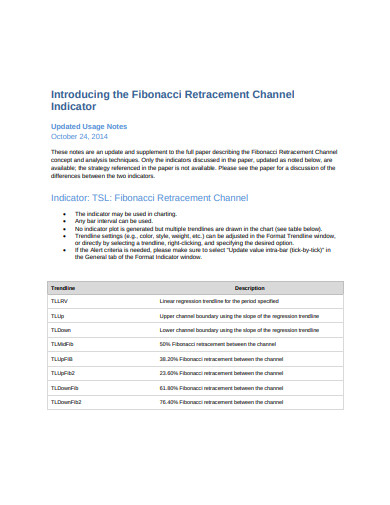

1. Fibonacci Retracement Channel Indicator

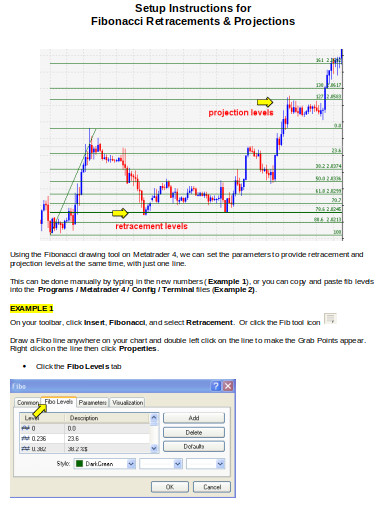

[/ns_row]Fibonacci is well communicated if you look into its context deeply reading all its history and the current functionality. The process is a very important tool for technical analysts who analyze the data and decides the investment strategy for any trade. The mentioned template is a well-documented source that would help you to get ideas on the Fibonacci retracement channel indicator. It can help you to design the Fibonacci retracement strategy. So, have a look at it now!

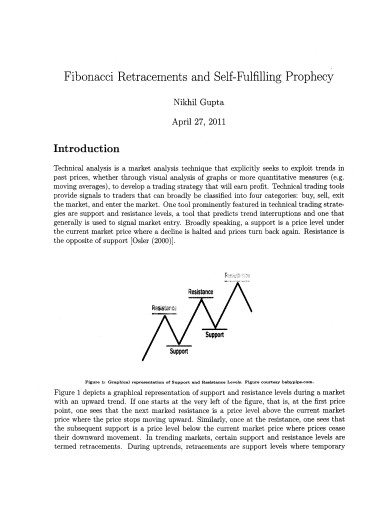

2. Fibonacci Retracements and Self Fulfilling Prophecy

Does Fibonacci sound new to you? Do you want to know how to use Fibonacci retracement? Then this template might be useful to you. Framed with descriptions on the way Fibonacci should be used and the way it needs to be processed it will help you with all your queries. So have a look at this template today and get to learn about one of the most used trading tools.

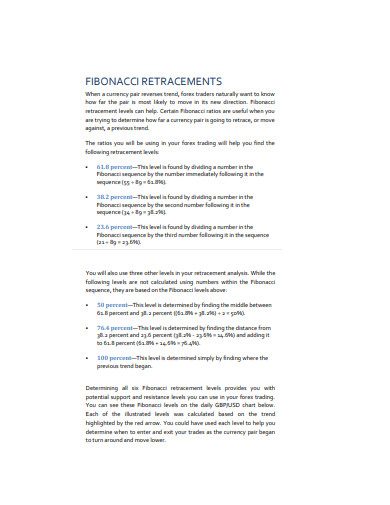

3. Fibonacci Retracement Example

Fibonacci retracement is a trading process in which the support and resistance levels fluctuate and moves to certain directions. If this sounds complicated to you the given sample of the template on the same subject can help you. Framed with detailed description on the Fibonacci retracement levels it would give you the ideas on the series and sequance of the levels. So, try the template today!

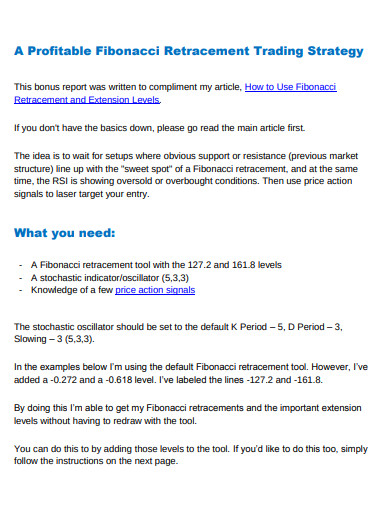

4. Profitable Fibonacci Retracement Trading Strategy

Almost every step and venture in business and trading needs to be strategized before acting upon them for their level of complexities. The Fibonacci retracement process in business is itself a complex process and strategizing it is even more tough. Thus we suggest you should choose this template on a Fibonacci retracement trading strategy that is framed with precise description and clear specifications. So, refer to it today and simplify your work.

5. Forex Market Fibonacci Retracement

Fibonacci retracements can help to analyze and predict different markets. Like the mentioned template has explained how it can help to make a prediction of the Forex market. You can refer to this template that has formulated a clear description of the ways of analyzing and highlighting the levels. You can also check out our descriptions on the Fibonacci retracement formula which might be helpful to you. So check the template out today!

6. Stock Market Fibonacci Retracement

The Fibonacci retracement process is a good tool to predict and analyze different market conditions and trending directions. The Fibonacci retracement tools are useful in defining such data. You can refer to the example mentioned here to shape your analysis as the document is prepared highlighting and to define its several aspects. So have a look at it today!

7. Fibonacci Strategy Example

8. Market Fibonacci Retracement

9. Predictive Investor Fibonacci Retracements

10. Startup Fibonacci Retracements

11. Fibonacci Retracement Analysis Example

What Predicting Stock Prices in Fibonacci Retracement?

Fibonacci ratios play an important role in the stock market, they are used by the traders to determine and manage the critical points that can cause a reversal in the price of the assets. The relative simplicity and partial applicability in any trading instrument make this one of the widely used Fibonacci trading tools. It is used to confirm the support and resistance level, to place stop-loss orders. It even helps to target the prices and works as a mechanism in strategizing the counter trend trading.

The chart of Fibonacci follows horizontal lines to clearly communicate where the possible support and resistance levels are at different times and dates. The Fibonacci series comes into play here in arranging the levels. Each level is associated and connected with the previous ratios or percentages. It is there to indicate that what percentage or ratio of the prior move the price has retraced. If the asset price is retraced to the listed ratios the prior direction of the trend is predicted to continue in the same direction.

10+ Fibonacci Retracement Examples to Download

Derived from the facts and ideas of ancient days, Fibonacci helps in technical analysis by dividing the two extreme ends in the chart. In business Fibonacci retracement is a method used for determining support and resistance levels. This method is inspired by the idea that a predictable portion of a move will be retracted by the market and it will continue to move in the trending direction.

What is the History of Fibonacci?

Fibonacci retracement is deeply connected with the Fibonacci series that is named after an Italian mathematician who discovered the Fibonacci numbers. This series is a sequence that starts with zero and is arranged in the order of the sum of the previous numbers. The series follows as 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89… infinity. This discovery in numbers was made by Leonardo Pisano Bogollo was mostly known as Fibonacci from Pisa, in the 12th century. He was an Italian mathematician expert.

every number is the sum of the previous numbers. Like

1+1=2

1+2=3

2+3=5

Another fact of this series is that after dividing any number by any previous number in the series the ratio always results as 1.618. Like

34/21= 1.618

55/34= 1.618

10+ Fibonacci Retracement Examples

1. Fibonacci Retracement Channel Indicator

tradestation.tradingappstore.com

Details

File Format

PDF

Size: 126 KB

[/ns_row]

Fibonacci is well communicated if you look into its context deeply reading all its history and the current functionality. The process is a very important tool for technical analysts who analyze the data and decides the investment strategy for any trade. The mentioned template is a well-documented source that would help you to get ideas on the Fibonacci retracement channel indicator. It can help you to design the Fibonacci retracement strategy. So, have a look at it now!

2. Fibonacci Retracements and Self Fulfilling Prophecy

digitalcommons.macalester.edu

Details

File Format

PDF

Size: 1 MB

Does Fibonacci sound new to you? Do you want to know how to use Fibonacci retracement? Then this template might be useful to you. Framed with descriptions on the way Fibonacci should be used and the way it needs to be processed it will help you with all your queries. So have a look at this template today and get to learn about one of the most used trading tools.

3. Fibonacci Retracement Example

cornertrader.ch

Details

File Format

PDF

Size: 750 KB

Fibonacci retracement is a trading process in which the support and resistance levels fluctuate and moves to certain directions. If this sounds complicated to you the given sample of the template on the same subject can help you. Framed with detailed description on the Fibonacci retracement levels it would give you the ideas on the series and sequance of the levels. So, try the template today!

4. Profitable Fibonacci Retracement Trading Strategy

fxdayjob.com

Details

File Format

PDF

Size: 214 KB

Almost every step and venture in business and trading needs to be strategized before acting upon them for their level of complexities. The Fibonacci retracement process in business is itself a complex process and strategizing it is even more tough. Thus we suggest you should choose this template on a Fibonacci retracement trading strategy that is framed with precise description and clear specifications. So, refer to it today and simplify your work.

5. Forex Market Fibonacci Retracement

scientificpapers.org

Details

File Format

PDF

Size: 487 KB

Fibonacci retracements can help to analyze and predict different markets. Like the mentioned template has explained how it can help to make a prediction of the Forex market. You can refer to this template that has formulated a clear description of the ways of analyzing and highlighting the levels. You can also check out our descriptions on the Fibonacci retracement formula which might be helpful to you. So check the template out today!

6. Stock Market Fibonacci Retracement

ijastnet.com

Details

File Format

PDF

Size: 911 KB

The Fibonacci retracement process is a good tool to predict and analyze different market conditions and trending directions. The Fibonacci retracement tools are useful in defining such data. You can refer to the example mentioned here to shape your analysis as the document is prepared highlighting and to define its several aspects. So have a look at it today!

7. Fibonacci Strategy Example

forex-station.com

Details

File Format

PDF

Size: 4 MB

8. Market Fibonacci Retracement

academicjournals.org

Details

File Format

PDF

Size: 102 KB

9. Predictive Investor Fibonacci Retracements

austinpublishinggroup.com

Details

File Format

PDF

Size: 344 KB

10. Startup Fibonacci Retracements

omeomy.com

Details

File Format

DOC

Size: 109 KB

11. Fibonacci Retracement Analysis Example

www.forexfactory.com

Details

File Format

DOC

Size: 4 KB

What Predicting Stock Prices in Fibonacci Retracement?

Fibonacci ratios play an important role in the stock market, they are used by the traders to determine and manage the critical points that can cause a reversal in the price of the assets. The relative simplicity and partial applicability in any trading instrument make this one of the widely used Fibonacci trading tools. It is used to confirm the support and resistance level, to place stop-loss orders. It even helps to target the prices and works as a mechanism in strategizing the counter trend trading.

The chart of Fibonacci follows horizontal lines to clearly communicate where the possible support and resistance levels are at different times and dates. The Fibonacci series comes into play here in arranging the levels. Each level is associated and connected with the previous ratios or percentages. It is there to indicate that what percentage or ratio of the prior move the price has retraced. If the asset price is retraced to the listed ratios the prior direction of the trend is predicted to continue in the same direction.