Finance Essentials for Small Business – Examples, Format, Steps, Pdf

Starting small is an excellent way to learn and grow with the process of going big. In regards to financing a small business, there are endless possibilities for it, such as bank loans, self-funding, credit cards, etc. Each varies from the toughness to acquire. However, garnering funds is one of the many business essentials for startups and entrepreneurs. Also, knowing how to handle finances wisely is an accounting essential every small business owner must learn.

How to Run a Profitable Business: Understanding Financial Ratios

Operating a business is fit for strong-willed people only because entrepreneurship is innately full of risk. Thus, to make the business healthily and profitably running, you need to be a competent and smart entrepreneur. To get along with the competition in the market, you should be willing to take and calculate risks to be one step ahead of the pack. Most importantly, study and comprehend the financial ratios to fully be aware of your company’s business operation. These are obtained from your establishment’s balance sheet, income statement, and cash flows.

A business owner must have the skill to alleviate company-specific hazards while concurrently taking products or services to deal at prices that reach the customer levels of demands. In most cases, however, a lot of small businesses fail in 1 year and six months of running. There are many factors that contribute to the said failure, such as lack of funds, ineffective business plan, poor management, and incompetent marketing. The insufficient capital and inefficient business plan are the most crucial contributors among those that are mentioned. It is because the former is one of the financial essentials for business success while the latter helps in financial analysis for business evaluation.

3+ Financial Essentials for Small Business Examples

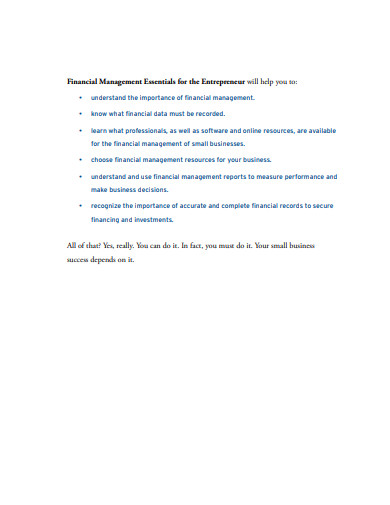

1. Financial Management Essentials for Small Business Entrepreneur

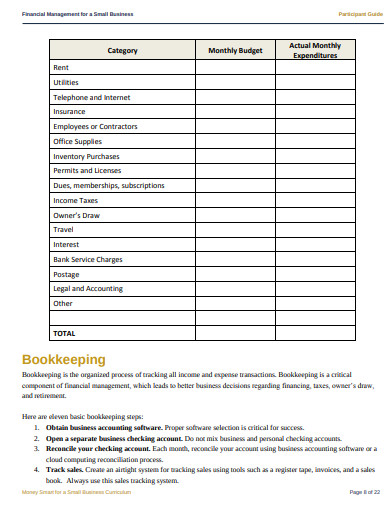

2. Financial Essentials for Small Business Example

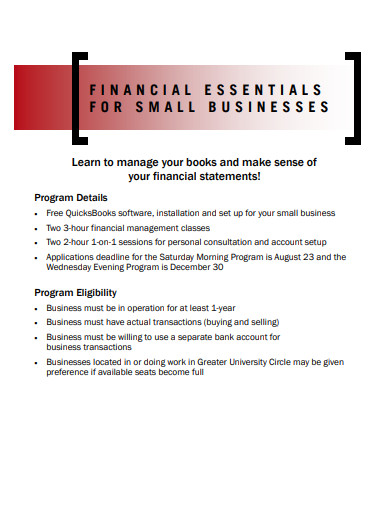

3. Financial Essentials for Small Business Template

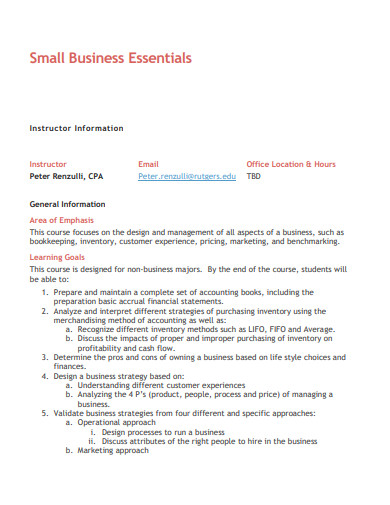

4. Small Business Financial Essentials Example

Importance of Cash Flow

The quantity of money going in and out of business from a particular time frame. — The common definition of cash flow. In other words, it is the key signifier of a company’s financial health status. The importance of cash flow is that it points out the current ability of a business establishment to produce and utilize money. Moreover, the significance of cash flow is not limited to indicating financial stability. It also provides a lot of benefits such as good debt management, an opportunity to grow, protection from foreclosure and loan mishaps, and upgrade in versatility.

How Small Businesses Organize their Finances

The financial part of your business plan must be spot-on because it decides whether your strategies and ideas are feasible or not. Furthermore, budgeting and calculating the cash inflows and outflows for the first months of business operation is essential because both flows determine your company’s creditworthiness. Poor cash flow management and finance organization are the usual causes of business failure. Thus, proper checking of the said cycle is crucial. For start-up companies, dealing with cash flow problems is challenging because there are a lot of expenditures than revenues. Looking for temporary fund sources is might be the best option to pick.

Moreover, when it comes to financial organisation, systematically creating methods in organizing might be the key. The said methods are the following: sheltering personal resources; separating personal and business funds; tracking finances digitally. Also, organizing printed documents; taking time to monitor the finances every week.

Cash flow Forecast

Cash flow projection is one of the corporate finance essentials. There are three components to the cash flow forecast formula. First, elaborate the cash income by writing a monthly estimated sales figure but only input the sales that can be gathered in cash. Next, list the cash expenditures that you truly look forward to paying for every month. Lastly, balance your revenues to the spending. The present month’s income are added to the balance while the expenses are being subtracted. Thus, the altered cash flow balance is carried out to the month that follows. Moreover, this formula plays a role in financial accounting since it is contained in the cash flow statement. The primary importance of financial accounting in decision making is that it helps in figuring what areas need improvement and how to uplift the current financial performance for the company’s advantage.

Effects of Bad Record Management

Record management is often neglected and underestimated process by many companies. Proper record management makes an efficient and well-operated company, while bad record management leads to a chaotic and impenetrable workplace, crabby workers, and data misplacement. Bad record management can also hurt a company, cease effectivity, consume time, and cause stress.

Steps in Making the Anticipated Profit for your Small Business

If your new small business is not giving the profit that you have expected to gain, then you need to adjust your views, strategies, and goals. In that case, you can provide more attention to your profit. Hence, here are the steps on how to make your start-up business produce your anticipated profit:

1. Revise the Operating Process

Your first procedures failed to live its duty and expectations. Thus, the best thing to do is to make adjustments and revisions in your business operation. Evaluate and analyze what needs to be improved or changed in order to produce more sales while decreasing your expenditure. Moreover, check your records such as your current business plan and marketing plan and upgrade both if necessary.

2. Connect and Get Recognized

As an entrepreneur, you should focus on being visible and as well as getting connected. Begin bringing up your A-game when it comes to advertising. Using marketing tools is an excellent way to hit two birds with one stone. Thus, outsmart your rivals by flaunting your business with its achievements, products, and services by taking over the online platform and the real world with the help of marketing materials.

3. Amplify your Cash Flow

A great way to achieve a healthy cash flow is to provide prepaid payment plans for your customers. For example, you offer a service for $100 an hour per day. To make excellent cash flow and a long-term agreement, you can present them a service plan good for 20 hours at $75 per hour. It may not look profitable in the beginning, but it makes good kinships and opens doors for more work.

The growth of your start-up business depends on how smart you are in handling your finances. Therefore, you must be meticulous in terms of money management and business organization. The struggle of acquiring your starting capital is just the first of the many hardships that you will encounter in running and expanding your company. Hence, as an entrepreneur, you need to harness your future-oriented and resourceful characteristics. You may start by mastering the financial modeling and financial risk management.