34+ Financial Analysis Examples to Download

In the business world, people always incorporate different practices on how to effectively run a company. They try various strategies to keep the business analysis floating and continue running in the competition. It is an unavoidable truth that in this field, people always try to get ahead of others to be on top.

Financial Analysis Template

Company Financial Analysis Template

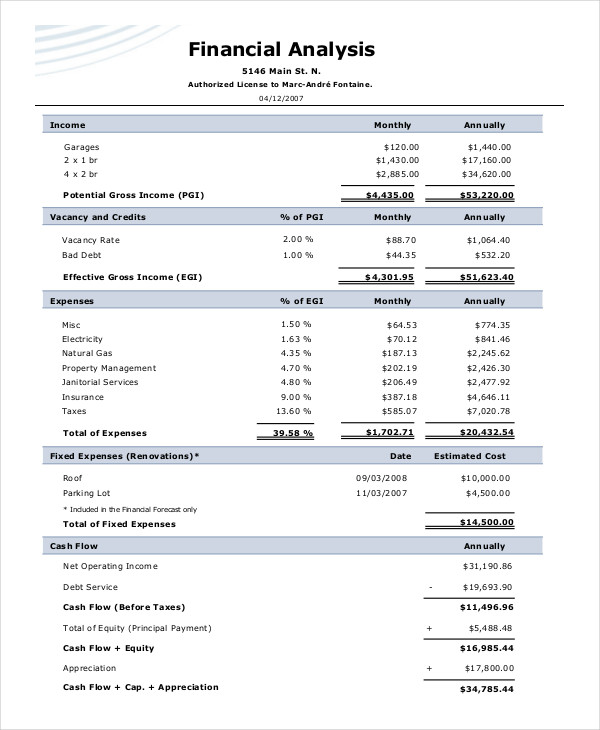

Real Estate Financial Analysis Example

Having this mindset is not bad at all especially if you are using right and legal means. There are certain methods that some businesses know and use and some others simply use the conventional ones. Writing financial reports and understanding the marketing flow are just some of those strategies you can use to help your business.

Restaurant Financial Analysis Template

Financial Analysis Template

Financial Ratio Analysis Template

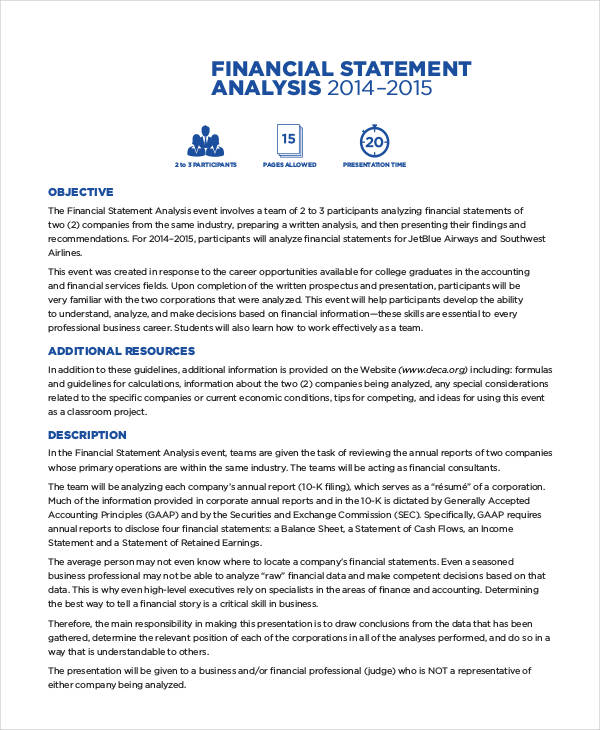

Financial Statement Analysis Template

Personal Financial Analysis

Personal Financial Statement

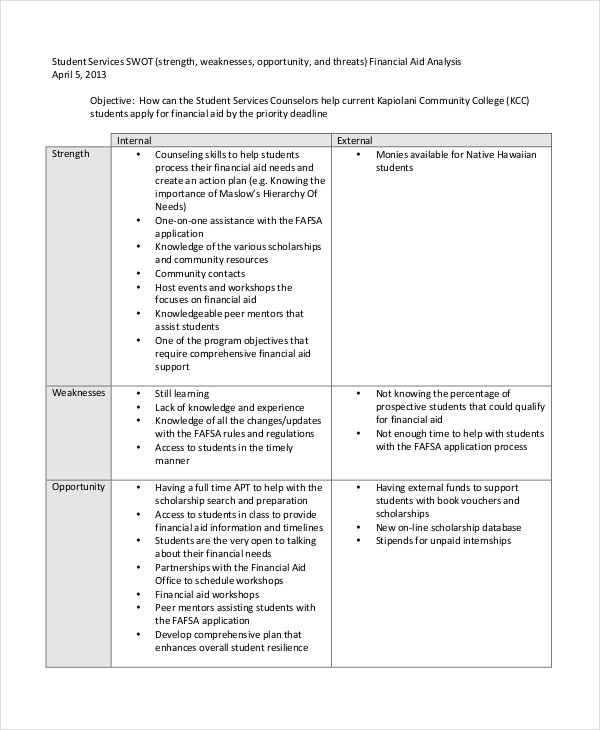

Financial SWOT Analysis

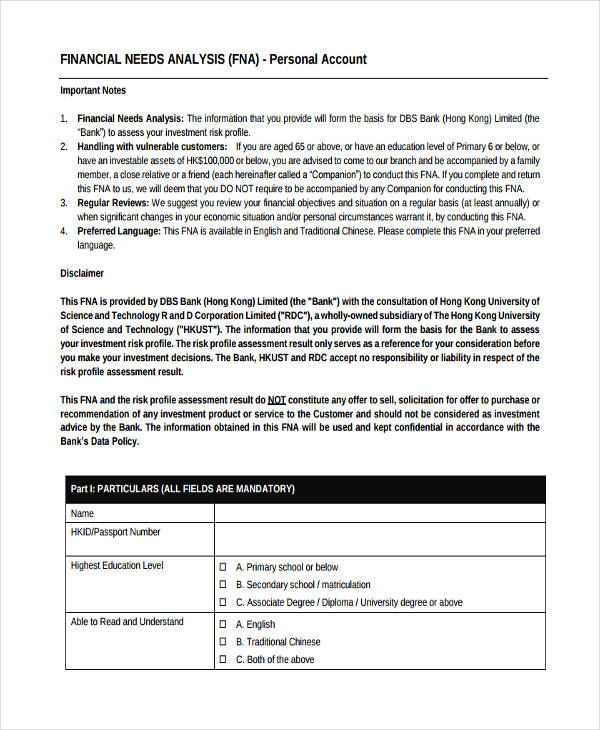

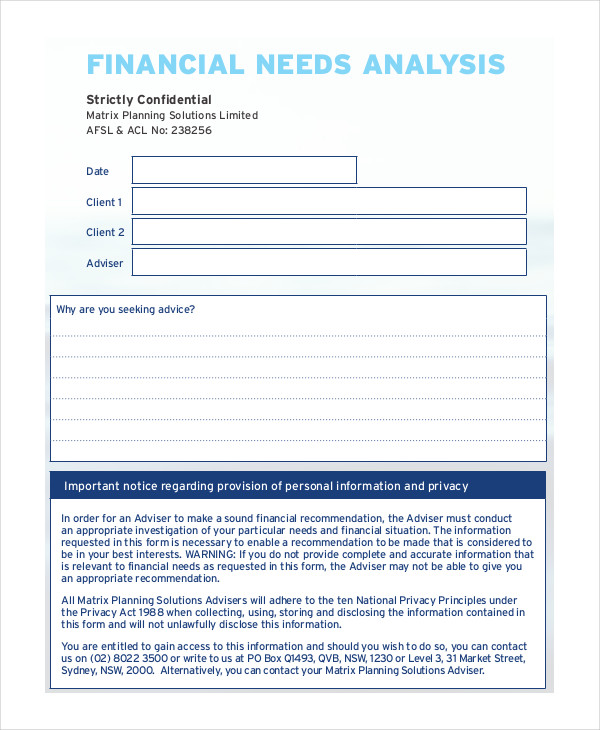

Financial Needs Analysis

Project Financial Analysis

Project Financial Feasibility

Project Risk Analysis

Project Performance

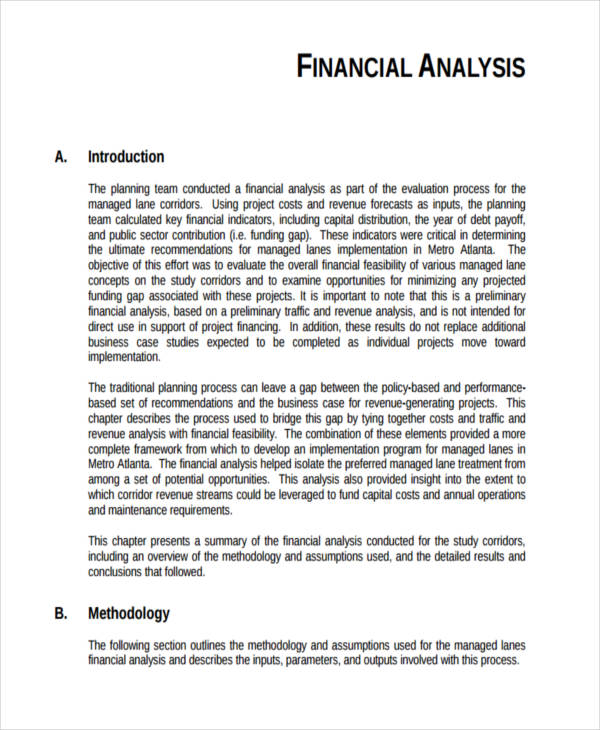

What Is Financial Analysis?

Financial analysis is a detailed examination or a thorough study of a business’s financial status and all other finance-related elements to understand its effectiveness and practicability. It is often incorporated in a business analysis to help an organization come up with strategies and methods to boost their production which could result to more profits and better gains.

What Is the Purpose of the Financial Analysis?

Without any knowledge or idea about your company’s finances could result to great loss and unimaginable negative effects. I would assume that no businessman would want to see his/her company go to ruins. The purpose of the financial analysis is to provide an overview of the business’s performance in terms of financial statement and to come up with ideal strategies to help grow the business.

Financial analysts also look into these documents to aid them in determining the strengths and weaknesses of a company. It helps them evaluate past financial problems and create tools and instruments for future performance report of a business.

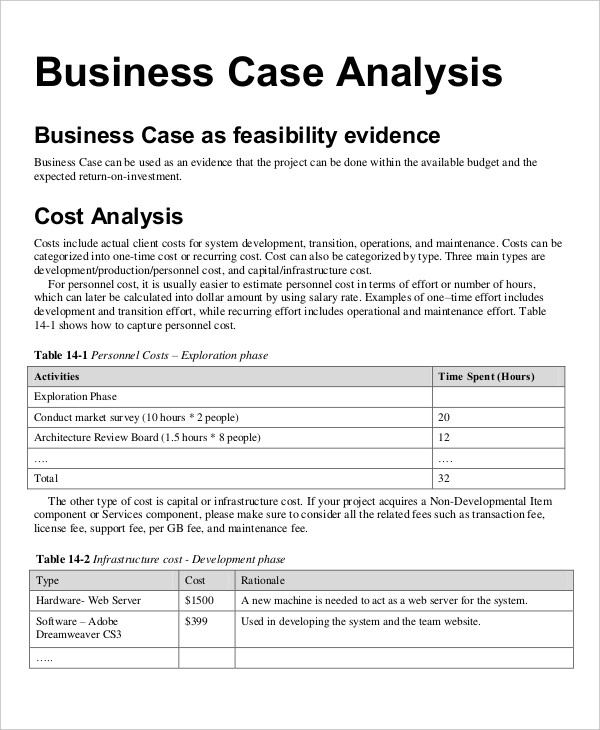

Business Financial Analysis

Business Case Financial

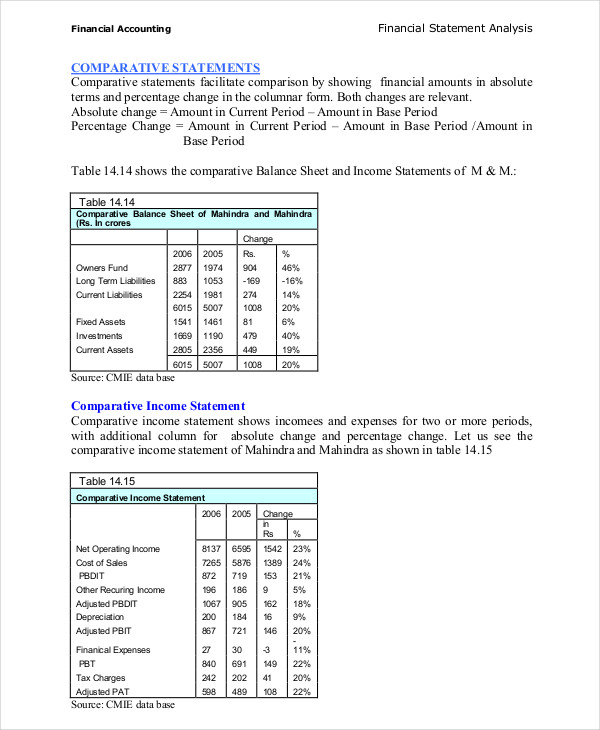

Comparative Financial Analysis Example

Comparative Statement Analysis

Comparative Financial Performance

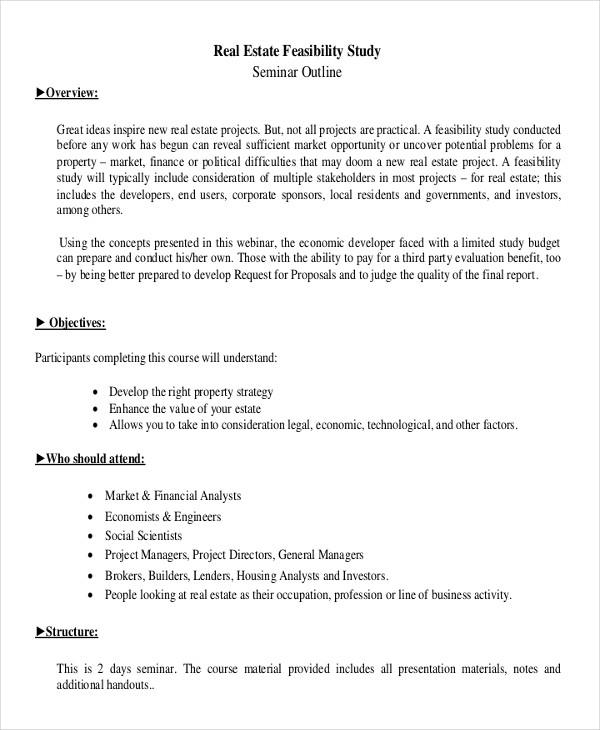

Real Estate Financial Analysis

Real Estate Investment Analysis

Commercial Real Estate Financial

Key Elements of a Financial Analysis

Every successful business has their own story of struggles and probably a couple of strategies as well. In fact, one of the most effective methods that they use is through constant monitoring and evaluation plan of their finances. The use of a financial analysis to help determine what needs to be done in business is very beneficial.

However, one must be equipped with the right amount of knowledge how it is written and what are the key elements to be included in it.

- Company objective. This refers to your shared vision and goal as a company. It serves as your guiding light on what you want to achieve in the future. Having an objective in your financial analysis example has the same effect if it’s done in a sales analysis. You have a driving force and a determination to reach success which will in turn pave a way to think of strategies for a better performance.

- Assets and revenues. These are the company’s physical or intangible properties which could be sources of income like building equipment, infrastructure, and warehouses. These things are to be included to show present profits out of it and future values.

- Liabilities and expenses. This includes the company’s taxes, leasing fees, and other company debts. It pertain anything that costs the business to release funds including those are need for production and operations. It also includes legal suits and loan interests.

- Operation efficiency. This refers to how effective the business’s performance is in terms of utilising the available resources. It also includes employee management and the distribution of labour. This is an important factor to determine how the company stands in the industry as well as to predict its future.

- Profit and loss. Determining the factors that contribute to the profit and loss of a business is important. It helps you determine and evaluate past and future probabilities of the company.

Corporate Financial Analysis

Corporate Financial Statement

Financial Needs Analysis

Financial Planning Needs

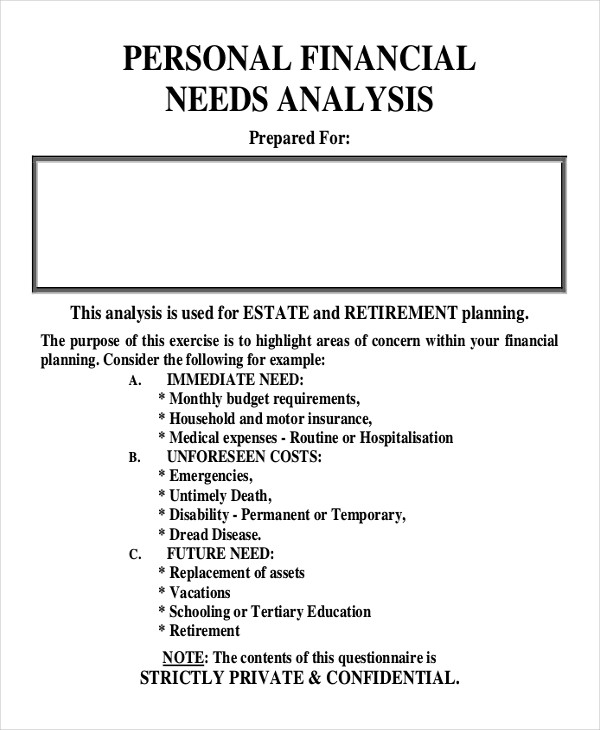

Personal Financial Needs

Financial SWOT Analysis

Financial Services SWOT

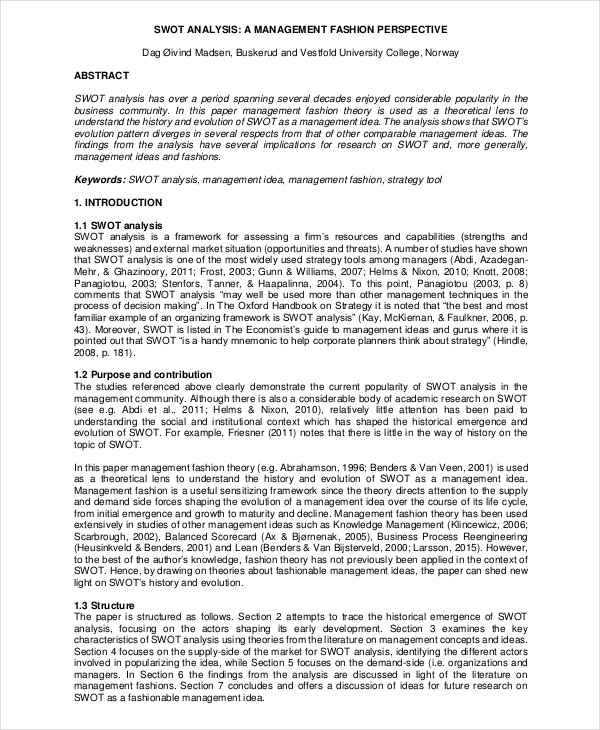

Management SWOT Analysis

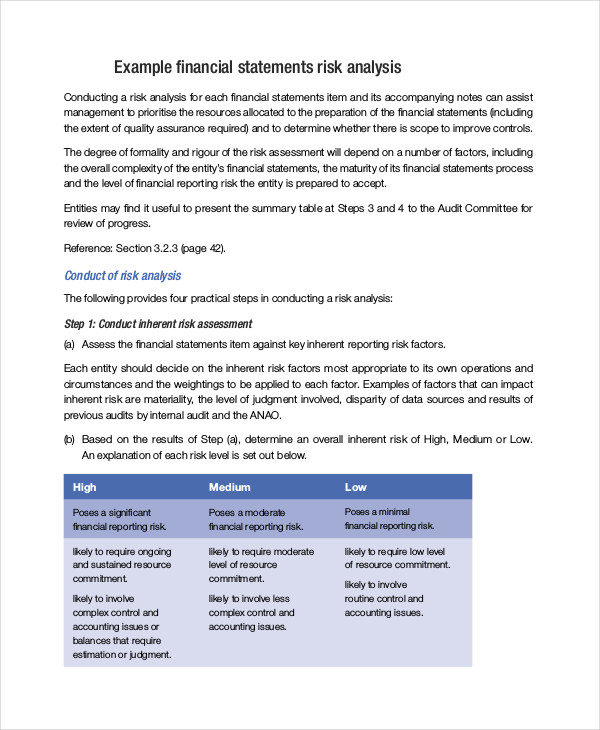

Financial Risk Analysis Example

Financial Management Risk

Statement Risk Analysis

Financial Credit Risk

What Is the Importance of a Financial Analysis?

A business can be groping in the dark if there is not constant and periodic evaluation of its financial performance. This is where the financial analysis comes in.

Having a financial analysis helps you to come up with better business decisions and plans. The reason for this is that through evaluation, you will be able to identify what are the positive and negative attributes of your business. You can then create plans on how to work out with those weaknesses. It also helps you on investment decisions. You can look for opportunities which would be for the benefit of your business.

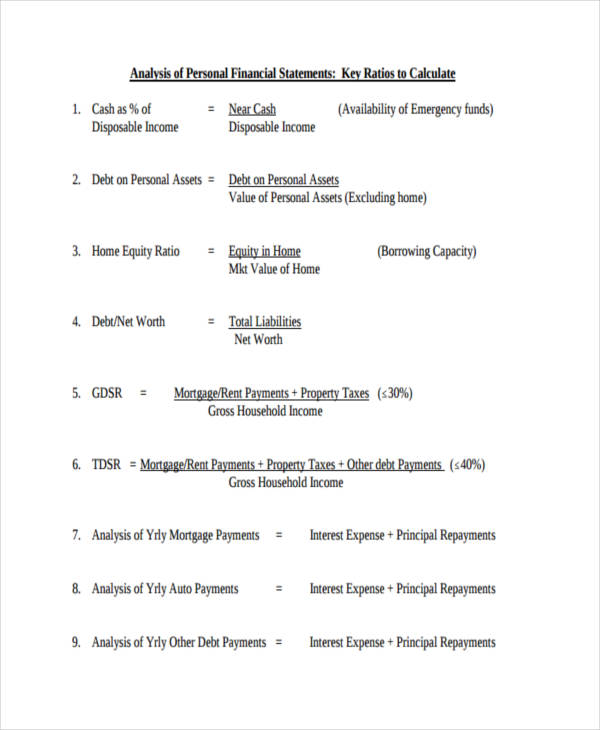

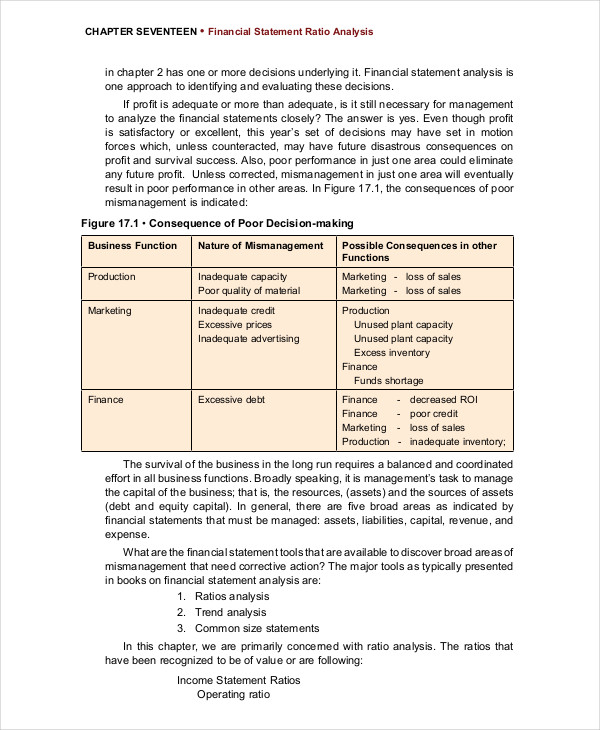

What Is a Financial Ratio Analysis Used For?

A viable business is characterized by the ability to create an effective finance scheme. Extensive planning is needed to be able to formulate methods and strategies to keep your company afloat. However, you also need tools to help you get that success you are dreaming of. You need to stop and evaluate your business performance before you can continue making decisions.

One helpful means is by using a financial ratio analysis. With this, you will be able to assess and figure out the various aspects of your business performance. You need to check its efficiency and its ability to bring in more profit. With this, you can come up with ideas and decisions that can provide positive results.

Financial Ratio Analysis

Financial Statement Ratio

Financial Management Ratio

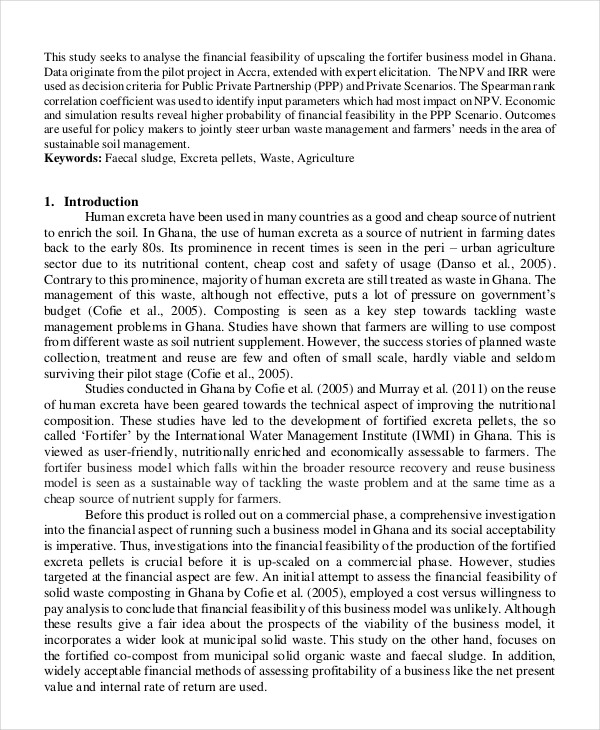

Financial Feasibility Analysis

Simple Financial Feasibility

Real Estate Feasibility Analysis

Company Financial Analysis

Construction Company Analysis

Free Financial Analysis

Free Financial Statement

Free Financial Needs

Strategic Financial Analysis

Strategic Plan Financial

Strategic Management Financial

Guidelines for Effective Financial Analysis

Writing an simple analysis requires keen attention to details and the ability to understand the complexity of the subject. As defined by Merriam-Webster, an analysis is “a detailed examination of anything complex in order to understand its nature or to determine its essential features.” This definition can serve as a guide on how a financial analysis is done.

- Understand the business objective. This is probably the primal consideration that you have to make. Knowing your business objective will help you come up with an effective tips financial analysis. It makes your task easier since you have a target to hit.

- Create a research group. Financial analysis is usually done with the help and cooperation of a group of people to make the job easy. Create a team that can help you in brainstorming and sourcing of the materials you need.

- Identify significant financial events. Just like what is done in an operational analysis, you need to be able to determine the important factors that affect subject. You need to evaluate the financial performance based on its peak lows and highs and find out its reasons.

- Observe marketing reports. Considering the outside environment of your business is also important. It sometimes becomes a determining factor in a business’s overall performance.