10+ Financial Authorization Letter Examples to Download

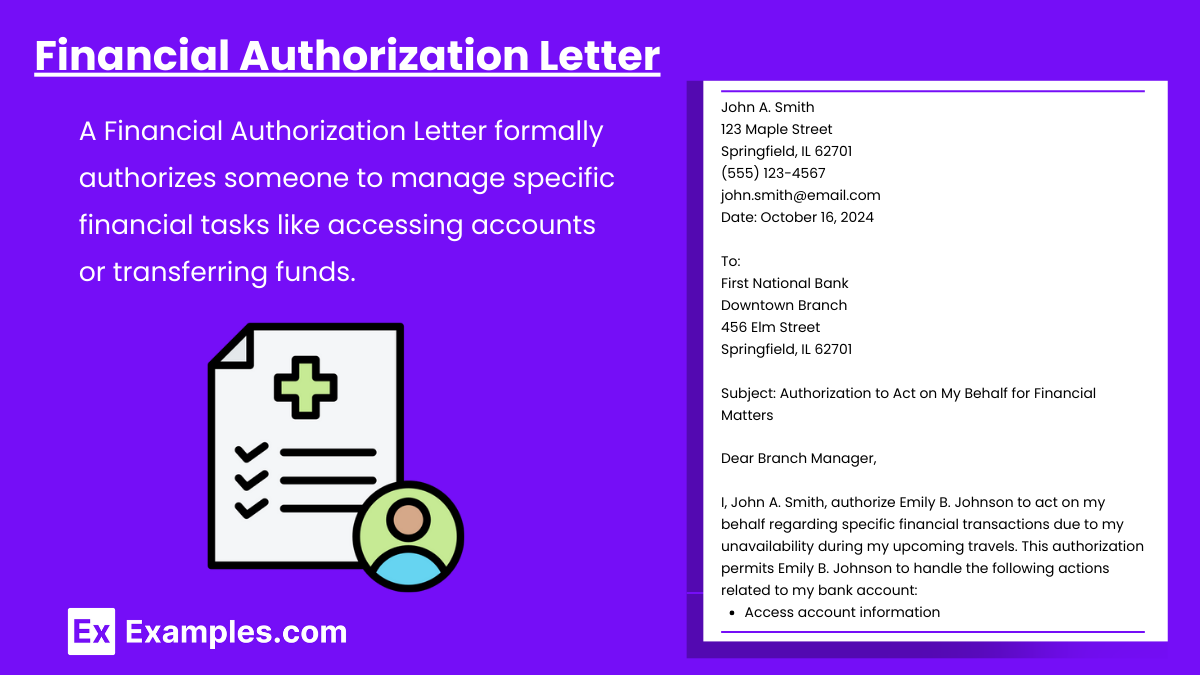

A Financial Authorization Letter is a formal document that grants someone permission to manage specific financial tasks on your behalf, such as accessing accounts, transferring funds, or claiming funds. This type of letter is particularly useful if you are unavailable due to travel, medical reasons, or other commitments, as it ensures that a trusted individual can handle your financial affairs responsibly. For more related information, explore topics like Authorization Letter for general use cases, Authorization Letter to Claim for delegating claims, or Signature Authorization Letter to delegate signing authority for specific financial matters.

What is a Financial Authorization Letter?

Download Financial Authorization letter Examples Bundle

Financial Authorization letter Format

Sender’s Information

- [Your Name]

- [Your Address]

- [City, State, ZIP Code]

- [Email Address]

- [Phone Number]

Date

- [Insert Date]

Recipient’s Information

- [Recipient’s Name]

- [Company/Bank Name]

- [Company/Bank Address]

- [City, State, ZIP Code]

Subject

Subject: Authorization for Financial Transactions

Salutation

Dear [Recipient’s Name],

Authorization Details

- I, [Your Full Name], hereby authorize [Authorized Person’s Full Name], residing at [Authorized Person’s Address], to act on my behalf for managing all financial matters related to my account(s).

- Account Holder’s Name: [Your Full Name]

- Account Number(s): [Your Account Number(s)]

- Branch Name: [Branch Name]

Scope of Authorization

- Withdrawal of Funds

- Deposit of Funds

- Account Information Access

- Check Writing/Issuance

- Loan/Financial Instrument Processing

- Any other necessary financial transactions related to the account(s)

Validity of Authorization

This authorization is valid from [Start Date] to [End Date], or until written revocation.

Contact Information

- Phone Number: [Your Phone Number]

- Email Address: [Your Email Address]

Closing

Thank you for your attention.

Sign-Off

- Sincerely,

- [Your Full Name]

- [Signature]

Financial Authorization Letter Example

John A. Smith

123 Maple Street

Springfield, IL 62701

(555) 123-4567

john.smith@email.com

Date: October 16, 2024

To:

First National Bank

Downtown Branch

456 Elm Street

Springfield, IL 62701

Subject: Authorization to Act on My Behalf for Financial Matters

Dear Branch Manager,

I, John A. Smith, authorize Emily B. Johnson to act on my behalf regarding specific financial transactions due to my unavailability during my upcoming travels. This authorization permits Emily B. Johnson to handle the following actions related to my bank account:

- Access account information

- Make deposits and withdrawals

- Transfer funds between accounts

- Sign financial documents as necessary

Authorized Person’s Details:

- Full Name: Emily B. Johnson

- Relationship: Sister

- Address: 789 Pine Avenue, Springfield, IL 62702

- Phone Number: (555) 987-6543

- Email Address: emily.johnson@email.com

Account Details:

- Bank Name: First National Bank

- Account Number: 123456789

- Account Type: Checking

This authorization is valid from October 20, 2024, to November 30, 2024, and may be revoked by me at any time with written notice to both the authorized person and your institution.

By signing below, I confirm that Emily B. Johnson has permission to carry out the actions specified above on my behalf. Should you need further information or verification, please contact me at (555) 123-4567 or via email at john.smith@email.com.

Signature of Authorizer: ___________________________

Printed Name: John A. Smith

Date Signed: October 16, 2024

Witness Signature (if applicable): ___________________________

Printed Name of Witness: ___________________________

Date Signed: ___________________________

Notary Public Signature (if required): ___________________________

Notary Seal: ___________________________

Date: ___________________________

Thank you for your assistance in this matter.

Sincerely,

John A. Smith

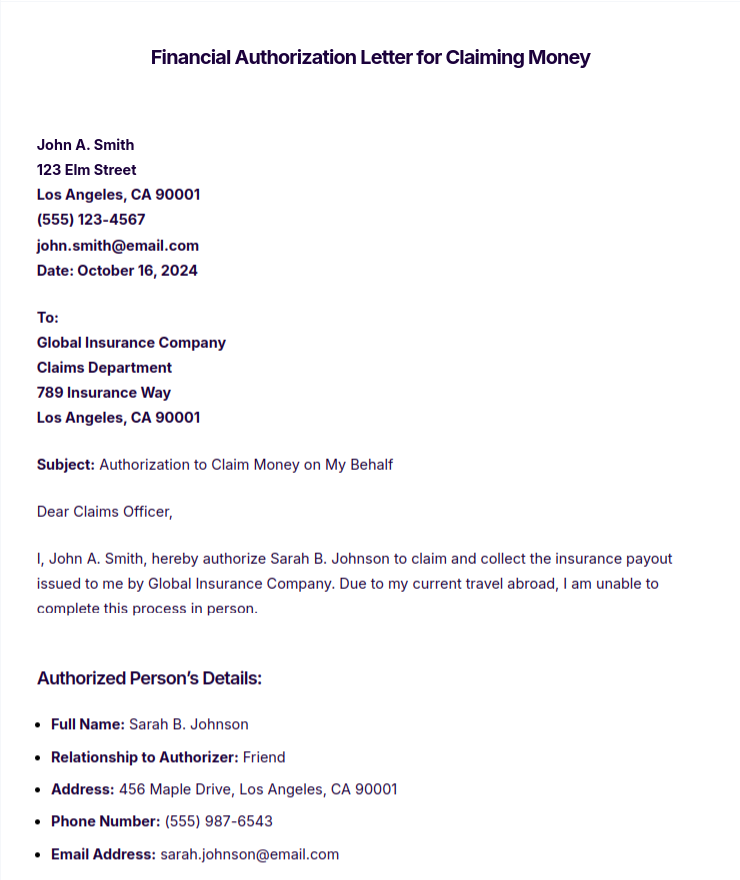

Financial Authorization Letter for Claiming Money

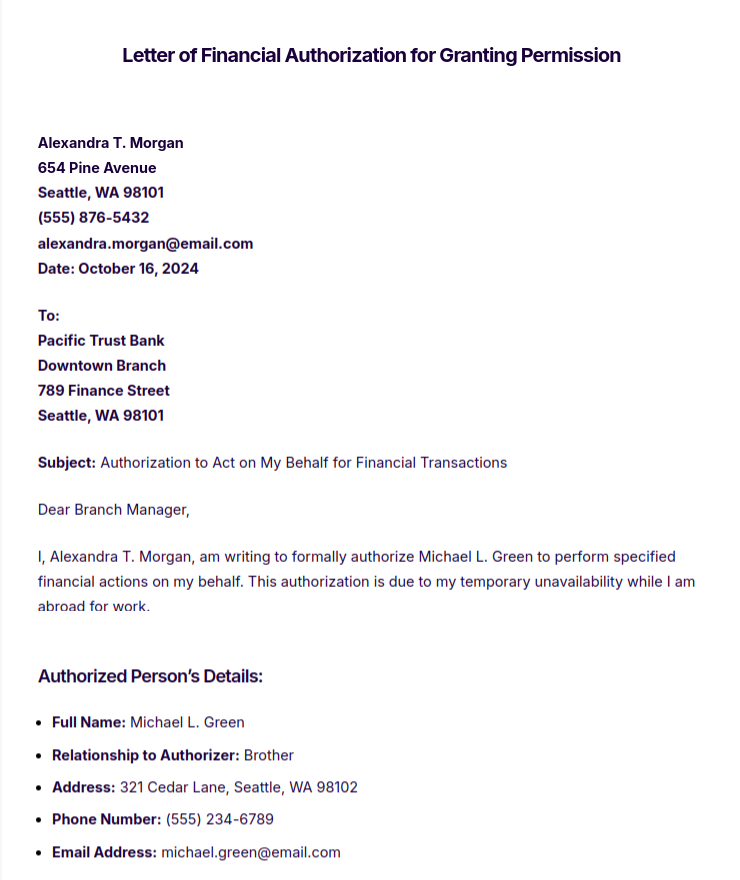

Letter of Financial Authorization for Granting Permission

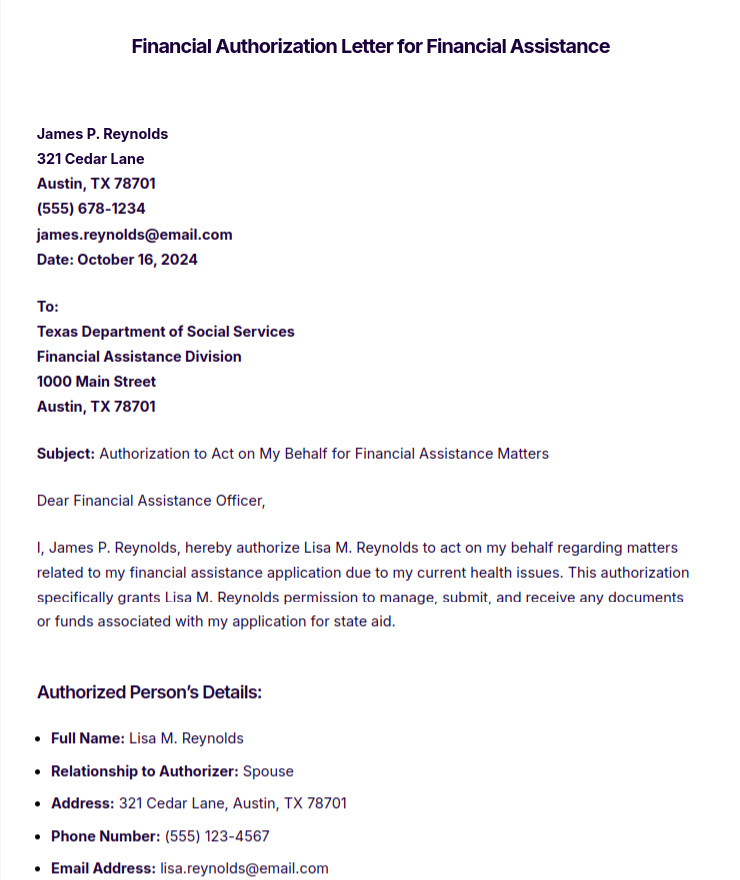

Financial Authorization Letter for Financial Assistance

More Financial Authorization Letter Examples and Samples

- Financial Authorization Letter to Represent the Company

- Financial Authorization Letter to Authorize Financial Transactions

- Letter of Authorization to Collect Documents

- Financial Authorization Letter for Medical Financial Assistance

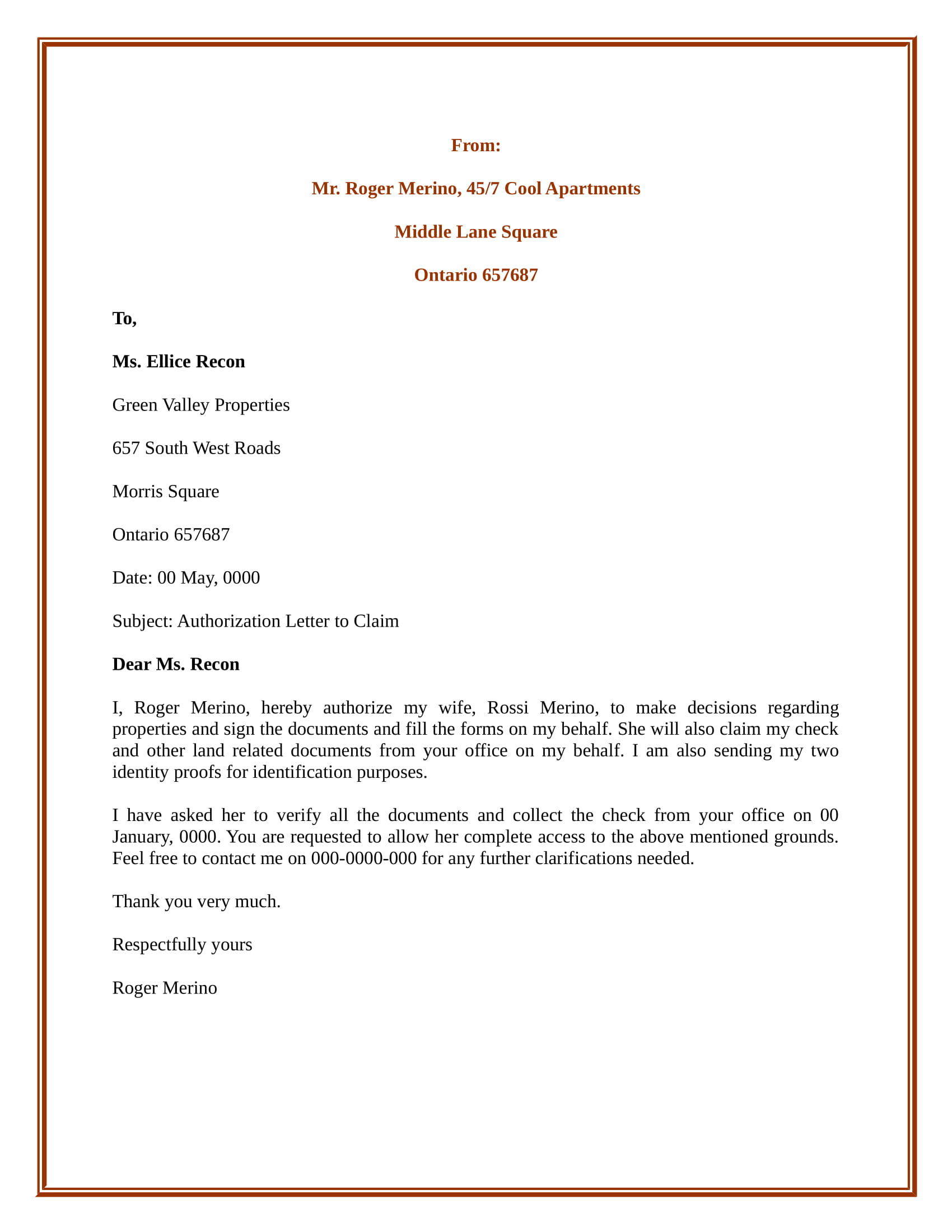

Authorization Letter for Claiming Example

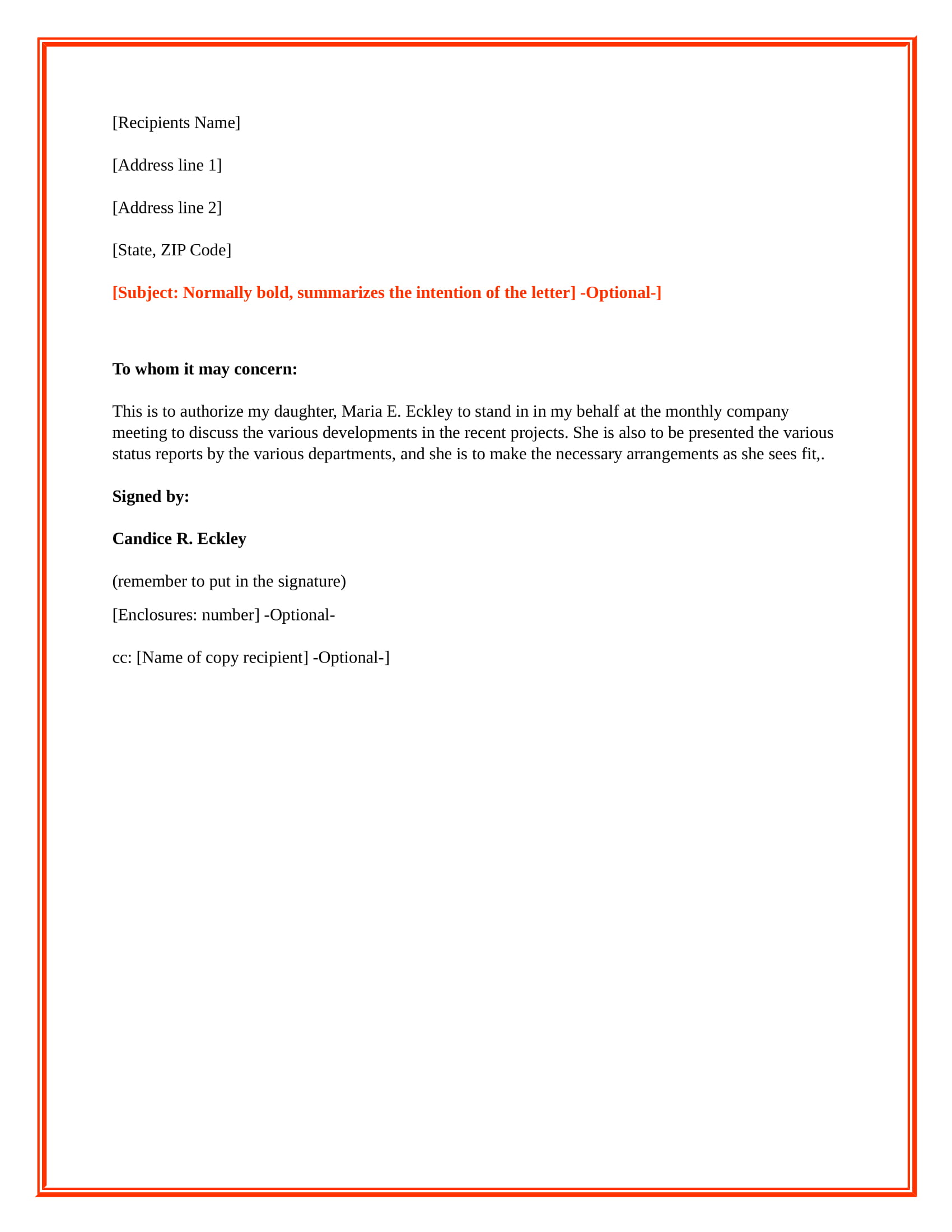

Authorization Letter to Act on Behalf Example

Letter of Authorization Example

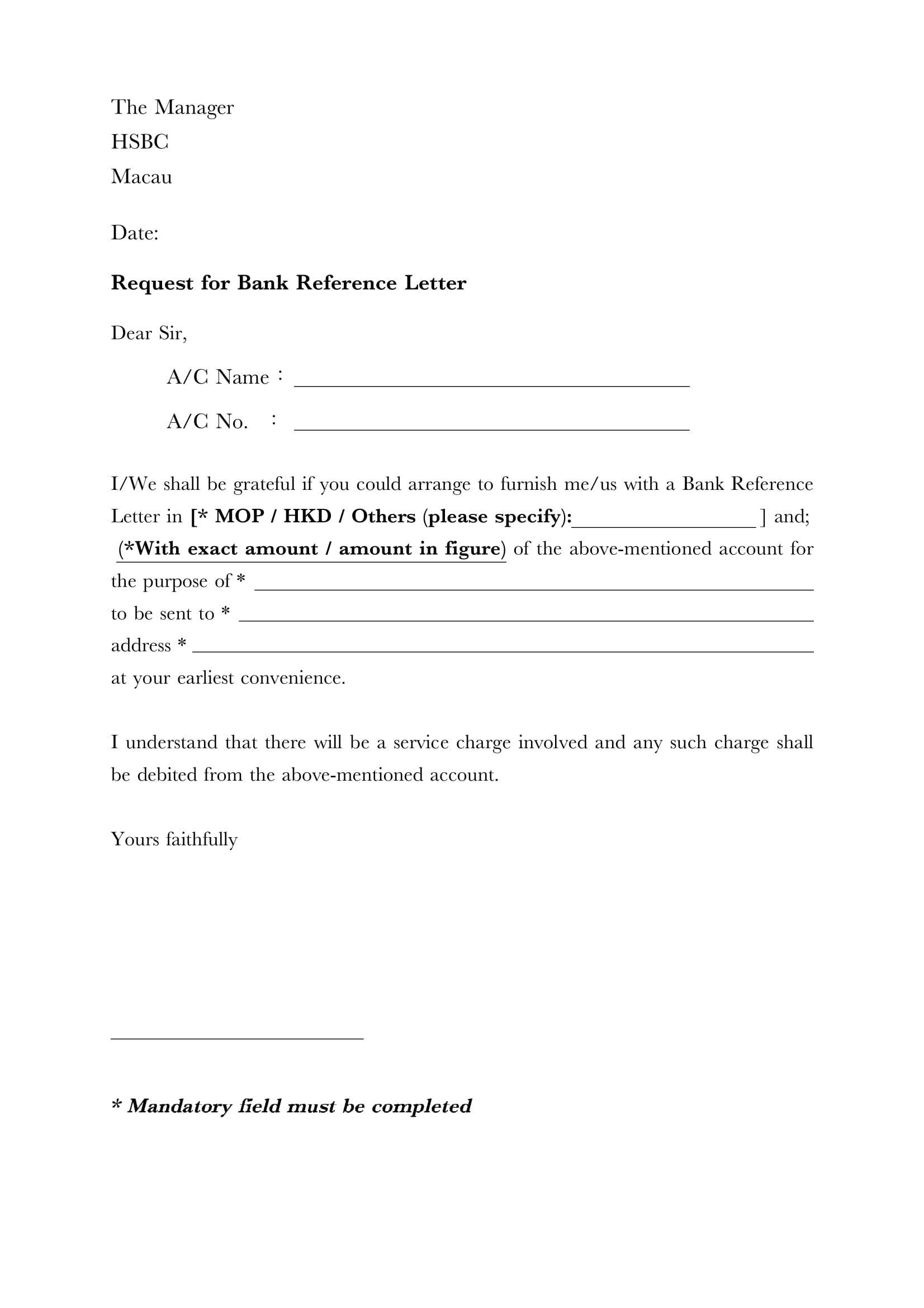

Financial Reference Letter Example

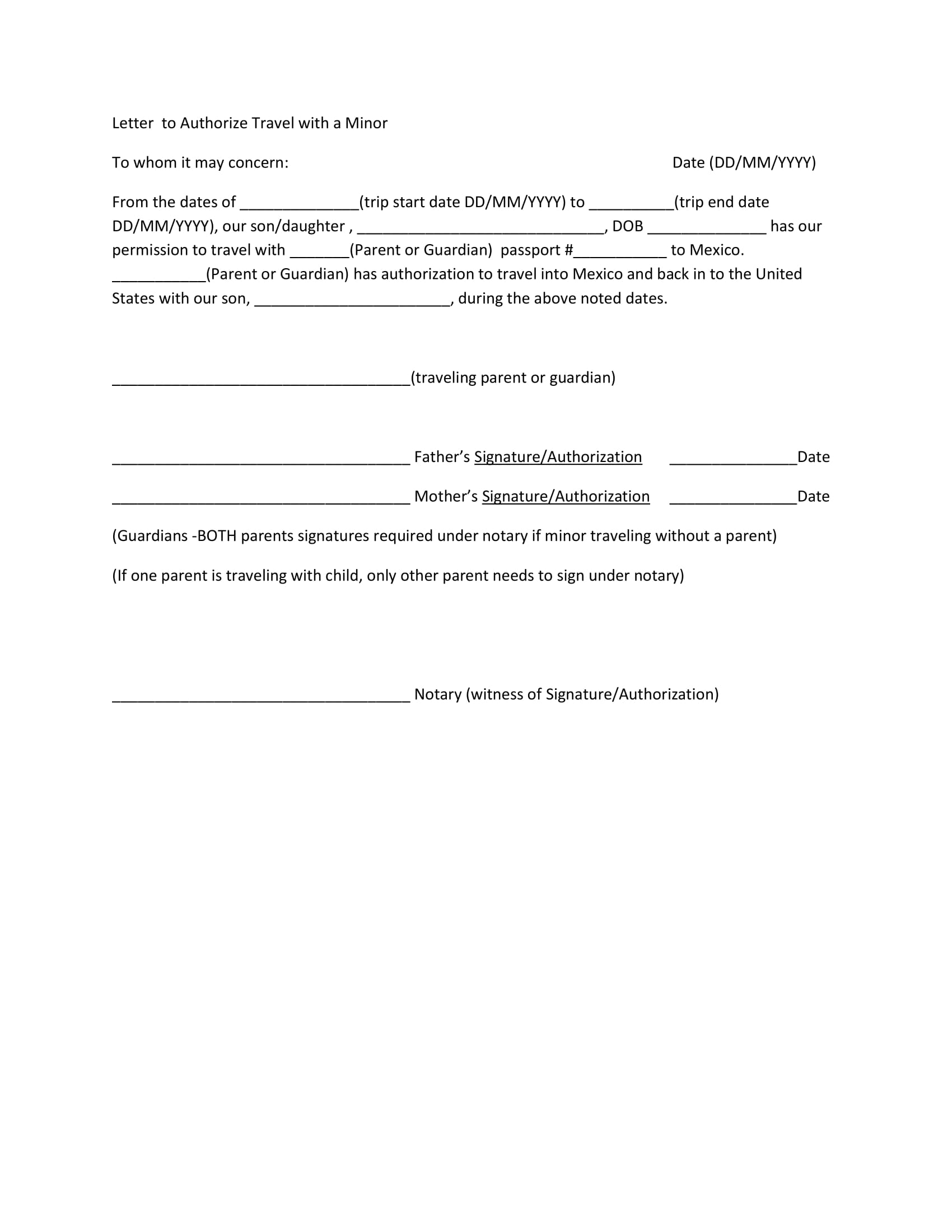

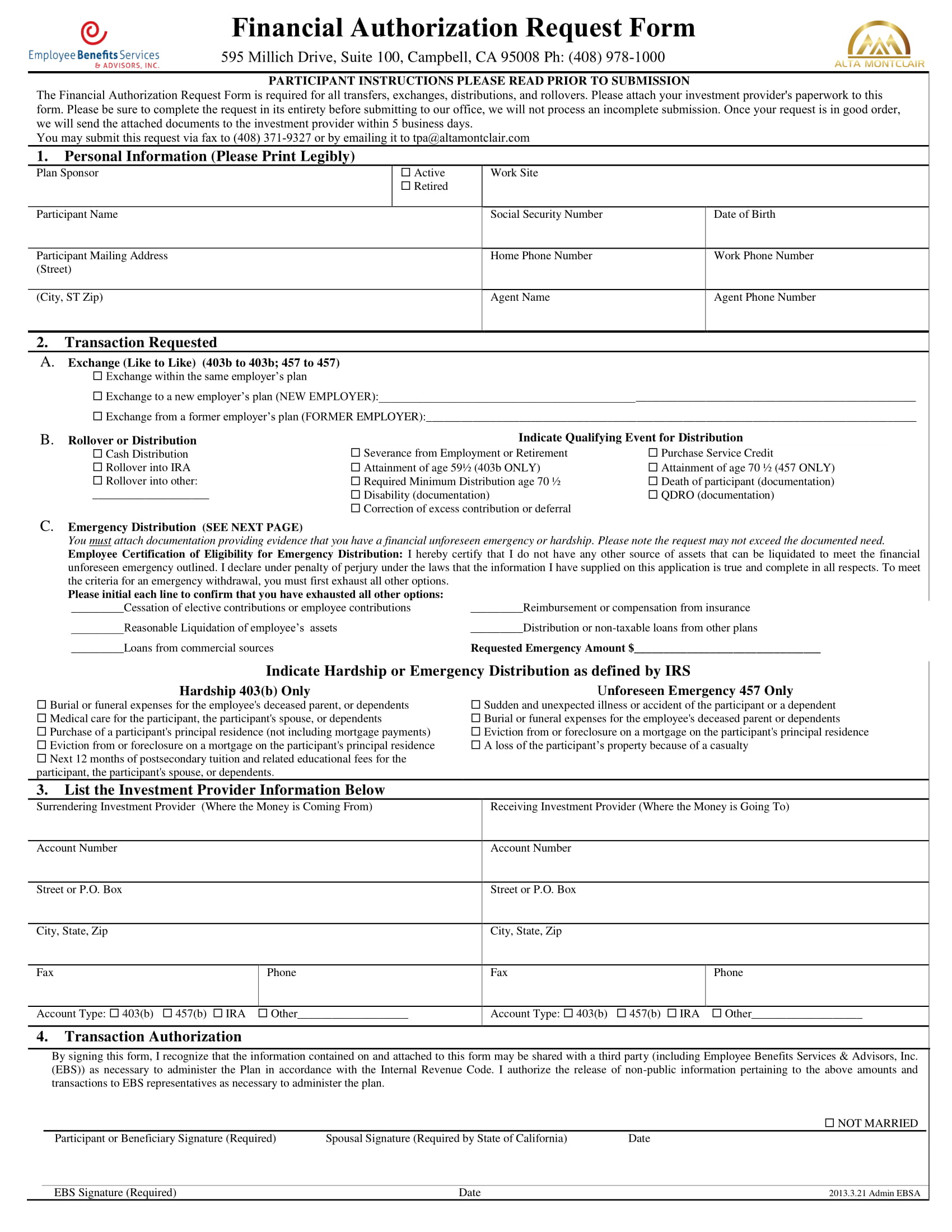

Final Authorization Request Form

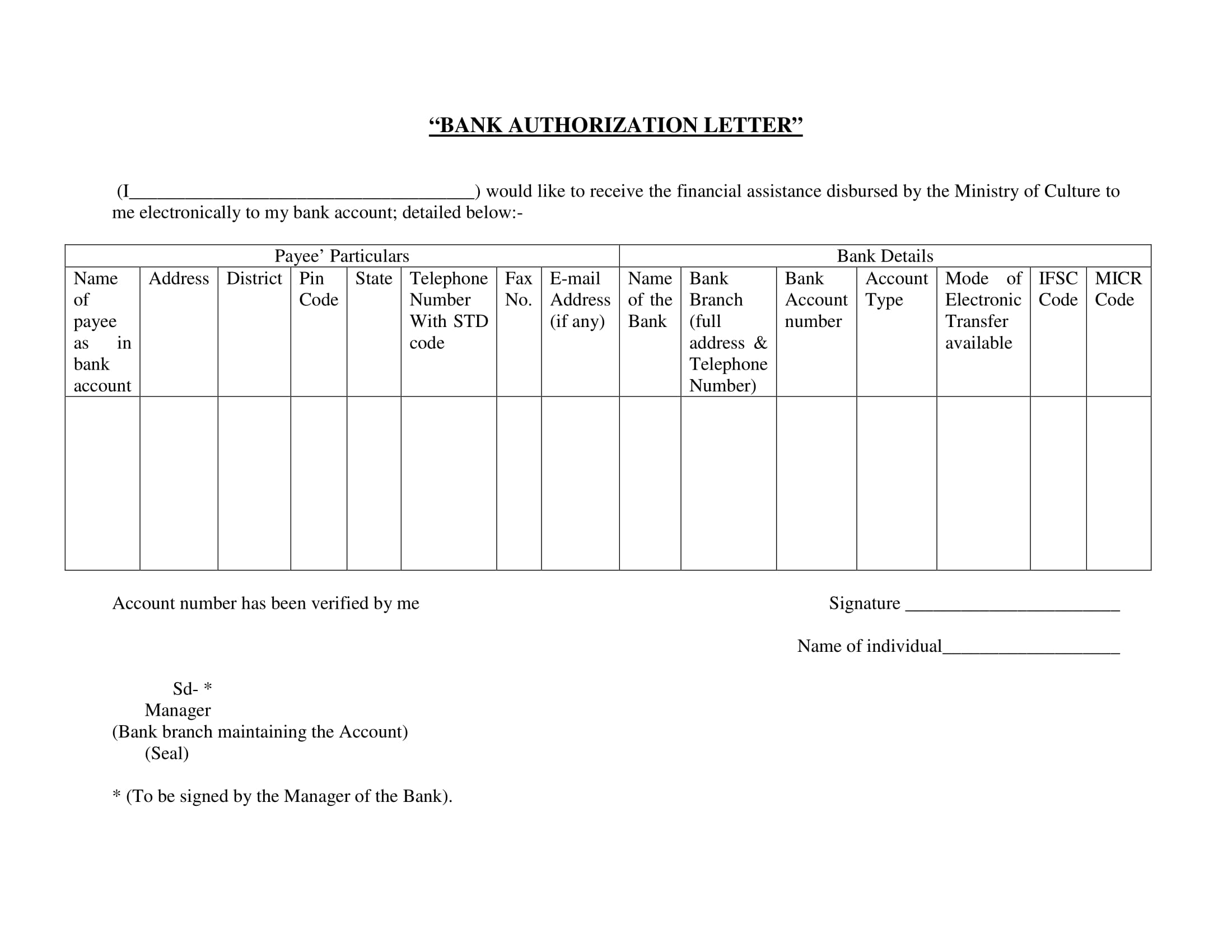

Bank Authorization Letter Example

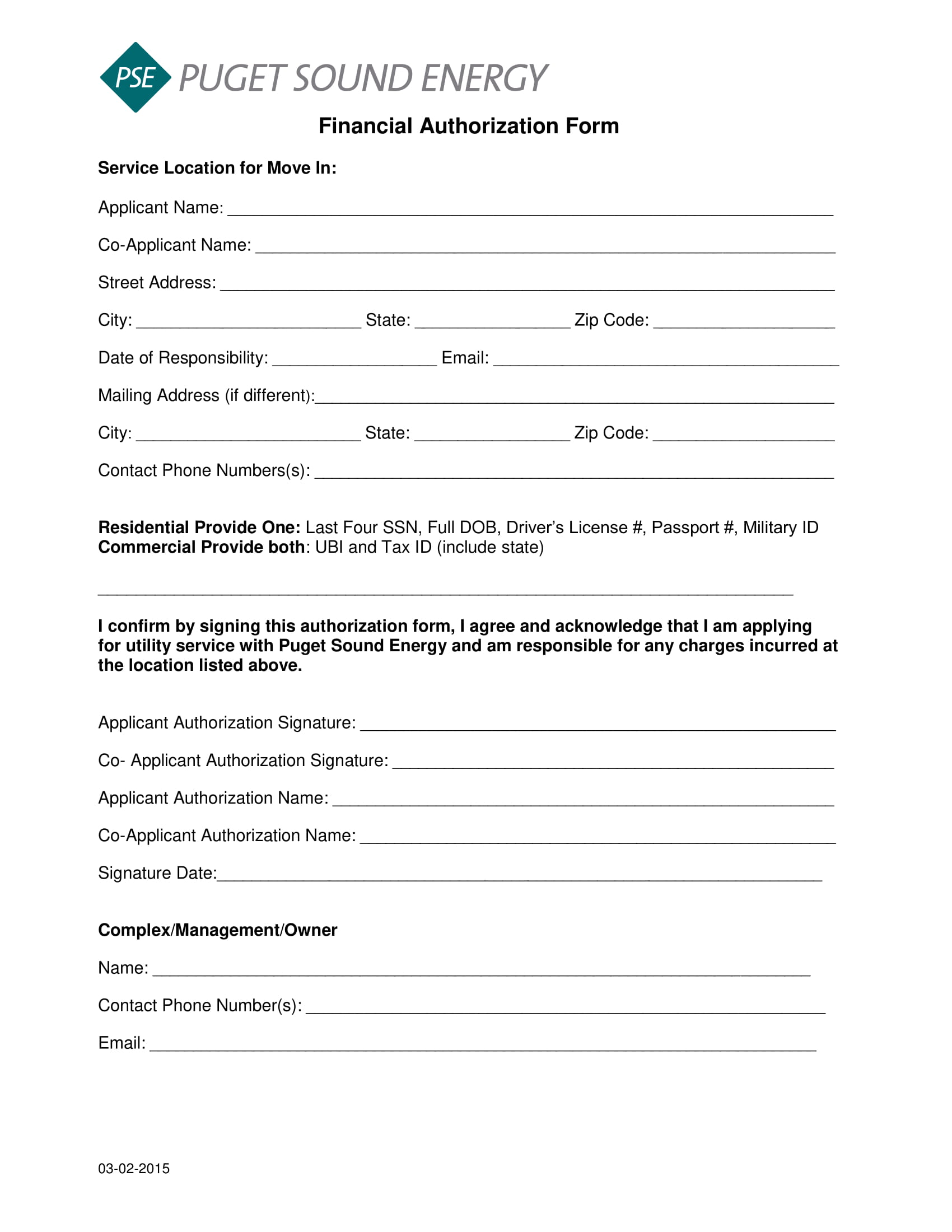

Financial Authorization Form Example

How to Write Financial Authorization Letter

Here’s a step-by-step guide on how to write a Financial Authorization Letter:

Start with Your Personal Information

At the top of the letter, include your full name, address, phone number, and email address.

Date the letter to specify when it was written.Include the Recipient’s Details

Write the name of the financial institution (e.g., bank) or the recipient’s name if it’s addressed to a specific person.

Include the branch name and address of the financial institution.Add a Subject Line

Use a clear subject line, such as “Authorization to Act on My Behalf for Financial Matters” to specify the purpose of the letter.

Begin with a Formal Greeting

Address the recipient by name if known, such as “Dear [Bank Manager/Recipient’s Name],” or simply “To Whom It May Concern” if you don’t have a specific contact.

State the Purpose of the Letter

Clearly state that you are granting authorization to someone else to handle your financial matters. Include the authorized person’s full name and reason for authorization, such as temporary unavailability.

Provide Details of the Authorized Person

List the authorized person’s full name, relationship to you (e.g., spouse, friend), address, phone number, and email address.

This helps verify their identity.Define the Scope of Authorization

Specify the financial actions the authorized person can take, such as: Accessing account information

Making deposits and withdrawals

Transferring funds

Signing financial documents

Be specific about what they can and cannot do to prevent misunderstandings.Include Account Details

Mention the bank name, branch name, account number(s), and account type(s) (e.g., checking, savings).

This ensures the authorization applies to the correct accounts.Set the Duration of the Authorization

Specify the start date and end date of the authorization or state if it is valid “until further notice.”

This allows you to control how long the authorization remains in effect.State Terms and Conditions

Clarify any limitations or conditions of the authorization.

Include a statement like, “I retain the right to revoke this authorization in writing at any time” to maintain control over your finances.Sign and Date the Letter

Sign the letter and include your printed name and the date.

If required, include a witness signature or notary public signature and seal for added legitimacy, especially for high-value transactions or if required by the financial institution.Provide Contact Information for Further Verification

Specify the financial actions the authorized person can take, such as:

Be specific about what they can and cannot do to prevent misunderstandings.Mention how the bank or recipient can contact you for any additional questions, with your phone number or email address.Close the Letter

End with a closing such as “Sincerely,” followed by your full name.

Why the Need for Financial Authorization Letter?

There may be cases when you do not need an authorization letter such as when the person you are asking from is very close to you, or a relative of yours. And the item or the matter involved is nothing serious, such as a ball pen or a 1 or 2 dollar amount. That may save you from not writing and sending a letter. But if the amount is a big one, relatively speaking, and especially when there is an involvement of a company, such as borrowing a cash advance from a company, then that may require a financial authorization letter.

This is a requirement, a necessity for the protection of either the two parties. And how does it work?

When asking for someone to claim something on your behalf, you are allowing a third person to be part in the transaction. In the supposed transaction, between you and the institution, the people involved are officially registered. Meaning, if whatever happens, if something sour happens, tracing the problem would not be that difficult because there is a personal record, such as a biodata or a resume, of the people involved in the incident. Also, the act of claiming something is already an expected event. The question of you going to claim something from someone is already in place. If something happens, the two of you will be the first suspects.

Tips for Writing a Financial Authorization Letter

- Be Specific and Clear

Clearly outline the tasks you are authorizing, such as deposits, withdrawals, or transfers. Specificity helps avoid misunderstandings and limits the scope of authorization. - Include Complete Identification Information

Provide full details of both the authorizer and the authorized person, including identification numbers, contact information, and addresses. This helps verify identities and ensures the letter is legally binding. - Define the Duration

Specify the start and end dates of the authorization, or state if it’s open-ended until further notice. This helps in maintaining control over the timeframe of authorization. - Set Limitations and Conditions

Detail any restrictions, such as limits on transaction amounts or specific account access. This allows you to control the extent of the authorized person’s financial power. - Consult with the Financial Institution

Some banks or financial institutions may require specific formats or additional documents, such as notarization. Confirm their requirements in advance to avoid delays. - Consider Notarization

Although not always required, notarizing the letter adds an extra layer of authenticity and can prevent legal disputes, especially for significant transactions. - Keep a Copy for Records

Always retain a copy of the signed letter for your records. This can be useful if you need to reference or revoke the authorization. - Review the Authorization Regularly

If the authorization is open-ended, periodically review it to ensure it remains appropriate. Life circumstances change, and ongoing authorization may need adjustment.

Importance of a Financial Authorization Letter

A Financial Authorization Letter provides clear legal documentation of consent, minimizing the risk of unauthorized transactions. It protects both the authorizer and the authorized person by defining duties and responsibilities.

- Enables Financial Flexibility

It allows someone to manage your finances on your behalf when you are unavailable, such as during travel or illness. This flexibility ensures that your financial matters are handled without interruption. - Prevents Misuse and Fraud

By specifying exactly what the authorized person can and cannot do, this letter helps prevent financial misuse or fraud. The limitations act as safeguards against unauthorized activities. - Provides Peace of Mind

Knowing that a trusted individual can access and manage your financial affairs can provide relief, especially in emergency situations. The letter formalizes this trust and ensures that the person has your full backing. - Facilitates Efficient Transactions

Financial institutions often require proof of authorization to allow someone other than the account holder to perform transactions. This letter meets that requirement and ensures that transactions proceed smoothly. - Ensures Compliance with Financial Institution Policies

Most banks and financial institutions require written authorization for third-party access to accounts. A Financial Authorization Letter ensures compliance with these policies, preventing service disruptions.

FAQ’s

Who can be an authorized person in a Financial Authorization Letter?

The authorized person can be anyone you trust, such as a family member, friend, or business associate. It is essential that the person is reliable and understands the responsibilities involved in managing your financial affairs.

What types of financial actions can be authorized?

Actions may include, but are not limited to:

Depositing and withdrawing funds

Transferring money between accounts

Signing financial or loan documents

Accessing account statements and details

Managing investments

Is a Financial Authorization Letter legally binding?

Yes, it is legally binding as long as it includes essential details, such as both parties’ identification information, the scope of authorization, and signatures. Notarizing the letter can further strengthen its legality.

Does the Financial Authorization Letter need to be notarized?

Notarization is not always required, but it is recommended, especially for significant financial transactions or if required by the financial institution. Notarization adds an extra layer of authenticity and can prevent legal disputes.

How long is a Financial Authorization Letter valid?

The validity depends on the terms set by the authorizer. It can be valid for a specific period, until a particular task is completed, or indefinitely until revoked. Always specify the duration to avoid any confusion.