11+ Financial Confidentiality Agreement Examples to Download

Financial information of a certain company must be kept confidential especially from those people who are not a party to the entity and their competitors. The financial information of the company describes the company’s position as regards their financial status. This must only be disclosed to shareholders, investors, suppliers, and other interested parties. You may also see non-disclosure confidentiality agreement examples.

When we say interested parties, they are those that are affected by a situation or those that are hoping to make money out of the situation. However, in certain cases, such as in business acquisition, merger and consolidation, audit, and accounting analysis, you must disclose your company’s financial information. You may also like employee confidentiality agreement examples.

Financial Confidentiality Agreement Example

Non-disclosure and Confidentiality Agreement

Bank Financial Confidentiality Agreement Example

Brief Financial Confidentiality Agreement Example

In order to protect those information, a financial confidentiality agreement is needed. This ensures that both parties involved in the agreement will comply to the terms of the general agreement and also to ensure that remedies are specified in case of breach of contract.Below are examples of financial confidentiality agreement that you might find useful.

Comprehensive Financial Confidentiality Agreement Example

Elements in a Financial Confidentiality Agreement

A financial confidentiality agreement must contain the necessary information and stipulations of the said agreement. The following are the elements of a financial confidentiality agreement that are commonly present in the confidentiality agreement most companies.

1. Introduction

In the introduction section of the financial confidentiality agreement, the parties of the agreement must be stated, the disclosing party and the receiving party. The date of the agreement must also be included, which is usually the date when the receiving party sign the simple agreement.

2. The Transaction

This section presents the subject of the agreement. You must take note that the core of the commercial agreement must be stated in this section. The subject of the agreement is the transaction between the parties.

3. The Definition of Confidential Information

In this section, the information that must be kept confidential must be clearly defined. Take note that if you are providing documentations, you must clearly specify that the information is confidential.

4. Non-Disclosure Agreement

You must state in this section that the confidential information must be kept confidential and should not be disclosed to third parties especially without you or your company’s consent.

5. Return of Confidential Information

This section must clearly state that the confidential information must be returned or destroyed after a certain period. The period is usually 30 days, but this is subject to change according to your preference.

6. Exclusions

This clause presents all information that are not covered by the financial confidentiality agreement. The exclusions are based on court decisions which states that there are certain types of information that do not qualify as a confidential information. You may also see staff confidentiality agreement examples.

7. Term of the Agreement

In this section, the term of the agreement must be specified. The term is the length of time that the agreement will take effect. The agreement should last as long as the confidential information is likely to remain a trade secret.

8. General Provisions

Sometimes referred to as boilerplate, general provisions are miscellaneous provisions that are grouped together at the end of the agreement. Some of the common general provisions are as follows:

- Relationships – Usually, confidentiality agreement would include this provision, disclaiming any relationship other than that defined in the standard confidentiality agreement.

- Severability – This provision states that if you wind up in a lawsuit and the court rules that a part of the agreement is not valid, that certain part can be cut out, and the rest of the simple agreement will remain valid.

- Integration – In this provision, it is verified that the version of the confidentiality information that you are signing is the final version and the past statement must not be relied on.

- Waiver – This clause states that if you will not promptly complain about a violation that you might find in the agreement, you can still complain about it later. You may also see HIPAA confidentiality agreement examples.

- Injunctive relief – This is a provision that states that if someone, a receiving party of the agreement, has violated the terms in the confidentiality agreement, a court order may be used to stop a person from using your confidential information.

- Legal fees – Whenever a party files for a lawsuit, there are legal fees involved. In your agreement, you must specify who will be charged for the legal fees incurred relating to the suit filed. You may also like mutual confidentiality agreement examples.

- Governing law – This provision will determine the state law that must govern the agreement.

- Jurisdictions – This is to get the parties of the agreement to consent to jurisdiction in one county or state and to give up the right to sue or be sued anywhere else.

- Successors and assigns – In this provision, it must state the successors and assigns that will be binded in this basic agreement.

9. Signatures

The agreement must be signed by someone with the necessary authority in behalf of the parties mentioned in the agreement. There must be two copies signed and must keep the other one for himself or herself.

Detailed Financial Confidentiality Agreement Example

Howard University Financial Confidentiality Agreement Example

Lengthy Financial Confidentiality Agreement Example

Financial Information Which Must Be Kept Confidential

1. Bank records

These pertain to documents or evidence of transactions that you have with a certain bank. This must be kept confidential as this might provide the amount you have in a certain bank or your interests and debts. You may also see medical confidentiality agreement examples.

2. Tax records

These are the tax expenses or payable by the company. The amount of tax of a certain company must among the classified information to be kept confidential.

3. Sales revenues

The revenue of an entity, usually presented in the general statement of comprehensive income, must only be disclosed to related parties or those parties who have business with the company.

4. Forecasts

These refer to an entity’s forecast with regard to their sales or expenses for a certain period based on their past and current performance.

5. Accounting records

These contain the transaction of the company with the clients or customers or the transactions with the suppliers and investors.

6. Investment holdings

These record the investment provided by the investors. This includes a record of the names of the investors as well as the amount of the investment. This must be kept confidential to protect the information of the investors. You may also like non-disclosure agreement examples & samples.

7. Wages or payroll

The salaries expense and payable of the employees in a company must also be kept private. Even timekeeping sheet and payslips must also remain private.

8. Income information

The income as well as the details of the income must of a company must not be disclosed to third parties especially if they do not have to do with the company or the company’s competitors.

9. Financial statement

The financial statement of a company contains several records of financial information, and the elements of a financial statement are presented in the next section.

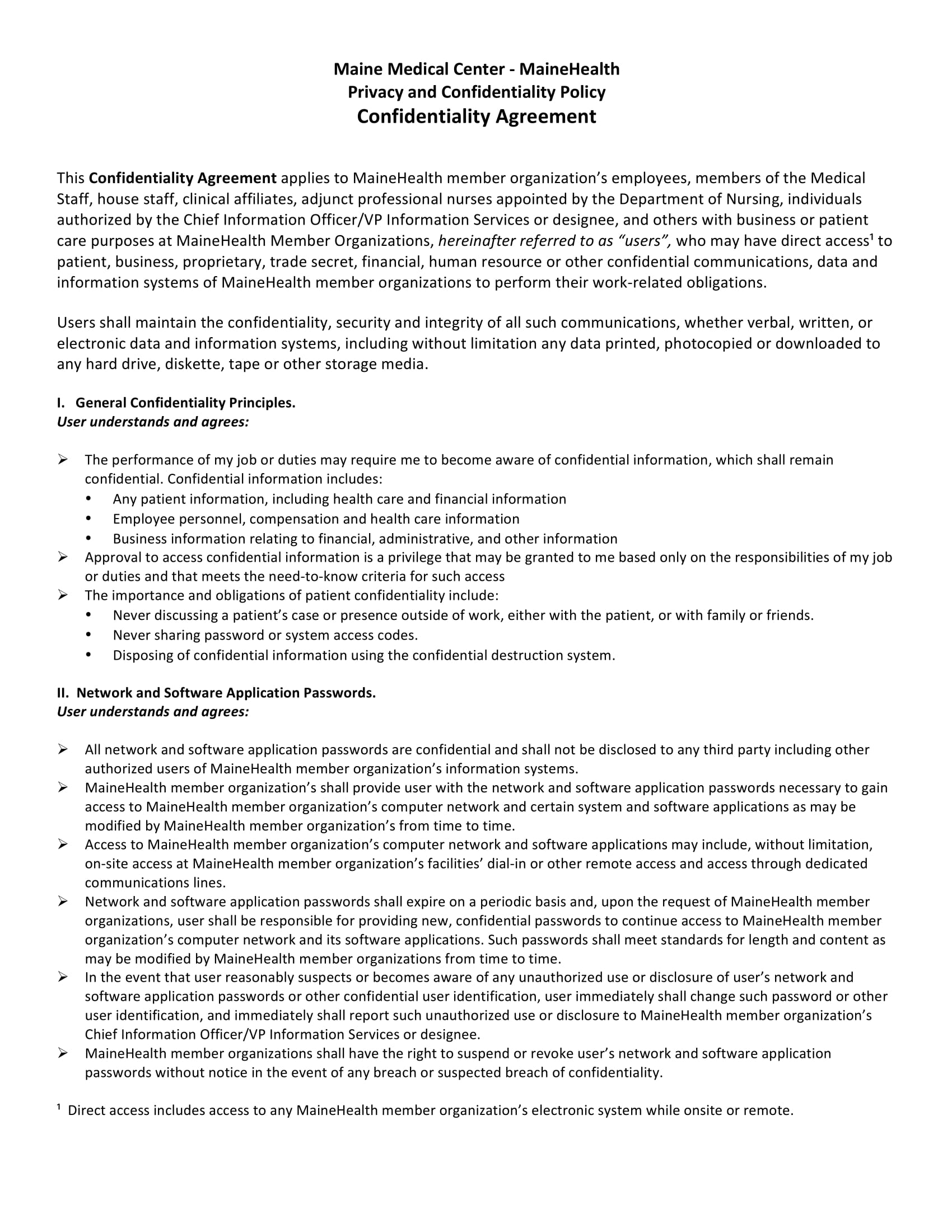

Maine Medical Center Financial Confidentiality Agreement Example

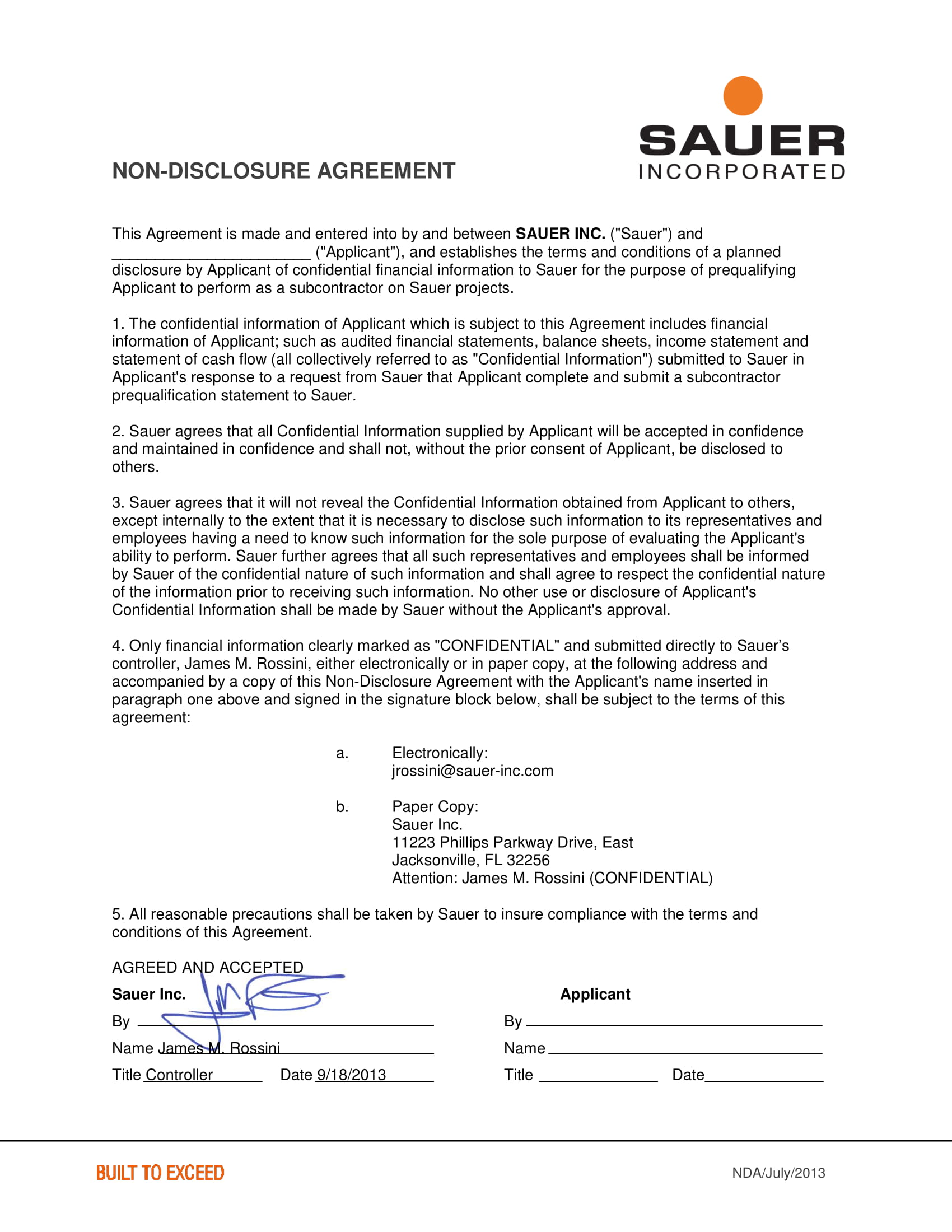

One-Page Financial Confidentiality Agreement Example

Elements of a Financial Statement

A financial statement is composed of balance sheet or statement of financial position, income statement or statement of profit or loss and other comprehensive income, simple statement of changes in equity, statement of cash flows, and notes to financial statement. These are important information as regards the financial aspect of a company. These are composed of the following elements:

1. Assets

These pertains to the economic resource of an entity that has probable future economic benefits and is obtained or controlled by the entity as a result of a past transaction or events. Assets are categorized as current and non-current asset. Current assets are those that are held by the entity for the purpose of trading and is expected to be realized within the entity’s normal operating cycle. All other assets are non-current assets. You may also see teacher confidentiality agreement examples.

Examples of assets are cash, inventory, investment property, financial assets, and trade receivables.

2. Liabilities

These refers to the obligations of an entity and are probable future sacrifices of economic benefits by transferring assets or providing services to other entities. Liabilities are also categorized as current and non-current liabilities. Current liabilities are those that are held for the purpose of trading and is expected to be settled within the entity’s normal operating cycle. All other liabilities are non-current. You may also like basic non-disclosure agreement examples.

Examples of liabilities are financial liabilities, trade and other payables, current tax liabilities, and provisions.

3. Equity

In essence, equity is the residual value when the assets are being deducted by the liabilities. This is usually composed of share capital such as common stock and preferred stock, capital surplus, retained earnings, treasury stock, stock options, and reserves. Alternatively, this can also refer to the capital stock of a company in which the value would depend on the entity’s future economic prospects. You may also check out patient confidentiality agreement examples.

4. Investments by Owners

This represents the entity’s issuance of ownership shares of stocks in exchange for cash. These investments increase the company’s equity resulting from transfers of resources in exchange for ownership interest.

5. Distributions to Owners

This refers to the resources that have been distributed to the owners such as a cash dividend that is paid by the company to its shareholders. This would decrease the equity since the resources from the equity of an entity is transferred to the shareholders or the owners of the business. You might be interested in HIPAA confidentiality agreement examples.

6. Revenues

Generally, revenues are inflows of assets or settlements of liabilities resulting from providing goods or rendering services to customers. This pertains to the profit of an entity from its normal operations. On the other hand, if the sale is not from their normal operation, this can be recognized as gain. You may also see real estate confidentiality agreement examples.

Examples of revenues are sales, service revenues, interest revenue, interest income, and fees earned.

7. Expenses

Expenses refer to the outflows of the economic resources of an entity or incurrence of liabilities from delivering goods or rendering services.

The common examples of expenses that are recognized in the financial statement are salaries and wages expense, utility expense such as water and electricity, cost of goods sold, administrative expense, finance cost, depreciation expense, impairment loss, interest expense, and tax expense. You may also like mutual confidentiality agreement examples.

8. Gains

As has been said above, gains are those increases in equity not resulting from the normal operation of the entity. They are from peripheral or incidental transactions of an entity.

For example, if a company manufacturing furniture would sell their delivery truck, the difference in the amount of sales in the truck and the book value of the truck will be recorded as gain from incidental transaction if the market value is greater than the book value. You may also check out non-compete agreement examples.

9. Losses

These represent the decrease in equity due to peripheral or incidental transactions of an entity and not from the normal operation of the entity.

Similarly, if a company manufacturing a furniture would sell their delivery truck and the book value of the truck is greater than the market value. Notice that both gains are losses are results from incidental transactions.

10. Comprehensive Income for a Certain Period

Last but not the least is the comprehensive income for a certain period. Comprehensive income does not equal net income. The difference lies in the treatment of certain changes in assets and liabilities that are not included in the determination of the net income. These items are recognized but they are reported collectively in a separate component of shareholder’s equity called accumulated other comprehensive income. You might be interested in license agreement examples.

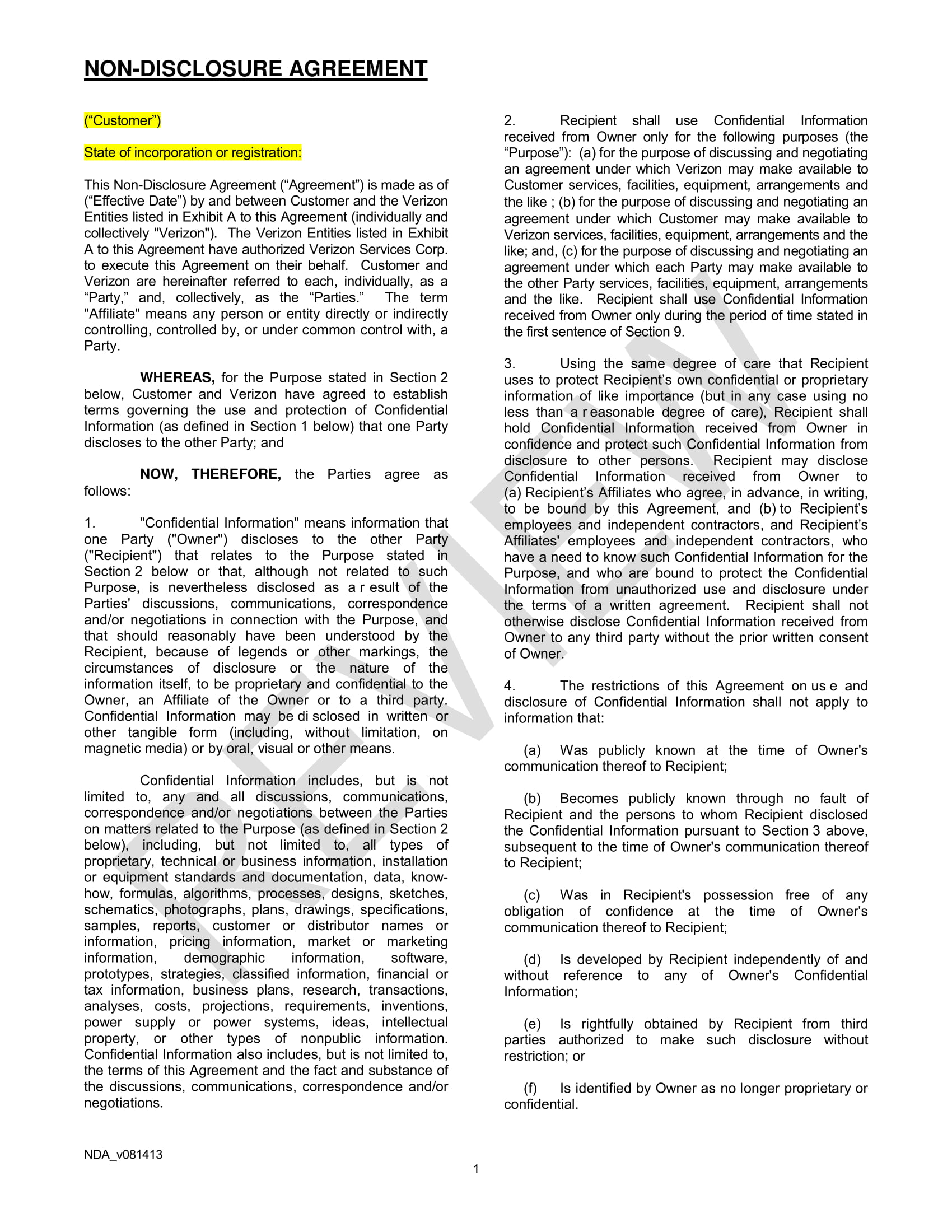

Standard Financial Confidentiality Agreement Example

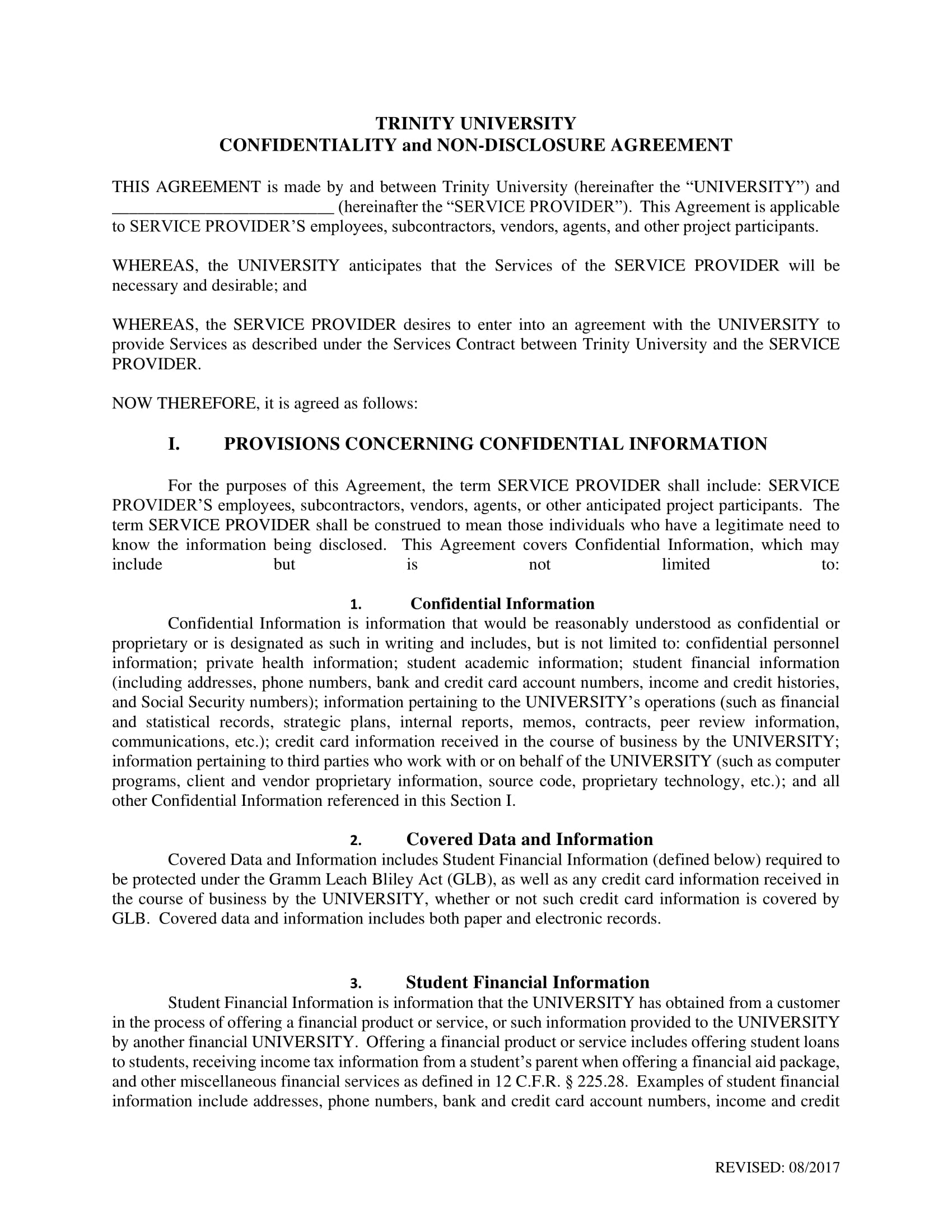

Trinity University Financial Confidentiality Agreement Example

Final Points

A company’s financial information and status must be kept confidential especially to parties not related to the entity as well as those who are not interested parties. However, there are certain cases where the financial information needs to be disclosed to a certain party. In order to protect the confidentiality of the financial information, a financial confidentiality agreement must be signed by the receiving party.

In any financial confidentiality agreement, it must consist of the following elements: introduction, the transaction, the definition of confidential information, non-disclosure agreement, return of confidential information, exclusions, term of the agreement, general provisions, and signatures.

You might include other important information for the completeness of your agreement, but the abovementioned elements would suffice and are commonly used by most entities.

Lastly, ensure to protect your files containing financial information through letting the contracted party sign a financial confidentiality agreement, the examples of which are presented in the previous section.

11+ Financial Confidentiality Agreement Examples to Download

Financial information of a certain company must be kept confidential especially from those people who are not a party to the entity and their competitors. The financial information of the company describes the company’s position as regards their financial status. This must only be disclosed to shareholders, investors, suppliers, and other interested parties. You may also see non-disclosure confidentiality agreement examples.

When we say interested parties, they are those that are affected by a situation or those that are hoping to make money out of the situation. However, in certain cases, such as in business acquisition, merger and consolidation, audit, and accounting analysis, you must disclose your company’s financial information. You may also like employee confidentiality agreement examples.

Financial Confidentiality Agreement Example

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Non-disclosure and Confidentiality Agreement

Details

File Format

Google Docs

MS Word

Pages

Size: A4, US

Bank Financial Confidentiality Agreement Example

chasebankkenya.co.ke

Details

File Format

PDF

Size: 126.6 KB

Brief Financial Confidentiality Agreement Example

nasdaqtrader.com

Details

File Format

PDF

Size: 26.1 KB

In order to protect those information, a financial confidentiality agreement is needed. This ensures that both parties involved in the agreement will comply to the terms of the general agreement and also to ensure that remedies are specified in case of breach of contract.Below are examples of financial confidentiality agreement that you might find useful.

Comprehensive Financial Confidentiality Agreement Example

cavell.co.nz

Details

File Format

PDF

Size: 117.5 KB

Elements in a Financial Confidentiality Agreement

A financial confidentiality agreement must contain the necessary information and stipulations of the said agreement. The following are the elements of a financial confidentiality agreement that are commonly present in the confidentiality agreement most companies.

1. Introduction

In the introduction section of the financial confidentiality agreement, the parties of the agreement must be stated, the disclosing party and the receiving party. The date of the agreement must also be included, which is usually the date when the receiving party sign the simple agreement.

2. The Transaction

This section presents the subject of the agreement. You must take note that the core of the commercial agreement must be stated in this section. The subject of the agreement is the transaction between the parties.

3. The Definition of Confidential Information

In this section, the information that must be kept confidential must be clearly defined. Take note that if you are providing documentations, you must clearly specify that the information is confidential.

4. Non-Disclosure Agreement

You must state in this section that the confidential information must be kept confidential and should not be disclosed to third parties especially without you or your company’s consent.

5. Return of Confidential Information

This section must clearly state that the confidential information must be returned or destroyed after a certain period. The period is usually 30 days, but this is subject to change according to your preference.

6. Exclusions

This clause presents all information that are not covered by the financial confidentiality agreement. The exclusions are based on court decisions which states that there are certain types of information that do not qualify as a confidential information. You may also see staff confidentiality agreement examples.

7. Term of the Agreement

In this section, the term of the agreement must be specified. The term is the length of time that the agreement will take effect. The agreement should last as long as the confidential information is likely to remain a trade secret.

8. General Provisions

Sometimes referred to as boilerplate, general provisions are miscellaneous provisions that are grouped together at the end of the agreement. Some of the common general provisions are as follows:

Relationships – Usually, confidentiality agreement would include this provision, disclaiming any relationship other than that defined in the standard confidentiality agreement.

Severability – This provision states that if you wind up in a lawsuit and the court rules that a part of the agreement is not valid, that certain part can be cut out, and the rest of the simple agreement will remain valid.

Integration – In this provision, it is verified that the version of the confidentiality information that you are signing is the final version and the past statement must not be relied on.

Waiver – This clause states that if you will not promptly complain about a violation that you might find in the agreement, you can still complain about it later. You may also see HIPAA confidentiality agreement examples.

Injunctive relief – This is a provision that states that if someone, a receiving party of the agreement, has violated the terms in the confidentiality agreement, a court order may be used to stop a person from using your confidential information.

Legal fees – Whenever a party files for a lawsuit, there are legal fees involved. In your agreement, you must specify who will be charged for the legal fees incurred relating to the suit filed. You may also like mutual confidentiality agreement examples.

Governing law – This provision will determine the state law that must govern the agreement.

Jurisdictions – This is to get the parties of the agreement to consent to jurisdiction in one county or state and to give up the right to sue or be sued anywhere else.

Successors and assigns – In this provision, it must state the successors and assigns that will be binded in this basic agreement.

9. Signatures

The agreement must be signed by someone with the necessary authority in behalf of the parties mentioned in the agreement. There must be two copies signed and must keep the other one for himself or herself.

Detailed Financial Confidentiality Agreement Example

nondisclosureagreement.com

Details

File Format

PDF

Size: 122.5 KB

Howard University Financial Confidentiality Agreement Example

howard.edu

Details

File Format

PDF

Size: 72.7 KB

Lengthy Financial Confidentiality Agreement Example

nbfm.ca

Details

File Format

PDF

Size: 248.5 KB

Financial Information Which Must Be Kept Confidential

1. Bank records

These pertain to documents or evidence of transactions that you have with a certain bank. This must be kept confidential as this might provide the amount you have in a certain bank or your interests and debts. You may also see medical confidentiality agreement examples.

2. Tax records

These are the tax expenses or payable by the company. The amount of tax of a certain company must among the classified information to be kept confidential.

3. Sales revenues

The revenue of an entity, usually presented in the general statement of comprehensive income, must only be disclosed to related parties or those parties who have business with the company.

4. Forecasts

These refer to an entity’s forecast with regard to their sales or expenses for a certain period based on their past and current performance.

5. Accounting records

These contain the transaction of the company with the clients or customers or the transactions with the suppliers and investors.

6. Investment holdings

These record the investment provided by the investors. This includes a record of the names of the investors as well as the amount of the investment. This must be kept confidential to protect the information of the investors. You may also like non-disclosure agreement examples & samples.

7. Wages or payroll

The salaries expense and payable of the employees in a company must also be kept private. Even timekeeping sheet and payslips must also remain private.

8. Income information

The income as well as the details of the income must of a company must not be disclosed to third parties especially if they do not have to do with the company or the company’s competitors.

9. Financial statement

The financial statement of a company contains several records of financial information, and the elements of a financial statement are presented in the next section.

Maine Medical Center Financial Confidentiality Agreement Example

mainehealth.org

Details

File Format

PDF

Size: 84.9 KB

One-Page Financial Confidentiality Agreement Example

sauer-inc.com

Details

File Format

PDF

Size: 166.3 KB

Elements of a Financial Statement

A financial statement is composed of balance sheet or statement of financial position, income statement or statement of profit or loss and other comprehensive income, simple statement of changes in equity, statement of cash flows, and notes to financial statement. These are important information as regards the financial aspect of a company. These are composed of the following elements:

1. Assets

These pertains to the economic resource of an entity that has probable future economic benefits and is obtained or controlled by the entity as a result of a past transaction or events. Assets are categorized as current and non-current asset. Current assets are those that are held by the entity for the purpose of trading and is expected to be realized within the entity’s normal operating cycle. All other assets are non-current assets. You may also see teacher confidentiality agreement examples.

Examples of assets are cash, inventory, investment property, financial assets, and trade receivables.

2. Liabilities

These refers to the obligations of an entity and are probable future sacrifices of economic benefits by transferring assets or providing services to other entities. Liabilities are also categorized as current and non-current liabilities. Current liabilities are those that are held for the purpose of trading and is expected to be settled within the entity’s normal operating cycle. All other liabilities are non-current. You may also like basic non-disclosure agreement examples.

Examples of liabilities are financial liabilities, trade and other payables, current tax liabilities, and provisions.

3. Equity

In essence, equity is the residual value when the assets are being deducted by the liabilities. This is usually composed of share capital such as common stock and preferred stock, capital surplus, retained earnings, treasury stock, stock options, and reserves. Alternatively, this can also refer to the capital stock of a company in which the value would depend on the entity’s future economic prospects. You may also check out patient confidentiality agreement examples.

4. Investments by Owners

This represents the entity’s issuance of ownership shares of stocks in exchange for cash. These investments increase the company’s equity resulting from transfers of resources in exchange for ownership interest.

5. Distributions to Owners

This refers to the resources that have been distributed to the owners such as a cash dividend that is paid by the company to its shareholders. This would decrease the equity since the resources from the equity of an entity is transferred to the shareholders or the owners of the business. You might be interested in HIPAA confidentiality agreement examples.

6. Revenues

Generally, revenues are inflows of assets or settlements of liabilities resulting from providing goods or rendering services to customers. This pertains to the profit of an entity from its normal operations. On the other hand, if the sale is not from their normal operation, this can be recognized as gain. You may also see real estate confidentiality agreement examples.

Examples of revenues are sales, service revenues, interest revenue, interest income, and fees earned.

7. Expenses

Expenses refer to the outflows of the economic resources of an entity or incurrence of liabilities from delivering goods or rendering services.

The common examples of expenses that are recognized in the financial statement are salaries and wages expense, utility expense such as water and electricity, cost of goods sold, administrative expense, finance cost, depreciation expense, impairment loss, interest expense, and tax expense. You may also like mutual confidentiality agreement examples.

8. Gains

As has been said above, gains are those increases in equity not resulting from the normal operation of the entity. They are from peripheral or incidental transactions of an entity.

For example, if a company manufacturing furniture would sell their delivery truck, the difference in the amount of sales in the truck and the book value of the truck will be recorded as gain from incidental transaction if the market value is greater than the book value. You may also check out non-compete agreement examples.

9. Losses

These represent the decrease in equity due to peripheral or incidental transactions of an entity and not from the normal operation of the entity.

Similarly, if a company manufacturing a furniture would sell their delivery truck and the book value of the truck is greater than the market value. Notice that both gains are losses are results from incidental transactions.

10. Comprehensive Income for a Certain Period

Last but not the least is the comprehensive income for a certain period. Comprehensive income does not equal net income. The difference lies in the treatment of certain changes in assets and liabilities that are not included in the determination of the net income. These items are recognized but they are reported collectively in a separate component of shareholder’s equity called accumulated other comprehensive income. You might be interested in license agreement examples.

Standard Financial Confidentiality Agreement Example

verizon.com

Details

File Format

PDF

Size: 131.1 KB

Trinity University Financial Confidentiality Agreement Example

inside.trinity.edu

Details

File Format

PDF

Size: 193.8 KB

Final Points

A company’s financial information and status must be kept confidential especially to parties not related to the entity as well as those who are not interested parties. However, there are certain cases where the financial information needs to be disclosed to a certain party. In order to protect the confidentiality of the financial information, a financial confidentiality agreement must be signed by the receiving party.

In any financial confidentiality agreement, it must consist of the following elements: introduction, the transaction, the definition of confidential information, non-disclosure agreement, return of confidential information, exclusions, term of the agreement, general provisions, and signatures.

You might include other important information for the completeness of your agreement, but the abovementioned elements would suffice and are commonly used by most entities.

Lastly, ensure to protect your files containing financial information through letting the contracted party sign a financial confidentiality agreement, the examples of which are presented in the previous section.