10+ Financial Market Analysis Examples to Download

A financial market analysis deals with the analysis of the trade, transactions, securities, stocks, etc. of financial market. The analysis is done observing the performance of the market that depends on the marketing of the different securities in a financial session. The performance of the market is decided as good or bad observing the price of its securities on the higher side or the lower side at the time the market closes. The measurement of the price movement and fluctuation is done by the index that shows every second ratio of the securities.

10+ Financial Market Analysis Examples

1. Big Data Analytics of Financial Market

2. Trading and Financial Market Analysis

3. Analysis of Financial Markets Example

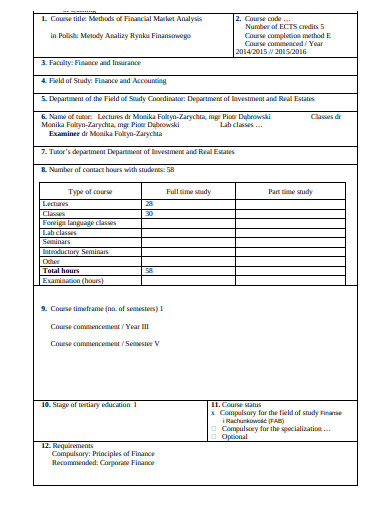

4. Methods of Financial Market Analysis

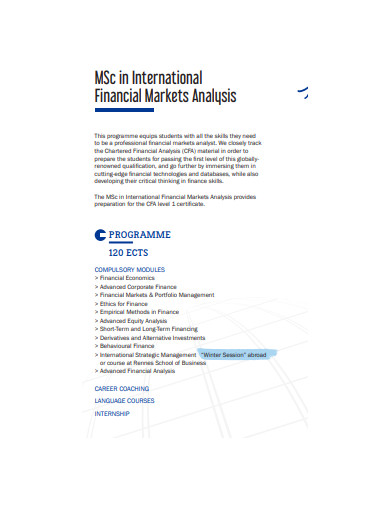

5. International Financial Market Analysis

6. Financial Markets Research in Marketing

7. Fin Techs and Market of Financial Analysis

8. Recent Financial Crisis and Market Efficiency

9. Financial Market Global Analysis Report

10. Financial Market Ratio Analysis

11. Advanced Economics and Financial Analysis

What does Securities mean in a Financial Market?

Security or securities in a financial market refers to certificates or other instruments that retain some capitalistic value and can be traded in the financial market. Securities are normally the stocks or the bonds or any expensive metal. They are classified as equity securities by which the traders derive capital to run their firm and its different operations. An authority and regulatory body had been established in the U.S. as the Securities and Exchange Commission (SEC). It has been assigned the job to monitor the different activities of securities in the market, security transactions, mutual fund trading, etc. to avoid any sort of fraud or deception.

What does Financial Market Function?

A financial market is a platform that lets the companies and organisation showcase their performance and get potential investors for their new venture. Stocks and bonds are the topmost of all the other market securities to do the trade with. Apart from this, there are different other markets and stocks to invest in and do the business. A financial market is open to the public and the price movement of the stocks, securities, and shares is also transparent and can be seen vividly in the index. The index reflects the exact, second to second, updates of the stocks and security’s position in the market.

What are the Different Types of Financial markets?

For the trading purpose and in the practice the term finance market refers to the trading platform in which one can raise capital and derive profit. The term is often in use because it accommodates the different types of markets in its frame. These markets can be classified into different categories based on their function and characteristics.

1. Capital Market

This market itself adds two more small categorisation within it, the stock market and the bond market. The capital market is a long-term trade with long-term investment in it. In the stock market, the traders or the corporation heads try to attract potential investors showing them the past performances of the firm. In return for the investment, the investors receive stocks or shares ownership from the corporation. Whereas the bond market issues bonds for selling it to the investors and the derived amount is used for the other business operations. The stock market and bond market never go to each side on the same side they are always placed in the opposite ends in the index. There are different types of bonds too like corporate, municipal, or Treasury bond and all these provide some liabilities.

2. Commodity Market

In the commodity market the traders buy and exchange natural resources. A large number of investors show their interest to invest in such resources as its prices are so volatile not always in large quantities though. The rise in price of each commodity, gradually, gives rise to the price of other resources. Many traders can not be wrong with their guesses simultaneously in the commodity market as it has impacts the overall volatility and the economy of the country had to suffer. Some of the most important commodity is Gold and Oil.

3. Derivation Market

The value of the financial products in the derivation market is often based on its underlined assets. It might get complicated also at times hedge funds and sophisticated investors invest in the instruments to manage the financial risks in this market.

4. Money Market

Money market is known for giving funds and lending capital as debts to the traders for a short period. The period of investments or funding in the money market is often less than a year.

5. Futures or Future Market

I this market the funds are provided by the investors to support the standardised futures contracts that allow trading in any future dates. This also includes the practice of buying and selling but a pre-specified time and price of a pre-specified commodity.

6. Foreign Exchange Market

This marketing adds the practices of foreign exchange like the trading of currencies. It determines the exchange rate of every currency in every country. It also includes the practice of buying and selling as the export and import of the products.

7. Crypto Currency Market

This market facilitates trade with virtual currency or digital assets. The usage of such currency for trade purposes is not legal in many nations and different nations suggest to adopt an alternative for it.