33+ Financial Report Examples to Download

Have you ever wondered just how big companies like Apple, Netflix, Sony, and Nintendo handle their finances? Well, if you ever get your hands on the Sony financial report or the Nintendo financial report, then all your questions are bound to be answered. Just like those companies, even smaller and less established ones started by common people will have others asking about their finances. It’s for that reason that financial reports are so important. If you want to learn more, get a financial report template, or just browse through the financial report example we have, then proceed to scroll on!

33+ Financial Report Examples

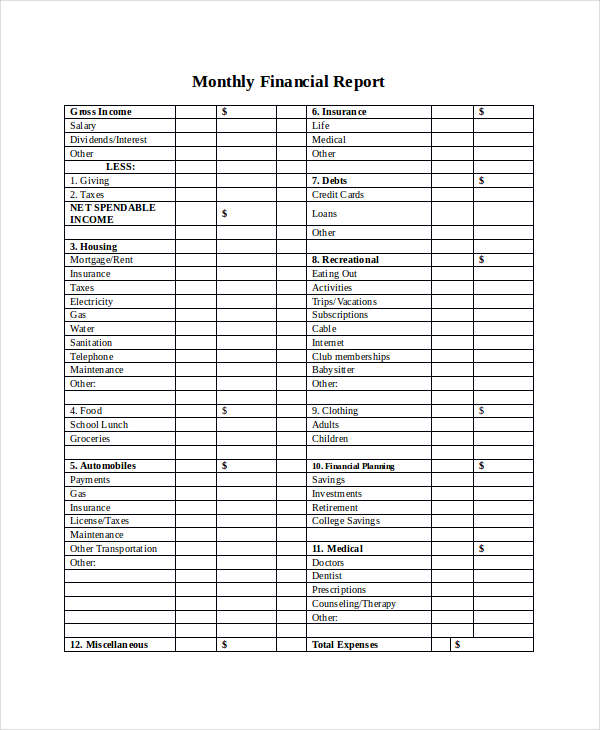

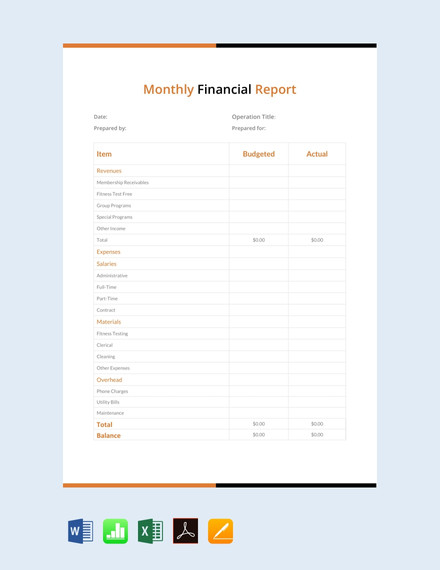

Monthly Financial Report Template

Church Financial Report Template

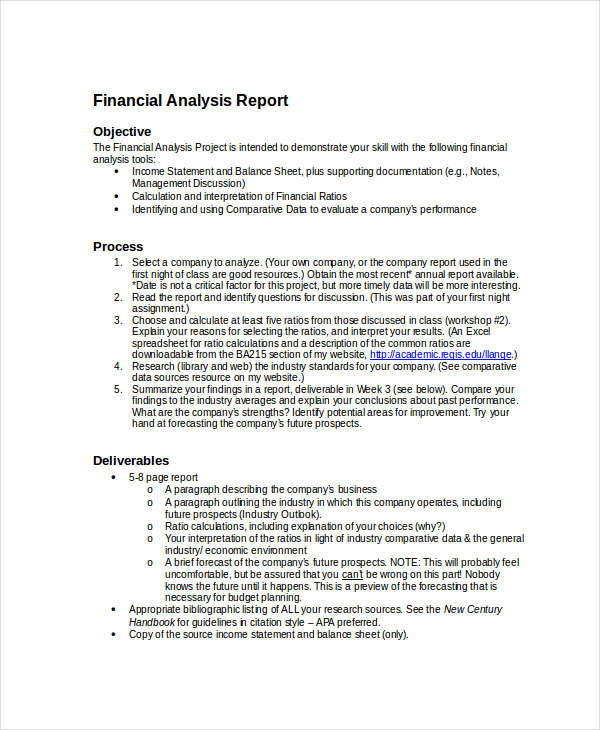

Financial Analysis Report Template

Financial Report Sample for Small Business Template

Annual Financial Report Template

Treasurer Financial Report Template

Monthly Financial Management Report Template

Financial Audit Report Template

Financial Report Template

Sample Financial Report Template

Annual Financial Report Template

Free Financial Report Template

Monthly Financial Report Template

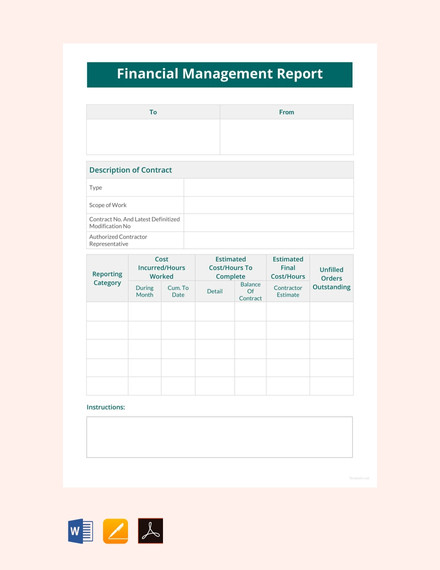

Financial Management Report Template

Financial Report To Board of Directors Template

Agency Financial Report Template

Sample Financial Report Template

Simple Financial Report Template

Financial Reporting Gantt Chart Template

Financial Reporting Manager Resume Template

Free Financial Reporting Manager Job Description Template

Monthly Financial Report

Financial Analysis

Financial Stability Report

Financial Due Diligence

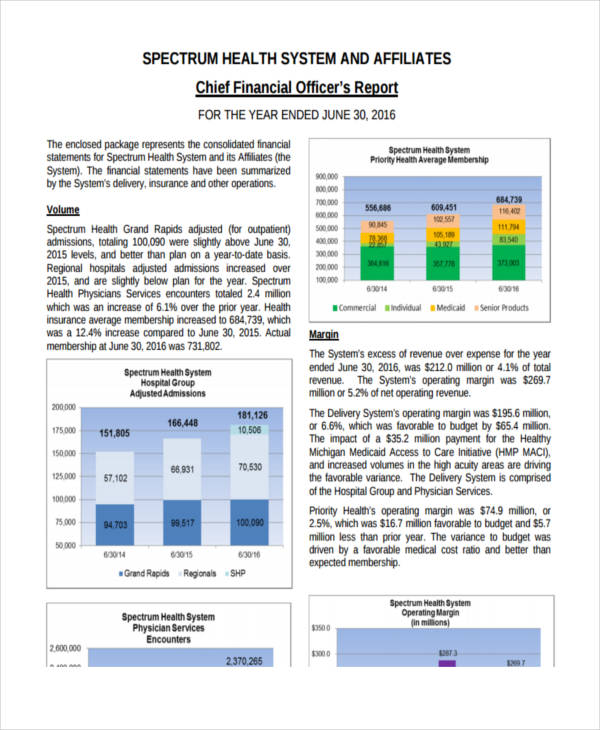

Health Report

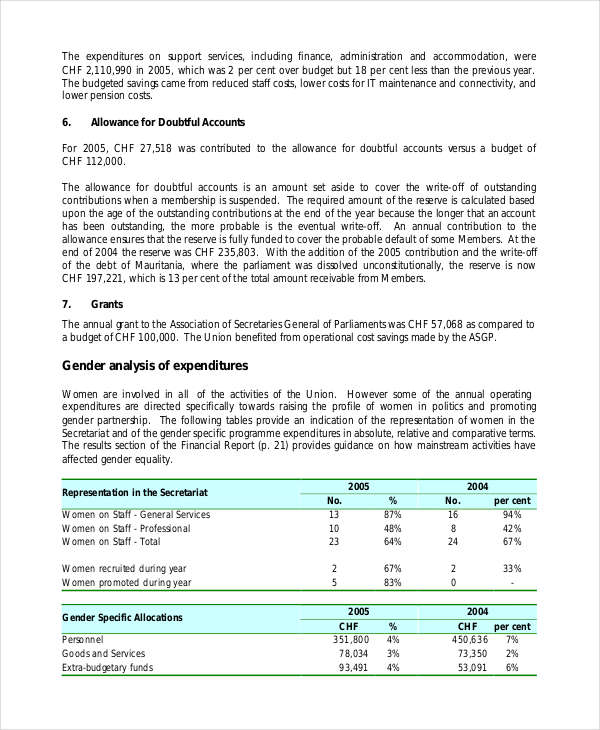

Financial Audit Report Example

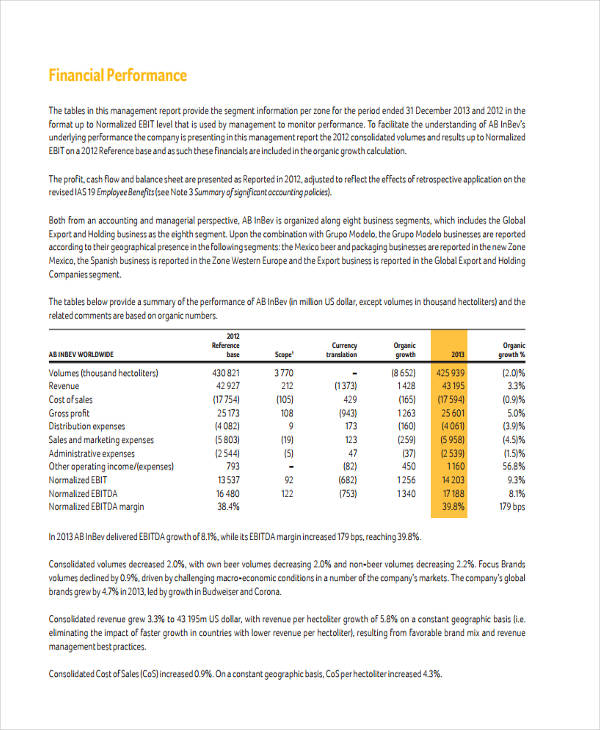

Business Financial Report

Financial Credit Report

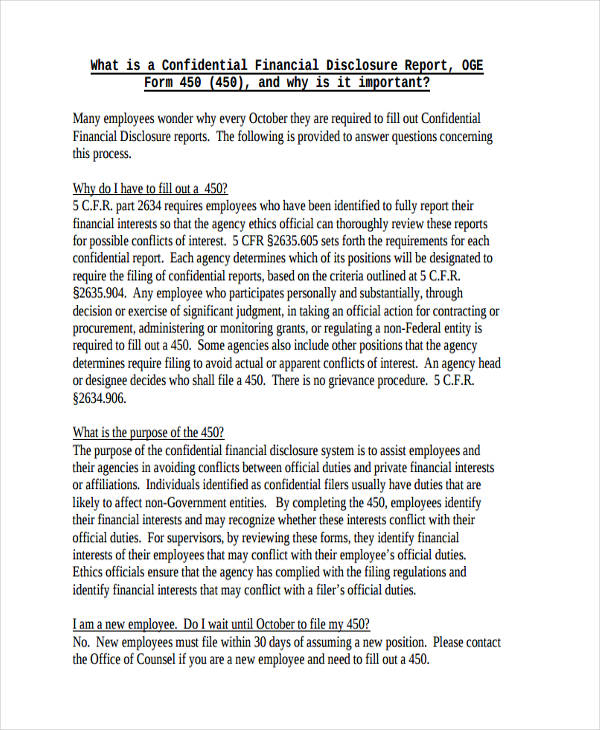

Confidential Financial Disclosure Report

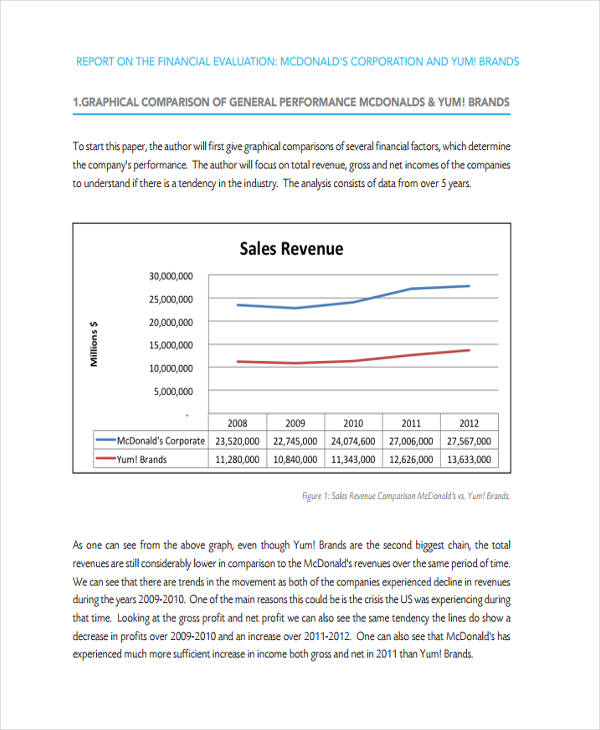

Financial Evaluation

Intelligence Report

Financial Planning Report

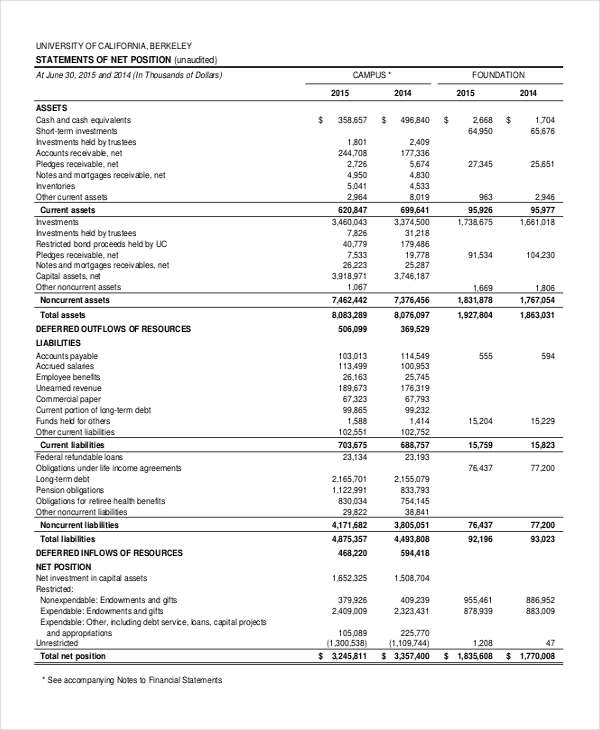

What Is a Financial Report?

A financial report is a document that contains all the relevant financial information of a person, business, or any entity. Its information also spans over specific periods, which is why variations like a weekly financial report and an annual financial report, among others, are common. Regarding its purpose, financial reports serve as foundations for making decisions that concern the overall strategies of the business. Besides that, the information provided is also meant for stakeholders and investors of the company, to assure them of the business’ financial health and the security of their investments.

How to Prepare Financial Reports

Those in business school or accounting courses learn how to prepare financial reports early on. Others learn through necessity, as their business may not have the right staff yet to prepare their company financial report for them. Regardless of your situation, learning how to prepare financial reports is an undeniably useful skill. As easy as it is to download a monthly financial report template, for example, following these steps will be even more invigorating and interesting.

Step 1: Determine the Time Frame

You can’t just prepare any financial report without knowing how long it’s going to cover. Remember, some reports have content that spans a day, while others prefer weekly, monthly, bi-annual, or even annual reports. Before you really get started, decide on what the time frame will be.

Step 2: Pour Over Your Ledgers

If you’ve been in business for some time, then you’re likely to have a lot to work with. As you look through your ledgers in search of data to present, be sure everything you want to include is accurate. Be as detail-oriented as possible.

Step 3: Prepare the Specific Reports

Financial reports tend to take different forms, depending on what specific needs you have. There are balance sheets to prepare, for example. And then you’ve got your income statement, your statement of cash flows, and even your statement of owner’s equity.

Step 4: Prepare Your Financial Statement

After completing reports, the next thing you need to prepare would be your financial statements. These are highly significant to your overall efforts since these also contain all the important information that needs to be present.

FAQs

What are the key components of a financial report?

The following are the key components of a financial report: you’ve got the balance sheet (or statement of financial position), the income statement, the cash flow statement, and then your statement of changes in owners’ or stockholders’ equity.

What are the specific uses of a financial report?

One, it is used to reveal specific business transaction details. It is also used to identify potential matters that are impacting a company’s profitability. Then you’ve got uses such as showing the position of a business and evaluating if a company can pay off its debts.

What do banks analyze in financial statements?

Banks commonly check the profit and loss statement and balance sheet. They then analyze the ratio between liabilities and equity in order to determine if a company can handle its current and/or future debt obligations.

As you now know, there’s no use understating or underestimating how important a financial report can be. You need to be aware of what it does for your company to fully appreciate all the sums and figures it contains. Now that you are better educated about this business document, what will you do now? Will you continue to speculate on the ongoings of huge companies, focus on your own finances, or be content to sit with this new information? Regardless of your choice, be assured that you’ve got what it takes to succeed, so act boldly today!