25+ Fixed Assets Examples to Download

Fixed assets are long-term tangible assets used in business operations, such as machinery, buildings, and equipment. Managing fixed assets involves creating a Depreciation Schedule to systematically allocate the cost over time, maintaining an Asset Inventory for tracking, and ensuring proper Asset Allocation for optimal usage and efficiency. Understanding these aspects is crucial for accurate financial reporting and effective asset management.

What are Fixed Assets?

A fixed asset is a long-term tangible asset used in business operations, such as buildings, machinery, and equipment. Unlike Inventory Assets, fixed assets are not intended for sale but for productive use. Proper management of these Assets is essential for accurate financial reporting and operational efficiency.

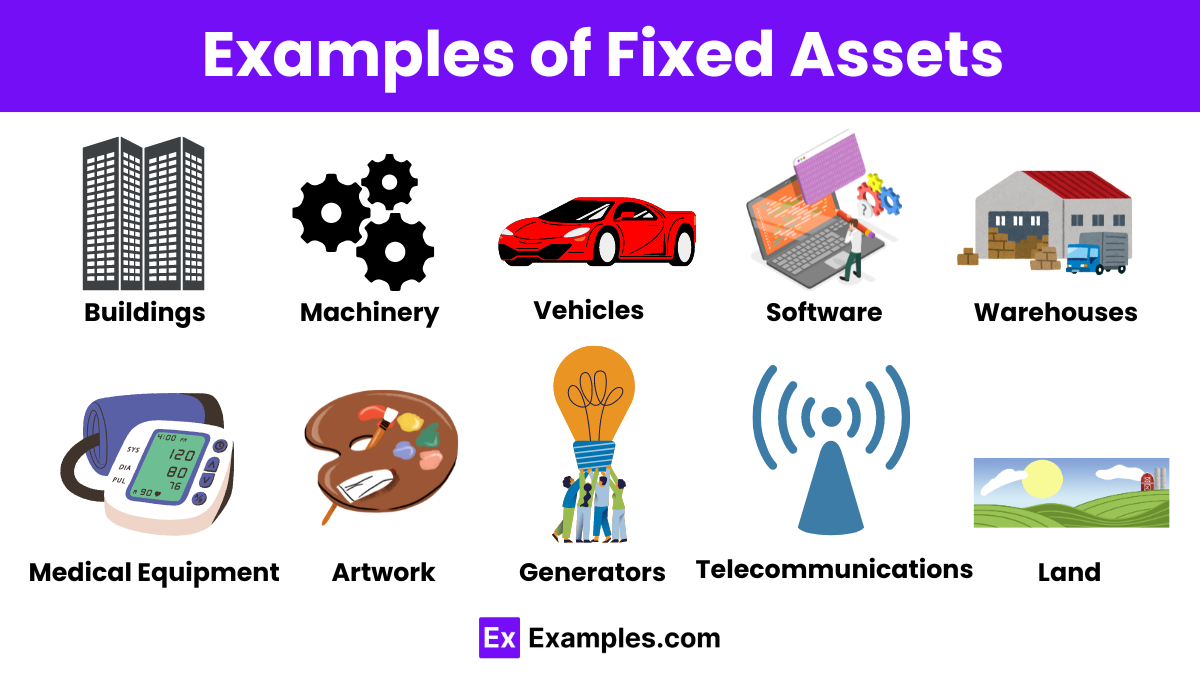

Examples of Fixed Assets

- Buildings: Structures owned by a company for business operations.

- Machinery: Equipment used in manufacturing or production processes.

- Vehicles: Company-owned cars, trucks, and vans used for business purposes.

- Office Furniture: Desks, chairs, and cabinets used in office environments.

- Computers: Laptops and desktops used for business operations.

- Land: Property owned by a business for its facilities or future development.

- Production Equipment: Tools and machines used in creating products.

- Fixtures: Permanent installations like lighting and plumbing systems.

- Leasehold Improvements: Modifications made to rented property to suit business needs.

- Software: Purchased software used for business operations.

- Medical Equipment: Devices used in healthcare facilities for patient care.

- Retail Fixtures: Shelving and displays used in retail environments.

- Industrial Tools: Specialized tools used in industrial processes.

- Manufacturing Plants: Facilities used for producing goods.

- Telecommunications Equipment: Devices used for communication purposes.

- Laboratory Equipment: Tools and instruments used in research and development.

- Security Systems: Surveillance cameras and alarm systems installed on business premises.

- Warehouses: Storage facilities for inventory and goods.

- Construction Equipment: Machinery like bulldozers and cranes used in construction.

- HVAC Systems: Heating, ventilation, and air conditioning systems.

- Servers: Hardware used to host company data and applications.

- Generators: Equipment providing backup power to business facilities.

- Boats: Vessels used for business-related transport or services.

- Patents: Legal rights to inventions owned by the business.

- Artwork: Paintings and sculptures owned for decoration or investment purposes.

Types of Fixed Assets

1. Land

Land is property owned by a company for use in operations or as an investment. It does not depreciate over time and can appreciate in value based on market conditions. Examples include commercial plots and agricultural land.

2. Buildings

Buildings are structures used for business operations, such as office buildings and warehouses. They depreciate over time and include the physical building and any improvements made.

3. Machinery and Equipment

These are tangible assets used in the production process, like manufacturing machines and office equipment. They depreciate over time due to usage and technological advancements.

4. Vehicles

Vehicles owned by a company for business purposes include delivery trucks and company cars. These assets depreciate over time based on usage and mileage.

5. Furniture and Fixtures

Items used to furnish and equip business premises, such as desks and chairs, fall under this category. They depreciate over a longer useful life.

6. Leasehold Improvements

Improvements made to leased property by the tenant, like interior renovations, are leasehold improvements. They depreciate over the shorter of the useful life of the improvements or the lease term.

7. Land Improvements

Enhancements made to land to make it more usable, such as parking lots and landscaping, are considered land improvements. These depreciate over time but at a different rate than buildings.

Importance of Fixed Assets

Fixed assets are vital for operational efficiency, financial health, and providing tax benefits through depreciation. They represent a significant portion of a company’s total assets and are key to long-term profitability and sustainability.

How do companies use fixed assets?

Fixed assets are essential for the operational efficiency and financial health of a company. They support various business functions and play a crucial role in generating revenue. Here’s how companies use fixed assets:

1. Production and Manufacturing

- Machinery and Equipment: Companies use machinery and equipment to produce goods. For example, a factory uses assembly lines and automated machines to manufacture products efficiently.

- Land and Buildings: Factories and production plants are built on land and within buildings designed to house the necessary equipment and staff.

2. Operational Support

- Office Spaces: Buildings are used as office spaces where employees conduct administrative, sales, and marketing activities.

- Furniture and Fixtures: These assets provide a functional and comfortable working environment. Desks, chairs, and lighting fixtures are essential for day-to-day operations.

3. Transportation and Logistics

- Vehicles: Companies use vehicles for delivering products to customers, transporting raw materials, and facilitating employee travel. Delivery trucks, company cars, and forklifts are common examples.

- Land Improvements: Enhancements like parking lots and loading docks support logistics and transportation needs.

4. Enhancing Customer Experience

- Retail Spaces: Retail companies use buildings and leasehold improvements to create attractive and functional shopping environments.

- Leasehold Improvements: Custom fixtures, interior renovations, and specialized lighting enhance the customer experience and operational efficiency.

5. Research and Development

- Specialized Equipment: Companies invest in advanced machinery and technology for research and development purposes. These assets are critical for innovation and staying competitive in the market.

- Dedicated Facilities: R&D centers and laboratories are built to house these activities, requiring significant investment in land and buildings.

6. Asset Appreciation and Investment

- Land: While not used in daily operations, land can appreciate over time, providing long-term investment value. Companies may hold land for future development or sale.

- Strategic Locations: Acquiring land and buildings in strategic locations can enhance a company’s market presence and logistical efficiency.

7. Financial Stability and Leverage

- Collateral for Loans: Fixed assets can be used as collateral to secure loans and financing. This helps companies raise capital for expansion, innovation, and other strategic initiatives.

- Balance Sheet Strength: Fixed assets contribute to the overall value of a company’s balance sheet, reflecting financial stability and long-term viability.

Advantages of fixed assets

Fixed assets offer numerous benefits to businesses, contributing significantly to their operational efficiency and financial stability. Here are the key advantages of fixed assets:

1. Long-Term Investment

- Stability and Durability: Fixed assets, such as buildings and machinery, provide long-term value and are typically used over many years, making them stable investments.

- Appreciation Potential: Certain fixed assets, like land, can appreciate in value over time, providing potential financial gains.

2. Operational Efficiency

- Enhanced Production Capacity: Machinery and equipment increase production efficiency and output, allowing companies to meet market demand effectively.

- Improved Infrastructure: Well-maintained buildings and facilities provide a conducive environment for business operations, enhancing overall productivity.

3. Cost Control and Savings

- Depreciation Benefits: Companies can deduct depreciation expenses on fixed assets, reducing taxable income and improving cash flow.

- Reduced Operational Costs: Owning assets such as vehicles and equipment can lower rental and leasing costs, leading to long-term savings.

4. Financial Leverage

- Collateral for Loans: Fixed assets can be used as collateral to secure loans and other financing options, enabling companies to raise capital for expansion or other investments.

- Balance Sheet Strength: Fixed assets enhance a company’s Non Profit balance sheet, reflecting financial health and stability to investors and creditors.

5. Enhanced Business Operations

- Customized Assets: Ownership of fixed assets allows companies to customize and modify them according to specific operational needs, leading to improved efficiency.

- Control Over Operations: Having control over essential assets, such as machinery and office spaces, ensures uninterrupted business operations.

6. Tax Advantages

- Depreciation Deductions: Companies can benefit from tax deductions through depreciation, which spreads the cost of the asset over its useful life.

- Investment Tax Credits: In some cases, businesses can receive tax credits for investing in certain types of fixed assets, further reducing their tax burden.

7. Competitive Advantage

- Technological Advancements: Investing in modern machinery and equipment allows companies to stay ahead of competitors by adopting the latest technologies.

- Asset Quality: High-quality fixed assets can improve product quality, service delivery, and overall customer satisfaction, giving companies a competitive edge.

Disadvantages of fixed assets

Fixed assets are crucial for business operations, but they come with certain disadvantages that companies need to consider. These disadvantages can impact both financial stability and operational flexibility.

1. High Initial Cost

- Capital Intensive: Fixed assets require significant upfront investment, which can strain a company’s financial resources.

- Fundamentals in Finance: High initial costs can lead to increased borrowing, affecting a company’s debt-to-equity ratio and financial leverage.

2. Depreciation

- Value Decline: Fixed assets depreciate over time, leading to a gradual reduction in their book value.

- Accounting Impact: Depreciation must be accounted for in financial statements, impacting net income and potentially leading to lower profits over time.

3. Maintenance and Operating Costs

- Ongoing Expenses: Fixed assets require regular maintenance and repairs, leading to ongoing operational costs.

- Operational Burden: These costs can add up, affecting the overall profitability and efficiency of the company.

4. Lack of Liquidity

- Illiquid Nature: Fixed assets are not easily converted into cash, limiting a company’s ability to quickly raise funds.

- Financial Flexibility: This lack of liquidity can hinder a company’s ability to respond to immediate financial needs or opportunities.

5. Obsolescence

- Technological Advancements: Fixed assets, especially machinery and equipment, can become obsolete due to rapid technological changes.

- Replacement Costs: Replacing outdated assets can be costly and disrupt business operations.

6. Risk of Impairment

- Market Fluctuations: The value of fixed assets can be impaired due to market conditions, natural disasters, or changes in regulations.

- Financial Health: Impairment losses need to be recognized in financial statements, potentially affecting the company’s financial health and investor confidence.

7. Impact on Nonprofit Balance Sheet

- Asset Allocation: Nonprofit organizations may face challenges in balancing fixed assets with the need for liquid assets to fund ongoing programs and services.

- Fund Accounting: Nonprofits must ensure that the acquisition and maintenance of fixed assets align with donor restrictions and organizational goals.

8. Limited Mobility

- Geographic Constraints: Fixed assets like land and buildings are tied to specific locations, limiting a company’s ability to relocate or expand operations flexibly.

- Strategic Limitations: This immobility can constrain strategic decisions and adaptation to market changes.

Fixed Assets vs. Current Assets

| Criteria | Fixed Assets | Current Assets |

|---|---|---|

| Definition | Long-term resources used in operations | Short-term resources convertible to cash |

| Duration | More than one year | Within one year |

| Purpose | To generate revenue over the long term | To meet short-term financial obligations |

| Examples | Land, buildings, machinery, vehicles | Cash, inventory, accounts receivable |

| Depreciation | Yes (except land) | No |

| Liquidity | Low | High |

| Initial Cost | High | Varies |

| Maintenance Costs | High | Low |

| Accounting Treatment | Depreciated over useful life | Recorded at face value |

| Financial Statement | Recorded on the balance sheet as PP&E | Recorded on the balance sheet as current assets |

| Impact on Cash Flow | Long-term impact | Immediate impact |

| Risk of Obsolescence | High, especially for technology assets | Low |

| Examples in Nonprofits | Property, office equipment | Donations, grants, short-term investments |

Why are fixed assets important?

Fixed assets play a crucial role in the operations and financial health of a company. They provide long-term value and are essential for sustained business growth and operational efficiency. Here are the key reasons why fixed assets are important:

1. Operational Efficiency

- Support Production: Fixed assets like machinery and equipment are vital for the production of goods and services.

- Infrastructure: Buildings and facilities provide the necessary infrastructure for operations, housing employees, and storing products.

2. Revenue Generation

- Income Production: Fixed assets are used to generate income over time. For example, manufacturing equipment helps produce goods for sale.

- Long-term Investments: Land and buildings can appreciate in value, contributing to long-term financial stability.

3. Financial Stability

- Asset Base: Fixed assets form a significant part of a company’s asset base, providing a foundation for financial stability.

- Collateral for Loans: Fixed assets can be used as collateral to secure loans, enabling companies to access capital for expansion and operations.

4. Depreciation Benefits

- Tax Deductions: Depreciation of fixed assets provides tax benefits by reducing taxable income.

- Cost Allocation: Depreciation helps allocate the cost of an asset over its useful life, matching expenses with the revenue generated by the asset.

5. Strategic Advantage

- Competitive Edge: Ownership of advanced machinery, prime real estate, and modern facilities can provide a competitive advantage.

- Market Presence: Fixed assets in strategic locations enhance market presence and operational reach.

6. Operational Support

- Logistics and Transportation: Vehicles and land improvements support logistics and transportation needs, ensuring efficient delivery of goods and services.

- Employee Productivity: Well-maintained office spaces and equipment improve employee productivity and morale.

7. Long-term Planning

- Investment Security: Fixed assets represent long-term investments that contribute to the company’s growth strategy.

- Resource Allocation: Owning fixed assets allows for better planning and allocation of resources, supporting sustainable business practices.

8. Nonprofit Organizations

- Program Delivery: Nonprofits rely on fixed assets like buildings and equipment to deliver programs and services.

- Asset Management: Proper management of fixed assets ensures that nonprofits can continue to meet their mission objectives efficiently.

What is the life cycle of fixed assets?

1. Acquisition

- Planning: Identifying the need for the asset, assessing options, and planning the acquisition process.

- Purchase: Acquiring the asset by purchasing or leasing. This includes negotiating terms, arranging financing, and finalizing the purchase.

- Installation: Setting up the asset for use, which may involve transportation, installation, and initial testing.

2. Utilization

- Operational Use: The asset is deployed and used for its intended purpose in daily operations.

- Maintenance: Regular maintenance and repairs are conducted to ensure the asset remains functional and efficient. This includes scheduled servicing and addressing any unexpected issues and Finance Essentials for Business Success.

3. Depreciation

- Depreciation Accounting: The process of allocating the cost of the asset over its useful life. This involves calculating and recording annual depreciation expenses.

- Financial Reporting: Depreciation is recorded in financial statements, impacting net income and the value of assets on the balance sheet.

4. Upgrades and Improvements

- Enhancements: Upgrading or improving the asset to extend its useful life or increase its efficiency. This might include adding new features or enhancing existing ones.

- Capitalization: Costs of significant upgrades are capitalized, meaning they are added to the asset’s book value and depreciated over time.

5. Impairment

- Assessment: Periodically assessing the asset for impairment, which means determining if the asset’s market value has fallen below its book value.

- Impairment Loss: If impairment is identified, the asset’s book value is reduced to its recoverable amount, and an impairment loss is recorded in the financial statements.

6. Disposal

- Decision to Dispose: Determining when the asset has reached the end of its useful life or is no longer needed. This decision can be influenced by factors such as technological obsolescence, excessive repair costs, or changes in business strategy.

- Disposal Methods: The asset can be sold, scrapped, or donated. The disposal method chosen affects the financial and tax implications.

- Accounting for Disposal: Removing the asset from the books, recording any gain or loss on disposal, and adjusting the balance sheet accordingly.

What are fixed assets?

Fixed assets are long-term tangible assets used in business operations, such as buildings, machinery, and vehicles, not expected to be converted into cash within a year.

How are fixed assets different from current assets?

Fixed assets are used for long-term operations and depreciate over time, while current assets are short-term and easily converted to cash within a year.

Why are fixed assets important for a company?

Fixed assets provide essential infrastructure, support production, and generate long-term revenue, contributing to a company’s operational efficiency and financial stability.

How is the value of fixed assets calculated?

The value is calculated by adding the initial purchase cost and additional costs, then subtracting accumulated depreciation.

What is depreciation in the context of fixed assets?

Depreciation is the process of allocating the cost of a fixed asset over its useful life, reflecting its decrease in value over time.

Can fixed assets be used as collateral for loans?

Yes, fixed assets can be used as collateral to secure loans, providing financial leverage for the company.

What are examples of fixed assets?

Examples include land, buildings, machinery, vehicles, furniture, and fixtures used in business operations.

How do companies account for fixed assets?

Companies record fixed assets on the balance sheet and account for depreciation annually to reflect the asset’s decreasing value.

What is the impact of fixed assets on a nonprofit’s balance sheet?

Fixed assets represent long-term investments, impacting a nonprofit’s balance sheet by showing substantial asset holdings and affecting financial stability.

How do fixed assets contribute to operational efficiency?

Fixed assets like machinery and buildings are essential for producing goods, providing services, and housing employees, enhancing overall operational efficiency.