Fixed Expenses – Meaning, Defination, & Examples

Fixed expenses are recurring costs that remain constant regardless of the level of production or sales. These expenses include rent, salaries, insurance, and utilities, which do not fluctuate with business activity. In a manufacturing budget, fixed expenses cover the costs necessary to maintain operations, such as factory rent and equipment depreciation. An operating budget includes fixed expenses to ensure smooth day-to-day business functions. For small businesses, managing a small business budget involves tracking fixed expenses to maintain financial stability. Understanding and planning for fixed expenses is crucial for accurate financial forecasting and ensuring the business can cover its essential costs regardless of revenue fluctuations.

What is Fixed expenses

Fixed expenses are costs that remain constant regardless of business activity levels. These expenses include rent, salaries, insurance, and utilities, which do not vary with changes in production or sales volume. Fixed expenses are essential for budgeting as they ensure the business can meet its financial obligations consistently.

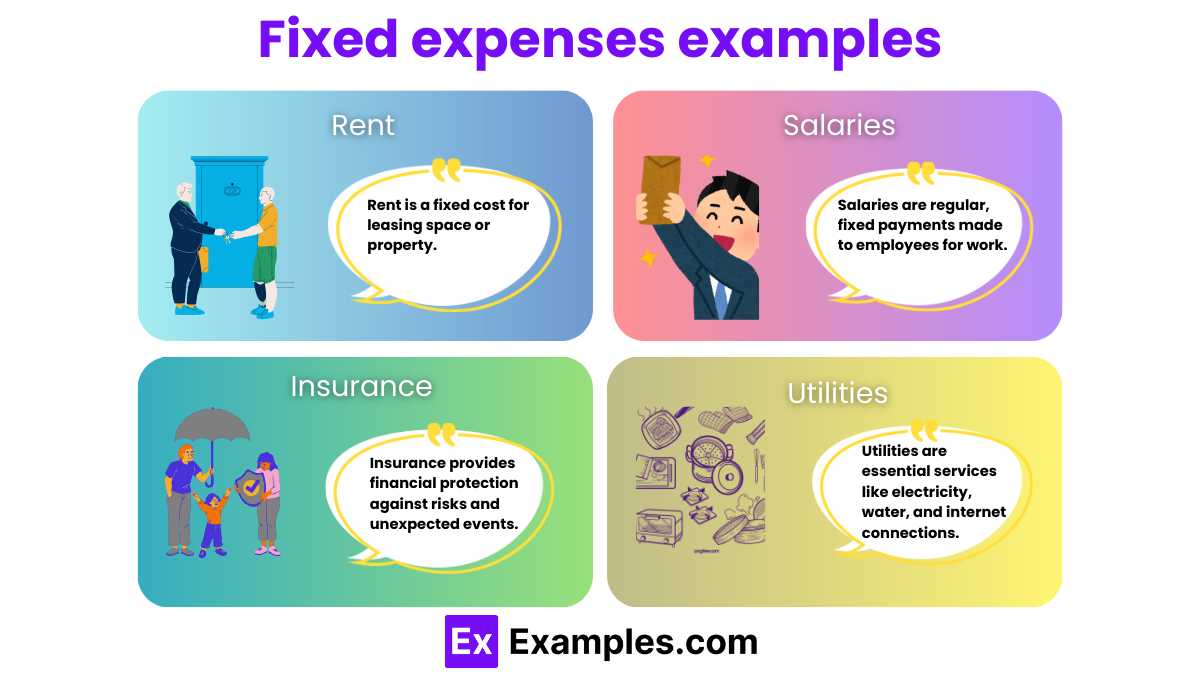

Fixed expenses examples

Rent: Rent is a fixed expense as it remains constant each month, regardless of business performance. It includes leasing costs for office spaces, warehouses, or retail locations.

Salaries: Salaries are fixed expenses paid to employees at regular intervals. This includes wages for administrative staff, managers, and permanent employees.

Insurance: Insurance premiums are fixed expenses that cover various policies, such as health, liability, and property insurance. These costs are consistent throughout the policy term.

Utilities: Utilities like electricity, water, and internet services are fixed expenses that do not vary significantly with business activity levels. These are essential for maintaining operations.

Fixed expenses vs variable expenses

Fixed Expenses

- Definition: Fixed expenses are costs that remain constant regardless of business activity levels.

- Examples: Rent, salaries, insurance, and utilities.

- Characteristics: Predictable and stable, essential for budgeting and financial planning.

- Impact: Do not fluctuate with production or sales volume, providing consistency in financial obligations.

Variable Expenses

- Definition: Variable expenses are costs that change directly with the level of production or sales.

- Examples: Raw materials, production supplies, shipping costs, and sales commissions.

- Characteristics: Fluctuate based on business activity, making them less predictable.

- Impact: Directly tied to business performance, increasing with higher production and sales and decreasing when business slows down.

Fixed and Variable Costs Examples

Fixed Costs Examples

- Rent: Monthly leasing cost for office, retail space, or warehouses.

- Salaries: Regular wages for administrative staff, managers, and permanent employees.

- Insurance: Premiums for health, liability, and property insurance policies.

- Utilities: Consistent costs for electricity, water, and internet services.

Variable Costs Examples

- Raw Materials: Costs for materials used in production, varying with output levels.

- Production Supplies: Expenses for supplies needed for manufacturing, fluctuating with production volume.

- Shipping Costs: Costs for delivering products to customers, varying with sales volume.

- Sales Commissions: Payments to sales personnel based on the number of sales made.

How to Budget for Fixed Expenses

Budgeting for fixed expenses involves identifying and listing all recurring costs on an expense sheet. Begin by detailing essential items like rent, salaries, insurance, and utilities, ensuring you account for every fixed cost. Utilizing an event cost analysis can help predict these expenses accurately, especially for small businesses or seasonal events. This method ensures that your budget covers all necessary outlays, maintaining financial stability. Consistently reviewing and updating your expense sheet allows you to adjust for any changes, providing a clear overview of your financial commitments and aiding in better financial planning.

Discretionary Expenses vs. Periodic Expenses

| Category | Discretionary Expenses | Periodic Expenses |

|---|---|---|

| Definition | Non-essential costs based on personal choice or preference. | Regularly occurring expenses that do not happen monthly but on a predictable schedule. |

| Examples | Entertainment, dining out, hobbies, vacations | Property taxes, car insurance, annual subscriptions |

| Characteristics | Flexible and can be adjusted or eliminated | Predictable but infrequent, requiring advance planning |

| Budgeting Strategy | Track and limit to save money or redirect funds | Set aside funds monthly to cover when due |

| Impact on Finances | Can be reduced or cut during financial constraints | Must be planned for to avoid financial shortfalls |

Fixed Expenses in Accounting

Fixed expenses in accounting are costs that remain consistent regardless of business activity levels. These include costs such as rent, salaries, insurance, and utilities. A Real Estate Expense Report often highlights these fixed costs, showcasing the regular expenses involved in maintaining properties. For businesses, accurately tracking fixed expenses is crucial for creating reliable budgets and financial forecasts. By including all fixed costs in accounting reports, businesses can ensure they allocate sufficient funds to meet these obligations consistently. Maintaining a comprehensive real estate expense report helps in managing property-related fixed expenses effectively, contributing to overall financial stability.

Fixed Expenses in Economics

Fixed expenses in economics are costs that do not change with the level of goods or services produced. These include rent, salaries, insurance, and utilities. Businesses must accurately track these costs using tools such as an expense-receipt to ensure all expenditures are recorded. Understanding fixed expenses is essential for economic planning and analysis, as these costs remain constant regardless of production levels. By effectively managing and documenting fixed expenses, businesses can maintain financial stability and make informed economic decisions, ensuring long-term sustainability.

Why are fixed expenses important in budgeting?

Fixed expenses provide predictability and stability, making it easier to plan and manage finances.

How do fixed expenses differ from variable expenses?

Fixed expenses remain constant, while variable expenses fluctuate with business activity levels.

What role do fixed expenses play in break-even analysis?

Fixed expenses must be covered by revenue before a business can start making a profit, making them crucial in break-even analysis.

Can fixed expenses affect cash flow?

Yes, since they are constant obligations, they can impact cash flow, especially if revenue is inconsistent.

How do fixed expenses relate to financial forecasting?

Accurate fixed expense tracking helps in making reliable financial forecasts.

Why are fixed expenses crucial in real estate expense reports?

They represent ongoing costs essential for property maintenance and operations.

What is an example of a fixed expense in manufacturing?

Factory rent is an example of a fixed expense in manufacturing.

How do businesses plan for fixed expenses?

By creating detailed budgets and tracking all fixed costs consistently.

Can fixed expenses be tax-deductible?

Yes, many fixed expenses, like rent and utilities, can be deductible for businesses.

What tools help track fixed expenses?

Expense reports, accounting software, and regular financial audits are useful tools.

Why is it important to distinguish between fixed and variable expenses?

Differentiating helps in budgeting, financial planning, and understanding cost behavior.