18+ Payroll Authorization Form Examples to Download

There are countless ways by which a Payroll Authorization Form can be utilized. It can be used to recruit, increase or decrease their salary, bring a change in the position of an employee and can be used to dismiss him from the job. These forms require the signature of authority from the said department. When this is done, this form is given to the finance department for approval. These forms are very important for the proper functioning of an organization.

The job record of a staff cannot be accepted or renovated without using these forms. While recruiting or re-recruiting a candidate, this form needs to be filled out by the concerned department. You may also like pay stub after going through this article.

Payroll Authorization Form Examples & Templates

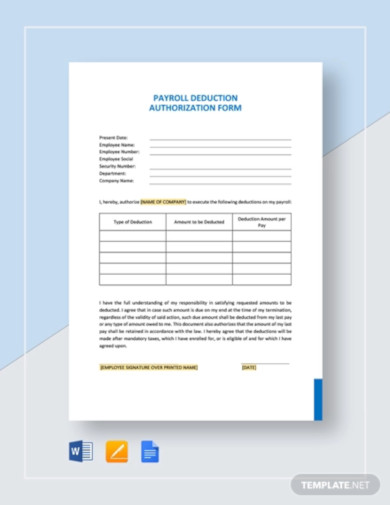

1. Payroll Deduction Authorization Form Template

When you are deducting an employee’s salary, there should be enough written explanation with it to assert the grounds for those deductions. This tailor made Payroll Deduction Authorization Form template can help you to create an authorization form for deduction made in the payroll deduction. The letter of authorization will give it a solid ground that the employee himself has consented in deducting an amount of money from his payroll. Moreover it is simple to edit, customized, adjusted according to the company’s needs.

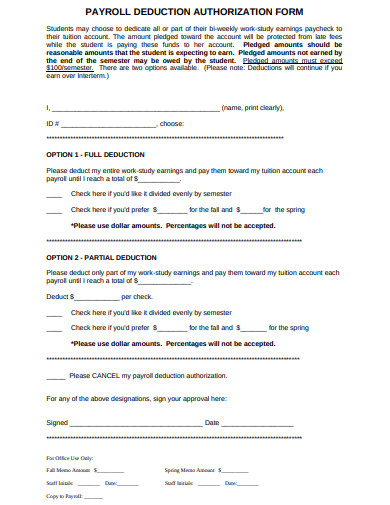

2. Payroll Deduction Authorization Form

Sometimes students pledge a certain amount that can be deducted from their earnings with their own consent. This is saved in their tuition account so that it can be used for later emergency use. This deduction form can be used for similar pledges for students.

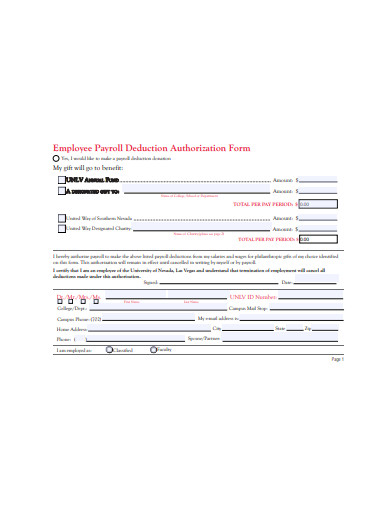

3. Employee Payroll Deduction Authorization Form

Charitable contributions are made by many and are a great gesture towards humanity. This example is one such contribution made through consented payroll deduction to UNLV Foundation to provide finance, health, education to the needy.

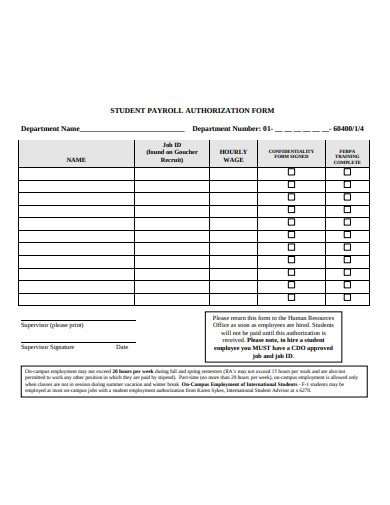

4. Student Payroll Authorization Form

This form can be readily used for authorizing the student payroll so that the students can get the pay for their part time work during their vacations.

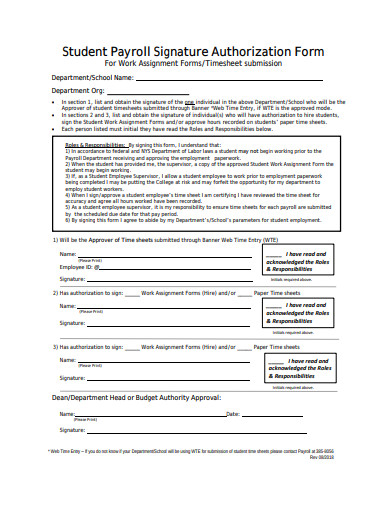

5. Student Payroll Signature Authorization Form

Before a student begins any work assignments or submits the timesheet, he has to furnish the signature authorization form for student payroll to the Payroll Department according to Labour Laws. This handy form can be used to do so.

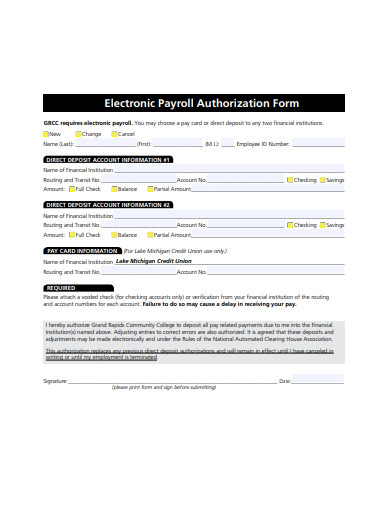

6. Electronic Payroll Authorization Form

This is another authorization format for payrolls that can be used by the student asking the college to transfer his pays to be deposited to different financial institutions electronically.

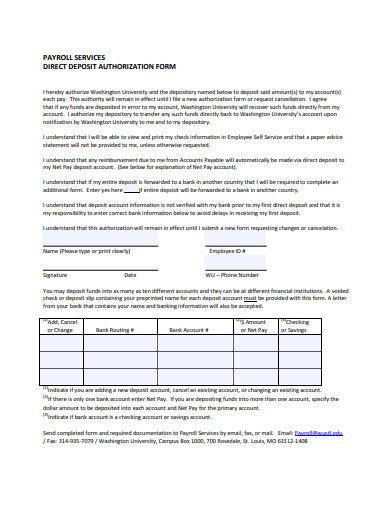

7. Payroll Direct Deposit Authorization Form

Washington University and a depository have received an authorization from the client to carry out financial transactions on behalf of the signatory. This undertaking has all the rules and regulations required to be followed.

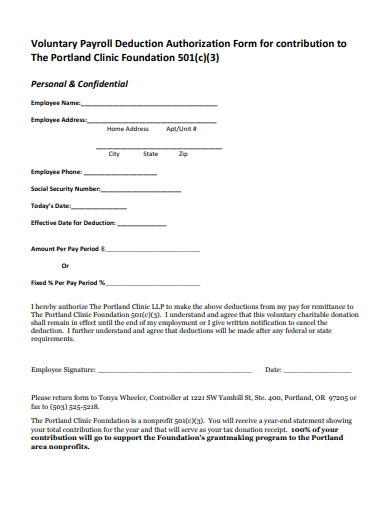

8. Voluntary Payroll Deduction Authorization Form

Here is another request from an employee of Portland Clinic who is providing deduction authorization so that an amount can be deposited for making charitable contributions to the Portland Foundation.

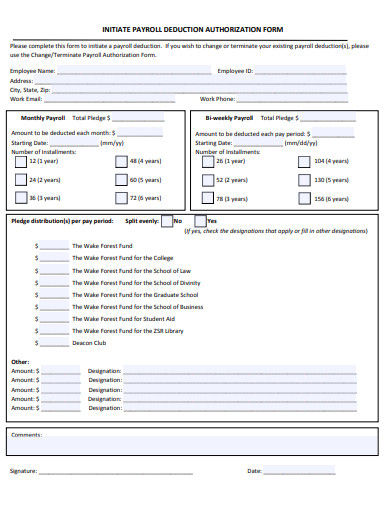

9. Initiate Payroll Deduction Authorization Form

This is an initiation form for payroll deduction authorization so that the deduction can be initiated and this format can be used in this regard.

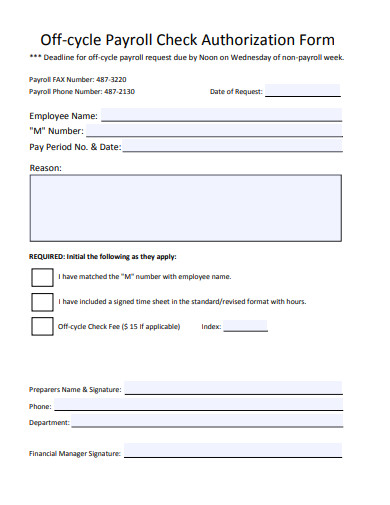

10. Payroll Check Authorization Form

Off-cycle Payrolls are used to make those payments which are outside of the regular payrolls like the bonuses. This format will very well suit the purpose of this kind of payment.

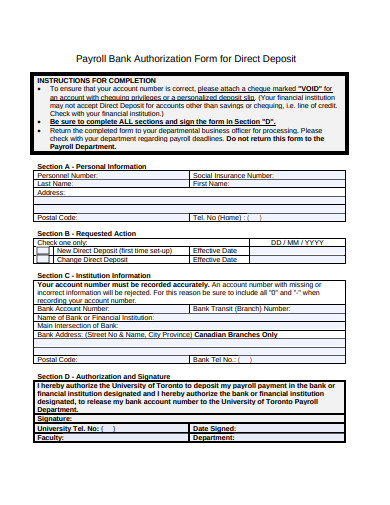

11. Payroll Bank Authorization Form

Any bank or financial institution needs authorization from the customer before doing a direct deposit in his account and here is an example of such an authorization from an employee of Toronto University.

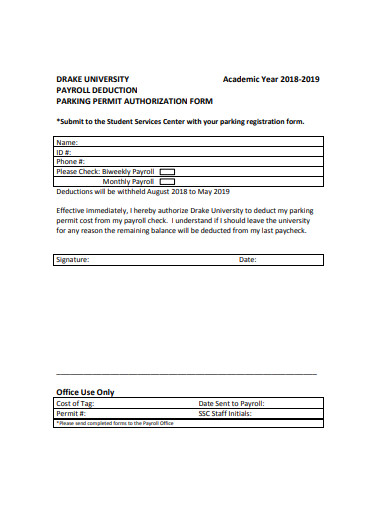

12. Parking Payroll Deduction Authorization Form

Here in this example, a working student of Drake University is authorizing the institution to deduct his parking fees from his payroll cheque. The format is simple to use and can be used for the same.

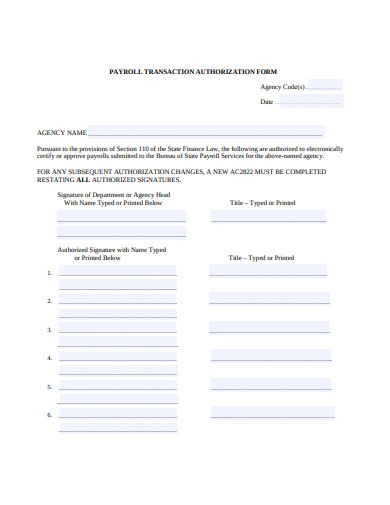

13. Payroll Transaction Authorization Form

These authorization form for payroll transaction can be used to hire new employees, increase or decrease the pay of an employee, change an employee’s designation as well as for job termination.

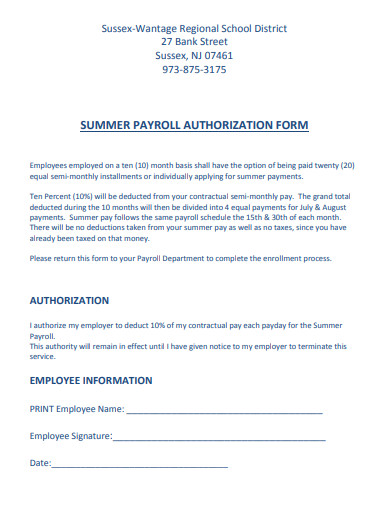

14. Summer Payroll Authorization Form

In this example an employee is authorizing the employer of a school to deduct 10% of his/he salary from each pay from the summer payroll. This form has been kept very simple in its format and this can be used as a standard authorization request form in case of this kind of applications.

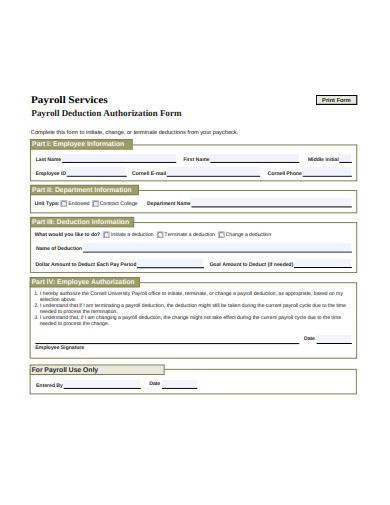

15. Payroll Deduction Authorization Form Example

An employee of Cornell University is giving the authorization to the Payroll office of its employer. Here, the office can do the needful changes if required in terms of initiation, termination, and change a payroll deduction based on his choice in the form. This is a standard form which can b used in similar authorizations by different users.

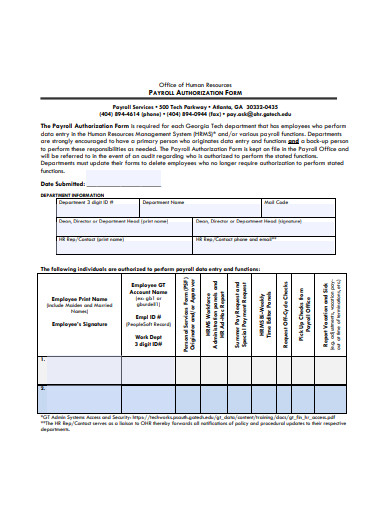

16. Payroll Authorization Form Example

Tech Department of Georgia requires this type of authorization form for its payroll for its data entry employees in the HRMS. It is also used for many other payroll functions. The contents of the form are used during the audit. To prove which authorized person did the mentioned function for the institution, this form is used. These applications are designed in a standard format and can be used by any employee easily for a similar purpose.

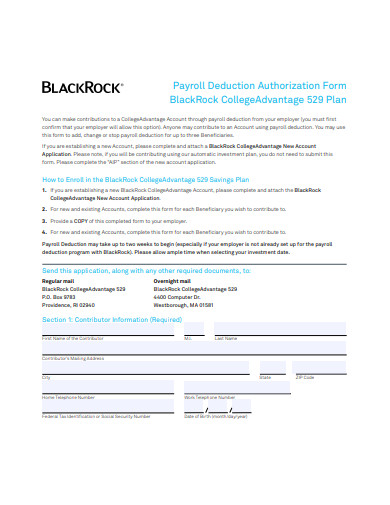

17. Sample Payroll Deduction Authorization Form

Any employee of BlackRock college wishes to make any contributions in the account of CollegeAdvantage, then he/she can use this as a standard format sample. The deductions for the contribution will be made from his/her payroll.

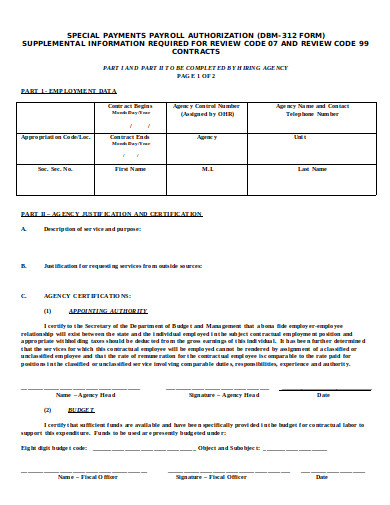

18. Payments Payroll Authorization Form

The secretary of a budget and management department has been authorized here to deduct the taxes as required from the contract worker’s total earnings. This request has been placed by using this special payments payroll authorization form.

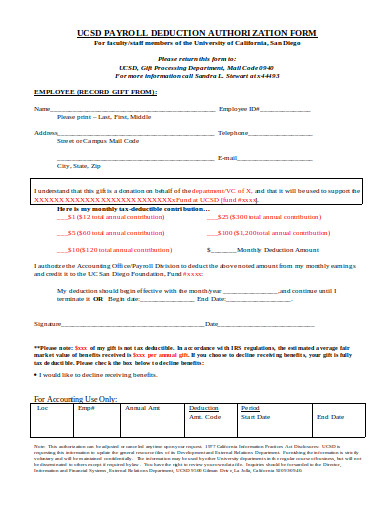

19. Payroll Deduction Authorization Form in DOC

California University faculty and staff members use this authorization form for payroll deduction. This deduction is done so that the employee can contribute to California University San Diego Foundation. This is given as a gift and is non-taxable.