9+ Fundamentals for Property Investors Examples to Download

Before investing money in any business you must know and understand its different fundamental aspects. Without understanding the business, investment is not a wise decision. That is why we suggest doing proper research before property investment. Understanding the fundamentals might get an idea on which aspect of the business you should make your huge investment.

9+ Fundamentals for Property Investors Examples in PDF

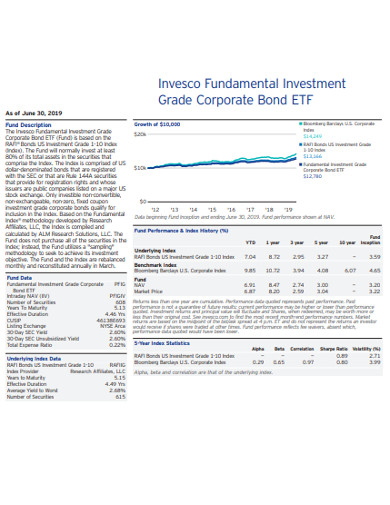

1. Financial Analysis of Real Property Investments

2. Real Estate Market Fundamentals Investors Example

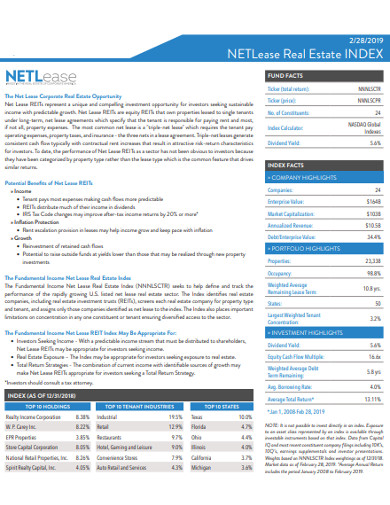

3. Real Estate Lease Fundamental investors Example

4. Formal Fundamental Property Investor Example

5. Standard Fundamental Investors Example

6. Fundamental Property Investment Investors Example

7. Fundamental Market Property Investor Example

8. Printable Fundamental Property Investor Example

9. Fundamental Property Investors in PDF

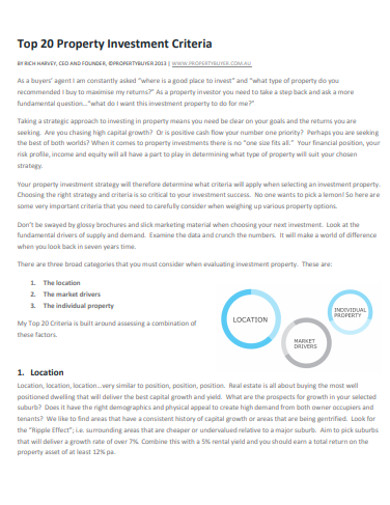

10. Five Fundamental Property Investor Example

Who are Property investors?

Property investors are the businessmen who study and research the market of real estate and other property businesses. Such people keep a proper plan ready along with some goals before investing in any business. The main moto of all the property investment or financing is to gain double or more than the capital invested. Different types of real estate properties are sold like residential, commercial and mixed.

Different Types of Properties to Invest in

1. Residential Property

Houses or places where people can reside are residential property which is a great means of business. People invest in residential properties after surveying the land or apartment to get long term profit. Often businessmen make long-term investments on residential properties as its demand grows higher with time the rates also get a hike.

2. Commercial Property

Commercial properties too give long term profits but investments for commercial purposes are specifically done identifying specific locations or areas suitable for a particular business. The rates of such properties may be too high but the return amount as the profit is always higher though it is not achieved instantly and immediately.

3. Combination Property

A combination property is an adjusted investment with the other party which is bought considering the place to be used for both commercial and survival purposes. For example, a house being used both for residing and the other part of it for some classes.

Why Property Investment?

Property investment is one of the oldest business by buying several real estates and other property materials people use them as assets. Such a sort of property might include residential places, land, and other immovable property like minerals, water, and corps. Property investment can be both long term and short term and both have different approaches in business.

Long-Term Investment

Long-term investments require much patience and the investor must need to have enough capital to support the investment for years. This sort of investment might be even risky sometimes but if planned and invested properly it gives profit in the long run. The maturity period of such investments is also long.

Short-Term Investment

Also called temporary investments, short-term investments keep on flipping to different actions and business after a certain point of time. These investments are conditioned by the bond signed by the parties involved. Conversion of the investments into cash is easy and quick in this process. This is often used by companies and businessmen to safeguard their capital from any sort of risk and use the investment as a financial asset.

What are the Fundamental Principles of Property Investor?

To Get Property at Discounts

While you are doing property business always try to get the property at a discounted price so that the capital you invest can get back to you as a reward with a double in quantity.

To Show Mutual Benefit in the Deal

Getting a property at a desirable price can not be possible at times. But you can always negotiate with the property holder by showing some mutual benefit and logic.

To Stress on the Location

In a real estate business or any other property, business location matters a lot. The location may be diverse for different sorts of property business so you should keep it in mind before investing your capital.

To Invest in Positive Cash Flow Property

Your service should always be offered by observing the demand of the public of certain locations. This can help you to get your investment amount covered without much delay from the speculated time.

To Find Logic and Visit the Property

While you are buying or financing any property you should not depend on word of mouth but should visit and inquire. Sometimes some property might tempt you by its various merits but you should invest following the logic and thinking about the capital and not the emotions.

To Make it Valuable

If the property is at a good locality but not in a very good condition, you might get it at a cheap price so grab it then and there. You may repair it or add different values to it by modifying and renovating that would not cost you much but would get you to benefit.

Research, Research, and Research

Before investing in property always make sure that you have done your homework well. This homework means to research the various aspects of the same business and its condition and status in the market at the period of investment.

To Plan and Strategize

Your investment strategy should be based on the market research of the property. The research would give you ideas on which period and location should be supplied with what service and demand satisfaction.

To Make Long Term Investment

Property investments can both be long term and short term, if your firm has a good capital appreciation rate investing in long term business is better. Because it keeps on giving you profit in the long run of the business. But you need to be patient enough for it as this wouldn’t take place in one day!

Tips for Property Investors

Tip 1: Analyze Your Investment- The property you are investing in or have already invested should be analyzed by you focusing on all the aspects of market condition. You should evaluate the merits and demerits of the property against the capital invested.

Tip 2: Have Patience- A property investment might take time to return you the actual capital along with the speculated profit, as it processes with time. So be patient and observe your capital being restored.

Tip 3: Invest Empathisingly- When you buy a property either for residential or commercial purposes, feel and think from the tenant’s or your business point of view. This can enable you to target the perfect audience for your business.