10+ Hedge Fund Examples to Download

The term hedge means to safeguard and hedge fund refers to the alternative investments that give protection against risks. It uses pooled funds that include funds from investors, banks, individuals, etc. It uses different strategies to earn good returns for the investors and their firm. The reason hedge is considered alternative investments as it comprises of different asset elements like derivatives, equities, bonds, convertibles, securities, etc.

What are the Features of the Hedge Fund?

1. Hedge funds are basically for accredited or qualified investors. Because the minimum contribution in this fund begins from millions.

2. It is a diversified investment of portfolio . This fund tries to cover almost all the assets classes like stocks, real estate, currencies, derivatives, bonds, equities, etc.

3. This funding process is based on the concepts of the expense ratio and management fee. Famously know as ‘Two and Twenty’ as there it charges 2% fixed fee and 20% of profits.

4. Hedge funds have more exposure to huge risks and the people might face huge losses. Because the lock-in period for investments is long and funds used for leverage can turn into loss.

5. Hedge funds are not bared by the taxation system and are charged at the investment fund level and the obligation for tax also passes through the unit-holders.

6. hedge funds are not required to and neither they have any compulsion to report or disclose Net Asset values or register their securities market regulators.

What Guidelines Hedge Funds follows?

The guidelines may be considered by different investors, differently which have its consequence on the capital and the returns. Thus talking about guidelines, the following can be some of the most common ones.

- The size of the firm or fund size needs to depend on the investor’s preference and the firm’s capability to accommodate that. There has to be a balance between the two to process it properly.

- Investors sometimes ask to have a track record of many months but this guideline is often get eliminated due to the arrival of any new fund.

- Minimum investments are a minus point to the investors for many reasons as for minimum use of fund diversification becomes problematic. Minimum investments are more seen to be done by the institutional investors whereas the individual investors often are seen to invest huge funds.

- Redemption terms in hedge funds have implications for liquidity. It is an important aspect of maintaining a highly illiquid portfolio. This guideline might be relaxed while a portfolio has adequate liquidity.

10+ Hedge Fund Examples

1. Hedge Fund Operating Expenses Example

Hedge funds are the safeguarding funds that pool up funds from different sources and diversifies investments. It might be a complex process for many amateurs as it is a very complex process in business. You can refer to this template if you want to invest in such funds and wants to invest in it. Before investing in hedge fund mastering in its different aspects is important and that can only be done by gathering knowledge and having a mock practice. So start that by referring to this template. Have a look at it and grab it today!

2. Sample Hedge Fund Example

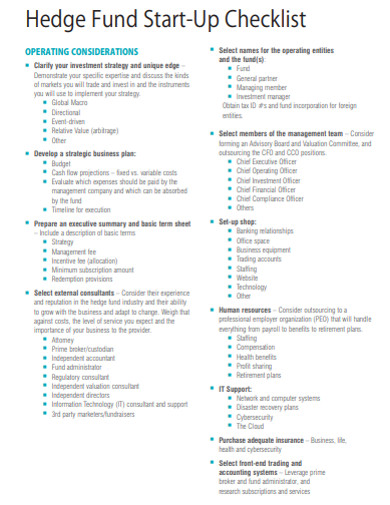

Have you ever invested in a hedge fund? Isn’t it new to you? If your answer is yes, don’t worry as this example template can help you to enlighten and show you the path required to be followed to invest in a hedge fund. The sample template frames description on different aspects and the processes that can make you have a properly planned and strategized investments to get maximum profit possible. You can check this template out if you find the content properly communicable to learn more about the process of hedge fund investing.

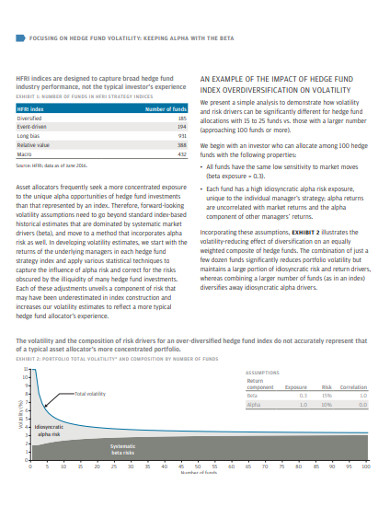

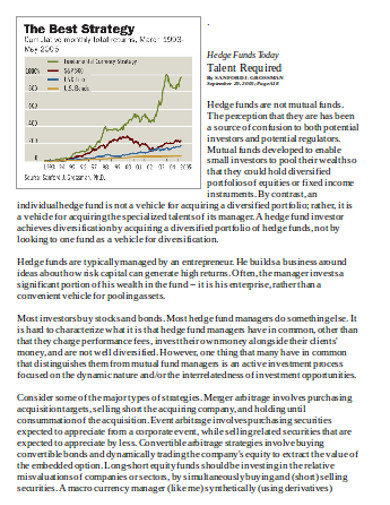

3. Simple Hedge Price Example

Have you ever seen the pricing system a hedge follows and uses? If not, this sample can help you in communicating that fact to you in a simple way. The mentioned template here frames the hedge pricing diversification process with the help of graphs and descriptions so that it be properly communicable to you. So check the template out today if it seems useful to you the template is just one click away from you!