15+ Payroll Examples to Download

When it comes to expanding your market, your employees are one of your most valued assets. They’re the ones who engage with your clients, carry out routine activities, and help bring new customers. Because of such, they’re entitled to fair payment for the time and dedication they provide. Your workers contribute significantly to the success of your business. It’s easy to imagine that payroll is as simple as writing a few checks and putting money in the bank. However, it’s much more complex than it seems.

Here are some template samples that you might need:

15+ Payroll Examples

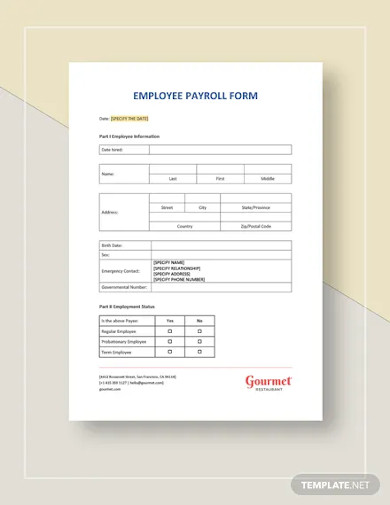

1. Employee Payroll Form Template

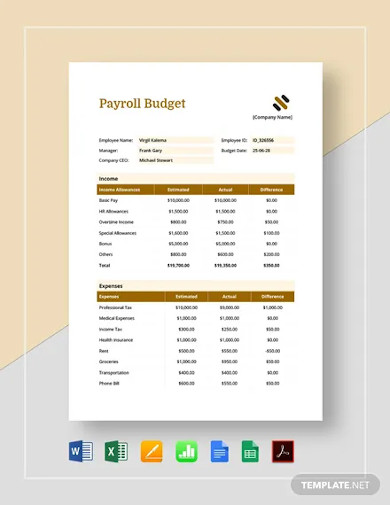

2. Payroll Budget Template

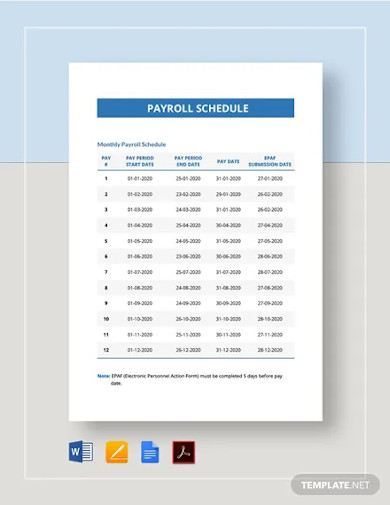

3. Payroll Schedule Template

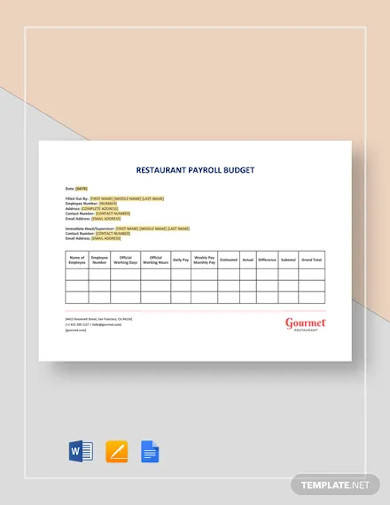

4. Restaurant Payroll Budget Template

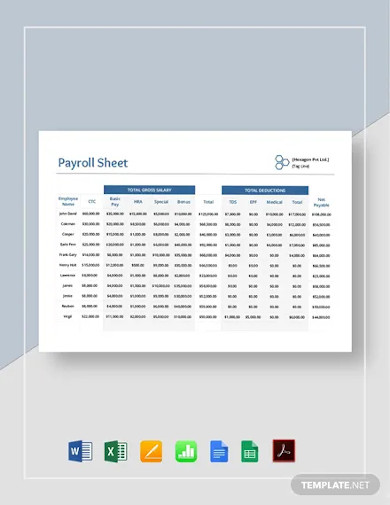

5. Payroll Sheet Template

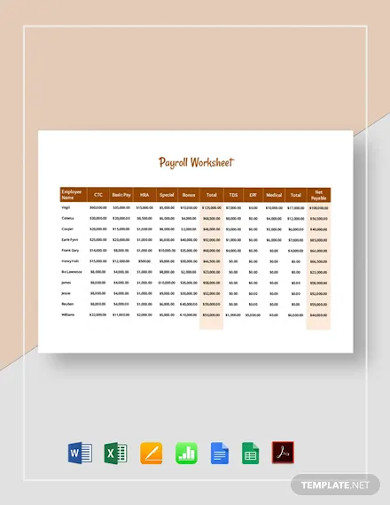

6. Payroll Worksheet Template

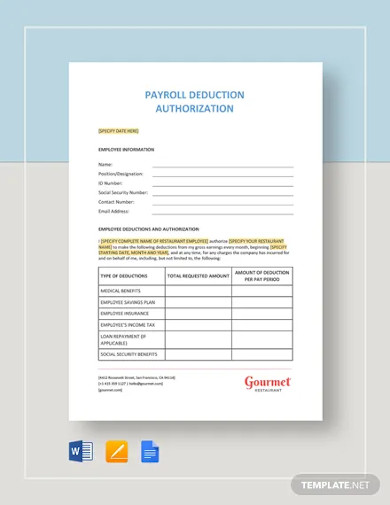

7. Payroll Deduction Authorization Template

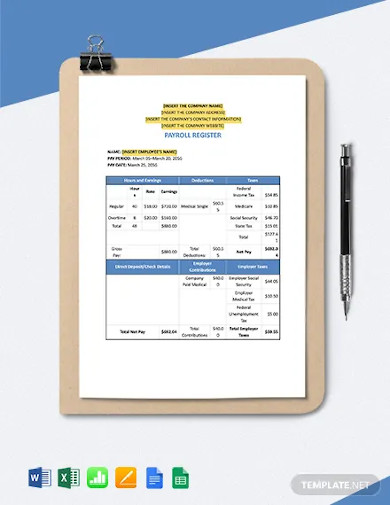

8. Payroll Register Template

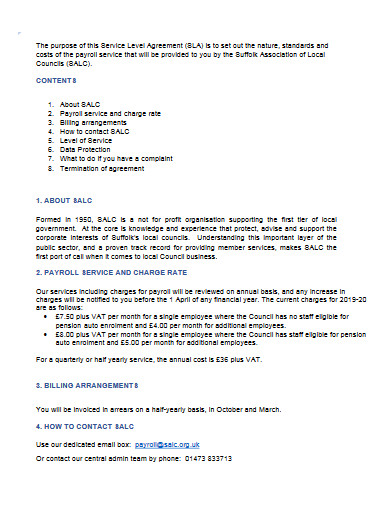

9. Payroll Service Template

10. Payroll Services Privacy Notice

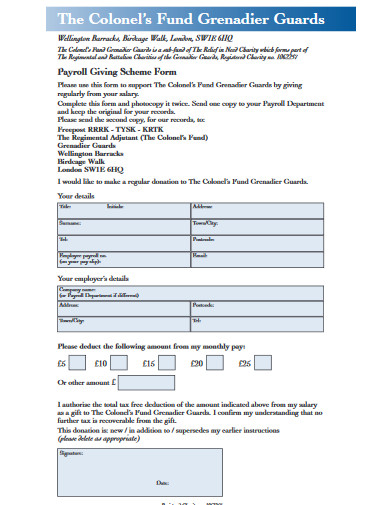

11. Payroll Form in PDF

12. Managed Payroll Service

13. Payroll Service Agreement

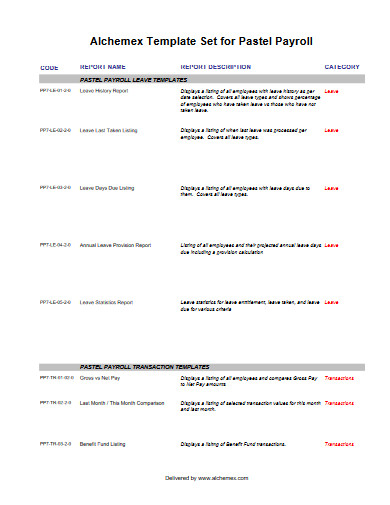

14. Sample Payroll Template

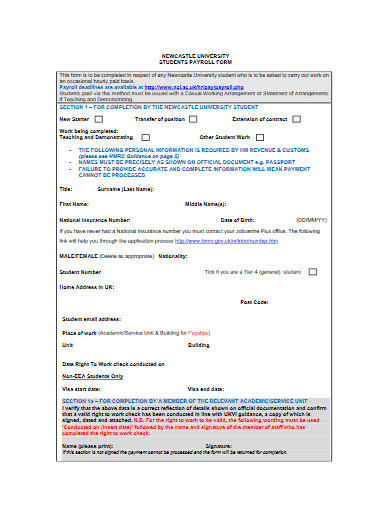

15. Students Payroll Form

What Is a Payroll?

A payroll is a list of workers compensated by the company. It also refers to the total amount of money paid to workers by the company. It entails the following.

- Creating a Compensation Schedule for the Company

- Defining the Elements of a Payslip

- Obtaining Additional Payroll Resources

- Calculation of Gross Salary

- Paying Employees’ Salaries

How to Create a Payroll?

When you have started your business, and you are at the point where you can recruit a few new hires and create payroll, you’re impressive! It’s a huge accomplishment for you, and you’ve already produced work for someone else. Isn’t that cool? However, before you start with the process, you should be aware of the factors to consider.

Here are the best tips for meeting most of the regulatory requirements for payroll processing while saving time and avoiding IRS fines.

1. Look for the Employer Identification Number

The first move is to obtain an EIN (Employer Identification Number) from the Internal Revenue Service (IRS). This number is released so that the IRS can identify your company. If you’re starting a new company, you’ll need to apply for an EIN. It is free to utilize, and you can do so online, via fax, courier, or through the phone. You can read about the process on how to apply for an EIN and learn more about the EIN software and procedure on the IRS website.

2. Obtain Tax Information From Employees

If you’ve obtained your EIN, it’s time to gather tax details from your staff. It means that you need to ensure that all workers complete a W-4 and an I-9 form. However, if you have freelance employees, you will need to collect 1099s. On these payroll documents, employees fill out relevant legal paperwork about their job conditions, select to take some deductions, and provide some essential information.

To learn more about it, you can always scan employee tax information.

3. Decide on a Payroll Schedule.

After you’ve collected all of the required tax documents about your corporation and its workers, you’ll need to consider if you’ll pay your employees. There are four different forms of payment schedules. It could be weekly, biweekly, semiweekly, and monthly. Each of the four plans has its own set of benefits, depending on how you choose to handle the yearly schedules. Most businesses choose a biweekly or semimonthly pay period.

4. Make a Total Compensation Calculation.

The first step in processing payroll on your own is to measure gross salary. Calculating is pretty simple. The number of hours an employee served in a pay cycle multiplied by their hourly wage equals gross pay. A spreadsheet is the most convenient way to keep track of employee hours. Once you have the average hours worked per pay cycle, add it by the employee’s hourly wage. And get the gross pay for the particular employee. Make sure to complete these steps for each employee of your company.

5. Calculate Withholdings, Credits, and Allowances.

The most vital part of processing payroll is identifying each employee’s allowances and deductions. Allowances and exceptions are the same. They refer to the amount of money taken out of your paycheck during the year. W-4 forms help to determine wages. The employees’ deductions are on the 1040EZ form. It’s the list of things you can deduct from your income when you do your taxes. That’s why you should pay attention to how workers fill out tax reports and withhold the required sums.

6. Maintain payroll reports and make appropriate corrections to correct errors.

It’s vital to maintain reliable and well-organized payroll records. If there’s ever a disparity in an employee’s net salary and what they planned, you’ll want to be sure to point to the documents. It’s also necessary to keep these notes on hand for tax purposes, especially when there’s a need to work with the IRS.

FAQs:

What’s involved in payroll?

When talking about payroll, it often refers to the workers you pay as well as their information. It includes the rate you pay them each pay period, method of measuring and disbursing salaries, and taxes. These help to calculate average payroll wages at the close of the calendar year.

What are the basic payroll activities?

There are several payroll activities that HR staff mostly do. It mainly consists of recordkeeping, new employee documentation, check collection, state and local tax compilation, and payment processing. These are the most substantial payroll practices.

Who prepares payroll?

The Human Resource office holds records of attendance and overtime services provided by the employees. Because of such, it’s ideal that they prepare the payroll. HR staff is in charge of a wide range of main deliverables daily, ranging from recruiting to success monitoring. The majority of products are within payroll, including wage increases, salary, compensation, employee working hours, and expense deductions.

Payroll accounting can be challenging even though the business is small.

Gathering employee records, calculating gross and net wages for each employee, and ensuring you’re withholding the correct amount of money for state and federal taxes each pay cycle takes time. That’s why you should look for the best strategy and platform for your company. Take note of the information given above.