9+ Income Verification Letter Examples to Download

Should an employee apply for a credit card, financial loan, rent an apartment or trying to buy a house, a proof for their income may be required. The lender requires for this king of document in order to make sure that the borrowing party is capable of paying the loan. If this letter is not provided, a loan may not be approved. This document helps verifies and confirms the borrower’s capacity to pay on time regardless of the mode or process of payment the lender and the borrower agree to follow.

An income verification is an important document because it helps provide a full picture of the borrower’s capacity to pay the loan or debt. In addition to this, the lender may also ask for an employment verification letter in order to demonstrate that the borrower has a steady source of income. If you are currently self-employed, you will need to provide other evidences the lender may require in order to verify your steady stream of income.

This letter makes it easier for your application to be approved since you have ample evidence supporting your claim to pay your dept on time.

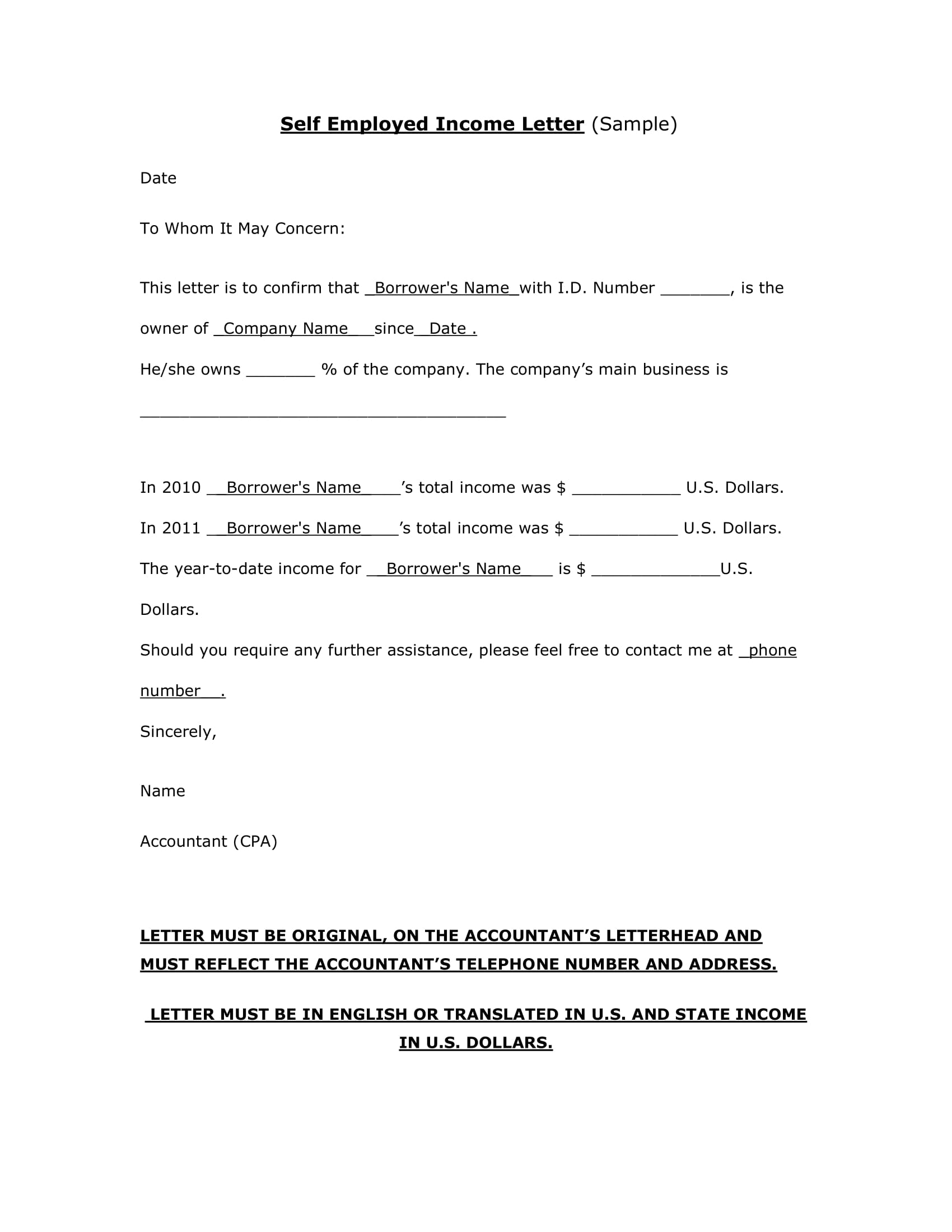

Self-Employed Income Letter Example

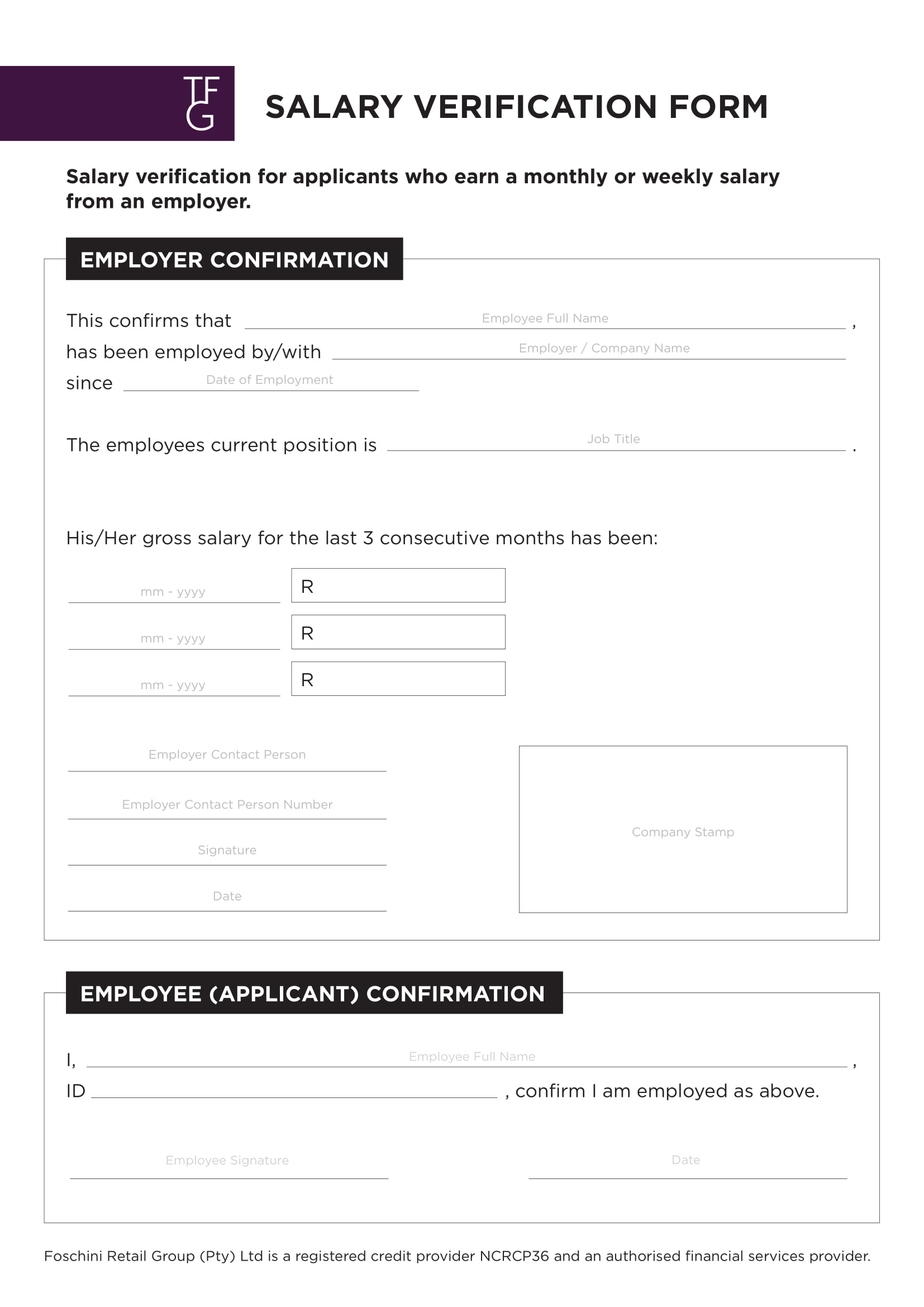

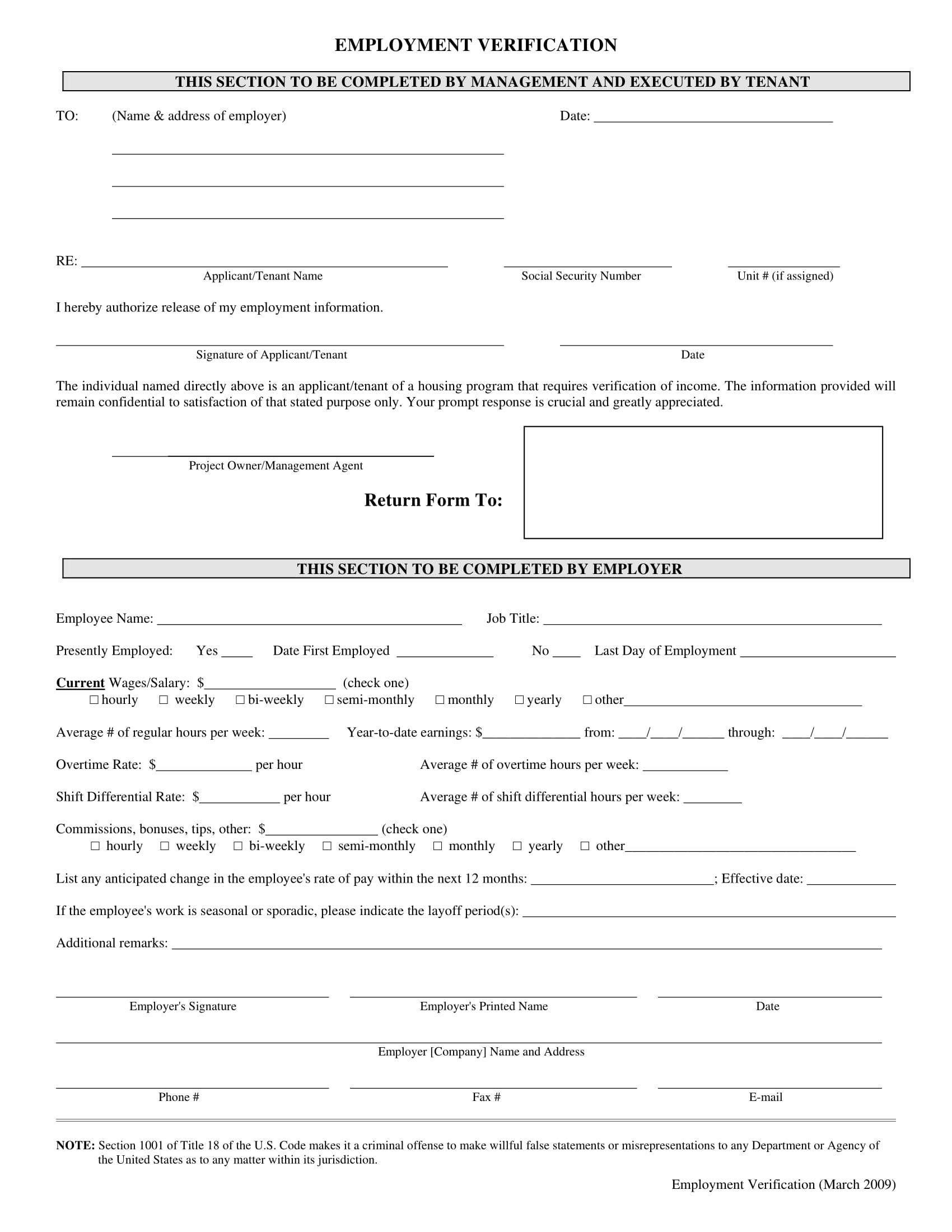

Salary Verification Form Example

Importance of an Income Verification Letter

As mentioned earlier, an income verification letter provide evidence of your capacity to pay a loan or rent an apartment as the borrower. Basically, it is a verification of a person’s financial status. It provides assurance to the lender that the borrower has a steady and legitimate source of income he/she can pay the debt with. It is provided by the current or former employer of the borrower as a response to a request from a potential employer, government agency, bank or various lending agencies. You may also see application letter examples & samples.

An income verification letter also gives the lender an idea of what type of payer the borrower will be. Some lending companies, use the letter to allow them to adjust they pay and schedule of payment based on the stated income in the letter. Meaning they base how much the borrower should pay and how often the pay for the loan will be collected with the help of the income verification letter. Not only that, it also provides additional proof of the borrower’s identity and credibility as a candidate for a loan or rental.

An income verification letter is an important document when it comes to providing proof and confirmation on the borrower’s legibility to be granted a loan. It helps the lending company take a good consideration on the application of the borrower since a proof for his/her capacity to pay the loan is proven to be true. In addition, it helps the lender make a final decision basing solely on the formal letter and its legibility. Therefore, a simple document holds a huge responsibility in confirming your application for loan or renting an apartment in the future.

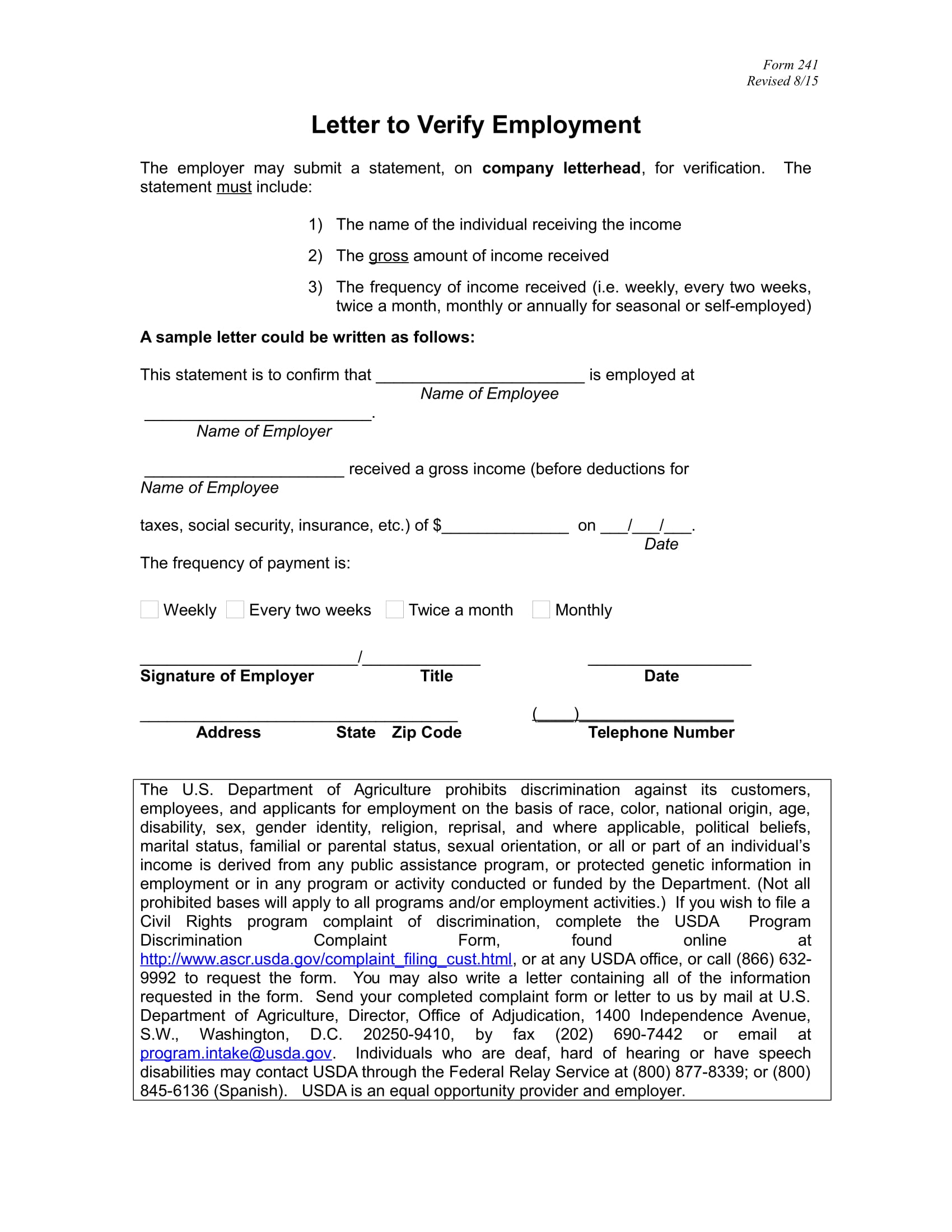

Basic Income Verification Letter Example

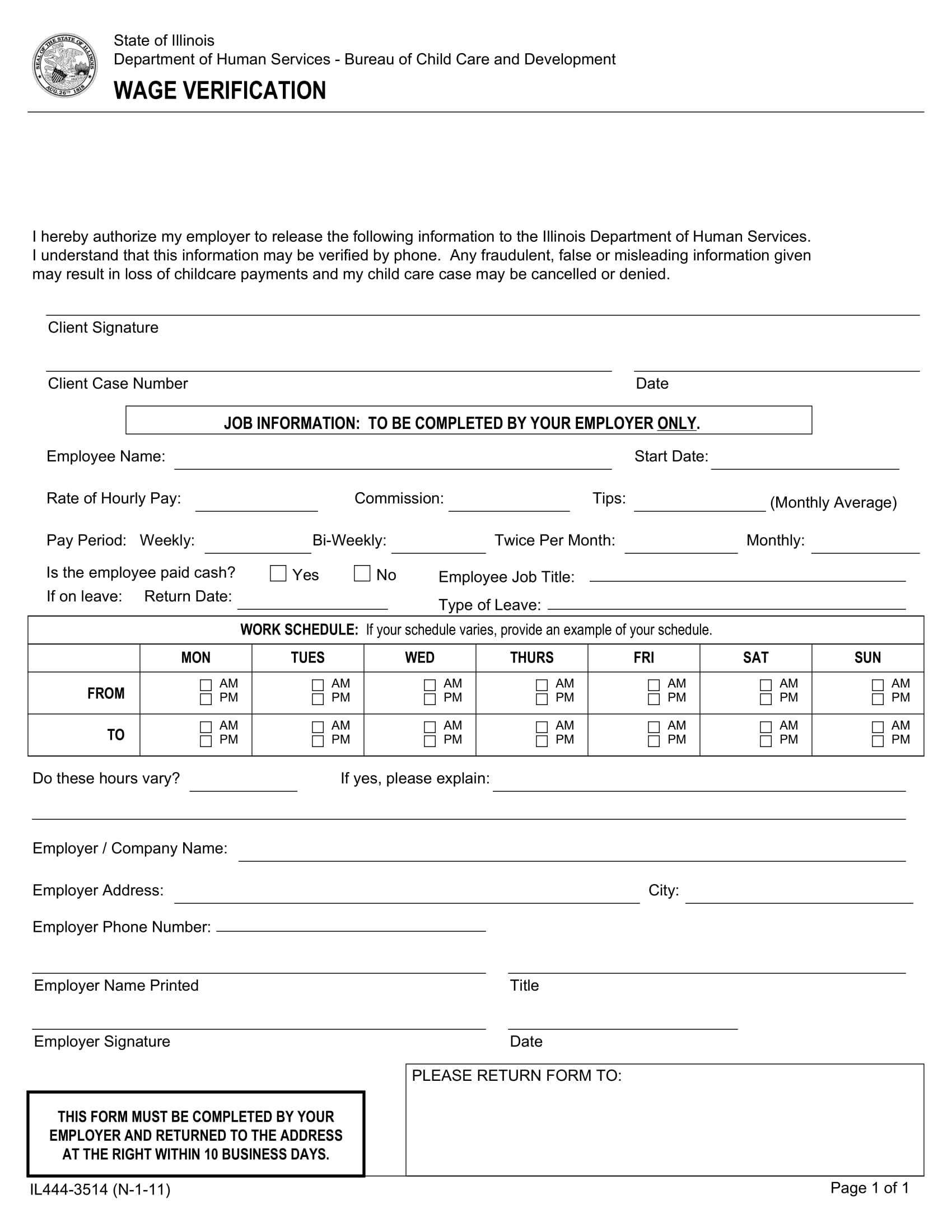

Wage Verification Letter Example

Other Credible Proof of Income

Aside from an income verification letter, banks or lending companies may require other proof of income. Provided below are a few other examples of probable and legitimate proof of income:

1. Pay stubs

When you are currently employed, your employer may provide a breakdown of your salary in a pay stub, also known as a payslip or paycheck stub. This paper may mostly contains the following: the period to which the pay slip relates, the gross amount and net amount of the payment, any amount paid that is an incentive-based payment, bonus, monetary allowance, deductions for absences and contributions, etc. You may also see thank-you letter examples.

This can be used as proof of income as it provides pertinent information abut your employer as well as how much your net income is for a given pay period. Most lenders require that you provide a pay stub or pay slip dated within 30 days of the date you applied for the loan as it is the most recent proof of your income.

2. Payroll schedule or documents

A payroll is basically a document listing all the names of its employees with the corresponding amount of money they should be paid. It is a record of the company’s employees’ salaries and wages, bonuses, and withheld taxes. It is prepared by the accounting department of the company that you work for. You may also like email cover letter examples.

Therefore, it reflects the amount the company pays you for a certain period. This is also a credible proof of income since it can only come from the accounting department of the company you work for. This will tell the lender that you have sufficient funds to pay the loan you have applied for.

3. Signed letter from employer

In a way, this can be called an employment verification letter. Some lenders may require you to submit a letter stating that you are in fact working for the company. This letter is usually prepared by the HR department of your company since they have the access to your service records. The letter should be signed by the official signing authority of your company in order to make relevance and authenticate its legitimacy. The letter will be used as proof that you have a source of income and capabilities to repay the loan.

4. W-2s

Tax documents such as a W-2 form can also be credible proof of your income. It is a form given by the employer to an employee and the Internal Revenue Service (IRS) at the end of the year. It contains reports an employee’s annual wages and the amount of taxes withheld from his or her paycheck.

5. Tax return

A tax return is also an acceptable tax document used as proof of income. A self-employed individual or someone who works from home, can use this document as basis for his/her capacity to repay the loan. It is also the most required document the lender may ask from an individual who is self-employed. You may also check out offer letter examples.

A tax return is form given by the authorities in the IRS which states the income, expenses, and other pertinent tax information of an individual. For most countries, it is an annual requirement to file a tax return for individuals or business with reportable income.

6. Direct deposit statements

Direct deposit statements show the amount of transactions in which you were paid for by your employers be it through freelancing or online jobs. These payments given to you by your employer or client is reflected in your bank statements. A direct deposit statement is a reliable proof of income because it shows that you have a constant source of income through your employer. You might be interested in business proposal letter examples.

7. Statements showing retirement income

Some banks and lending companies may ask you to show proof of income if you qualify for Social Security payments, or have other income during retirement. You bank statement should also show that your receive a certain amount of money from the social security services of your country for example the U.S. Social Security Administration. They will need to make sure should you resign or retire from a job that you still have the resources to repay your debt. You may also see how to write an official letter.

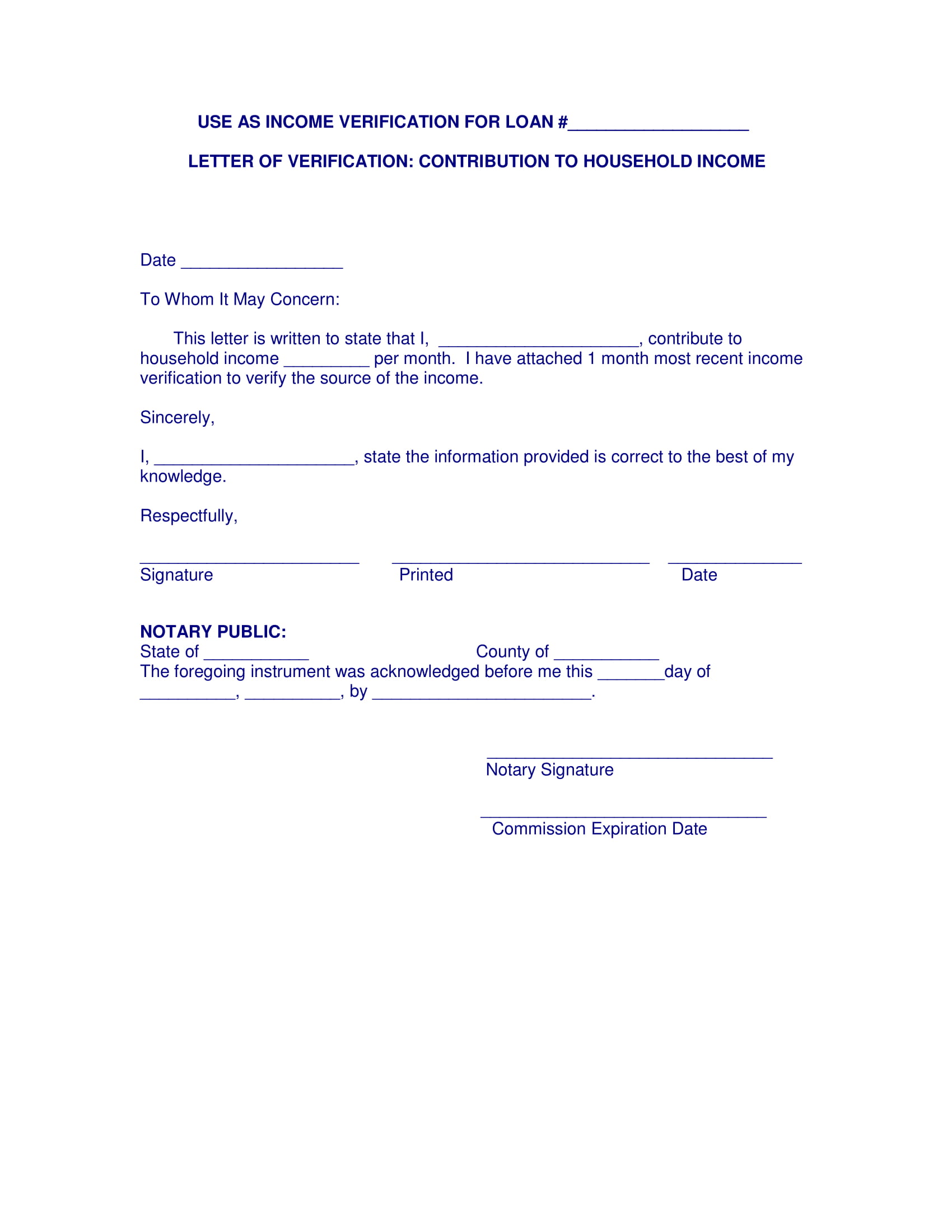

You can also provide proof that your receive supplemental income from other sources such as investments, retirement savings account or subsidy from your family.

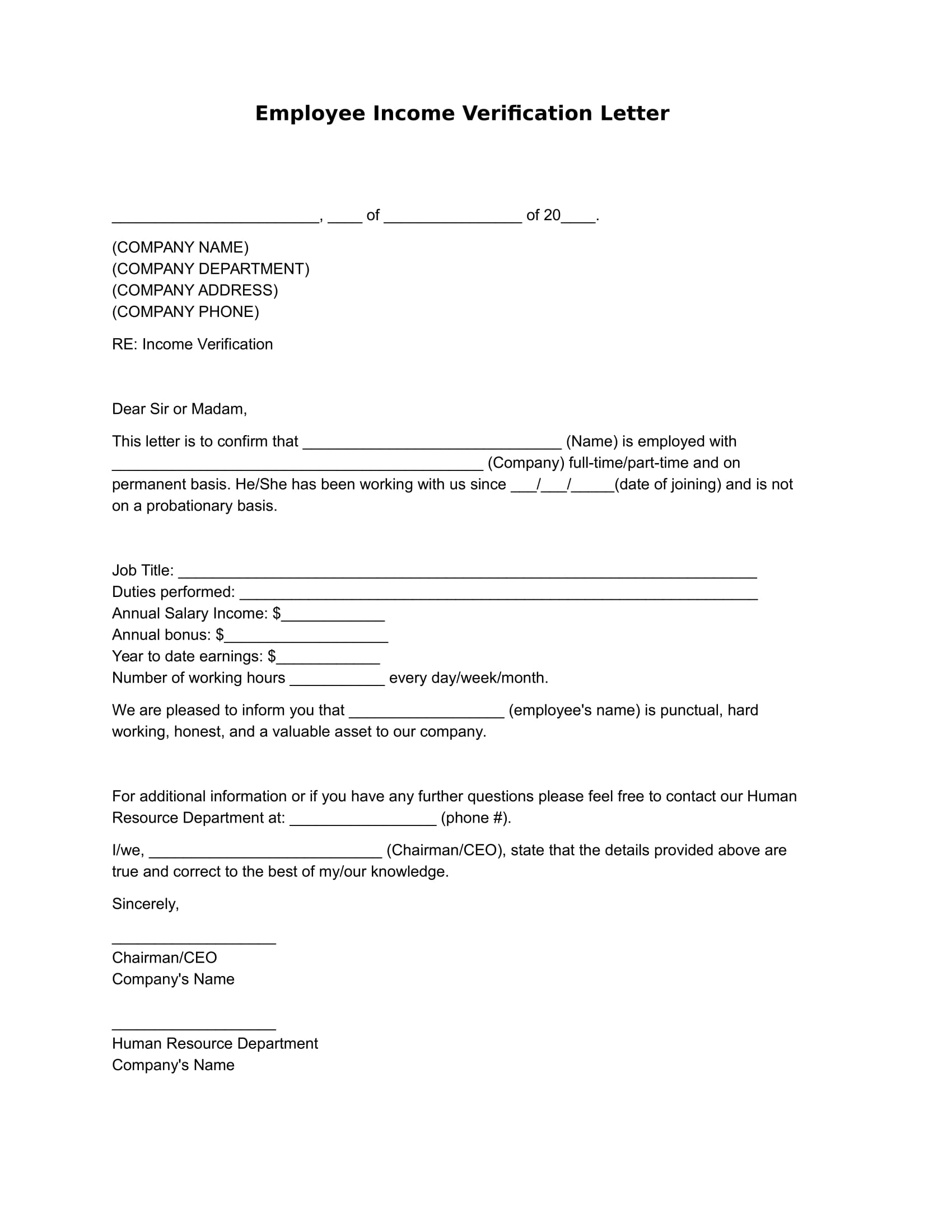

Employee Income Verification Letter Example

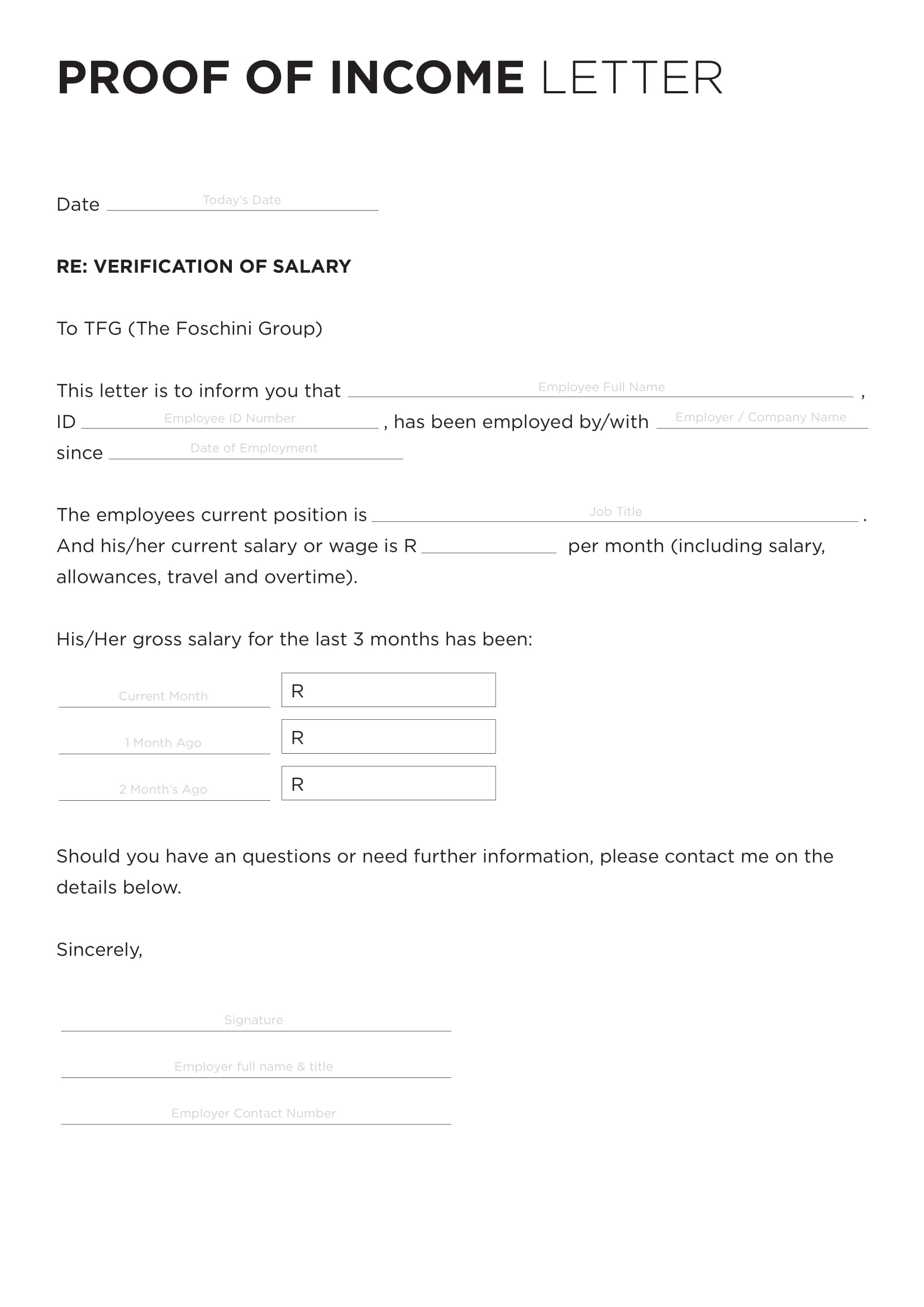

Employment Income Verification Letter Format Example

How to Make an Income Verification Letter

This letter although holds authority, is somehow formatted like an informal letter. It is direct to the point and doesn’t come off as conversational. As you may noticed on the given examples, it is a brief and straightforward letter containing all the necessary facts about the employment and corresponding income of the employee. You may also see reference letter examples.

First, you must start the letter with a proper letterhead. The letterhead can contain the company’s official logo along with the company name, address and contact information. After the letterhead, you include the date when the letter was made or written. Unlike in a formal letter, in this letter you can just use a general salutation such as “To Who It May Concern” followed by a colon (:). You may also like notice letter examples.

After that, you can then directly proceed on the actual content of the letter. The introduction of your letter can start with a statement saying that you, as the confirming authority of the company, certify that the individual concern is employed in the company. You also need to include the date when the individual started working in the company and his/her nature of employment i.e probationary, regular, permanent, etc. You may also check out complaint letter examples.

The next paragraph of the letter is used for the other necessary information. It will be easier for your if you use a bullet format when stating the individual’s job title, job role, annual income, annual bonus, year to date earnings, number of required working hours, etc. You can also use income verification templates available online and just tweak and edit it to fit your company’s standard. you might be interested in job application letter examples.

After that, you can state your or the company’s willingness for future correspondence should the bank or lending company need other information regarding the employee. As a closing statement, mention and testify to the correctness of the information stated in your letter.

Lastly, use the appropriate complimentary close and affix you or the signing authority of the company’s signature along with the corresponding name and position/designation of the signatory directly below the signature.

Income Verification Letter for Loan Example

Income Verification Letter Example

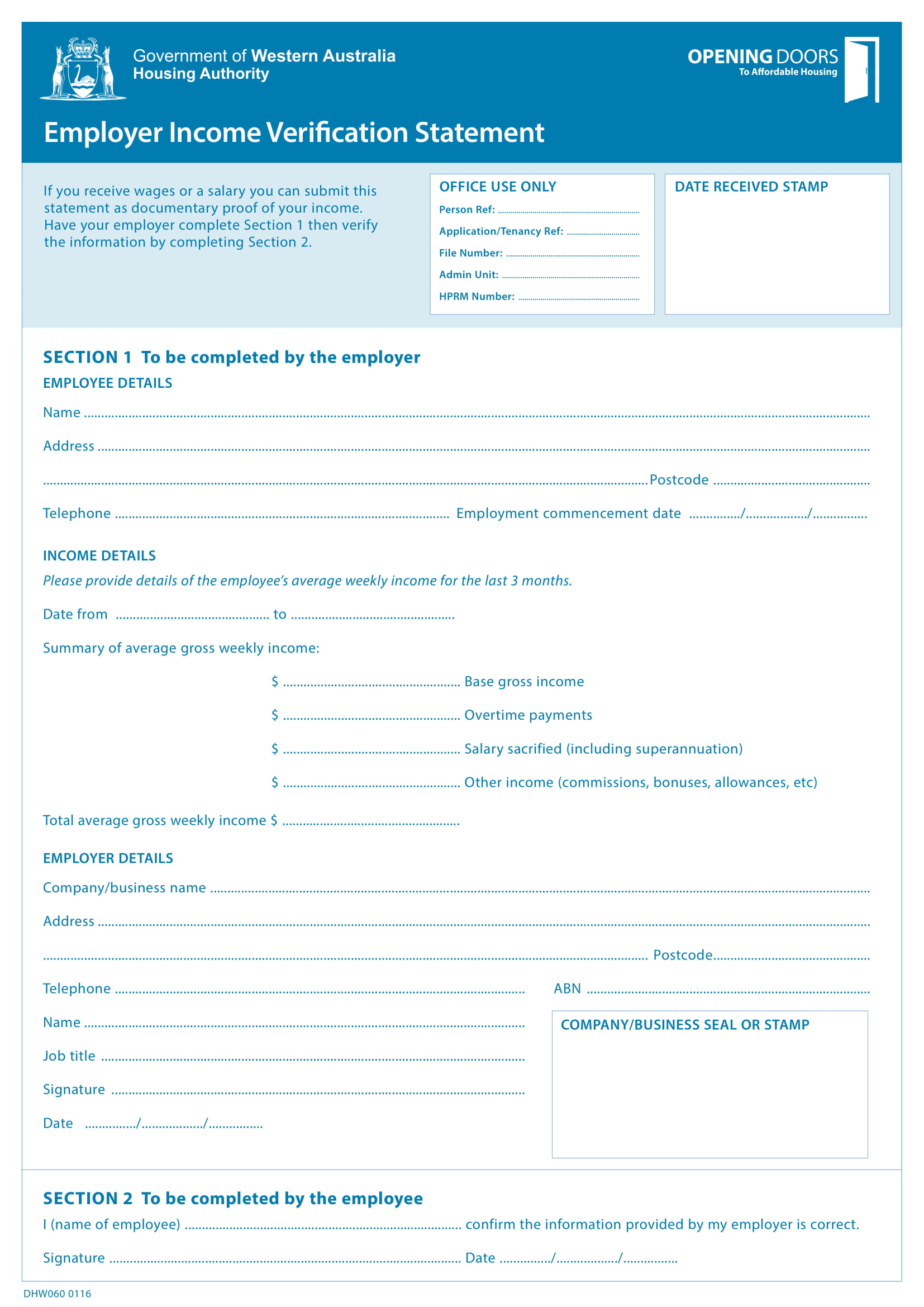

Employer Income Verification Statement Example

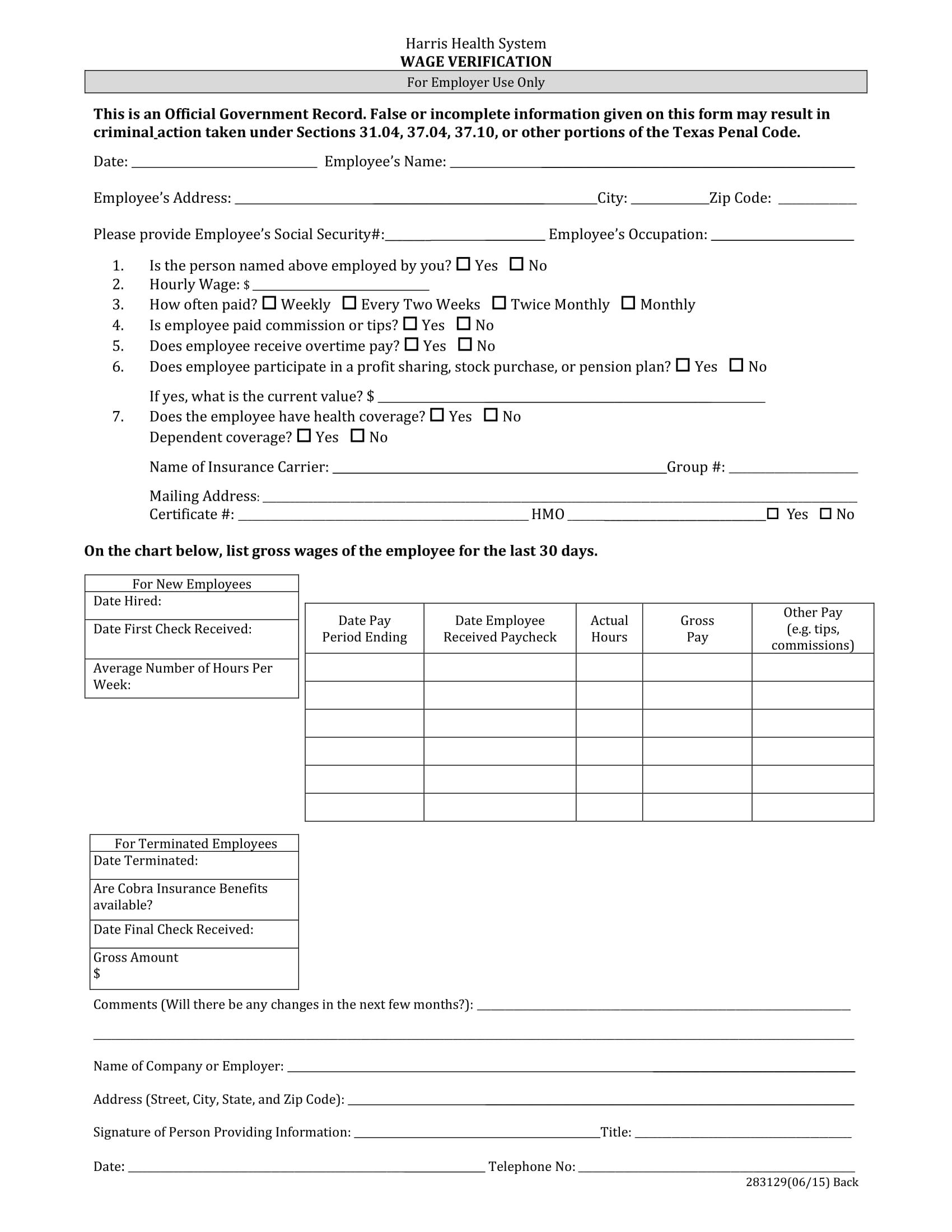

Health Employee Wage Verification Letter Example

Conclusion

An income verification letter is an important document that verifies and testifies to the legitimacy of a borrower’s capacity to pay loans and debts. It helps the employee have a chance of getting his/her loan application be approved by the bank or lending company. Therefore, you as an employer, must be willing to provide such vital document. You may also see professional letter format examples.