40+ Intangible Assets Examples to Download

Tangible assets are physical items of value owned by a business, such as machinery, buildings, and inventory. These assets play a crucial role in a company’s operations and financial health. Understanding tangible assets requires distinguishing between current assets, which are short-term and easily liquidated, and non-current assets, which are long-term and include property and equipment. The holistic marketing concept emphasizes the integration of all marketing aspects, including the effective management and utilization of tangible assets, to create a cohesive and customer-centered business strategy.

What are Intangible Assets?

Intangible assets are non-physical items of value that a business owns, such as patents, trademarks, and goodwill, which can significantly influence a company’s worth and competitive advantage. These assets, often included in a business sale agreement, contrast with tangible items like classroom inventory.

Examples of Intangible Assets

- Patents: Legal rights granted for inventions, allowing the holder to exclude others from making, using, or selling the invention without permission.

- Trademarks: Symbols, names, or phrases legally registered or established by use as representing a company or product.

- Copyrights: Exclusive legal rights given to creators for their literary, artistic, or musical works.

- Brand recognition: The extent to which consumers can correctly identify a particular product or service by its brand.

- Goodwill: The value of a company’s brand name, solid customer base, good customer relations, and other intangibles.

- Franchises: Authorization granted by a company to an individual or group enabling them to carry out specified commercial activities.

- Trade secrets: Practices, designs, formulas, processes, or any information that provides a business advantage over competitors who do not know or use it.

- Software: Programs and other operating information used by a computer.

- Domain names: Addresses on the internet that are bought and sold, representing online presence.

- Customer lists: Compiled data of customers, including their contact details and purchase history, valuable for marketing and sales strategies.

- Licensing agreements: Contracts where the licensor allows the licensee to use patents, trademarks, technology, or other intangible assets.

- Non-compete agreements: Contracts that restrict one party from competing with another party for a specified period.

- Broadcast rights: Rights granted to broadcast television and radio programs.

- Publication rights: Legal rights to publish written content, often encompassing books, articles, and other literary works.

- Contracts: Binding agreements between parties that create mutual obligations enforceable by law.

- Supplier agreements: Contracts between a supplier and a buyer, outlining the terms of product supply.

- Customer relationships: The ongoing connection between a company and its customers, critical for business retention and growth.

- Intellectual property: Creations of the mind, such as inventions, literary and artistic works, and symbols, names, and images used in commerce.

- Logos: Graphic marks, emblems, or symbols used to aid and promote public identification and recognition.

- Trade names: Names used by businesses to identify themselves and distinguish their brand.

- Distribution rights: Rights granted to distribute a product within a certain territory or market.

- Marketing rights: Rights pertaining to the promotion and selling of products or services.

- Artistic-related intangibles: Non-physical assets associated with artistic endeavors, such as rights to visual art, music, and performance.

- Mineral rights: Legal rights to exploit and extract minerals from the land.

- Air rights: The right to control, occupy, or use the vertical space above a property.

- Lease agreements: Contracts outlining the terms under which one party agrees to rent property from another party.

- Research and development (R&D): Innovative activities undertaken by corporations or governments in developing new services or products, or improving existing ones.

- Technological know-how: Proprietary knowledge and technical expertise that provides a business advantage.

- Organizational capital: The value of an organization’s processes, structure, and culture that contributes to its ability to generate future economic benefits.

- Strategic alliances: Partnerships between businesses to pursue agreed-upon objectives while remaining independent organizations.

Identifiable and Unidentifiable Intangible Assets

Identifiable Intangible Assets

Identifiable intangible assets are non-physical assets that can be separated from the business and sold, transferred, licensed, rented, or exchanged. They have a specific value and can be clearly identified.

Examples:

- Patents: Legal rights granted to an inventor, giving exclusive rights to use, sell, and license the invention for a certain period.

- Trademarks: Recognizable signs, designs, or expressions that distinguish products or services from others.

- Copyrights: Legal rights that grant the creator of original works exclusive rights to use and distribute their work.

- Franchise Agreements: Contracts allowing the use of a company’s business model and brand for a specific period.

- Customer Lists: Databases containing information about clients and potential clients.

- Licenses: Permissions granted to use certain intellectual property or assets.

Unidentifiable Intangible Assets

Unidentifiable intangible assets are non-physical assets that cannot be separated from the business. They represent the value of the business as a whole rather than specific items.

Examples:

- Goodwill: The excess value paid over the net assets of a business during acquisition, representing brand reputation, customer loyalty, and other unquantifiable benefits.

- Employee Know-How: The collective knowledge, skills, and expertise of a company’s workforce.

- Company Culture: The values, beliefs, and behaviors that contribute to the unique social and psychological environment of a business.

- Brand Recognition: The extent to which consumers are familiar with the qualities or image of a particular brand of goods or services.

Types of Companies With Intangible Assets

Technology Companies

Examples: Microsoft (software like Windows and Office), Google (search engine and online services)

Intangible Assets: Patents, software licenses, trademarks

2. Pharmaceutical Companies

Examples: Pfizer (medications and vaccines), Johnson & Johnson (healthcare products)

Intangible Assets: Patents on drugs, research knowledge, trademarks

3. Media and Entertainment Companies

Examples: Disney (films and TV shows), Netflix (streaming service)

Intangible Assets: Copyrights on content, trademarks, brand reputation

4. Consumer Goods Companies

Examples: Coca-Cola (beverages), Nestlé (food and drinks)

Intangible Assets: Trademarks, brand recognition, secret recipes

5. Financial Services Companies

Examples: Goldman Sachs (investment banking), JPMorgan Chase (banking services)

Intangible Assets: Customer databases, brand reputation, proprietary algorithms

6. Healthcare Companies

Examples: Mayo Clinic (medical research and patient care), Medtronic (medical devices)

Intangible Assets: Patient databases, research knowledge, trademarks

7. Retail Companies

Examples: Nike (sportswear and equipment), Walmart (consumer products)

Intangible Assets: Trademarks, brand reputation, customer loyalty programs

8. Professional Services Firms

Examples: McKinsey & Company (management consulting), Deloitte (audit and advisory services)

Intangible Assets: Brand reputation, client lists, proprietary methods

Balance sheet of Intangible Assets

A balance sheet provides a snapshot of a company’s financial position at a specific point in time. It includes assets, liabilities, and shareholders’ equity. Intangible assets, being non-physical assets that provide long-term value, are an essential part of this financial statement. Below is an example of how intangible assets appear on a balance sheet.

Example Balance Sheet

XYZ Corporation Balance Sheet as of December 31, 2023

| Assets | Amount |

|---|---|

| Current Assets | – |

| Cash and Cash Equivalents | $50,000 |

| Accounts Receivable | $75,000 |

| Inventory | $100,000 |

| Prepaid Expenses | $10,000 |

| Total Current Assets | $235,000 |

| Non-Current Assets | – |

| Property, Plant, and Equipment | $500,000 |

| Accumulated Depreciation | ($150,000) |

| Net Property, Plant, Equipment | $350,000 |

| Intangible Assets | – |

| Patents | $40,000 |

| Trademarks | $30,000 |

| Goodwill | $60,000 |

| Software | $20,000 |

| Total Intangible Assets | $150,000 |

| Total Non-Current Assets | $500,000 |

| Total Assets | $735,000 |

- Patents: Legal rights to inventions and processes, providing exclusive use for a specified period.

- Trademarks: Brands, logos, and symbols that distinguish products or services.

- Copyrights: Protection for original works of authorship, such as literary and artistic works.

- Goodwill: Excess purchase price over the fair value of net identifiable assets in a business acquisition.

- Accumulated Amortization: Total amortization expense charged against intangible assets over time, reducing their book value.

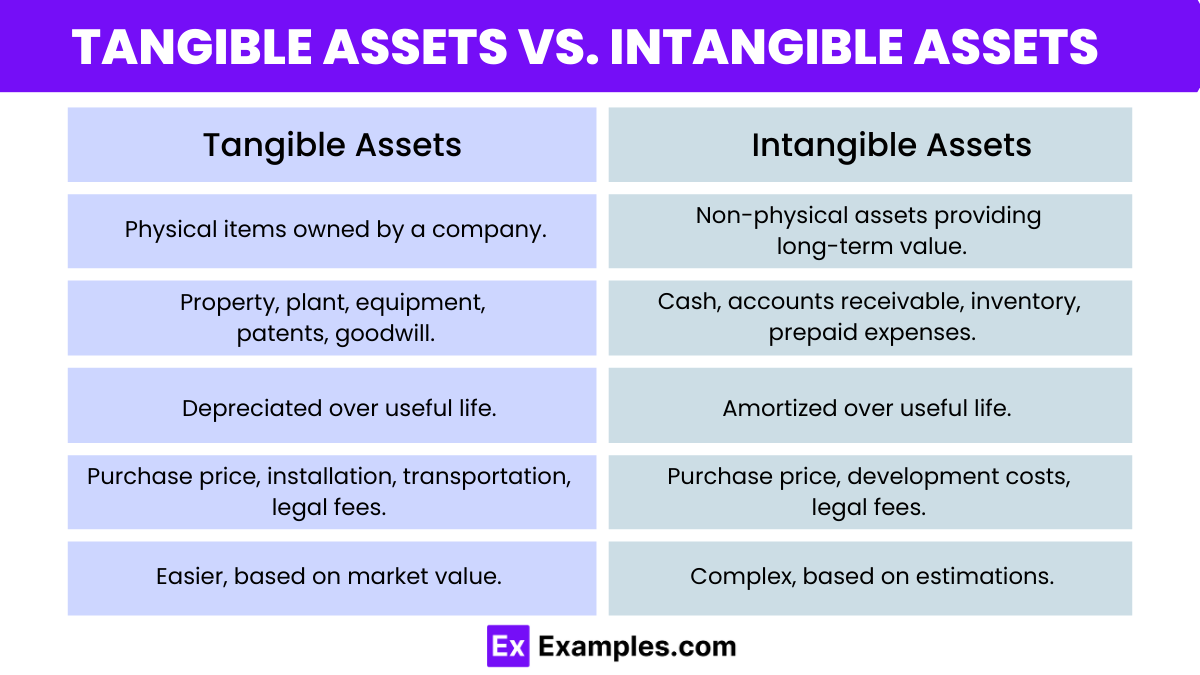

Tangible Assets vs. Intangible Assets

| Aspect | Tangible Assets | Intangible Assets |

|---|---|---|

| Definition | Physical items owned by a company | Non-physical assets providing long-term value |

| Physical Presence | Yes | No |

| Depreciation/Amortization | Depreciated over useful life | Amortized over useful life |

| Examples | Buildings, Machinery, Vehicles, Inventory | Patents, Trademarks, Goodwill, Software |

| Acquisition Cost | Purchase price, installation, transportation, legal fees | Purchase price, development costs, legal fees |

| Valuation | Easier, based on market value | Complex, based on estimations |

| Maintenance and Repairs | Routine maintenance and major repairs | Not applicable |

| Disposal | Sale, write-off | Impairment testing |

| Research and Development | Not applicable | Research costs expensed, development costs capitalized if criteria met |

| Goodwill | Not applicable | Arises from acquisitions, tested for impairment |

Accounting for Tangible and Intangible Assets

Accounting for assets involves identifying, measuring, and reporting the economic resources owned by a business. Assets can be classified into two categories: tangible and intangible. Understanding the differences between these assets and the specific accounting practices associated with each is crucial for accurate financial reporting.

Tangible Assets

Tangible assets are physical items that a company owns and uses in its operations. These assets have a clear, physical presence and can be seen and touched. Examples include buildings, machinery, vehicles, and inventory.

Characteristics of Tangible Assets

- Physical Form: Tangible assets have a physical presence.

- Depreciation: These assets typically depreciate over time due to wear and tear.

- Valuation: The value of tangible assets can be easily measured and recorded.

Accounting for Tangible Assets

Acquisition Cost:

- Purchase Price: The initial cost of acquiring the asset.

- Installation Costs: Expenses incurred to make the asset operational.

- Transportation Costs: Costs related to delivering the asset to its location.

- Legal Fees: Fees paid for acquiring legal rights over the asset.

Depreciation:

- Straight-Line Method: Spreads the cost evenly over the asset’s useful life.

- Declining Balance Method: Applies a fixed percentage of depreciation to the reducing book value.

- Units of Production Method: Depreciates the asset based on its usage or output.

Maintenance and Repairs:

- Routine Maintenance: Costs for regular upkeep to maintain the asset’s functionality.

- Major Repairs: Significant expenditures to restore the asset’s productivity, which may be capitalized.

Disposal:

- Sale: Recording proceeds from the sale and removing the asset from the books.

- Write-Off: Removing the asset if it is no longer usable or has no resale value.

Intangible Assets

Intangible assets are non-physical assets that provide long-term value to a company. They include intellectual property, patents, trademarks, copyrights, goodwill, and software.

Characteristics of Intangible Assets

- Lack of Physical Form: Intangible assets do not have a physical presence.

- Amortization: These assets are amortized over their useful life.

- Valuation: Valuing intangible assets can be complex and often involves estimations.

Accounting for Intangible Assets

Acquisition Cost:

- Purchase Price: The cost of acquiring the intangible asset.

- Development Costs: Expenses incurred in developing the asset internally.

- Legal and Registration Fees: Costs for legal protection and registration.

Amortization:

- Straight-Line Method: Spreads the cost evenly over the asset’s useful life.

- Impairment Testing: Regular assessment to ensure the asset’s value has not declined below its book value.

Research and Development (R&D):

- Research Costs: Typically expensed as incurred.

- Development Costs: Capitalized if they meet specific criteria, such as technical feasibility and intention to use or sell.

Goodwill:

- Recognition: Arises from business acquisitions when the purchase price exceeds the fair value of net identifiable assets.

- Impairment Testing: Tested annually for impairment rather than amortized.

What are intangible assets?

Intangible assets are non-physical assets that provide long-term value, such as patents, trademarks, copyrights, goodwill, and software.

How are intangible assets recorded on the balance sheet?

Intangible assets are listed under non-current assets on the Analyze balance sheet, typically after tangible assets.

What is goodwill in intangible assets?

Goodwill arises during a business acquisition when the purchase price exceeds the fair value of net identifiable assets.

How is amortization of intangible assets calculated?

Amortization is calculated using the straight-line method over the asset’s useful life, reflecting periodic expense allocation.

Why are intangible assets important in a proposal to buy a business?

A Proposal to Buy a Business Intangible assets can significantly impact a company’s value, affecting the purchase price and future profitability.

What is impairment testing for intangible assets?

Impairment testing ensures an asset’s carrying amount doesn’t exceed its recoverable amount, preventing overstatement on the balance sheet.

Can research and development costs be capitalized as intangible assets?

Development costs can be capitalized if they meet criteria such as technical feasibility and intention to use or sell the asset.

What types of intangible assets are commonly seen on a balance sheet?

Common types include patents, trademarks, copyrights, goodwill, franchises, and proprietary technology.

How does the valuation of intangible assets differ from tangible assets?

Intangible asset valuation often involves complex estimations and professional judgment, unlike tangible assets’ market-based valuation.

What role do intangible assets play in a company’s financial health?

Intangible assets contribute to a company’s competitive edge, innovation, and overall market value, reflected on the balance sheet.