21+ Investment Contract Examples to Download

There’s a lot to prepare before a sale of the stock shares of an individual or an organization takes place. Among the many documents required, which one stands out? The answer to that is the investment contract. This allows the transaction to be legally binding especially since investments usually require a big amount of money. Just like a security contract example, an investment contract should have all the details that can establish credibility and trustworthiness between the parties involved. Compared to the processes of making an advertising contract and other kinds of business contracts, it will also be faster, more efficient and easier for you to create an investment contract with the help of references.

21+ Investment Contract Examples

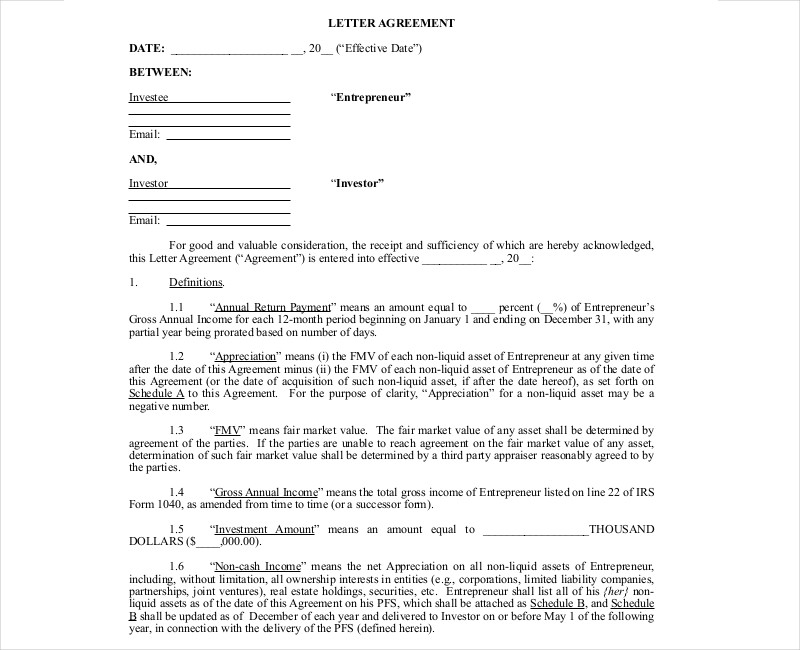

1. Simple Investment Example Contract

2. Real Estate Investment Contract Example

3. Simple Short Term Investment Contract Example

4. Investor Contract Example

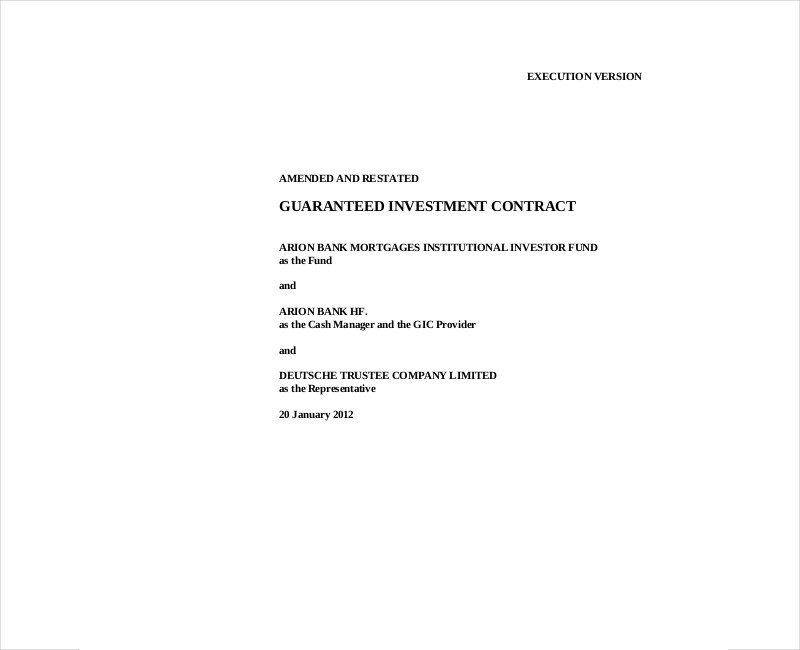

5. Guaranteed Investment Contract Example

6. Restaurant Investment Contract Example

7. Synthetic Investment Contract Example

8. Investment Contract Template

9. Simple Investment Contract

10. Guaranteed Investment Contract

11. Synthetic Investment Contract

12. Music Investor Contract Template

13. Investment Advisory Contract

14. Discretionary Investment Advisory Contract

15. Investment Advisor Services Agreement

16. Investment Advisor Firm Agreement

17. Investment Management Agreement

18. Sample Investment Advisory Agreement

19. Investment Representative Advisor Agreement

20. Client Application & Investment Advisory Agreement

21. Guaranteed Investment Contract

22. Personal Investment Contract

What Is an Investment Contract?

An investment contract is an agreement where a party pledges to invest money, with an expected return on investment coming some time afterward. This contract is often utilized in multiple kinds of industries, with notable examples being real estate and business. Not unlike yearly contract examples, there are fixed time periods where the validity of this contract is no longer legally enforceable.

How to Make an Investment Contract

Using a guaranteed investment contract template may not always be the right way to go. In such cases, learning how to come up with an investment contract is important for any business. Although it is usually drawn up by lawyers, business owners can write one themselves and save up on any legal fees that would be otherwise involved. Here is how you can do so in five easy steps

Step 1: Begin With The Opening Recitals and the Applicable Statements

The first thing to do is to write the opening recitals. This should specify what date the agreement was entered into, along with the specific addresses and names of both parties. Once that is done, proceed to the “whereas” statements. This is where the first party is specified as seeking investment and the other party is singled out as being willing to invest. Follow the “whereas” statements with a “therefore” statement.

Step 2: List Down the Contract’s Articles

When talking about articles, these are everything that was already discussed before, which both parties agreed upon. The only difference is, now they take on a written form as an important part of the investment contract. As you list them down, do so one at a time. Specify each one according to their number, such as “article 1” and “article 2.” The purpose of these articles will involve how much money is expected to be invested, along with statements that express how one party will make good use of the investment.

Step 3: Write Down the Payment Terms

For the third step, you must make sure that you include all the basic terms that an investment contract will need. These include the purpose of the investment transaction, as well as the identification of all the involved parties in the transaction. Just like when making a consulting contract or a Project Contract, the completion of details within the document makes the transaction much more transparent. Also, do not forget to clarify all the terms of the investment. This way, the investor and all the entities involved in the transaction can have an idea of the agreements present in the legal document.

Step 4: Specify the Start of Term and its Termination

A term is what identifies how long the agreement is going to be valid. Basically, this will refer to the period length that it will take the investing party to make their contribution, and receive the return on investment. When we talk about the termination, this describes how this specific agreement will end and how the involved parties can choose to end it early, if they so desire.

Step 5: Write Down the Company Contacts and its Choice of Law

For this last step, there are several important details that you need to include. Without these, the investment contract sample would not be complete. Be sure not to forget the name, address, telephone number, email, fax number, and title for both parties. Take note that the law is going to vary depending on where these parties are based, so it is imperative that this portion also specifies which state has jurisdiction over this newly-made document.

FAQ

What are the four types of investment?

Also referred to as class assets, the four investment types are growth investments, defensive investments, cash, and fixed interest investments. Each of these come with their own distinct traits, benefits, and risks. Growth investments, for example, include a company’s shares and property. On the other hand, cash investments include term deposits and high-interest savings accounts.

What are prime examples of investments?

Anything that produces income, be it sooner or later, are considered investments. This is particularly true if an item’s worth increases over time. For prime examples, there are bonds, stocks, mutual funds, and real estate. Other examples that aren’t as widely recognized include jewelry, comic books, and artwork.

What are the safest investments?

The top four safest investments, especially for those who are already at retirement age are certificates of deposit, treasuries, municipal bonds, and bond mutual funds. A portfolio that contains all of these is one that is balancing growth and safety simultaneously.

There are multiple benefits that await you when you download an investment contract template. Just like a payment contract or a sales contract, a guaranteed investment contract is necessary from time to time. Though there is nothing wrong with making investment contracts from scratch–and the steps provided above should make the creation process easier–having templates and examples is certainly quite convenient. Ensure that you will select a document guide that is related to the specific investment contract that you would like to have. Hurry up and grab these printable templates while you still can!