8+ Investment Research Report Examples to Download

While it is true that there are many ways business people can invest their money, how sure are they that their wealth will grow through these investments? People can pour their money in a real estate business, retail business, stocks, bonds, mutual funds, etc. However, if they do not have enough knowledge on how to manage their investments, there will be chances that they will incur more losses than earning money. This scenario gives you, as a research firm leader, an opportunity to help out these people. Enlighten these wealth seekers by feeding them the essential information about the investment data before they can waste their money blindly on the investment schemes which they may not be familiar with.

What is Investment Research?

By conducting investment research, you can get a better understanding of the performance of different investments, such as stocks, mutual funds, and other assets. Through this study, you can give out the most recent information and provide data-driven recommendations to the investors.

What is Investment Research Report?

Strategists and equity analysts who are part of the investment research company of brokerage or investment banks prepare investment research reports to help investors decide which investment and company are best for them. These reports may include information about stocks, industry sectors, currency updates, and recommendations, which are the necessary information that will support your judgment.

Bank Recommendations

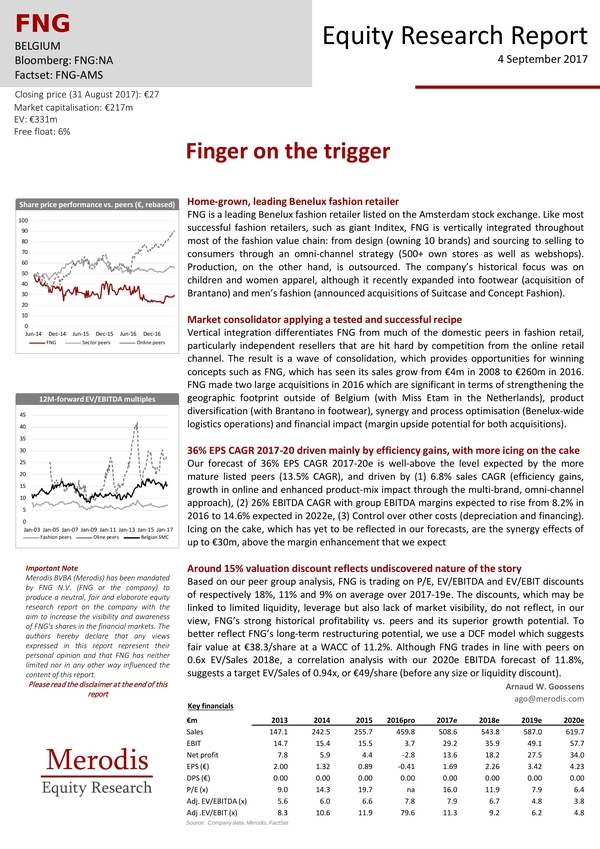

Speaking of recommendations, did you know that investment banks also earn money for publishing quarterly or annual equity analysis or other types of investment research reports? Yes, they do! Aside from creating collateralized products, propriety trading, dark pools, and swaps, banks also publish investment research reports such as equity research reports. Through this activity, banks can recommend the businesses they cover to the institutional investors, which encourages them to buy more shares. With that, they are getting commissions. JP Morgan is one of these banks.

8+ Investment Research Report Templates & Examples – Google Docs, MS Word, Pages

One of the most critical parts of an investment research paper development is creating a research report. It may also be the most time-consuming section of your research paper, especially if it is your first time to conduct this type of research. However, you don’t have to worry because we have collated a list of investment research report templates and examples below, which you can use for your investment research report creation. You can download these templates and samples in any file format mentioned right next to each of the contents for your convenience.

1. Market Research Report Template

2. Business Research Report Template

3. Free Research Report Cover Page Template

4. Market Research Report

5. Fashion Retailer Equity Research Report

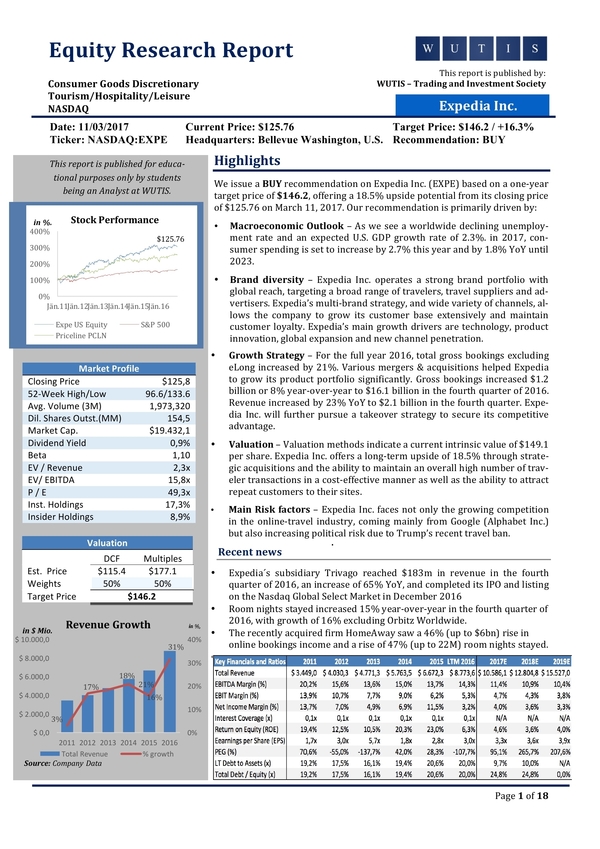

6. Equity Research Report

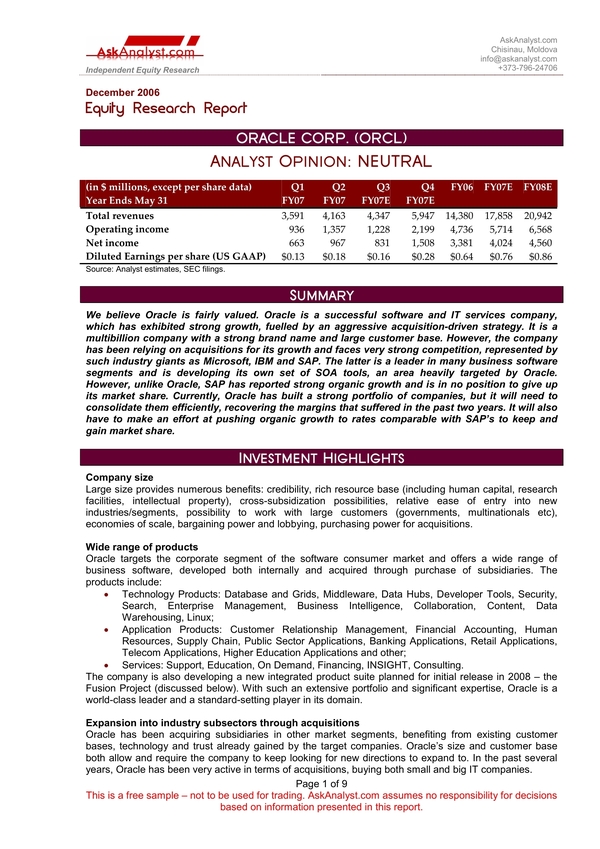

7. IT Firm Equity Research Report

8. IT Company Equity Research Report

9. Equity Research Report

Writing an Investment Research Report

There are several factors to consider when creating an investment research report. However, there are a few basic things that you should remember to ensure that the document you create will have an impact on your target market. Follow the instructions below to develop an efficient investment research report.

1. Do Your Research

Needless to say, before you can write anything, you have to be knowledgeable about your topic before you can start writing. For example, you are researching an individual company. You can begin by looking at the company’s form 10-k. Through this report, you can have a bigger picture of the business’ financial performance. Specificifically, you can get an overview or summary of the company’s primary operations, risk factors, financial data, etc.

2. Sort the Information That You Have

Once you have gathered all the necessary data, the next thing that you will do is to organize this information. In this step, you should be able to outline how your report will go following the research proposal. You should also know the proper flow of the information you are providing. Create graphs, charts, and other tools that will help you with the interpretation of the data that you hold. After that, you can analyze this data to create useful conclusions and come up with data-driven recommendations.

3. Start Writing

One of the hardest parts of creating an investment research report is getting started in writing. We recommend that you start with the basics. First, write down the necessary parts. Use the outline that you created earlier and start breaking down with the details. On the process, you will start noticing the unnecessary and missing information. Once you have written and placed all the information correctly, you can now proceed to the next step.

4. Proofread

This step is may not be the main essence of the document, but this will also play an essential role in convincing investors with your objectives. If you aim to convince new investors, you need to ensure that they will fully understand the contents of your stock research report. To do that, you need to observe correct grammar and spelling. You also need to consider the type of audience or target market of your research. You can also use the help of your team to read your report to spot any errors and ask update suggestions from them.

As an investment researcher, you should understand that the ultimate goal of an investor is to gain more profit. They hire people like you to materialize their goals. Therefore, you should ensure that the information that you will provide to them can actually help them attain their intention. In return, you will earn their trust and reach your organizational goals. This article is just a glimpse of the big world of investment. However, there are several materials that you can use to enhance your craft and learn more about your field. You can start by reading private equity investment.