10+ Investment Examples

Investment is the act of allocating resources, typically money, with the expectation of generating an income or profit. Diversified investments spread risk across various assets, enhancing stability. Investment analysis and portfolio management involve evaluating assets and strategizing to optimize returns. Tools like investment research reports , Call Option , and private equity investment opportunities aid in informed decision-making. Essential documents like an equity investment agreement formalize terms, while an investment portfolio tracks performance and growth.

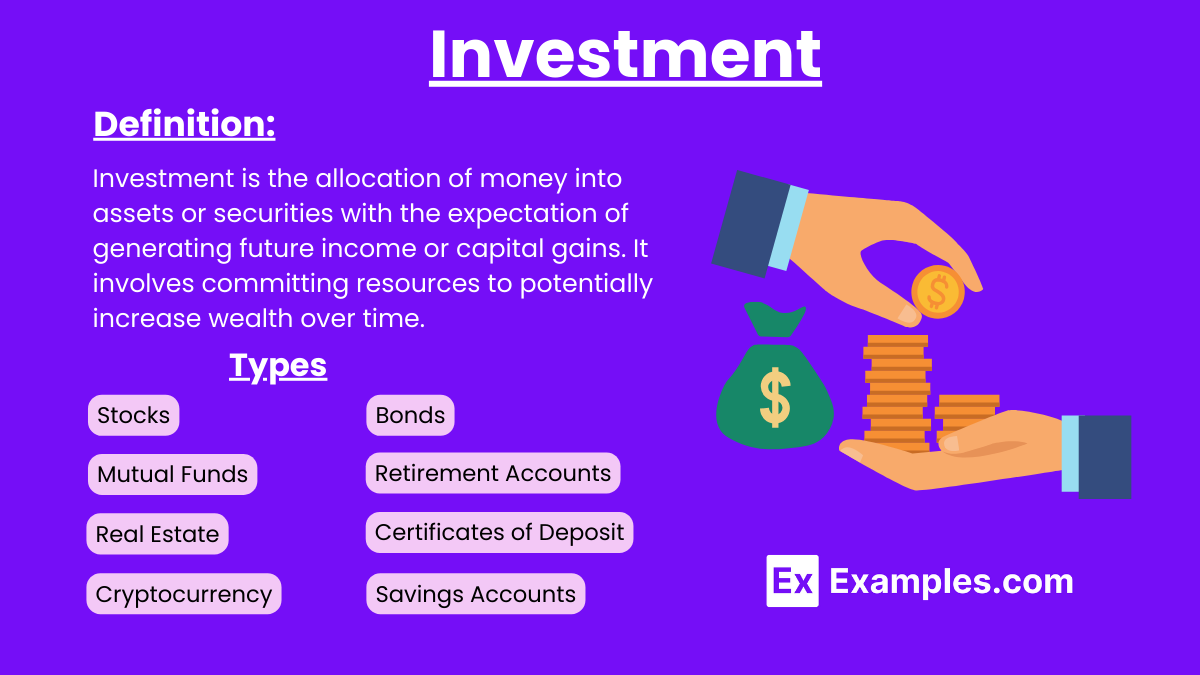

What is Investment?

Investment is the act of allocating money or resources into assets or ventures with the expectation of generating profit or income over time. It involves a calculated risk to grow wealth and achieve financial goals. Common forms include stocks, bonds, Market Economy, real estate, and mutual funds.

What Are the 3 Main Investment Categories?

1. Stocks

Definition: Stocks, also known as equities, represent ownership in a company. When you purchase a stock, you become a shareholder and own a portion of that company.

Examples:

- Common stocks of publicly traded companies like Apple, Amazon, and Microsoft.

- Preferred stocks, which provide fixed dividends and have priority over common stocks in asset liquidation.

2. Bonds

Definition: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity

Examples:

- Government Bonds: U.S. Treasury bonds, municipal bonds.

- Corporate Bonds: Investment-grade bonds, high-yield (junk) bonds.

3. Cash Equivalents

Definition: Cash equivalents are short-term, highly liquid investments that can be easily converted into cash. They are considered low-risk and offer modest returns.

Examples:

- Money Market Funds: Investment funds that invest in short-term, high-quality securities.

- Certificates of Deposit (CDs): Bank-issued time deposits with fixed interest rates and maturity dates.

- Treasury Bills (T-Bills): Short-term government securities with maturities ranging from a few days to one year.

How to Invest

Set Your Financial Goals

- Determine your short-term and long-term financial goals.

- Consider factors like buying a house, retirement, education, or vacation.

Assess Your Risk Tolerance

- Evaluate your willingness to take risks, which can range from conservative to aggressive.

- Understand that higher potential returns often come with higher risks.

Create a Budget

- Analyze your income, expenses, and savings.

- Allocate a specific amount of money for investments without compromising your financial security.

Educate Yourself

- Learn basic investment concepts, including stocks, bonds, mutual funds, and ETFs.

- Familiarize yourself with diversified investment strategies to mitigate risk.

Choose an Investment Account

- Open a brokerage account or a retirement account like an IRA or 401(k).

- Research different account types and providers to find the best fit for your needs.

Develop an Investment Strategy

- Decide between active and passive investing.

- Consider using Investment analysis and portfolio management to guide your decisions.

Build a Diversified Portfolio

- Spread your investments across various asset classes, such as stocks, bonds, and real estate.

- Use investment research reports to inform your choices and minimize risk.

Invest in Individual Assets

- Purchase individual stocks, bonds, mutual funds, or ETFs.

- Explore opportunities in private equity investment for higher potential returns.

Monitor and Review Your Investments

- Regularly review your investment portfolio to track performance.

- Adjust your strategy as needed based on market conditions and personal goals.

Seek Professional Advice

- Consult with a financial advisor for personalized guidance.

- Ensure all investments are formalized with appropriate documents, such as an equity investment agreement.

Types of Investments

Stocks

- Description: Buying shares of companies.

- Benefits: High potential returns.

- Risks: Prices can rise and fall sharply.

Bonds

- Description: Lending money to governments or corporations.

- Benefits: Regular interest payments.

- Risks: Lower returns than stocks; some risk of default.

Mutual Funds

- Description: Pooling money with other investors to buy a mix of stocks and bonds.

- Benefits: Diversification and professional management.

- Risks: Fees and varying performance based on the fund.

ETFs (Exchange-Traded Funds)

- Description: Similar to mutual funds, but traded on stock exchanges.

- Benefits: Lower fees, easy to buy and sell.

- Risks: Can fluctuate with market changes.

Real Estate

- Description: Buying property to rent or sell.

- Benefits: Potential rental income and property value increase.

- Risks: Market changes, maintenance costs.

Savings Accounts

- Description: Depositing money in a bank.

- Benefits: Very safe, easy access to money.

- Risks: Low interest rates, minimal growth.

Certificates of Deposit (CDs)

- Description: Bank deposits with fixed terms and interest rates.

- Benefits: Guaranteed returns, safe.

- Risks: Money is locked in for a set period.

Retirement Accounts (IRA, 401(k))

- Description: Special accounts for retirement savings.

- Benefits: Tax advantages, long-term growth.

- Risks: Depends on chosen investments.

Precious Metals

- Description: Investing in gold, silver, etc.

- Benefits: Hedge against inflation.

- Risks: Price volatility.

Cryptocurrency

- Description: Digital currencies like Bitcoin.

- Benefits: High potential returns.

- Risks: Highly volatile, speculative.

Examples of Investment

Stocks: Investing in shares of publicly traded companies to gain potential capital appreciation and dividends. Stocks can be volatile but offer high growth potential.

Bonds: Loaning money to a government or corporation in exchange for periodic interest payments and the return of principal at maturity. Bonds are generally considered safer than stocks.

Mutual Funds: Pooling money with other investors to buy a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer diversification.

Exchange-Traded Funds (ETFs): Investing in a basket of securities that track an index, commodity, or sector. ETFs are traded on stock exchanges and offer diversification with lower fees than mutual funds.

Real Estate: Purchasing property to generate rental income or for potential appreciation. Real estate can provide steady cash flow and long-term growth, though it requires significant capital.

Real Estate Investment Trusts (REITs): Investing in companies that own, operate, or finance income-producing real estate. REITs offer real estate exposure without the need to manage properties directly.

Certificates of Deposit (CDs): Depositing money in a bank for a fixed period in exchange for a guaranteed return. CDs offer low risk and fixed interest rates, making them suitable for conservative investors.

Savings Accounts: Keeping money in a bank account that earns interest. Savings accounts are highly liquid and safe but offer lower returns compared to other investments.

Commodities: Investing in physical goods like gold, silver, oil, or agricultural products. Commodities can hedge against inflation but can be volatile and require careful market analysis.

Cryptocurrencies: Buying digital currencies like Bitcoin and Ethereum. Cryptocurrencies offer high growth potential but are highly volatile and speculative.

Index Funds: Investing in funds that aim to replicate the performance of a market index like the S&P 500. Index funds offer low fees and broad market exposure.

Pension Plans: Contributing to employer-sponsored retirement plans like 401(k)s. Pension plans provide tax advantages and potential employer matching contributions.

Annuities: Purchasing insurance contracts that provide regular payments for a specified period or for life. Annuities can offer stable income in retirement.

Hedge Funds: Investing in pooled funds managed by professionals using diverse strategies. Hedge funds often require high minimum investments and can be risky.

Private Equity: Investing directly in private companies or through private equity funds. Private equity can offer high returns but is typically illiquid and involves significant risk.

Venture Capital: Providing capital to startups and early-stage companies in exchange for equity. Venture capital can yield substantial returns but carries high risk and uncertainty.

Peer-to-Peer Lending: Lending money directly to individuals or small businesses through online platforms. Peer-to-peer lending offers higher interest rates but involves the risk of borrower default.

Collectibles: Investing in items like art, antiques, coins, or wine. Collectibles can appreciate significantly over time but require specialized knowledge and market understanding.

Treasury Securities: Buying government debt instruments like Treasury bonds, notes, and bills. Treasury securities are considered very safe and are backed by the U.S. government.

Dividend Stocks: Investing in stocks that pay regular dividends. Dividend stocks provide income and potential for capital appreciation, making them attractive for income-focused investors.

What is the goal of an investment?

Capital Appreciation: Capital appreciation refers to the increase in the value of an asset or investment over time. The main objective is to buy an asset at a lower price and sell it at a higher price in the future.

Key Features:

- Long-Term Growth: Suitable for investors looking to grow their wealth over the long term.

- Higher Risk: Often involves higher risk, as the value of investments can fluctuate.

Examples:

- Investing in stocks with the potential for significant growth.

- Purchasing real estate properties expected to appreciate in value.

Income Generation: Income generation focuses on creating a steady stream of income from investments. This income can come from interest, dividends, or rental income.

Key Features:

- Regular Cash Flow: Provides periodic income, which can be used for living expenses or reinvested.

- Lower Risk: Generally involves lower risk compared to capital appreciation-focused investments.

Examples:

- Investing in dividend-paying stocks.

- Holding bonds that pay regular interest.

- Owning rental properties that provide rental income.

Capital Preservation: Capital preservation aims to protect the initial investment amount, ensuring that the investor does not lose principal value. This goal is often prioritized by conservative investors or those nearing retirement.

Key Features:

- Low Risk: Involves minimal risk, prioritizing the safety of the invested capital.

- Modest Returns: Typically offers lower returns compared to growth-focused investments.

Examples:

- Investing in government bonds or high-quality corporate bonds.

- Holding money market funds or certificates of deposit (CDs).

Diversification: Diversification aims to reduce risk by spreading investments across various asset classes, sectors, or geographic regions. The goal is to minimize the impact of poor performance in any single investment.

Key Features:

- Risk Management: Helps in managing and mitigating risk by not putting all eggs in one basket.

- Stable Returns: Can lead to more stable and predictable returns over time.

Examples:

- Building a portfolio that includes a mix of stocks, bonds, and cash equivalents.

- Investing in different sectors such as technology, healthcare, and consumer goods.

Meeting Specific Financial Goals: Investing can also be tailored to meet specific financial goals, such as saving for retirement, funding education, or purchasing a home.

Key Features:

- Goal-Oriented: Investments are chosen based on their ability to meet specific financial objectives.

- Time-Bound: Investments are often aligned with a particular time frame to achieve the desired goal.

Examples:

- Contributing to a retirement account like a 401(k) or IRA.

- Investing in a 529 college savings plan for a child’s education.

- Saving for a down payment on a house through a mix of short-term and long-term investments.

How does the investment work?

1. Understanding Different Types of Investments

There are various types of investments, each with its own characteristics and potential returns:

- Stocks: Represent ownership in a company. Investors buy shares in hopes of future appreciation and dividends.

- Bonds: Debt securities issued by entities such as governments or corporations. Investors lend money in exchange for periodic interest payments and the return of the principal at maturity.

- Real Estate: Involves purchasing property to generate rental income or to sell at a higher price in the future.

- Mutual Funds and ETFs: Pooled investment vehicles that allow investors to diversify across many securities.

- Cash Equivalents: Short-term, highly liquid investments such as money market funds or certificates of deposit (CDs).

2. Setting Investment Goals

Before investing, it is crucial to set clear financial goals. These might include:

- Retirement Planning: Investing to ensure financial security during retirement.

- Education Funding: Saving for a child’s college education.

- Wealth Accumulation: Growing wealth over time for major purchases or future financial stability.

3. Determining Risk Tolerance

Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. It depends on factors such as age, financial situation, and investment horizon. Generally:

- High Risk Tolerance: Younger investors or those with a longer time horizon might invest more in stocks.

- Low Risk Tolerance: Investors nearing retirement or those who need to preserve capital might prefer bonds or cash equivalents.

4. Diversification

Diversification involves spreading investments across various asset classes to reduce risk. A diversified portfolio might include:

- A mix of stocks and bonds

- Different sectors (technology, healthcare, etc.)

- Geographic regions (domestic and international)

5. Asset Allocation

Asset allocation is the strategy of dividing an investment portfolio among different asset categories. The allocation should align with the investor’s risk tolerance, goals, and time horizon. For example:

- Aggressive Portfolio: High allocation to stocks.

- Conservative Portfolio: Higher allocation to bonds and cash equivalents.

6. Investment Vehicles and Accounts

Investors can choose from various accounts to hold their investments, each offering different tax advantages:

- Retirement Accounts: 401(k), IRA, Roth IRA.

- Taxable Brokerage Accounts: For general investing without tax-advantaged status.

- Education Accounts: 529 plans for college savings.

7. Buying and Selling Investments

Investments are bought and sold through:

- Brokerages: Firms that facilitate the buying and selling of securities.

- Direct Purchase: Some companies and governments offer direct purchase plans for stocks and bonds.

8. Monitoring and Rebalancing

Investing is not a one-time activity. It requires regular monitoring to:

- Track Performance: Ensure investments are meeting expectations and goals.

- Rebalance: Adjust the portfolio periodically to maintain the desired asset allocation.

9. Compounding and Time Horizon

One of the key principles of investing is the power of compounding, where investment returns generate their own earnings. Over a long time horizon, compounding can significantly increase the value of an investment.

What are the benefits of investing for investors?

Wealth Accumulation: Investing allows individuals to grow their wealth over time. By putting money into assets that appreciate, such as stocks, real estate, or mutual funds, investors can increase their net worth.

Benefits:

- Potential for high returns compared to traditional savings accounts.

- Ability to build substantial wealth through long-term compounding.

Income Generation: Investments can provide a regular income stream. This is particularly important for retirees or those looking to supplement their income.

Benefits:

- Dividends from stocks.

- Interest payments from bonds.

- Rental income from real estate.

Beating Inflation: Inflation erodes the purchasing power of money over time. Investing in assets that appreciate or provide higher returns than the inflation rate helps preserve and grow purchasing power.

Benefits:

- Protection against the diminishing value of money.

- Ability to maintain or improve standard of living over time.

Achieving Financial Goals: Investing can help individuals meet specific financial goals, such as buying a home, funding education, or preparing for retirement.

Benefits:

- Targeted growth for major life milestones.

- Structured approach to saving and achieving long-term objectives.

Tax Advantages: Certain investment accounts offer tax benefits that can enhance returns. Retirement accounts like IRAs and 401(k)s allow for tax-deferred growth, while Roth IRAs offer tax-free withdrawals.

Benefits:

- Deferred tax payments, allowing investments to grow without immediate tax impact.

- Potential for tax-free income in retirement (Roth IRAs).

Diversification and Risk Management: Investing in a variety of assets can spread risk and reduce the impact of poor performance in any single investment.

Benefits:

- Reduced portfolio volatility.

- Balanced risk through asset allocation.

Liquidity: Some investments, such as stocks and bonds, are easily convertible to cash, providing liquidity to investors when needed.

Benefits:

- Flexibility to access funds quickly.

- Ability to respond to unexpected financial needs.

Ownership and Control: Investing in stocks or real estate can provide ownership and a sense of control over one’s financial destiny.

Benefits:

- Influence over investment decisions and strategies.

- Participation in the growth and success of companies or properties.

Compounding Returns: Reinvesting earnings from investments allows for compounding, where returns generate additional returns over time.

Benefits:

- Exponential growth of investment value.

- Significant wealth accumulation over the long term.

Learning and Engagement: Investing encourages individuals to learn about financial markets, economics, and business, leading to better financial literacy and engagement.

Benefits:

- Improved understanding of economic principles and market dynamics.

- Enhanced decision-making skills for personal finance.

What are the risks of investing?

Market Risk: Market risk, also known as systematic risk, refers to the potential for an investor to experience losses due to factors that affect the overall performance of the financial markets. This includes:

- Economic Recessions

- Political Instability

- Natural Disasters

Credit Risk: Credit risk is the possibility that a bond issuer will default on its debt obligations. When this happens, investors might lose both the interest payments and the principal amount invested. Key factors include:

- Company Bankruptcy

- Downgraded Credit Ratings

Liquidity Risk: Liquidity risk occurs when an investor cannot easily sell an investment at its fair market value. This can happen with:

- Real Estate

- Small-Cap Stocks

- Collectibles

Interest Rate Risk: Interest rate risk is the danger that the value of an investment will decrease due to changes in interest rates. This is particularly relevant for:

- Bonds

- Fixed-Income Securities

Inflation Risk: Inflation risk is the risk that inflation will erode the purchasing power of money. Investments that are particularly vulnerable include:

- Cash

- Fixed-Rate Bonds

Reinvestment Risk: Reinvestment risk occurs when the returns on an investment, such as interest or dividends, must be reinvested at a lower rate than the original investment. This often affects:

- Bonds

- Certificates of Deposit (CDs)

Currency Risk: Currency risk, also known as exchange rate risk, arises from the change in the price of one currency against another. It affects:

- International Investments

- Foreign Bonds

Management Risk: Management risk is the risk associated with poor management decisions in a company or fund. This risk can lead to:

- Poor Performance

- Financial Losses

Regulatory Risk: Regulatory risk refers to the possibility of a change in regulations that could negatively affect an investment. This includes:

- Tax Law Changes

- New Financial Regulations

Political Risk: Political risk is the risk of loss due to political instability or changes in government policies. This can affect investments in:

- Emerging Markets

- Countries with Unstable Governments

Difference Between Direct Investment and Indirect Investment

| Criteria | Direct Investment | Indirect Investment |

|---|---|---|

| Definition | Directly purchasing assets such as real estate, stocks, or business ownership. | Investing through intermediaries like mutual funds or ETFs. |

| Control | Investors have direct control over investment decisions. | Investors have limited control, as decisions are made by fund managers. |

| Examples | Real estate properties, individual stocks, business ventures. | Mutual funds, ETFs, index funds. |

| Risk Level | Higher risk due to direct exposure to market fluctuations. | Generally lower risk as it is spread across multiple assets. |

| Liquidity | Often less liquid; selling assets can take time. | Usually more liquid; easier to buy or sell shares. |

| Investment Knowledge | Requires in-depth knowledge and active management. | Requires less expertise; managed by professionals. |

| Costs | Higher costs due to transaction fees, maintenance, and management. | Typically lower costs, but includes management fees. |

| Diversification | Limited diversification, dependent on individual choices. | High diversification, spread across many assets. |

| Returns | Potential for higher returns if investments perform well. | Generally provides moderate returns, reflecting overall market performance. |

| Time Commitment | High time commitment for research, monitoring, and management. | Lower time commitment, as fund managers handle the work. |

| Tax Implications | Direct tax liabilities on income and capital gains. | Tax efficiency can vary; some funds offer tax advantages. |

What are the best investment strategies?

Diversification: Diversification involves spreading investments across various asset classes, sectors, and geographical regions to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a poor-performing investment on your overall portfolio.

Dollar-Cost Averaging: Dollar-cost averaging is the practice of investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of volatility and eliminates the need to time the market.

Value Investing: Value investing involves buying undervalued stocks with strong fundamentals. Investors seek stocks that are priced lower than their intrinsic value, often due to market overreactions or temporary setbacks.

Growth Investing: Growth investing targets companies with high potential for earnings growth. These companies often reinvest profits to fuel expansion, leading to significant capital appreciation over time.

Income Investing: Income investing focuses on generating regular income from investments, such as dividends from stocks or interest from bonds. This strategy is ideal for investors seeking a steady cash flow.

What Factors should be considered when Investing?

Investment Goals: Align your investments with specific financial objectives such as retirement, education, or wealth accumulation. Clear goals help guide your investment strategy and decisions.

Risk Tolerance: Assess your ability to handle market volatility and potential losses. Your risk tolerance is influenced by factors like age, financial situation, and emotional capacity.

Time Horizon: Determine your investment strategy based on how long you plan to invest. Short-term goals may require safer, more liquid investments, while long-term goals can accommodate higher-risk options.

Diversification: Spread your investments across various asset classes like stocks, bonds, and real estate. Diversification helps reduce risk and improves the potential for stable returns.

Fees and Costs: Consider the costs associated with your investments, including brokerage fees, management fees, and taxes. Minimizing these costs can significantly impact your overall returns.

How do I start investing?

Start by setting financial goals, assessing risk tolerance, and choosing investment types like stocks, bonds, or mutual funds.

What are the risks of investing?

Investment risks include market volatility, loss of principal, inflation, and liquidity issues.

What is diversification?

Diversification involves spreading investments across various asset classes to reduce overall risk.

How much should I invest?

Invest an amount you can afford to lose, considering your financial goals and risk tolerance.

When should I sell an investment?

Sell an investment when it meets your financial goals, underperforms, or your risk tolerance changes.

What is compound interest?

Compound interest is the process where the interest earned on an investment is reinvested, generating additional earnings over time.

How do I assess my risk tolerance?

Assess risk tolerance by considering your financial situation, investment goals, and ability to handle market fluctuations.

What are dividends?

Dividends are payments made by a company to its shareholders, typically from profits, providing regular income.

What is a 401(k) plan?

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute pre-tax income for retirement.

What are the benefits of investing early?

Investing early allows more time for compound interest to grow your investments, increasing potential returns.