15+ Invoice Examples to Download

Paying attention to the design of your business invoice is important since it is an extension of your brand, which means that any impression people will have of it will affect your business.

Luckily for you, this article will help you learn everything there is to know about invoices along with the process of making them.

Elements of a Good Invoice

Designing an effective invoice is important because it helps you convey a professional image. To achieve that, here are a few key elements to remember:

1. Your business name and contact information: Clearly list your business name, email, phone number, website, and physical address, just as you would list it on any other formal correspondence.

2. Your client or customer’s name and contact information: Clearly list the customer’s name, or the contact person’s name and title, if you are working with a larger organization. Include as much contact information as possible, including one’s email and physical address.

3. The invoice number: Each invoice you create should have a unique number associated with it. You can start invoice numbers at any number you want, which is useful if you don’t want to send your very first client an invoice that says ‘Invoice #0001’. You can assign invoice numbers chronologically or use a unique format for each client.

4. The PO number, if there is one: Some of your customers, especially if they are bigger businesses, will require you to list a PO number on the invoice. When they agree to buy a certain product or service from you, their accounting team creates a PO, or a purchase order, and corresponding PO number. All you need to do is include that number on your business invoice so they can match it to the original purchase order and process your payment without delay.

5. The invoice sent date and due date: List the day the invoice was sent as well as the payment due date. You could specify that the invoice is due upon receipt, upon completion of a project or delivery of a product, on a specific date in the future, and so on.

6. A breakdown of products or services provided: Include an itemized description of each product, project, task or service you are invoicing for. For example, if you sell a product, your invoice should list each item purchased, the quantity purchased, the price per item, and the total price. If you are providing a service, your invoice should list the flat fee you charge for that service, or the hourly fee you charge and the total hours worked. Also, clearly note the date when that service was provided, or will be provided in the future.

7. The total balance due: Once you have itemized all the products and services you are billing for, add the appropriate tax, if applicable, and list the total balance due.You may also see sales invoice examples.

8. Payment terms: Specify payment terms for this invoice. For example, if there is a deposit, when is it due? If a client pays an invoice past the due date, is there a late fee?

9. Any notes for the client or customer: It can be nice to leave a brief message for your customer, even if it’s just a simple “thank you” for doing business with you.

15+Invoice Templates

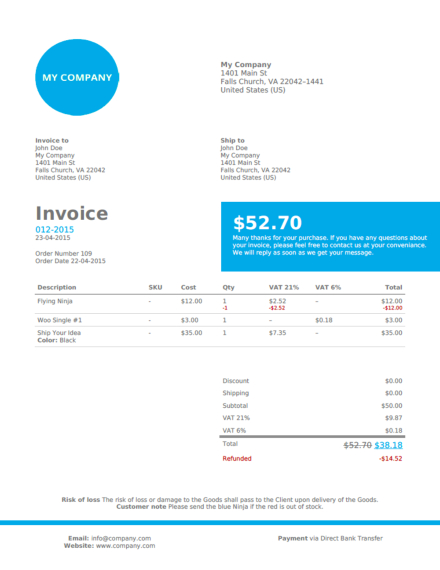

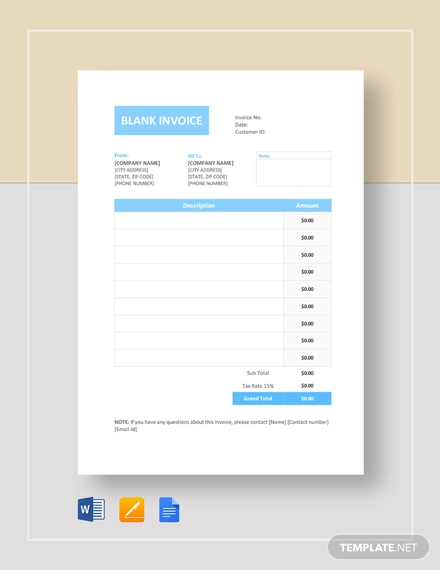

Basic Invoice Template

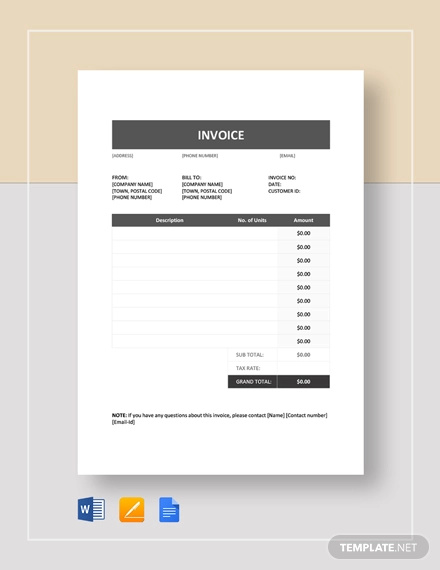

Invoice Example

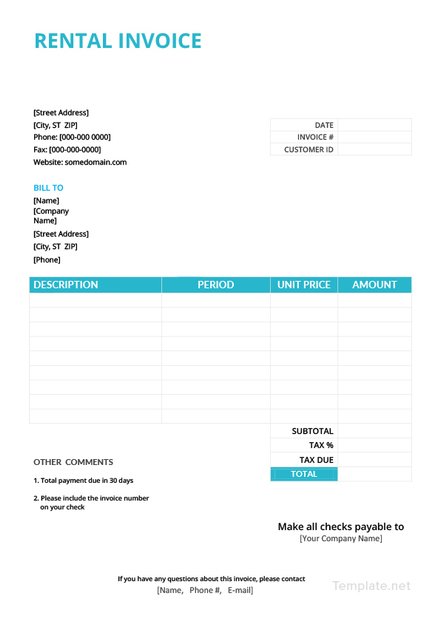

Rental Invoice Template

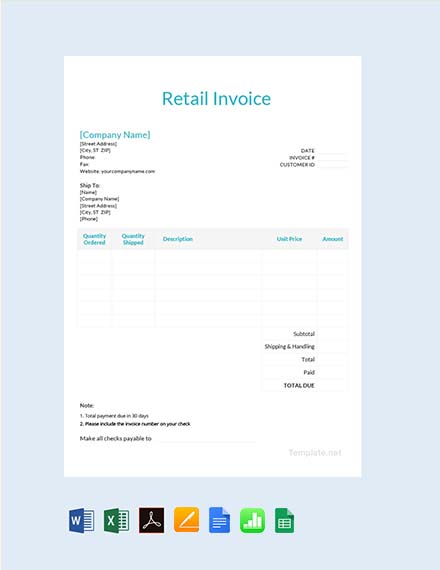

Retail Invoice

Plumbing Invoice Template

Simple Invoice Format

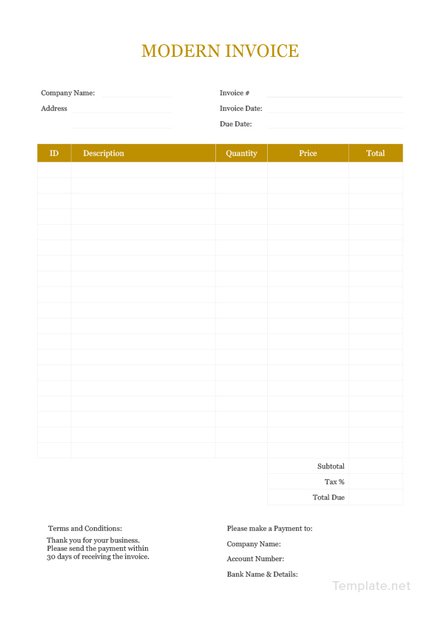

Modern Invoice Template

Tax Invoice Template

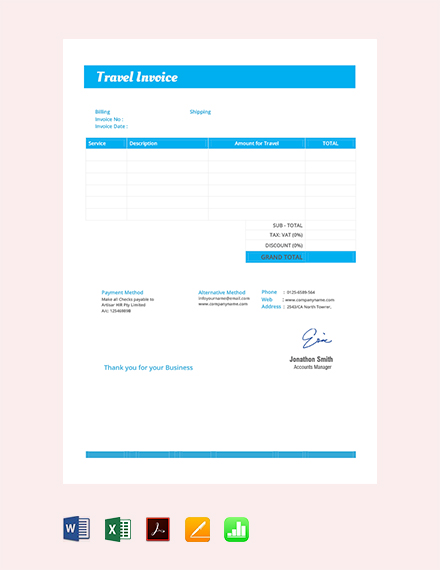

Travel Invoice Template

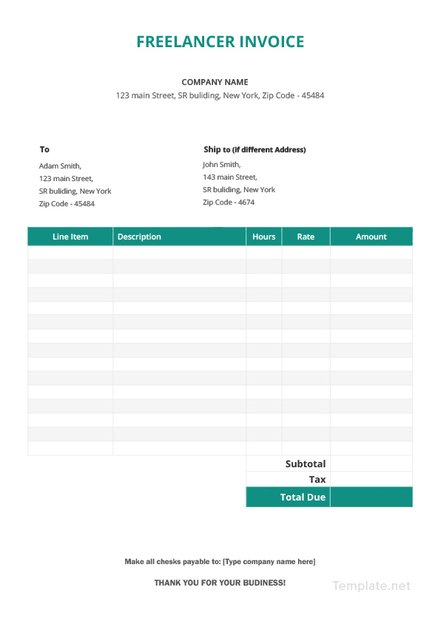

Freelancer Invoice

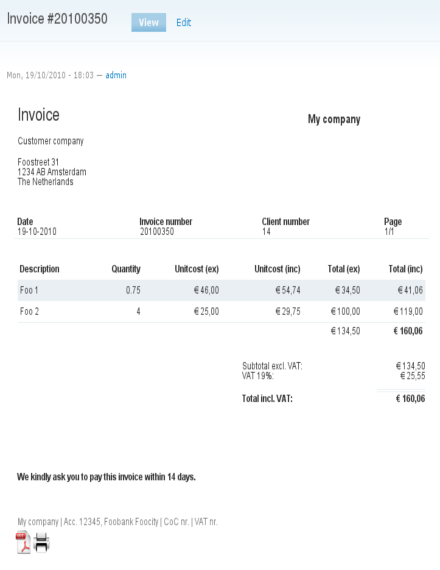

Standard Invoice Template

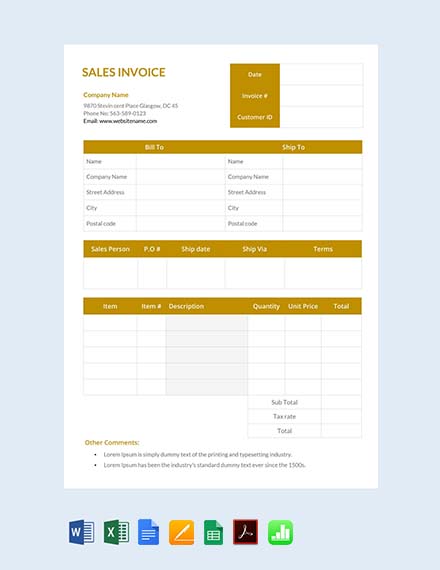

Sales Invoice Template

Micro Invoice Template

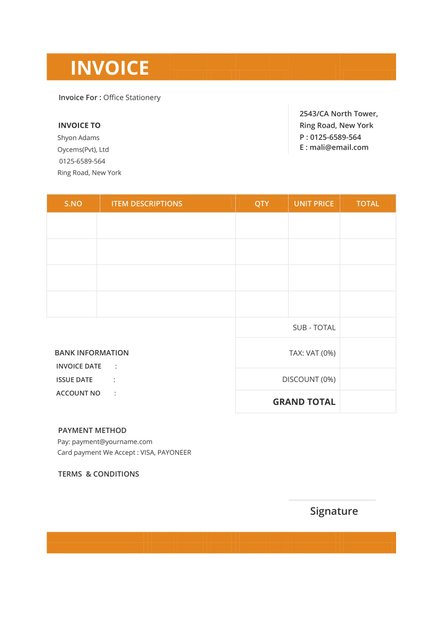

Invoice Template

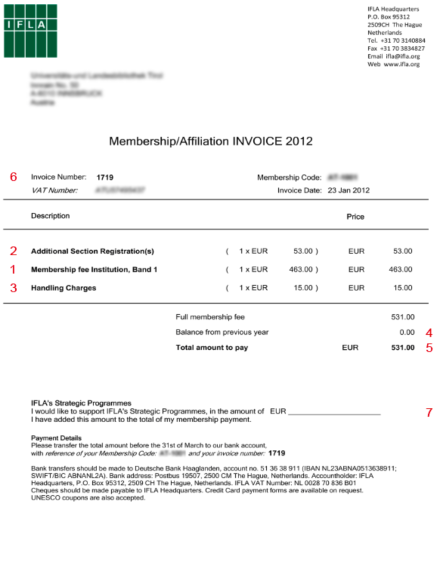

Membership Affiliation Invoice

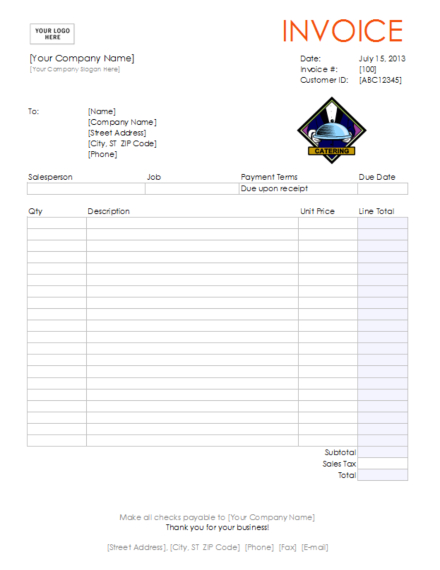

Catering Invoice Template

Color-Themed Invoice Template

How to Create an Invoice

Below is a discussion of everything that you need to know about invoicing and why it’s important to get it right.

1. Be Transparent: Your client wants to know exactly where their money is going, and your invoice is a great vehicle for communicating the nitty gritty details of the job. Be specific rather than general with your line items. Instead of listing Materials as a single expense, list each on its own line, such as paint, nails, plywood, etc. It’s also a good idea to attach simple receipts to back your claims. Don’t risk having your customer wonder if you’re padding the bill.

2. Use a Digital Format: Using a digital format is one way to ensure your invoice is professional, and to indicate that you are likely to use the latest tools, and follow the best practices, on the job.

3. Track your time: Time is money, so it’s vital to keep track of it. It will also help you learn how long it will take to complete similar projects in the future. Accurate time tracking also adds a level of transparency to your billing and helps you get compensated accordingly.

Simple Tips For an Excellent Invoice

If you want to engage in a more effective invoicing, you need to have a plan. Here are a few tips you can use for effective invoicing:

- List a due date: One of the most effective things you can do when invoicing is to list a due date, which will serve as a deadline to your clients. It gives them a timeline to follow. Without the date, you just have to hope that your client will pay in a timely manner. It’s true that you can’t force someone to pay by the due date you set, but you increase your chances of timely payment when you include a due date on your invoice.

- Include payment types accepted: Be clear on what payment methods you accept. Effective invoicing means that you make it easy for your clients to pay you. The more types of payments you accept, the easier it is for your clients to pay you. You may also see invoice examples in excel.

- Know who should get the invoice: The most effective invoicing practice involves making sure that you know who should receive the invoice. Is there an accounts payable email address to send to? Do you have the name of a contact? Find out this information. You want the invoice to go through as few people as possible. The more people to pass the invoice go, the more likely it is that your payment will be delayed.

- Keep good records of your work: Make sure that you keep records of the work that you are doing. If you freelance, keep track of the project. If you charge hourly, make sure you have time tracking that can prove what you spent. From inventory to time to published tweets, whatever it is you are supposed to be measuring, keep track. You want detailed records to back up your service invoice.

- Consider automating your invoicing: One of the most effective invoicing strategies is to avoid thinking about it at all. If you don’t have to remember to send out invoices, so much the better.

- Consider late payment fees: This can be a good way to encourage clients to pay on time since they will be penalized if they don’t. You can charge a flat fee or a percentage. Many business owners wait until after an invoice has been paid 30 days late or longer before they start charging fees. You can decide how it will work best for your business.

Types of Invoices

On the basis of the different demands by different industries and also for different products and services, invoices can be of several types:

- Standard Invoice: This is a basic format for an invoice and can be used in the same format for different business transactions. This type of invoice consists of all the basic information that is to be included in any invoice such as the unique invoice number, name of the seller, the company’s name, address, contact details, the name of the buyer, address, items purchased, total cost, etc.

- Commercial Invoice: Unlike the sales invoice we receive from the nearby department store or e-commerce site, a commercial invoice is a special invoice designed for documentation of any foreign trade such as the shipment of machine parts from one country to another. It is used for customs declaration when the product is crossing international borders.

- Progress Invoice: This kind of invoice is commonly used in works that stretch over a long period. It is most common in the construction industry as this is one industry which not only takes a lot of time for each project but is also very expensive. Contractors send invoices or bills from time to time showing the progress of the work and quoting the amount required to be paid to them, as well as to cover the expenses made during the present construction work. You may also see hotel invoice examples.

- Timesheet: This is a special kind of invoice that is preferred by professionals whose services are evaluated on the basis of the time for which the service is being provided. Such invoices are usually provided by consultants, psychotherapists, lawyers, tuition teachers, and mostly by those whose services are more intellectual than technical.

- Pending Invoice: The balance amount or the pending payment is a part of a pending invoice. In the case of a pending bill, the outstanding amount, or the amount which was not paid during the last payment is presented in the pending invoice.

Invoice FAQs

What is the difference between an invoice and a bill?

A bill is the amount of money owed to a person or a business for goods supplied or services rendered. It is usually expressed in a printed or written statement of charges. An invoice, on the other hand, is a list of goods sent or services provided, with a financial statement of the sum due for them.

Is an invoice the same as a receipt?

The difference between an invoice and a receipt is that an invoice is released prior to the payment, while a receipt is issued after the payment. The invoice is used to track the sale of goods or services, while a receipt acts as a documentation for the buyer that the amount of the merchandise has been paid.

The tiny things, such as issuing a well-written invoice, is often an overlooked part of running a business, when, in fact, it is just as important as, say, your marketing strategy or your weekly inventory. Your invoice is a valuable tool in accounting, and if you want to run this business right, learn how to make one.