12+ Tax Invoice Examples to Download

A tax invoice plays a vital role in the world of business. Almost all business issue a tax invoice to have a proof of their goods provided and/or their service rendered. Failure to issue a correct tax invoice or even just a non-trade invoice in excel may result in fine and penalty of a large amount or worst, imprisonment.

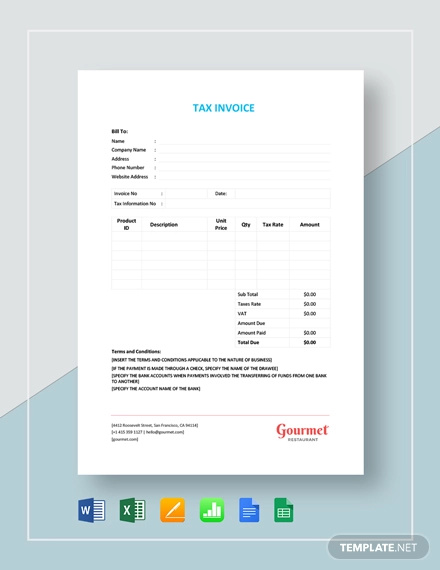

Tax Invoice Sample

Simple Tax Invoice Template

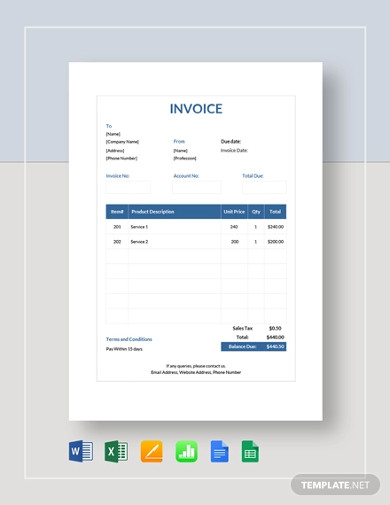

Non Tax Invoice Template

A tax invoice is a special type of simple invoice, which contains important and necessary information needed for an effective and efficient maintenance of the GST system, A tax invoice is critical because they record decent acquisitions for which an input tax credit can be claimed. Without proper tax invoice, a business can not deduct input tax.

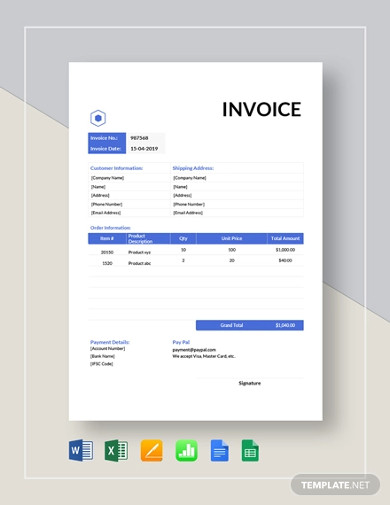

Printable Tax Invoice Template

Invoice with Sales Tax Template

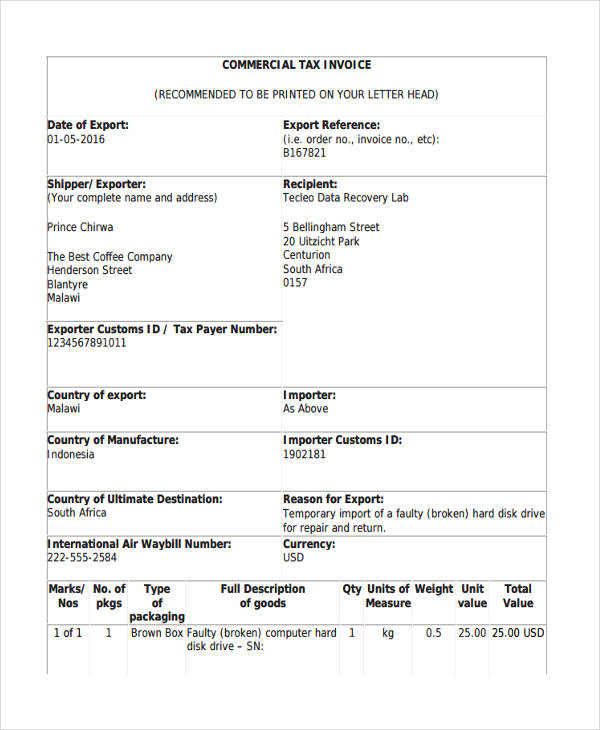

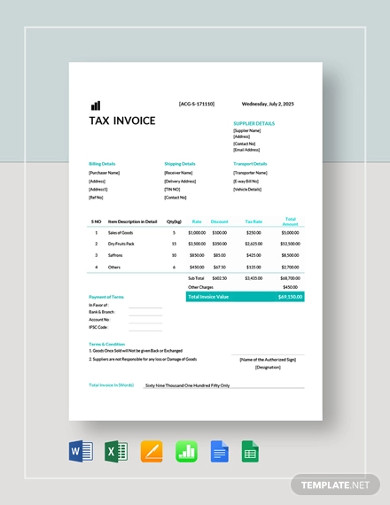

Commercial Tax Invoice

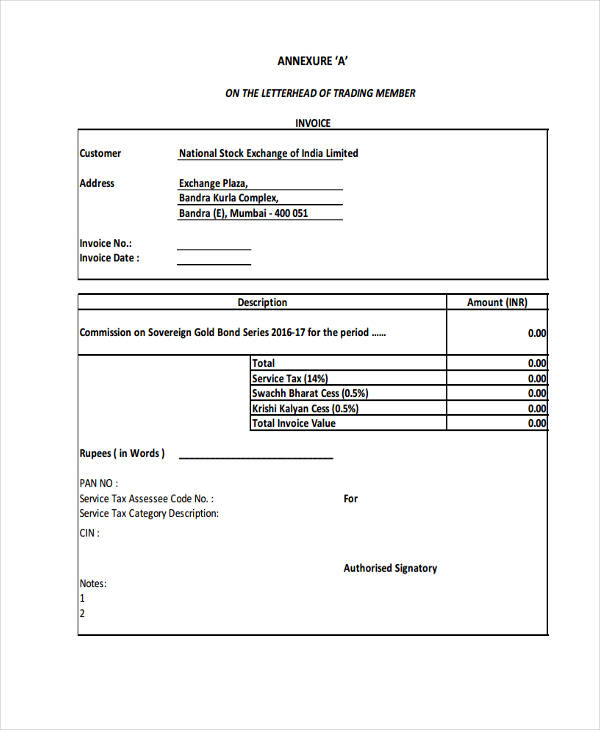

Service Tax

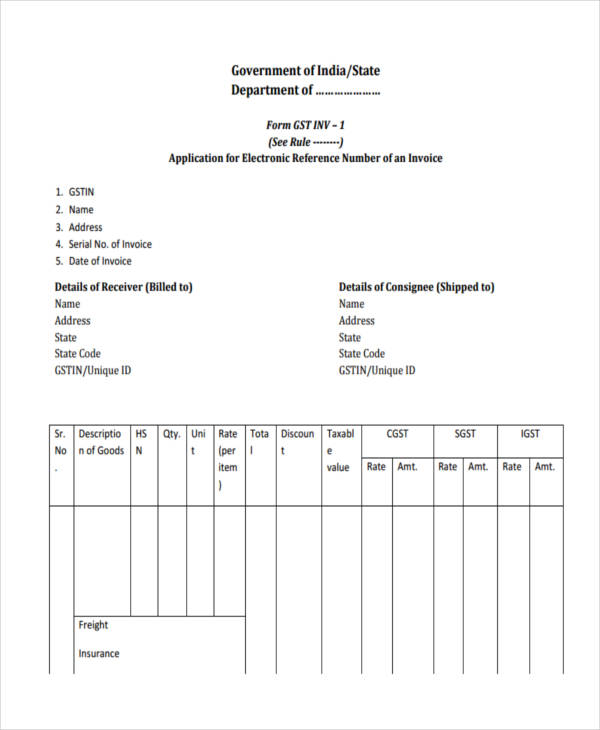

Goods Invoice

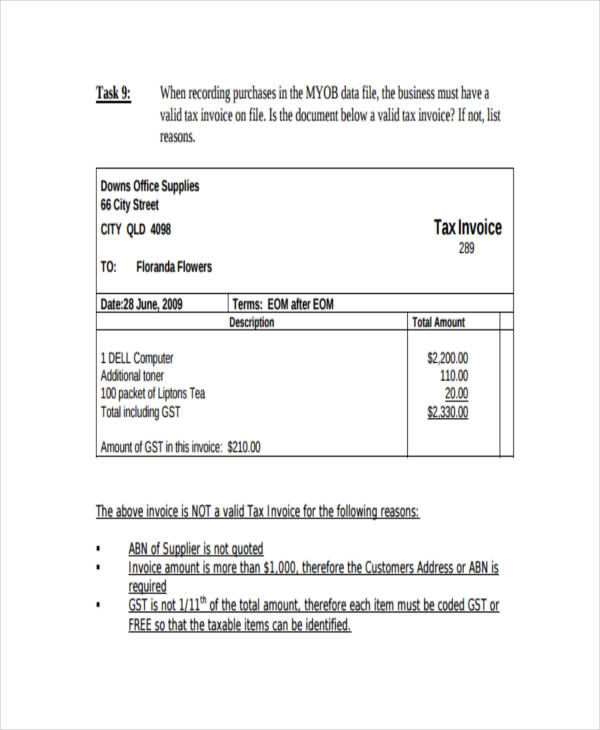

Valid Tax Invoice

What Is a Tax Invoice?

A tax invoice is an account that appears in the balance sheet in pdf of a business. A tax invoice shows the GST (Goods and Services Tax) on the goods and services provided. A tax invoice is a standard invoice required under GST system. All business must issue a tax invoice to their customer.

How to Issue a Tax Invoice

A tax invoice must be issued within 21 days from the time the goods delivered or services rendered. A tax invoice is not issued on a zero-rated supply and for a supply of second-hand goods and imported services.

Browse our tax invoice in PDF and other file formats here.

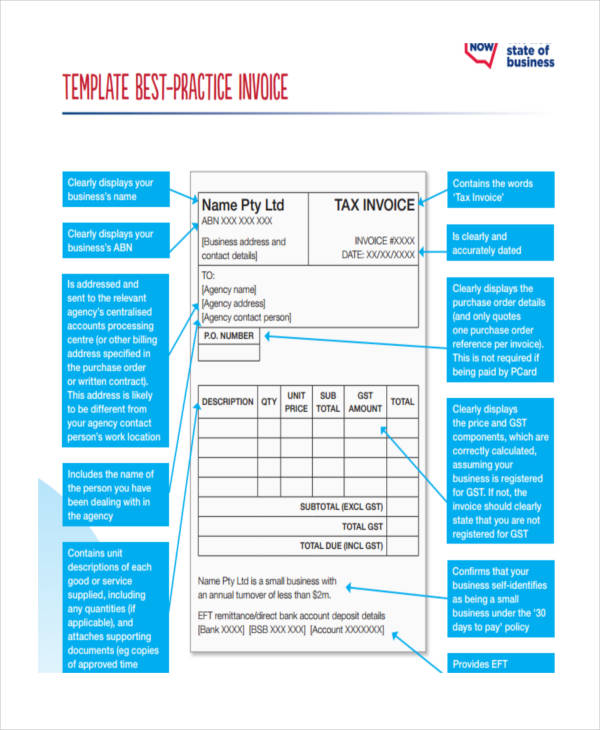

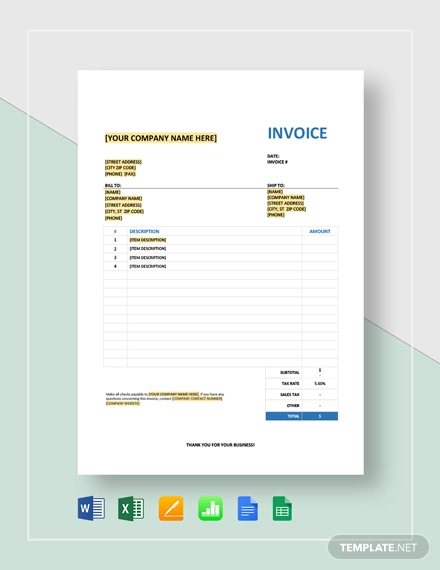

How To Write A Tax Invoice?

If your business provides a tax invoice, there are particular things you need to include in your tax invoice for it to be valid:

- The word “Tax Invoice” must be written clearly at the top

- The tax invoice number together with the business invoice number

- Date of the tax invoice issued

- Business name, address, and the GST registration number

- Name and address of the customer

- Detailed list of the goods delivered or the services rendered

- Quantity of the goods and/or services

- Discounts and promo (if any)

- Total sale amount before GST

- Rate of tax

- Total GST Charged

- The overall total amount including GST

Business Tax Invoice

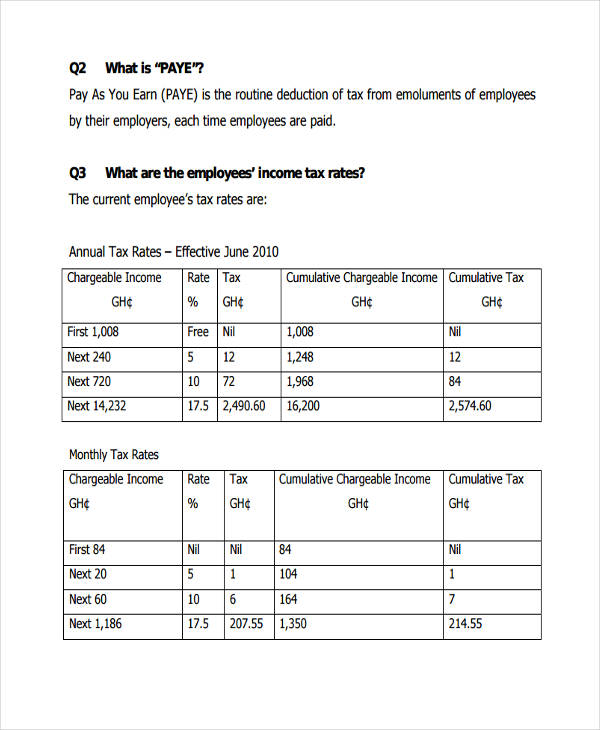

Income Tax

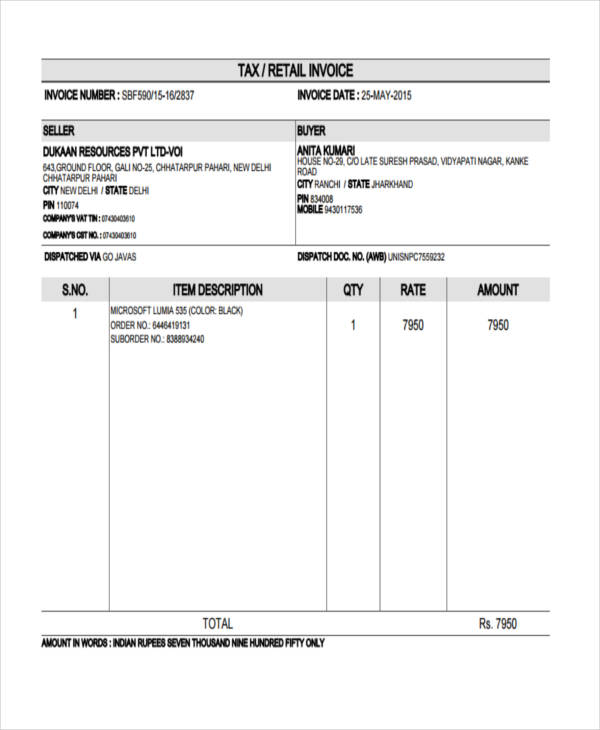

Retail Invoice

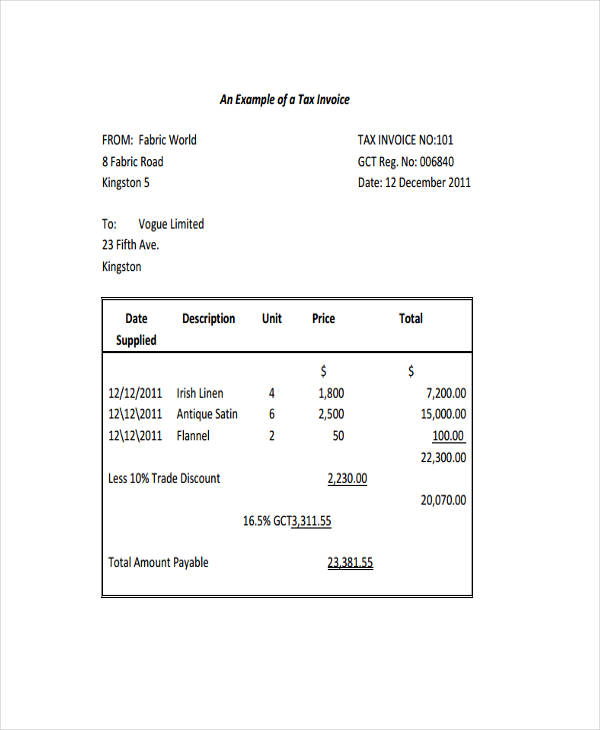

Sample Tax

The Purpose of Tax Invoice

There are numbers of reason why a tax invoice is important.

- A tax invoice is used to claim back the GST they have paid on the purchase from a supplier.

- A tax invoice informs the customer the goods or service they bought and their total payment.

- A tax invoice records how much VAT (Value Added Tax) you paid.

- A tax invoice is used to keep their books accurate.

- A tax invoice in word also helps the business track the taxes they have taken from the customer.

Feel free to browse and download our printable invoice to give you a head start on creating a tax invoice.

Requirements for Tax Invoice

A tax invoice must supply a number of requirements. It should include the following data.

- Name and address of the supplier

- VAT identification number of the supplier

- Customer’s name and address. A simplified tax invoice form may not include this data.

- The invoice number

- The Invoice Date and the date the goods and services supplied.

- The quantity and the type of good and/or service provided.

- The goods and service invoice.

- The price per unit excluding the VAT

- Reductions of the price

- VAT tariff that is included in the tax invoice

- The cost (excluding VAT)

- The date of advance payment

- The amount of VAT