Fund Transfer Letter

People who take vacations in foreign lands always have to be very careful with how they may spend their money. Not saying that they do not, rather, simply saying that there are a lot of scams around foreign lands that one cannot be too careful. To be careful with how they may deal with their money as well as having to let someone wire them the money without any hassle or afterthought. Some banks may agree to simply wiring a certain amount of money while others may have stricter rules that the account holder has to comply with. Have you ever witnessed this before or have you ever tried it? The fact that you want your bank to wire you a certain amount of money to a different bank but in a foreign country. If so, you may say that it took a lot of time and some requirements which is why some banks do ask for a fund transfer letter. What is a fund transfer letter and what does this have to do with banks and foreign banks? Well, this kind of letter has everything to do with banks and foreign banks. You may call it a requirement or a problem, depending on how you see it. But you can also take a look below, aside from the 10+ examples to know what this is about and how it works. As well as how to write one in case you may need it.

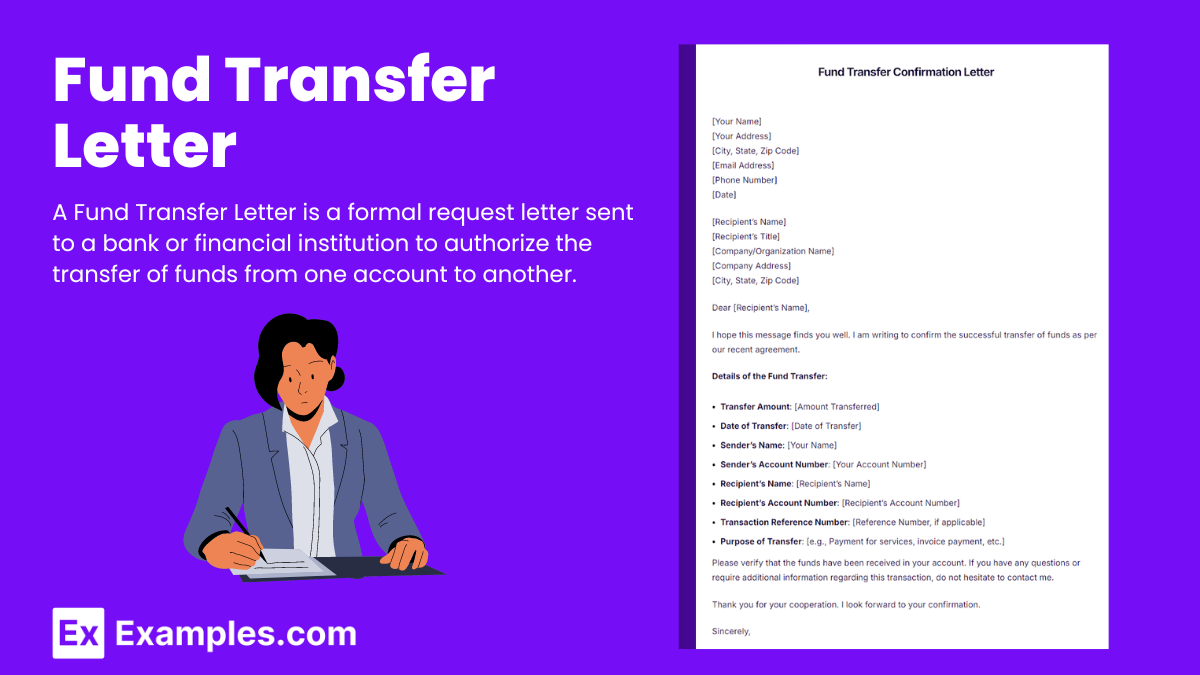

What is Fund Transfer Letter?

Download Fund Transfer Letter Bundle

Fund Transfer Letter Format

Opening Remarks

- Greeting: Begin with a respectful greeting.

- Example: “Dear [Bank Manager/Recipient’s Name],”

Introduction

- Purpose: Briefly state the purpose of the letter.

- Example: “I am writing to request the transfer of funds from my account to the recipient’s account as detailed below.”

Fund Transfer Request Details

- Sender’s Information

- Account Information: Provide the sender’s account details.

- Example: “Account Name: [Your Name], Account Number: [Your Account Number]”

- Recipient’s Information

- Account Information: Provide the recipient’s account details.

- Example: “Recipient’s Name: [Recipient’s Name], Recipient’s Account Number: [Recipient’s Account Number], Bank Name: [Recipient’s Bank Name]”

- Transfer Amount

- Amount to be Transferred: Clearly specify the transfer amount.

- Example: “The amount to be transferred is [Amount].”

- Transfer Date

- Date of Transfer: State the intended transfer date.

- Example: “Please initiate the transfer on [Date].”

Acknowledgments

- Confirmation of Transfer: Request a confirmation once the transfer is completed.

- Example: “Kindly provide a confirmation once the funds have been successfully transferred.”

- Contact Information: Include your contact information in case there are any issues or clarifications needed.

- Example: “Should you require further information, please feel free to contact me at [your phone number] or via email at [your email address].”

Closing Remarks

- Gratitude: Thank the recipient for their assistance in processing your request.

- Example: “Thank you for your prompt attention to this matter.”

- Final Thanks: Offer a final word of appreciation.

- Example: “I appreciate your help in ensuring this transfer is completed smoothly.”

Farewell

- Goodbye: End with a polite farewell.

- Example: “Yours sincerely,” or “Kind regards,”

Fund Transfer Letter Example

Dear Sir/Madam,

I am writing to formally request the transfer of funds from my account.

Please transfer the amount from my account number 123456789 at ABC Bank. The amount to be transferred is $5,000 in USD.

Please credit the amount to the following account:

Recipient Name: John Doe

Account Number: 987654321

Bank Name: XYZ Bank

SWIFT/BIC Code: ABCDUS33.

Kindly provide a confirmation once the funds have been successfully transferred. Should you require further information, please feel free to contact me at (555) 123-4567 or via email at [email protected].

Thank you for your prompt attention to this matter. I appreciate your help in ensuring this transfer is completed smoothly.

Yours sincerely,

[Your Name]

Short Fund Transfer Letter Example

Dear Sir/Madam,

I am writing to request a fund transfer from my account.

Please transfer $2,000 from my account number 123456789 at ABC Bank to the following account:

Recipient Name: Jane Smith

Account Number: 112233445

Bank Name: DEF Bank.

Kindly confirm once the transfer is complete.

Thank you for your assistance.

Kind regards,

[Your Name]

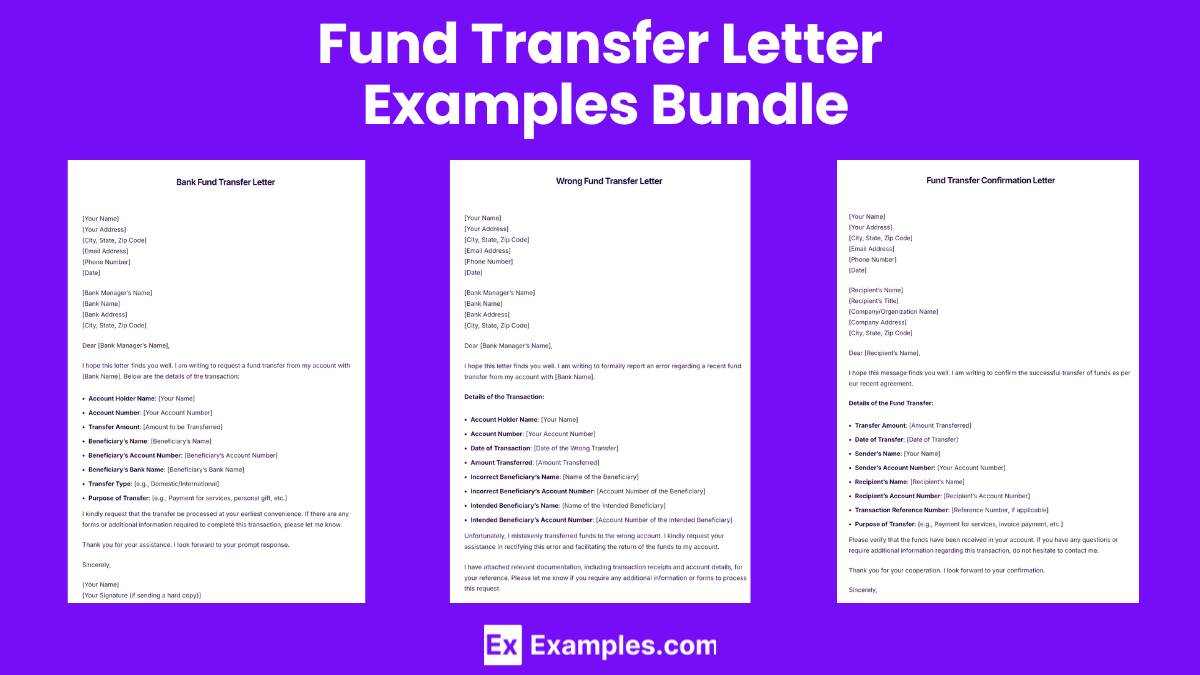

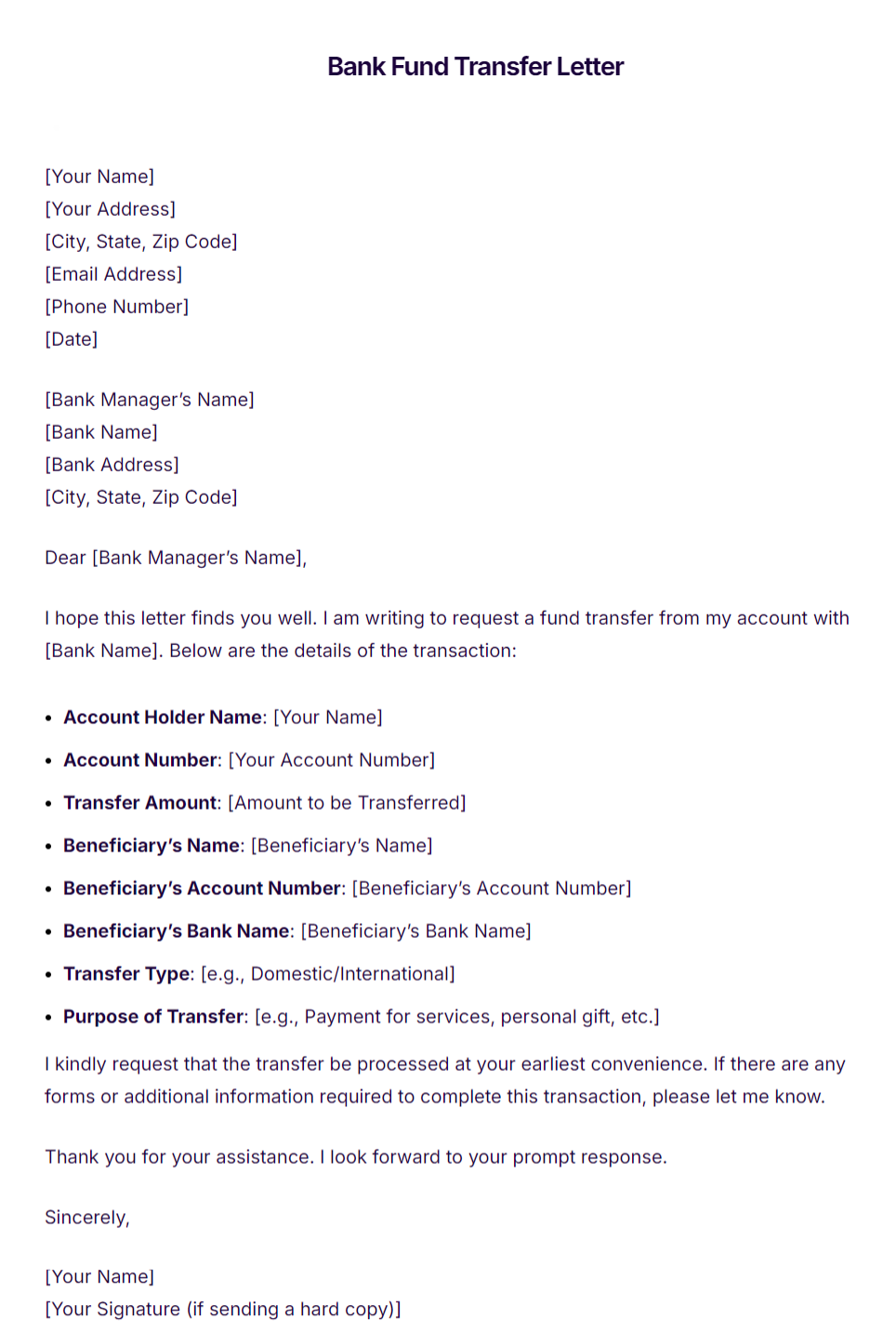

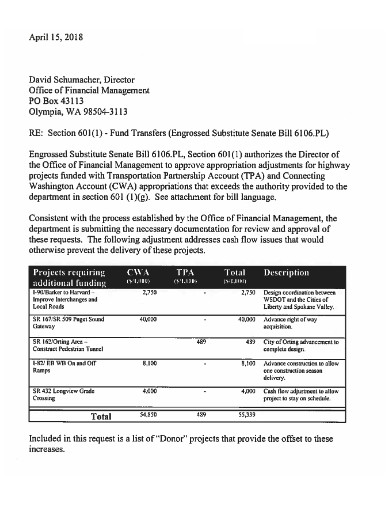

Bank Fund Transfer Letter

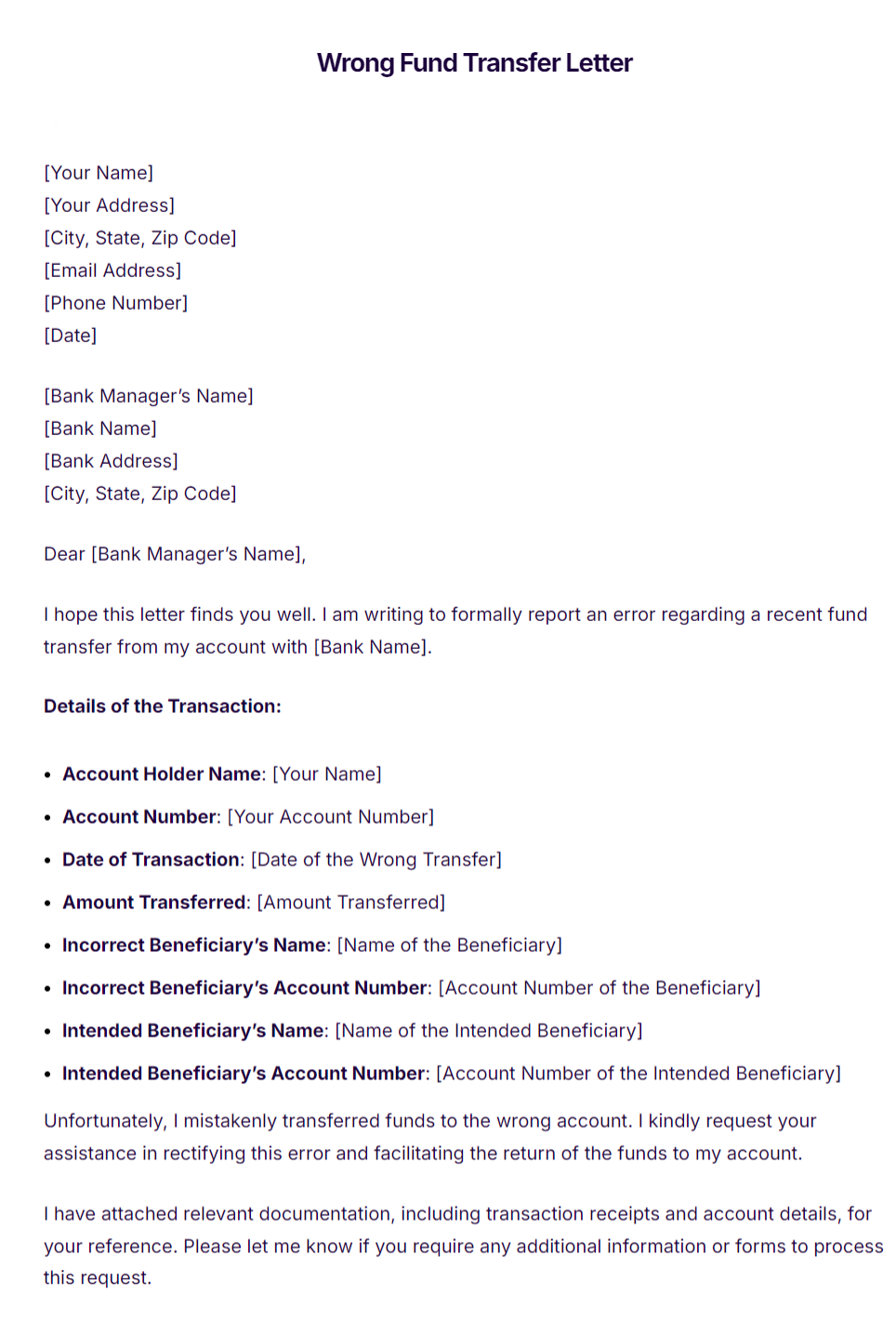

Wrong Fund Transfer Letter

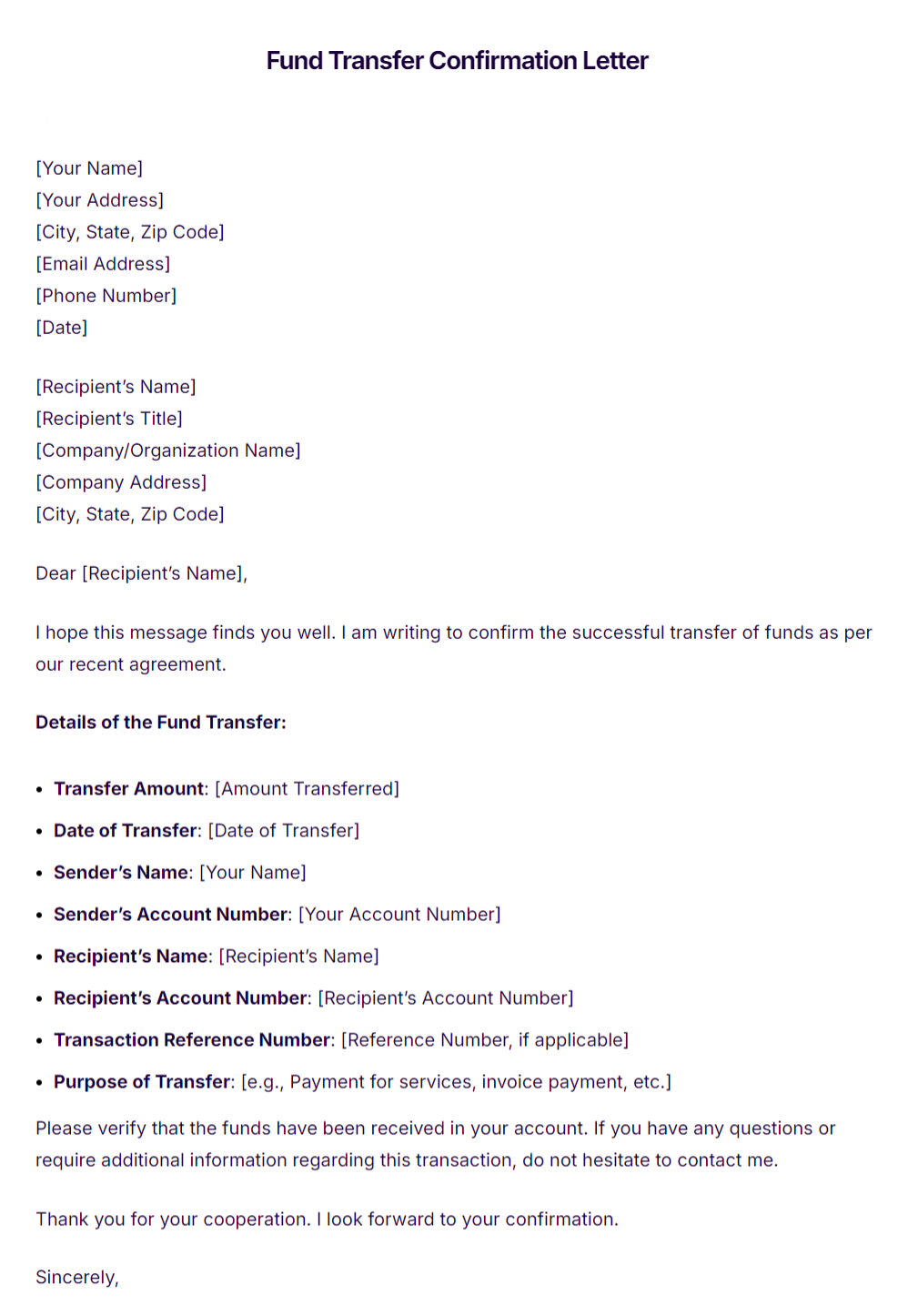

Fund Transfer Confirmation Letter

- Request for Fund Transfer Letter

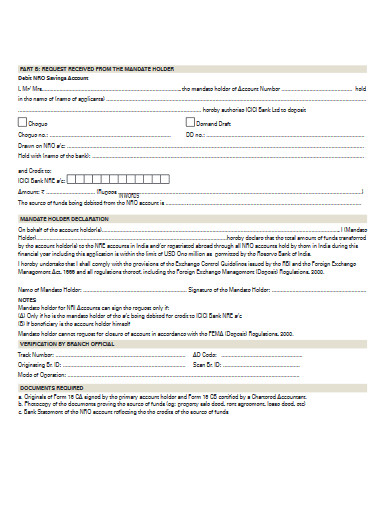

- Fund Transfer without Cheque Letter

- Fund Transfer Stop Order Letter

- Fund Transfer Approval Letter

- Bulk Fund Transfer Letter

Fund Transfer Letter Examples

1. Free Fund Transfer Letter

2. Free Fund Transfer Letter to Bank Manager

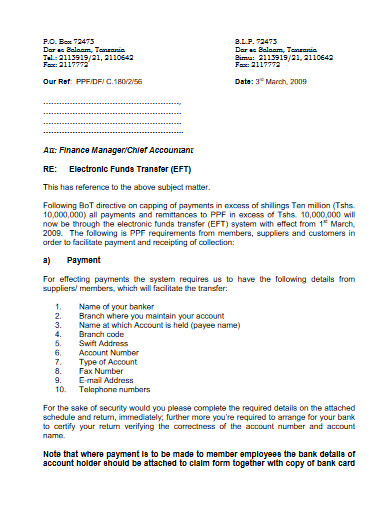

3. Electronic Funds Transfer Letter

4. Sample Fund Transfer Letter

5. Request Letter for Transfer of Funds

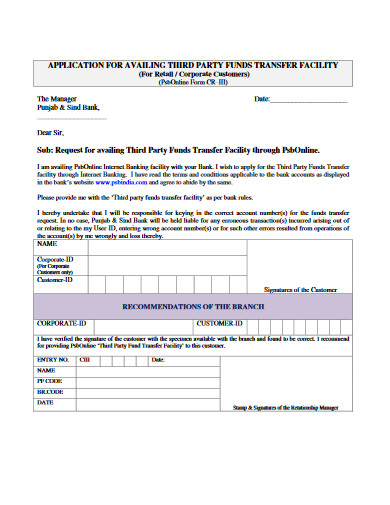

6. Third Party Funds Transfer Letter

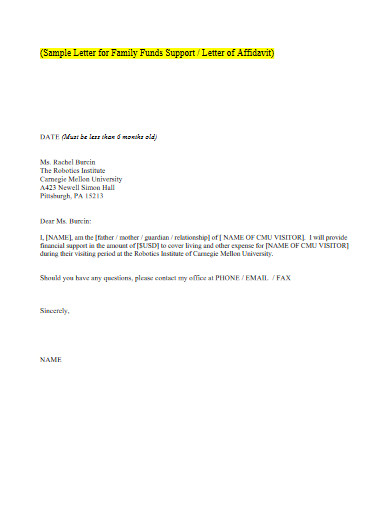

7. Simple Family Funds Transfer Letter

How to Write a Fund Transfer Letter?

Writing a fund transfer letter is a formal way to request a bank or financial institution to transfer money from your account to another account. Here’s a step-by-step guide to writing an effective fund transfer letter:

Use a Formal Letter Format

Include your personal details such as your name, address, and contact information.

Write the date of the letter.

Include the recipient’s details, such as the bank’s name, address, and any contact information.Subject Line

Use a clear and concise subject line that explains the purpose of the letter. For example:

Subject: Request for Fund TransferGreeting

Start the letter with a formal greeting, such as “Dear Sir/Madam” or “To Whom It May Concern.”

State the Purpose

In the first paragraph, explain the purpose of the letter. This should include your request for transferring funds.

Example:

“I am writing to request the transfer of funds from my account to the following recipient account.”Provide Account and Transfer Details

Include your account number and details of the recipient’s account, such as the account number, recipient’s name, and the recipient’s bank details.

If applicable, provide the SWIFT/BIC code for international transfers.

Clearly state the amount you want to transfer.

Example:

“Please transfer the amount of $5,000 from my account number 123456789 at ABC Bank to the following account:

Recipient Name: John Doe

Account Number: 987654321

Bank Name: XYZ Bank

SWIFT Code: ABCDUS33.”Request Confirmation

Ask for confirmation once the transfer has been completed. This ensures that you are informed of the status of the transfer.

Example:

“Kindly confirm once the transfer has been successfully completed.”Offer Contact Information for Clarification

Provide your contact details in case the bank needs additional information to process the transfer.

Example:

“If you need any further information, please contact me at (555) 123-4567Express Gratitude

Thank the recipient for their assistance in processing your request.

Example:

“Thank you for your prompt attention to this matter.”Closing

End the letter with a formal closing, such as “Yours sincerely” or “Kind regards,” followed by your name and signature.

FAQS

When should I write a fund transfer letter?

You should write a fund transfer letter when you want to formally request a bank to transfer funds, especially if you’re not using online banking services. It can also be used when the transfer requires special instructions or approval, or when documentation is necessary.

Can I stop a fund transfer once the letter has been submitted?

Stopping a fund transfer depends on the bank’s policies. If the transfer hasn’t been processed yet, you can write a Fund Transfer Stop Order Letter to halt the transfer. However, once the funds have been transferred, it may be difficult to reverse the process.

Do I need to attach any documents with the fund transfer letter?

In most cases, you don’t need to attach any documents. However, some banks may require proof of identity, proof of address, or the reason for the transfer (especially for large sums). It’s best to check with your bank regarding any specific documentation they may need.

How long does it take for a bank to process a fund transfer after submitting the letter?

Processing times can vary depending on the bank and the type of transfer (domestic vs. international). Domestic transfers typically take 1-2 business days, while international transfers may take 3-5 business days. Your bank can provide an estimate based on your specific situation.

Do I need to attach any documents with the fund transfer letter?

In most cases, you don’t need to attach any documents. However, some banks may require proof of identity, proof of address, or the reason for the transfer (especially for large sums). It’s best to check with your bank regarding any specific documentation they may need.