10+ Limited Partnership Agreement Examples

It is undeniable that building up a business on your own is hard to achieve. Big businesses, like real estates and law firms, for example, take not just one but two or more minds for its smooth sailing. This management of two or more proprietors is also known as joint ventures. The business affair is also applicable to small business partnerships and family partnerships. Keep in mind that a simple handshake won’t authorize businessmen to operate as partners. They have to draft and sign a legal document or deed called a partnership agreement. One of its types is the limited partnership agreement. The contract includes general specifications about the shared ownership of carried interests, equities, capitals, investments, and more, but limited to the management and liability aspects. Discover more about the partnership agreement through this article.

10+ Limited Partnership Agreement Examples

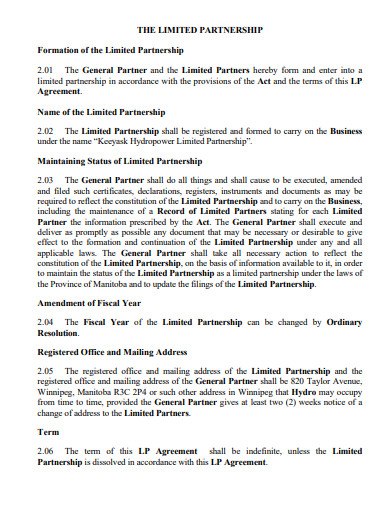

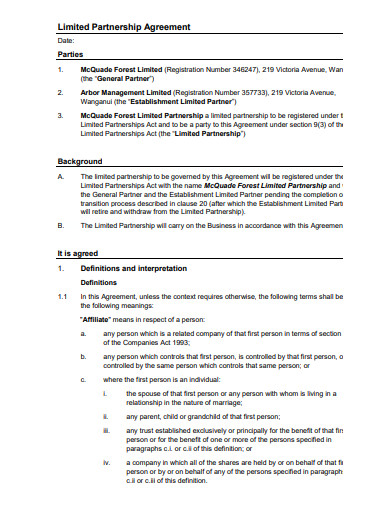

1. Limited Partnership Agreement

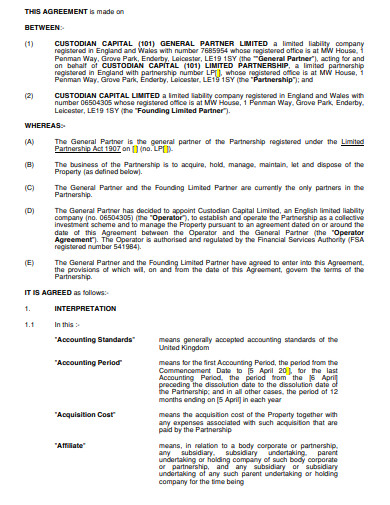

2. Restaurant Limited Partnership Agreement

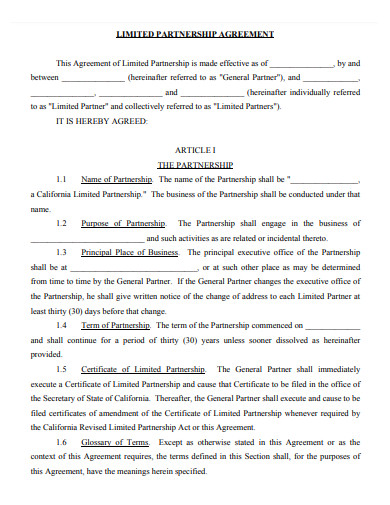

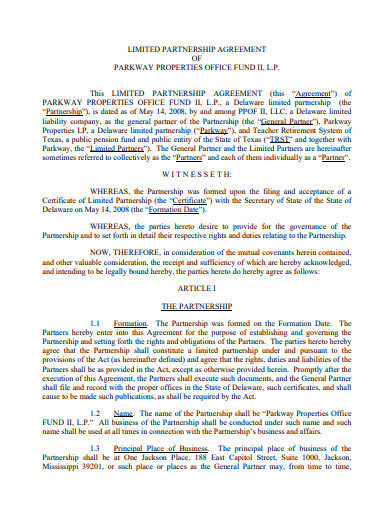

3. Simple Limited Partnership Agreement

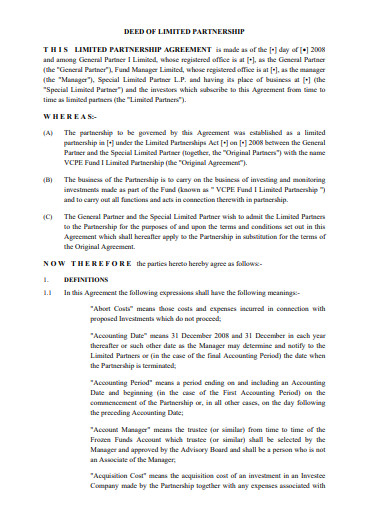

4. Limited Partnership Agreement Private Equity

5. Restaurant Limited Partnership Agreement

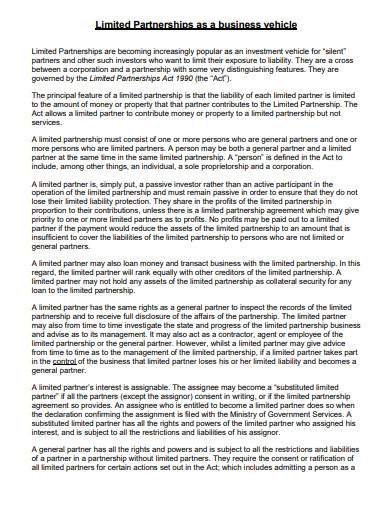

6. Business Limited Partnership Agreement

7. Sample Limited Partnership Agreement

8. Basic Limited Partnership Agreement

9. Company Limited Partnership Agreement

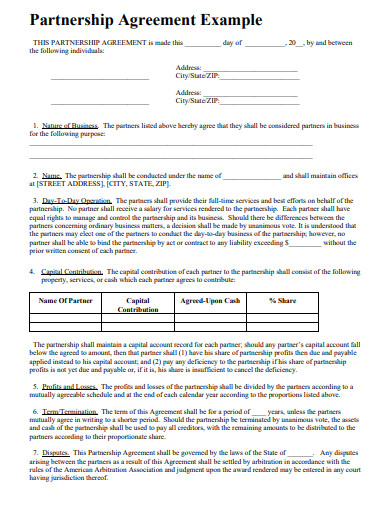

10. Limited Partnership Agreement Example

11. Printable Limited Partnership Agreement

What Is a Limited Partnership Agreement?

A limited partnership agreement is a legal document that details the business arrangement between two or more parties. It entails the parties’ sharing of business resources and profits. However, the limited partner or partners have options either or not to take part in the management of the business. Their liabilities will vary depending on their held dividends, as well. According to Rocket Lawyer, a limited partnership agreement can be used in two situations. First is when a businessman is all set to form a cooperative with other businessmen and wants to expound business terms. Second is when a businessman already agreed to form partnerships with certain individuals, and want to formalize the agreement.

Advantages and Disadvantages of a Limited Partnership

Every business undertaking has its advantages and disadvantages. Here are some for limited partnerships:

Advantages:

1. Since there can be two or more partners in this type of partnership, the business’s inventory asset is wide. This goes, most especially, for its corporate finance essentials.

2. Limited partners can’t be held liable for any debt. Thus, they can be confident that their personal budget will be left untouched.

3. The expertise of the partners is shared with one another. With the combined organizational knowledge and a wide skills inventory, the business can take on any problem that can get on the way.

Disadvantages

1. Each of the partners has his or her own business principles and beliefs. If one disagrees with the propositions of the other, you may need to start reviewing your dispute resolution policies.

2. The general partner will be held the only person accountable for debts. So when risks of insolvency present themselves, he or she has to work on a debt management plan alone.

3. Most of the time, it is the general partner who receives, analyzes, and acts on the monthly management reports of the business. In other words, limited partners can only suggest some points in the general partner’s decision criteria but can’t really put them into effect. Therefore, if one bad decision has been made by the general partner, the limited partners will be highly affected, as well.

How To Prepare a Limited Partnership Agreement

A limited partnership agreement, just like other agreements or contracts, is often made by contract lawyers. Though it is not necessary, such a document contains legal statements and areas that normal professionals may have trouble with. To help you create a standardized agreement without the help of lawyers, we have set out our outline of guidelines. Check them out below.

1. Set Partnership Name

When you and your partners’ business becomes successful, businessmen and consumers won’t recognize you by your individual names. This is why you have to come up with your partnership name for your convenience, as well as theirs.

2. Cite Partnership Endowments

Depending on what each of your co-partners has written down in their capability statements, identify and cite all the things they are willing to contribute to your planned business. On another aspect, you should also settle the proportion of ownership with respect to the weight of contributions.

3. Detail the Profits, Losses, and Draws Divisions

By the time your planned business has something to write in its profit and loss statements, you and your co-partners will be dividing them accordingly. To avoid chaos among yourselves, you should detail the division of these factors as per their contributions way ahead of time. Plus, you must not always forget about you and your co-partners’ draws.

4. Authorize Business Partners

If your business was set up long before you met your business partners, then you should grant them the authority to flick through your business inventory. Not just that, as partners, they should be able to go in and out of your establishment.

5. State Approaches for Partnership Withdrawals

Your co-partners could withdraw their involvement in your business for various reasons. It may be because they receive retirement invitations, or they found new business ventures. Whatever the reason is, you should be ready with a process that can provide them their harmonious exit.

FAQs:

What are the different types of partnership?

There are four types of partnerships. They include general, limited, limited liability, and limited liability company (LLC) partnership.

What is a silent partner?

Silent partners are business professionals whose implications on certain business partnerships are only bound for capital provisions. Aside from their absence in daily operations, they usually miss out on management meetings.

What is the difference between business partners and investors?

Partners share roles in creating, managing, and developing a business. Investors, on the other hand, only provide financial support in high hopes of financial returns.

A former chief executive officer (CEO) of Starbucks Coffee Company, Howard Schultz, once said, “Success is best when it’s shared.” It may be true when you tackle business. However, it is in the business’s nature to come with risks. Business partnership, for example, has its own set of advantages and disadvantages. These pros and cons vary on what type of partnership a particular businessman is willing to adopt. And to experience these pros and avoid the cons, a businessman must set things right at the very moment of agreement.