21+ Loan Agreement Examples

There will come a time where one would require to make a certain document which shows that two parties have come to an understanding about something. For example, one can look at commercial agreement examples to know how to create a commercial contract between a business and a vendor.

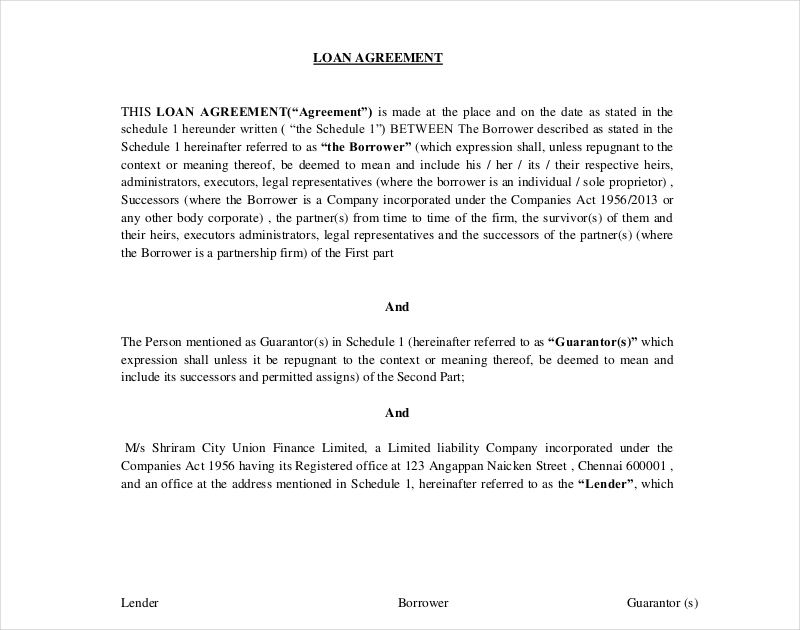

Loan Agreement Example

Equipment Loan Agreement Example

Restaurant Loan Agreement Stockholder to Corporation Template

Another would be management agreements where it explains how management will operate in a certain organization. So what if you would want to create an agreement in regards to a loan? This would mean that you’ll need to create a loan agreement and this article will teach you how to do just that.

Commercial Loan Agreement Example

Car Loan Agreement Form

Loan Agreement Stockholder to Corporation Example

Loan Agreement Template

Sample Loan Agreement

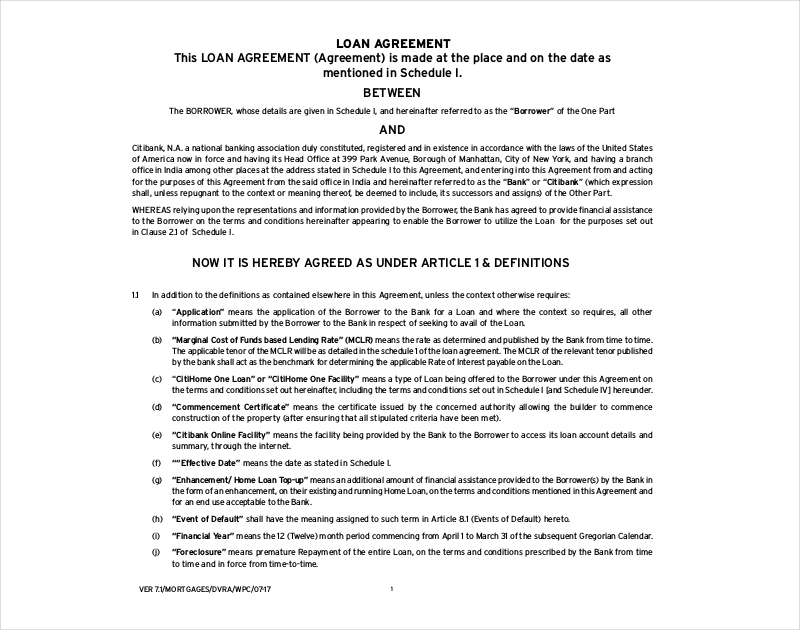

Mortagae Loan Agreement

How to Make a Loan Agreement

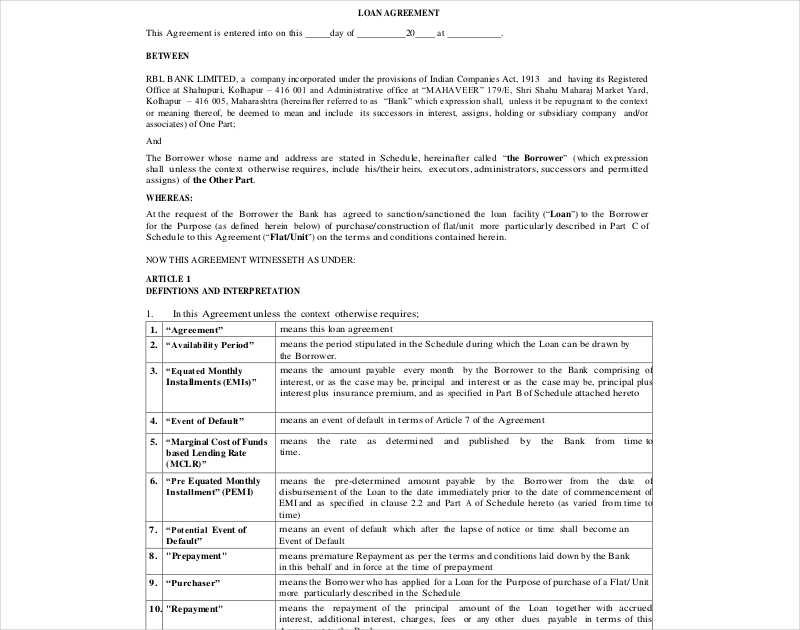

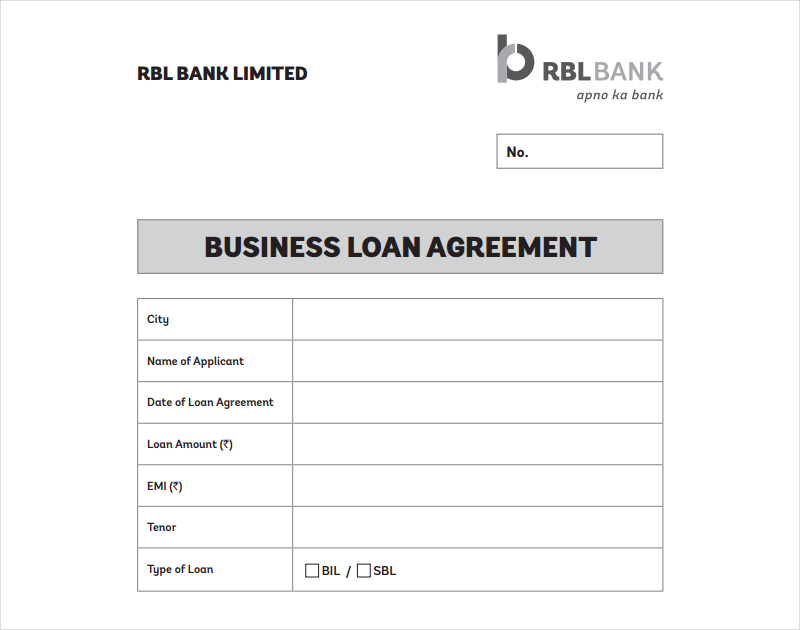

Much like a non-disclosure agreement or a work for hire agreement , a Loan agreement can be a very complex document. This is basically a contract between a person who’s willing to lend money and a borrower that’s willing to take it. This would mean that there are certain pieces of information that this kind of document will definitely require.

So here are the things that you should include in your loan agreement:

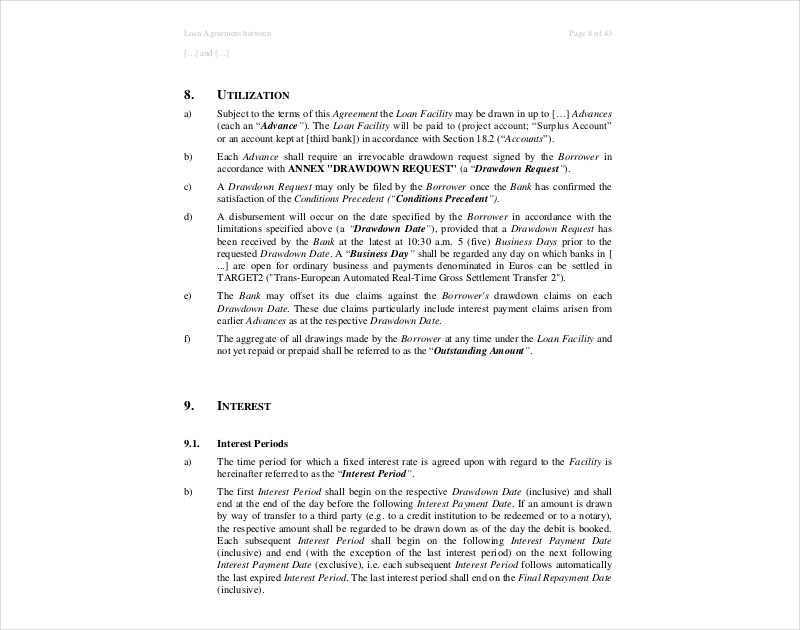

1. Interest

This is one of the more important clauses that your loan agreement will need. Think of it like a settlement agreement where you discuss how the payment will be settled. There are two main types of interest rates:

- Floating fee rates

- Fixed fee rates

When you think of the word “fixed fee rates”, then you should know that it’s basically interest that one has to pay that contains a number which will not change all throughout the course of the loan. As for a floating fee rate, the amount is based on an interest rate margin added to a benchmark rate.You may also see management agreements

2. Default Interest

A well-drafted Loan Agreement will also contain a default interest clause. This will increase the rate which is payable in the amounts that have yet to be paid in the event that they fall on the due date. The default rate must accurately reflect the cost to the lender of the amount that has yet to be paid even after when it is already due. If the rate is excessive there is a risk that it will be deemed a “penalty” rate.You may also see non-disclosure agreement

Home Loan Agreement

Business Loan Agreement

Vehicle Loan Agreement

Mortgage Loan Agreement Example

Standard Loan Facility Agreement

Master Securities Loan Agreement

3. Prepayment

It is important that a Loan Agreement allows the borrower to pay the loan as early as he or she wants to. By doing this, you’re making the loan more flexible and it will give your borrower the incentive to pay it sooner rather than later. Prepayments should only be allowed at the end of an interest period in order to avoid any payment of breakage costs. There are also certain circumstances where there are loans which require the borrower to make prepayments. A good example would be if one were to acquire a loan to purchase purchase a company share. It’s pretty much similar to a services agreement where you have to pay a certain amount ahead before the service can take place.

4. Repayment – On Demand or Fixed Term

One of the major elements of a Loan Agreement is whether it is repayable on demand, or it’s only repayable at a fixed term. If the loan is repayable on demand, there will be no need for an “Events of Default” clause. This is because the lender can recall the loan at his or her own will, thus meaning that the borrower is not contractually obligated to maintain certain promises. If, however, the loan is a fixed term loan, then it will be necessary for the Loan Agreement to contain an “Events of Default” clause.You may also see transfer agreement

An Event of Default is simply an event which forces the person borrowing the money into a default. The definition of an Event of Default is therefore of crucial importance, and it’s also subject to change depending on the type of loan that’s going to be acquired and many other factors. So think of it as a confidentiality agreement or sales agency agreement where there are certain specific factors that can highly affect the terms of the agreement.

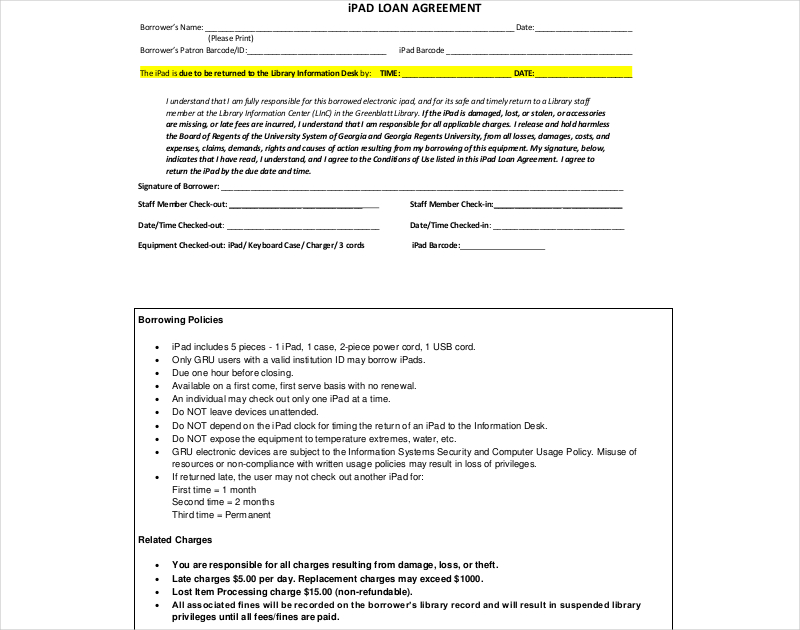

iPad Loan Agreement

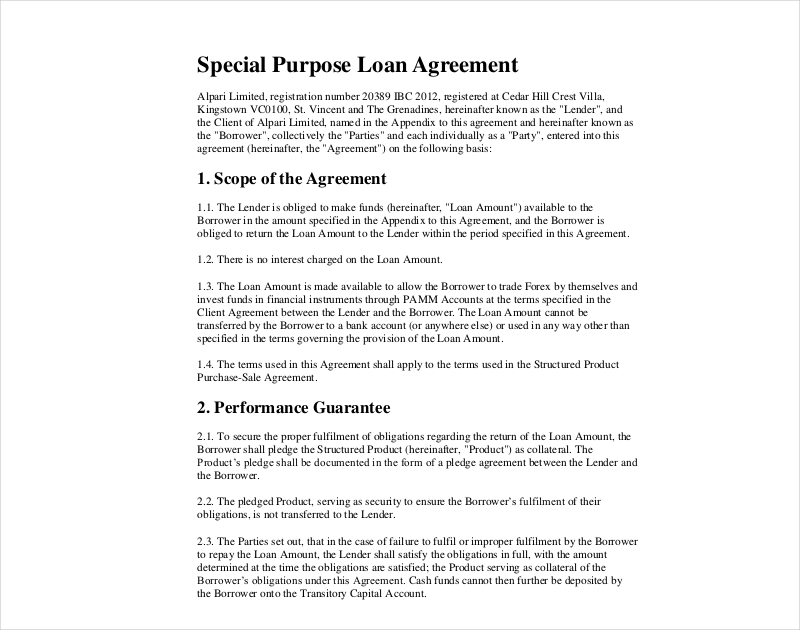

Special Purpose Loan Agreement

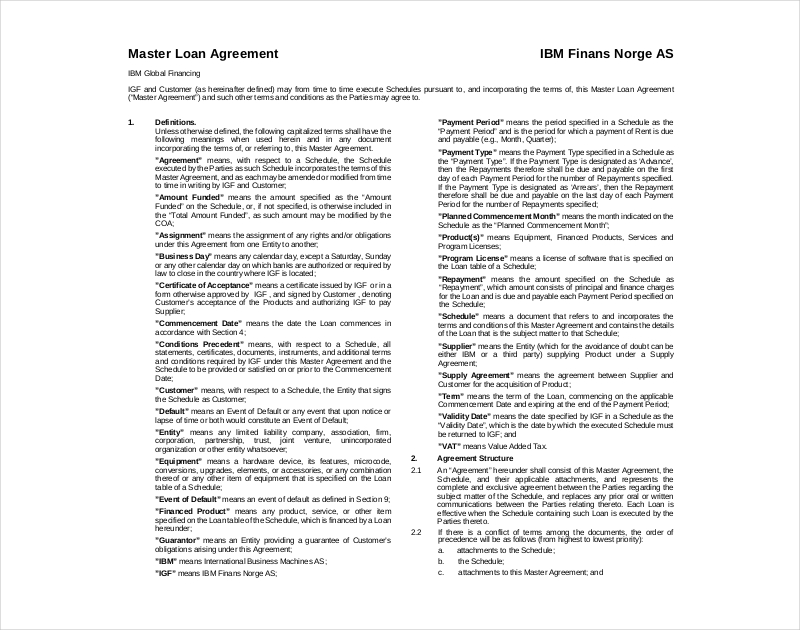

Master Loan Agreement

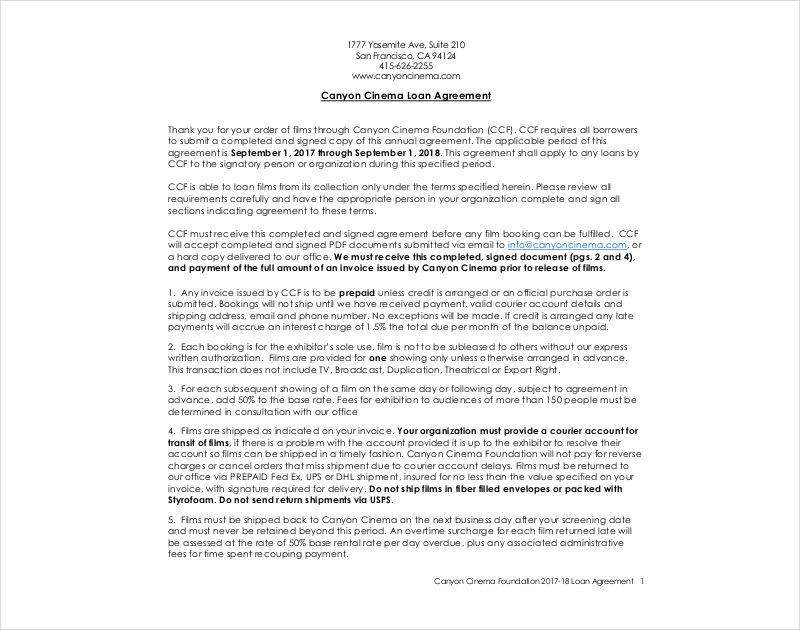

Cinema Loan Agreement

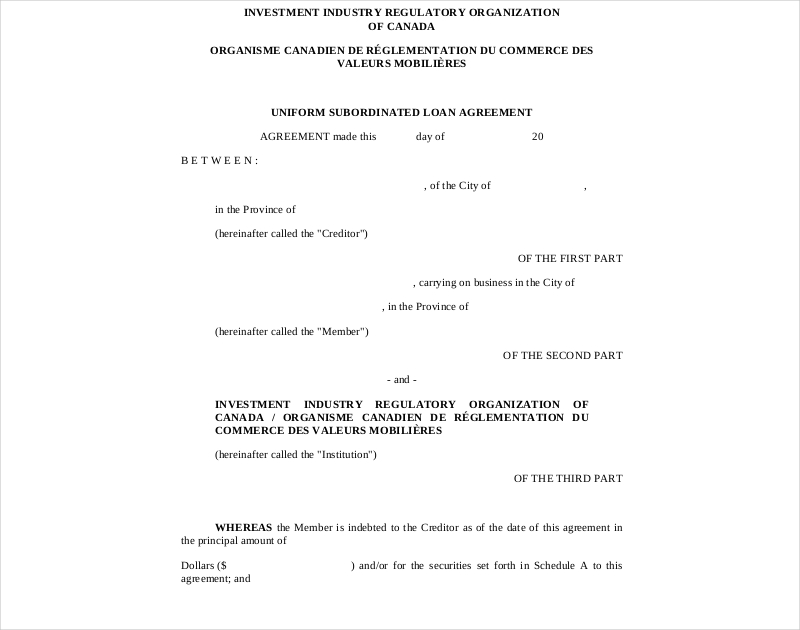

Uniform Subordinated Loan Agreement

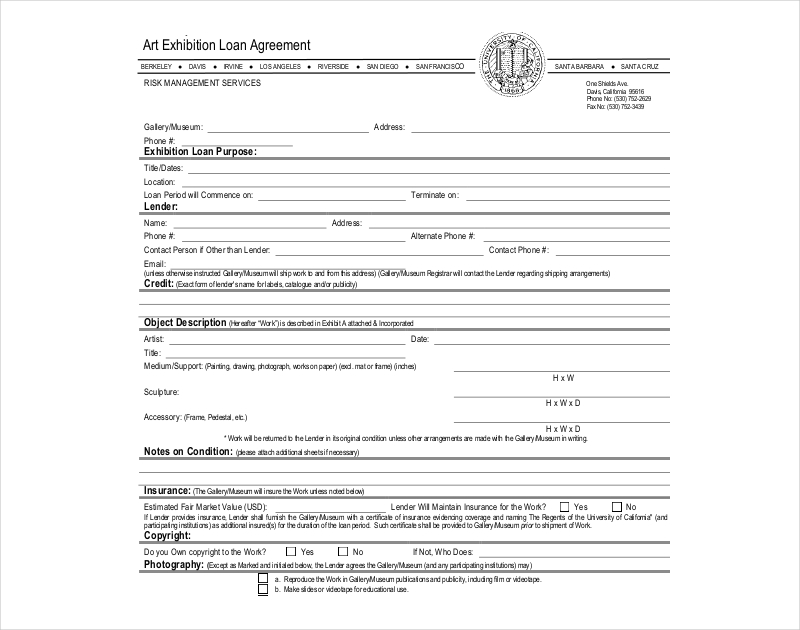

Art Exhibition Loan Agreement

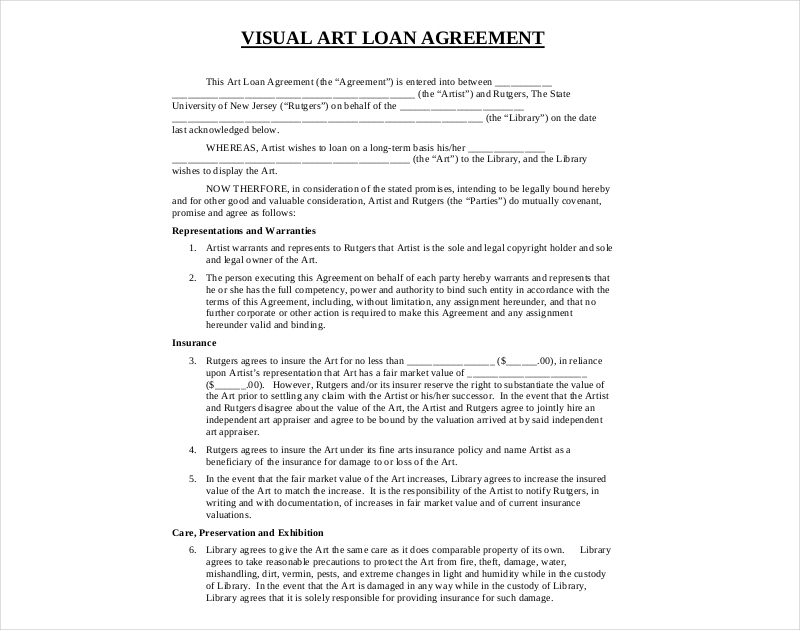

Visual Art Loan Agreement

5. Secured or Unsecured

The majority of loans, for instance home loans, are secured against a particular asset (If we’re talking about a home loan, then the obvious asset would be the home itself) In certain circumstances, however, the parties to a transaction may agree to not go with a secured loan. So if the lender were to go with one that’s unsecured, then that means there’s more risk which will have a flow on effect to other areas of the agreement. Examples would be the lender increasing the interest rate and that the loan may be on demand rather than having a fixed time as to when it should be paid.You may also see lease agreement.

6. Repayment – On Demand or Fixed Term

Another key term relates to the repayment provisions of the Loan Agreement.Is the facility to be repaid on demand or is there a set date or schedule in which it has to be paid? Generally the parties to a Loan Agreement will agree on a fixed repayment schedule, but then there are occasions that the borrower may have poor credit. Should that be the case, the lender may insist on an on demand facility.You may also see attorney agreement

Bilateral or Syndicated

Finally, it’s important to check whether a loan is bilateral or syndicated. A bilateral loan is basically funds that are transferred to a borrower through one lender. They’re usually the most simple and easy to understand, but the problem is that there’s more risk to the lender as opposes to going with a syndicated loan.

The opposite being a syndicated loan is one where there are more than one lenders. Since there’s more than one person who the borrower owes money to, there’s more security in ensuring that the borrower will pay back all the money that he or she has taken.. Generally a loan will only be syndicated if the lenders are corporate or investment banks and the amount that’s usually borrowed is of a high amount.You may also see promotion agreement

In the event that you would like to have the services of a consultant to help you determine what kind of loan you should take or even if you should take a loan at all, then you always have the option to create a consulting agreement to get the kind of help you need. Just remember that this will be costly, so only do so if you have the resources which allows you to.

If you would like to learn about other types of agreements that you may have to make (shareholders agreement , franchise agreement, etc), then what you’ll want to do is go through our site. We have all the articles that should contain the information you need to help you or your business during certain situations where they would actually come in handy.