11+ Loan Agreement Examples to Download

A loan application can be used to mean either the process of applying for a loan of any kind or the form containing the borrower’s information, including personal and financial information. In most cases, the lender uses the information written on the loan application examples as basis whether to approve the borrower of a loan or not.

Guidelines for filling up a loan application or processing a loan application may vary depending on the lender or the lending company. However, the borrower needs to provide the information and necessary documents, as requested by the lender.

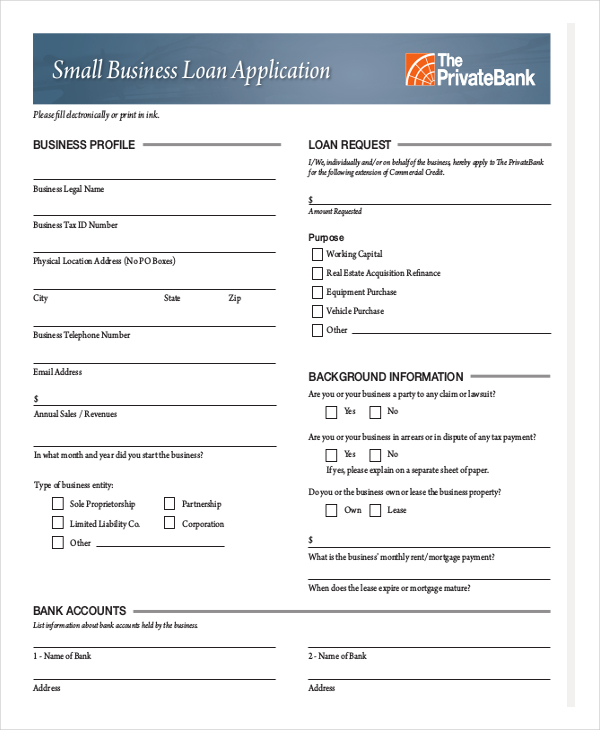

Small Business Loan

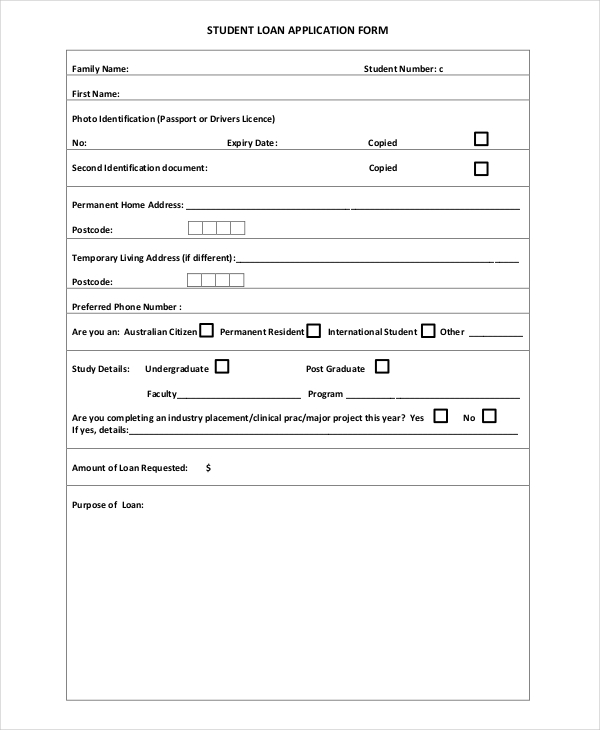

Student Loan Application

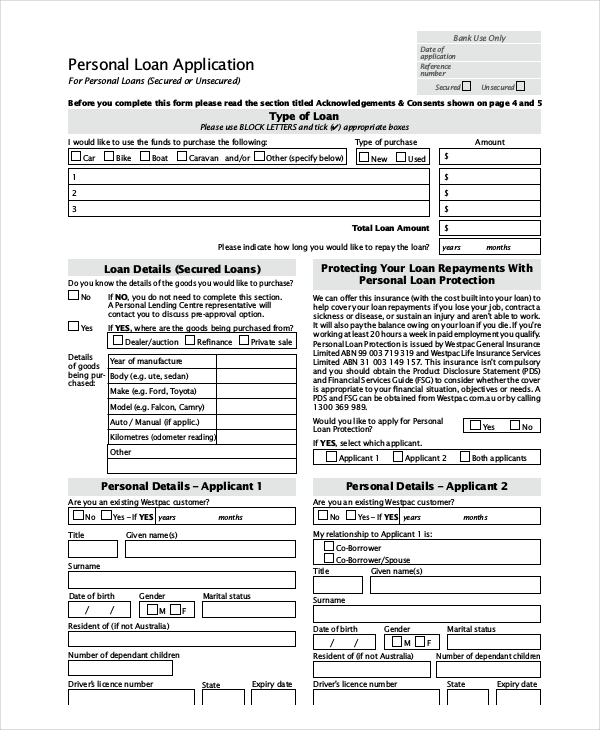

Personal Loan Sample

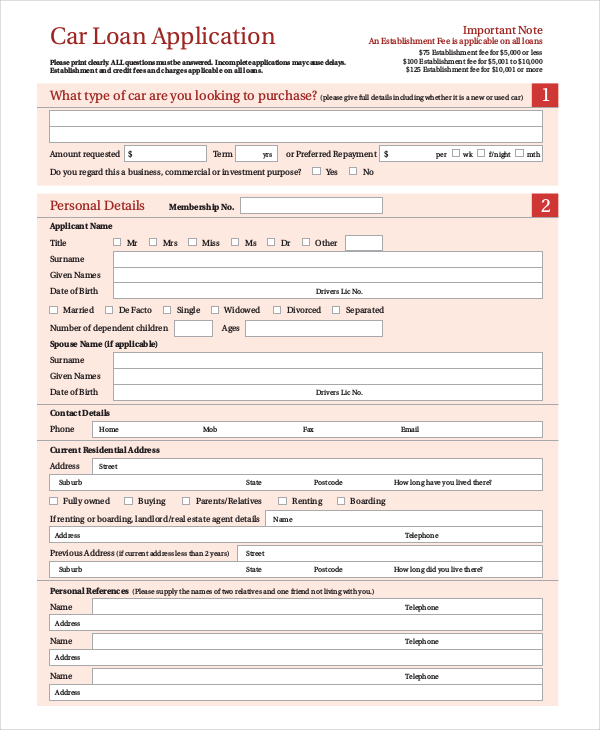

Car Loan Application

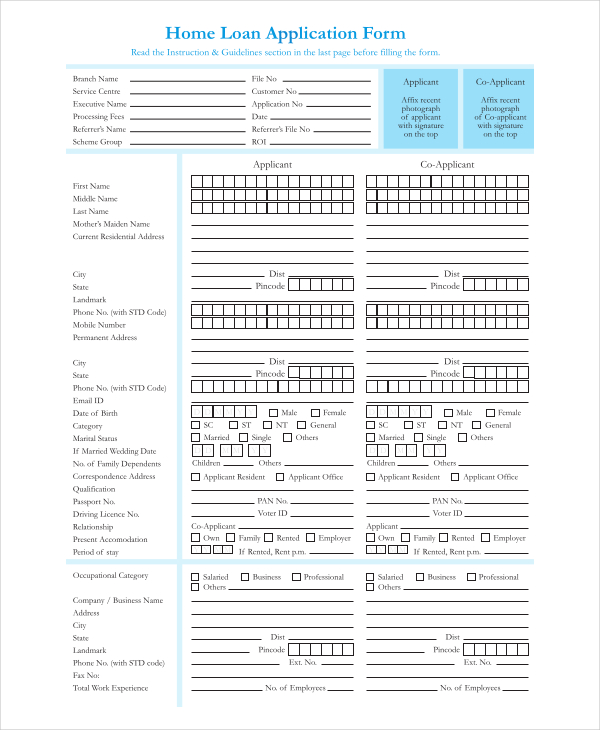

Home Loan Example

The Loan Application Process

Aside from filling up forms, one also needs to endure waiting for his/her turn among others whose loans are also waiting to be processed. Not to mention the process might get a bit confusing. This article contains free application examples which you may refer to. And here’s a guide to the basic steps in processing a loan application:

- Pre-qualification process. In this process, the lender usually views the borrower’s credit report to determine the borrower’s financial status.

- Application process. This is where you usually fill out a loan application (the form), and provide the requested documents.

- Verification of title. Here, you need to verify the title and all information regarding the property you are buying (if any) using the loan.

- Income sources verification. Here, you need to verify your employment, income, and assets. This is to ensure that you are capable of repaying the loan.

- Loan review. Any mistakes or errors, if there is any, will be found in this process.

- Processing. After seeing no error or mistake in your application, your loan may be sent for processing.

- Confirmation. This is where your lender will inform you if they approved your loan or not.

The process, however, may vary on every lender. Some may include processes which are not listed above, and others may skip a process or two.

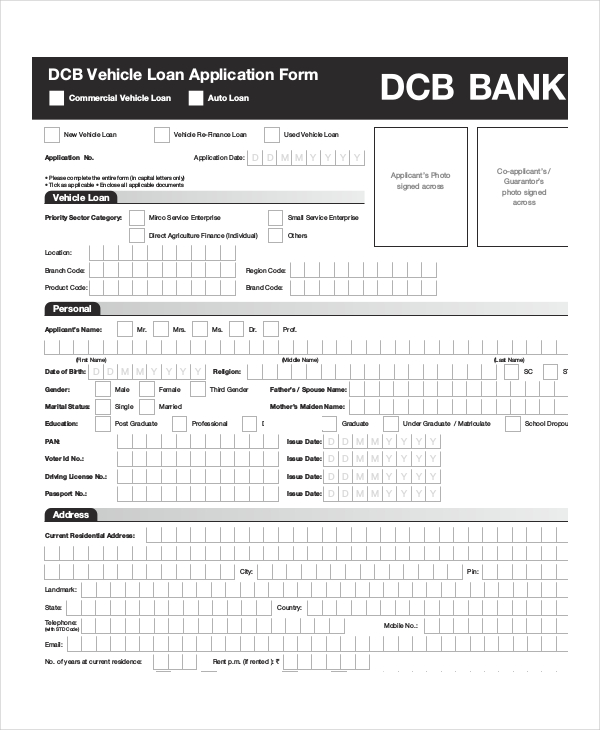

Vehicle Loan Application

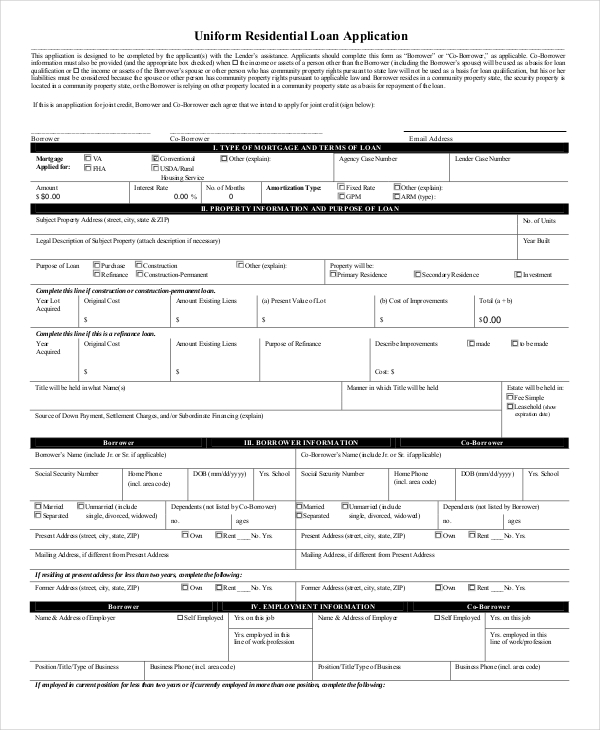

Uniform Residential Loan

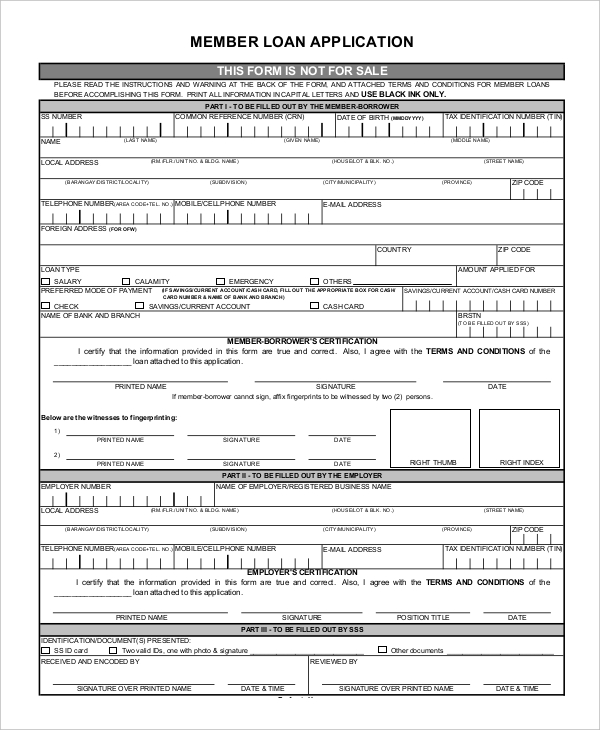

Member Loan Application

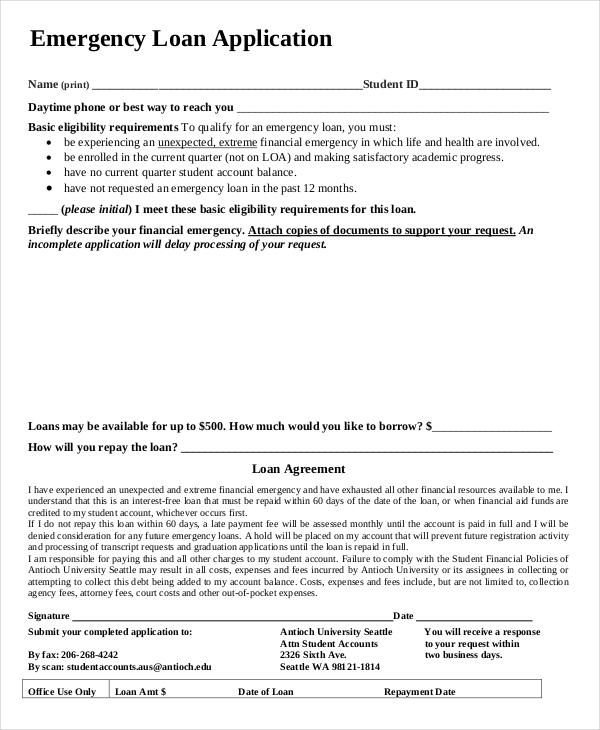

Emergency Loan Sample

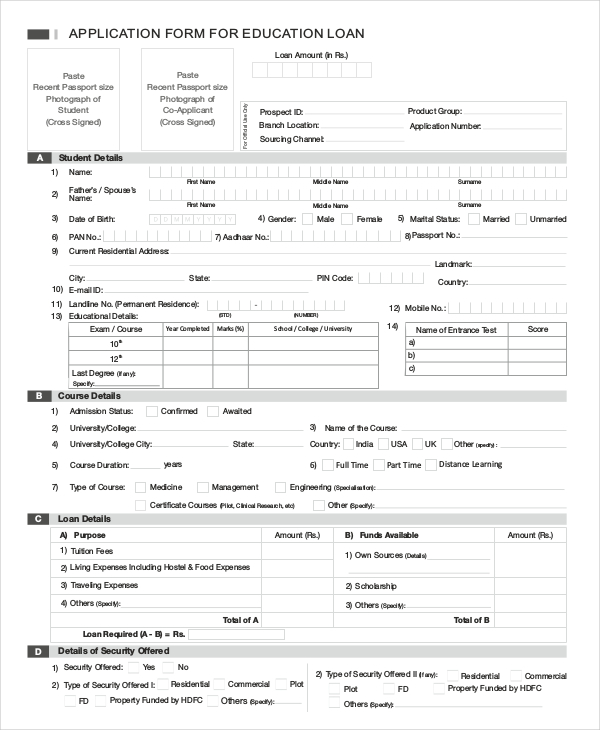

Educational Loan Application

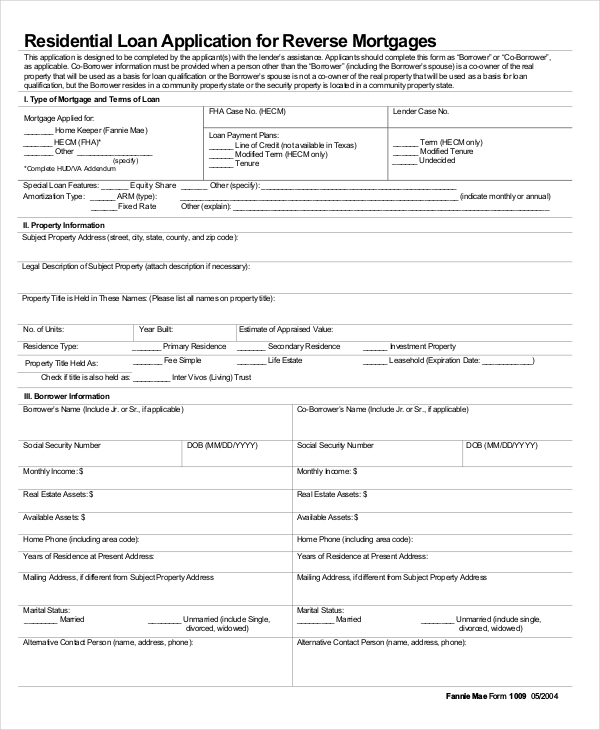

Residential Loan Example

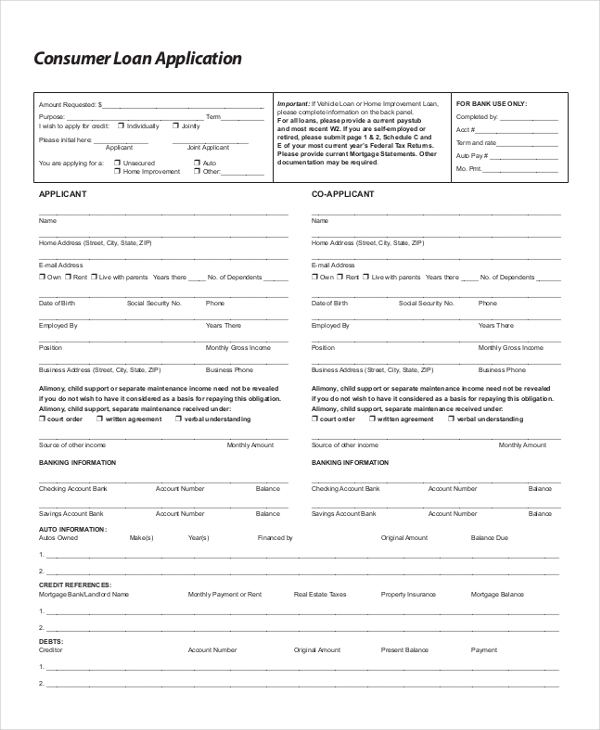

Consumer Loan Application

How to Fill Out a Loan Application

If you want to buy a property but you don’t have enough finances, chances are, you’ll want to file a loan application. Filling out a loan application is just like filling out a school application, but a bit more complicated. Generally, loan applications will ask for your personal information, and other details your lender needs.

Forms can be a bit confusing, and it’s not unusual to miss something. I often fill out forms using pencil and I also write in UPPERCASE letters to ensure clarity. It is always best to fill out each form neatly, and review afterwards to make sure you’ve filled out everything you need to fill out. You might want to familiarize some application examples in PDF found in this source.

Tips for a Successful Loan Application

A loan application cannot always be a successful one. Everything depends on the lender’s decision. So to ensure a better chance for a successful application, check out these steps:

- Make sure your credit report has the accurate information about your finances.

- Provide the correct information. Be honest.

- Understand the process and the rules. Know what you must do and what you must not.

- Look for the right lender. Do your research.