7+ Loan for a Startup Business Examples to Download

You probably have a great business idea and a foolproof strategy for running it successfully in your head, but the only problem is that you are short on cash. For any aspiring entrepreneur today, this is the most common scenario. No matter how big your ideas are, if you don’t have enough money to get started, your dreams of starting your own company will remain a pipe dream. You may also be interested in loan templates.

7+ Loan for a Startup Business Examples

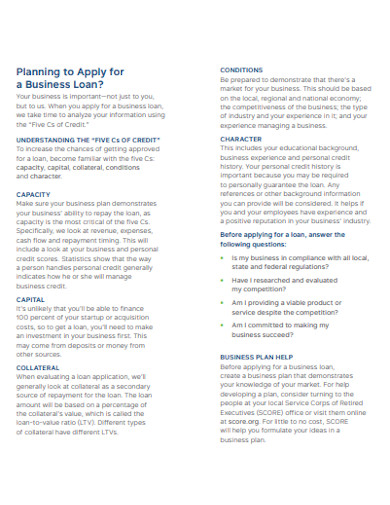

1. Small Business Loan Guaranty Program

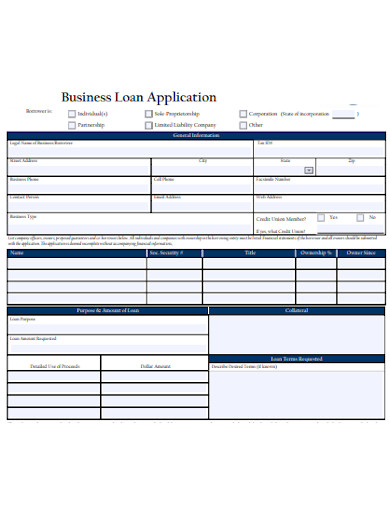

2. Startup Business Loan Application

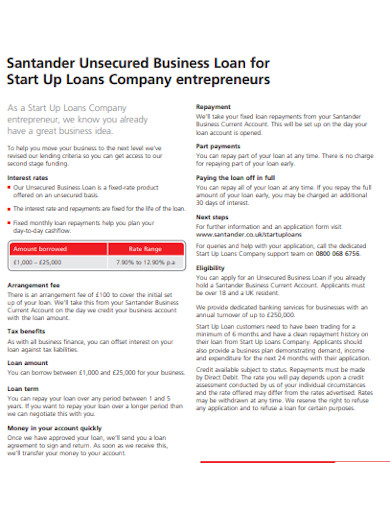

3. Unsecured Business Startup Loan

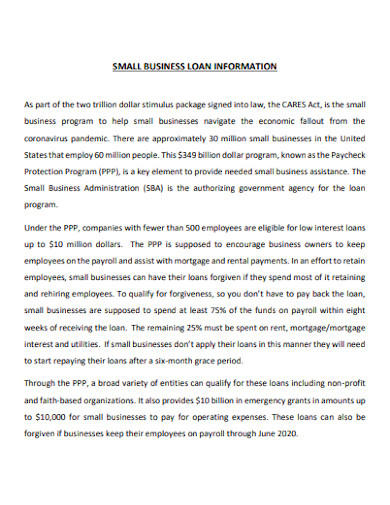

4. Small Business Loan Information Template

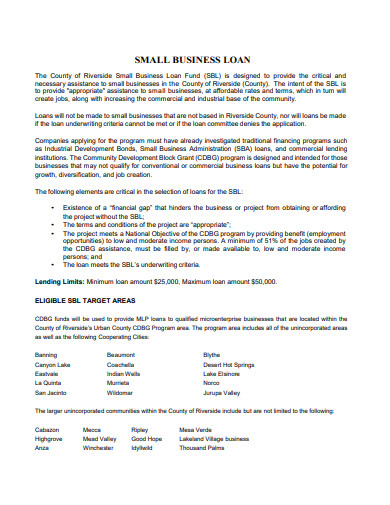

5. Small Business Loan in PDF

6. Loan Funds for Start-Up Companies

7. Sample Loan for Startup Business

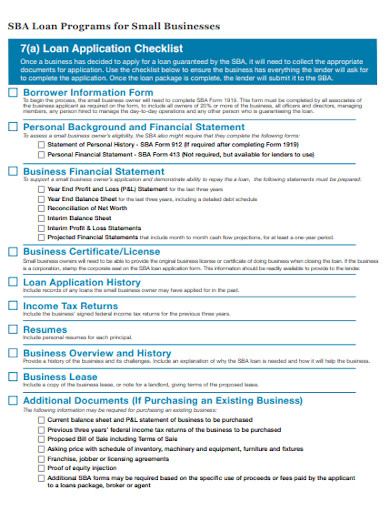

8. Small Business Loan Application Checklist

What Is a Loan Application?

Borrowers use a loan application to apply for a loan. Borrowers reveal essential financial information to the lender through the loan application. The loan application is crucial in determining whether or not the lender will grant the loan request.

How To Secure a Loan Successfully?

Unfortunately, no matter how intense the business strategy is, it will not ensure that you receive the funding you need. However, there is another way for you to get the money you need. Your next choice is to get a loan from a trustworthy bank or financial institution. Since most investors are hesitant to put their money into a small startup company, many small businesses have found loans reliable. Don’t worry; in this segment, we’ll show you how to obtain a loan to start your business efficiently and fruitfully.

1. Check to see if you have a good credit history and score.

When it comes to getting a loan, your credit history and score are significant. Whether you’re starting a business or need more money, your personal credit history and score are scrutinized before a bank, or other financial institution will give you a loan. Make sure to request copies of your credit history from the major credit reporting agencies.

2. Look for reputable financial institutions and banks.

After you’ve double-checked your credit history and score, the next step is to look for banks and financial institutions that have a good reputation. This is a crucial step to take because if you do business with a shady lender, instead of your business flourishing with the money you’ve borrowed, they’re likely to suck every last cent out of you by imposing high interest rates and hidden fees. The best way to avoid doing it is by researching backgrounds and finding out what your past clients have to say about services.

3. Determine how much money you’ll require and how you’ll spend it.

Before writing a loan application, it is critical to determine the loan amount and develop a plan for its use. To ensure that you can raise this problem, you should create a well-supported budget plan with a realistic financial projection. You can download and use our financial projection templates as a guide.

4. Make a letter of application for a loan.

A loan application letter is a requirement document that someone seeking a loan must submit to a loan officer. You’ll need to make your letter compelling if you want to increase your chances of getting a loan. You are required to submit a business plan outlining how you intend to develop and grow your company successfully.

FAQS

Is it possible to get a loan to start a business?

You want to start a company. Lenders need cash flow to help repay the loans so that companies typically cannot obtain business loans in their first year. Instead, you must check on other types of startup funding, such as business credit cards and personal loans.

Is it difficult to get a loan for a new business?

It is challenging for a new business to obtain a loan for a business startup from a commercial bank or lender. New business loans are the riskiest loans that a bank or lender may encounter.

How do businesses fund themselves?

Debt and equity are the two most common ways to fund a small business. Debt is a loan or line of credit that gives you a specific amount of money that you must repay over time. Assets guarantee most loans, so the lender can take away holdings if you do not pay.

Now that we’ve reached the end of this post, we hope that we’ve been able to provide you with some valuable tips and ideas for obtaining a loan necessary for starting a company. Although getting a loan can be a time-consuming operation, you can use our loan application letter templates as a guide. Be yourself, and have faith in your ability to obtain a loan and make your company a big success.